August 2025

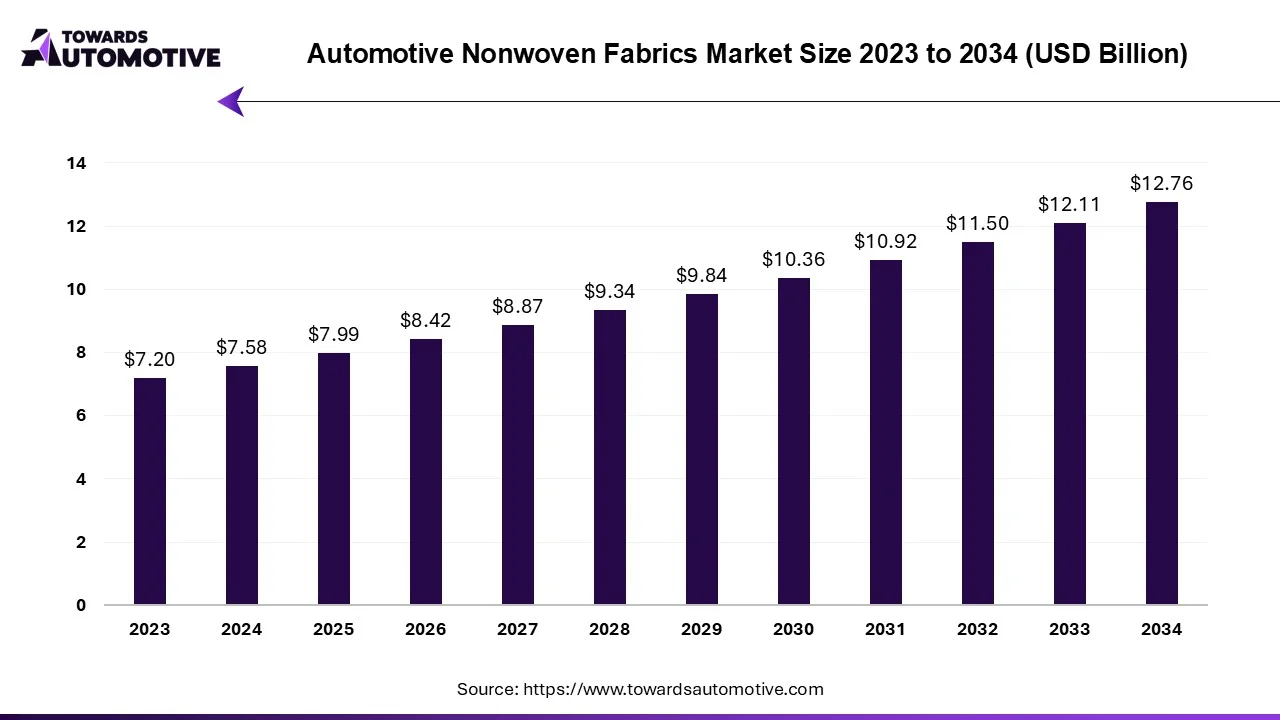

The automotive nonwoven fabrics market is expected to increase from USD 7.99 billion in 2025 to USD 12.76 billion by 2034, growing at a CAGR of 5.34% throughout the forecast period from 2025 to 2034. The rising demand for high-quality fabrics from the automotive sector to enhance the interior looks of vehicles coupled with rapid adoption of light-weight materials by sport car manufacturers has contributed to the industrial expansion. Additionally, rapid investment in the fabric manufacturing sector as well as increasing sales of luxury vehicles in different parts of the world is playing a vital role in shaping the market in a positive direction. The research and development associated with bio-degradable fabrics is expected to create ample growth opportunities for the market players in the upcoming days.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive nonwoven fabrics market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of nonwoven fabrics for the automotive sector. These fabrics are manufactured using several materials including polyester, polypropylene, nylon, polyethylene, synthetic fibers and some others. It is developed using numerous types of technologies comprising of spunbond, needle punched, meltblown, wetlaid and some others. The automotive applications of these fabrics consist of interior trim, upholstery, carpeting, headliners, parcel shelfs, trunk liners, air filters, engine covers and some others. This market is expected to rise significantly with the growth of the advanced materials industry in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 7.58 Billion |

