October 2025

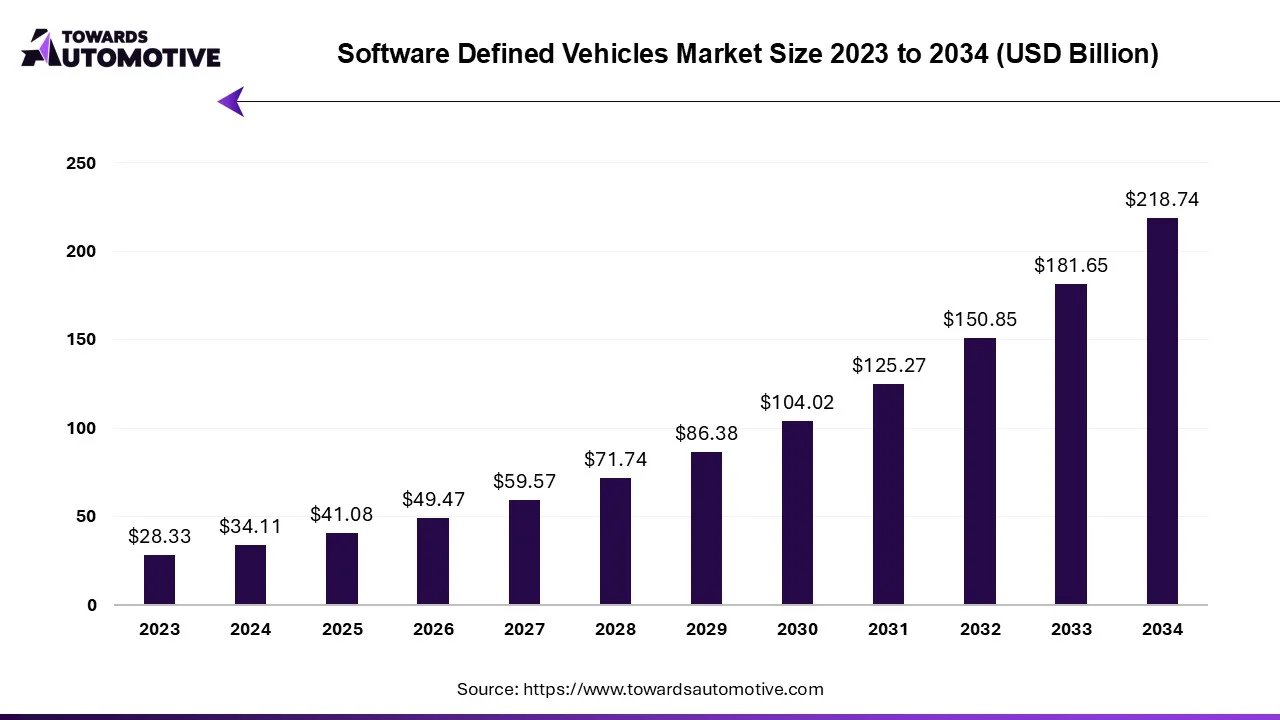

The software defined vehicles market is forecasted to expand from USD 41.08 billion in 2025 to USD 218.74 billion by 2034, growing at a CAGR of 20.42% from 2025 to 2034.

In the rapidly evolving landscape of automotive technology, the software-defined automotive industry is witnessing substantial growth driven by its contributions to safety, security, and environmental sustainability. By leveraging advanced software capabilities, real-time monitoring, predictive analysis, and intervention mechanisms, software-defined vehicles are playing a crucial role in reducing accidents and enhancing overall safety on the roads. These vehicles utilize data-driven insights to promote eco-driving behaviors among users, further improving safety outcomes and contributing to a greener environment.

Moreover, the integration of automotive Over-The-Air (OTA) systems is revolutionizing the software-defined automotive industry by enabling continuous improvements and flexibility. OTA technology allows for seamless software updates, enhancing vehicle functionality, security features, and user experience remotely. This capability is particularly significant in the context of emerging technologies such as autonomous driving and advanced driver assistance systems, where regular updates are essential to ensuring optimal performance and safety.

Automotive OTA systems facilitate prompt resolution of safety issues and errors, ensuring that vehicles remain up-to-date with the latest safety standards and regulations. Consequently, automotive OTA plays a pivotal role in driving the development of software-defined tools, enhancing market competitiveness, and elevating customer satisfaction levels.

However, the integration of various software components into a cohesive software-defined ecosystem poses challenges. Interoperability issues may arise when different products and applications from diverse vendors need to seamlessly integrate to provide a consistent user experience. Incompatibilities and interaction issues can lead to software malfunctions, decreased system performance, and compromised security features. To address these challenges effectively, continuous development of business models and processes is essential to ensure effective communication between different software components and harmonious operation within the automotive ecosystem.

