September 2025

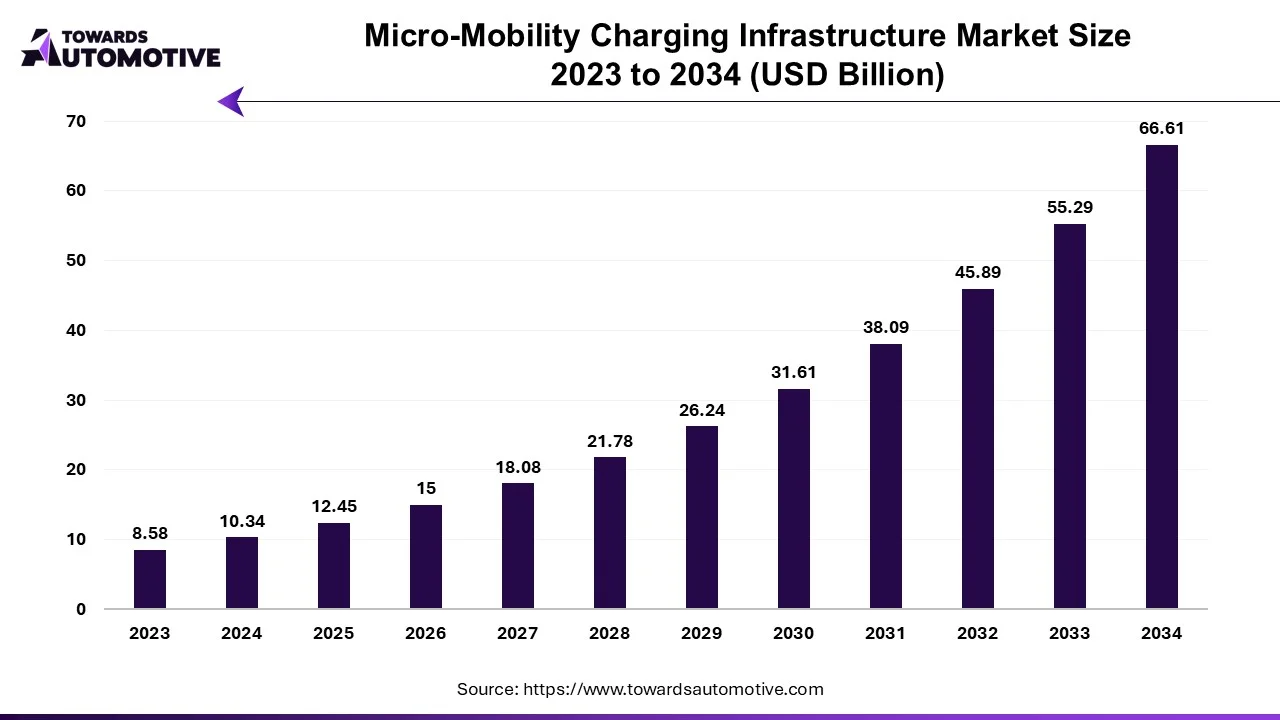

The micro-mobility charging infrastructure market is projected to reach USD 66.61 billion by 2034, growing from USD 12.45 billion in 2025, at a CAGR of 20.48% during the forecast period from 2025 to 2034.

The micro-mobility charging infrastructure market is experiencing significant growth, driven by the rapid adoption of micro-mobility solutions such as e-scooters, e-bikes, and other light electric vehicles (LEVs). These eco-friendly and cost-effective transportation options have become popular in urban areas worldwide, addressing the increasing demand for sustainable mobility, reducing traffic congestion, and lowering carbon emissions. As the adoption of micro-mobility vehicles rises, the need for an efficient, reliable, and accessible charging infrastructure has become critical to support their operation and growth.

This market includes solutions such as public charging stations, docking systems, and battery-swapping technologies tailored for the specific needs of micro-mobility vehicles. Governments and private stakeholders are making significant investments to expand charging networks, integrating them into smart city initiatives to enhance urban mobility ecosystems. Moreover, advancements in technology, such as IoT-enabled charging systems and renewable energy integration, are further boosting the market. These innovations improve operational efficiency, reduce costs, and promote the use of clean energy sources.

Additionally, the growing collaboration between micro-mobility operators, urban planners, and technology providers is driving the development of standardized and scalable infrastructure solutions. With the increasing focus on sustainability and urban mobility, the micro-mobility charging infrastructure market is poised for substantial growth, playing a pivotal role in shaping the future of transportation in cities worldwide. The market’s expansion underscores its importance in enabling the widespread adoption of micro-mobility solutions and fostering greener, smarter urban environments.

