September 2025

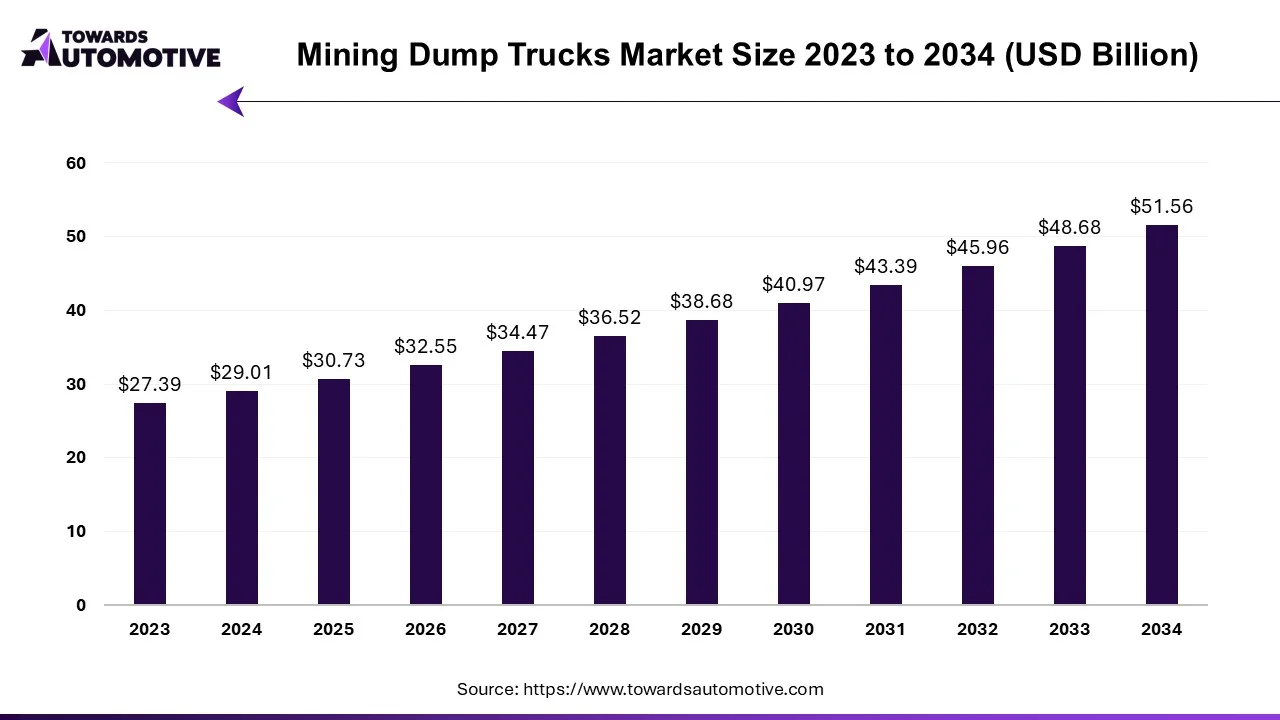

The mining dump trucks market is forecasted to expand from USD 30.73 billion in 2025 to USD 51.56 billion by 2034, growing at a CAGR of 5.92% from 2025 to 2034.

The demand for mining trucks is anticipated to increase due to the rising mining activity driven by the continuous demand for minerals and ores, essential for various industries and infrastructural projects. Moreover, the global mining industry requires skilled human resources. The COVID-19 outbreak and subsequent industrial shutdowns have prompted mining companies to enhance production efficiency, consequently driving the demand for more mining trucks. Additionally, 2021 witnessed substantial growth in mining activities, marking a phase of recovery and growth potential.

The Dump Trucks and Mining Trucks Market size is estimated at USD 28.76 billion in 2024, and it is projected to reach USD 38 billion by 2029, with a compound annual growth rate (CAGR) of 5.73% during the forecast period (2024-2029).

