December 2025

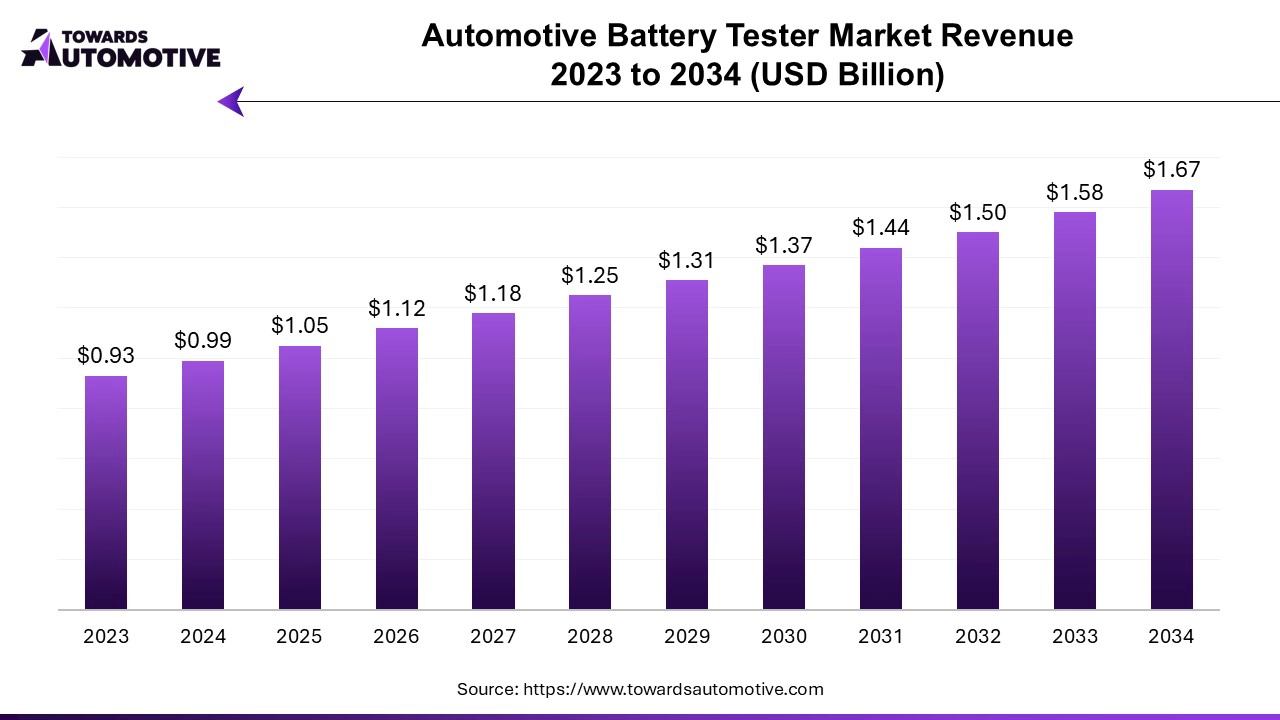

The automotive battery tester market is predicted to expand from USD 1.05 billion in 2025 to USD 1.67 billion by 2034, growing at a CAGR of 5.49% during the forecast period from 2025 to 2034.

The automotive battery tester market is a crucial sector of the automotive industry. This industry deals in manufacturing and distribution of automotive battery testers around the world. There are various types of testers developed in this sector comprising of simple testers and integrated testers. These testers are designed for checking batteries of numerous types of vehicles including two-wheelers, passenger cars, commercial vehicles and some others. It finds application in several sectors including OEM and aftermarket. This market is expected to rise significantly with the growth of the electric vehicles in different parts of the globe.

The major trends in this market consists of opening new battery testing centers, growing sales of cars and integration of AI in battery testers.

Several battery equipment companies have started investing for inaugurating new battery testing centers to increase the adoption of EVs. For instance, in May 2025, UL Solutions announced to open an advanced battery testing facility in Germany. This center is inaugurated to cater the needs of EV consumers of this nation. (Source: Business Wire, Inc.)