AI plays a transformative role in the micro-mobility charging infrastructure market, optimizing operations, improving user experience, and driving the integration of smart city solutions. One of the primary applications of AI is in predictive maintenance of charging stations. By analyzing data from IoT-enabled sensors, AI algorithms can identify potential issues with chargers before they fail, reducing downtime and ensuring reliable service for micro-mobility users. This predictive capability also minimizes repair costs and extends the lifespan of charging equipment.

AI enhances energy management by optimizing the use of renewable energy sources, such as solar or wind, in charging infrastructure. It achieves this by forecasting energy demand, balancing grid loads, and scheduling charging during off-peak hours to lower operational costs and reduce carbon footprints. Additionally, AI facilitates real-time monitoring and dynamic pricing for charging services, enabling operators to manage demand effectively while providing cost-efficient solutions for users.

For end-users, AI improves the overall experience by enabling features such as smart navigation to locate the nearest available charging stations, reservation systems, and personalized recommendations based on usage patterns. AI-powered mobile apps allow users to monitor charging status and receive alerts, streamlining the charging process.

Moreover, AI contributes to fleet management for shared micro-mobility services by optimizing charging schedules and vehicle deployment based on real-time demand, weather conditions, and traffic patterns. This not only boosts operational efficiency but also supports sustainable urban mobility by ensuring the availability of charged vehicles.

Supportive government initiatives aimed at promoting sustainable transportation are significantly driving the growth of the micro-mobility charging infrastructure market. Governments worldwide are increasingly recognizing the role of micro-mobility solutions, such as e-scooters, e-bikes, and e-mopeds, in reducing urban congestion, cutting greenhouse gas emissions, and enhancing public transportation systems. This has led to the implementation of policies, subsidies, and infrastructure investments specifically tailored to bolster the adoption of micro-mobility and its supporting charging infrastructure. Many cities are providing financial incentives for charging station installations, offering grants, and creating favorable regulations to encourage private and public sector investments in this space.

Additionally, urban planning initiatives that prioritize green and smart city development are further fueling demand for micro-mobility charging infrastructure. Governments are incorporating micro-mobility charging hubs into integrated transport networks, ensuring seamless connectivity and accessibility. Incentives such as tax benefits for companies investing in sustainable charging solutions and the allocation of public spaces for charging stations are also accelerating the market's growth.

Moreover, initiatives aimed at increasing the adoption of renewable energy in transportation are creating opportunities for the development of eco-friendly charging solutions. This not only aligns with global sustainability goals but also appeals to environmentally conscious users. By fostering an ecosystem that supports widespread micro-mobility adoption, these government-driven efforts are creating a robust foundation for the growth of the micro-mobility charging infrastructure market. As policies and infrastructure investments continue to evolve, this market is expected to witness sustained expansion.

The micro-mobility charging infrastructure market faces several restraints, including high installation costs, limited availability of charging networks in remote or underdeveloped areas, and the lack of standardized charging protocols. These factors hinder widespread adoption, particularly in emerging economies with insufficient infrastructure. Additionally, the dependency on grid electricity raises concerns about energy sustainability and reliability, especially during power outages. Consumer hesitation due to inadequate awareness and the perceived complexity of installation further restrain the growth of this market segment.

The growing adoption of shared micro-mobility services including electric scooters, e-bikes, and e-mopeds, is creating significant opportunities in the micro-mobility charging infrastructure market. As urbanization accelerates and cities face rising traffic congestion and environmental concerns, shared micro-mobility services offer a sustainable, efficient, and affordable transportation solution. This surge in adoption necessitates the development of robust charging infrastructure to support fleets of shared vehicles. Operators require scalable, efficient, and strategically located charging stations to ensure seamless service and minimize downtime. The integration of advanced technologies, such as IoT-enabled charging stations and data-driven fleet management, further enhances operational efficiency, driving the demand for modern charging solutions.

Moreover, public-private partnerships are increasingly investing in charging infrastructure to support shared mobility, with municipalities incentivizing the development of accessible and sustainable solutions. Opportunities also arise from the integration of renewable energy sources, such as solar-powered charging hubs, aligning with global sustainability goals and reducing operating costs. Additionally, as shared mobility expands to suburban and rural areas, there is a growing need for decentralized and community-focused charging networks, creating opportunities for providers to tap into new markets. By addressing these demands, the micro-mobility charging infrastructure market is poised to play a pivotal role in the growth and sustainability of shared mobility services worldwide.

