December 2025

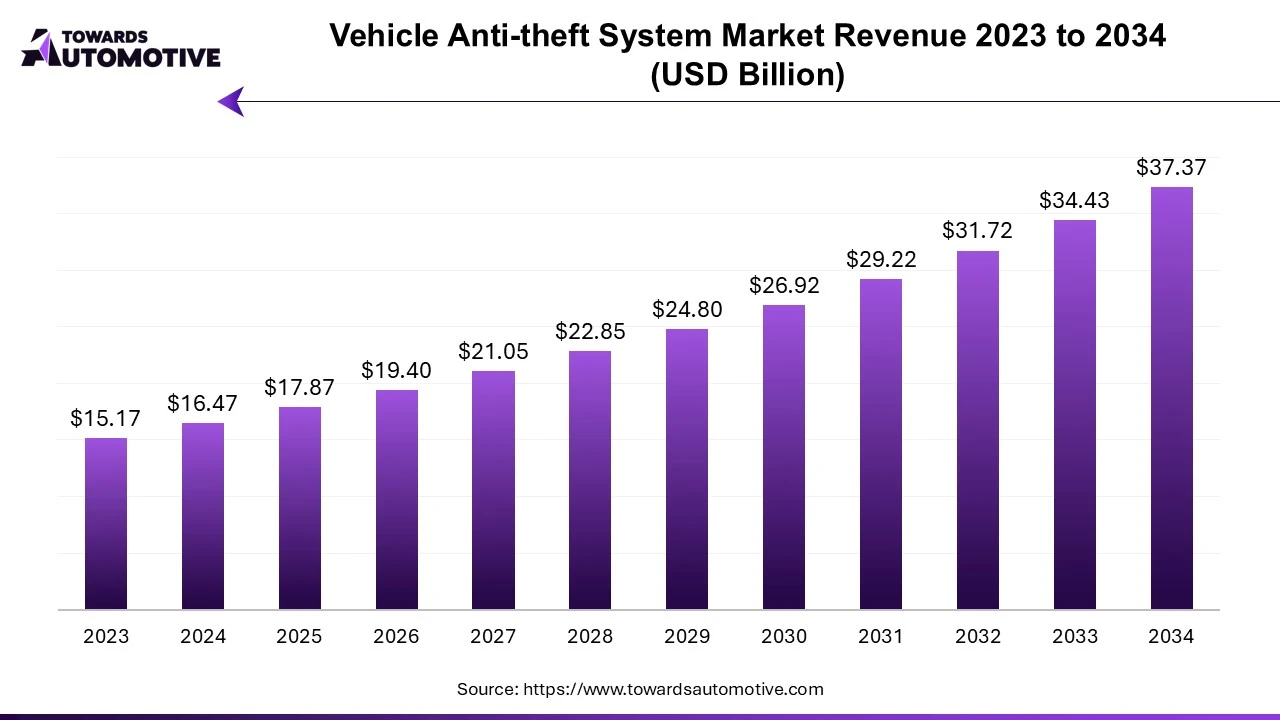

The global vehicle anti-theft system market is forecasted to expand from USD 17.87 billion in 2025 to USD 37.37 billion by 2034, growing at a CAGR of 8.54% from 2025 to 2034.

The vehicle anti-theft system market is experiencing steady growth due to increasing vehicle theft incidents and the rising demand for advanced security solutions. As car thefts become more sophisticated, both consumers and automakers are prioritizing the integration of robust anti-theft technologies into vehicles. These systems range from basic alarms and immobilizers to advanced GPS tracking, biometric systems, and remote disabling technologies. With the surge in vehicle ownership, particularly in urban areas, the need for enhanced security features to protect valuable assets has driven the adoption of these systems across both commercial and personal vehicles.

One of the key drivers of this market is the growing awareness among consumers about vehicle security, coupled with stricter government regulations mandating the inclusion of certain security features in new vehicles. Many regions have implemented laws that require the installation of anti-theft devices, particularly in high-risk areas. Automakers are increasingly incorporating these systems as standard features, which further drives market growth. The shift toward electric and autonomous vehicles is also contributing to the demand for sophisticated anti-theft technologies, as these vehicles come with higher risks of cyberattacks and hacking attempts.