The sales of passenger cars and commercial vehicles has increased rapidly due to rising disposable income and integration of advanced technologies in vehicles. According to the International Organization of Motor Vehicle Manufacturers, around 95314731 vehicles were sold globally in 2024. (Source: OICA)

Several market players are integrating AI in battery testers to enhance the testing capabilities along with reducing dependency on engineers. For instance, in July 2023, Midtronics launched an AI-enabled automotive battery tester. This tester helps in providing battery testing results accurately and detects the faults in batteries. (Source: Midtronics)

The simple tester segment held the largest share of this industry. The growing adoption of simple testers in local automotive workshops to diagnose battery health has driven the market growth. Additionally, the rising demand for easy-to-use battery testers among personal car owners and old-age population is further adding to the industrial growth. Moreover, rapid investment by market players for developing affordable battery testers to enhance testing process is expected to propel the growth of the automotive battery tester market.

The integrated tester segment is expected to rise with a considerable CAGR during the forecast period. The growing adoption of multi-functioning testers in battery testing centers for detection of temperature and gathering information of charging and discharging cycle has boosted the market growth. Additionally, the rapid deployment of IoT-integrated testers in automotive service centers along with rising use of BMIS testers in EV battery industry is contributing to the market expansion. Moreover, numerous market players have started developing AI-based testers to enhance testing capabilities, thereby fostering the growth of the automotive battery tester market.

The aftermarket segment led this industry. The rise in number of aftermarket services centers in various nations such as India, Japan, the U.S. and some others has increased the demand for advanced battery testers to operate their daily operations, thereby fostering the market growth. Additionally, the rising consumer preference to visit aftermarket shops as it provides easy accessibility and affordable servicing is further adding to the industrial expansion. Moreover, partnerships among market players and aftermarket brands for deploying superior-quality battery testers in workshops is driving the growth of the automotive battery tester market.

The OEM segment is expected to grow with a notable CAGR during the forecast period. The growing preference of rich consumers to visit authorized workshops for regular car servicing activities has driven the market growth. Also, the rapid adoption of AI-enabled battery testers by several automotive brands such as Tata Motors, BYD, Tesla, BMW and some others is contributing to the industrial expansion. Moreover, rising investment by automotive OEMs for integrating advanced battery testing equipment to reduce operational error is expected to boost the growth of the automotive battery tester market.