The demand for mining trucks is anticipated to increase due to the rising mining activity driven by the continuous demand for minerals and ores, essential for various industries and infrastructural projects. Moreover, the global mining industry requires skilled human resources. The COVID-19 outbreak and subsequent industrial shutdowns have prompted mining companies to enhance production efficiency, consequently driving the demand for more mining trucks. Additionally, 2021 witnessed substantial growth in mining activities, marking a phase of recovery and growth potential.

Over recent years, major markets for dump and mining trucks such as China, India, and Europe have implemented stringent emissions standards, necessitating electrification and hybridization. These regulations, such as Bharat 6 in India, China 6 in China, and Euro 6 in Europe, have propelled the adoption of electric vehicles. Governments are promoting electric truck sales through incentives like direct tax credits, further encouraging adoption. Electric trucks offer significant emissions reduction potential, crucial for the mining sector, where trucks contribute over 60% of total mine emissions.

For example, in September 2022, Kaunis Iron in Sweden commenced testing 74-ton electric trucks in collaboration with Volvo Trucks. The electric trucks were tested for transporting iron ore over a 160 km road, with Kaunis Iron planning to invest significantly in electrifying its truck fleet. Similarly, Newcrest Mining announced plans to electrify its entire diesel truck fleet at its Brucejack gold-silver mine in Canada, aiming to achieve substantial CO2 emission reductions.

