September 2025

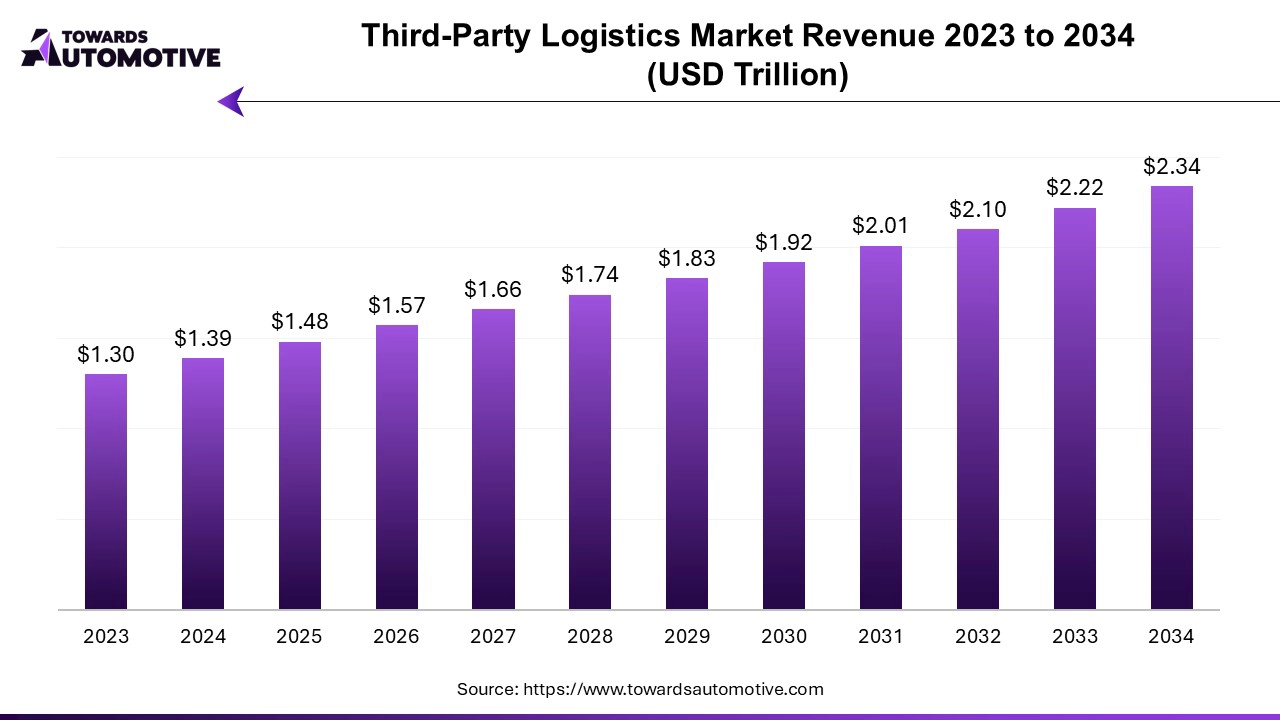

The third-party logistics market is projected to reach USD 2.34 trillion by 2034, growing from USD 1.48 trillion in 2025, at a CAGR of 5.47% during the forecast period from 2025 to 2034. The growing adoption of 3PL services by pharmaceutical companies to enhance the supply chain operations in different parts of the world coupled with rapid investment by logistics companies for launching freight logistics services is playing a vital role in shaping the industrial landscape.

Additionally, the rising development of the e-commerce sector along with increasing popularity of last-mile delivery services has contributed to the overall market expansion. The integration of cloud computing and digital twins in the logistics sector is expected to create ample growth opportunities for the market players in the upcoming days.

Unlock Infinite Advantages: Subscribe to Annual Membership

The third-party logistics market is a crucial segment of the logistics industry. This industry deals in providing 3PL services in different parts of the world. There are several types of services delivered by this sector comprising of dedicated contract carriage/ freight forwarding, domestics transportation management, international transportation management, warehousing and distribution, value-added logistics services and some others. These services are operated using numerous modes of transportation including roadways, railways, waterways, airways and some others. The end-user of this sector consists of manufacturing, retail, healthcare, automotive and some others. This market is expected to rise with the growth of the e-commerce sector around the globe.

The major trends in this market consists of warehouse automation, investment in logistics sector and development in road infrastructure.

The logistics companies have started integrating automated tools in warehouses to enhance the working efficiency and reduce errors in logistics operations.

Numerous market players are investing heavily for launching international 3PL services to cater the needs of the healthcare and automotive sector.

