October 2025

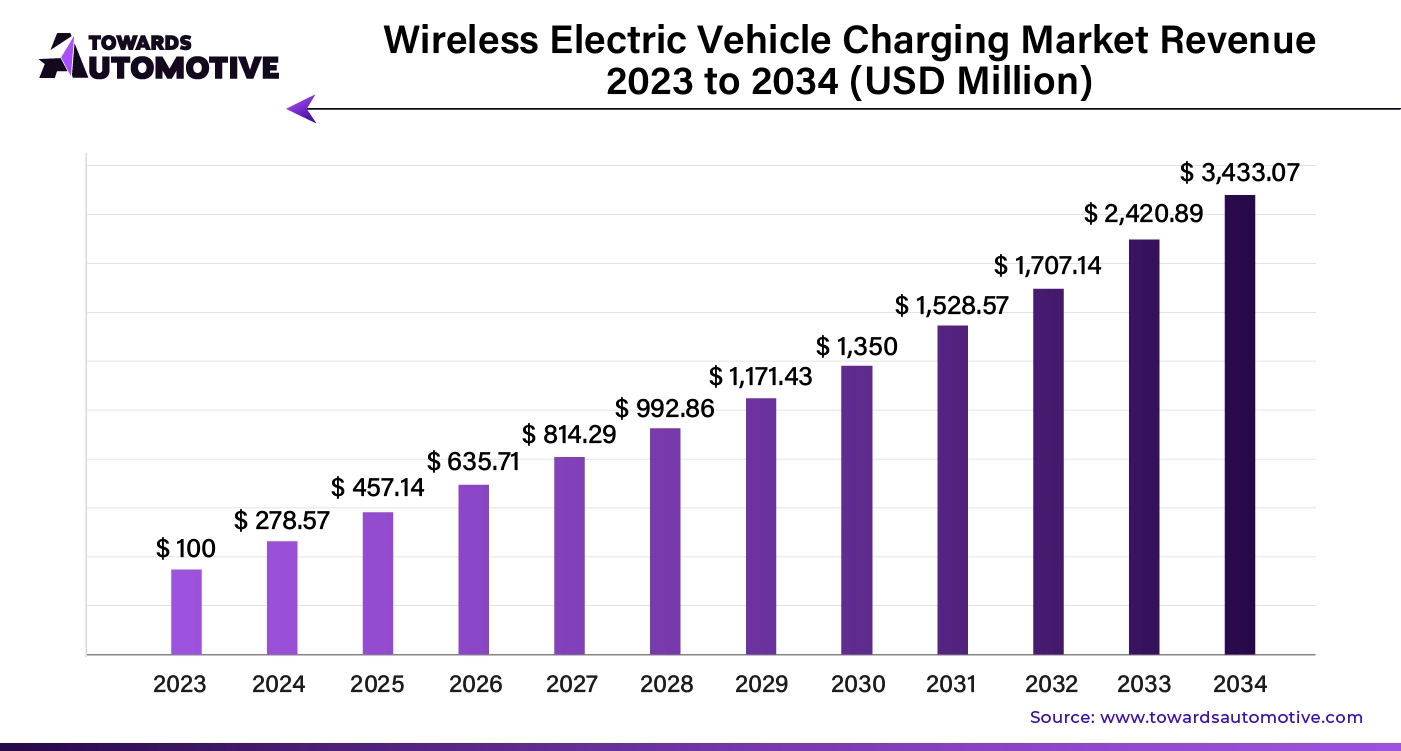

The wireless charging electric vehicle market is anticipated to grow from USD 457.14 million in 2025 to USD 3,433.07 million by 2034, with a compound annual growth rate (CAGR) of 37.06% during the forecast period from 2025 to 2034.

