September 2025

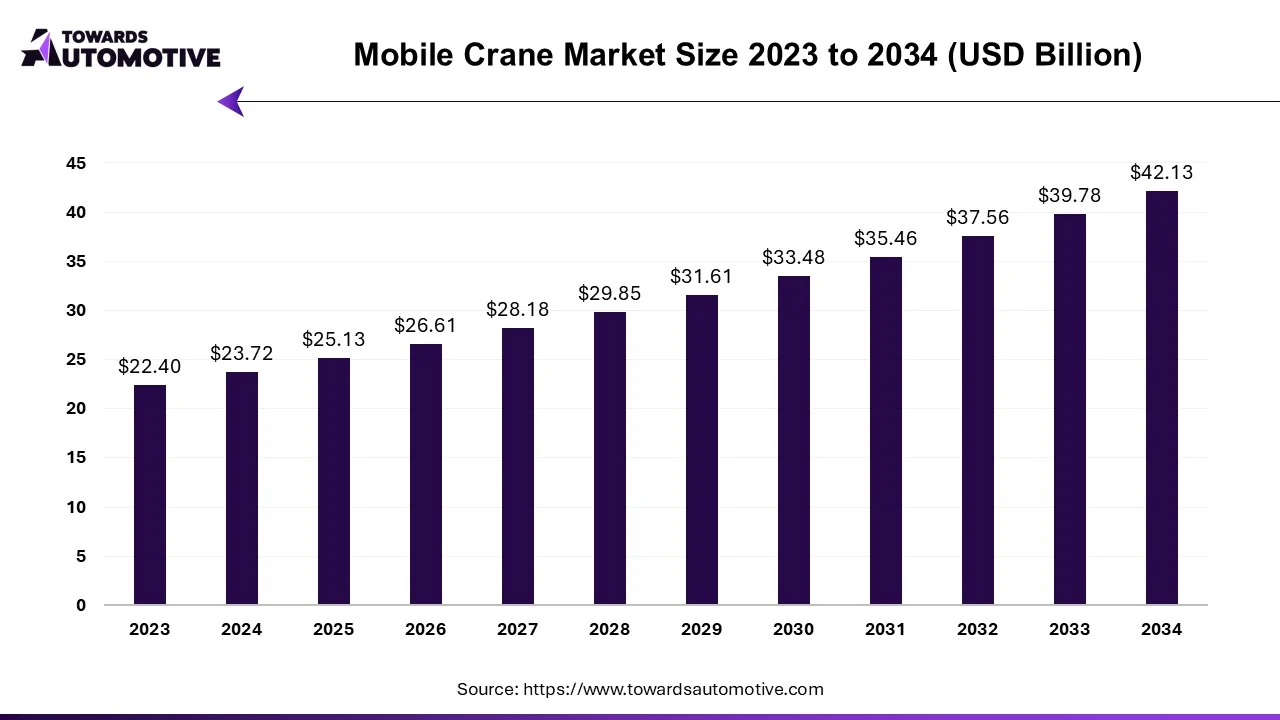

The mobile crane market is expected to grow from USD 25.13 billion in 2025 to USD 42.13 billion by 2034, with a CAGR of 5.91% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Despite facing initial setbacks due to the COVID-19 pandemic, characterized by temporary closures of construction sites mandated by governmental regulations worldwide, the mobile crane market exhibited resilience, particularly within the mining sector where operations persisted even during the lockdowns.

In recent times, the demand for mobile cranes has surged owing to burgeoning infrastructure development initiatives and significant investments by construction companies. This trend is anticipated to continue driving market growth, especially with the integration of advanced technologies featuring eco-friendly attributes. Innovations such as cruise control and GPS tracking systems are expected to bolster the utility of mobile cranes, particularly in the highway construction sector.

Moreover, the market dynamics are influenced by the financial strategies adopted by construction firms, including the utilization of credit services and the incorporation of second-hand equipment into their operations. Original Equipment Manufacturers (OEMs) are thus incentivized to continually innovate and develop new equipment to meet the evolving demands of the industry.

