September 2025

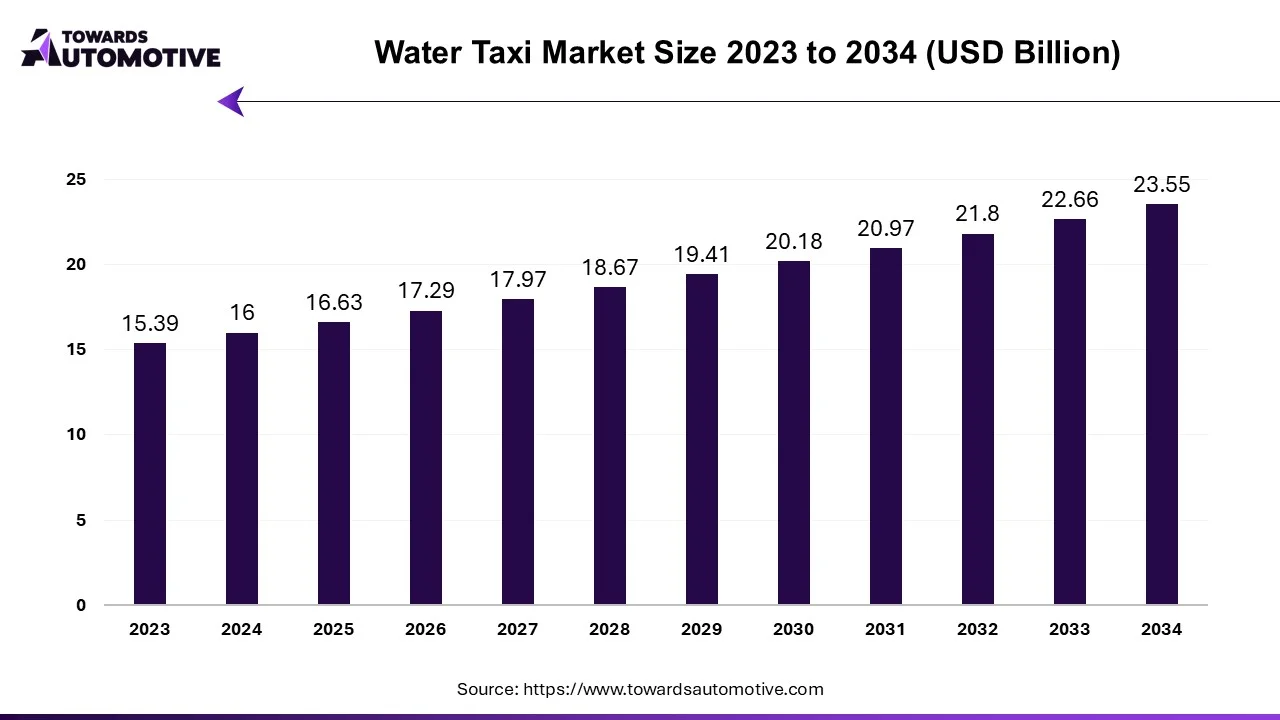

The water taxi market is projected to reach USD 22.19 billion by 2034, expanding from USD 15 billion in 2025, at an annual growth rate of 4% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Through its ability to make sophisticated decisions and make predictions, artificial intelligence greatly enhances safety and real-time navigation in water taxi operations. AI systems are able to process information from weather sensors, sonar radar, and GPS to give real-time information about obstacles, water traffic, and shifting environmental conditions. This enables drivers to choose more intelligent routes, steer clear of accidents, and react swiftly to unforeseen dangers. To further improve operational safety, AI-powered systems can also notify crews of mechanical problems or maintenance requirements before they become more serious. In certain sophisticated configurations, AI also facilitates semi-autonomous or autonomous navigation, which lowers human error and boosts productivity on crowded waterways.

The water taxi market refers to the commercial operation of small- to mid-sized boats or ferries used to transport passengers over water in urban, coastal, island, and riverine areas as an alternative or supplement to land-based transport. Water taxis can operate on fixed routes (like public ferries) or on-demand (like maritime ride-hailing), and they range from traditional diesel-powered vessels to electric and hybrid boats aimed at sustainable mobility.

In coastal cities, the demand for water taxis is being driven by growing urban congestion which makes traditional road networks congested and ineffective, particularly during rush hours. By using unused waterways for transportation, avoiding traffic, and lowering commuter stress, water taxis provide a useful and time-saving substitute. To reduce the strain on roads and metro systems, authorities are incorporating water-based transit in several densely populated cities, including Bangkok, New York, and Mumbai. This change encourages more sustainable urban mobility and enhances connectivity overall, making water taxis a desirable choice for both tourists and daily commuters.

