July 2025

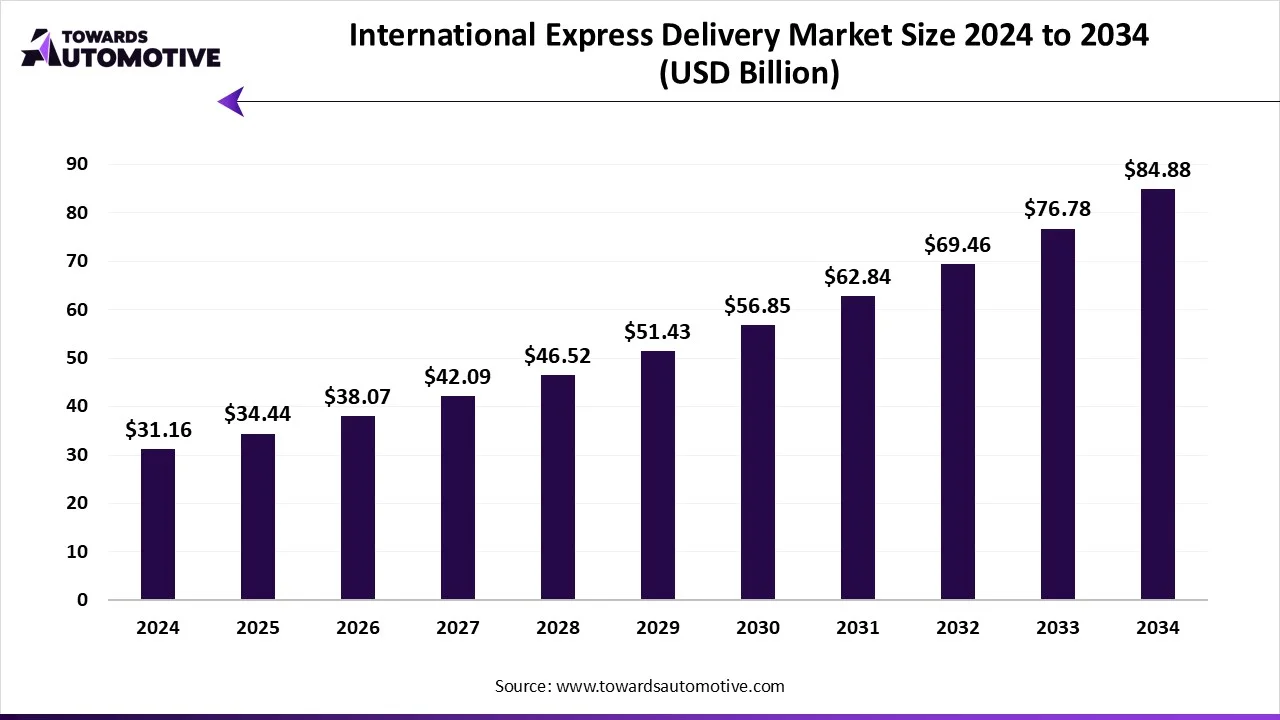

The international express delivery market is expected to increase from USD 34.44 billion in 2025 to USD 84.88 billion by 2034, growing at a CAGR of 10.54% throughout the forecast period from 2025 to 2034.The international express delivery market is growing rapidly due to the increasing emphasis of people for buying items online from international e-commerce platforms. Demand for the market is growing as consumers and businesses increasingly want fast and reliable shipping options.

Moreover, digital visibility, tracking, automation, and AI-enabled technology are allowing logistics providers to develop faster and more efficient delivery solutions. In addition, partnerships and collaborations between logistics companies and digital platforms provide strong opportunities to expand global networks and capture a wider customer base.

The International Express Delivery Market refers to the global industry involved in providing fast, time-sensitive transportation and logistics services for parcels, documents, and goods across international borders. Companies that provide these major express delivery services target consumers and businesses with services for same-day, next-day, and standard delivery. It comprises of numerous modes of transport such as air, road, rail, and water. The types of customers that take international deliveries are individual consumers, small and medium enterprises (SMEs), and large enterprises. Payment methods in the international express delivery comprise prepaid services and cash on delivery (COD). Express delivery services can benefit e-commerce, healthcare, manufacturing, and retail industries specifically from the standpoint of speed, convenience, quality assurance, and ease of deployment. Strong opportunities arise in the market to cater to the growing demand from consumers, businesses, and government because of globalization and the increasing number of people shopping globally through digital platforms.

The trends in the international express market comprise of partnerships and collaborations between companies.

The air segment captured 56.7% of the international express delivery market share. Air transport is a dominant mode of transport for international goods because it is the fastest and most reliable, offering a guarantee of urgent delivery for high-value and perishable goods. Airport infrastructure, global airline networks, and consumer demand for next-day delivery dominate the use of air transport for international trade. Moreover, the e-commerce and healthcare sectors rely on air freight for time-sensitive shipments.