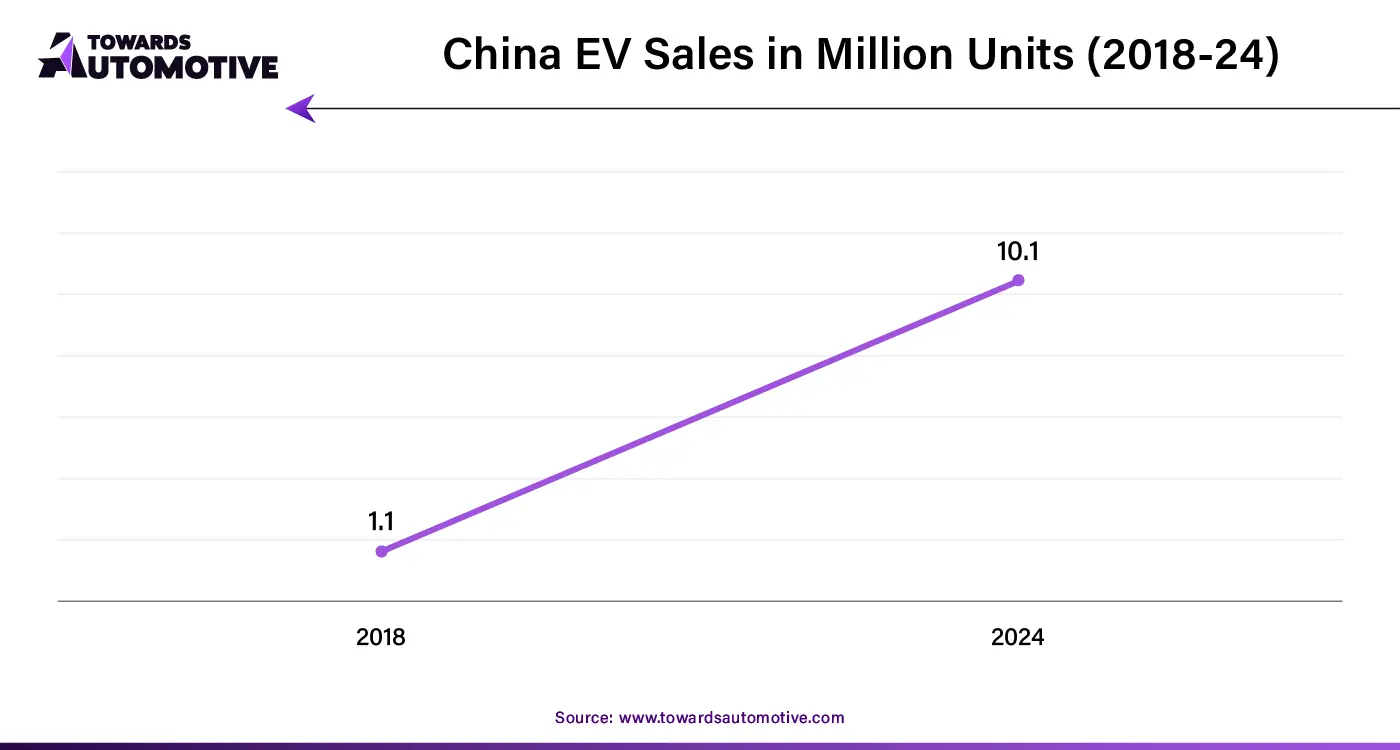

The wireless charging electric vehicle market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of wireless charging solutions for EVs around the world. The wireless chargers are integrated with different technologies including magnetic field charging, inductive charging, resonant inductive charging and others. These chargers are designed for numerous types of vehicles consisting of passenger vehicles, light commercial vehicles, heavy commercial vehicles and others. The end-user of this industry comprises of individual consumers, fleet operators, government and municipalities. The growing sales of EVs in different parts of the globe has contributed to the overall expansion of the industry. This market is likely to rise drastically with the growth of the electric vehicle industry in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 278.57 Million |

| Projected Market Size in 2034 | USD 3,433.07 Million |

| CAGR (2025 - 2034) | 37.06% |

| Leading Region | North America |

| Market Segmentation | By Technology, By Charging Infrastructure, By Vehicle Type, By End User and By Region |

| Top Key Players | Dashdynamic, Wipowerone, Witricity, HEVO, Electreon, ChargePoint, Ola Electric |

The inductive charging segment held a dominant share of the market. The growing demand for fast-charging solutions among EV consumers has boosted the market expansion. Also, the rising adoption of inductive chargers due to several benefits including convenience and ease of use, reduced maintenance and durability, increased safety and durability, and some others is contributing to the overall industrial growth. Moreover, several EV charger manufacturers are constantly engaged in developing high-quality inductive chargers to cater the needs of the EV consumers, thereby accelerating the growth of the wireless charging electric vehicle market.

