July 2025

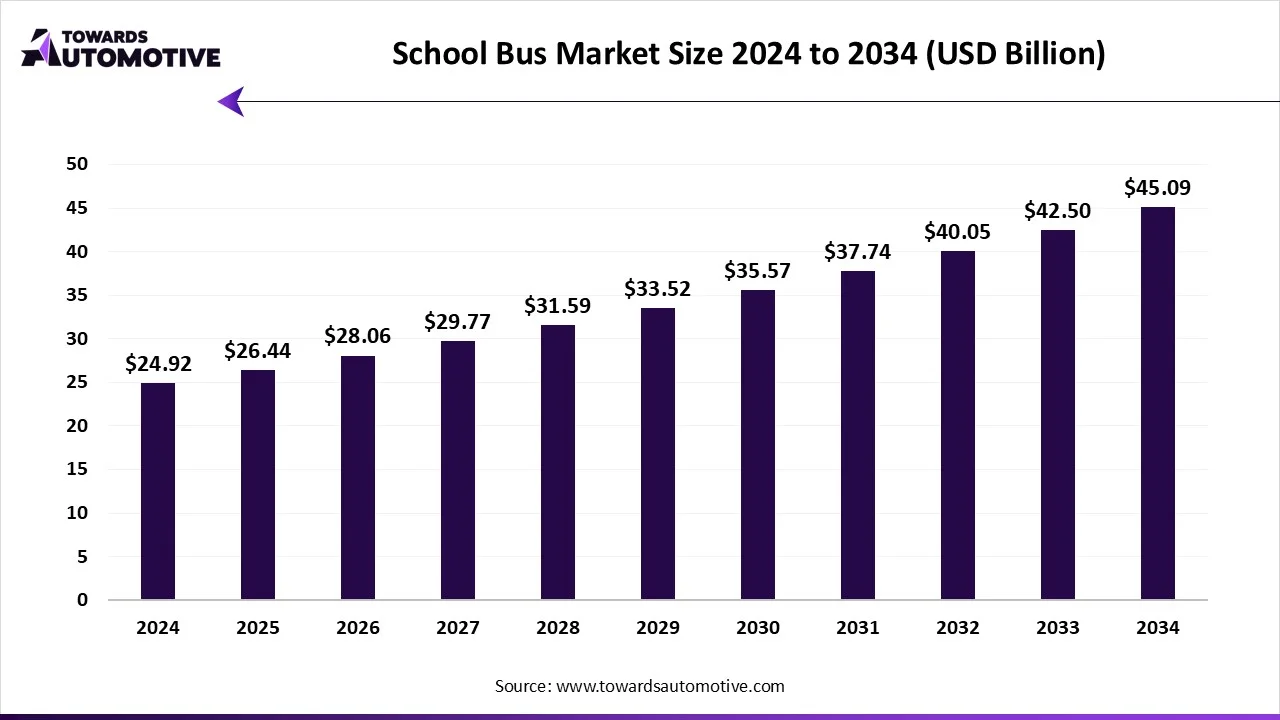

The school bus market is expected to increase from USD 26.44 billion in 2025 to USD 45.09 billion by 2034, growing at a CAGR of 6.11% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The school bus market is a prominent segment of the automotive industry. This industry deals in manufacturing and distribution of school buses in different parts of the world. There are several types of buses developed in this sector consisting of Type A buses, Type B buses, Type C buses and Type D buses. These buses are powered using different types of fuel comprising of gasoline, diesel, electric and hybrid. The school buses are equipped with various types of drive systems including 4*2, 4*4, 6*4, 6*6 and others. It is integrated with numerous safety features such as advanced driver assistance systems (ADAS), electronic stability control (ESC), anti-lock braking system (ABS), seatbelts, cameras and some others. The growing sales of electric school buses in different parts of the world has boosted the market expansion. This market is expected to rise significantly with the growth of the bus manufacturing industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 24.92 billion |

| Projected Market Size in 2034 | USD 45.09 billion |

| CAGR (2025 - 2034) | 6.11% |

| Leading Region | Europe |

| Market Segmentation | By Bus Type, By Propulsion and By Region |

| Top Key Players | TAM-Europe (Slovenia), IVECO Bus (Italy), Gillig LLC (U.S.), Navistar Inc. (U.S.), Blue Bird Corporation (U.S.), Collins Bus Corporation (U.S.) |

School Bus Market Size, By Bus Type, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Type A | 10.22 | 10.79 | 11.39 | 12.03 | 12.70 | 13.41 | 14.16 | 14.95 | 15.78 | 16.66 | 17.58 |

| Type B | 3.49 | 3.67 | 3.87 | 4.08 | 4.30 | 4.53 | 4.77 | 5.02 | 5.29 | 5.57 | 5.86 |

| Type C | 6.98 | 7.43 | 7.92 | 8.42 | 8.97 | 9.55 | 10.17 | 10.83 | 11.53 | 12.28 | 13.08 |

| Type D | 4.23 | 4.55 | 4.88 | 5.24 | 5.62 | 6.03 | 6.47 | 6.94 | 7.45 | 7.99 | 8.57 |

The type A segment held a dominant share of the market. The growing adoption of Type A school buses for transporting students on shorter routes has boosted the market expansion. Additionally, the increasing preference of parents to send their children in type A buses is further adding to the industrial growth. Moreover, several advantages of these school buses including enhanced safety, smoot ride experience, cost-effectiveness, reduced traffic congestion and some others is accelerating the growth of the school bus market.

