September 2025

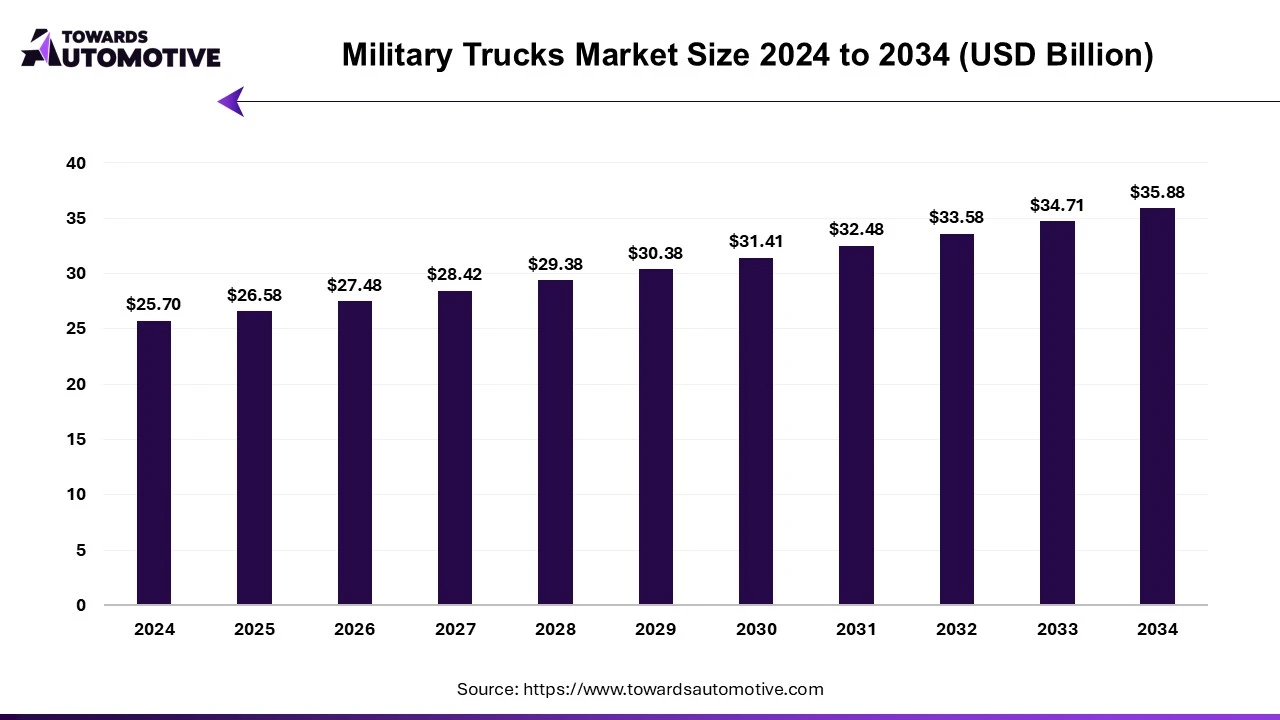

The global military trucks market size to grew to USD 26.58 billion in 2025, and is projected to reach around USD 35.88 billion by 2034. The market is expanding at a CAGR of 3.40% between 2025 and 2034.

The rising defense expenditure by government of several countries coupled with entry of new startup companies has contributed to the industrial expansion. Additionally, technological advancements in the defense sector along with rapid adoption of driverless trucks in the military sector is playing a vital role in shaping the industry in a positive direction. The research and development activities related to hybrid and electric trucks for the military sector is expected to create ample growth opportunities for the market players in the upcoming years.

The military trucks market is a crucial branch of the defense industry. This industry deals in manufacturing and distribution of military trucks in different parts of the world. There are several types of trucks developed in this sector comprising of armored trucks, cargo trucks, personnel carriers, specialized trucks and some others.

