June 2025

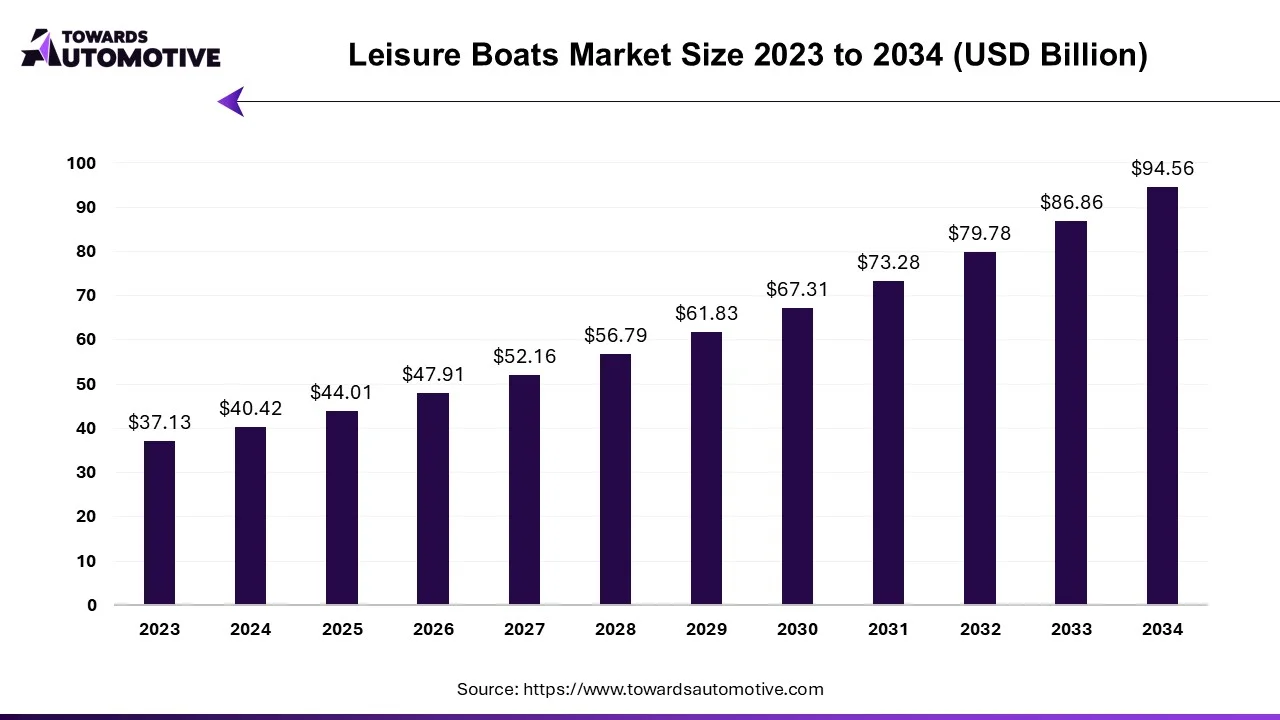

The leisure boats market is projected to reach USD 94.56 billion by 2034, expanding from USD 44.01 billion in 2025, at an annual growth rate of 8.87% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The leisure boats market is a dynamic and rapidly growing segment within the global recreational marine industry. Activities like fishing, sailing, cruising, and water sports are the main uses for these boats among families and individuals. Increased participation in outdoor recreational activities, rising disposable incomes, and expanding coastal tourism are the main factors propelling market expansion. Electric propulsion systems, integrated navigation tools, and intelligent onboard systems are examples of technological advancements that are changing user experiences and increasing demand. The use of eco-friendly materials and sustainable boating also affects consumer choices.

| Metric | Details |

| Market Size in 2024 | USD 40.42 Billion |

| Projected Market Size in 2034 | USD 94.56 Billion |

| CAGR (2025 - 2034) | 8.87% |

| Leading Region | North America |

| Market Segmentation | By Type, By Product and By Geography |

| Top Key Players | Brunswick Corporation, Groupe Beneteau, Ferretti Group, Yamaha Motor Co. |

Transition toward hybrid & electric models: Leading leisure boat builders are fast tracking hybrid and fully electric craft to meet tougher emission standards and rising eco tourism demand. These vessels combine high density battery packs with efficient hulls, delivering silent cruising and lower running costs.

