August 2025

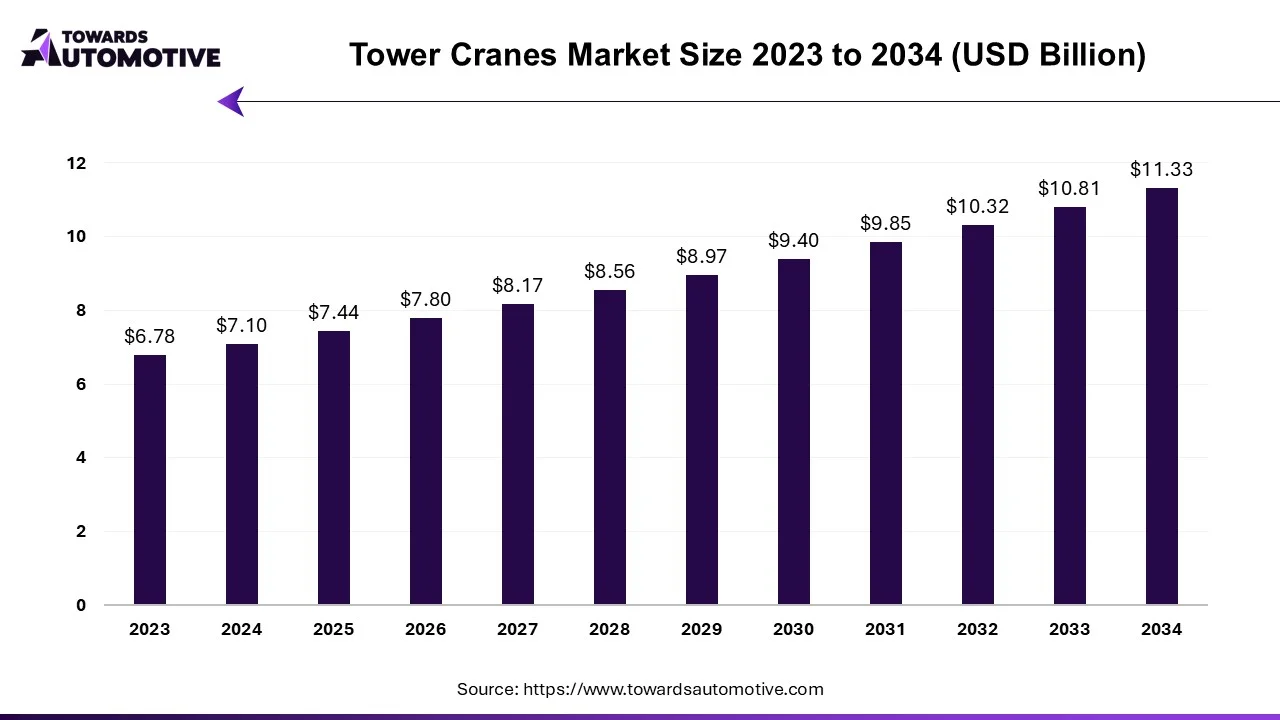

The tower crane market is anticipated to grow from USD 7.44 billion in 2025 to USD 11.33 billion by 2034, with a compound annual growth rate (CAGR) of 4.78% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The tower crane market is undergoing significant transformation stimulated by the growing need for vertical construction and rapid developments in international infrastructure. Tower cranes are being integrated with digital systems, remote control, and anti-collision technologies to help in construction projects. There are different types of tower cranes available in the market consisting of hammerhead cranes, flat top cranes, luffing jib cranes, self-erecting cranes and some others. These cranes are capable of towing weights ranging from 5 tons to 50 tons. It is powered using various propulsion technology comprising of electric, diesel, hybrid and some others. The end-user of these cranes comprises of construction companies, mining sector, logistics centers and some others. This market is projected to grow significantly with the rise of the heavy equipment industry around the world.

| Metric | Details |

| Market Size in 2024 | USD 7.10 Billion |

| Projected Market Size in 2034 | USD 11.33 Billion |

| CAGR (2025 - 2034) | 4.78% |

| Leading Region | Asia Pacific |

| Market Segmentation | Liebherr, Zoomlion, Manitowoc, Terex, XCMG |

| Top Key Players | By Type, By Application and By Geography |

Tower cranes can now perform remote diagnostics, predictive maintenance, and real-time performance tracking due to the combination of telematics and IoT technology. These advanced solutions increase operational effectiveness, decrease downtime, and improve site safety. Cranes with sophisticated sensors and software are being developed by manufacturers to assist operators in tracking load dynamics and averting mishaps.

The market is shifting towards electric-powered cranes to meet the requirements of the environmental regulations and sustainability goals. The demand for electric cranes has drastically increased in the mining sector for lowering emission arising from uranium mines and gold mines.

Due to the high cost of ownership, rental companies are expanding their tower crane fleets to meet rising demand from infrastructure developers and real estate sectors. Rental models allow contractors to scale operations without investing heavy capital for purchasing tower cranes.

Flat top segment dominated the tower crane market with the largest share in 2024. The demand for flat top cranes has increased due to its short size that enables workers to move and install it on constrained urban building sites, thereby driving the market growth. These cranes are mainly preferred by contractors and construction brands to enhance building capabilities. Moreover, rapid investment by market players for developing advanced flat-top cranes has further driven the growth of the tower crane market.

Hammerhead segment is expected to grow at the fastest rate in the market. Hammerhead cranes are becoming more popular in large-scale infrastructure and high-rise building projects due to their sturdy design and capacity to lift heavier loads in long distances. Their strong lifting capacity and fixed horizontal jib enable them to be used in demanding tough construction environments, which propels their quick global adoption. The need for hammerhead cranes is growing rapidly as infrastructure and urbanization has attained prominent traction in recent times. The above-mentioned factors is likely to foster the growth of the tower crane market.

