December 2025

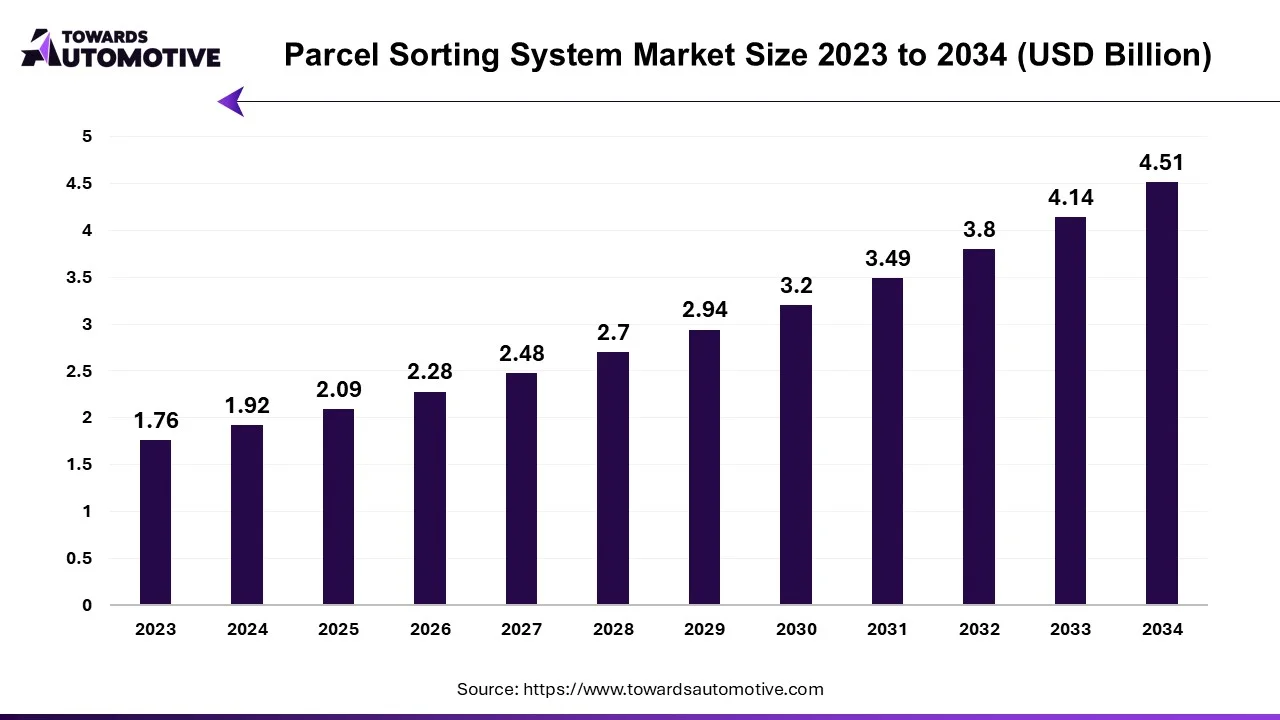

The parcel sorting system market is set to grow from USD 2.09 billion in 2025 to USD 4.51 billion by 2034, with an expected CAGR of 8.94% over the forecast period from 2025 to 2034.

The parcel sorting system market is a crucial segment of the logistics industry. This industry deals in development and distribution of parcel sorting solutions around the world. There are various types of sorting systems developed in this sector including cross-belt sorters, shoe sorters, tilt tray sorters, pop-up wheel sorters, vertical sorter modules, helix sorters and combination sorters. These sorters are integrated with numerous types of control systems consisting of PLC-based control systems, PC-based control systems, motion control systems and some others. It finds application in different sectors comprising of manufacturing, healthcare, food and beverage, retail, logistics, and some others. The growing demand for parcel sorting system from the e-commerce sector has contributed to the industrial expansion. This market is expected to grow significantly with the rise of the advanced machinery sector in different parts of the globe.

| Metric | Details |

| Market Size in 2024 | USD 1.92 Billion |

| Projected Market Size in 2034 | USD 4.51 Billion |

| CAGR (2025 - 2034) | 8.94% |

| Leading Region | North America |

| Market Segmentation | By Sorting System, By Sorting Process, By Conveyor Type, By Application, By Control System and By Region |

| Top Key Players | TGW, Fives Intralogistics, Veltec Systems (USA) Inc., Dambach Lagersysteme |

The major trends in this industry consists of partnerships, smart warehouses, integration of AI in sorting systems.

Partnerships

Several market players are partnering with logistics providers to deploy advanced sorting systems in warehouses. For instance, in August 2023, Falcon Autotech partnered with DTDC Express. This partnership is done for deploying Autotech’s sorting systems in warehouse of DTDC based in Chennai, India. (Source: Indian Transport & Logistics News)

Smart Warehouses

Nowadays, the e-commerce brands have started investing heavily for developing smart warehouses to enhance efficiency and improve productivity. For instance, in 2024, Huawei collaborated with Telkomsel. This collaboration is done for opening a smart warehouse in Indonesia. (Source: Privatenetworks)

Integration of AI in Sorting Systems

The adoption of AI-based parcel sorting system has increased rapidly in the manufacturing sector. These sorting systems comes with numerous advantages such as route optimization, reducing error, improved efficiency and some others. For instance, in January 2025, Ambi Robotics launched AmbiStack. AmbiStack is an AI-enabled robotic system designed for optimizing sorting process in logistics sector. (Source: Business Wire, Inc.)

