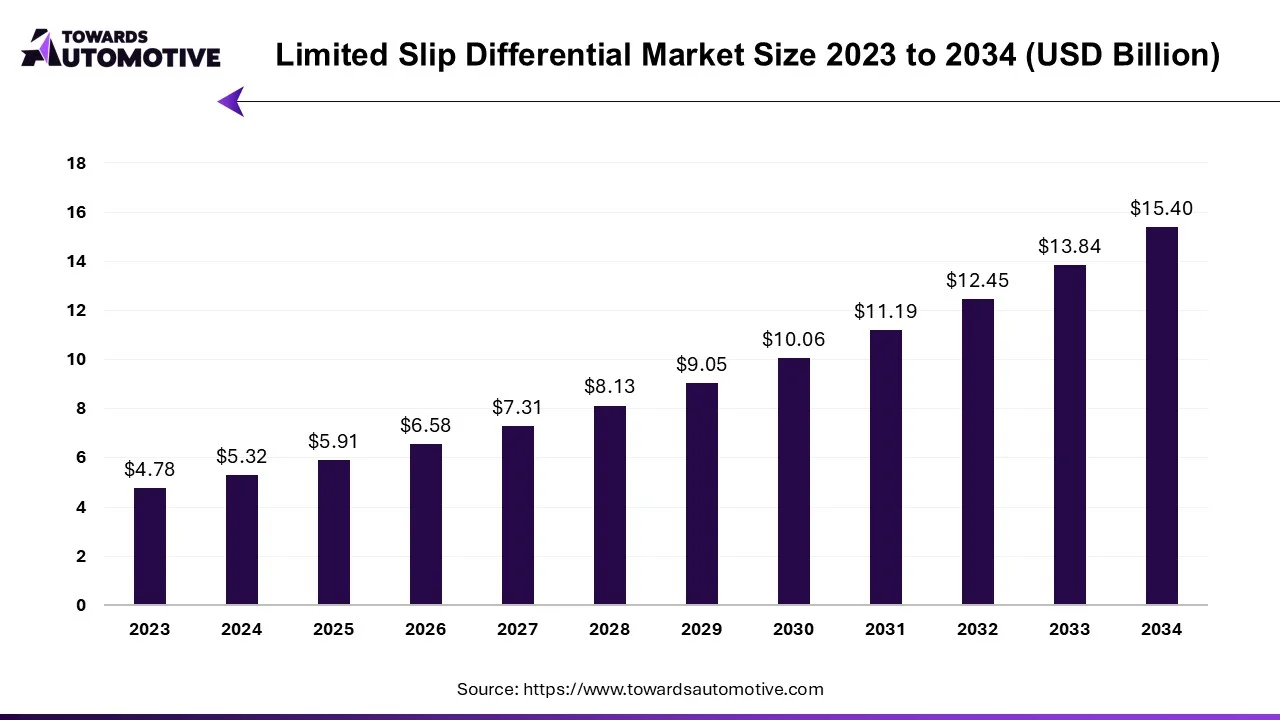

The limited slip differential market is set to grow from USD 5.91 billion in 2025 to USD 15.40 billion by 2034, with an expected CAGR of 11.22% over the forecast period from 2025 to 2034. The growing sales of SUVs in developed nations coupled with increasing use of limited slip differentials in high-performance vehicles to enhance traction and improve stability has boosted the market expansion.

Additionally, rapid investment by automotive brands to integrate high-quality components in vehicles along with availability of automotive components in online platforms is playing a vital role in shaping the industry in a positive direction. The technological advancements in hybrid vehicles and electric vehicles is expected to create ample growth opportunities for the market players in the upcoming days.

Unlock Infinite Advantages: Subscribe to Annual Membership

The limited slip differential market is a crucial branch of the automotive component industry. This industry deals in manufacturing and distribution of limited slip differential across the world. There are various types of differentials manufactured in this sector comprising of mechanical limited slip differential, electronic limited slip differential, torque blasting differential and clutch type differential. These differential finds application in cars, motorcycles and heavy machineries. The increasing sales of PHEVs in developing nations has contributed to the market expansion. This market is expected to rise significantly with the growth of the EV industry in different parts of the globe.

