October 2025

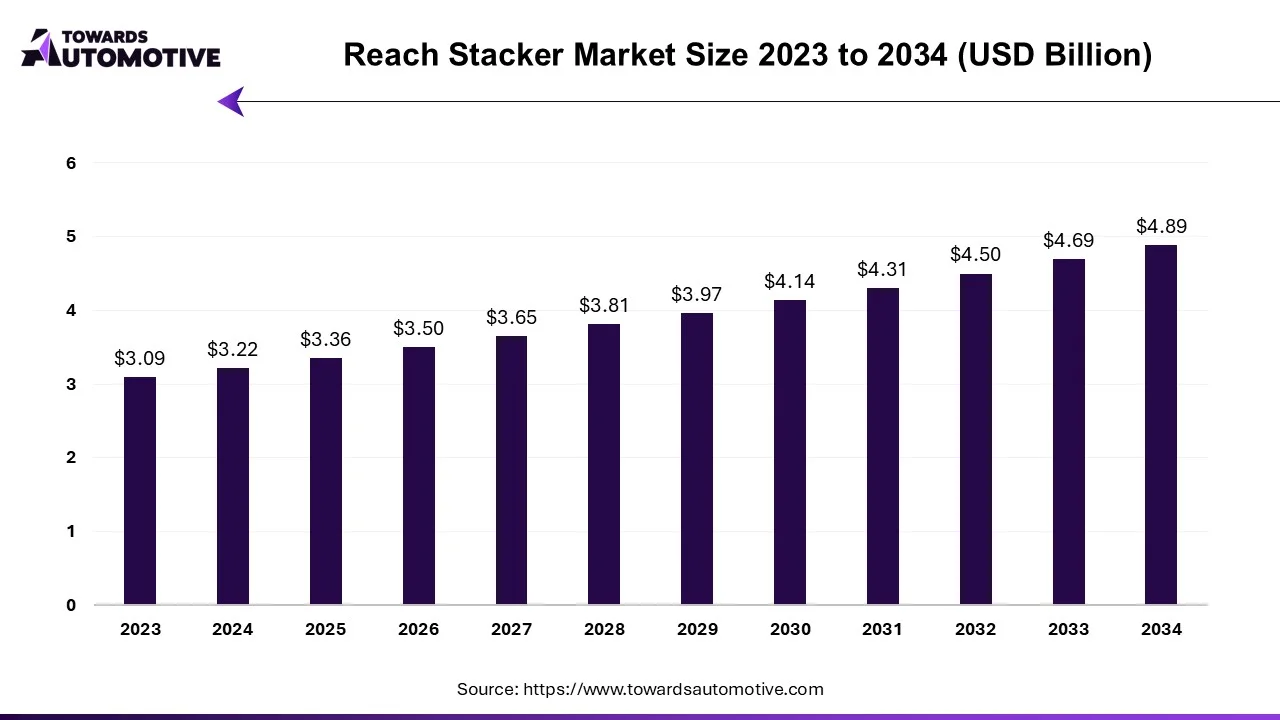

The reach stacker market is forecasted to expand from USD 3.36 billion in 2025 to USD 4.89 billion by 2034, growing at a CAGR of 4.26% from 2025 to 2034.

The reach stacker market is poised to experience substantial demand growth in the forecast period, driven by the expanding economic activities within the industry and government investments in the construction of new ports and the enhancement of port capacity.

The outbreak of the COVID-19 virus resulted in a global decline in production and trade, leading to reduced import demand and disruptions in global supply chains, particularly due to China's lockdown measures. This had a significant impact on various sectors, including electronics, medical equipment, and consumer goods. However, the decline in demand for certain products was partially offset by reduced air freight demand from ports, as many goods, including antibiotics, are predominantly manufactured in China.

Furthermore, escalating trade tensions between major economies like China and the United States have contributed to a downturn in international maritime trade. Despite the adverse effects on global trade, efforts to resolve these disputes are anticipated to lead to a gradual increase in trade activities.