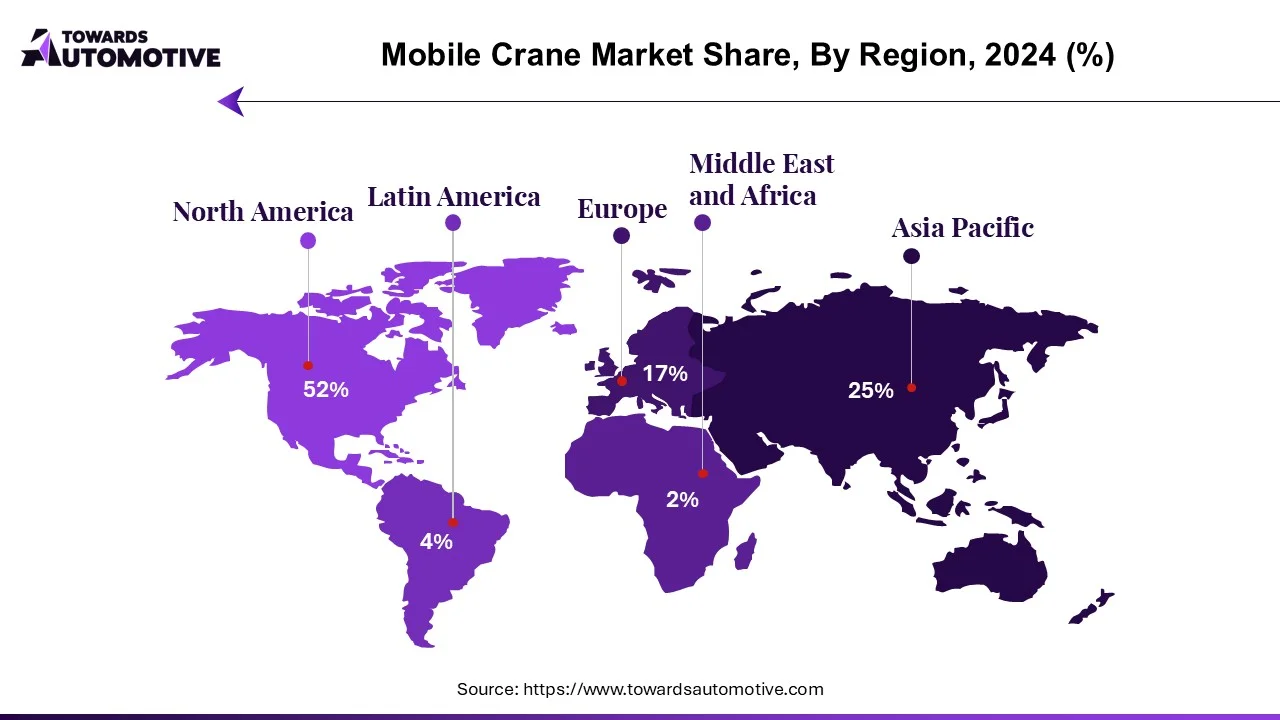

Regionally, the Asia Pacific region is poised to dominate global construction spending in the medium term, propelled by robust infrastructure development initiatives in countries like China and India. The ease of undertaking small and medium-sized projects in Asia further augments market demand. Additionally, increased government funding and the participation of major corporations in North America and Europe are expected to fuel economic growth, thereby contributing to the expansion of the mobile crane industry.

Recent instances indicate a growing emphasis on sustainability within the mobile crane sector, with manufacturers increasingly focusing on eco-friendly features and energy-efficient technologies. Furthermore, advancements in automation and remote operation capabilities are revolutionizing crane operations, enhancing safety standards, and optimizing efficiency in construction projects.

The mobile crane industry is poised for significant growth driven by infrastructure development, technological advancements, and favorable market dynamics across various regions. With a focus on innovation and sustainability, stakeholders are primed to capitalize on emerging opportunities and navigate challenges to harness the full potential of this dynamic market landscape.