Government of various countries such as China, India, the U.S., Japan and some others are launching new initiatives for developing the road infrastructure.

| Metric | Details |

| Market Size in 2024 | USD 1.39 Trillion |

| Projected Market Size in 2034 | USD 2.34 Trillion |

| CAGR (2025 - 2034) | 5.47% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Service, By Transport, By End-Use and By Region |

| Top Key Players | CEVA Logistics; DSV; DB Schenker Logistics; FedEx; BDP International |

The domestic transportation management (DTM) segment dominated the market. The growing use of 3PL services by frozen food companies to transfer food items from one city to another has boosted the market expansion. Additionally, rising investment by logistics companies to launch new 3PL services to cater the demands of the local industries is playing a vital role in shaping the industrial landscape. Moreover, the increasing application of DTM in manufacturing sector is expected to propel the growth of the third-party logistics market.

The international transportation management (ITM) segment is expected to rise with a significant CAGR during the forecast period. The increasing use of ITM solutions by e-commerce brands to transport goods internationally has driven the market expansion. Additionally, the growing adoption of advanced logistics solutions by international brands to easily transport goods from one nation to another is playing a vital role in shaping the industrial landscape. Moreover, the rising investment by government for strengthening the cross-border trade activities is expected to foster the growth of the third-party logistics market.

The manufacturing segment held the largest share of the market. The rising adoption of 3PL services by manufacturing companies to transport goods from one region to another has driven the market expansion. Additionally, the increasing use of airway-based logistics services by manufacturing sector to supply products quickly coupled with numerous government initiatives aimed at developing the manufacturing sector is playing a vital role in shaping the industrial landscape. Moreover, numerous partnerships and collaborations among manufacturing entities and logistics providers to maintain a suitable supply chain is expected to foster the growth of the third-party logistics market.

The automotive segment is expected to grow with the highest CAGR during the forecast period. The rapid development in the automotive sector coupled with technological advancements in the logistics industry has boosted the market expansion. Additionally, the growing adoption of online platforms for purchasing automotive components along with rapid investment by public sector entities for enhancing automotive logistics is playing a vital role in shaping the industrial landscape. Moreover, joint ventures among automotive brands and logistics operators to maintain supply chain of automotive products in different parts of the world is expected to propel the growth of the third-party logistics market.

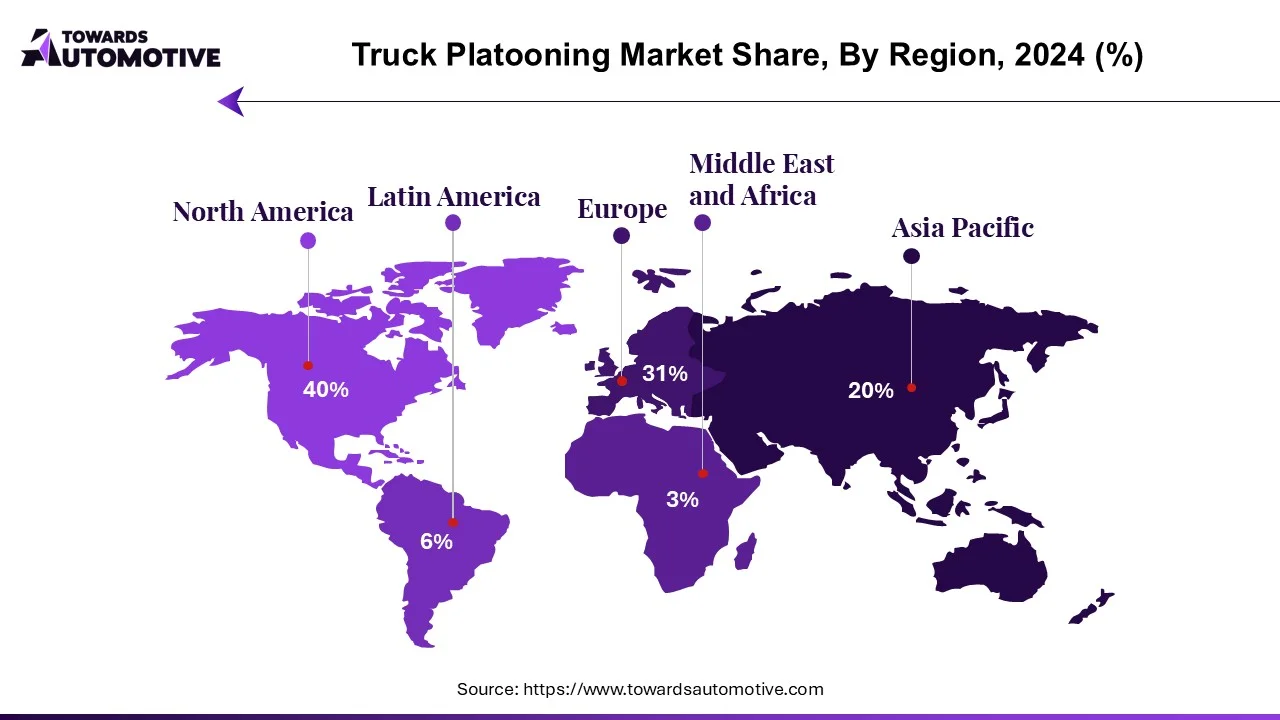

Asia Pacific led the third-party logistics market. The growing demand for superior logistics services in several countries such as India, China, Japan, South Korea and some others has driven the market expansion. Additionally, the rapid expansion of the e-commerce sector coupled with integration of advanced technologies such as AI and IoT in the logistics sector is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of several market players such as Nippon Express, Yusen Logistics Co. Ltd., Kerry Logistics and some others is expected to drive the growth of the third-party logistics market in this region.