| Projected Market Size in 2034 | USD 12.7 Billion |

| CAGR (2025 - 2034) | 5.34% |

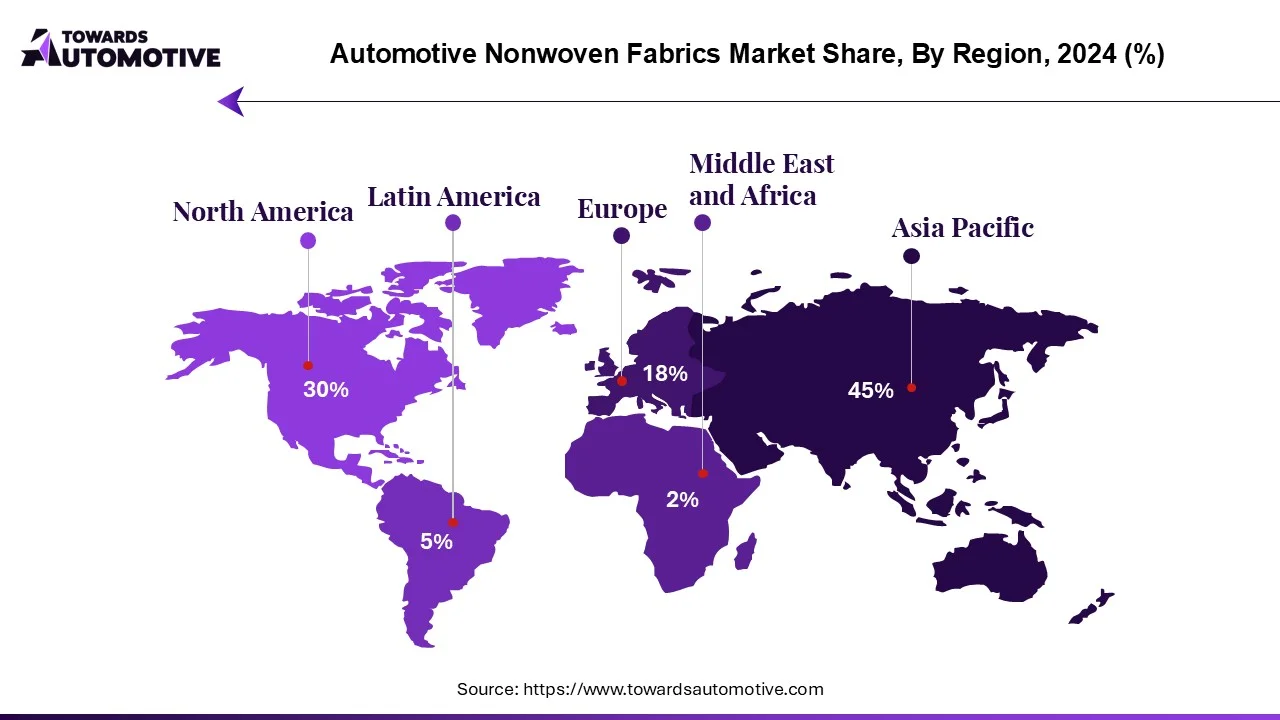

| Leading Region | Asia Pacific |

| Market Segmentation | By Material Type, By Technology, By Application, By Vehicle Type, By Sales Channel and By Region |

| Top Key Players | Kimberly-Clark Corporation, DuPont de Nemours, Lydall, Hollingsworth & Vose Company, Berry Global Group |

The major trends in this market consists of increasing sales of EVs, rising commercial vehicle production and rapid adoption of sustainable fabrics in vehicles.