The resonant inductive charging segment is likely to rise with a considerable growth rate during the forecast period. The rising investment by government of several countries such as China, U.S., India, Japan and some others for strengthening the EV charging infrastructure has driven the market growth. Additionally, surge in demand for wireless EV charging solutions among the EV consumers of developed nations such as Canada, UK, Germany and some others is adding significantly to the industrial expansion. Moreover, numerous advantages of this charging technology including dynamic charging capability, superior grid load management, cost-effectiveness, enhancing contactless EV charging and some others is projected to boost the growth of the wireless charging electric vehicle market.

The home charging stations segment held the largest share of the market. The growing demand for home-based wireless EV chargers has boosted the industrial growth. Also, the rising emphasis of EV charger brands on developing advanced wireless chargers for residential purposes is further accelerating the market expansion. Additionally, rapid developments associated smart chargers along with increasing sales of electric SUVs is driving the growth of the wireless charging electric vehicle market.

The public charging stations segment is anticipated to witness rapid growth during the forecast period. The growing adoption of wireless fast charging solutions for commercial purposes has boosted the market expansion. Also, numerous government initiatives aimed at developing the public charging infrastructure coupled with various subscription plans provided by EV charging stations is contributing significantly to the industrial growth. Moreover, rapid deployment of EV charging stations in developed nations such as U.S., Norway, Denmark, U.S., Germany and some others is projected to foster the growth of the wireless charging electric vehicle market.

The passenger vehicles segment held a significant share of the industry. The growing demand for affordable EV hatchbacks in developing nations such as India, Indonesia, Argentina, Vietnam and some others has boosted the industrial expansion. Additionally, the rising adoption of electric SUVs among off-roading enthusiasts along with numerous subsidies for purchasing electric passenger cars is playing a vital role in shaping the industrial landscape. Moreover, several automotive companies such as Audi, Tesla, Mercedes, BYD and some others are developing electric luxury cars, thereby fostering the growth of the wireless charging electric vehicle market.

The light commercial vehicles segment is predicted to rise with a considerable CAGR during the forecast period. The growing adoption of light commercial EVs for operation short-distance logistics operations has boosted the market expansion. Additionally, surge in demand for eco-friendly vehicles to enhance passenger commute is further adding to the industrial growth. Moreover, the rising focus by EV startups such as Jupiter Electric Mobility, Switch Mobility, Euler Motors and some others for developing LCEVs is anticipated to propel the growth of the wireless charging electric vehicle market.