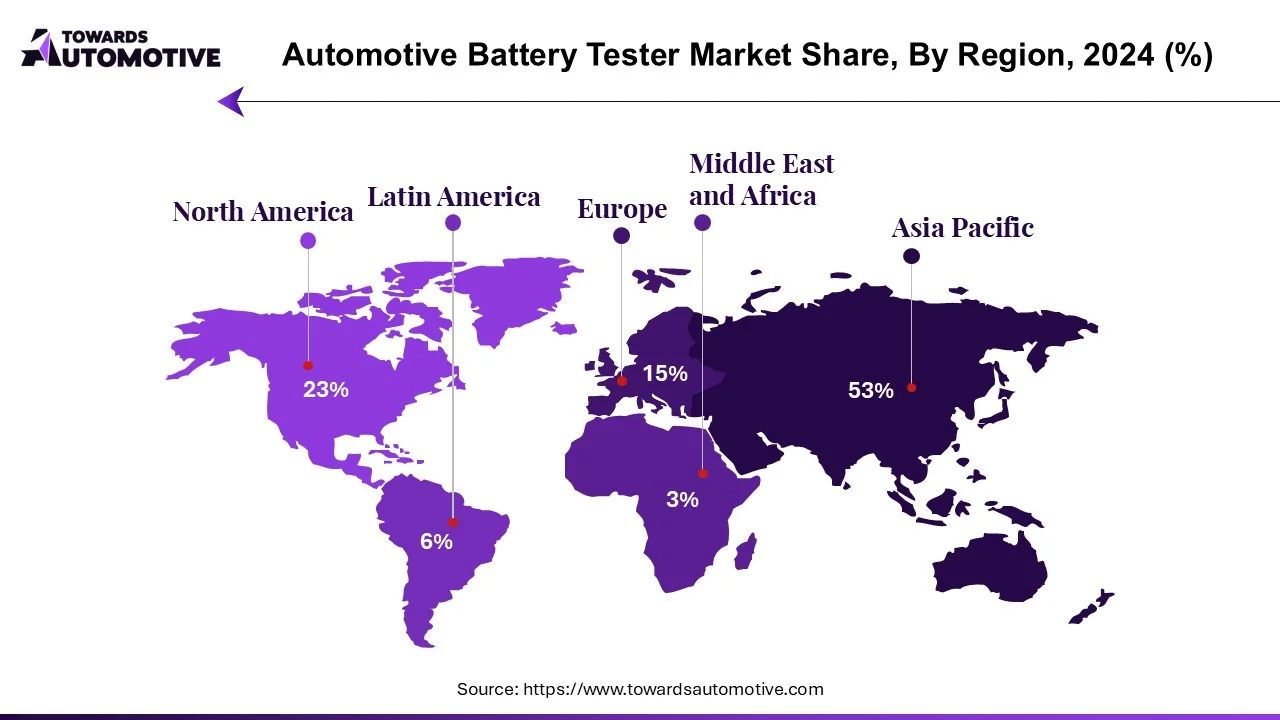

Asia Pacific dominated the battery tester market. The growing demand for budget-friendly passenger cars in numerous countries such as India, Vietnam, Indonesia, Thailand and some others has boosted the market growth. Additionally, rapid growth in the EV battery industry along with rising sales of electric two-wheelers is playing a positive role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Shenzhen Foxwell Technology Co. Ltd, Gamela Enterprise Co. Ltd, Meco Instruments Pvt. Ltd. and some others is expected to propel the growth of the automotive battery tester market in this region.

China dominated the market in this region. The growing sales and production of vehicles along with technological advancements in the battery industry has boosted the market growth. Moreover, the presence of advanced equipment companies along with presence of several automotive brands has driven the industrial expansion.

North America is expected to rise with a significant CAGR during the forecast period. The growing demand for luxury cars in the U.S. and rising sales of SUVs in Canada has driven the market expansion. Additionally, the growing adoption of electric trucks in several industries such as e-commerce, mining, chemicals and some others along with increasing trend of battery swapping is shaping the industry in a positive direction. Moreover, the presence of local automotive battery tester manufacturers such as EZRED, Innova Electronics, Fortive Corporation and some others is expected to drive the growth of the automotive battery tester market in this region.

U.S. is the major contributor in this region. In the U.S., the market is generally driven by the rising adoption of electric vehicles along with opening of new battery testing centers. Additionally, the growing demand for luxury buses coupled with presence of numerous automotive brands such as Tesla, Ford, Rivian and some others further contributes to the overall industrial expansion.