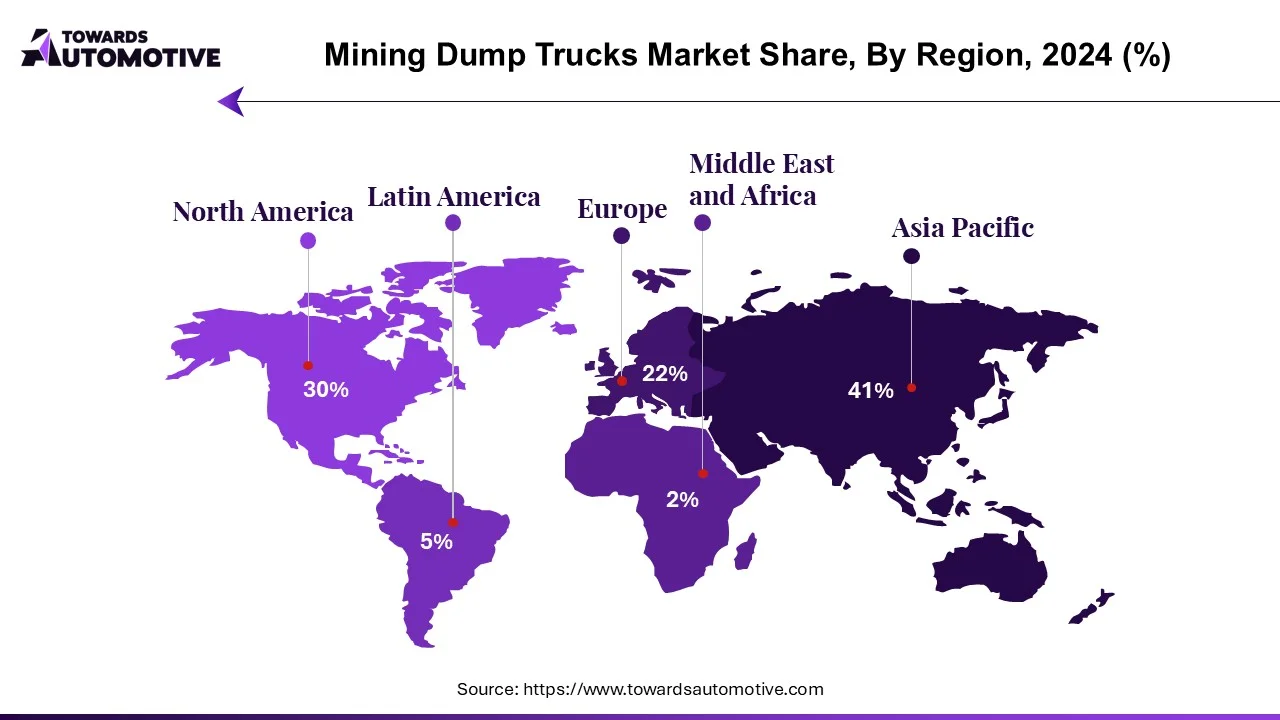

The Asia-Pacific dump trucks and mining trucks market is driven by increased mining activities in countries like China, India, Japan, and Australia. China's efforts to reduce coal import dependency and boost steel production contribute significantly to mining truck demand. India has also witnessed growth in mining output, with initiatives like Coal India Limited's pilot project to use LNG as an alternative fuel for dump trucks, aimed at reducing carbon emissions.

China is taking significant steps to lessen its reliance on energy resources. The National Development and Reform Commission (formerly the State Planning and National Development Planning Office) has announced plans to surpass 4 billion tons of coal production in 2021, aiming to increase production by 300 million tons annually. This move is intended to decrease the country's dependence on energy imports. Amid record-high global prices following Russia's invasion of Ukraine, this increase in production capacity is expected to reduce China's reliance on foreign energy sources. Additionally, China stands as the world's largest steel producer, manufacturing about half of the global steel output. Furthermore, the country dominates the production of rare metals, accounting for approximately 90% of the world's total.

Similarly, India has played a significant role in boosting mining production in the Asia-Pacific region. As per the Indian Ministry of Mines, as of FY22, there are 1,245 operational mines contributing to sustainable resource development. The robust activities in the mining sector have prompted various stakeholders to introduce innovative transportation methods and mining technologies at mining sites. For instance, in September 2021, Coal India Ltd partnered with the national gas company GAIL and Indian mining company OWM BEML to initiate a pilot project utilizing LNG for the dual-fuel operation of dump trucks. With the aim of reducing carbon emissions, these companies have begun installing LNG conversion equipment on two 100-ton trucks deployed by Mahanadi Coalfields Ltd (MCL) at its Lakhanpur mine in Odisha's Jharsuguda district.

The global dump trucks and mining trucks market exhibits a moderate level of consolidation, characterized by the presence of a limited number of active local and international players. Key market players include industry giants such as Caterpillar, Inc., Doosan Infracore, Hitachi Construction Machinery Co., Ltd., and Liebherr Group, among others. These companies are actively engaged in developing and integrating new technologies into their existing models, introducing new models to the market, and exploring new and untapped market opportunities.

Mining companies are increasingly investing in expanding their operations, presenting lucrative opportunities for various mining equipment manufacturers. For instance, in March 2021, Rio Tinto Company announced its plans to commence Tellurium production at the Kennecott mine in the United States. The company disclosed an investment of USD 2.9 million towards the metal recovery process, with a projected production capacity of 20 tons per year. Tellurium holds significance in the production of photovoltaic cells, thus indicating the strategic importance of this investment in meeting the growing demand for renewable energy sources.

Overall, the dump trucks and mining trucks market is witnessing dynamic growth driven by increased mining activities globally. The continuous demand for minerals and ores, essential for various industries and infrastructure projects, is fueling the demand for mining trucks. Furthermore, factors such as the need for enhanced production efficiency, particularly in the aftermath of the COVID-19 pandemic-induced disruptions, are further propelling the demand for mining trucks.

The industry is also responding to evolving regulatory requirements, particularly regarding emissions and environmental sustainability. To comply with stringent regulations and reduce their carbon footprint, mining companies are increasingly adopting innovative technologies such as electrification and automation. Electric powertrains and hybridization are becoming increasingly prevalent in mining truck designs, aiming to minimize emissions and improve operational efficiency.

Asia-Pacific emerges as a key region driving the growth of the dump trucks and mining trucks market, owing to the significant mining activities in countries like China, India, Japan, and Australia. With the rise in surface mining operations and the increasing adoption of advanced mining technologies, the region presents ample opportunities for market expansion.