| Metric | Details |

| Market Size in 2025 | USD 5.91 Billion |

| Projected Market Size in 2034 | USD 15.40 Billion |

| CAGR (2025 - 2034) | 11.22% |

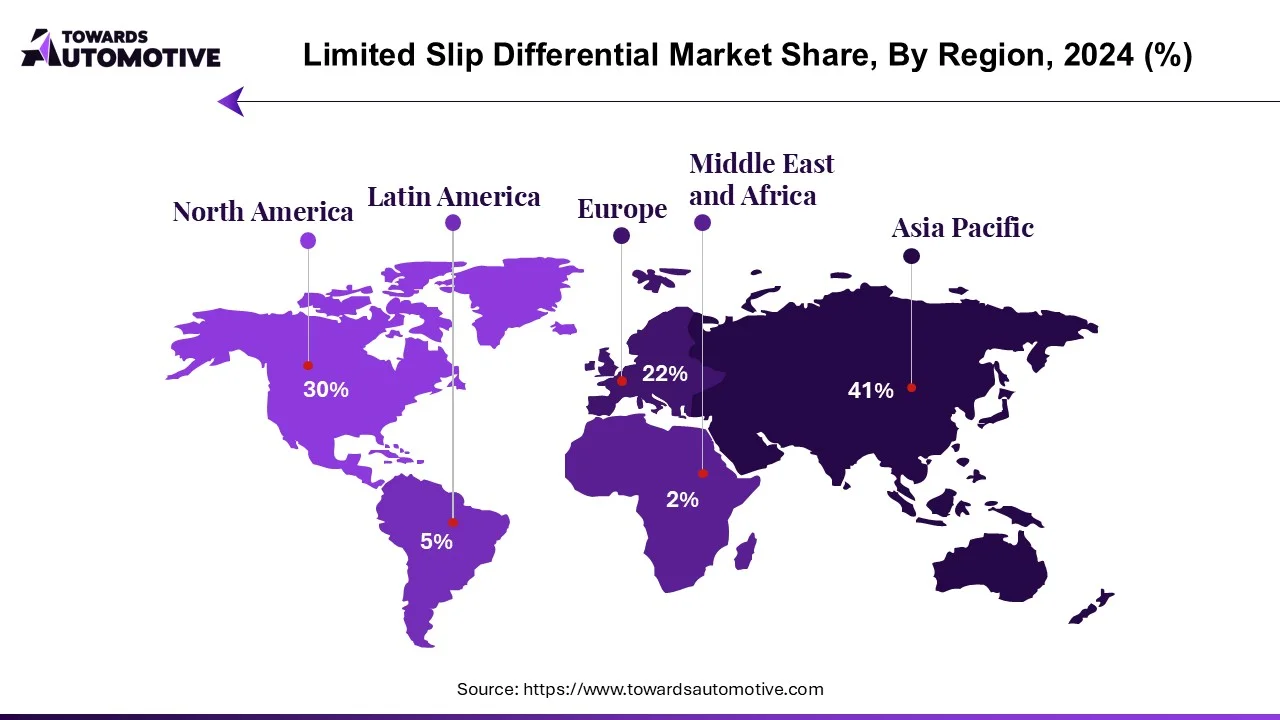

| Leading Region | North America |

| Market Segmentation | By Type, By End Use, By Application, By Drive Type and By Region |

| Top Key Players | Dana, Mitasu Oil, JTEKT, Toyota Industries, BorgWarner, Aisin Seiki, Schaeffler |

The major trends in this market consists of rapid adoption of EVs, acquisitions and growing sales of SUVs.

The EV adoption rate has increased drastically in the developed nations with an aim at reducing CO2 emission.

Numerous automotive brands are acquiring small component manufacturers to enhance their production capabilities.

The sales of SUVs have grown significantly due to rising interest of consumers towards off-roading activities coupled with enhanced comfort provided by SUVs.

The mechanical limited slip differential segment led the market. The rising use of mechanical limited slip differential systems in SUVs and off-roading vehicles to enhance stability has boosted the market growth. Additionally, various benefits of these differential systems such as enhanced traction, better handling, improved performance, reduced wheelspin and some others is expected to propel the growth of the limited slip differential market.

The electronic limited slip differential segment is expected to grow with a significant CAGR during the forecast period. The growing use of electronic limited slip differential in racing cars to enhance performance has driven the market expansion. Moreover, numerous advantages of these differential systems including improved traction, enhanced stability, active yaw control, driver-selectable modes and some others is expected to boost the growth of the limited slip differential market.

The passenger vehicles segment dominated the market. The growing production of passenger cars in several countries such as China, Germany, the U.S. and some others has boosted the market expansion. Additionally, the rising application of electronic limited slip differential in sports cars and drifting cars is playing a vital role in shaping the industry in a positive direction. Moreover, partnerships among market players and passenger car manufacturers to develop high-quality differentials is expected to propel the growth of the limited slip differential market.

The commercial vehicles segment is expected to rise with a considerable CAGR during the forecast period. The growing demand for pickup trucks from the e-commerce sector to deliver products at short distances has boosted the market expansion. Additionally, rapid investment by market players to manufacture advanced differential for commercial vehicles coupled with increasing sales of commercial vehicles in the APAC region is shaping the industrial landscape. Moreover, the rising use of mechanical limited slip differential in hybrid trucks and electric buses is expected to drive the growth of the limited slip differential market.