Severe traffic congestion results from the overcrowding of traditional transportation systems in many riverbanks and coastal cities. Water taxis which use underutilized waterways to offer faster commute options are a much-needed alternative. In cities with little room for new roads, this is especially advantageous during rush hours. While preserving mobility, the move to water-based transit is aiding in the decongestion of urban areas. The demand for effective substitutes such as water taxis is growing as the population of cities increases. Strong market demand is being generated for both private and public water taxi services as a result.

Over time tourism in waterfront locations in island regions and coastal cities has steadily increased. Water taxis are a desirable choice for short-distance commuting and sightseeing since tourists are increasingly choosing unusual and picturesque forms of transportation. The entire tourist experience is improved by these services, which also provide quick access to beaches, islands, and historical sites. Nowadays a lot of tour companies include water taxi services in their packages, increasing their market awareness. Seasonal spikes in tourism, particularly around the holidays, also help to boost ridership. This demand pushes operators to increase fleets and routes.

Weather patterns and seasonal demand have a significant impact on water taxi operations. High tides, fog, storms, and heavy rain can all cause service disruptions that affect dependability and passenger confidence. Off-season ridership drastically drops in many are as, which lowers profitability. Typically, touristic water taxis are only used during the busiest travel seasons, which leaves other months underutilized. These variations present difficulties for staffing and fleet management. Operations are made more uncertain by the unpredictable climate brought about by global warming.

Many regions, particularly in developing countries, lack adequate marine infrastructure such as docks, terminals, ticketing systems, and safety facilities. Poorly maintained waterways, congestion at docks, and the absence of night navigation systems hamper smooth operation. Without proper integration with other public transit systems, water taxis struggle to gain mass adoption. Infrastructure development is capital-intensive and often delayed by bureaucratic or environmental approval processes. This hinders scalability and limits expansion into high-potential areas.

A significant opportunity exists for incorporating water taxis into multimodal transit systems as cities embrace smart urban mobility models. For quicker and cleaner transportation, coastal cities are creating transportation plans that incorporate waterways. App-based ticketing and real-time tracking are two examples of smart infrastructure that water taxi services can integrate with to draw in both commuters and tourists. This integration can ease traffic on the roads and subways while improving connectivity. Partnerships between the public and private sectors can help with funding support and large-scale deployment.

The global shift towards cleaner mobility offers room for growth in electric and hybrid water taxi segments. Operators adopting sustainable vessels can benefit from government subsidies, lower fuel costs, and green branding. This also appeals to environmentally conscious passengers and tourism boards. As battery technologies improve, electric water taxis will become more cost-effective and efficient. Manufacturers focusing on lightweight, high-efficiency vessels are well-positioned to capitalize on this trend.

Conventional (diesel/gasoline) water taxis dominate the water taxi market because they are widely accessible, reasonably priced, and have a well-established refueling infrastructure. These boats, which have a track record of dependability on both short- and long-distance routes, are frequently utilized in areas without access to solar or electric power. Their engines are reliable, simple to service, and backed by easily accessible parts and services. Because of their experience and familiarity with marine transit systems, operators prefer them. This market segment is dominated by operational dependability, affordability, and pre-existing infrastructure.

Solar-powered water taxis are growing fastest as cities work to find sustainable and clean transportation options. These boats are perfect for tourist routes and environmentally sensitive areas because they have lower emissions and fuel costs. Efficiency and adoption are being increased by technological developments in solar panels for battery storage and lightweight designs. Their adoption is also being accelerated by growing environmental regulations and public preference for green alternatives.

Water Taxi Market Size, By Passenger Capacity, (USD Billion)

| Year | Up to 10 Passengers | 11–30 Passengers | 31–100 Passengers | More than 100 Passengers |

| 2024 | 3.00 | 6.00 | 3.75 | 2.25 |

| 2025 | 3.10 | 6.27 | 3.90 | 2.32 |

| 2026 | 3.21 | 6.55 | 4.06 | 2.40 |

| 2027 | 3.32 | 6.85 | 4.22 | 2.48 |

| 2028 | 3.44 | 7.16 | 4.39 | 2.56 |

| 2029 | 3.56 | 7.48 | 4.56 | 2.65 |

| 2030 | 3.68 | 7.82 | 4.74 | 2.73 |

| 2031 | 3.81 | 8.17 | 4.93 | 2.82 |

| 2032 | 3.94 | 8.54 | 5.13 | 2.92 |

| 2033 | 4.08 | 8.92 | 5.34 | 3.01 |

| 2034 | 4.22 | 9.33 | 5.55 | 3.11 |

11-30 passengers dominate the water taxi market as they offer the ideal balance between cost-efficiency and service flexibility. These vessels are suitable for both daily commuters and tourist routes, with easy maneuverability and lower fuel and maintenance costs. Their size allows faster boarding and docking, especially in crowded urban waterways. Operators also benefit from fewer crew and regulatory requirements compared to larger vessels. This segment is dominating the market driven by cost-efficiency, versatility, and ease of operation.