Dump trucks and mining trucks market is poised for robust growth in the coming years, driven by factors such as increased mining activities, technological advancements, and regulatory compliance requirements. Key players are focusing on innovation and strategic partnerships to capitalize on emerging opportunities and maintain their competitive edge in the market.

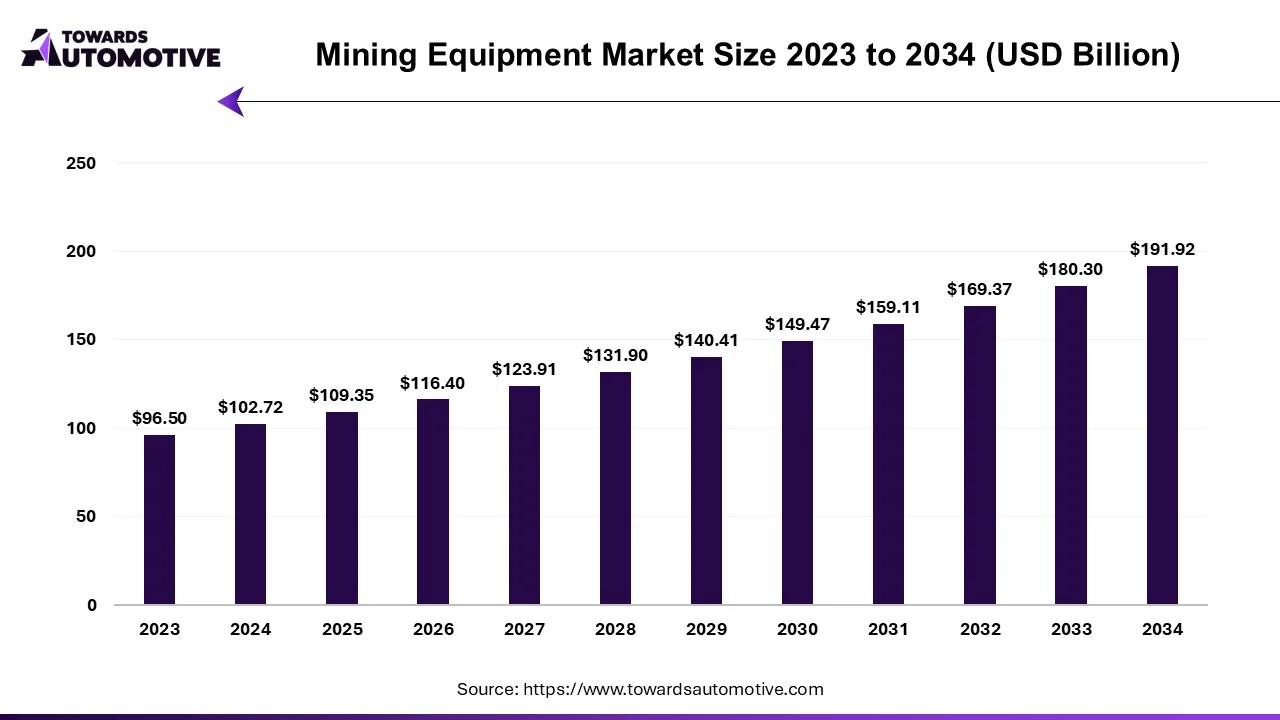

The mining equipment market is forecast to grow from USD 109.35 billion in 2025 to USD 191.92 billion by 2034, driven by a CAGR of 6.45% from 2025 to 2034.

The mining equipment market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of equipment that are used for enhancing mining activities. There are numerous types of equipment developed in this sector comprising of underground mining equipment, surface mining equipment, crushing equipment, pulverizing equipment, screening equipment, drills, breakers and some others. These equipment are powered by different sources including gasoline and electric. It finds several applications in metal mining, non-metal mining, coal mining and some others. The rapid growth in mine production has increased the demand for mining equipment, thereby contributing to the industrial expansion. This market is expected to grow significantly with the rise of the mining industry in different parts of the world.

