December 2025

The industry 4.0 to automotive manufacturing market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The growing emphasis of automotive brands for deploying AI-based technologies for enhancing the manufacturing capabilities along with rise in number of AI startups in the APAC region is playing a crucial role in shaping the industrial landscape.

Additionally, rapid investment by automotive companies to deploy robots in their manufacturing units coupled with partnerships among automotive brands and software companies has boosted the market expansion. The advancements in AR and VR technology related to the automotive sector is expected to create ample growth opportunities for the market players in the future.

The industry 4.0 to automotive manufacturing market is generally by the growing emphasis of EV makers to deploy AI-based solutions in their manufacturing centers coupled with rapid adoption of SCARA robots by automotive companies for improving operational efficiency. Industry 4.0 to automotive manufacturing refers to the digitalization and automation solutions deployed by automotive brands for enhancing numerous functions such as vehicle design, component manufacturing, assembly, testing and some others. There are several types of hardware components used in this sector comprising of sensors, PLCs/controllers, robots, vision cameras, edge devices and some others. Also, numerous types of software are deployed in this sector consisting of MES, analytics, PLM, digital twin, cloud apps and some others. These software are deployed by different modes in the automotive sector including on-premises, cloud, hybrid and some others.

The industry 4.0 in automotive finds several applications such as assembly line automation & production control, quality control & automated inspection, predictive maintenance & asset management, supply-chain / inbound logistics & traceability, inventory & warehouse automation, R&D / virtual commissioning / digital twin for line design, worker assistance & training (AR/VR) and some others. These advanced solutions are designed for manufacturing several types of vehicles such as passenger cars, light commercial vehicles, heavy commercial vehicles, two-/three-wheelers & specialty vehicles and some others. This market is expected to rise significantly with the growth of the automotive sector in different parts of the world.

| Metric | Details |

| Investors | Active PE/strategic interest; hyperscalers & platform vendors expanding manufacturing AI suites and centers |

| Leading Region | North America |

| Market Segmentation | By Technology, By Solution Type, By Component / Product, By Deployment Mode, By Application / Use Case, By Vehicle/Production Type, By Industry Buyer and By Region |

| Top Key Players | Siemens, Schneider Electric, Honeywell, IBM, Microsoft (Azure),PTC, KUKA, Keyence, Omron, AspenTech, Altair |

The major trends in this market consists of partnerships, rising sales of passenger vehicles and government initiatives.

The internet of things / IIoT platforms segment dominated the market with a share of around 25%. The growing adoption of IoT-based solutions in the automotive manufacturing centers has boosted the market expansion. Additionally, the advancements in sensor technology coupled with rapid investment by automakers for deploying IoT software in their automotive manufacturing centers is playing a vital role in shaping the industrial landscape. Moreover, partnerships among IoT developers and EV brands for deploying advanced IoT analytics tools is expected to boost the growth of the industry 4.0 to automotive manufacturing market.

The AI/ML and digital twin segment is expected to grow with the highest CAGR during the forecast period. The increasing adoption of AI and ML solutions in the automotive sector for enhancing operational efficiency has boosted the market expansion. Additionally, rapid investment by automotive brands for developing the AI infrastructure along with rising focus of EV brands for deploying ML technologies in their production centers is contributing to the industry in a positive manner. Moreover, numerous advantages of digital twin technology such as cost reduction, enhanced decision-making, increased sustainability, real-time monitoring and some others is expected to drive the growth of the industry 4.0 to automotive manufacturing market.

The hardware segment led the market with a share of around 38%. The growing demand for robots and vision cameras from the automotive sector has boosted the market expansion. Additionally, rapid investment by automotive companies for deploying advanced hardware systems to automate several tasks is playing a vital role in shaping the industrial landscape. Moreover, the increasing use of edge devices in the automotive manufacturing centers is expected to foster the growth of the industry 4.0 to automotive manufacturing market.

The software & services segment is expected to rise with the fastest CAGR during the forecast period. The increasing emphasis of automotive brands for deploying AI-software in their production centers has boosted the market growth. Also, rapid investment by automotive manufacturing companies to develop advanced software for automating numerous tasks in the vehicle assembly facilities is expected to drive the growth of the industry 4.0 to automotive manufacturing market.