These trucks can carry different payload capacities including light (less than 5 tons), medium (5-15 tons) and heavy (more than 15 tons). It is equipped with various protection level consisting of unarmored level, light armored level, medium armored level, heavy armored level and some others. The growing sales of all-terrain military trucks in advanced nations has contributed significantly to the industrial expansion. This market is expected to rise drastically with the growth of the automotive sector around the globe.

The major trends in this market consists of rising geopolitical issues, increasing defense budget and rapid adoption of autonomous military trucks.

The armored trucks segment led this industry. The growing demand for armored trucks from military sector to provide additional protection to personnel from enemies has boosted the market growth. Additionally, the rising use of advanced trucks that are equipped with several weapons systems including cannons, machine guns, missile launchers and some others is expected to drive the growth of the military trucks market.

The cargo trucks segment is expected to rise with the fastest CAGR during the forecast period. The growing application of cargo trucks in warfare zones for transporting several items such as food items, ammunitions, fuel and some others is driving the market expansion. Also, the increasing demand for 6*6 cargo trucks for operating off-roading activities along with rapid adoption of electrically-powered cargo trucks in defense sector is expected to propel the growth of the military trucks market.

The all-terrain segment dominated the market. The demand for all-terrain trucks has rapidly increased from the military sector for operating in isolated areas, thereby driving the market expansion. Additionally, the growing adoption of stealth-guided military vehicles to provide additional security in the defense sector is expected to propel the growth of the military trucks market.

The off-highway segment is expanding with a considerable CAGR during the forecast period. The growing application off-highway military trucks in battlefields for several applications including equipment transfer, troops transportation, towing purposes and some others has boosted the market expansion. Also, the rising defense expenditure of several countries along with rapid investment by tire companies for developing advanced tires for military vehicles is expected to foster the growth of the military trucks market.

The heavy segment dominated this industry. The demand for heavy-duty trucks has increased rapidly in the military sector for carrying heavy military equipment, artilleries, bulk protective gears and some others, thereby driving the industrial expansion. Moreover, rapid investment by market players for developing military trucks with payload capacity of more than 15 tons is expected to propel the growth of the military trucks market.

The medium segment is expected to grow with the fastest CAGR during the forecast period. The rising application of medium-duty trucks in military headquarters for transporting food items and light-weight equipment has driven the market growth. Also, the growing demand for 7-ton cargo trucks for operating in rough-terrains is expected to boost the growth of the military trucks market.

North America held the dominant share of the military trucks market. The growing adoption of electric trucks for military purposes to reduce vehicular emission in the U.S. and Canada has boosted the market expansion. Also, the rising investment by government for strengthening the military sector along with rapid developments in the aerospace and defense sector is shaping the industry in a positive direction. Moreover, the presence of various market players such as Textron Systems, Lockheed Martin, General Dynamics Land Systems and some others is expected to drive the growth of the military trucks market in this region.

U.S. dominated the market in this region. In the U.S., the market is generally driven by the rising demand for all-terrain military trucks coupled with rising defense expenditure. Moreover, the presence of well-established defense industry along with increasing sales of cargo-based military trucks has contributed to the market growth.

Asia Pacific is expected to rise with a significant CAGR during the forecast period. The rising geopolitical tensions among several countries along with deployment of advanced military equipment for strengthening the defense sector has driven the market expansion. Additionally, the rapid adoption of autonomous trucks in warfare zones coupled with numerous government initiatives aimed at developing the military sector is contributing to the overall industrial growth. Moreover, the presence of several military truck manufacturers such as Mitsubishi Heavy Industries, Ltd., Tata Advanced Systems Ltd, Dongfeng Motor Corporation and some others is expected to foster the growth of the military trucks market in this region.

China leads the market in this region. The growing adoption of heavy-duty military trucks for several activities in border areas has boosted the market growth. Additionally, rapid investment by government for strengthening the military equipment industry coupled with constant geopolitical tensions is further adding to the industrial expansion.