Advancement in Autonomous & Smart Navigation: Automation is moving from super yachts into mainstream runabouts, with computer vision docking aids and AI route planning making boating easier and safer for novices.

Material Innovations for Hull Efficiency: Manufacturers are adopting lighter, stronger composites and next gen coatings to cut drag, curb fouling, and extend service intervalsboosting range for both electric and diesel craft.

Digital Integration & Predictive Maintenance: Connected telematics, OTA software updates, and AI diagnostics are transforming boats into data rich platforms, reducing downtime and enhancing the user experience.

Used leisure boat segment dominated the market in 2024, due to more people choosing affordable ownership particularly first-time purchasers and seasonal users. Dealer-certified programs, reputable resale platforms, and alluring financing options all contribute to the growing market for used boats. Customers who value immediate availability and lower depreciation risks than new boats are also drawn to the used boat market.

New leisure boat segment is expected to grow at the fastest rate during the forecast period, driven by the increasing adoption of electric and smart boats, as well as rising disposable incomes in emerging economies. Technological upgrades, custom design trends, and government incentives for green boating are encouraging consumers to invest in newer models. The surge in post-pandemic recreational demand is also pushing boat manufacturers to ramp up new production lines globally.

Motorized leisure boats held the dominant share of the market in 2024, owing to their adaptability and practicality for leisurely water sports fishing, and cruising. Demand across multiple user groups is supported by the availability of a broad variety of motor types including inboard outboard and jet propulsion. Motorized boats also provide superior power speed control and onboard amenities which makes them perfect for both luxury and recreational markets. Further encouraging adoption has been ongoing advancements in autopilot navigation noise reduction and engine efficiency. They are a popular option for charter operators and families due to their capacity to accommodate larger groups and their cutting-edge entertainment systems.

Non-motorized leisure boats are projected to grow at the fastest pace, fueled by a growing consciousness of environmental issues and the appeal of low-impact silent water sports like paddleboarding, kayaking, and sailing. Additionally popular for fitness and wellness, these boats are particularly popular in areas with inland waterways or ecotourism destinations. They are accessible to a wider range of customers due to their low maintenance costs and affordability. The use of non-motorized boats is also encouraged by national parks and nature reserves to protect marine biodiversity. It is anticipated that this market will continue to grow due to the increasing impact of adventure travel and minimalist leisure trends.