The industrial robots & cobots segment led the market with a share of around 18%. The growing emphasis of several robotic brands such as Kawasaki, Fanuc, Yasakawa and some others to develop high-quality cobots has driven the market growth. Also, collaborations among robotics brands and automakers to deploy advanced robotic systems in the automotive sector is expected to propel the growth of the industry 4.0 to automotive manufacturing market.

The vision & inspection systems segment is expected to grow with the highest CAGR during the forecast period. The increasing use of advanced IoT sensors for inspecting various components in the automotive manufacturing units has boosted the market expansion. Additionally, the growing focus of EV companies to deploy high-quality cameras for enhancing vision in their assembly centers is expected to boost the growth of the industry 4.0 to automotive manufacturing market.

The on-premise / local (edge-first) segment led the market with a share of around 45%. The growing demand for on-premises automation solutions from the automotive sector has boosted the market expansion. Additionally, numerous advantages of on-premises tools including low latency, high efficiency, real-time monitoring and some others is expected to drive the growth of the industry 4.0 to automotive manufacturing market.

The hybrid segment is expected to rise with the highest CAGR during the forecast period. The rising emphasis of two-wheeler brands to deploy hybrid solution their assembly centers has boosted the market expansion. Also, numerous benefits of hybrid deployment mode such as scalability, cost efficiency, enhanced security and some others is expected to boost the growth of the the industry 4.0 to automotive manufacturing market.

The assembly line automation & production control segment dominated the industry with a share of around 28%. The increasing emphasis of automotive brands to adopt AI and IoT in their assembly centers for automating numerous tasks has boosted the market expansion. Additionally, collaborations among robotic companies and automotive manufacturers to deploy advanced robots in the automotive manufacturing centers is expected to foster the growth of the industry 4.0 to automotive manufacturing market.

The predictive maintenance & asset management segment is expected to rise with the highest CAGR during the forecast period. The increasing focus of EV makers to integrate AI-based predictive management tools in their production facilities has driven the market expansion. Also, the deployment of advanced IoT-enabled sensors for managing assets in the automotive manufacturers is expected to boost the growth of the industry 4.0 to automotive manufacturing market.

The passenger cars segment led the market with a share of around 60%. The increasing focus of automotive companies to deploy advanced technologies such as AI and IoT for designing passenger cars has boosted the market growth. Also, the growing demand for passenger vehicles in several countries such as Germany, the U.S., India, Canada and some others is contributing to the industry in a positive manner. Moreover, rapid investment by passenger vehicles manufacturers to integrate automated tools in their production units is expected to propel the growth of the industry 4.0 to automotive manufacturing market.

The light commercial vehicles segment is expected to expand with a significant CAGR during the forecast period. The increasing application of light commercial vehicles in several industries such as mining, logistics, construction, e-commerce and some others has boosted the market growth. Also, rapid investment by EV manufacturers to integrate generative AI solutions for manufacturing LCEVs is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among robotic companies and automotive brands for deploying collaborative robots in manufacturing centers is expected to foster the growth of the industry 4.0 to automotive manufacturing market.

The OEMs segment led the market with a share of around 55%. The growing demand for advanced PLM and Digital Twin software from automotive OEMs for enhancing the operational efficiency has boosted the market expansion. Additionally, rapid investment by automotive OEMs to open new research centers in different parts of the world is contributing to the industry in a positive manner. Moreover, collaborations among OEMs and AI providers to accelerate the deployment of AI solutions in automotive manufacturing is expected to propel the growth of the industry 4.0 to automotive manufacturing market.

The tier-1 & tier-2 suppliers segment is expected to rise with the highest CAGR during the forecast period. The growing emphasis of tier 1 suppliers to integrate AI-based automated solutions in their manufacturing centers has driven the market growth. Additionally, rapid investment by tier-2 suppliers for deploying SCARA robots in designing of intricated automotive parts is playing a vital role in shaping the industrial landscape. Moreover, partnerships among tier-1 suppliers and tech companies for deploying advanced technologies in their production hubs is expected to boost the growth of the industry 4.0 to automotive manufacturing market.

