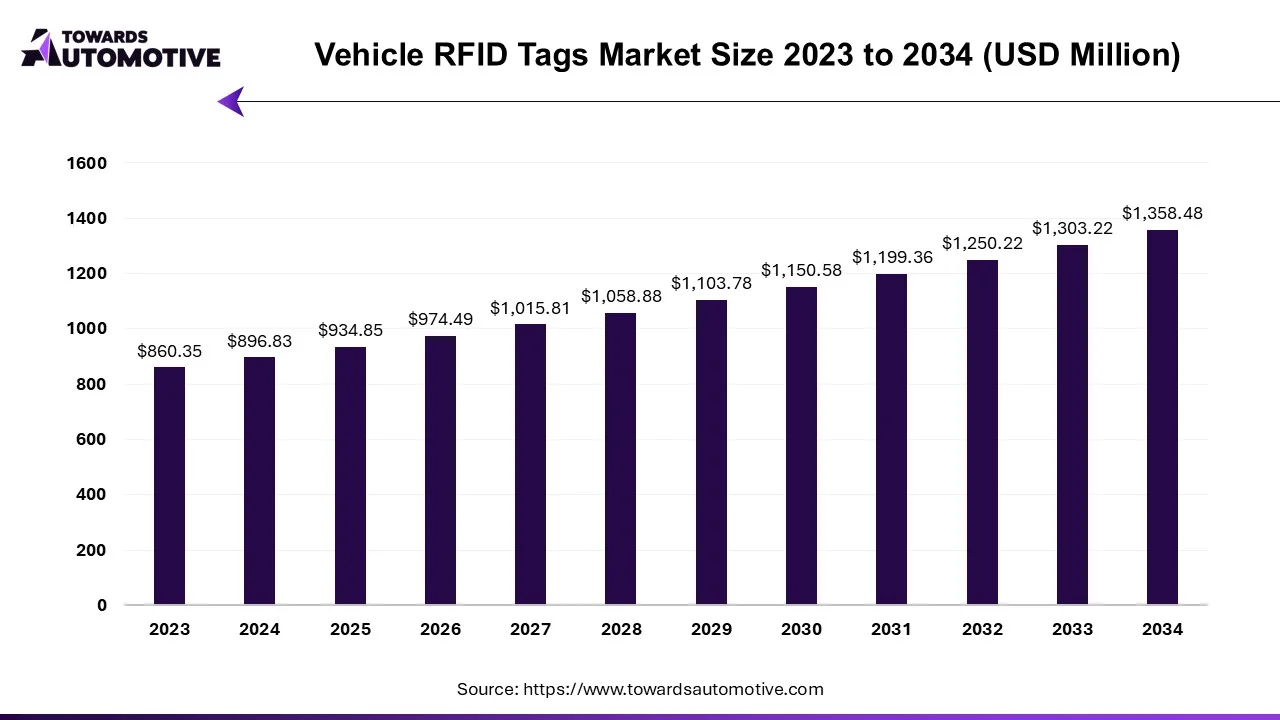

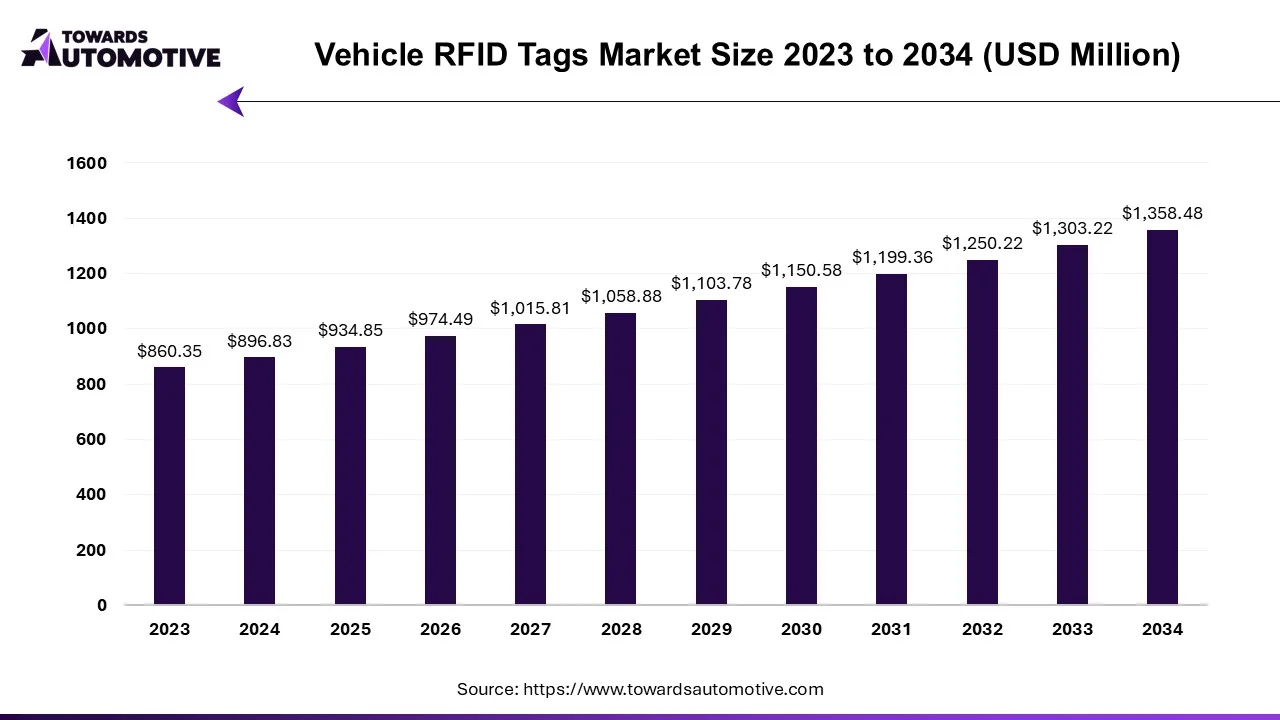

The vehicle RFID tags market is forecasted to expand from USD 934.85 million in 2025 to USD 1,358.48 million by 2034, growing at a CAGR of 4.24% from 2025 to 2034.

The vehicle RFID tags market is on the brink of a transformative journey, characterized by burgeoning demand and technological advancements. With an increasing emphasis on efficiency, security, and sustainability in transportation, RFID (Radio Frequency Identification) technology has emerged as a pivotal enabler, revolutionizing the way vehicles are tracked, managed, and secured.

The vehicle RFID tags market is poised for unprecedented growth and innovation, driven by the convergence of RFID technology with IoT, AI, and sustainable mobility initiatives. As the automotive and transportation sectors embrace digital transformation, RFID-enabled solutions will play a pivotal role in optimizing operations, enhancing security, and driving environmental sustainability. By fostering collaboration, standardization, and technological advancement, the industry can unlock the full potential of RFID technology and pave the way for a smarter, more efficient future of mobility.

The vehicle RFID tags market is witnessing remarkable growth, driven by the imperative need for streamlined operations, enhanced security measures, and optimized logistics in various sectors, including automotive, transportation, and fleet management. RFID tags, embedded with unique identifiers and capable of wireless communication via radio frequency, enable real-time tracking, authentication, and data capture of vehicles across diverse applications.