The rail segment is expected to experience the highest growth rate in the market between 2025 and 2034. Rail is growing the fastest because it provides a good balance between cost and speed. Rail transport is cheaper than air and faster than sea freight, making it an attractive choice. The cross-border networks for rail transport are expanding in Asia and Europe to meet demand for more sustainable and efficient transport solutions.

The next-day delivery segment captured around 45% of the market. Next-day delivery dominates the market because it provides a balance between speed and delivery costs, making it an affordable option. Next-day delivery is regarded as the first choice for e-commerce platforms and consumers wishing for delivery speed, while also being an affordable shipping option. Additionally, advanced networks in air transport and smart warehousing, together with global tracking systems, have enabled next-day delivery to be a reliable speed of delivery and the most accessible delivery speed internationally.

The same-day delivery segment is set to experience the fastest rate of market growth from 2025 to 2034. Same-day delivery is seeing the fastest growth as customers are demanding things instantly. Key drivers for this segment include investments in urban warehouses, drone technology, and automated last-mile delivery. Retailers and health care providers have the most use for this type of demand, where urgency is of importance. However, this delivery speed is limited to certain cities or geographical areas.

The small package shipments contributed around 60% of the total market share. Small packages will probably always dominate shipping as most international e-commerce orders are lightweight. Small package shipments are easier to ship (lighter), cheaper for customers and more streamlined through customs. Warehousing, automated sorting and flying generally have their protocols optimized for small parcels. There has never been a greater volume, per se, of shipped small packages than now due to the growth in online retailing, especially with cross-border consumers. Thus far, small packages lead the way in both dollar volume and shipping quantity.

The medium package shipments segment is expected to expand rapidly in the market in the coming years. Medium shipments are benefitting from the fastest growth rate due to demand for electronics both internationally and domestically, fashion items and multi-product orders. Companies are shipping more and more medium parcels across regions to offer consumers a premium product at a better value. And when a mid-size company ships from market or dropships an international order, more freight forwarders and express providers are investing in infrastructure to help accommodate this size of package. It is not just only cross-border it is the growth of B2B trade developments, and in-turn further global demand for freight and shipping medium package parcel forwarding.

The individual consumers segment led the market, capturing around 70% of the market share. This is because numerous individuals globally are demanding goods from retailers that are located in different geographical locations. Additionally, online payment platforms, smartphones, and international trade access allow individuals to seamlessly purchase products from anywhere in the world.

The SMEs segment is expected to witness significant growth in the market over the forecast period. This is due to the entry of new businesses into the global e-commerce landscape. Platforms like Shopify and Amazon have opened the world for sellers and their cross-border trade. SMEs have an even higher dependency on express delivery services to fulfill the needs of their international customers. Affordable delivery costs and digital payments for e-commerce, along with trade policies focused on consumer choice, keep SMEs up and coming in the international express delivery market.

The prepaid service market captured around 80% of the international express delivery market. Prepaid services dominate payment for international shopping because they are the fastest and most secure transaction method for cross-border shipments. Consumers prefer to pay pre-market to minimize their risk in the transaction, while logistics companies also benefit since they'll be guaranteed payment when the shipment is brought to their facility. Moreover, digital wallets, cards, and online payment platforms have made prepaid payment a more viable option.

The cash-on-delivery (COD) segment will gain a significant share of the market in the forecasted period. Cash on delivery is growing the fastest in these regions since trust in online payments is low in many regions. Emerging markets in Asia, Africa, and Latin America are moving towards the COD payment method. Moreover, a shift in consumer preference to pay only after they receive the goods boosts the COD segment in the market. E-Commerce companies in the markets cater to the emerging markets by offering cash-on-delivery services to expand their customer base.

The standard delivery segment led the market with a hold of 65% of the total market share. Standard delivery is the most popular option because it is the most affordable. Standard delivery becomes the most viable option when volumes are large, time frames are generally predictable, and cost is a matter of importance. Logistics providers all over the world have modified their systems to manage mass standard deliveries efficiently across all international countries to maintain operational efficiency of standardized parcels.

The expedited delivery segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Expedited delivery is growing the fastest because of the rising customer demand for immediate cross-border service. There are industries that need expedited delivery services, which typically include healthcare, electronics, and luxury merchandise. To cater to the growing market, express delivery providers are investing in expedited delivery through enhanced air networks and better customs clearance processes.

The international segment led the market and captured around 85% of the market share. International delivery is the leader in the market due to increased globalization and cross-border e-commerce and trade. Businesses and consumers are purchasing from sellers worldwide, which creates a massive demand for express delivery-type services. Additionally, trade agreements, customs technology improvements, and global logistics hubs have supported this segment.