The COVID-19 pandemic has indeed presented significant challenges to the software-defined automotive industry, with disruptions reverberating across various aspects of production, supply chains, and consumer behavior. Global trade disruptions, coupled with factory closures and reduced consumer spending, have severely impacted production and sales within the automotive sector. Automotive companies have encountered difficulties in sourcing essential components, leading to delays in the development and deployment of software-defined vehicles.

The heightened market uncertainty stemming from the pandemic has resulted in a decrease in consumer demand for new vehicles. With economic uncertainties looming large, consumers have become more cautious in their purchasing decisions, thereby dampening the prospects for new car sales. This decline in demand has further exacerbated the challenges faced by automotive manufacturers, particularly in terms of revenue generation and market expansion.

Moreover, the uncertain business environment has prompted a slowdown in research and development (R&D) investments within the software-defined automotive industry. Companies are adopting a more cautious approach to innovation as they navigate the uncertainties brought about by the pandemic. This deceleration in R&D activities has hindered the advancement of software-defined vehicle technology, delaying the introduction of new features and capabilities that could otherwise enhance the competitiveness of automotive products.

COVID-19 pandemic has posed significant obstacles to the software-defined automotive industry, impacting production, sales, consumer demand, and R&D investments. Overcoming these challenges will require adaptive strategies, resilient supply chains, and sustained investments in innovation to drive the industry forward in a post-pandemic landscape.

The collaboration between technology companies, automakers, and research institutions represents a pivotal driver in the growth of the software-defined vehicle industry, particularly in the context of autonomous vehicle development. By pooling together their expertise, resources, and capabilities, these stakeholders can accelerate progress in the field of driverless cars, fostering innovation and driving technological advancements.

A noteworthy example of such collaboration is the memorandum of understanding (MoU) signed between Tata Technologies and TIHAN IIT Hyderabad in May 2023. Through this strategic partnership, the two entities aim to collaborate on various fronts, including platform and proof of concept (POC) development, software-defined development tools (SDV), and advanced driver assistance systems (ADAS). By leveraging their collective strengths, Tata Technologies and TIHAN IIT Hyderabad seek to devise creative solutions that expedite the development of autonomous vehicles, reduce incubation times, and minimize costs associated with research and development efforts.

This collaborative approach underscores the importance of synergistic partnerships in driving innovation and overcoming challenges in the software-defined vehicle industry. By fostering an ecosystem of collaboration and knowledge sharing, stakeholders can harness the collective power of their expertise to address complex technological hurdles and propel the development of autonomous vehicles to new heights. Through initiatives like the Tata Technologies and TIHAN IIT Hyderabad partnership, the industry can unlock new opportunities for growth and advancement, ultimately paving the way for a future where software-defined vehicles redefine the automotive landscape.

The software-defined commercial vehicle market exhibits a notable segmentation by vehicle type, with passenger cars and commercial vehicles representing distinct segments. In 2022, the dominance of the passenger segment is evident, comprising over 80% of the market share. Automakers are spearheading growth within the passenger vehicle segment through the development of innovative software-defined vehicles (SDVs) that offer unparalleled flexibility and adaptability.

One noteworthy example of this trend is the collaboration between Groupe Renault and Valeo, announced in May 2023. Together, these industry leaders are focused on enhancing the electrical and electronic components of Renault's future vehicles, with a particular emphasis on refining the architecture of software-defined vehicles. This collaborative effort aims to create a dynamic SDV framework capable of seamlessly integrating new functionalities throughout the vehicle's lifecycle, without necessitating hardware modifications. By leveraging this software-centric approach, automakers can empower consumers with the ability to continuously customize and enhance their driving experience, driving demand for software-defined passenger vehicles.

In terms of application, the software-defined automotive industry encompasses a diverse array of categories, including infotainment systems, advanced driver assistance systems (ADAS), autonomous driving capabilities, remote information processing, and powertrain control, among others. Among these categories, the advanced driver assistance systems (ADAS) segment is poised to capture a significant market share of approximately 29% by 2022.

The growth trajectory of ADAS is primarily propelled by its pivotal role in enhancing vehicle safety. These sophisticated systems encompass a range of functionalities, including adaptive cruise control, lane departure warning, and automatic emergency braking, among others, which collectively bolster vehicle safety and mitigate the risk of accidents by providing real-time assistance to drivers. As consumer preferences increasingly prioritize safety features, automakers are swiftly integrating ADAS technologies into their vehicles to meet this demand, driving widespread adoption of the technology across the automotive industry.

