September 2025

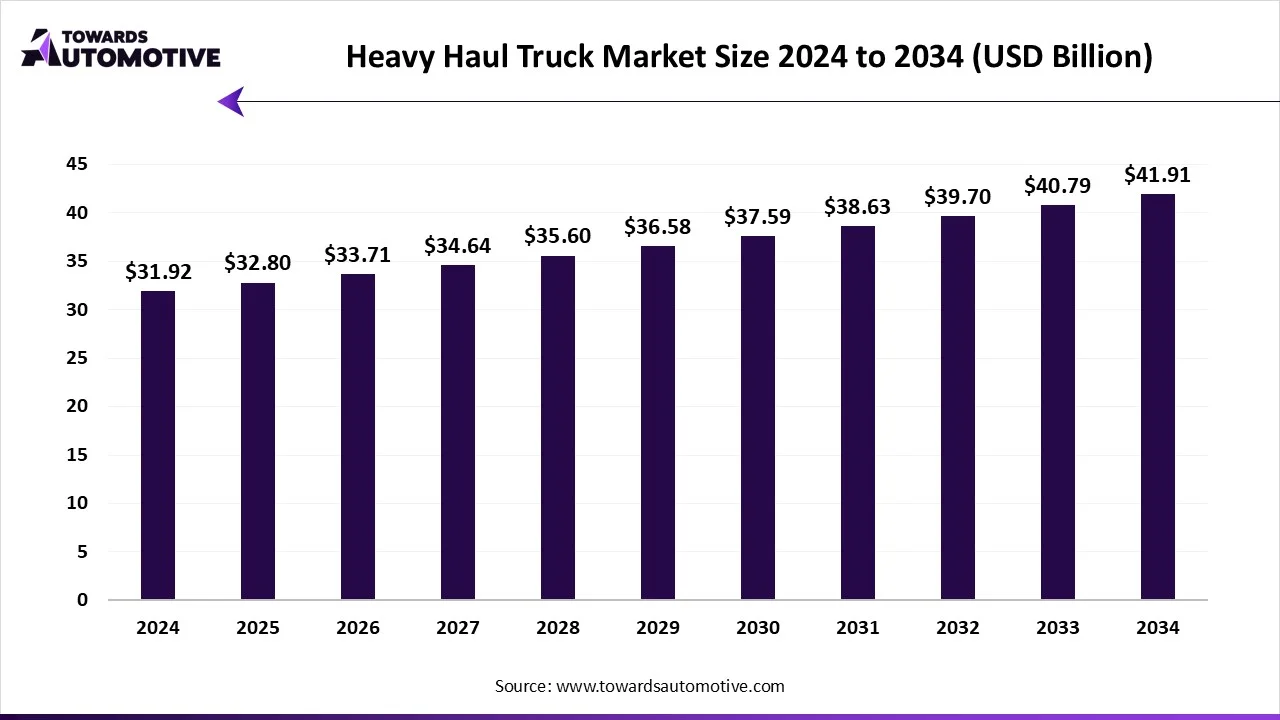

The heavy haul truck market is projected to reach USD 41.91 billion by 2034, expanding from USD 32.8 billion in 2025, at an annual growth rate of 2.77% during the forecast period from 2025 to 2034.

The heavy haul truck market is a crucial segment of the global commercial vehicle industry. These vehicles are designed to carry heavy machinery infrastructure parts and other oversized and overweight items. Construction, mining, oil, gas, and logistics are among the industries that use them the most.

There is an increasing need for dependable and high-capacity haulage solutions due to the growing demand for infrastructure development, rising investments in major construction projects, and growing energy exploration activities. Advanced telematics and driver assist systems are two examples of technological advancements that are fueling market growth.

| Metric | Details |

| Market Size in 2024 | USD 31.92 Billion |

| Projected Market Size in 2034 | USD 41.91 Billion |

| CAGR (2025 - 2034) | 2.77% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Application, By Vehicle Type, By Engine type, By Load Capacity and By Geography |

| Top Key Players | Caterpillar Inc., Komatsu Ltd., Liebherr Group, Hitachi Construction Machinery, Volvo Group, XCMG Group |

Transition Toward Hybrid and Electric Models: Leading manufacturers are innovating in hybrid and electric heavy haul trucks due to stricter emission norms and sustainability mandates.

Advancement in Autonomous Hauling: Automation in the heavy haul segment is gaining momentum. Companies are introducing autonomous navigation and telematics-based fleet management.

Material Innovations for Load Efficiency: Lighter yet stronger chassis materials are being adopted to improve the payload-to-weight ratio. This results in higher fuel efficiency and reduced wear and tear.

Digital Integration and Predictive Maintenance: Fleet operators are increasingly deploying real-time tracking and diagnostics systems. AI-driven platforms help reduce downtime and improve safety. Telematics enabled fleet management platforms to see a 30% rise in adoption from 2023 to 2025.

Construction segment dominated the heavy haul truck market in 2024, because of its crucial function in delivering substantial prefabricated bridge components, tunnel segments, and high-rise building elements. These trucks serve specialized purposes like transporting tunnel shields and prestressed concrete beams in addition to supporting standard logistics. Their reputation is supported by their versatility in handling various job site environments including off-road urban and mountainous terrain. Furthermore, custom configurations tailored to the needs of specific megaprojects are becoming possible thanks to collaborations between infrastructure developers and truck manufacturers.