The domestic segment is expected to experience the highest growth rate in the market in the forecasted period. Domestic express delivery is growing the fastest with the expansion of local e-commerce. As customers expect next-day or same-day shipping within their countries, express delivery companies are challenged to improve their last-mile networks exponentially. The growth of groceries, food delivery, and quick-commerce in certain regions further supports the domestic segment.

The retail and e-commerce segment captured around 50% of the total market share. This is due to the boom of online shopping throughout the world. A consumer from anywhere in the world can buy clothes, electronics, and household goods from foreign sellers and expect them to arrive fast. Improvements in digital payment platforms for global merchants and expanding e-commerce websites support the growth of this segment. Moreover, in a few countries like India and China, the massive boom in quick commerce highlights the rising demand in express delivery for the retail sector.

The healthcare & pharmaceuticals segment is set to experience the fastest rate of market growth in the forecasted period. The healthcare sector is growing at the fastest rate due to the urgent need for medicines, vaccines, and medical equipment requiring fast and reliable delivery. Cold-chain logistics and express services deliver products in the best condition to remain effective in transit. As health needs are increasing on a global scale, hospitals, medical laboratories, and pharmacies rely heavily on express providers to fulfill the demand. Moreover, the recent pandemic has elucidated the importance of urgent and quick international delivery for healthcare.

The digitally enabled delivery segment captured around 60% of the international express delivery market. Digitally enabled delivery dominates the market as real-time tracking, mobile applications, and smart dashboards have become a common practice. Moreover, to respond to customer expectations, logistics companies are investing in AI, automation, and cloud platforms that ensure their customers receive products accurately and in the right timeframe. Due to surging smartphone and internet users globally, digitally enabled services have become the core form of express delivery.

The autonomous delivery segment is expected to grow with the highest CAGR in the market in the forecasted period. Rapidly developing technologies such as drones, robots, and autonomous vans are being launched globally, supporting the growth of autonomous delivery. Automated delivery for last-mile logistics reduces the cost of delivery and reduces delivery time. Moreover, governments of numerous countries support pilot programs to test whether larger-scale use will be practical for autonomous delivery.

The B2B segment led the market, capturing over 55% of the international express delivery market. B2B plays a dominant role as global enterprises rely on express shipping to send documents, spare parts, and goods for trade. Corporations will often have ongoing, reliable, and fast delivery requirements across borders. Key drivers such as globalization through international trade, manufacturing supply chains, and cross-border partnerships ensure the dominance and growth in the segment.

The B2C segment is expected to expand rapidly in the market in the coming years. B2C is expanding at the fastest rate due to the boom in e-commerce globally. Consumers are now shopping across borders, and the volumes of parcels delivered continue to grow. Accessible, cost-effective platforms and apps for international shopping have made B2C shopping possible for millions of consumers around the world. Moreover, the increased usage of smartphones and digital payments supports B2C growth.

The standard packaging segment held around 75% of the international express delivery market share. Most parcels are sent in standard packaging as it is the most cost-efficient option, it is easily available off the shelf, it suits most goods, and it's the easiest option for companies to ship their goods in. Logistics companies use standard packaging as it provides the best overall efficiency and handling. Standardized box sizes are easier to track and manage as parcels can be sorted and stored more easily than odd packaging items or weights.

The custom packaging segment is expected to witness significant growth in the market over the forecast period. Custom packaging is accelerating the fastest in the last-mile delivery since businesses are transforming towards branding and ultimate protection for their products. E-commerce sellers are using custom boxes to create lasting customer experiences. Furthermore, fragile, luxury, and high-value items require packaging that includes custom elements. With the increasing competition in the online retail market, the incorporation of custom packaging as a form of marketing and protection has become a trend.

The online platforms segment captured 80% of the total market share. E-commerce, mobile applications, and online logistics platforms are enhancing simplicity and transparency in the process. Companies throughout the globe are increasingly investing in online platforms to attract customers and to boost the speed and efficiency of operations.

The offline stores segment will gain a significant share of the market over the studied period of 2025 to 2034. Offline stores will grow fastest as many customers prefer face-to-face booking and payment, especially in the developing regions. Emerging markets will use physical service centers instead of online platforms due to a lack of digital adoption in certain regions. Logistics providers and third-party service platforms are collaborating to expand the number of retail outlets available to customers without digital literacy.

The morning delivery segment led the market, capturing over 40% of the total market share. Morning delivery is most frequent because it is generally preferred by businesses and consumers. Receiving a parcel in the morning aligns with work schedules and the availability of a person to sign for it. Additionally, offices and retail stores would benefit from shipments arriving in the morning to manage their supply chains smoothly.

