October 2025

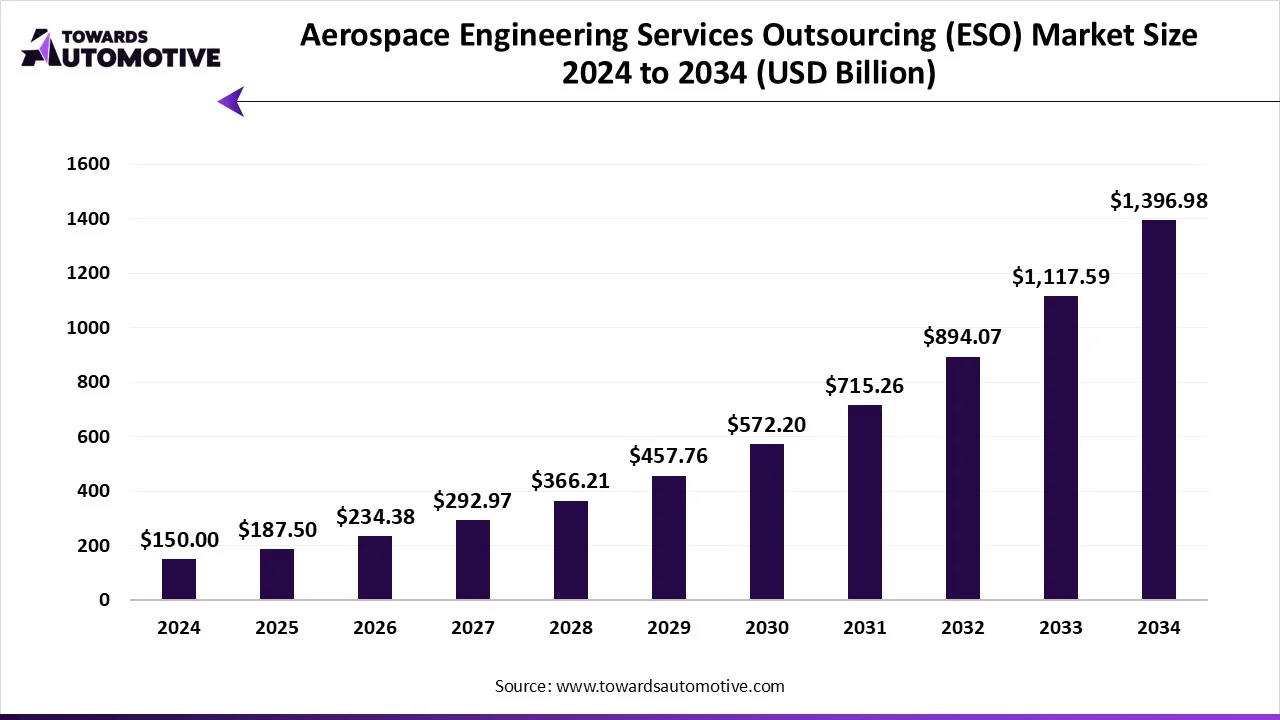

The aerospace engineering services outsourcing (ESO) market is forecast to grow from USD 187.5 billion in 2025 to USD 1396.98 billion by 2034, driven by a CAGR of 25% from 2025 to 2034. The growing demand for military aircrafts from the defense sector coupled with numerous government initiatives aimed at enhancing aerospace safety has boosted the market expansion.

Additionally, the increasing cases of aircraft crashes along with rapid investment by public sector entities for strengthening the aerospace and defense sector is playing a vital role in shaping the industrial landscape. The growing demand for light-weight aircrafts to deliver superior mileage is expected to create ample growth opportunities for the market players in the future.

The aerospace engineering services outsourcing (ESO) market is a prominent segment of the aerospace industry. This industry deals in providing aerospace related services across the world. There are several types of services delivered by this sector comprising of design & prototyping, testing & simulation, manufacturing support, embedded systems & avionics, MRO engineering services, systems engineering & integration and some others. It finds application in different aircraft parts including aerostructures, avionics, engines, cabin interiors, landing gear, propulsion systems, flight control systems and some others. The end-user of this sector comprises of OEMs, tier 1 suppliers, airlines & MRO providers, space agencies and startups, and some others. This market is expected to rise significantly with the growth of the aircraft manufacturing industry around the globe.

The major trends in this market consists of partnerships, opening of new centers and rising defense expenditure.

How did the design & prototyping segment led the aerospace engineering services outsourcing (ESO) market in 2025?

The design & prototyping segment led the market with 28%. The growing investment by aerospace brands to deploy cloud-based solutions in engineering centers for designing aircraft components has boosted the market growth. Also, the rising popularity of CAD modeling & drafting and 3D modeling & virtual prototyping in the aircraft manufacturing sector is playing a crucial role in shaping the industrial landscape. Moreover, the integration of AI in aerospace designing platforms is expected to foster the growth of the aerospace engineering services outsourcing (ESO) market.