The wired segment held a dominant share of the market. The wired segment plays a pivotal role in driving the growth of the micro-mobility charging infrastructure market, offering a reliable, cost-effective, and widely accessible solution for charging electric scooters, bikes, and other micro-mobility vehicles. This segment is characterized by traditional plug-and-charge systems that use wired connections to power vehicles, making them a dependable option for both public and private charging needs. As micro-mobility solutions continue to gain traction worldwide, the wired segment provides a foundational infrastructure that supports their widespread adoption.

One of the key growth drivers of the wired segment is its affordability and ease of deployment. Compared to wireless or advanced charging technologies, wired systems require less capital investment, enabling rapid installation in urban areas, residential complexes, and commercial spaces. This affordability is particularly significant in emerging markets where budget constraints often limit the adoption of cutting-edge technologies.

Furthermore, the compatibility of wired systems with a diverse range of vehicles ensures their widespread applicability, attracting investments from private operators and municipalities looking to establish robust charging networks. The simplicity of operation and maintenance of wired charging stations enhances their appeal, fostering user confidence and driving consistent utilization rates.

The wired segment also benefits from technological advancements, such as smart charging solutions that optimize energy use and provide real-time monitoring. These innovations enhance efficiency and align with sustainability goals, further solidifying the wired segment’s role in the market.

The residential segment led the industry. The residential segment plays a crucial role in driving the growth of the micro-mobility charging infrastructure market, as the increasing adoption of electric scooters, bikes, and other micro-mobility vehicles for personal use creates a growing need for convenient and accessible home-based charging solutions. With urbanization and the rising preference for eco-friendly transportation, consumers are investing in micro-mobility vehicles, and residential charging infrastructure has emerged as a key enabler for their seamless operation. This segment addresses the demand for hassle-free, private charging options, allowing users to recharge their vehicles at their convenience.

One of the primary growth drivers in the residential segment is the increasing shift toward sustainable transportation solutions. As more individuals embrace micro-mobility vehicles for daily commutes, the need for home charging systems that offer flexibility and cost savings becomes vital. Home charging stations reduce reliance on public charging networks, ensuring vehicles are fully charged overnight and ready for use, thus enhancing user convenience.

The residential segment also benefits from advancements in charging technology, such as compact, energy-efficient charging units that are easy to install and integrate into existing electrical systems. Moreover, smart home integration and IoT-enabled chargers allow users to monitor energy usage and schedule charging, aligning with the broader push for energy efficiency and sustainability.

Government incentives and subsidies for home-based charging installations further encourage adoption, making residential charging a critical driver for the expansion of the micro-mobility charging infrastructure market. This segment not only supports the growth of the market but also accelerates the transition towards cleaner, greener transportation.