Technological advancements in artificial intelligence (AI), IoT, and machine learning are enhancing the effectiveness of vehicle anti-theft systems. Smart systems that can detect unusual patterns, communicate with mobile devices, and send real-time alerts to vehicle owners or authorities are becoming increasingly popular. These innovations not only improve theft prevention but also make vehicle recovery more efficient. The combination of rising vehicle theft rates, regulatory support, and advancements in technology positions the vehicle anti-theft system market for continued growth in the coming years, offering enhanced protection for vehicle owners.

AI plays a transformative role in the vehicle anti-theft system market by enhancing the intelligence, precision, and adaptability of security solutions. With the increasing sophistication of car theft techniques, AI-powered systems provide advanced, proactive security that goes beyond traditional alarms and immobilizers. AI can analyze patterns in vehicle usage and detect anomalies, such as unauthorized access attempts or unusual driving behavior, which allows for real-time threat detection and prevention. This capability greatly reduces false alarms while improving the overall accuracy of threat identification.

One of AI's key contributions is in the area of predictive analytics. By analyzing historical data and real-time information from connected systems, AI can predict potential theft scenarios before they occur. For instance, machine learning algorithms can recognize suspicious behaviors, such as repeated proximity to a vehicle, and alert the owner or take preventive action, such as remotely locking the vehicle or disabling the engine.

AI also enhances biometric security systems, such as facial recognition or voice authentication, ensuring that only authorized individuals can access or start a vehicle. Additionally, AI is crucial in enabling remote monitoring and control through mobile applications, where vehicle owners can receive real-time notifications of suspicious activities and remotely lock, track, or disable their vehicles.

The integration of AI with GPS and IoT systems also allows for more efficient vehicle tracking and recovery in case of theft. AI can optimize the route to recover stolen vehicles and collaborate with law enforcement agencies by providing precise real-time data.

The trend of central locking systems significantly drives the growth of the vehicle anti-theft system market by enhancing vehicle security and convenience for consumers. Central locking systems allow drivers to lock or unlock all vehicle doors simultaneously with a single action, typically through a key fob or a button inside the car. This feature not only streamlines the locking process but also provides an added layer of security, as it minimizes the risk of leaving doors unlocked inadvertently. As vehicle theft rates continue to rise globally, the demand for effective anti-theft solutions, including central locking systems, has grown substantially.

Modern central locking systems are often integrated with additional security features, such as immobilizers and alarms, making them a vital component of comprehensive vehicle security. This integration means that when a vehicle's central locking system is activated, it can simultaneously engage other anti-theft measures, creating a multi-layered defense against theft. Moreover, many central locking systems are now equipped with advanced technologies, such as remote keyless entry and smart locking mechanisms that use Bluetooth or smartphone apps. These innovations not only enhance security but also cater to the growing consumer preference for convenience and technological integration in their vehicles.

As automakers increasingly recognize the importance of security features in attracting customers, they are incorporating central locking systems as standard offerings across various vehicle segments. This trend is particularly pronounced in the automotive market, where consumer awareness about vehicle security is rising. Additionally, government regulations in some regions mandate the installation of specific anti-theft devices, including central locking systems, in new vehicles, further driving their adoption. As the central locking system trend continues to evolve, it will remain a significant factor in the expansion of the vehicle anti-theft system market, meeting the growing demand for reliable and user-friendly security solutions in automobiles.

The vehicle anti-theft system market faces several restraints that could hinder its growth. High installation and maintenance costs of advanced anti-theft technologies can deter consumers, particularly in price-sensitive markets. Additionally, the effectiveness of these systems may be undermined by sophisticated theft methods employed by criminals, leading to skepticism about their reliability. Limited consumer awareness regarding the benefits and functionalities of modern anti-theft systems can also hinder adoption. Furthermore, the growing trend of using smart keys and keyless entry systems may result in vulnerabilities, as they can be susceptible to hacking and signal interception, posing challenges for the market.