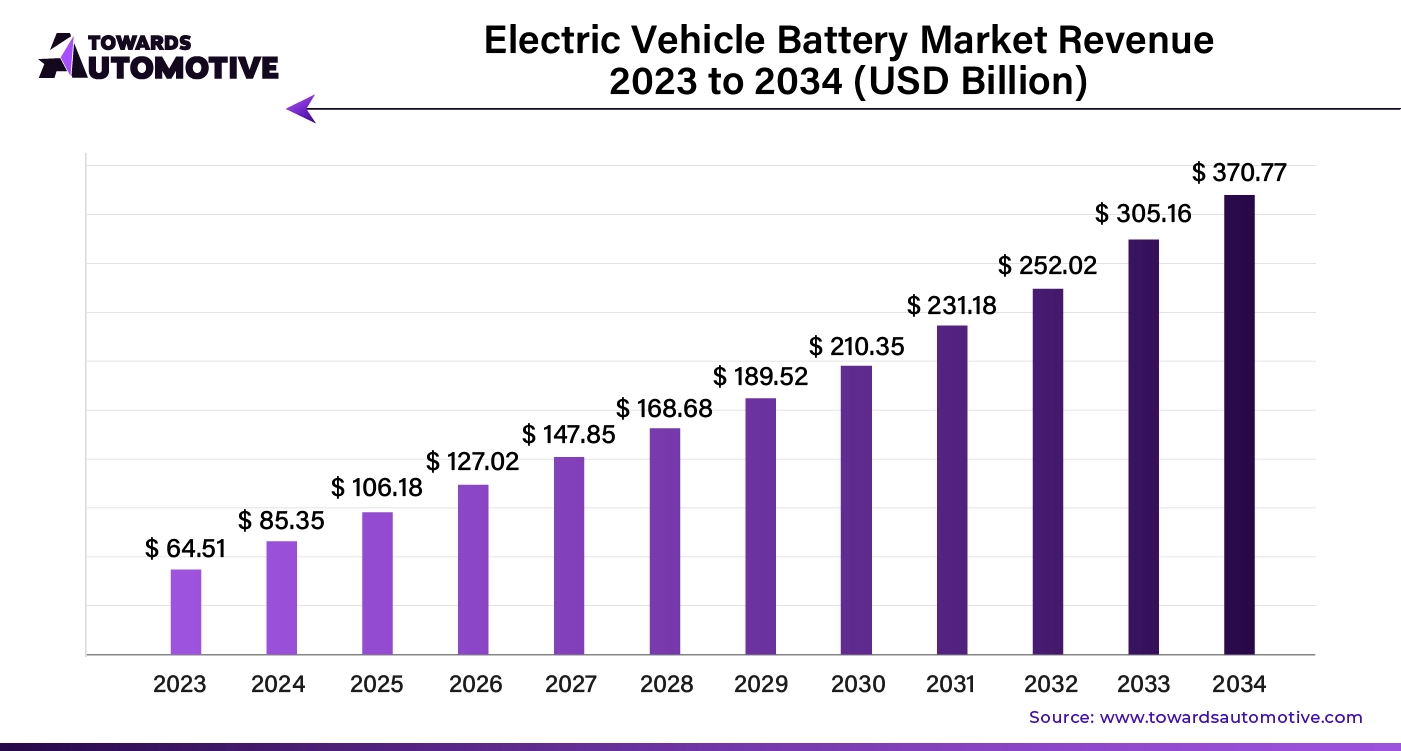

The global electric vehicle battery market is anticipated to grow from USD 106.18 billion in 2025 to USD 370.77 billion by 2034, with a CAGR of 21.50% during the forecast period from 2025 to 2034.

The electric vehicle battery market is experiencing rapid growth, driven by the increasing global adoption of electric vehicles as part of the transition toward cleaner, more sustainable transportation. EV batteries are a critical component of electric vehicles, powering everything from passenger cars to commercial trucks, and their performance directly impacts vehicle range, efficiency, and cost. As governments worldwide implement stricter emissions regulations and provide incentives for EV adoption, the demand for advanced, high-capacity batteries has surged.

