December 2025

The AI-based driving systems (L2 to L5) market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The growing adoption of autonomous vehicles by fleet operators to reduce their dependency on manual drivers coupled with rapid development in the ADAS industry has played a vital role in shaping the industrial landscape.

Moreover, the integration of AI in driving systems for enhancing safety as well as numerous government initiatives aimed at mandating ADAS in commercial vehicles is contributing to the industry in a positive way. The technological advancements in autonomous driving coupled with the increasing use of embedded sensors in modern vehicles is expected to create ample growth opportunities for the market players in the upcoming days.

The AI-based driving systems (L2 to L5) market is a crucial sector of the automotive industry. This industry deals in the development and distribution of AI-enabled driving solutions across the world. There are several levels of autonomous driving developed in this sector comprising of level 2, level 3, level 4, and level 5. The main components of this sector include AI hardware (Chips, GPUs, ASICs, FPGAs), software (perception, planning, control algorithms), sensors (LiDAR, radar, cameras, ultrasonic sensors), connectivity modules (V2X, 5G, Edge Devices), HD mapping & localization tools and some others. These components are designed for different types of vehicles including passenger cars, commercial vehicles, robotaxis and some others. The end-users of this sector comprise of OEMs, tech providers / ai startups, fleet operators, mobility-as-a-service (MaaS) companies, logistics & delivery companies and some others. This market is expected to grow significantly with the rise of the electric vehicle industry in different parts of the globe.

The major trends in this market consists of partnerships, popularity of autonomous vehicles and government initiatives related to ADAS.

The level 2 segment dominated the market with 52%. The growing use of L2 autonomous solutions in mid-ranged vehicles for enhancing the driving experience and improving safety has boosted the market expansion. Additionally, the integration of adaptive cruise control (ACC), lane-keeping assist (LKA), automated parking assistance and traffic jam assist in L2 vehicles has driven the growth of the AI-based driving systems (L2 to L5) market.

The level 4 segment is expected to grow with the highest CAGR during the forecast period. The rising emphasis on integrating high-level of autonomy in luxury cars to enhance the convenience and safety has boosted the market growth. Also, the deployment of L4 autonomous cars by different ride-sharing platforms such as Uber, Waymo, Beijing Didi Chuxing Technology Co., Ltd. and some others is expected t boost the growth of the AI-based driving systems (L2 to L5) market.

What made the AI hardware to be the most dominant segment of the AI-based driving systems (L2 to L5) market in 2025?

The AI hardware segment led the market with a share of 34%. The growing use of advanced ultrasonic sensors in luxury cars to enhance autonomous driving has boosted the market growth. Additionally, rapid investment by electronic companies to manufacture a wide range of ADAS hardware components including chips, GPUs, ASICs, FPGAs along with increasing application of 360’ cameras in driverless cars is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among automotive brands and electronic brands to develop a wide range of components to cater the needs of autonomous cars is expected to drive the growth of the AI-based driving systems (L2 to L5) market.

The software segment is expected to expand with the fastest CAGR during the forecast period. The growing deployment of cloud-software to enhance autonomy in in modern cars has boosted the market expansion. Also, rapid investment by startup companies to develop advanced software to cater the needs of autonomous vehicles is playing a prominent role in shaping the industrial landscape. Moreover, collaborations among automotive brands and software developers to integrate advanced software in SDVs is expected to foster the growth of the AI-based driving systems (L2 to L5) market.

The passenger vehicles segment led the market with a share of 58%. The growing demand for luxury cars in several countries such as Singapore, Japan, the U.S., UK, Germany, France and some others has boosted the market growth. Also, the integration of partial autonomous driving systems in mid-ranged cars for enhancing safety coupled with numerous government initiatives for mandating ADAS in passenger cars is expected to propel the growth of the AI-based driving systems (L2 to L5) market.

The robo-taxis / autonomous shuttles segment is expected to grow with the highest CAGR during the forecast period. The rising adoption of robotaxis by several ride-sharing companies to reduce their dependency on manual drivers has driven the market expansion. Additionally, partnerships among autonomous shuttles and automotive brands for integrating AI-based driving systems in vehicles is expected to foster the growth of the AI-based driving systems (L2 to L5) market.

