October 2025

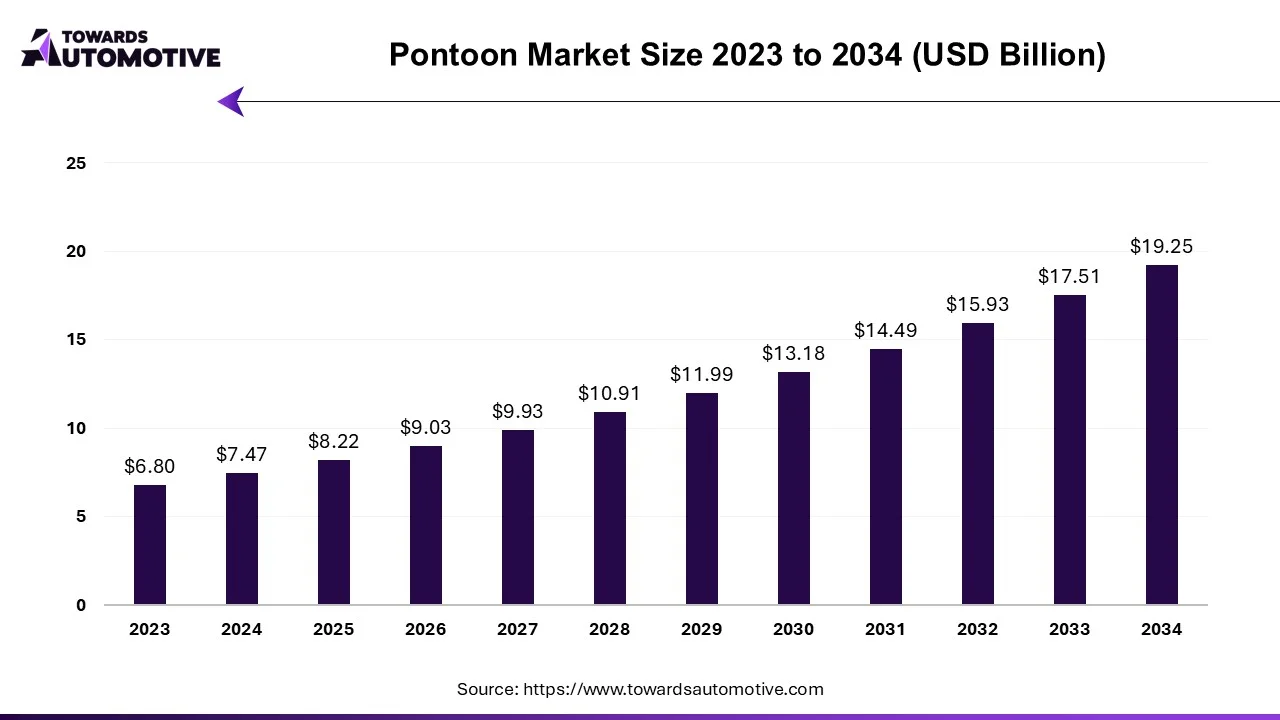

The pontoon market accounted for USD 8.22 billion in 2025 and is expected to reach around USD 19.25 billion by 2034, growing with a CAGR of 9.92% from 2025 to 2034. This market is growing due to increasing consumer demand for versatile, family-friendly recreational boats that offer comfort, stability, and multipurpose use for leisure, fishing, and watersports.

The pontoon boat market is experiencing steady growth driven by the growing popularity of water-based tourism, family-friendly pastimes, and recreational boating. Pontoon boats are becoming increasingly well-liked among first-time purchasers, rental operators, and multigenerational users due to their roomy layout's stability and adaptability. Their allure is being further enhanced by technological developments like high-performance engines, smart navigation systems, and luxurious seating. Pontoons are changing from casual cruisers to fully equipped lifestyle boats due to rising use for fishing and water sports, growing disposable income, and the growth of boat-sharing platforms.

The stability, comfort, and capacity of pontoon boats make them the top choice for family gatherings, birthday cruises, and weekend escapes. With seats for 8-15 people, they provide a fun and safe ride, particularly for older and younger travelers. Additionally, they are appropriate for shallow waters close to beaches or sandbars due to their low draft. Bimini tops, shade structures, sound systems, and swim ladders are among the amenities that families appreciate most on board. The market has also witnessed an increase in party barge models which are built with social layouts in mind.

