December 2025

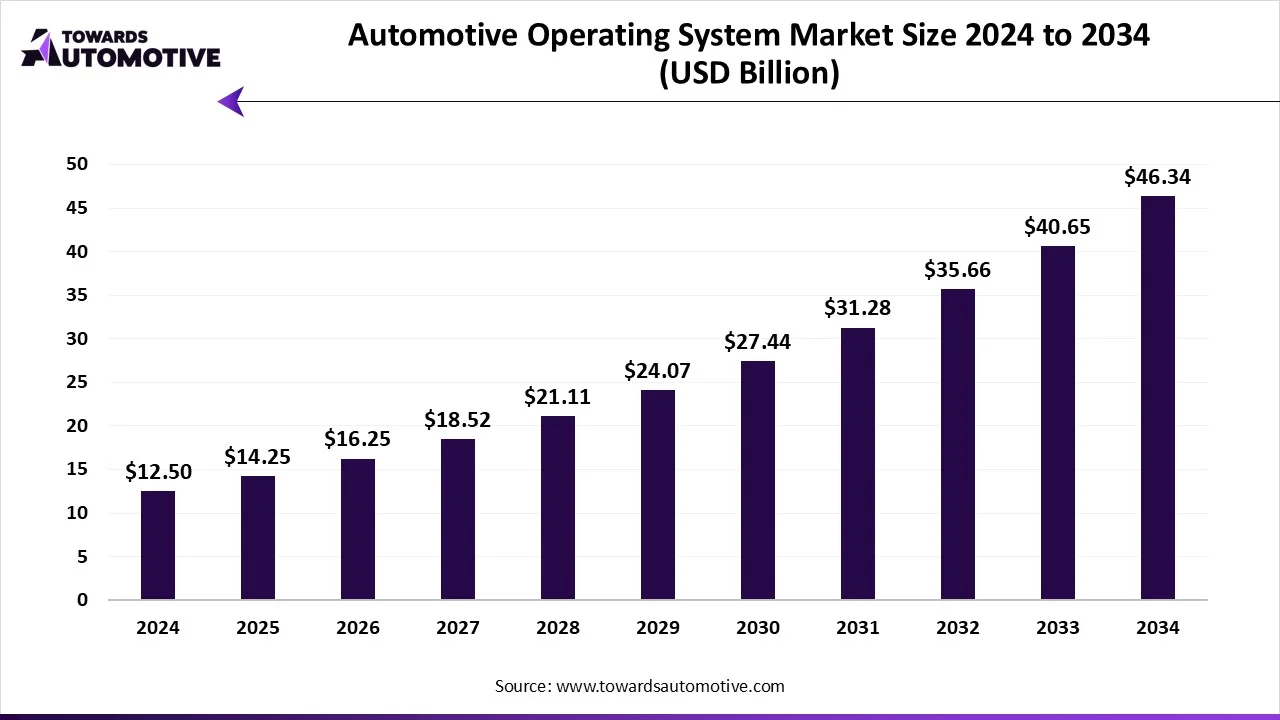

The automotive operating system market is set to grow from USD 14.25 billion in 2025 to USD 46.34 billion by 2034, with an expected CAGR of 14% over the forecast period from 2025 to 2034. The rising popularity software-defined vehicles coupled with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape.

Moreover, the deployment of advanced OS in modern cars to enhance the driving experience along with rapid investment by automakers to develop multitasking operating systems for the automotive sector has boosted the market expansion. The integration of AI and augmented reality (AR) in automotive operating systems is expected to create ample growth opportunities for the market players in the future.

The automotive operating system market is a crucial branch of the automotive industry. This industry deals in providing development and distribution of OS for the automotive sector. There are different types of OS developed in this sector consisting of embedded Linux OS, android automotive OS, QNX, RTOS, windows embedded automotive OS, proprietary OEM OS and some others. These OS are designed for numerous types of vehicles comprising of passenger vehicles, commercial vehicles, two-wheelers & micro-mobility vehicles. It is used in numerous automotive applications including infotainment & multimedia, advanced driver assistance system, powertrain & battery management, body control & comfort systems, telematics & connectivity, autonomous driving systems and some others. The growing demand for convenience features in luxury vehicles has boosted the market expansion. This market is expected to rise significantly with the growth of the software industry around the world.

| Metric | Details |

| Market Size in 2025 | USD 14.25 Billion |

| Projected Market Size in 2034 | USD 46.34 Billion |

| CAGR (2025 - 2034) | 14% |

| Leading Region | Europe |

| Market Segmentation | By OS Type, By Vehicle Type, By Application Domain, By Deployment Mode, By Vehicle Software Architecture and By Region |

| Top Key Players | Google, BlackBerry QNX, Automotive Grade Linux (AGL), Microsoft, Green Hills Software, Wind River Systems, Mentor Graphics (Siemens), Continental AG. |

The major trends in this market consists of partnerships, rising sales of EVs and rapid investment in 5G technology.