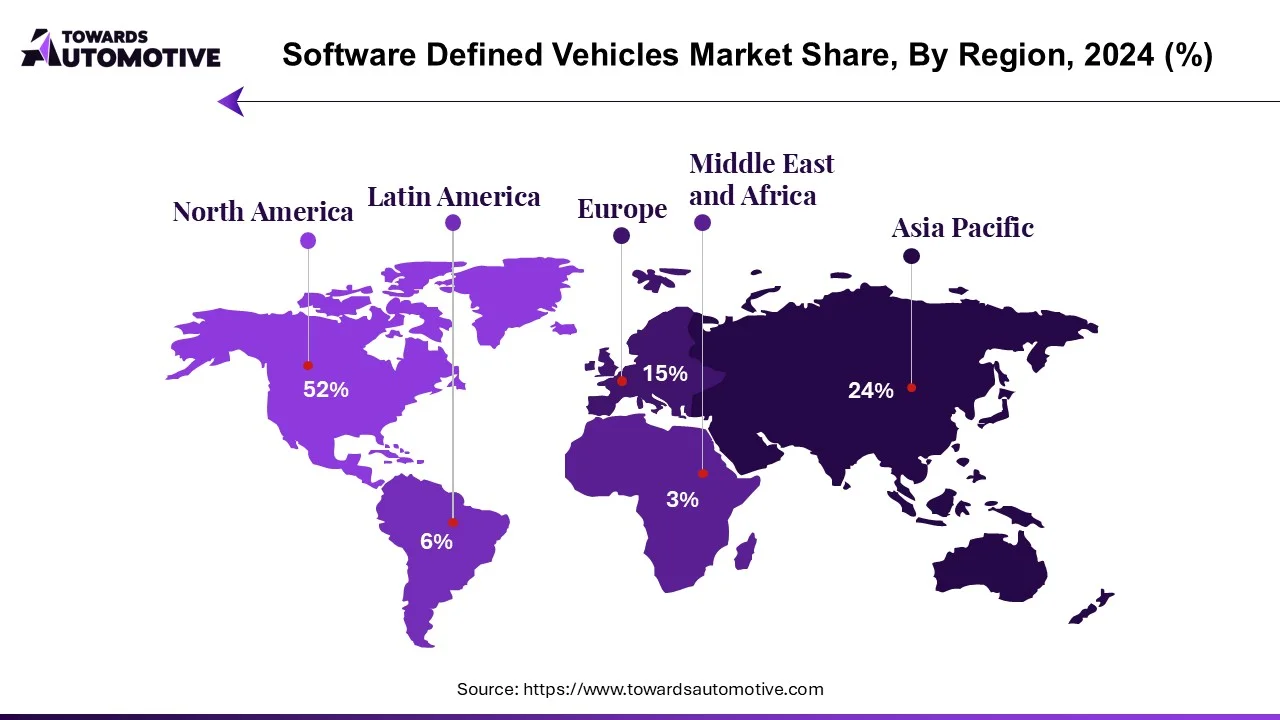

North America stands at the forefront of the global software-defined automotive innovation industry, with the United States emerging as a key driver of growth within the North American market. Fueled by a relentless pursuit of advanced technologies, such as over-the-air (OTA) vehicle updates and cutting-edge advanced driver assistance systems (ADAS), the region is continuously enhancing vehicle performance and safety standards. This culture of innovation has garnered substantial investments both domestically and internationally, solidifying North America's position as a premier hub for software-defined vehicle development.

The dynamic business landscape and relentless pursuit of innovation within North America are instrumental in propelling growth and shaping global trends in automotive technology. With a steadfast commitment to pushing the boundaries of what's possible in the automotive industry, North American companies are paving the way for transformative advancements that redefine the driving experience and set new benchmarks for safety, efficiency, and connectivity on a global scale.

Major players operating in the software-defined vehicle market are:

Tesla Inc. and Nvidia Corp. stand out as major investors in the software-defined automotive market, each bringing unique strengths and innovations to the table. Tesla's approach involves a high degree of vertical integration, with the company developing a significant portion of its vehicle software and hardware in-house. This level of control enables Tesla to rapidly iterate and customize its software-defined solutions to align with its specific objectives and priorities, fostering innovation and agility within the organization.

On the other hand, Nvidia Corp. is renowned for its cutting-edge technology platforms, particularly the NVIDIA DRIVE platform, tailored specifically for autonomous driving applications. This comprehensive hardware and software solution encompasses powerful GPUs, hardware accelerators, software development kits (SDKs), and libraries, offering a robust foundation for driver development and innovation. By providing advanced tools and resources to automotive manufacturers and developers, Nvidia empowers them to accelerate the development and deployment of software-defined automotive solutions, driving progress and shaping the future of mobility.

By Vehicle Type

By Application

By Software Type

By Connectivity

By Propulsion Type

By Geography

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us