Advanced authentication methods are creating significant opportunities in the vehicle anti-theft system market by enhancing security and user convenience. Traditional keys and fobs are increasingly being replaced by sophisticated technologies, such as biometrics, smart cards, and mobile applications, which offer greater protection against unauthorized access and vehicle theft. Biometric authentication methods, such as fingerprint recognition and facial recognition, provide a high level of security as they rely on unique physical traits of the vehicle owner. This technology not only minimizes the risk of theft but also offers a seamless user experience, allowing for quick and easy access to the vehicle without the need for conventional keys.

Additionally, mobile app-based authentication systems are gaining popularity, enabling vehicle owners to control access to their vehicles directly from their smartphones. These apps often incorporate multi-factor authentication, requiring users to verify their identity through a combination of methods, such as passwords, PINs, or biometric data. This level of security not only deters potential thieves but also instills confidence among consumers regarding the safety of their vehicles. As smartphone usage continues to rise globally, the integration of mobile technologies into vehicle anti-theft systems presents a lucrative opportunity for manufacturers.

Moreover, the growing trend of connected vehicles and the Internet of Things (IoT) facilitates the implementation of advanced authentication methods. Manufacturers can leverage vehicle-to-cloud connectivity to provide real-time monitoring and alerts, allowing owners to track their vehicles' locations and receive notifications of unauthorized access attempts. This capability not only enhances vehicle security but also fosters consumer trust in advanced anti-theft systems.

As automakers increasingly prioritize vehicle security in their designs, the adoption of advanced authentication methods will continue to expand. This trend is likely to lead to partnerships between automotive manufacturers and technology firms, driving innovation and further opportunities in the vehicle anti-theft system market.

The alarms segment led the industry. The alarms segment is a key driver of growth in the vehicle anti-theft system market, owing to its widespread adoption, technological advancements, and its role as an essential first line of defense against vehicle theft. Vehicle alarm systems have become a standard feature in many cars, offering immediate protection by triggering loud alerts when unauthorized access is detected. This sound-based deterrent has proven effective in discouraging theft, as criminals tend to avoid vehicles equipped with alarms to minimize the risk of being caught. The popularity of alarms stems from their cost-effectiveness and ease of installation, making them an attractive option for both consumers and manufacturers.

Technological advancements have significantly enhanced the functionality and appeal of modern alarm systems. Basic alarms have evolved to include sophisticated features such as shock sensors, motion detectors, and real-time notifications sent to the vehicle owner's smartphone. These innovations not only detect break-ins but can also alert owners remotely, offering added peace of mind and convenience. Some advanced alarm systems are integrated with GPS tracking and immobilizers, allowing users to track their vehicle's location and disable the engine in the event of a theft attempt. This integration of multiple security features into alarm systems is driving their increased demand across the market.

Additionally, insurance companies often offer incentives or discounts to vehicle owners who install certified alarm systems, providing financial motivation for adoption. This, combined with rising vehicle theft rates in regions such as North America and Europe, is pushing both consumers and fleet operators to prioritize security solutions. As alarms become more intelligent and adaptable to modern vehicles, their role in driving the growth of the vehicle anti-theft system market is expected to strengthen further, catering to the growing need for reliable and affordable vehicle protection.

The passenger cars segment held the dominant share of the market. The passenger car segment plays a crucial role in driving the growth of the vehicle anti-theft system market, largely due to the rising ownership of personal vehicles and the increasing demand for advanced security features. As more people purchase passenger cars, particularly in urban areas with higher vehicle theft rates, the need for reliable and efficient anti-theft solutions has grown. Passenger cars represent the largest segment of vehicles on the road globally, and this broad base of vehicles requires security systems to protect owners from potential theft. As a result, automakers and consumers alike are investing in a range of anti-theft technologies, from basic alarms to advanced GPS tracking systems and biometric locks.