- RFID Tags: The cornerstone of vehicle RFID systems, RFID tags are compact devices equipped with microchips and antennas, capable of storing and transmitting unique identification data wirelessly. These tags are affixed to vehicles, enabling automated identification, tracking, and monitoring throughout their lifecycle.

- RFID Readers: RFID readers, installed at strategic locations such as entry/exit points, checkpoints, and parking facilities, facilitate communication with RFID tags, capturing data and enabling real-time visibility of vehicle movements. Advanced readers offer enhanced functionalities such as long-range scanning, multi-protocol support, and integration with existing infrastructure.

- RFID Middleware: Middleware software acts as the bridge between RFID readers and backend systems, facilitating data processing, filtering, and integration with enterprise applications such as fleet management software, inventory systems, and access control solutions. RFID middleware plays a crucial role in enabling seamless data exchange and interoperability within RFID ecosystems.

Key Market Dynamics and Trends

- Integration with IoT and AI: The convergence of RFID technology with Internet of Things (IoT) and Artificial Intelligence (AI) is reshaping the vehicle RFID tags market landscape. IoT-enabled RFID systems enable real-time data analytics, predictive maintenance, and autonomous decision-making, enhancing operational efficiency and asset utilization.

- Enhanced Security and Anti-Theft Measures: Vehicle RFID tags play a pivotal role in enhancing security measures and mitigating the risk of theft and unauthorized access. Advanced RFID solutions offer tamper-resistant features, encryption protocols, and geofencing capabilities, ensuring secure vehicle tracking and protection against theft or misuse.