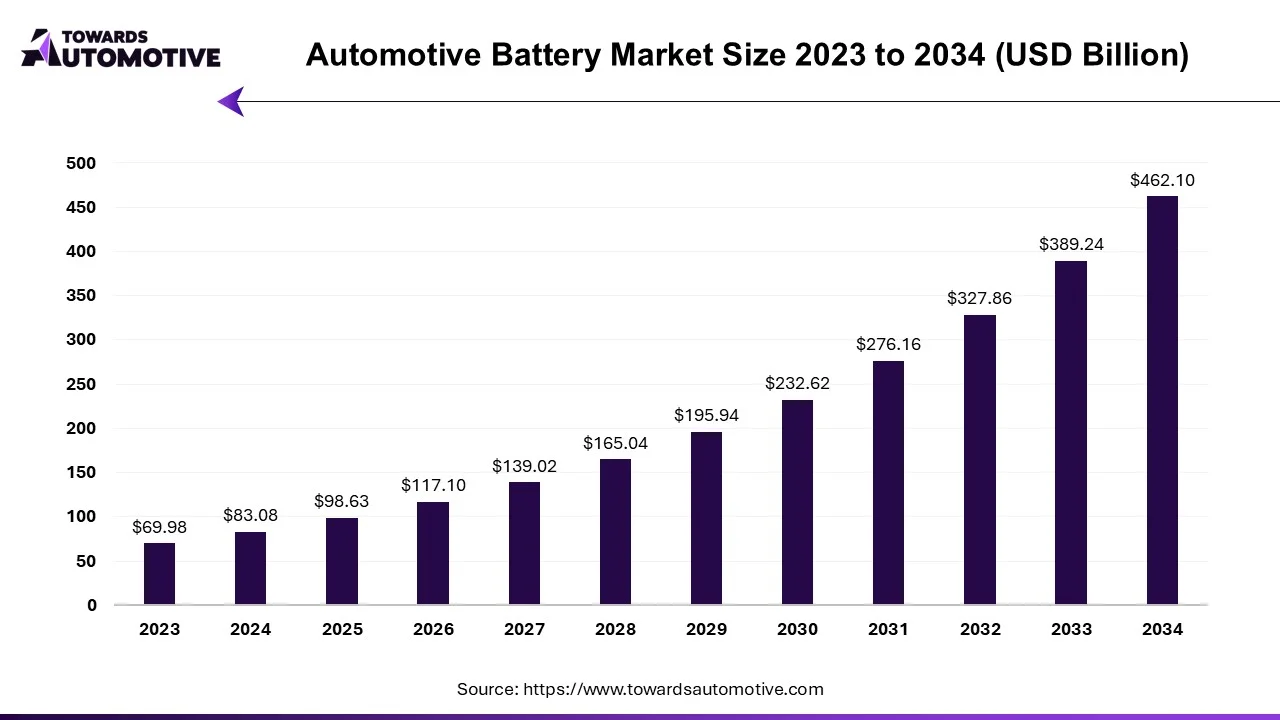

The automotive battery market is set to grow from USD 98.63 billion in 2025 to USD 462.10 billion by 2034, with an expected CAGR of 18.72% over the forecast period from 2025 to 2034.

The automotive battery market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of batteries for the automotive sector. There are several types of batteries developed in this sector comprising of lithium-ion based, lead-acid based, nickel based, sodium-ion and some others. These batteries are designed for different types of vehicles consisting of passenger cars, commercial vehicles, and some others. The growing sales of BEVs in different parts of the world has boosted the market expansion. This market is expected to rise significantly with the growth of the electric vehicle industry around the world.

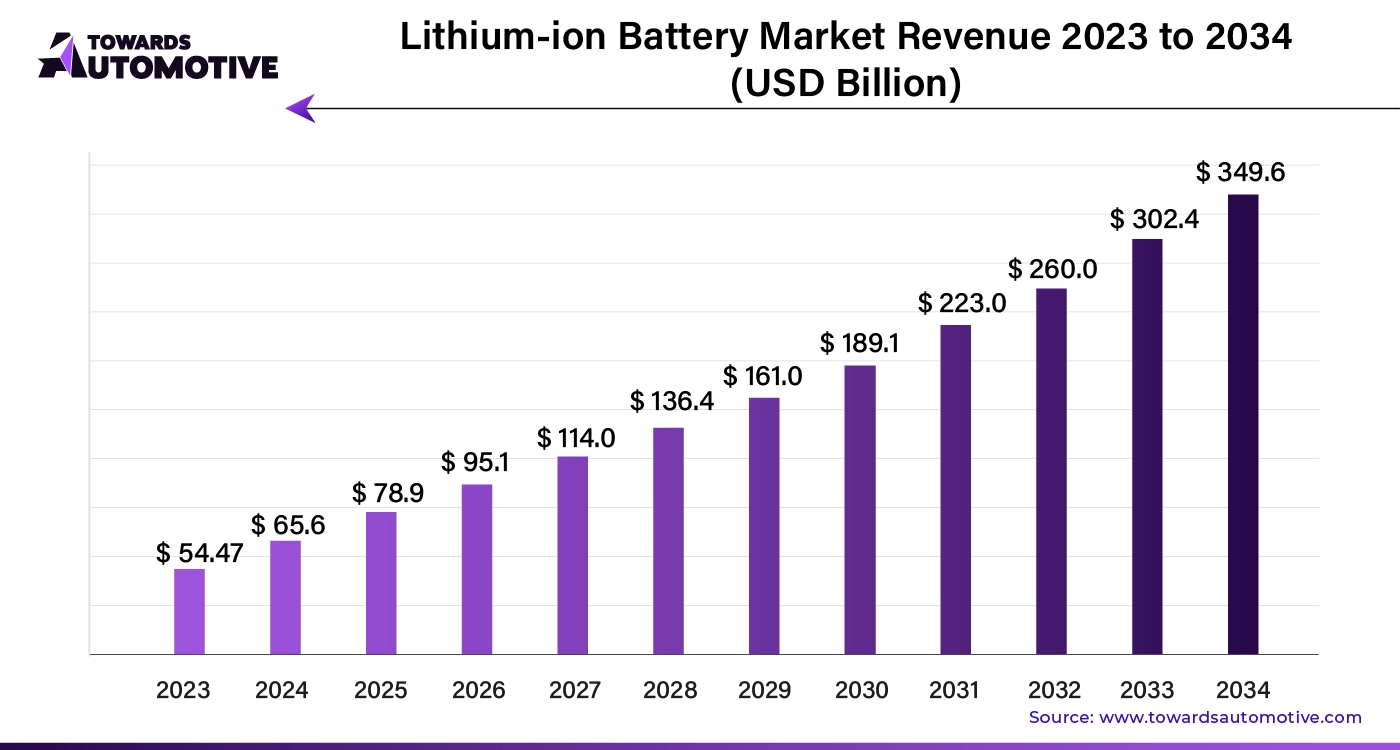

The global lithium-ion battery market size is calculated at US$ 54.47 billion in 2023 and is expected to grow with a CAGR of 20.34 % from 2024 to 2030.