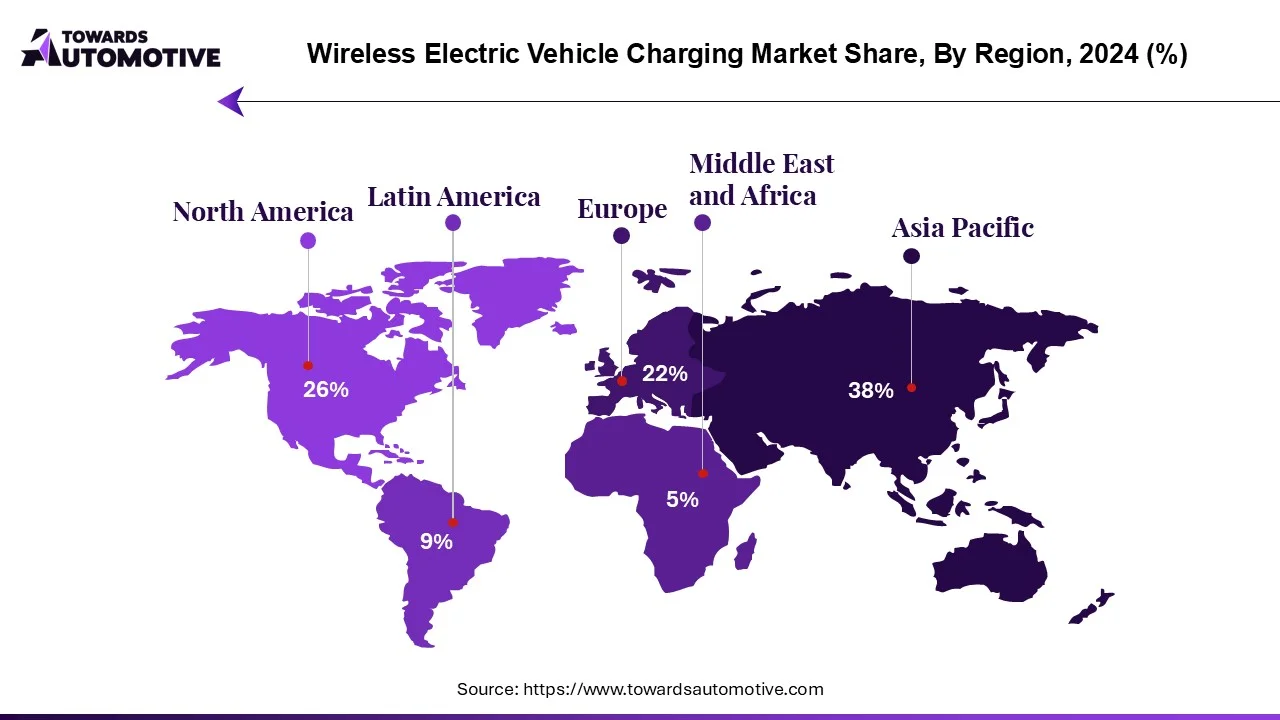

North America held the highest share of the wireless charging electric vehicle market. The growing sales of electric supercars in countries such as the U.S. and Canada has boosted the market growth. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with presence of several EV brands such as Tesla, Rivian, GM, Lucid Motors and some others is positively shaping the industrial landscape. Moreover, the presence of several market players such as WiTricity Corporation, Momentum Dynamics Corporation, Qualcomm has further accelerated the growth of the wireless charging electric vehicle market in this region.

U.S. and Canada are significantly contributing to the market in this region. In the U.S., the market is generally driven by the growing demand for luxury EVs coupled with rapid investment by automotive companies for strengthening the EV manufacturing capabilities. In Canada, the rising demand for LCEVs from E-commerce sector and increasing adoption of wireless residential chargers is driving the market expansion.

Europe is expected to grow with a significant CAGR during the forecast period. The growing adoption of electric trucks for operating several heavy tasks in industries such as construction, oil and gas, mining, logistics and some others has boosted the market expansion. Additionally, rapid investment by government of several countries such as Norway, Germany, UK, France and some others for strengthening the EV charging infrastructure is shaping the industry in a positive direction. Moreover, the presence of several automotive brands such as Ferrari, Volkswagen, Volvo and some others that are constantly engaged in manufacturing various EV models is further expected to propel the growth of the wireless charging electric vehicle market in this region.

Germany is the dominating country in this region. The growing adoption of electric buses by fleet operators for enhancing sustainable transportation has boosted the industrial expansion. Also, numerous partnerships among EV charger brands and automotive companies for deploying wireless charging in Germany has further added to market growth. Moreover, the presence of several automotive companies such as Audi, BMW, Mercedes and some others has boosted the market growth in this nation.