The type B segment is likely to rise with a considerable growth rate during the forecast period. The rising use of medium-sized school buses for student transportation has boosted the market growth. Additionally, these buses are built on front section chassis platform that increases the overall carrying capacity, thereby fostering the industrial expansion. Moreover, the growing adoption of type B buses for long-distance transportation of students is further anticipated to drive the growth of the school bus market.

The diesel segment held the largest share of the market. The growing adoption of diesel-based school buses in APAC region due to lack of EV charging stations has boosted the market growth. Also, numerous advantages of diesel-powered school buses including high reliability, low operating costs, less maintenance, superior mileage and some others is playing a vital role in shaping the industrial landscape. Moreover, numerous bus companies are collaborating with modern schools for delivering high-performance diesel buses that in turn is expected to boost the growth of the school bus market.

The electric segment is anticipated to witness fastest growth during the forecast period. The growing demand for electric school buses in western nations such as the U.S., UK, Germany, France and some others has boosted the market growth. Also, numerous government initiatives aimed at strengthening the EV charging infrastructure coupled with rapid consumer awareness to reduce emission is driving the industrial expansion. Moreover, the increasing sales of electric school buses along with rising investment by EV brands for developing advanced buses for school sector is expected to propel the growth of the school bus market.

School Bus Market Size, By Region, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Europe | 8.22 | 8.67 | 9.15 | 9.65 | 10.17 | 10.73 | 11.31 | 11.93 | 12.58 | 13.26 | 13.98 |

| North America | 6.73 | 7.09 | 7.46 | 7.86 | 8.28 | 8.71 | 9.18 | 9.66 | 10.17 | 10.71 | 11.27 |

| Asia-Pacific | 5.98 | 6.42 | 6.90 | 7.41 | 7.96 | 8.55 | 9.18 | 9.85 | 10.57 | 11.35 | 12.17 |

| Latin America | 2.24 | 2.41 | 2.58 | 2.77 | 2.97 | 3.18 | 3.41 | 3.66 | 3.93 | 4.21 | 4.51 |

| Middle East & Africa | 1.75 | 1.85 | 1.97 | 2.08 | 2.21 | 2.35 | 2.49 | 2.64 | 2.80 | 2.97 | 3.16 |

Europe held the highest share of the school bus market. The rising adoption of electric school buses due to increased emphasis on reducing emission has boosted the market expansion. Additionally, the rise in number of convent schools coupled with numerous government initiatives aimed at strengthening the educational sector is playing a vital role in shaping the industrial landscape. Moreover, the growing development in the automotive sector along with presence of several school bus manufacturing brands is expected to propel the growth of the school bus market in this region.

UK dominated this region. The rise in number of private schools has increased the demand for school buses, thereby boosting the market expansion. Additionally, rising preference of parents to send their child safely to schools is further contributing to the industrial growth. Moreover, the schools of England and Wales are adopting electric buses for operating their daily operations that in turn is likely to shape the industrial landscape.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The growing demand for high-quality education in countries such as India, China, Japan and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the school infrastructure coupled with rising concern about student safety is further accelerating the industrial growth. Furthermore, the rising adoption of Type A school buses along with technological advancements in automotive sector is expected to boost the growth of the school bus market in this region.

China and India contributed significantly to the market. In China, the market is generally driven by the rising demand for advanced school buses equipped with features such as ADAS, ABS, ESC and some others coupled with rapid investment by bus manufacturers for developing superior quality school buses. In India, the rise in number of private schools along with rapid adoption e-buses for transporting students is driving the market growth.

The school bus market is a highly developing industry with the presence of a numerous dominating players. Some of the prominent companies in this industry consists of Trans Tech Bus (U.S.), TAM-Europe (Slovenia), IVECO Bus (Italy), Gillig LLC (U.S.), Navistar Inc. (U.S.), Blue Bird Corporation (U.S.), Collins Bus Corporation (U.S.) and some others. These companies are constantly engaged in developing school buses and adopting numerous strategies such as partnerships, collaborations, business expansions, launches, acquisitions, joint ventures and some others to maintain their dominant position in this industry. For instance, in November 2023, Trans Tech launched Type A school bus. This school bus is designed for the students of New York, U.S. Also, in May 2023, Collins Bus launched Ford E-Transit Type A school bus. This school bus is equipped with a 68-kWh battery and an 8-year/100,000-mile warranty.

By Bus Type

By Propulsion

By Region

July 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us