The sales of electric vehicles have increased rapidly in numerous countries, thereby increasing the application of nonwoven fabrics. According to the International Energy Agency, around 300000 BEVs were registered in France during 2024. (Source: International Energy Agency)

The manufacturing of commercial vehicles such as trucks, buses, vans and some others has rapidly grown in several regions that in turn rises the demand for nonwoven fabrics. According to the International Organization of Motor Vehicle Manufacturers, around 1095493 commercial vehicles were manufactured in Japan during 2024. (Source: OICA)

The automotive brands are adopting eco-friendly fabrics in modern vehicles with an aim at reducing vehicular emission. For instance, in December 2024, Vulcaflex launched a new range of vegan fabrics. This new range of fabrics are designed for several applications in automotive interiors. (Source: Vulcaflex)

The polyester segment led the market. The growing use of polyester fabrics for manufacturing numerous automotive components such as seat fabrics, safety belts, airbags and some others has driven the market growth. Additionally, numerous advantages of polyesters including enhanced durability, wrinkle resistance, easy care and some others is expected to drive the growth of the automotive nonwoven fabrics market.

The polypropylene segment is expected to expand with a considerable CAGR during the forecast period. The rising application of polypropylene fabrics for manufacturing various automotive parts including dashboards, door panels, trims, instrument panels and some others has boosted the market expansion. Moreover, partnerships among market players and automotive brands to integrate high-quality polypropylene materials in EVs is expected to propel the growth of the automotive nonwoven fabrics market.

The passenger vehicles held the largest share of the market. The rising demand for affordable hatchbacks in developing nations such as Thailand, Indonesia, Vietnam and India has boosted the market expansion. Additionally, numerous applications of nonwoven fabrics in luxury vehicles such as carpeting, door panels, seat upholstery and some others is playing a vital role in shaping the industrial landscape. Moreover, partnerships among market players and car manufacturers to developed polyester-based fabrics for modern vehicles is expected to propel the growth of the automotive nonwoven fabrics market.

The electric vehicles segment is expected to expand with the fastest CAGR during the forecast period. The growing sales of EVs in several countries such as Germany, the U.S., Norway, China and some others has boosted the market expansion. Additionally, rising consumer awareness to reduce vehicular emission coupled with surging emphasis on developing light-weight EV components is contributing to the industrial growth. Moreover, the application of nonwoven fabrics in EVs including filter systems, seat backs, soundproofing, speaker covers, trunk liners, squeak prevention and some others is expected to foster the growth of the automotive nonwoven fabrics market.

Asia Pacific held the largest share of the automotive nonwoven fabrics market. The growing production of vehicles in several countries such as China, India, Japan, South Korea and some others has boosted the market expansion. Additionally, availability of essential raw materials coupled with increasing popularity of vehicle modification is playing a crucial role in shaping the industrial landscape. Moreover, the presence of several market players such as Mitsui Chemicals, Asahi Kasei Corporation, Toray Industries, Inc. and some others is expected to drive the growth of the automotive nonwoven fabrics market in this region.

North America is expected to rise with a significant CAGR during the forecast period. The rising sales of electric vehicles in the U.S. and Canada has boosted the market expansion. Also, the rapid investment by automotive brands for developing light-weight automotive materials coupled with increasing demand for luxury vehicles from elite-class consumers is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of several local nonwoven fabric manufacturers such as Kimberly-Clark Corporation, DuPont de Nemours, Hollingsworth & Vose Company and some others is expected to foster the growth of the automotive nonwoven fabrics market in this region.