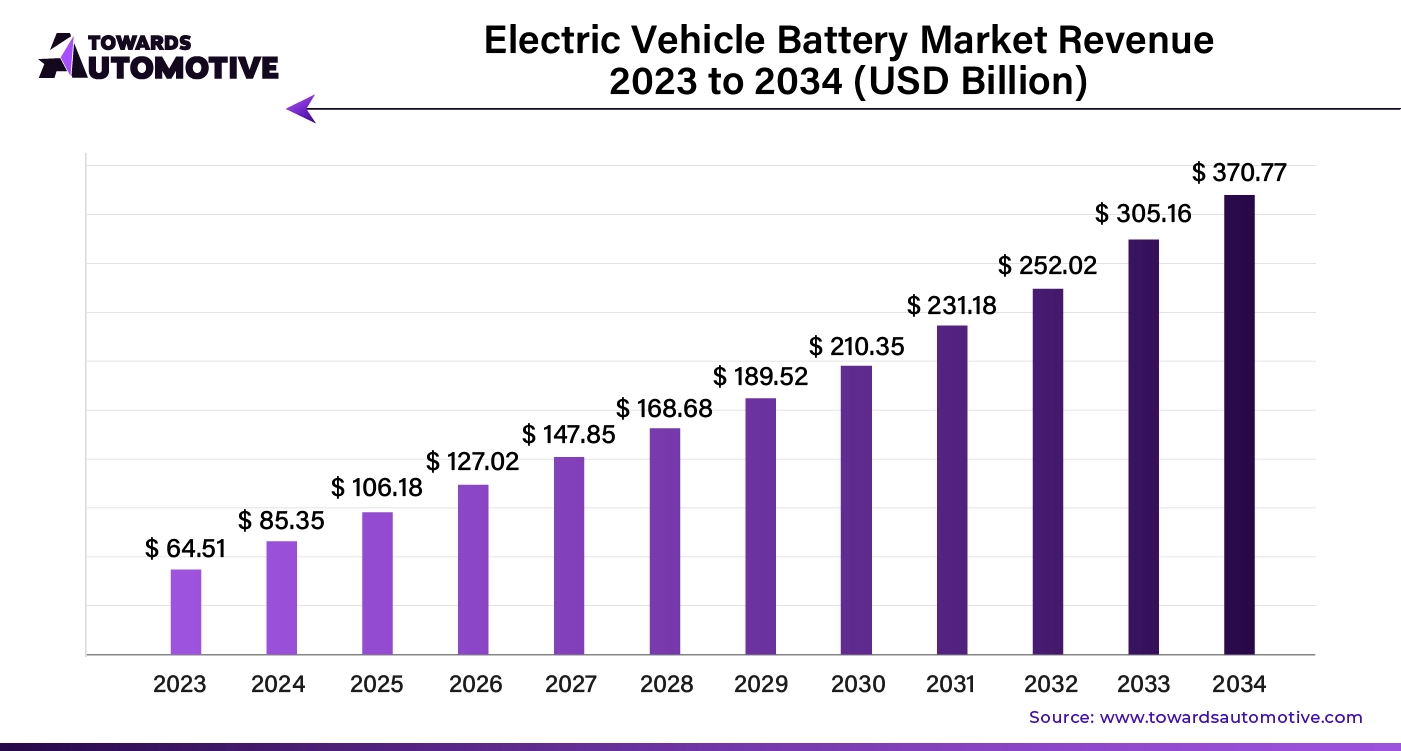

The electric vehicle battery market will grow from USD 106.18 billion in 2025 to USD 370.77 billion by 2034 (CAGR 21.50%). We quantify demand by product (lithium-ion largest; lead-acid; nickel-metal hydride; others) and vehicle type (BEVs dominant; PHEVs; HEVs), with regional splits for Asia Pacific (lead), Europe (significant CAGR), North America, Latin America, and MEA. Competitive analysis benchmarks CATL, LG Energy Solution, Panasonic, BYD, Samsung SDI, Toshiba, Exide, Amara Raja, Okaya, Tata AutoComp GY, Exicom on capacity build-out, chemistries (LFP/NMC), cost curves, and partnerships. We map the value chain (raw materials cells modules/packs BMS/thermal OEMs/aftermarket), include trade flows for cells, packs, and active materials, and provide manufacturer & supplier scorecards (plant footprints, certifications, utilization, and 2024–2025 margin bands).

The electric vehicle battery market is experiencing rapid growth, driven by the increasing global adoption of electric vehicles as part of the transition toward cleaner, more sustainable transportation. EV batteries are a critical component of electric vehicles, powering everything from passenger cars to commercial trucks, and their performance directly impacts vehicle range, efficiency, and cost. As governments worldwide implement stricter emissions regulations and provide incentives for EV adoption, the demand for advanced, high-capacity batteries has surged.