Pontoon boats are a favorite in the boat rental industry because they are user-friendly and appealing to novice boaters. Their broad market appeal, stability, and minimal maintenance requirements are valued by rental companies. This tendency is more pronounced in tourist locations where casual visitors are looking for quick water experiences. Platforms for peer-to-peer boat rentals such as GetMyBoat and Boatsetter have made pontoons more accessible. Additionally, rentals give prospective purchasers a chance to try things out.

Pontoon boats can cost as much upfront as a luxury car, especially the more recent and luxurious models. The total cost of ownership includes the purchase price as well as recurring expenses like insurance fuel docking fees, trailer storage, and seasonal maintenance. Those who are on a tight budget or who don't use their boats frequently may find that these total costs outweigh the advantages.

Further discouraging ownership is the possibility that pontoon resale value will decline more quickly than anticipated. Especially in developing markets or when first-time buyers are comparing rental vs the costs of ownership.

Typically utilized only in the spring and summer in temperate climates; pontoon boats are highly reliant on favorable weather conditions. The short boating window deters investment in regions with long winters or erratic rainfall. Additional expenses for winterization and off-season storage may also be incurred by owners. Seasonal variations can result in irregular revenue and fleet underutilization for rental companies. These factors impact the market's full potential by limiting year-round usability and decreasing demand in colder climates.

With features like GPS tracking, fish finder app-based diagnostics, onboard Wi-Fi digital helm controls, and real-time data dashboards, pontoon boats are evolving into tech-enabled connected platforms. This opens possibilities for premium pricing and brand differentiation. Additionally, boating is becoming more user-friendly thanks to digital interfaces and safety automation, which appeals to younger and newer buyers. Both the ownership and rental models may be revolutionized by incorporating AI for diagnostics, battery monitoring, or IoT for predictive maintenance.

The need for reasonably priced, family-friendly watercraft is rising in emerging economies in the Middle East, Asia Pacific, and Latin America. Pontoons are becoming more in demand in local rental fleets, marinas, and recreational clubs due to the growing middle class, fast urbanization, and increased interest in waterfront tourism. Manufacturers can open new revenue streams with tailored products that fit local tastes and income levels. Additionally, local boating cultures are being promoted, and waterfront infrastructure is being invested.

Three-tube pontoons dominate the market because they outperform conventional two-tube designs in terms of performance stability and load-bearing capacity. They are appropriate for luxury applications and watersports because the addition of this tube improves balance at high speeds makes rides smoother in choppy water, and increases horsepower compatibility premium experiences, particularly in the United States for boaters U.S. favor tritons due to their ability to combine comfort and functionality which has led to their widespread use.

Two-tube pontoons are experiencing the fastest growth due to their affordability and appeal among entry-level buyers. These boats are ideal for calm inland waters and family cruising, making them a popular choice for casual boaters. Their lower purchase and maintenance costs attract budget-conscious consumers and rental operators, particularly in smaller marinas and emerging markets.

Medium-sized pontoons dominate the market as they offer the best balance of capacity, handling, and affordability. Typically ranging from 20 to 24 feet, they are ideal for families or groups looking for versatile use in cruising, light fishing, or watersports. Their popularity stems from their ability to comfortably seat 8-10 passengers while remaining easy to tow, dock and maintain. Manufacturers often focus their new launches on the size range due to high demand and widespread use.

Small pontoons are growing rapidly as they appeal to first-time buyers, solo boaters, and those with limited docking space. Their lower weight makes them easier to trailer and store, and they’re ideal for narrow lakes and shallow waters. These compact models are also being adopted for electric retrofits, boosting their appeal among eco-conscious consumers and renters.

Recreational use dominates the pontoon boat market due to the boat's roomy interior's comfort and appropriateness for group activities, family vacations and leisure, and cursing. With swim decks, loungers, and entertainment systems, pontoon boats are incredibly customizable and are frequently referred to as floating patios. The popularity of leisure boating in calm waters is increased by their stable flat design, which makes them safer and more palatable for non-technical users.