The growing incorporation of advanced technologies, such as smart alarms, immobilizers, and keyless entry systems, in modern passenger cars is driving the demand for anti-theft systems. These features, once reserved for luxury vehicles, are now becoming standard in mid-range and even economy models. This shift is fueled by consumer awareness and the desire for better protection against theft. Many new passenger cars are now equipped with factory-installed security systems, offering enhanced convenience, real-time tracking, and remote-control options through smartphones. The widespread adoption of these technologies in the passenger car market is significantly contributing to the growth of the vehicle anti-theft system market.

Furthermore, government regulations and insurance policies are supporting this trend. In many regions, insurance companies provide premium discounts to car owners who install certified anti-theft systems, creating financial incentives for adoption. Additionally, stricter regulations in several countries mandate the use of certain security features in new vehicles, further driving the integration of anti-theft technologies in passenger cars. As personal vehicle ownership continues to rise, particularly in emerging markets, the passenger car segment will remain a key driver of the vehicle anti-theft system market’s growth.

The OEM segment led the market. The OEM (Original Equipment Manufacturer) segment significantly drives the growth of the vehicle anti-theft system market by integrating advanced security features directly into vehicles during the manufacturing process. As vehicle theft rates continue to rise globally, consumers and automakers alike are prioritizing in-built anti-theft solutions, making the OEM segment a key player in the market. Many automakers are now offering factory-installed anti-theft systems as standard or optional features, ranging from basic alarms and immobilizers to sophisticated technologies such as GPS tracking, biometric access, and keyless entry systems. These pre-installed systems not only enhance vehicle security but also offer convenience and reliability, factors that are highly valued by customers.

The demand for enhanced safety and security features is particularly strong in premium and luxury vehicle segments, where theft risks are higher. OEMs in these markets are incorporating cutting-edge technologies, such as artificial intelligence (AI) and machine learning algorithms, to create more responsive and intelligent security systems. This growing trend of integrating advanced security systems at the manufacturing stage is spreading to mid-range and economy vehicles, further expanding the market. With the rise in connected cars and the Internet of Things (IoT), OEMs are focusing on seamless integration between vehicle anti-theft systems and other onboard technologies, such as infotainment systems and driver assistance tools, making the security systems more efficient and user-friendly.

In addition, government regulations that mandate the inclusion of specific security features in new vehicles, particularly in regions such as North America and Europe, are boosting the adoption of OEM-installed anti-theft systems. Insurance companies also encourage consumers to purchase vehicles with factory-installed security systems by offering premium discounts, making OEMs an integral part of the vehicle anti-theft system market. The ability of OEMs to provide robust, reliable, and technologically advanced security solutions at the production stage positions them as key drivers of market growth.