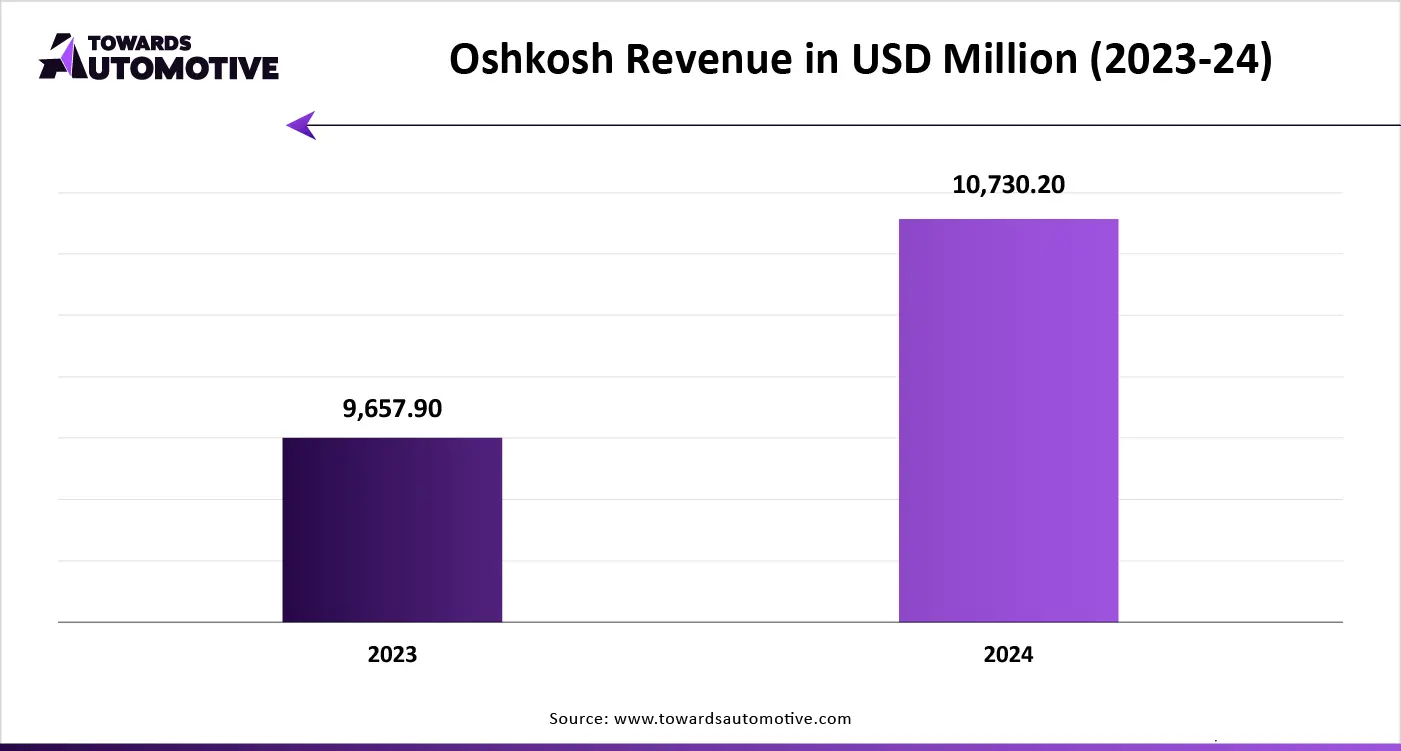

The military trucks market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of BAE Systems, ST Engineering, Iveco Defence Vehicles, Tatra Trucks, Daimler Truck AG, Oshkosh Corporation, Textron Systems, ND Defense, AM General, PAC Group, Renault Trucks Defense, General Motors and some others. These companies are constantly engaged in developing military trucks and adopting numerous strategies such as business expansions, launches, collaborations, acquisitions, joint ventures, partnerships and some others to maintain their dominance in this industry.

By Type

By Payload Capacity

By Mobility

By Protection Level

By Region

September 2025

October 2025

July 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us