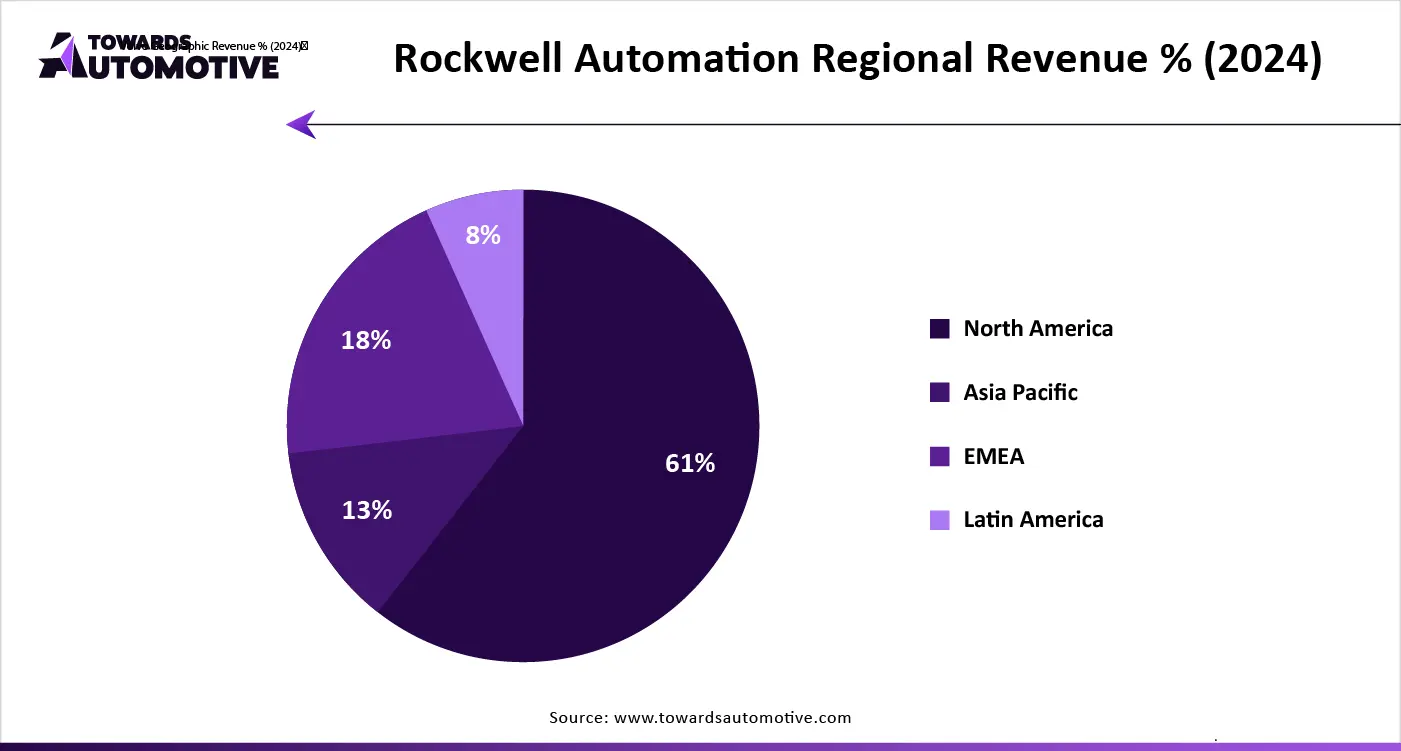

North America led the industry 4.0 to automotive manufacturing market with a share of around 37%. The increasing demand for luxury cars in the U.S. and Canada from the HNIs has boosted the market growth. Additionally, numerous government initiatives aimed at developing the automotive sector coupled with technological advancements in the EV sector is contributing to the industry in a positive manner. Moreover, the presence of various market players such as Amazon Web Services (AWS), IBM, Microsoft, Nvidia and some others is expected to drive the growth of the industry 4.0 to automotive manufacturing market in this region.