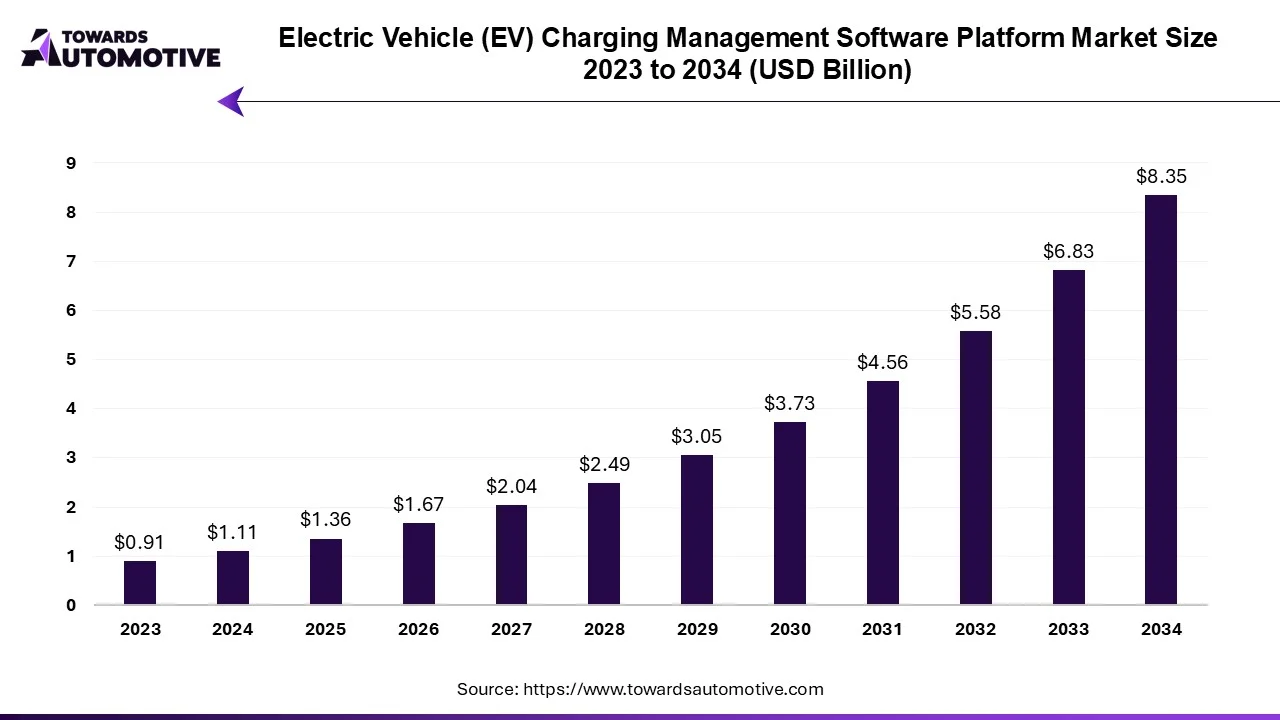

The electric vehicle (EV) charging management software platform market is forecasted to expand from USD 1.36 billion in 2025 to USD 8.35 billion by 2034, growing at a CAGR of 22.33% from 2025 to 2034.

The EV charging management software platform market is experiencing robust growth and is expected to expand significantly in the coming years, driven by the rapid adoption of electric vehicles worldwide and the growing need for efficient charging infrastructure. With the increasing demand for clean and sustainable transportation solutions, governments, businesses, and consumers are investing in electric vehicles and charging infrastructure, creating a favorable environment for the growth of the EV charging management software platform market.

The electric vehicles market is forecast to grow from USD 2,072.80 billion in 2025 to USD 29,283.45 billion by 2034, driven by a CAGR of 34.21% from 2025 to 2034. The increasing demand for eco-friendly vehicles in developing nations along with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape.

The electric vehicles market is a prominent segment of the automotive industry. This industry deals in development and distribution of vehicles that are powered by batteries. There are several types of vehicles developed in this sector comprising of scooters, motorcycles, three-wheelers, passenger cars, buses, trucks, and some others.

The wireless charging electric vehicle market is a highly competitive industry with the presence of a numerous dominating players along with new startups. Some of the prominent companies in this industry consists of Evatran, Dashdynamic, Wipowerone, Witricity, HEVO, Electreon, ChargePoint, Ola Electric and some others. These companies are constantly engaged in developing high-quality wireless chargers for EVs and adopting numerous strategies such as partnerships, collaborations, business expansions, launches, acquisitions, joint ventures and some others to held their dominant position in this industry. For instance, in November 2024, Electreon partnered with the State of Michigan. This partnership is aimed at deploying wireless EV charging network in Michigan, U.S. Also, in April 2024, Witricity partnered with Kansai Electric Power Co., Inc., Daihen Corporation, Mitsubishi Research Institute, Ltd.and Sinanen Corporation. This partnership is done for forming a council to develop wireless EV charging system in Japan.

By Technology

By Charging Infrastructure

By Vehicle Type

By End User

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us