More than 100 passengers are growing rapidly due to the need for high-capacity solutions in urban and tourist-heavy locations. These vessels can carry large volumes of passengers during peak hours, reducing the number of trips required. They are increasingly being integrated into public transportation systems in coastal megacities. Investment in dockside infrastructure and safety systems is further supporting growth in this segment.

Scheduled/fixed-route water taxi services dominated the market by providing organized, reliable, and steady transportation through urban waterways. Public transportation systems frequently include these services which link important terminals of islands and coastal communities. They are dependable for everyday commuters and easy for operators to handle in terms of crew planning logistics and fare collection thanks to regular schedules. Additionally, public awareness and government support increase their use. The market is dominated by this segment due to its organized operations, dependability of commuters, and integration with public transportation.

On-demand/ private charter services are the fastest-growing segment, driven by the growing desire for individualized and flexible travel experiences. Tour groups for corporate clients and luxury travelers looking for convenience and exclusivity are served by these services. Fleet utilization and accessibility have increased due to the growth of digital platforms and app-based reservations. Particularly in areas that are heavily dependent on tourism operators, profit from premium pricing and focused marketing.

Monohull water taxis continue to dominate the market due to their operational stability, affordability, and straightforward design. Because of their simplicity in construction, ease of maintenance, and suitability for the majority of docks and terminals, these vessels are frequently utilized in both urban and tourist routes. Additionally, monohulls are adaptable to a variety of operating conditions because they perform well in both calm and semi-rough waters. The market is dominated by this segment due to its widespread usability, cost-effectiveness, and simple design.

Hydrofall and foiling water taxis are the fastest growing segment owing to their reduced water resistance and high-speed capabilities. These cutting-edge hull designs rise above the water surface, lowering drag and providing faster smoother rides, especially in contemporary urban transportation systems. They are perfect for high-end and time-sensitive routes because they improve passenger comfort and efficiency. The increasing need for innovation and performance in maritime transit is driving adoption.

Tourism and leisure segments dominate the market as these services are widely used for sightseeing, island hopping, and waterfront access in popular destinations. Water taxis offer scenic, convenient, and memorable experiences for travelers, often integrated with local attractions and hospitality services. Their appeal to both international tourists and local visitors ensures steady year-round demand, especially in urban waterfronts and heritage areas. This segment is dominating the market driven by consistent tourist demand, scenic value, and service integration with hospitality sectors.

Private commuter and corporate transport use of water taxis is expanding rapidly due to due to increasing demand for time-efficient, traffic-free alternatives in busy coastal cities. Professionals and business travelers are turning to premium water transit for quicker travel between key locations. With rising congestion on roads, these services offer reliable, on-demand options tailored for high-income urban users. Growth is also supported by app-based booking platforms and rising interest in executive mobility solutions.

Water Taxi Market Size, By Region, (USD Billion)

| Year | North America | Europe | Asia-Pacific | Latin America | Middle East & Africa |

| 2024 | 5.25 | 3.75 | 3.00 | 1.50 | 1.50 |

| 2025 | 5.43 | 3.91 | 3.14 | 1.56 | 1.56 |

| 2026 | 5.61 | 4.07 | 3.28 | 1.63 | 1.63 |

| 2027 | 5.80 | 4.24 | 3.43 | 1.70 | 1.70 |

| 2028 | 6.00 | 4.42 | 3.58 | 1.78 | 1.77 |

| 2029 | 6.20 | 4.61 | 3.74 | 1.85 | 1.84 |

| 2030 | 6.42 | 4.80 | 3.91 | 1.93 | 1.92 |

| 2031 | 6.63 | 5.00 | 4.09 | 2.02 | 2.00 |

| 2032 | 6.86 | 5.21 | 4.27 | 2.10 | 2.09 |

| 2033 | 7.09 | 5.43 | 4.46 | 2.19 | 2.17 |

| 2034 | 7.33 | 5.66 | 4.66 | 2.29 | 2.26 |

North America continues to dominate the water taxi market because of its sophisticated maritime infrastructure, dense coastal urbanization, and robust public transportation integration. The region gains from widespread use of scheduled water routes, increased tourism in waterfront cities, and steady government support. Modernization of fleets including electric and hybrid models has also been aided by technological advancements and environmental regulations. This area is leading the market thanks to its well-developed infrastructure, robust integration of public transportation, and growing demand from commuters.

Asia Pacific is emerging as the fastest-growing region in the water taxi market, driven by increasing urban population, rising congestion in coastal cities, and growing investments in water-based mobility solutions. Governments in the region are focusing on eco-friendly transportation and expanding inland and coastal waterway connectivity. Rapid tourism growth and infrastructure development are further accelerating the adoption of water taxi services, especially in cities with dense populations and limited land transit options.

By Type of Propulsion

By Passenger Capacity

By Type of Service

By Hull Type

By End-User

By Region

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us