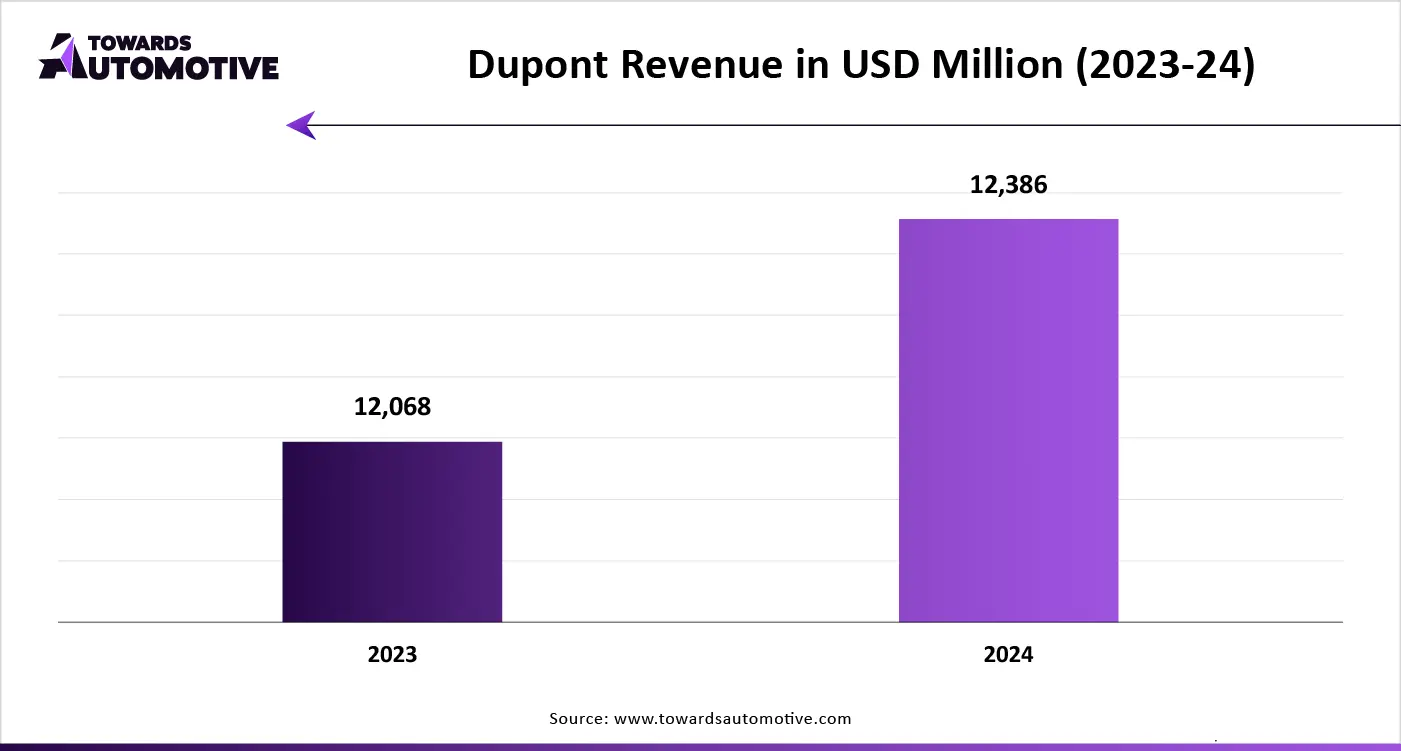

The automotive nonwoven fabrics market is a highly fragmented industry with the presence of various dominating players. Some of the prominent companies in this industry consists of Toray Industries, Mitsui Chemicals, Freudenberg Performance Materials, Ahlstrom-Munksj, Kimberly-Clark Corporation, DuPont de Nemours, Lydall, Hollingsworth & Vose Company, Berry Global Group, Asahi Kasei Corporation and some others. These companies are constantly engaged in developing nonwoven fabrics for the automotive industry and adopting numerous strategies such as joint ventures, launches, acquisitions, partnerships, business expansions, collaborations and some others to maintain their dominance in this industry.

By Material Type

By Technology

By Application

By Vehicle Type

By Sales Channel

By Region

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us