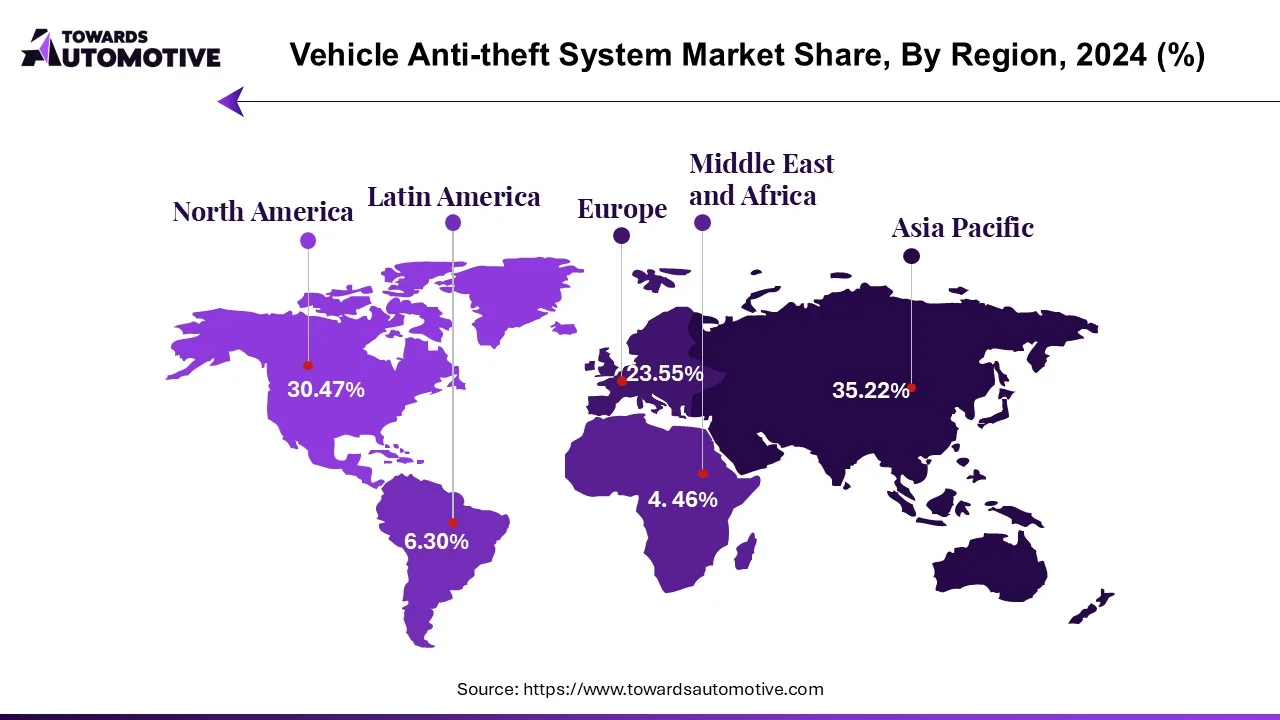

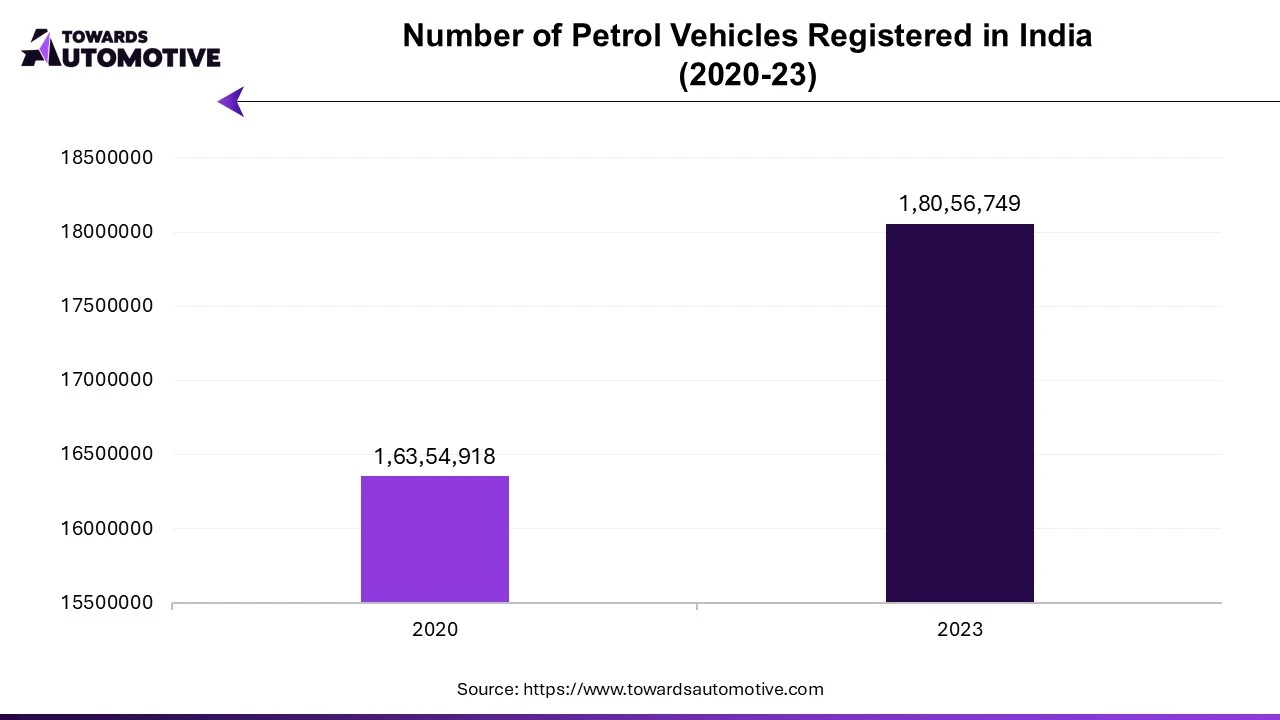

Asia Pacific dominated the vehicle anti-theft system market. The growth of the vehicle anti-theft system market in the Asia-Pacific (APAC) region is being significantly driven by increasing vehicle ownership, technological advancements, and rising disposable incomes. As economies across APAC, including China, India, Japan, and Southeast Asia, experience rapid urbanization and industrial development, more individuals and businesses are purchasing vehicles. This surge in vehicle ownership, fueled by the expanding middle class and improved access to affordable financing, has created a rising demand for reliable security solutions to protect these valuable assets from theft. The need for effective vehicle protection is becoming paramount as the number of vehicles on the road grows, particularly in urban areas where theft rates tend to be higher.

Technological advancements are also playing a pivotal role in driving the growth of the vehicle anti-theft system market in APAC. Innovations such as biometric authentication, GPS tracking, artificial intelligence (AI), and Internet of Things (IoT) connectivity are being increasingly integrated into modern vehicle security systems. These advanced technologies offer more effective and intelligent solutions, enhancing theft prevention and recovery capabilities. Features like real-time tracking, remote immobilization, and AI-driven threat detection provide a high level of security that appeals to consumers and fleet operators alike. The availability of these cutting-edge systems, often incorporated as standard features in newer vehicles, is encouraging widespread adoption.

Rising disposable income across the region is further contributing to market expansion. As consumers have more spending power, they are willing to invest in vehicles equipped with enhanced security features, recognizing the long-term benefits of theft prevention. This trend is particularly evident in emerging markets, where economic growth is enabling consumers to upgrade to more sophisticated vehicles and security systems. Together, these factors are driving significant growth in the vehicle anti-theft system market across the APAC region, with a strong outlook for continued expansion.