- Expansion in Automotive Manufacturing: The automotive manufacturing sector represents a significant growth avenue for the vehicle RFID tags market. RFID technology is increasingly deployed in automotive production lines for inventory management, asset tracking, and quality control, optimizing manufacturing processes and ensuring seamless supply chain operations.

- Environmental Sustainability: RFID-enabled vehicle management solutions contribute to environmental sustainability by optimizing vehicle utilization, reducing idle time, and minimizing fuel consumption. Efficient fleet management facilitated by RFID tags leads to reduced emissions, lower carbon footprint, and overall environmental conservation.

Global Trends and Market Outlook

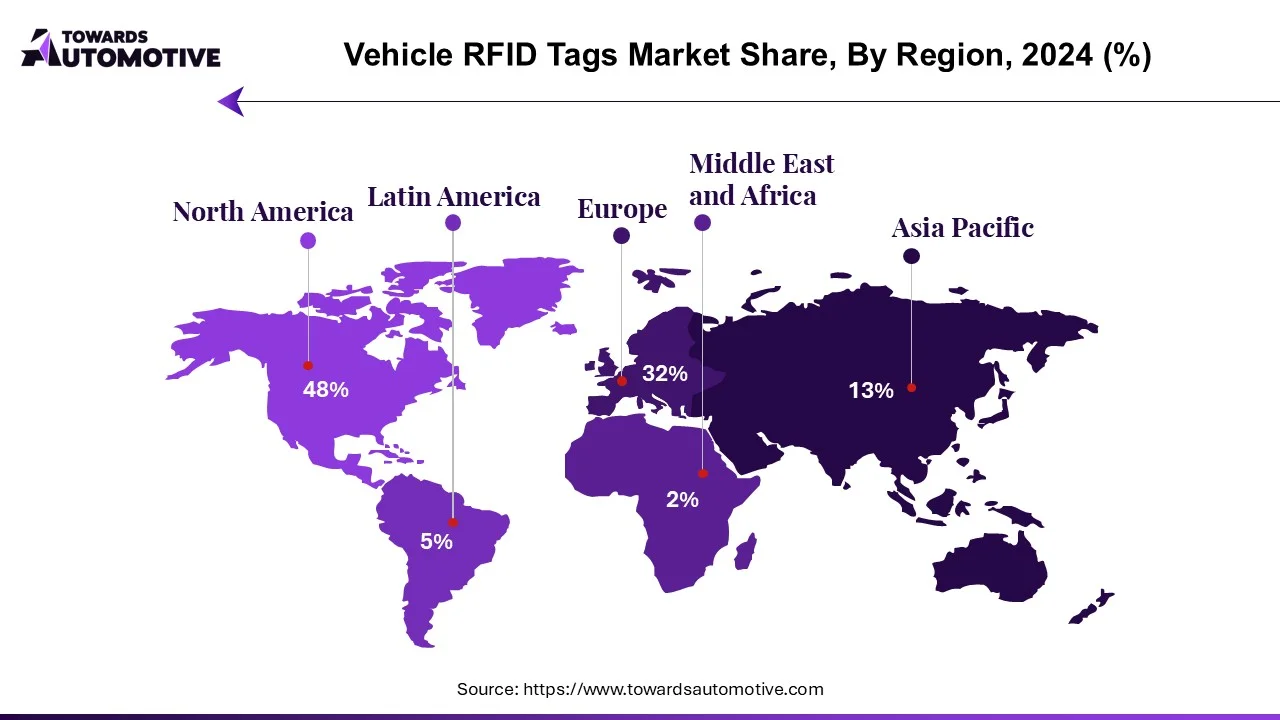

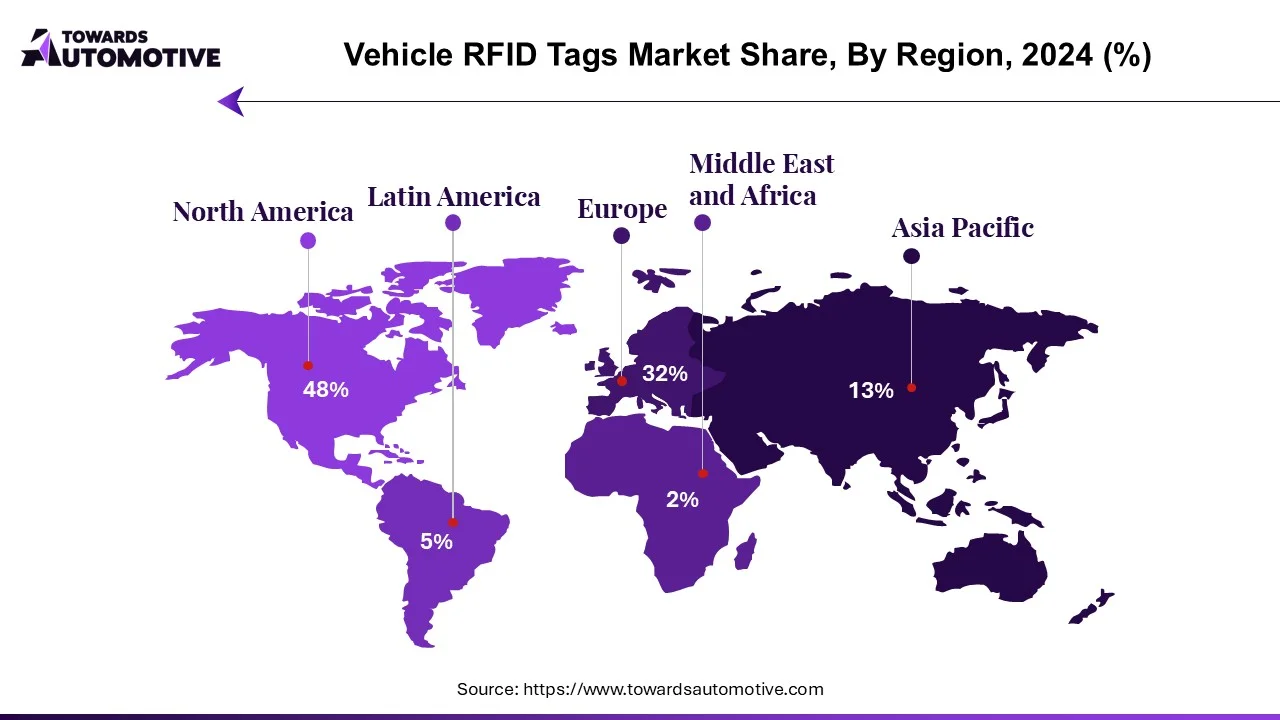

- North America and Europe Driving Adoption: North America and Europe are at the forefront of RFID adoption in the automotive and transportation sectors, driven by stringent regulatory mandates, technological innovation, and a robust automotive manufacturing ecosystem. Key players in these regions are investing in RFID-enabled solutions to enhance operational efficiency and compliance with industry standards.