The electric vehicles (EVs) segment dominated the industry with a share of 44%. The growing adoption of electric vehicles in developed nations with an aim at reducing vehicular emission has boosted the market growth. Additionally, numerous government initiatives aimed at enhancing safety in EVs coupled with rise in number of EV startups is playing a vital role in shaping the industrial landscape. Moreover, numerous partnerships among EV makers and software developers to integrate autonomous driving technology in EVs is expected to boost the growth of the AI-based driving systems (L2 to L5) market.

The internal combustion engine (ICE) segment is expected to rise with a significant CAGR during the forecast period. The growing demand for high-performance cars from youths coupled with integration of L2 driving systems in compact SUVs to enhance vehicular safety has boosted the market growth. Also, rapid investment by automotive brands to incorporate advanced sensors in luxury buses to enhance the driving experience is playing a vital role in shaping the industry in a positive direction. Moreover, collaborations among automotive companies and AI developers to develop advanced driving systems for heavy-duty trucks is expected to drive the growth of the AI-based driving systems (L2 to L5) market.

The OEMs segment dominated the market with a share of 49%. The growing consumer preference to use genuine driving systems in their vehicles has boosted the market growth. Additionally, numerous offers and benefits provided by automotive OEMs for regular servicing coupled with partnerships among automotive OEMs and AI providers to develop advanced frameworks to enhance autonomous driving is expected to propel the growth of the AI-based driving systems (L2 to L5) market.

The fleet operators segment is expected to expand with the highest CAGR during the forecast period. The rising adoption of autonomous vehicles by fleet operators to reduce dependency on manual drivers along with collaborations among ADAS companies and fleet operators has boosted the market expansion. Moreover, the rise in number of fleet operators in several countries such as India, China, Japan, the U.S., Italy and some others coupled with deployment of EVs by ride-sharing companies to reduce emission is expected to foster the growth of the AI-based driving systems (L2 to L5) market.