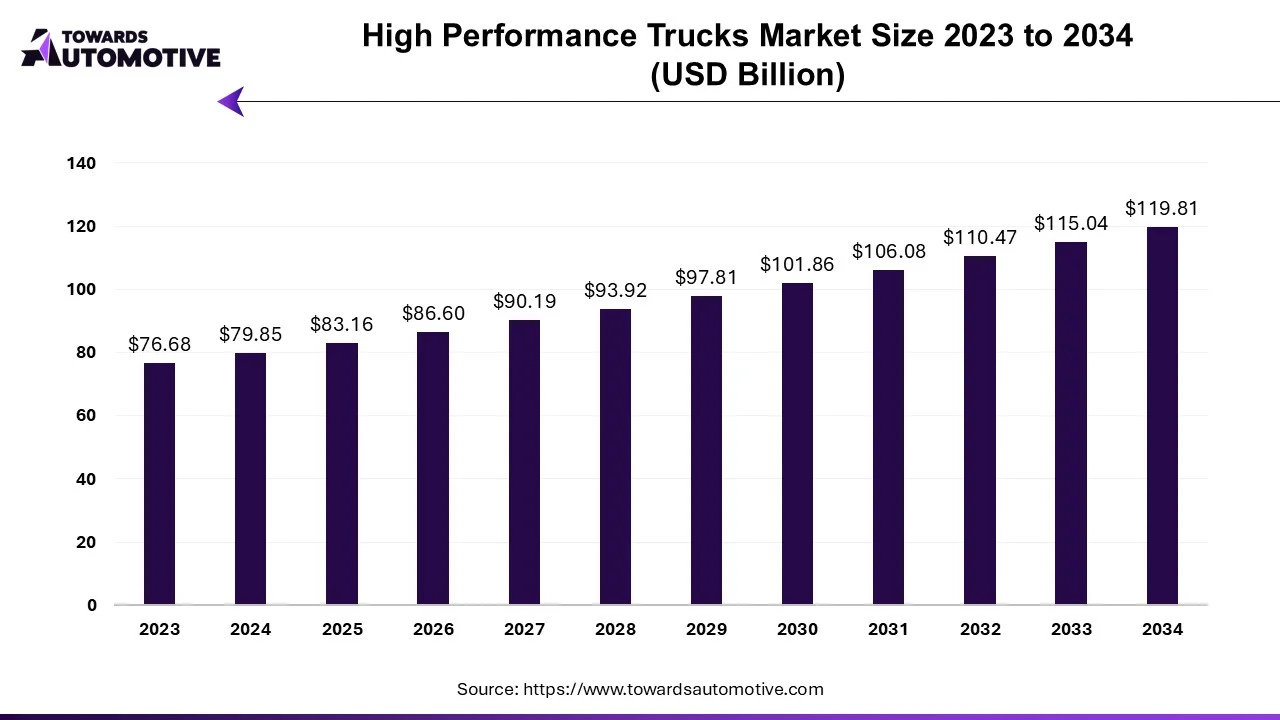

The high performance trucks market is anticipated to grow from USD 83.16 billion in 2025 to USD 119.81 billion by 2034, with a compound annual growth rate (CAGR) of 4.14% during the forecast period from 2025 to 2034.

Initially, trucks were solely utilized for heavy-duty tasks. However, modern automakers have adapted by offering high-performance vehicles that serve as contemporary automobiles, providing enhanced comfort (accommodating up to five occupants), increased interior space, and improved fuel efficiency. High-performance trucks represent the pinnacle of truck technology, featuring robust engines and sophisticated electronic controls for efficient operation. These vehicles are equipped with advanced electronic control systems, power steering, and traction systems, making them ideal for various applications such as refrigerated transport, tanker operations, container hauling, and ready-mixed concrete delivery. High-performance trucks are typically classified into medium trucks, heavy trucks, and pickup trucks. The commercial vehicle market is primarily driven by increased investments in trucks and demands for quality enhancements by buyers.