The embedded systems & avionics segment is expected to expand with the highest CAGR during the forecast period. The integration of advanced sensors and IoT in the aerospace engineering centers for enhancing aircraft designing process has boosted the market expansion. Additionally, the growing use of advanced electronics systems in modern aircrafts is shaping the industry in a positive direction. Moreover, the rising application of embedded systems in spaceships to manage navigation, critical flight functions, communication and some others is expected to propel the growth of the aerospace engineering services outsourcing (ESO) market.

The aerostructures segment held the largest share of the market with a share of 32%. The rising emphasis on developing high-quality aerostructure to ensure the aircraft's structural integrity, aerodynamic efficiency, overall performance and some others has boosted the market expansion. Also, the growing use of aluminum alloys and advanced composites for manufacturing aerostructure further adds to the industrial expansion. Moreover, the increasing demand for chevron nozzle in modern jets to reduce noise and enhance fuel efficiency is expected to foster the growth of the aerospace engineering services outsourcing (ESO) market.

The cabin interiors segment is expected to rise with the fastest CAGR during the forecast period. The growing demand for luxury interiors in modern aircrafts to enhance the travelling experience of passengers has boosted the market growth. Also, the rising use of high-quality recycling seats in private jets to improve comfort level along with integration of smart technologies such as IoT and AI in aircraft cabins is further adding to the industrial expansion. Moreover, the increasing adoption of sustainable materials for developing cabin interiors in fighter jets is expected to boost the growth of the aerospace engineering services outsourcing (ESO) market.

The commercial aviation (narrow-body) segment dominated the market with 40%. The rising demand for commercial aircrafts to transport passengers from one country to another has boosted the market growth. Also, the increase in number of airline companies coupled with growing consumer preference to adopt domestic planes for short distance commutes is contributing to the industrial expansion. Moreover, the increasing demand for fuel-efficient airplanes from airline providers is expected to boost the growth of the aerospace engineering services outsourcing (ESO) market.

The urban air mobility (eVTOLs) segment is expected to grow with the fastest CAGR during the forecast period. The growing popularity of eVTOLs in densely populated areas to curb emission and mitigate traffic congestions has boosted the market expansion. Additionally, the rising use of UAVs in the defense sector to invade enemy’s territory along with rapid adoption of drones in the e-commerce sector for delivering goods in different areas is playing a vital role in shaping the industrial landscape. Moreover, partnerships and collaborations among UAM brands and AES providers to enhance the manufacturing and maintenance capabilities of electric aircrafts is expected to boost the growth of the aerospace engineering services outsourcing (ESO) market.

The offshore segment led the industry with a share of 61%. The rising trend of hiring a third-party company in a different country to provide aerospace services has boosted the market expansion. Additionally, numerous benefits of offshore approaches including cost reduction, access to expertise, 24*7 operations and some others has boosted the growth of the aerospace engineering services outsourcing (ESO) market.

The onshore segment is expected to grow with a significant CAGR during the forecast period. The rising demand for cost-effective aerospace services in developing nations to enhance aircraft manufacturing process has boosted the market growth. Moreover, partnerships among aerospace companies and onshore service providers to deploy advanced technologies in engineering centers is expected to drive the growth of the aerospace engineering services outsourcing (ESO) market.

The OEMs segment dominated the market with a share of 48%. The rapid investment by aircraft OEMs to open new engineering centers to enhance the manufacturing capabilities has boosted the market expansion. Additionally, numerous partnerships among OEMs and third-party companies to develop advanced technologies for the aerospace sector is further adding to the industrial growth. Moreover, the rising adoption of advanced technologies such as AI, Blockchain, Big Data Analytics and some others by OEMs is expected to drive the growth of the aerospace engineering services outsourcing (ESO) market.

The space agencies & startups segment is expected to expand with the highest CAGR during the forecast period. The rise in number of aerospace startups in several countries such as the U.S., India, France, Germany and some others has boosted the market growth. Also, the growing investment by space agencies such as ISRO, NASA, JAXA and some others for deploying advanced solutions in rocket manufacturing is contributing to the industrial expansion. Moreover, partnerships among space agencies and solution providers to adopt advanced technologies in the aerospace sector is expected to boost the growth of the aerospace engineering services outsourcing (ESO) market.

North America led the aerospace engineering services outsourcing (ESO) market with a share of 35%. The growing demand for private jets among HNIs in the U.S. and Canada has boosted the market expansion. Additionally, rapid investment by market giants for setting up new aerospace development centers coupled with numerous government initiatives aimed at enhancing aircraft safety is playing a vital role in shaping the market in a positive direction. Moreover, the presence of numerous market players such as Lockheed Martin Corporation, Boeing, Northrop Grumman Corporation, Raytheon Technologies and some others is expected to drive the growth of the aerospace engineering services outsourcing (ESO) market in this region.

The U.S. dominated the market in this region. The growing defense expenditure along with the presence of well-established aircraft manufacturing hub has boosted the market growth. Additionally, technological advancements in the aerospace sector coupled with rise in number of airline companies is playing a vital role in shaping the industrial landscape.