Automotive Operating System Market Size, By OS Type, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Embedded Linux | 1.50 | 1.71 | 1.96 | 2.23 | 2.55 | 2.92 | 3.33 | 3.80 | 4.34 | 4.96 | 5.67 |

| Android Automotive OS (AAOS) | 1.88 | 2.14 | 2.44 | 2.79 | 3.18 | 3.64 | 4.15 | 4.74 | 5.41 | 6.17 | 7.05 |

| QNX (BlackBerry) | 3.13 | 3.58 | 4.10 | 4.70 | 5.39 | 6.17 | 7.07 | 8.10 | 9.29 | 10.64 | 12.19 |

| RTOS | 1.25 | 1.42 | 1.62 | 1.84 | 2.10 | 2.39 | 2.72 | 3.10 | 3.53 | 4.02 | 4.57 |

| AUTOSAR Classic | 1.00 | 1.14 | 1.29 | 1.47 | 1.66 | 1.89 | 2.15 | 2.44 | 2.77 | 3.15 | 3.57 |

| AUTOSAR Adaptive | 0.88 | 0.99 | 1.12 | 1.27 | 1.44 | 1.63 | 1.85 | 2.10 | 2.38 | 2.69 | 3.05 |

| Windows Embedded Automotive | 0.63 | 0.70 | 0.79 | 0.89 | 1.01 | 1.13 | 1.28 | 1.44 | 1.62 | 1.82 | 2.05 |

| Proprietary OEM Systems | 2.25 | 2.56 | 2.91 | 3.32 | 3.77 | 4.29 | 4.89 | 5.56 | 6.33 | 7.20 | 8.19 |

The QNX (BlackBerry) segment dominated the market with a share of 30%. The integration of QNX OS in commercial vehicles to monitor real-time insights in fleet operations has boosted the market expansion. Additionally, the growing use of this OS to facilitate digital instrument clusters and advanced driver-assistance systems (ADAS) in modern vehicles is playing a crucial role in shaping the industrial landscape. Moreover, the deployment of QNX OS by several automotive brands such as Audi, BMW, Mercedes-Benz, Toyota, Ford, General Motors, Honda, Volkswagen, Volvo and some others is expected to boost the growth of the automotive operating system market.

The android automotive OS segment is expected to expand with the highest CAGR during the forecast period. The increasing application of automotive OS in mid-ranged vehicles to enhance the infotainment and multimedia experience has boosted the market expansion. Additionally, the ability of android OS to connect electronic devices such as mobile phones, tablets, laptops and some others is contributing to the industry in a positive direction. Moreover, the increasing popularity of android systems coupled with availability of several automotive android apps in Google Play Store is expected to propel the growth of the automotive operating system market.

The passenger vehicles segment held the largest share of the market with a share of 70%. The rising sales and production of passenger cars in several countries such as India, Germany, Japan, China, the U.S. and some others has boosted the market expansion. Additionally, rapid investment by automotive brands for integrating advanced OS in luxury vehicles is playing a vital role in shaping the industrial landscape. Moreover, partnerships among passenger vehicle companies and software providers to develop advanced OS for the passenger cars is expected to boost the growth of the automotive operating system market.

The electric passenger vehicles segment is expected to rise with the fastest CAGR during the forecast period. The rising adoption of electric vehicles in numerous developed nations with an aim at reducing vehicular emission has boosted the market growth. Also, the growing use of android OS in EVs to enhance safety coupled with the increasing application of advanced software in EVs for powertrain & battery management is playing a vital role in shaping the industry in a positive direction. Moreover, collaborations among EV brands and OS providers to deploy high-quality OS in premium EVs is expected to propel the growth of the automotive operating system market.