- Emerging Markets in Asia-Pacific: Asia-Pacific is emerging as a lucrative market for Vehicle RFID Tags, propelled by rapid urbanization, infrastructure development, and the expansion of automotive production facilities. Countries such as China, India, and Japan are witnessing increasing investments in RFID technology to address transportation challenges and improve logistics efficiency.

| Rank |

Manufacturer (global) |

2024 Share (%) |

| 1 |

Avery Dennison (incl. Smartrac) |

18 |

| 2 |

Beontag (incl. Confidex) |

12 |

| 3 |

HID Global (incl. Omni-ID) |

8 |

| 4 |

Honeywell |

6 |

| 5 |

Invengo |

5 |

| 6 |

TÖNNJES E.A.S.T. (license-plate RFID) |

4 |

| 7 |

William Frick & Company |

3 |

| 8 |

Tatwah / XMINNOV |

3 |

| 9 |

TP-RFID |

2.5 |

| 10 |

Syndicate RFID |

2 |

| |

Others (regional & niche vendors) |

36.5 |

Status: Analyst estimate for 2024 based on triangulation of public market sizing and supplier coverage; use as directional unless you have primary sales disclosures for adjustments.

Company Snapshots

- Avery Dennison (incl. Smartrac): Global RFID leader with strong windshield and vehicle ID label portfolio.

- Beontag (incl. Confidex): Fast-growing supplier known for transport and automotive UHF tags in global programs.

- HID Global (incl. Omni-ID): Specialist in rugged, durable RFID solutions for fleet and yard vehicle tracking.

- Honeywell: Integrates RFID windshield labels into its mobility and auto-ID solutions for tolling and access.