The evening delivery segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Evening deliveries are growing at the fastest rate because customers are looking to be more flexible after their work hours. In busy lifestyles, customers are not available to take deliveries during the day and expect them during evenings after working hours. E-commerce companies are starting to provide this evening delivery window for their customers to provide the ultimate convenience and avoid missed deliveries.

The one-time delivery segment captured around 65% of the market share. One-time delivery has the largest share of the market, as the majority of shipments are infrequent and typically motivated by urgency, such as the delivery of important documents or gifts. Customers want flexibility and control over their costs without the need for a long-term contract. This is an appealing shipping option for small businesses and individuals needing international shipping only when they require it.

The recurring delivery segment is expected to experience the highest growth rate in the market between 2025 and 2034. Recurring delivery has the fastest rate of growth due to the inevitable need for global businesses, e-commerce platforms, or subscription services to establish regular and efficient cross-border shipping. Regular recurring delivery can be vital for companies conducting business internationally and selling products online. Moreover, recurring delivery accommodates reliable supply chains, predictable costs, and logistics partners to honor contractual obligations.

The standard delivery segment captured 90% of the international express delivery market. Standard delivery has the largest share of the market because it is the middle-ground between cost and speed of deliveries. Cost and speed make this a viable option for businesses or customers who are sending items that are not urgent and that are somewhat discretionary. In addition to a strong logistics capability, standard inter-country delivery provides predictable timelines and expected costs, at reasonable and predictable rates, making it the most commonly chosen delivery for international shipments.

The carbon-neutral delivery segment is set to experience the fastest rate of market growth from 2025 to 2034. Carbon-neutral delivery is growing at the fastest rate, driven by customers and regulators demanding more environmentally responsible shipping solutions. Logistics providers, on behalf of customers, will utilize carbon offsets, alternative renewables, and greener modes of transportation to reduce the effects of emissions released. Additionally, companies are utilizing this service to advance their sustainability goals and fulfill their carbon emission objectives.

Asia-Pacific captured around 44.66% share of the international express delivery market. The region dominates the market due to its rapid growth in the e-commerce sector, rising export , and a large manufacturing base. Several countries in the region such as China, Japan, and India have the largest volumes of parcels that are supported by advanced logistics hubs and growing digital trade. The strength of cross-border trade in electronics, textiles, and consumer goods, as well as investments in new delivery networks, is enabling Asia-Pacific businesses to be efficient with their delivery processes.

China led the international express delivery market in the Asia-Pacific region. China is home to E-commerce giants like Alibaba and JD.com that create substantial amounts of parcel volumes from their cross-border operations. China's strength and the scope of its exports provide a steady supply of international shipments to delivery providers. Additionally, the Chinese government has made substantial investments in logistics infrastructure to enhance efficiency in the logistics sector.

Latin America is expected to grow with the highest CAGR during the forecast period of 2025 to 2034. In Latin America, businesses and consumers have become increasingly reliant on international express delivery to gain access to the global goods market. Notable trends in the region include increasing trade links between Latin American countries and North America, improvements to domestic logistics infrastructure, and investment by businesses in last-mile delivery services.

Brazil dominates the international express delivery market in Latin America due to its large population and a growing culture of online shopping. Moreover, businesses in this region depend on international express delivery services to engage with North American, European, and Asian countries. Additionally, investment in logistics infrastructure, demand for express delivery and some others are a few key drivers for the country.

The international express delivery market is highly competitive. Some of the prominent players in the market are DHL Express, FedEx Corporation, United Parcel Service (UPS), Aramex PJSC, SF Express (Group) Co. Ltd, China Post Group Corporation, Japan Post Holdings Co., Ltd., Royal Mail Group, La Poste (France), Canada Post Corporation, Australia Post, Deutsche Post AG, Yamato Holdings Co., Ltd., Singapore Post Limited, Poste Italiane S.p.A., Swiss Post, Korea Post, India Post, Hongkong Post and South African Post Office. Companies operating in the global express delivery services market are expanding globally. Numerous companies are making capital investments in smart warehouses and automated last-mile delivery to enable digital solutions and real-time monitoring of their supply chains. Additionally, companies are also establishing relationships with third-party e-commerce platforms, government partners, or logistics hubs to expand their customer bases.

By Mode of Transport

By Delivery Speed

By Shipment Size

By Customer Type

By Payment Method

By Service Type

By Geographic Scope

By End User Industry

By Technology Adoption

By Delivery Model

By Packaging Type

By Delivery Channel

By Delivery Time Window

By Delivery Frequency

By Environmental Impact

By Regional Segment

The global electric vehicle fluid market, valued at USD 1.65 billion in 2024, is anticipated to reach USD 25.84 billion by 2034, growing at a CAGR of ...

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us