The infotainment & multimedia segment dominated the market with a share of 35%. The rising use of android operating systems in modern cars to enhance several features such as infotainment and multimedia has driven the market expansion. Additionally, increasing emphasis of automotive brands to deploy advanced OS in luxury cars for improving the audio and video experience is contributing to the industrial growth. Moreover, the integration of AI and IoT in automotive infotainment systems is expected to foster the growth of the automotive operating system market.

The ADAS & autonomous driving systems segment is expected to grow with the fastest CAGR during the forecast period. The increasing popularity of autonomous vehicles in developed nations such as the U.S., China, Singapore and some others has driven the industrial expansion. Also, the growing adoption of driverless vehicles by fleet operators to reduce dependency on manual drivers is playing a vital role in shaping the industrial landscape. Moreover, numerous government initiatives aimed at mandating ADAS in passenger cars is expected to drive the growth of the automotive operating system market.

The onboard (embedded) segment led the market with a share of 65%. The integration of onboard operating systems in low-range vehicles to enhance vehicular functions has boosted the market expansion. Additionally, the growing use of embedded OS in automotive to handle communication with sensors and actuators is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of onboard operating systems including improved control, enhance security, superior performance and some others is expected to foster the growth of the automotive operating system market.

The cloud-connected (OTA-enabled) segment is expected to rise with a the highest CAGR during the forecast period. The growing use of cloud-based operating systems in luxury vehicles to enhance navigation and improve safety has boosted the market growth. Additionally, the increasing emphasis of automotive brands to deploy cloud-based OS in modern vehicles is playing a crucial role in shaping the industry in a positive direction. Moreover, several advantages of cloud-based OS such as reduced costs, enhanced flexibility, improved accessibility and some others is expected to propel the growth of the automotive operating system market.

The domain-centric architecture segment held the highest share of the industry with 50%. The growing adoption of domain-centric architecture in modern cars to control the electronic functions has boosted the market expansion. Additionally, numerous advantages of this architecture including reduced complexity, adaptability, reduce debugging time, efficient resource utilization and some others has driven the growth of the automotive operating system market.

The centralized/server-based architecture (SDV) segment is expected to grow with the fastest CAGR during the forecast period. The growing popularity of software defined vehicles coupled with the increasing use of centralized OS in the automotive sector for enhancing autonomous driving capabilities in vehicles has boosted the market expansion. Additionally, various advantages of these OS including centralized management, improved security, scalability, optimized resource utilization and some others is expected to boost the growth of the automotive operating system market.

Automotive Operating System Market Size, By Region, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| North America | 3.13 | 3.56 | 4.07 | 4.64 | 5.29 | 6.03 | 6.88 | 7.85 | 8.95 | 10.21 | 11.64 |

| Europe | 3.75 | 4.28 | 4.90 | 5.59 | 6.39 | 7.30 | 8.34 | 9.53 | 10.89 | 12.44 | 14.22 |

| Asia-Pacific | 3.75 | 4.27 | 4.87 | 5.55 | 6.33 | 7.22 | 8.23 | 9.38 | 10.69 | 12.18 | 13.89 |

| Latin America | 1.00 | 1.14 | 1.29 | 1.46 | 1.66 | 1.89 | 2.14 | 2.43 | 2.76 | 3.13 | 3.55 |

| Middle East & Africa | 0.88 | 0.99 | 1.12 | 1.27 | 1.44 | 1.63 | 1.85 | 2.09 | 2.37 | 2.68 | 3.04 |

Europe led the automotive operating system market with a share of 40%. The increasing sales of electric vehicles in several nations such as Germany, Italy, France, UK and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at enhancing safety in vehicles coupled with rapid adoption of software-defined vehicles is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of numerous market players such as Stellantis, Continental AG, NXP Semiconductors, Robert Bosch and some others is expected to drive the growth of the automotive operating system market in this region.

Germany dominated the market in this region. The growing demand for luxury cars coupled with technological advancements in the automotive sector has boosted the market expansion. Additionally, the presence of several automotive brands such as BMW, Audi, Volkswagen and some others is playing a vital role in shaping the industry in a positive direction.

Asia Pacific is expected to grow with the fastest CAGR during the forecast period. The growing sales and production of passenger vehicles in various countries such as India, China, Japan, South Korea and some others has driven the market growth. Also, rapid development in the software industry along with rise in number of automotive startups is crucial for the industrial expansion. Moreover, the presence of several market players such as Panasonic Automotive, Denso, Toyota and some others is expected to boost the growth of the automotive operating system market in this region.