U.S. is the major contributor in this region. The increasing adoption of advanced technologies in the automotive sector coupled with numerous government initiatives aimed at deploying Industry 4.0 in heavy industries has boosted the market expansion. Also, rapid investment by several automakers such as Ford Motors, Tesla, Rivian and some others for integrating AI and IoT in their manufacturing centers is playing a vital role in shaping the industrial landscape.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The growing sales of electric vehicles in various countries such as China, India, Japan, South Korea and some others has boosted the market expansion. Also, rapid investment by automotive brands to deploy advanced technologies in their production centers for automating several tasks along with rise in number of automotive research centers is playing a prominent role in shaping the industrial landscape. Moreover, the presence of several market players such as Fanuc, Mitsubishi Electric, Kawasaki and some others is expected to boost the growth of the industry 4.0 to automotive manufacturing market in this region.

China and Japan are the prominent contributors in this region. In China, the market is driven by the increasing production and sales of commercial vehicles coupled with surging deployment of advanced sensors in the automotive manufacturing plants. In Japan, the increasing adoption of collaborative robots by automotive companies along with rapid expansion of the robotic industry is playing a crucial role in shaping the industrial landscape.

| May 2025 | Announcement |

| Rakesh Sancheti, Chief Growth Officer and Chief Business Officer – Industrial Manufacturing, Tredence | Automotive companies are sitting on years of OT and IT data, but it's locked in systems that don't talk to each other and can't keep up with real-time demands. Our AI-driven smart manufacturing and supply chain solutions, along with GenAI-led migration accelerators, unify OT and IT data to drive actionable insights. Powered by Snowflake's scalable AI and data cloud platform, our solutions help customers unlock measurable business value. |

| October 2025 | Announcement |

| Motohiro Yamanishi, Company President, Industrial Automation Company, OMRON Corporation | We see immense potential in the dynamism of India's manufacturing sector. The Automation Center underscores India's profound importance to our global as well as Asia Pacific vision and is designed to work hand-in-hand with local partners to enhance their global competitiveness and jointly address evolving societal needs through innovative automation. This Center is more than a showcase of technology; it is an engine for co-creation. With smart technologies driving efficiency and innovation, facilities like these are set to be one of the key catalysts in India's journey toward becoming a global manufacturing leader. |

| May 2025 | Announcement |

| Jarvis, Founder and CEO of ROX Motor | The UAE's Operation 300Bn strategy reflects a bold national vision to revitalise its industrial sector, with the automotive industry playing a key role in that transformation. Our presence in the UAE signals a long-term commitment to building with the region, and our participation in MIITE reinforces our dedication to advancing the UAE's sustainable mobility ambitions. |

| June 2025 | Announcement |

| Shailesh Hazela, CEO and Managing Director of Stellantis India | Through Project INSPIRE, we are equipping youth with the skills essential to thrive in the evolving fields of electric mobility, automation and sustainability. By aligning with national priorities like Viksit Bharat 2047 and Industry 4.0, this initiative bridges the gap between education and employment while also supporting the automotive industry in its transition to a greener, more digital future. We are grateful for the partnership of ASSIST Asia and NITTTR Chennai, whose collaboration is integral to the success of this project. |

| February 2025 | Announcement |

| Benjamin Lin, the President of Delta Electronics India | Delta is proud to showcase our innovative smart manufacturing solutions at ELECRAMA 2025. Our focus has always been on delivering solutions that advance industries to become more efficient, sustainable, and resilient. The new solutions we are introducing – from the D-Bot Cobots to the Ultron IPT Series UPS – are designed with these values in mind, and we are committed to driving the transition to smart and sustainable manufacturing across India and beyond. |

The industry 4.0 to automotive manufacturing market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Mitsubishi Electric, Microsoft (Azure), NVIDIA, ABB, Amazon Web Services (AWS), Bosch, Cognex, Dassault Systèmes, Emerson, FANUC, GE Digital, Honeywell, IBM, Keyence, KUKA, PTC, Rockwell Automation, SAP, Schneider Electric, Siemens and some others. These companies are constantly engaged in developing industry 4.0 solutions for the automotive sector and adopting numerous strategies such as business expansions, acquisitions, launches, partnerships, collaborations, joint ventures and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Technology

By Solution Type

By Component / Product

By Deployment Mode

By Application / Use Case

By Vehicle/Production Type

By Industry Buyer

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us