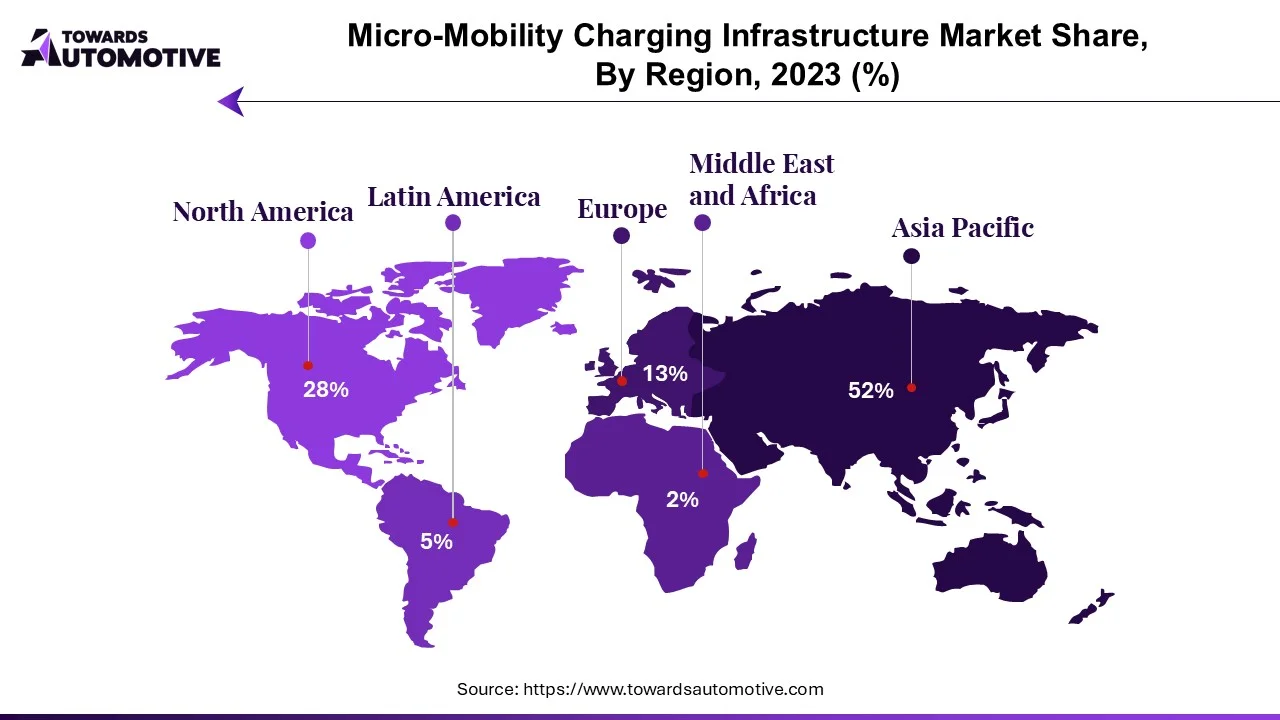

Asia Pacific dominated the micro-mobility charging infrastructure market. The micro-mobility charging infrastructure market in Asia-Pacific (APAC) is driven by rapid urbanization, government initiatives promoting electric mobility, and the increasing popularity of shared micro-mobility services. APAC's burgeoning urban population has created a demand for compact, cost-effective, and sustainable transportation solutions like e-scooters and e-bikes, boosting the need for robust charging infrastructure.

Government support plays a pivotal role in fostering the market. Countries like China, India, and Japan are implementing policies and providing subsidies to encourage the adoption of electric vehicles, including micro-mobility solutions. Investments in green energy projects and the establishment of smart city initiatives further propel the development of charging networks across urban and semi-urban areas.

The rapid expansion of shared mobility services is another significant growth driver in the region. Companies offering e-scooter and e-bike rentals are scaling their operations to meet the increasing demand from commuters seeking affordable and eco-friendly alternatives. This trend has led to a surge in the deployment of dedicated charging hubs to ensure operational efficiency.

Advancements in charging technology, such as portable and fast-charging solutions, enhance the convenience of micro-mobility users, making these vehicles more accessible and practical for daily commutes. Additionally, the integration of IoT-based energy management systems in charging networks optimizes energy use and reduces operational costs, attracting investments in the market.

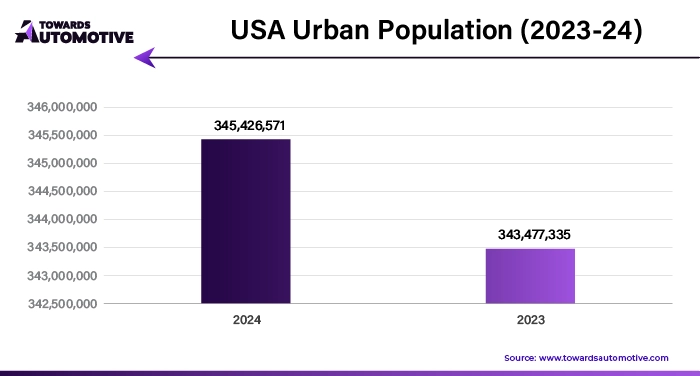

North America is expected to grow with the highest CAGR during the forecast period. The growth of the micro-mobility charging infrastructure market in North America is driven by several factors, including increasing urbanization, rising adoption of shared mobility services, and strong government support for sustainable transportation solutions. The growing trend of urbanization in the region has led to greater demand for compact, eco-friendly transportation options such as e-scooters, e-bikes, and other micro-mobility solutions. This surge in adoption necessitates a robust charging infrastructure to support the widespread use of these vehicles, spurring market growth.

The rise of shared mobility services further accelerates the demand for micro-mobility charging infrastructure. Companies offering e-scooter and e-bike sharing services are rapidly expanding their fleets across major cities in North America. To ensure seamless operations and minimize downtime, these providers are investing in dedicated charging hubs and integrating advanced solutions, thereby driving the market.

Government initiatives and regulations promoting green energy and sustainable urban mobility also play a crucial role. Federal, state, and local governments in North America are introducing subsidies and incentives to encourage the adoption of electric vehicles, including micro-mobility solutions. They are also investing in the development of public charging infrastructure, further supporting market expansion.

Technological advancements in charging solutions, such as wireless and fast-charging systems, enhance user convenience and boost adoption. Additionally, the integration of IoT and AI technologies in charging networks improves energy management and operational efficiency, attracting investments and fostering market growth in the region. Thus, the above-mentioned factors position North America as a key region for the growth of the micro-mobility charging infrastructure market.

By Vehicle Type

By Charger Type

By Power Source

By End-Use

By Region

September 2025

July 2025

February 2025

February 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us