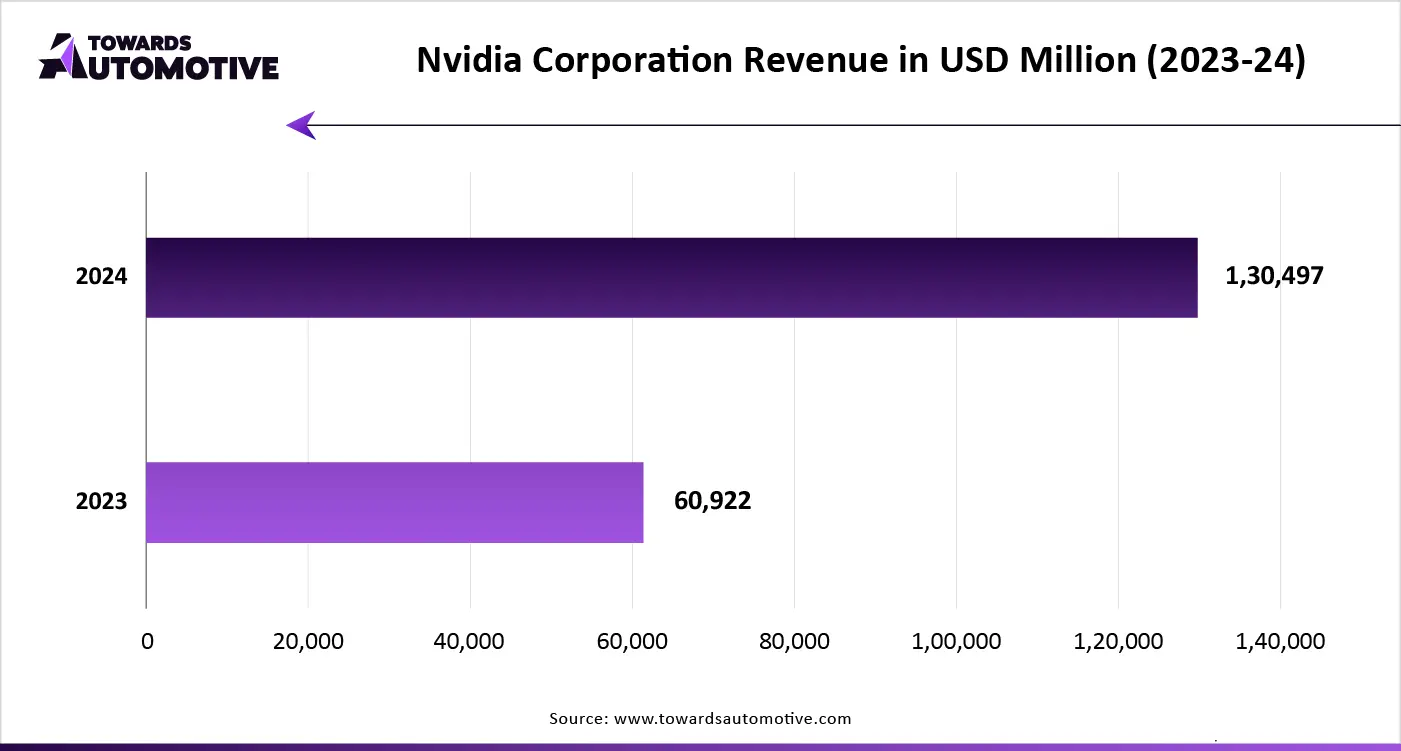

North America led the AI-based driving systems (L2 to L5) market with a share of 36%. The growing popularity of autonomous vehicles in the U.S. and Canada has boosted the market expansion. Additionally, rapid investment by government for developing the road infrastructure coupled with increasing consumer awareness about the benefits of driverless cars is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Qualcomm Technologies, Intel Corporation (Mobileye), Nvidia Corporation, Alphabet Inc. (Waymo) and some others is expected to drive the growth of the AI-based driving systems (L2 to L5) market in this region.

U.S. dominated the market in this region. The rising adoption of driverless cars by fleet operators to earn maximum profits and enhance vehicular safety has driven the market expansion. Additionally, increasing cases of road accidents coupled with the presence of numerous automotive brands such as Tesla, Rivian, Ford, General Motors and some others is accelerating the industrial growth.

Asia Pacific is expected to expand with the highest CAGR during the forecast period. The increasing demand for luxury vehicles in several countries such as India, China, Japan, South Korea and some others has driven the market growth. Also, numerous government initiatives aimed at mandating ADAS in vehicles along with rapid adoption of driverless trucks in the mining sector is positively contributing to the industry. Moreover, the presence of various market players such as Hyundai Mobis, XPeng Motors (XNGP System), Huawei Technologies and some others is expected to boost the growth of the AI-based driving systems (L2 to L5) market in this region.

China and Japan are the prominent contributors in this region. In China, the market is generally driven by the rising production of BEVs coupled with rapid adoption of ADAS in commercial vehicles. In Japan, the growing demand for luxury sedans along with technological advancements in the automotive sector is playing a crucial role in shaping the industrial landscape.

The AI-based driving systems (L2 to L5) market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Intel Corporation (Mobileye), Alphabet Inc. (Waymo), Baidu, Apollo, Tesla, Inc., NVIDIA Corporation, Huawei Technologies, Qualcomm Technologies, Aptiv PLC, Continental AG, Bosch Mobility Solutions, ZF Friedrichshafen AG, Uber ATG (Acquired by Aurora), Aurora Innovation, Cruise (GM), Pony.ai, Nuro Inc., AutoX, Valeo, Hyundai Mobis, XPeng Motors (XNGP System) and some others. These companies are constantly engaged in developing AI-based driving systems and adopting numerous strategies such as joint ventures, launches, partnerships, collaborations, business expansions, acquisitions, and some others to maintain their dominance in this industry.

By Automation Level

By Component

By Vehicle Type

By Propulsion Type

By End User

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us