- Invengo: China-based major with large-scale UHF production and strong APAC vehicle ID deployments.

- TÖNNJES E.A.S.T.: Pioneer in RFID-enabled license plates (IDePlate) for national vehicle identification projects.

- William Frick & Company: North American niche provider of durable RFID windshield and fleet ID solutions.

- Tatwah / XMINNOV: High-volume Chinese manufacturer supplying low-cost vehicle RFID tags worldwide.

- TP-RFID: Supplier of windshield RFID tags focused on parking, gated community, and tolling applications.

- Syndicate RFID: India-based vendor providing vehicle RFID solutions for tolling and access control projects.

- Others: A fragmented set of regional vendors (e.g., GAO RFID, SIVA, Metalcraft) serving local vehicle ID needs.

Challenges and Opportunities

- Interoperability and Standardization: One of the key challenges facing the vehicle RFID tags market is the lack of interoperability and standardization across RFID systems and protocols. Addressing interoperability issues requires industry collaboration, development of common standards, and adoption of open-source technologies to ensure seamless integration and compatibility.

- Data Privacy and Security Concerns: The widespread deployment of RFID technology raises concerns regarding data privacy, security vulnerabilities, and potential misuse of personal information. To foster trust and compliance, RFID solution providers must adhere to stringent data protection regulations, implement robust encryption mechanisms, and educate stakeholders about security best practices.

- Infrastructure Readiness and Investment: The successful implementation of RFID-enabled vehicle management systems hinges on the availability of robust infrastructure, including RFID readers, communication networks, and backend servers. Governments, enterprises, and technology providers must collaborate to invest in infrastructure development and overcome logistical challenges, particularly in remote or underserved areas.

The vehicle RFID tags market encompasses a diverse ecosystem of RFID solution providers, technology vendors, automotive manufacturers, and system integrators.

Some of the prominent players in the market include

- Zebra Technologies Corporation

- HID Global Corporation

- Impinj, Inc.

- Honeywell International Inc.

- NXP Semiconductors N.V.

- Siemens AG

- Avery Dennison Corporation

- Alien Technology, LLC

- GAO RFID Inc.

- Confidex Ltd.

Market Segmentation and Regional Outlook

By Application

- Vehicle Tracking and Identification

- Access Control and Security

- Inventory Management

- Toll Collection and Road Pricing

By End-User

- Automotive Manufacturing

- Fleet Management

- Transportation and Logistics

- Retail and Automotive Aftermarket

By Region

- North America

- Europe

- Germany

- United Kingdom

- France

- Asia-Pacific

- Latin America

- Middle East and Africa

- In December 2023, NXP Semiconductors introduced its latest UCODE DNA RFID tag series, specifically designed for automotive applications. These RFID tags offer enhanced security features, such as cryptographic authentication and tamper detection, making them suitable for vehicle identification, tracking, and anti-counterfeiting purposes within the automotive supply chain.

- In November 2023, Impinj, Inc. announced the release of its Monza R6-P RAIN RFID tag chip, optimized for automotive asset tracking and inventory management. The Monza R6-P offers high read sensitivity, ruggedized design, and extended read range capabilities, enabling efficient tracking of vehicles and automotive components throughout production, distribution, and aftermarket services.

- In October 2023, HID Global launched its HID OMNIKEY® 5427 CK Gen 2 RFID reader, designed to support a wide range of RFID technologies, including high-frequency (HF) and ultra-high-frequency (UHF) standards used in the automotive industry. The OMNIKEY 5427 CK Gen 2 reader facilitates seamless integration of RFID-based vehicle access control, tolling, and parking systems, enhancing convenience and security for drivers and fleet operators.

- In September 2023, Avery Dennison Corporation introduced its AD-843 UHF RFID tag, engineered for automotive exterior applications such as vehicle registration, tolling, and electronic vehicle identification (EVI). The AD-843 RFID tag offers weather-resistant construction, adhesive backing, and global frequency compatibility, enabling reliable and cost-effective deployment across various automotive markets worldwide.

- In August 2023, Confidex Ltd. unveiled its Steelwave Micro II RFID tag, specifically designed for metal-mount applications in the automotive manufacturing and aftermarket sectors. The Steelwave Micro II features a compact form factor, high-temperature resistance, and robust read performance on metal surfaces, making it suitable for asset tracking, inventory management, and supply chain optimization in automotive production facilities and distribution centers.