High-rise segment dominated the tower crane market with the largest share in 2024 due to rising demand for tall building projects and skyscrapers in different parts of the world. In these sectors, tower cranes are necessary for safe and effective lifting of heavy materials to great heights. This market is constantly in high demand due to the ongoing expansion of urbanization and commercial real estate development.

Dam building segment is expected to grow at the fastest rate in the market. The demand for heavy-duty lifting equipment such as tower cranes has increased due to rising investments in massive hydroelectric and water infrastructure projects worldwide. These cranes are also essential for handling of large construction materials in difficult terrain, which propels the industrial expansion. Several market players are launching advanced cranes for cater the needs of dam building operations, thereby fostering the growth of the tower crane market.

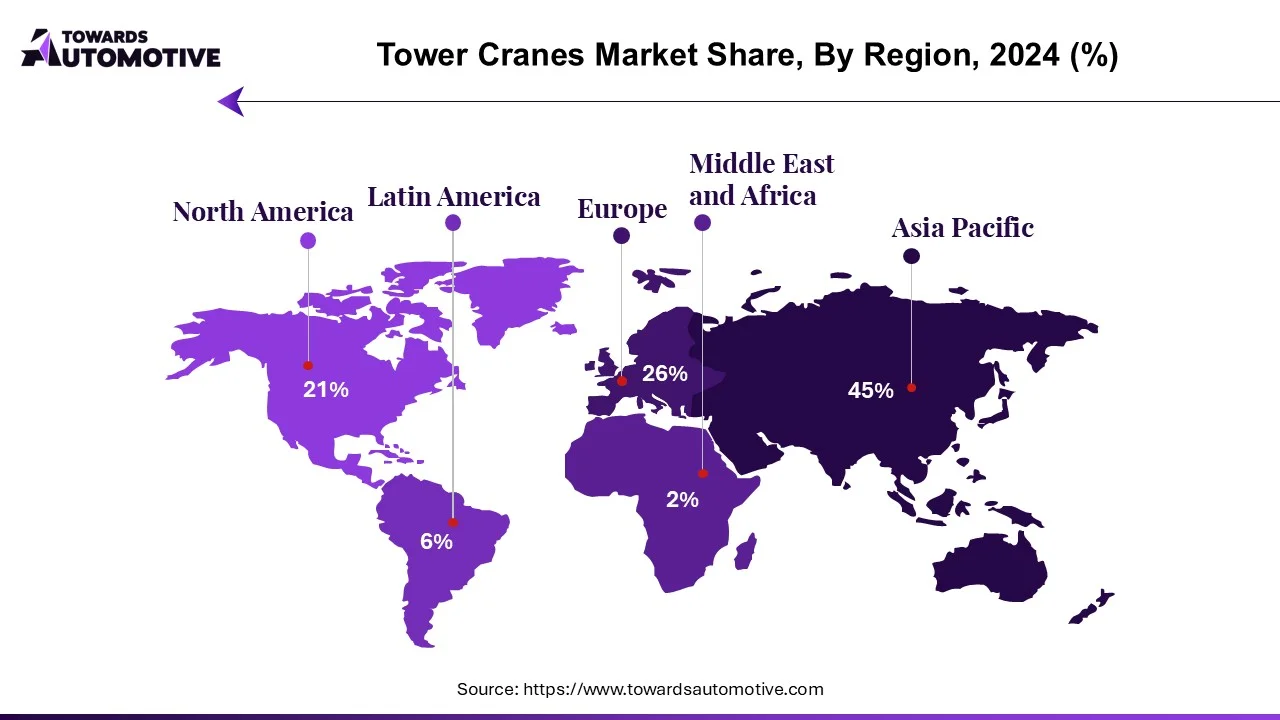

Asia Pacific dominated the tower crane market in 2024 due to large-scale infrastructure investments by government, rapid urban development, and growing construction activities. The area's strong industrial growth and demand for intricate and high-rise construction projects have allowed it to maintain its dominant market share. Government expenditures on energy transportation and housing projects has further contributed to the industrial expansion of tower cranes. The region leads in this market due to the presence of large manufacturers such as Favelle Favco, Zoomlion Heavy Industry Science & Technology Co. Ltd, , Yongmao Holdings Limited and some others.

China dominated the market in this region. In China, the market is generally driven by the rising government investment for strengthening the infrastructures along with technological advancements in heavy equipment industry. Moreover, the presence of several local manufacturers of tower cranes such as Sany Heavy Industry Co. Ltd and Xuzhou Construction Machinery Group Co. Ltd further adds to the market expansion.

North America holds a significant share in the tower crane market, driven by consistent commercial building infrastructure modernization and technological advancements related to lifting equipment. Advanced crane technologies have become popular in the U.S. and Canada due to rapid investment in construction projects that prioritize sustainability and safety. Furthermore, the deployment of tower cranes in major cities is still being driven by the rising demand for high-rise commercial buildings and renovation projects. Additionally, the presence of several crane manufacturers such as Terex Corporation, Manitowoc Company Inc and some others is further driving the growth of the tower crane market in this region.

The tower crane industry in 2025 features strong competition among global players, prioritizing technological advancements, fleet expansion, and regional presence. Major companies include Liebherr, Zoomlion, Manitowoc, Terex, XCMG, Potain, Comansa, Jaso, and Yongmao. These firms are focusing on automation, energy efficiency, and real-time data systems to offer safer, smarter, and more sustainable crane solutions.

By Type

By Application

By Geography

August 2025

August 2025

August 2025

June 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us