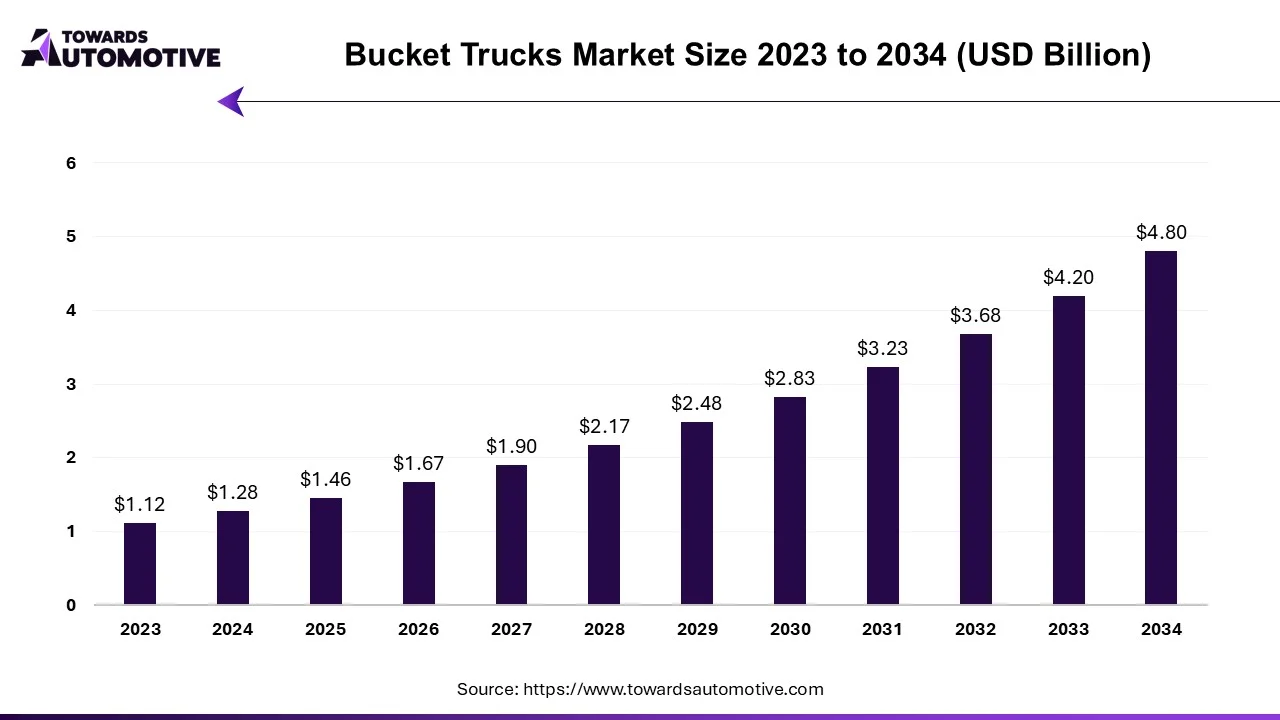

The bucket trucks market is forecasted to expand from USD 1.46 billion in 2025 to USD 4.80 billion by 2034, growing at a CAGR of 14.14% from 2025 to 2034.

The global economy relies heavily on the development and maintenance of infrastructure, which encompasses a wide range of projects such as roads, bridges, and public facilities. As countries invest in infrastructure projects to accommodate urbanization and economic growth, the demand for trucks, especially specialized ones like bucket trucks, is on the rise. These trucks play a crucial role in various tasks such as lighting installation, power line maintenance, and repair work in elevated areas. The expansion and improvement of cities, coupled with the initiation of new infrastructure projects, continue to drive the growth of the truck market. As urban areas expand and new construction projects emerge, there is a growing need for trucks equipped to handle specialized tasks efficiently and safely.