North America led the limited slip differential market. The growing adoption of BEVs in the U.S. and Canada to reduce emission and rising prices of fuel has boosted the market growth. Additionally, the existence of a well-established automotive sector due to numerous companies such as Tesla, Ford, General Motors, Rivian and some others along with rising demand for autonomous trucks from the logistics sector is further adding to the industrial expansion. Moreover, the presence of numerous market players such as BorgWarner, Dana Incorporated, American Axle & Manufacturing Inc. and some others is expected to propel the growth of the limited slip differential market in this region.

Asia Pacific is expected to expand with a significant CAGR during the forecast period. The rising investment by automotive component manufacturers for constructing new manufacturing hubs in several countries such as Japan, China, South Korea and some others has driven the market expansion. Also, the availability of skilled workforce coupled with increasing production of passenger vehicles is contributing to the industrial development. Moreover, the presence of various local differential manufacturers such as JTEKT Corporation, CUSCO Japan Co., Ltd., Hyundai Mobis and some others is expected to drive the growth of the limited slip differential market in this region.

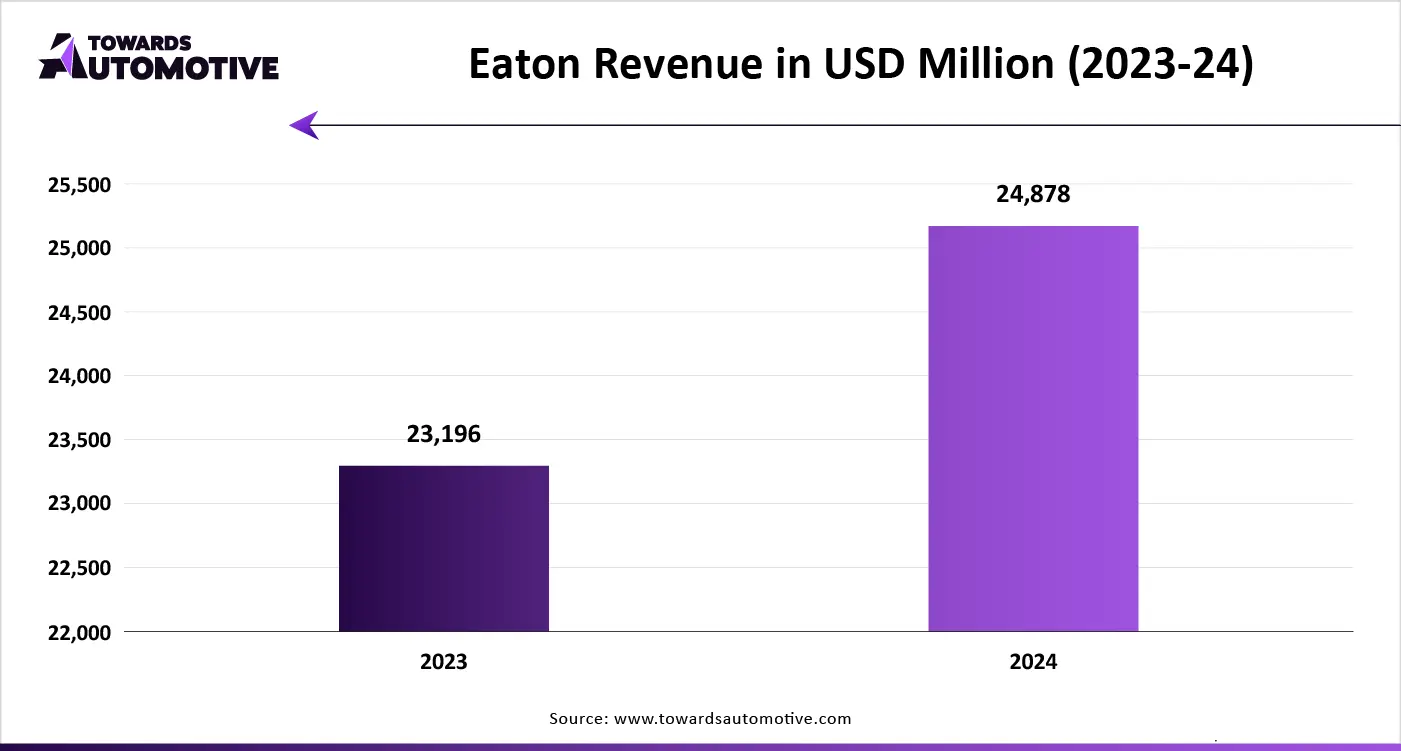

The limited slip differential market is a consolidated industry with the presence of a few dominating players. Some of the prominent companies in this industry consists of Dana, Mitasu Oil, JTEKT, Toyota Industries, BorgWarner, Aisin Seiki, Schaeffler, Hyundai Mobis, Nissan, Eaton, ZF Friedrichshafen, Torsen, Mitsubishi, GKN, Omron and some others. These companies are constantly engaged in developing high-quality differentials and adopting numerous strategies such as acquisitions, launches, business expansions, partnerships, joint ventures, collaborations and some others to maintain their dominance in this industry.

By Type

By End Use

By Application

By Drive Type

By Region

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us