The long-term demand for hybrid and electric transportation solutions is expected to drive the need for supportive infrastructure, including reach stackers. Port owners are increasingly adopting hybrid port equipment to enhance efficiency while addressing environmental concerns amid stringent government regulations aimed at improving air quality.

Moreover, advancements in technology, such as automation and the Internet of Things (IoT), are enabling port operators to deploy automated tools for enhanced safety measures and operational efficiency.

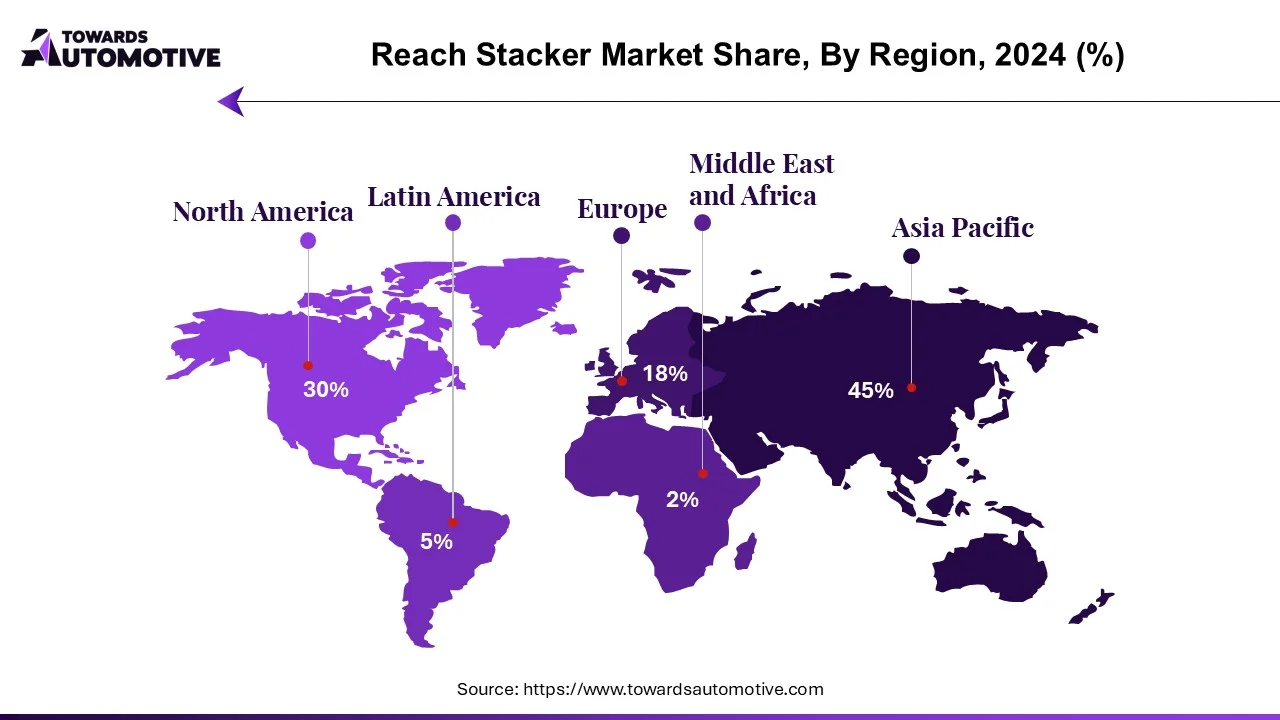

The Asia-Pacific region remains a key focal point for demand, fueled by the robust shipping industry in countries like India, China, Japan, and South Korea, which boast significant potential for growth and development in the sector.

The escalating global carbon emissions and the resulting climate change pose significant challenges for governments worldwide, both in developed and developing nations. The transportation sector, accounting for approximately 24% of global CO2 emissions, is a major contributor to greenhouse effects. To mitigate these emissions, there is a pressing need to deploy low-carbon or zero-carbon emission technologies on a large scale.