North America is expected to grow with a significant CAGR during the forecast period. The growth of the vehicle anti-theft system market in North America is being driven by several key factors, including rising vehicle theft rates, government regulations, insurance incentives, and the widespread adoption of cutting-edge automotive technologies. Over the past few years, vehicle theft rates have surged in the United States and Canada, prompting both consumers and automakers to prioritize vehicle security. As theft techniques become more sophisticated, the need for advanced, reliable anti-theft solutions has intensified. This has led to increased demand for high-tech systems like GPS tracking, biometric authentication, and real-time alerts, which provide vehicle owners with enhanced protection and peace of mind.

Government regulations have also played a significant role in this market's expansion. Many states and regions have introduced laws mandating the installation of anti-theft devices in new vehicles or high-risk areas, particularly for commercial fleets and luxury cars. These regulations ensure that a basic level of security is met, pushing automakers to incorporate anti-theft systems as standard features. Additionally, insurance companies offer financial incentives for installing certified anti-theft devices, such as discounts on premiums. This creates a dual benefit for consumers: securing their vehicles while reducing their insurance costs, further driving the adoption of advanced security systems.

The widespread integration of cutting-edge automotive technologies, such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT), is another crucial factor driving market growth. These technologies allow for intelligent and connected anti-theft systems that can detect suspicious behavior, track vehicle location, and even remotely disable a stolen vehicle. The adoption of these technologies, particularly in high-end vehicles and commercial fleets, is transforming the vehicle anti-theft landscape in North America, providing more robust and proactive security solutions for consumers and businesses alike.

By Product

By Vehicle Type

By Sales Channel

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us