The lithium-ion battery market is experiencing robust growth driven by advancements in technology, increasing demand across various sectors, and a global push toward sustainable energy solutions. Li-ion batteries are renowned for their high energy density, long life cycle, and lightweight characteristics, making them a preferred choice for a wide range of applications, from consumer electronics and electric vehicles (EVs) to renewable energy storage and portable devices. The rise in electric vehicle adoption is a significant driver of this market, as automakers seek efficient and high-performance battery solutions to enhance vehicle range and performance.

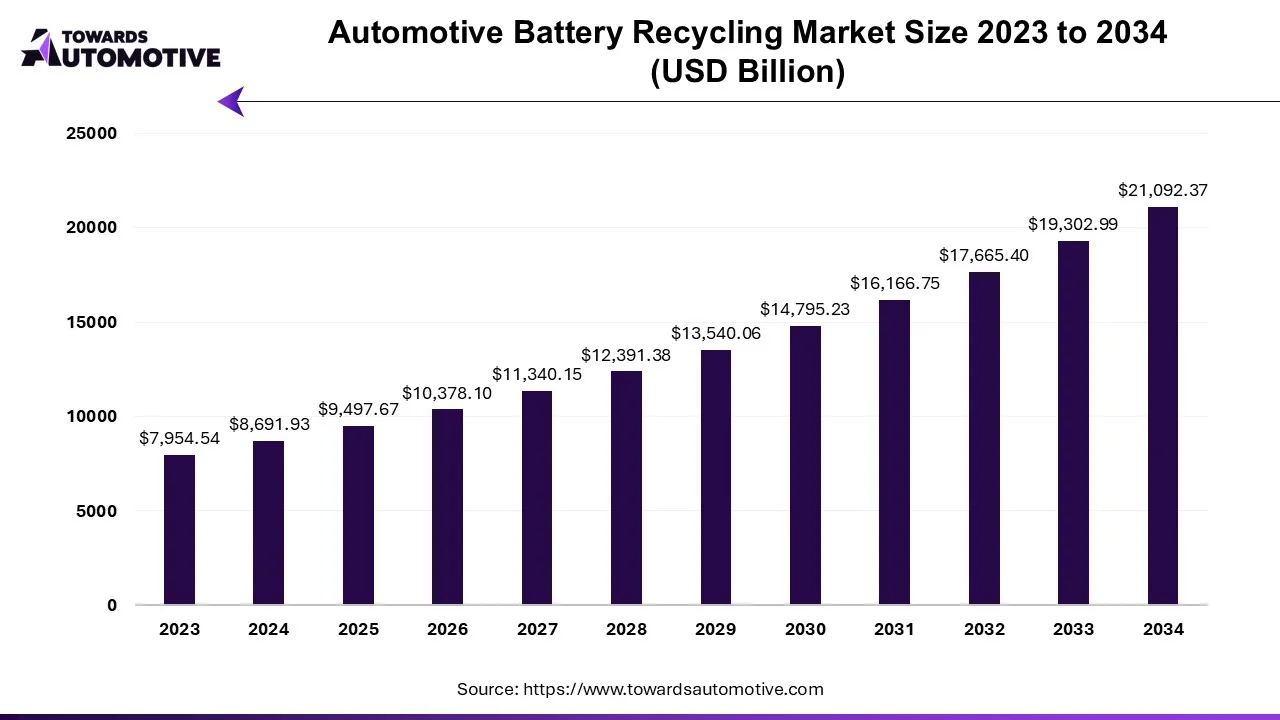

The automotive battery recycling market is set to grow from USD 9497.67 billion in 2025 to USD 21092.37 billion by 2034, with an expected CAGR of 9.27% over the forecast period from 2025 to 2034.