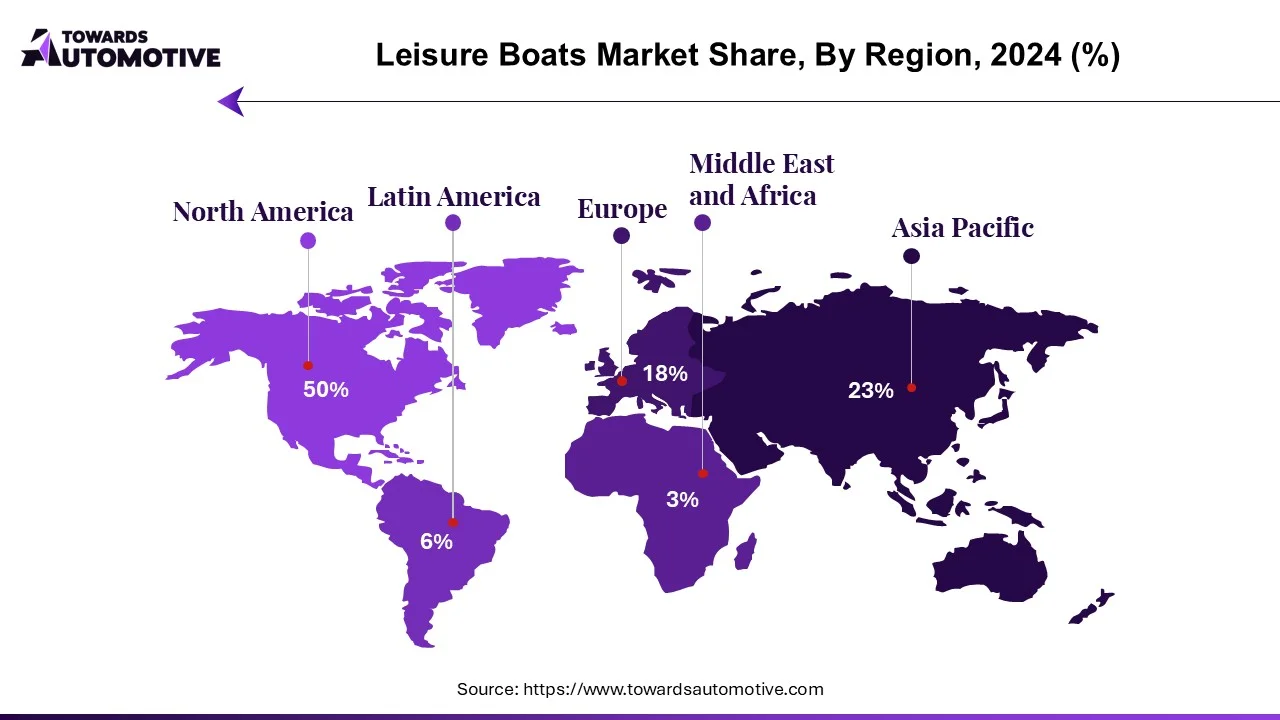

North America dominated the leisure boats market in 2024, supported by a strong culture of recreational boating, mature marina infrastructure, and a high concentration of boat ownership. Demand is bolstered by growing interest in marine tourism, lakefront living, and luxury watercraft. The presence of leading boat manufacturers and the widespread adoption of boat club services contribute significantly to market dominance. Seasonal boating activities and favorable boating laws also support high usage rates throughout the year.

Asia Pacific is expected to grow at the fastest rate, driven by the construction of new marina infrastructure, the growth in popularity of recreational marine activities, and rising income levels. Spending more on recreation is a result of both urbanization and the expansion of the middle class. To serve private boat owners and rental operators, new waterfront developments and leisure ports with a tourism focus are being created. Younger generations are becoming more aware of and desirous of owning a boat as a result of rapid digitalization and the influence of social media.

Europe holds a notable position in the global leisure boats market, supported by a strong consumer desire for environmentally friendly boating technologies and a long-standing tradition of marine recreation. The area keeps funding new developments in electric and hybrid boats as well as virtual boating experiences. Inland waterways and coastal cruise routes are closely spaced out, allowing for high levels of recreational use. Yacht events, marine expos and regional boat shows are also essential for sustaining consumer involvement and brand awareness.

The leisure boats market is a highly dynamic and innovation-driven industry, featuring several prominent players that continue to shape global trends. Key companies include Brunswick Corporation, Groupe Beneteau, Ferretti Group, Yamaha Motor Co., Candela Boats, Sunseeker International, Freedom Boat Club, Greenline Yachts, and Princess Yachts. These players are actively focusing on expanding their electric and hybrid boat portfolios, enhancing onboard technologies, and tapping into flexible ownership models such as boat clubs and subscription services. Strategies like technological partnerships, international boat show participation, regional expansions, and smart system integration are widely adopted to maintain their competitive edge.

By Type

By Product

By Geography

June 2025

June 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us