In this context, alternative fuel vehicles (AFVs) have emerged as a promising solution to address the issue of carbon emissions. Particularly in the logistics and goods services sector, which significantly contributes to the GDP, there is a growing push towards electrifying the entire ecosystem to achieve sustainable transportation.

For example,

As trade activities between nations continue to increase, the capacity of existing ports and the demand for new port developments have become major areas of concern for governments globally. To address this demand, governments are strategizing and allocating funds for the development of both existing and new ports under various initiatives.

Despite the ongoing trade tensions between the United States and China, two of the world's largest economies, strong demand for exports to other regions has prompted significant investments in port facilities across the Asia-Pacific region. As the forecast period progresses, it is expected that the trade dispute between the two countries will ease, leading to a normalization of the economy and a subsequent increase in exports from the region. Notably, the Asia-Pacific region currently accounts for approximately 40% of global trade. In anticipation of future growth, governments in the region are heavily investing in expanding port capacity while emphasizing environmental sustainability.

China, with its 34 major ports and 2,000 small ports, is playing a pivotal role in driving the region's economy forward. Many of these ports have a rich history of contributing to global commerce and trade. Additionally, 158 ports along China's east and south coasts serve as crucial hubs for production and exports. Chinese authorities are actively promoting the development of ports not only domestically but also globally. By 2025, major ports in China are expected to complete their transition to green, smart, and safe operations, with further expansion anticipated by 2035 to achieve world-class status. By 2050, most of the world's ports are projected to attain a similar level of development.

India, another rapidly growing economy, heavily relies on sea-based trade, with over 90% of trade volume conducted through maritime routes. To support the "Make in India" initiative and foster manufacturing growth, continuous upgrades to ports and related infrastructure are essential. The country boasts 13 major ports, including Kandla, Mumbai, Mangalore, Mormugao, JNPT, and Cochin on the west coast, and Chennai, Visakhapatnam, Tuticorin, Kolkata, Paradip, and Ennore on the east coast.

The proliferation of ports in the region has spurred significant demand for reach stackers, essential for efficient material handling and transportation services. Key players in the industry are actively developing new, efficient, and environmentally friendly equipment tailored to the region's ports to reduce carbon footprint while enhancing productivity.

In June 2022, Kalmar announced the delivery of three Eco Reachstackers to Yantai Port in Northern China, aimed at enhancing the port's overall efficiency, financial security, and safety. Yantai Port, strategically located in the north of the Shandong Peninsula, serves as a critical node along the 21st Century Maritime Silk Road. The collaboration between Kalmar and Yantai Port dates back to 1990, reflecting a longstanding partnership focused on driving port innovation and development.

The Reach Stacker Market is indeed dominated by a handful of key players, including CVS Ferrari, Kalmar, Konecranes, Liebherr, and others. These companies continuously innovate and collaborate to maintain and expand their market share. Here are some additional recent developments in the industry:

Reach stackers are essential equipment used in small terminals and medium-sized ports to efficiently handle intermodal cargo containers and transport them as needed. These versatile machines are highly mobile, allowing them to maneuver containers over short distances and stack them in various rows based on accessibility.

The Reach Stacker Market is categorized based on application, tonnage, powertrain type, and geographical location. In terms of application, the market is divided into two main segments: seaports and industrial facilities. Regarding tonnage capacity, reach stackers are classified into low, medium, and high tonnage categories.

By Application

By Tonnage

By Power Train Type

By Geography

According to market projections, the global small marine engine sector is expected to grow from USD 8.84 billion in 2024 to USD 17.09 billion by 2034,...

Projections indicate that, precision gearbox industry is projected to rise from USD 3.30 billion in 2024 to USD 8.50 billion by 2034, reflecting a CAG...

The pedestrian detection system industry is projected to rise from USD 7.39 billion in 2024 to USD 35.21 billion by 2034, reflecting a CAGR of 16.90% ...

According to market projections, thex-by-wire system sector is expected to grow from USD 410.31 billion in 2024 to USD 9,397.68 billion by 2034, refle...

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us