Oil and gas segment is expected to grow at the fastest rate, driven by renewed global investments in both onshore shale and offshore deepwater projects. Heavy haul trucks are increasingly being utilized for last-mile delivery of modular drilling platforms and subsea production units. As energy companies reassess supply chain resilience, there’s a surge in demand for advanced trucks equipped with telemetry, real-time load monitoring, and remote diagnostics—especially in harsh climates or inaccessible regions. Furthermore, decarbonization mandates are compelling fleets to adopt cleaner heavy transport solutions, accelerating modernization in this vertical.

Flatbed trailers segment dominated the heavy haul truck market in 2024 because they can transport a wide range of goods with unparalleled flexibility including pipe racks industrial modules, excavators, and cranes. They are indispensable in a variety of end-use industries due to their capacity to support large loads without regard to size restrictions. Modular flatbeds with hydraulic leveling and adjustable axle spacing are examples of innovations that improve their suitability for uneven construction sites. To guarantee safety and reduce damage while in transit, fleet operators are also combining them with cutting-edge traction control and air suspension systems.

Heavy equipment transporters segment is expected to grow at the fastest rate made to transport extremely heavy and out-of-gauge equipment such as wind turbine blades and mining draglines which reduces costs and time on intricate projects. When navigating soft ground or weak bridges, their multi-axle modular designs enable dynamic load distribution. The use of sophisticated braking and computer-controlled steering improves stability and route flexibility. These transporters' logistical sophistication is growing with the addition of aftermarket services for route permits and engineering studies.

Natural gas-powered heavy haul trucks running on CNG or LNG continue to be preferred for their lower particulate and NOₓ emissions. Many operators in regulated regions, such as California or Europe, benefit from favorable gas pricing and lower carbon intensity compared to diesel. Engine manufacturers are further optimizing high-pressure tank designs and cryogenic fuel storage to extend range and safety. Plus, several fleets have reported operational cost savings of 10–15%, incentivizing reinvestment into new NG-powered powertrains.

Hybrid segment is expected to grow at the fastest rate as diesel or LNG engines are combined with electric motors and regenerative braking systems in hybrid heavy haul trucks to drastically cut fuel consumption. In stop-start operations such as port handling or urban delivery, the electric component can power low-speed maneuvers reducing noise and emissions. Plug-in hybrids that enable on-site charging are being introduced by manufacturers making integration at depots easier. By increasing battery capacity and charging speed, R&D hopes to reduce greenhouse gas emissions by up to 30% by 2027.

The above 50 tons segment dominated the heavy haul truck market in 2024 because they are essential to the delivery of mega modules for industrial infrastructure power plants and petrochemicals. These rigs frequently use hydraulic lift systems for steering bogies and coordinated multi-truck formations to handle heavy loads. To help operators maintain regulatory compliance and steer clear of expensive fines, the industry is also shifting toward digital monitoring systems that track axle load in real-time. The need for these high-capacity configurations is still high as megaprojects multiply.

30-50 tons segment is expected to grow at the fastest rate because they combine improved route access, reduced permit complexity, and heavy-duty capability. These rigs are ideal for the deployment of railway equipment in mid-size plant installations and urban expansion projects. To increase safety and agility, OEMs provide multiple drum winch options, adjustable chassis lengths, and improved steering modules. Solutions for fleet management that lower empty miles are also becoming more common in this weight range.

Asia Pacific dominated the market with the largest share in 2024 because of enormous continuous expenditures in energy infrastructure and industrial growth. Megaprojects, including high-capacity power plants, renewable energy installations, and highway expansions are proliferating in the area and call for specialized heavy transportation. Local producers are increasing their output of high-load modular trailers and sophisticated axle systems to satisfy local demand. The region's leadership is further solidified by the implementation of digitalized logistics planning and enhanced intermodal connectivity.

North America is expected to grow at the fastest rate in the upcoming years fueled by large investments in clean energy initiatives, fleet logistics modernization, and transportation infrastructure. Fleet procurement strategies are changing as more people choose environmentally friendly modes of transportation such as natural gas and hybrid trucks. Additional factors supporting growth include improved permitting systems for telematics-based route optimization developments and regulatory clarity regarding wide-load movement. For increased efficiency and compliance heavy haul, operators are also working with tech companies to implement AI-powered load management systems

Europe holds a notable position in the heavy haul trucks market, backed by innovative technology, robust regulatory frameworks, and an emphasis on sustainability. The need for cutting-edge heavy haul solutions is being driven by the region's aggressive investments in green logistics hubs and smart transportation corridors. To meet stricter emission regulations manufacturers are moving more and more toward electric and hybrid models, and logistics companies are implementing digital platforms for load tracking and compliance management. Furthermore, the need for specialized fleets is being driven by the prevalence of high-precision engineering projects like offshore component transportation and industrial retrofits.

The heavy haul truck market is a rapidly evolving industry characterized by the presence of several dominant players. Some of the prominent companies in this market include Caterpillar Inc., Komatsu Ltd., Liebherr Group, Hitachi Construction Machinery, Volvo Group, XCMG Group, BelAZ, Scania AB, Terex Trucks and SANY Group.

These companies are actively focusing on enhancing truck capacity, incorporating electric and autonomous technologies, and expanding their footprint in the high-demand mining and infrastructure sectors. Key strategies such as new product launches, joint ventures, digital transformation, and participation in global construction expos are commonly adopted by these firms to maintain their competitive edge.

By Application

By Vehicle Type

By Engine type

By Load Capacity

By Geography

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us