Asia Pacific is expected to rise with the fastest CAGR during the forecast period. The growing sales of commercial aircrafts in several countries such as India, China, Singapore, Japan, and some others has boosted the market growth. Also, increasing emphasis by government agencies for deploying advanced aircrafts in military sector for enhancing cross-border safety coupled with rise in number of aerospace startups is crucial for the industrial expansion. Moreover, the presence of various market players such as Tech Mahindra, L&T Technology Services, Wipro and some others is expected to foster the growth of the aerospace engineering services outsourcing (ESO) market in this region.

China led the market in this region. In China, the market is generally driven by the rising development in the drone industry coupled with abundance of essential raw materials. Also, rapid investment aerospace companies to construct new engineering centers along with growing use of advanced satellites for strengthening the telecom sector is further adding to the industrial expansion.

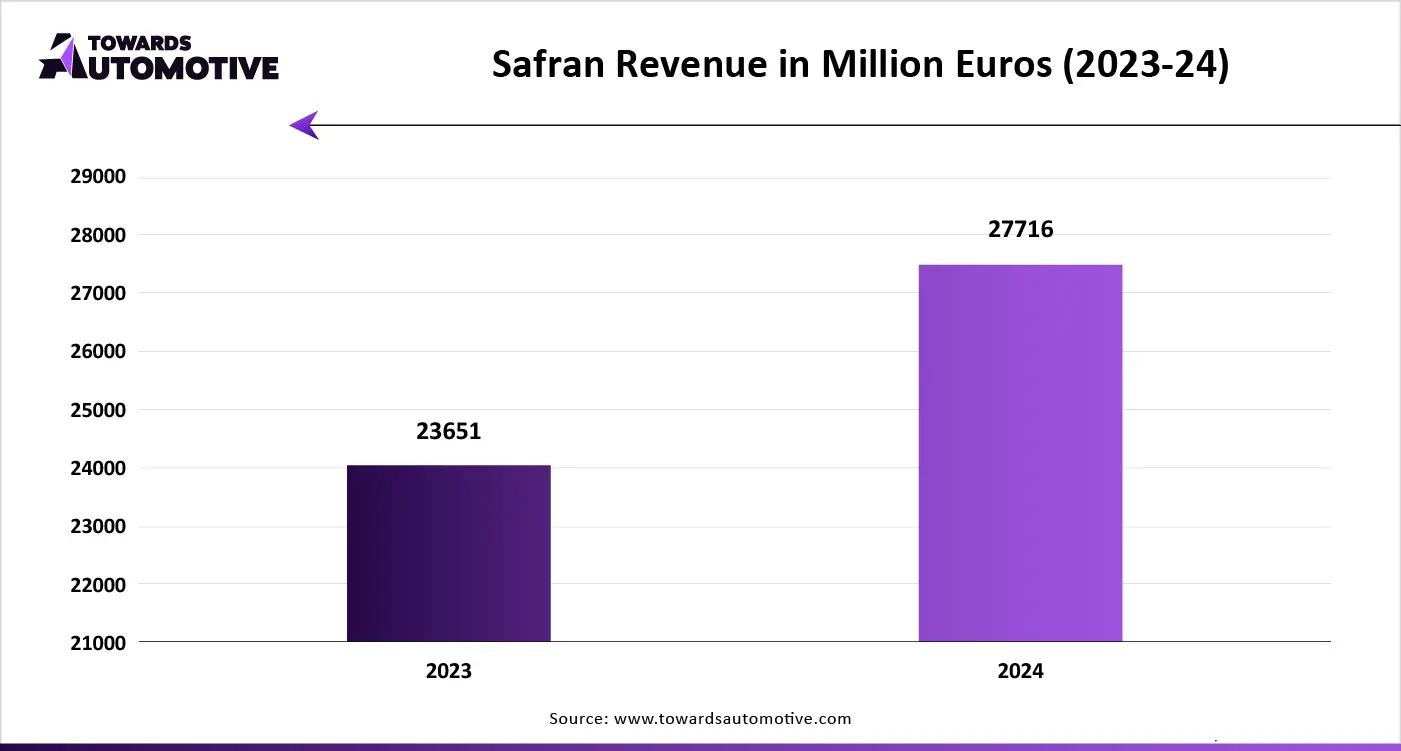

The aerospace engineering services outsourcing (ESO) market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Infosys, L&T Technology Services, Cyient, Capgemini Engineering (formerly Altran), ALTEN Group, AKKA Technologies (now part of Akkodis), Quest Global, Tata Technologies, Tech Mahindra, HCLTech, Wipro, Bertrandt, Alten Calsoft Labs, EPAM Systems, Accenture, ALTIMETRIK, Assystem, Segula Technologies, Safran Engineering Services, Expleo Group and some others. These companies are constantly engaged in providing aerospace engineering services and adopting numerous strategies such as launches, collaborations, partnerships, joint ventures, business expansions, acquisitions, and some others to maintain their dominance in this industry.

By Service Type

By Application

By Platform Type

By Outsourcing Approach

By Client Type

By Region

October 2025

April 2025

April 2025

January 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us