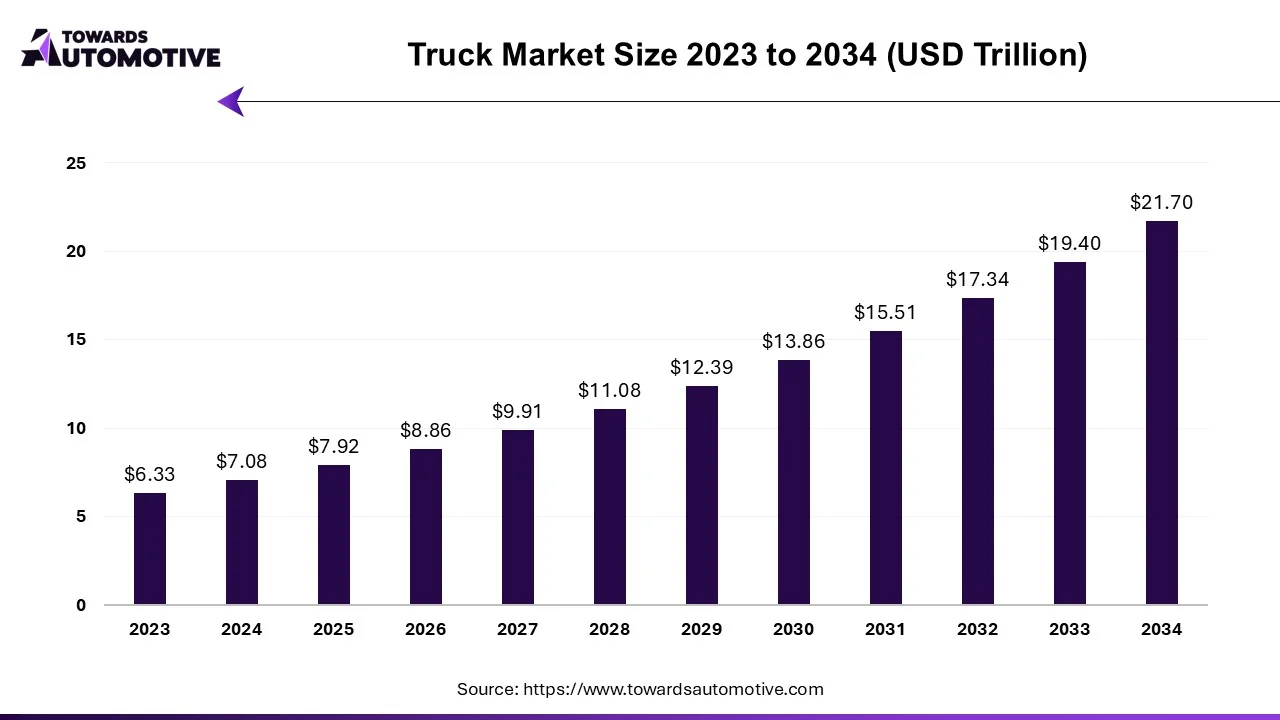

The truck market is forecast to grow at a CAGR of 11.85%, from USD 7.92 trillion in 2025 to USD 21.70 trillion by 2034, over the forecast period from 2025 to 2034. The growing demand for light-duty trucks from the e-commerce sector coupled with technological advancements in the automotive industry is playing a vital role in shaping the industrial landscape.

Moreover, the rapid adoption of electric trucks in the logistics sector along with rise in number of fleet operators has contributed to the market expansion. The research and development activities related to hydrogen trucks is expected to create ample growth opportunities for the market players in the future.

The truck market is a prominent branch of the commercial vehicle industry. This industry deals in manufacturing and distribution of trucks in different parts of the world. There are different classes of trucks available in the market comprising of class 3 trucks, class 4 trucks, class 5 trucks, class 6 trucks, class 7 trucks, class 8 trucks and some others. These trucks are powered by various propulsion technologies including gasoline, diesel, electric, natural gas, FCEVs and some others. It finds application in numerous end-user industries consisting of logistics & transportation, construction & infrastructure, retail & e-commerce, mining and some others. This market is expected to rise drastically with the growth of the automotive sector across the globe.

By Truck Type

By Fuel Type

By Capacity Type

By Application Type

By Geography

September 2025

June 2025

October 2025

June 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us