The automotive battery recycling market is a crucial segment of the automotive industry. This industry deals in providing battery recycling services for automotives. There are various types of batteries recycled in this sector including lead acid batteries, lithium-ion batteries, nickel metal hydride batteries and some others. These batteries are used in numerous types of vehicles consisting of passenger cars, electric vehicles and commercial vehicles. The growing sales of commercial vehicles around the world has boosted the industrial expansion. This market is expected to rise significantly with the growth of the battery industry around the world.

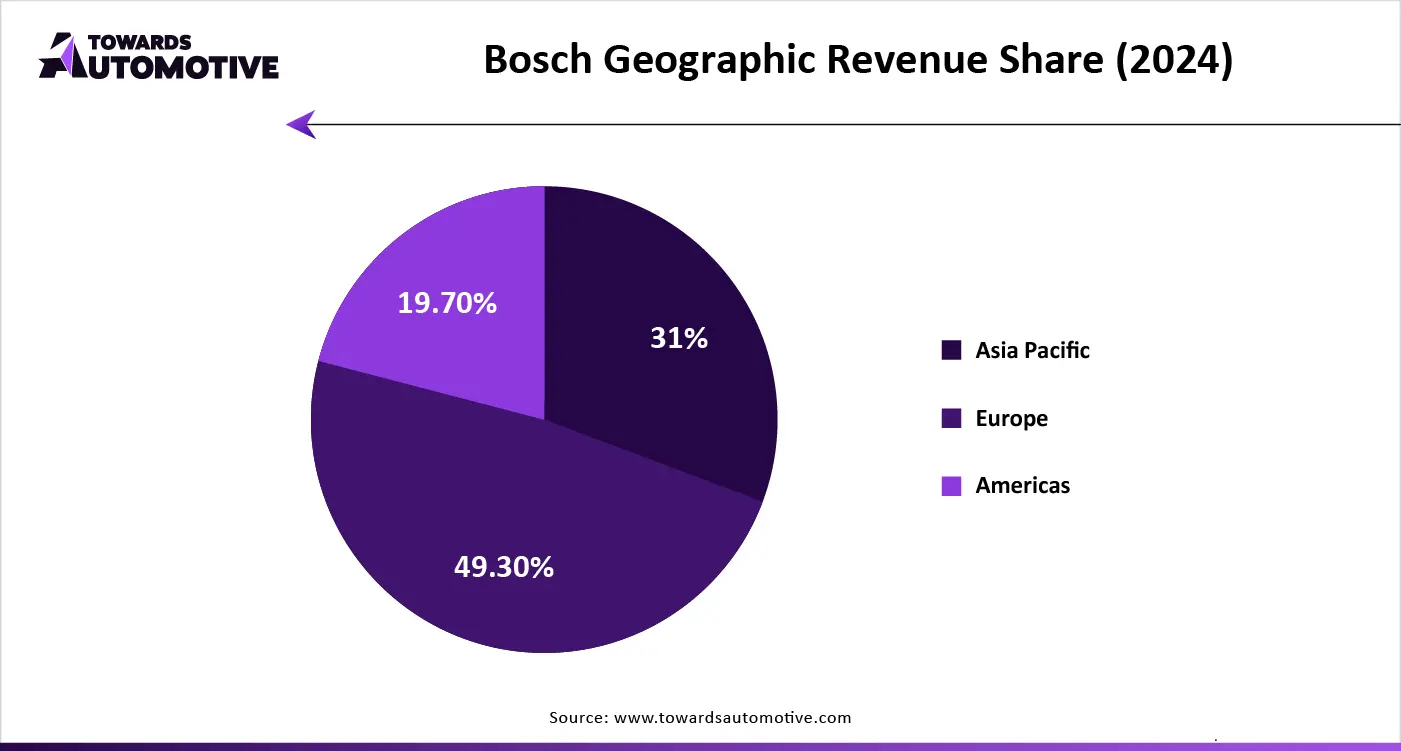

The automotive battery tester market is a rapidly growing industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of Midtronics, Inc., CLOREAUTOMOTIVE.COM, Associated Equipment, Schumacher Electric Corporation, Bosch Automotive Service Solutions Inc., Meco, Autometer Products, Fortive, IEC, MotoBatt and some others. These companies are constantly engaged in developing advanced battery testing equipment and adopting numerous strategies such as joint ventures, launches, partnerships, acquisitions, business expansions, collaborations, and some others to maintain their dominance in this industry.

By Technology

By Application

By Mobility

By Vehicle

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us