Fishing is the fastest-growing application segment as producers release pontoon models designed specifically for fishing, complete with swivel seats, trolling motors, rod holders, and LiveWell. These boats appeal to fishermen who desire room flexibility and a more social fishing experience because they combine the comfort of pantoons with the practicality of conventional fishing boats. In freshwater lakes throughout the United States, they are especially well liking U.S. in addition to Canada.

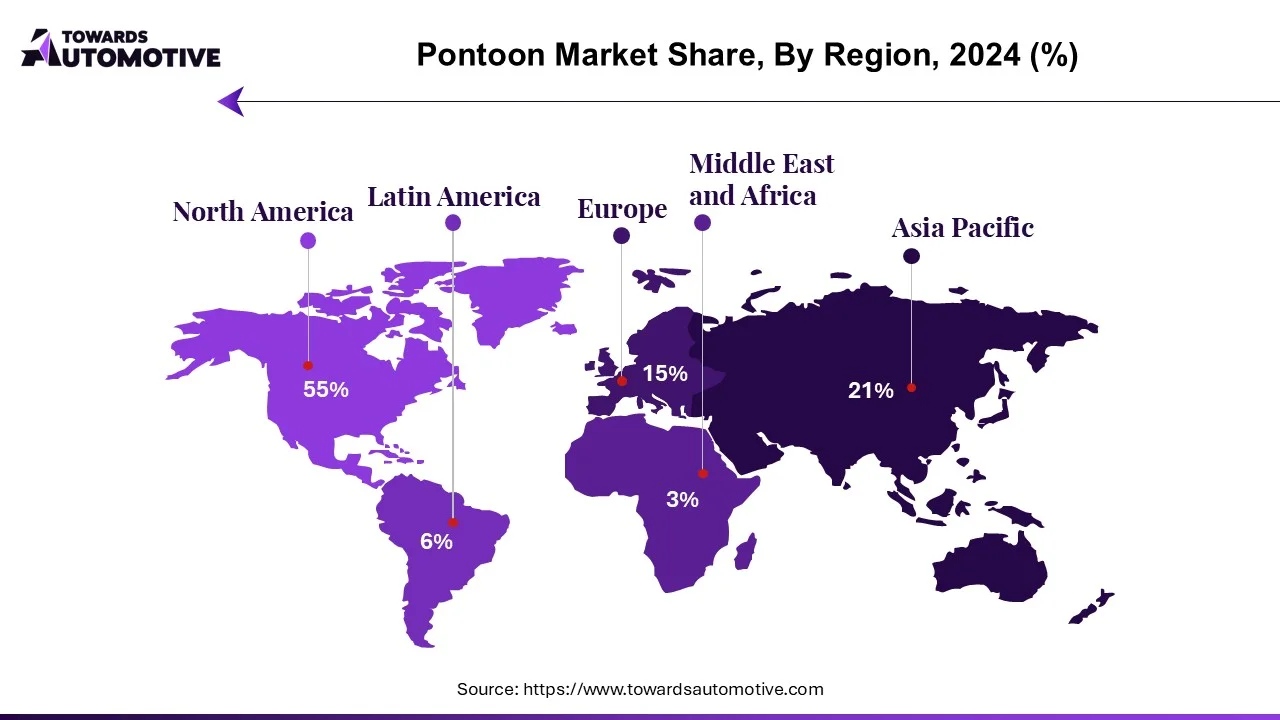

North America dominates the pontoon boats market due to its vast network of inland lakes and rivers, its deeply ingrained recreational boating culture, and its high level of consumer disposable income. A popular option for weekend leisure activities fishing and family vacations, pontoon boats are in high demand due to both private ownership and robust rental infrastructure.

The area also gains from having top pontoon boat producers who are constantly innovating and accommodating a wide range of customer tastes. North America dominates the global pontoon market thanks to a strong dealer network, frequent financing options, and seasonal boating events.

Asia Pacific is emerging as the fastest-growing region in the pontoon boat market, due to stimulation by growing waterfront tourism, rising lifestyle spending, and growing interest in recreational boating. Customers in the area are increasingly choosing roomy and user-friendly watercraft such as pontoons for recreational and rental uses.

Adoption and awareness are being increased through investments in lakefront developments, boating events, and marina infrastructure. The demand for pontoons is anticipated to increase gradually throughout the region as recreational water sports become increasingly popular among the younger generation and wealthy people.

By Type

By Size

By Application

By Geographic

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us