September 2025

The utility terrain vehicles market is expected to increase from USD 8.92 billion in 2025 to USD 13.68 billion by 2034, growing at a CAGR of 4.87% throughout the forecast period from 2025 to 2034. The rising demand for electric UTVs from the construction industry coupled with rapid adoption of technologically advanced solutions in the agricultural sector is playing a vital role in shaping the industrial landscape.

Moreover, growing investment by market players for developing powerful UTVs for commercial transportation along with increasing consumer interest towards off-roading activities has contributed to the market growth. The research and development activities related to exploration of solid-state batteries is expected to create ample growth opportunities for the market players in the future.

-market-size.webp)

Unlock Infinite Advantages: Subscribe to Annual Membership

The utility terrain vehicles market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of utility vehicles in different parts of the world. There are different types of UTVs developed in this sector comprising of two-seater UTVs, four-seater UTVs, six-seater UTVs, eight-seater UTVs and some others. These UTVs are powered by numerous types of engines consisting of ICE, electric engine and hybrid engines. It finds applications in various sectors including recreation, transportation, agriculture, construction and some others. This market is expected to rise significantly with the growth of the EV sector across the globe.

| Metric | Details |

| Market Size in 2025 | USD 8.92 Billion |

| Projected Market Size in 2034 | USD 13.68 Billion |

| CAGR (2025 - 2034) | 4.87% |

| Leading Region | North America |

| Market Segmentation | By Displacement, By Propulsion, By Drive Type, By Application and By Region |

| Top Key Players | Polaris Inc., Textron Inc. (Arctic Cat), Kawasaki Heavy Industries, Ltd., Yamaha Motor Co., Ltd., Honda Motor Co., Ltd. |

The major trends in this market consists of partnerships, business expansions and government initiatives.

Several construction brands are partnering with UTV companies to deploy powerful UTVs in the construction sites for operating in tough conditions.

Numerous market players are investing heavily for opening up new UTV manufacturing centers to increase the production output.

Government of several countries such as the U.S., Germany, Canada, India and some others have started launching initiatives for increasing the adoption of EVs to reduce vehicular emission.

The between 400 CC and 800 CC segment led the market. The growing demand for 400 cc UTVs from the recreational sector and sports sector has boosted the market expansion. Also, the increasing application of 500 CC UTVs in the utility sector coupled with superior mileage provided by these vehicles is contributing to the industrial growth. Moreover, technological advancements in UTV engines along with rapid investment by automotive brands for developing mid-ranged UTVs is expected to propel the growth of the utility terrain vehicles market.

The greater than 800 CC segment is expected to grow with a significant CAGR during the forecast period. The growing demand for powerful UTVs from the construction sector for operating heavy-duty tasks has boosted the market growth. Also, the increasing application of 800-900 CC UTVs in the mining sector for operating in rough terrains is further adding to the market expansion. Moreover, the rising emphasis of UTVs manufacturers on developing 1000 CC UTVs for the military sector is expected to drive the growth of the utility terrain vehicles market.

The gasoline segment held the largest share of the industry. The increasing demand for powerful compact vehicles in the mining sector and agricultural sector to operate in complex situations has increased the demand for gasoline-powered UTVs, thereby driving the market expansion. Additionally, lack of well-established charging infrastructure in underdeveloped regions is further adding to the industrial growth. Moreover, ease of maintenance and high durability as compared to electric UTVs along with rapid investment by market players for developing gasoline-powered UTVs is expected to boost the growth of the utility terrain vehicles market.

The electric segment is expected to expand with the fastest CAGR during the forecast period. The growing awareness to reduce vehicular emission coupled with rising prices of gasoline has boosted the market growth. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure along with technological advancements in EV powertrains is shaping the industry in a positive direction. Moreover, upsurge in demand for electric UTVs from the mining sector and construction sector is expected to propel the growth of the utility terrain vehicles market.

The utility segment dominated the market. The growing application of UTVs in various sectors including forestry, agriculture, mining and some others has boosted the market expansion. Additionally, the rising adoption of electric UTVs in the construction sites along with surge in demand for compact vehicles to function in utility sector is playing a vital role in shaping the industrial landscape. Moreover, the low operational and maintenance cost of UTVs as compared to large machineries is expected to drive the growth of the utility terrain vehicles market.

The military segment is expected to rise with a notable CAGR during the forecast period. The growing demand for advanced mobility equipment in the warfare zones has increased the demand for UTVs, thereby driving the market growth. Additionally, increasing fundings by government of several countries for strengthening the defense sector is further contributing to the industrial expansion. Moreover, partnerships among defense organizations and UTV manufacturers to deploy powerful UTVs in the military sector is expected to boost the growth of the utility terrain vehicles market.