North America is expected to grow with a significant CAGR during the forecast period. The growing adoption of green logistics in the U.S. and Canada has driven the market growth. Additionally, numerous government initiatives aimed at developing the logistics sector coupled with presence of well-established automotive industry is further adding to the industrial expansion. Moreover, the presence of several 3PL service providers such as UPS, FedEx Corporation, C.H. Robinson and some others is expected to propel the growth of the third-party logistics market in this region.

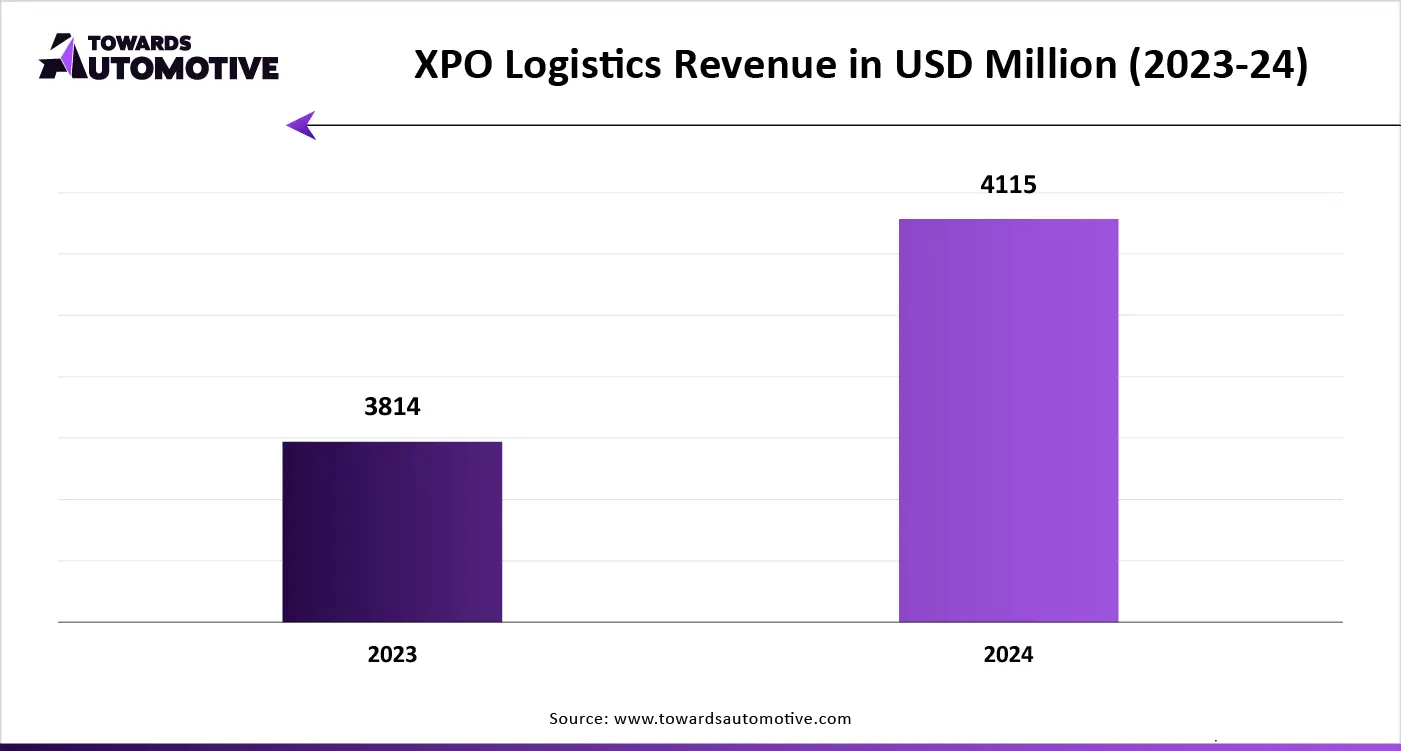

The third-party logistics market is a highly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of CEVA Logistics; DSV; DB Schenker Logistics; FedEx; BDP International; Burris Logistics; C.H. Robinson Worldwide, Inc.; J.B. Hunt Transport, Inc.; Kuehne + Nagel; Nippon Express; United Parcel Service of America, Inc.; XPO Logistics, Inc; Yusen Logistics Co. Ltd. and some others. These companies are constantly engaged in delivering 3PL services and adopting numerous strategies such as collaborations, acquisitions, partnerships, joint ventures, launches, and some others to maintain their dominance in this industry.

By Service

By Transport

By End-Use

By Region

September 2025

June 2025

June 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us