Why cross-belt sorters segment to hold the largest share of the parcel sorting system market in 2025?

The cross-belt sorters segment led this industry. The demand for cross-belt sorters has rapidly increased in the e-commerce sector for sorting small parcels, thereby driving the market growth. Additionally, numerous advantages of cross-belt sorters including high sorting accuracy and flexible handling is further driving the growth of the parcel sorting system market.

The tilt-tray sorters segment is expected to rise with a significant CAGR during the forecast period. The demand for tilt-tray sorter has increased rapidly from the airports for sorting checked luggage, thereby driving the market expansion. Also, numerous benefits of these sorters such as high sorting speeds, versatility, space optimization, adaptability and some others has boosted the growth of the parcel sorting system market.

The belt conveyors segment held the highest share of the industry. The growing demand for belt conveyors from several industries such as chemical, healthcare, semiconductor and some others has boosted the market growth. Additionally, numerous advantages of belt conveyors including cost-effectiveness, high load-bearing capacity, durability and some others is expected to propel the growth of the parcel sorting system market.

The roller conveyors segment is expected to grow with a considerable CAGR during the forecast period. The increasing demand for advanced material handling solutions from numerous sectors such as warehousing, food and beverage, manufacturing and some others has driven the market growth. Also, various advantages of roller conveyors including enhanced safety, reduced operational costs, increased efficiency and some others is expected to drive the growth of the parcel sorting system market.

The retail and e-commerce segment led the industry. The growing proliferation of smartphones has enabled people to purchase and sell products in online platforms, thereby driving the market expansion. Additionally, rapid investment by market players for developing advanced sorting systems to cater the needs of the e-commerce sector, thereby driving the growth of the parcel sorting system market.

The manufacturing segment is expected to rise with a notable CAGR during the forecast period. The rapid adoption of automated material handling solutions in the manufacturing sector has boosted the market growth. Also, the growing use of cross-belt sorters in numerous industries such as textiles, electronics and some others is expected to drive the growth of the parcel sorting system market.

North America led the parcel sorting system market due to numerous government initiatives aimed at developing the logistics sector coupled with growing trend of online-shopping. Also, rapid deployment of advanced parcel sorting systems in warehouses coupled with rising development in the manufacturing sector has further contributed to the overall industrial expansion. Moreover, the presence of several market players such as Dematic, Honeywell, TGW Logistics Group and some others is expected to drive the growth of the parcel sorting system market in this region.

U.S. is the major contributor in this region. In the U.S., the market is generally driven by the rising trend of last mile delivery coupled with increasing emphasis on green logistics. Moreover, rapid development in the food and beverage sector as well as growing adoption of smart warehouses has contributed to the market growth.

Asia Pacific is expected to rise with the fastest CAGR during the forecast period. The growing demand for advanced parcel sorting systems from pharmaceutical industry has boosted the market expansion. Additionally, the integration of AI-enabled sorting systems in logistics warehouses for enhancing sorting procedure is playing a vital role in shaping the industrial landscape. Moreover, the presence of various parcel sorting system brands such as Daifuku Co. Ltd, Okura Yusoki Co., Ltd., Murata Machinery, Ltd. and some others is expected to boost the growth of the parcel sorting system market in this region.

Japan dominated the market in this region. The technological advancements in robotics sector along with rise in number of e-commerce startups has boosted the market growth. Additionally, the presence of several market players coupled with rapid adoption of sustainable solutions in logistics sector is positively impacting the industry.

The parcel sorting system market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of TGW, Fives Intralogistics, Veltec Systems (USA) Inc., Dambach Lagersysteme, Beumer Group, Dematic, Transbotics, Vanderlande, Swisslog, Egemin Automation, Mecalux, Honeywell, Daifuku Co., SSI Schaefer and some others. These companies are constantly engaged in developing parcel sorting systems and adopting numerous strategies such as collaborations, launches, partnerships, joint ventures, business expansions, acquisitions, and some others to maintain their dominance in this industry.

By Sorting System

By Sorting Process

By Conveyor Type

By Application

By Control System

By Region

A revenue surge in the automotive computer-based diagnostics market is on the horizon, with growth expected to reach hundreds of millions by 2034, rev...

According to market projections, the integrated traffic system sector is expected to grow from USD 36.93 billion in 2024 to USD 90.03 billion by 2034,...

The turboprop engine industry is expected to grow from USD 1.35 billion in 2024 to USD 2.53 billion by 2034, driven by a CAGR of 6.5%. Asia Pacific le...

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us