-market-share-by-region.webp)

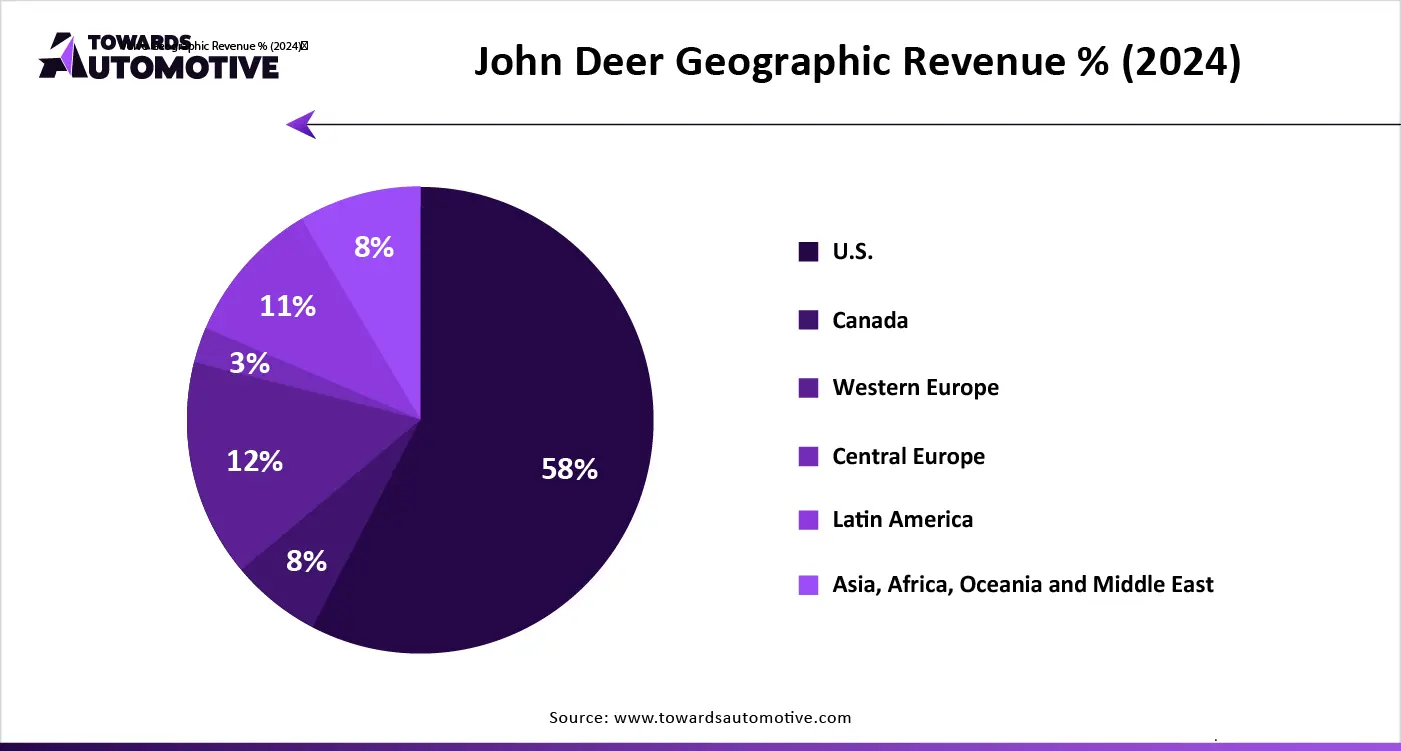

North America led the utility terrain vehicles market. The growing sales of electric UTVs in the U.S. and Canada with an aim at reducing vehicular emission has boosted the market expansion. Additionally, rapid investment by government for strengthening the military and defense sector coupled with increasing popularity of motorsport and trail riding is further adding to the industrial growth. Moreover, the presence of several market players such as Polaris Inc., Arctic Cat Inc., HISUN Motors and some others is expected to propel the growth of the utility terrain vehicles market in this region.

Asia Pacific is expected to expand with a significant CAGR during the forecast period. The increasing demand for UTVs from the agricultural sector for operating complex tasks has driven the market growth. Additionally, technological advancements in the battery manufacturing sector along with rise in number of residential constructions in several countries such as India, China, Singapore and some others is playing a positive role in shaping the industry. Moreover, the presence of various local UTV manufacturers such as Kawasaki, Honda, CF Moto and some others is expected to foster the growth of the utility terrain vehicles market in this region.

The utility terrain vehicles market is a rapidly developing industry with the presence of various dominating players. Some of the prominent companies in this industry consists of Vanderhall Motor Works Inc., Volcon, Kawasaki, HuntVe, INTIMIDATOR, LLC, American LandMaster, DRR USA, Hisun Motors Corporation USA, Kaxa Motos, Polaris Inc., John Deere, TRACKER OFF ROAD, TUATARA VEHICLES, and some others. These companies are constantly engaged in developing UTVs and adopting numerous strategies such as launches, business expansions, acquisitions, partnerships, joint ventures, collaborations and some others to maintain their dominance in this industry.

By Displacement

By Propulsion

By Drive Type

By Application

By Region

September 2025

September 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us