The construction industry in North America is poised for robust growth, buoyed by strong financial backing, government emphasis on infrastructure development, and stringent financial regulations that promote stability and investment. Despite experiencing a temporary slowdown in the wake of the pandemic, the industry is projected to rebound strongly during the forecast period, fueled by ongoing projects and supportive government policies.

Recent legislative measures, such as the $1 trillion infrastructure spending bill announced by the US Congress in November 2021, are expected to provide a significant boost to construction activities. This bill allocates $550 million over eight years for improving roads, bridges, highways, and modernizing urban transportation and passenger transit systems. Although lower than the initial proposal, this substantial investment is anticipated to catalyze growth across various sectors, including construction, over the coming months and years.

Furthermore, increasing demand for trade at US ports has prompted manufacturers and port operators to invest in infrastructure, including dock and mobile cranes, to enhance cargo handling capabilities. For instance, SeaPortManatee and Logistec USA Inc. recently acquired two additional mobile dock cranes, capable of lifting significant loads, thereby augmenting cargo capacity and facilitating smoother operations at the port.

In April 2022, Allison Transmission, a leading designer and manufacturer of electric and electronic vehicle propulsion solutions, formed a joint venture with Bell Equipment Group Services (BELL) to evaluate and integrate Allison's 4000 Series™ into TerraTran, a multi-purpose vehicle suitable for applications such as communication trucks, mobile cranes, and wide-body mining dump trucks. This collaboration underscores the industry's commitment to innovation and sustainability, with a focus on advancing technology to meet evolving needs.

Additionally, as North America addresses the rebuilding of properties ravaged by wildfires, both the Canadian and Mexican construction industries are expected to witness heightened demand from residential sectors. Moreover, the anticipated rise in oil prices and the melting of Arctic ice caps are projected to create new business opportunities, leading to increased demand for marine and offshore cranes in the region.

North American construction industry is poised for significant growth, driven by favorable economic conditions, government support, and strategic investments in infrastructure. Embracing technological advancements and addressing emerging challenges will be pivotal for stakeholders to capitalize on opportunities and sustain momentum in this dynamic sector.

The mobile crane industry boasts several significant players, including Liebherr, Cargotec, Tadano, Manitowoc, and Palfinger, who have adeptly leveraged the substantial demand for dependable cranes across the construction, mining, and industrial sectors. These companies are well-positioned in terms of comprehensive research into supply chains, secondary product offerings, and regional market dynamics, catering to a diverse range of small and medium-sized applications.

Rapid growth in research and development investments by major industry players underscores a commitment to innovation and efficiency. The persistent demand for high-performance, efficient, and safe equipment is expected to foster competitiveness and profitability in the training industry throughout the forecast period.

Recent developments within the industry further highlight the commitment of key players to expansion and innovation:

The mobile crane industry is experiencing notable advancements and strategic collaborations, reflecting a commitment to meeting evolving market demands and enhancing operational efficiency.

Recent instances underscore key players' efforts to expand their market presence, upgrade equipment fleets, and drive innovation:

Mobile cranes are vehicles mounted on wheels, utilizing cables or hydraulically operated telescopic boom cranes for functionality. These cranes are equipped with electronic components and stabilizers, which are extendable legs attached on both sides to enhance stability and expand the working radius, facilitating the lifting of heavy loads.

The Mobile Crane Market is segmented based on machine type, application type, and region. In terms of machine type, the market comprises mobile cranes, fixed cranes, and marine and port cranes. Mobile cranes are designed for mobility and versatility, while fixed cranes are stationary and commonly used in construction or industrial settings. Marine and port cranes are specialized equipment tailored for cargo handling in maritime environments.

Application type further divides the market into construction, mining and excavation, marine and offshore, industrial applications, and other specialized sectors. Each segment presents unique demands and requirements for mobile crane equipment, necessitating a diverse range of product offerings and specialized solutions to cater to specific industry needs.

Overall, segmentation in the Mobile Crane Market enables manufacturers and suppliers to target specific customer segments effectively and address their distinct requirements, contributing to the industry's growth and adaptation to varying market dynamics.

By Machine Type

By Application Type

By Geography

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us