China and Japan are the prominent contributors in this region. In China, the market is generally driven by the growing sales and production of passenger vehicles. In Japan, the increasing development in the software industry coupled with rising popularity of software-defined vehicles is playing a prominent role in shaping the industrial landscape.

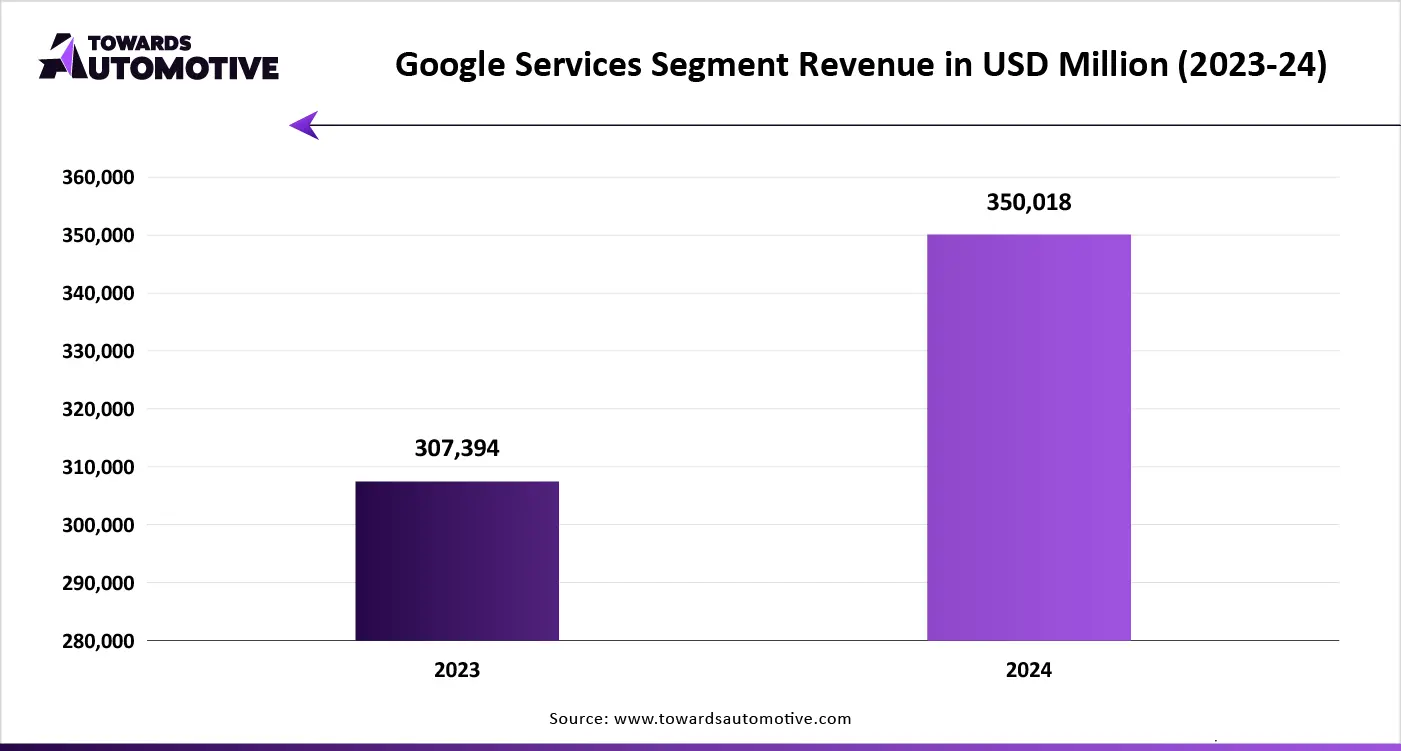

The automotive operating system market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Continental AG, Elektrobit, Bosch, Google, BlackBerry QNX, Automotive Grade Linux (AGL), Microsoft, Green Hills Software, Wind River Systems, Mentor Graphics (Siemens), NVIDIA, Tesla, Apple, Panasonic Automotive, NXP Semiconductors, Renesas Electronics, Aptiv, Vector Informatik and some others. These companies are constantly engaged in developing operating systems for the automotive industry and adopting numerous strategies such as business expansions, joint ventures, acquisitions, collaborations, launches, partnerships, and some others to maintain their dominance in this industry.

By OS Type

By Vehicle Type

By Application Domain

By Deployment Mode

By Vehicle Software Architecture

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us