December 2025

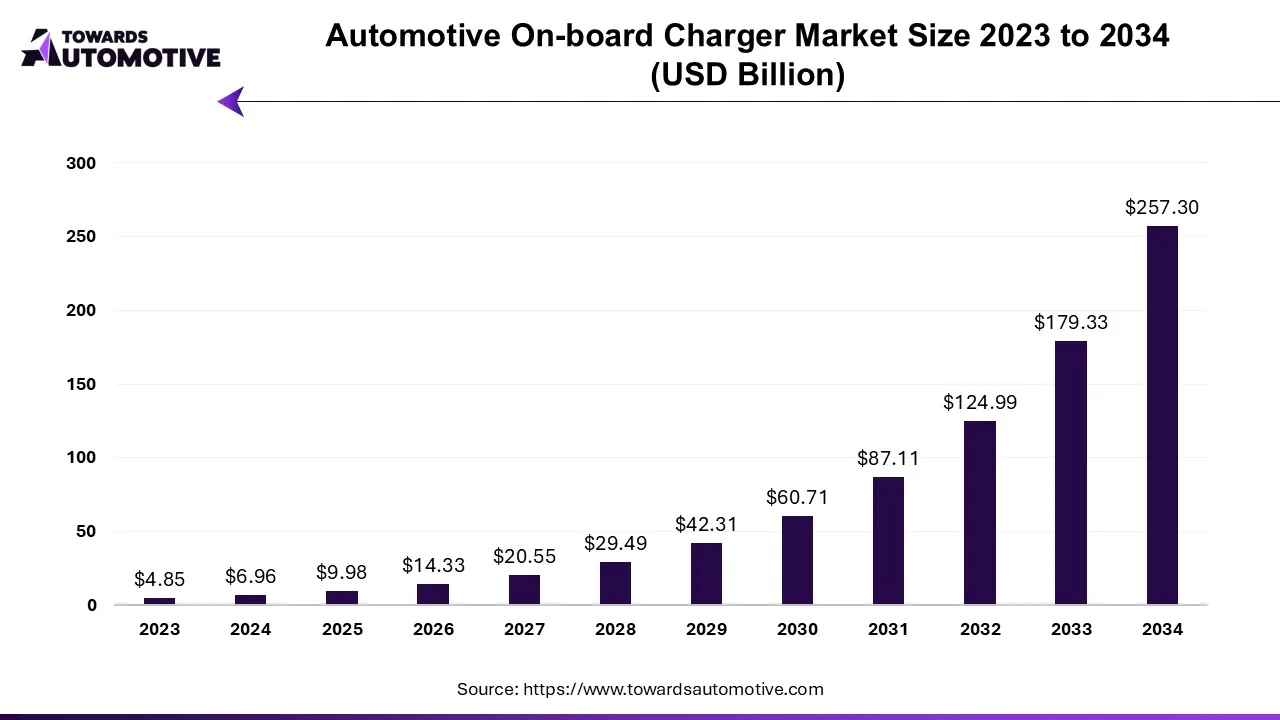

The automotive on-board charger market is forecast to grow from USD 9.98 billion in 2025 to USD 257.30 billion by 2034, driven by a CAGR of 43.48% from 2025 to 2034.

The impact of COVID-19 on the onboard charger market was inevitable as it affected nearly every other industry worldwide. However, the electric vehicle (EVs) market is experiencing significant growth due to the rapidly increasing adoption rate of battery electric vehicles year-on-year. For example, there was a dramatic rise in electric vehicle sales in China and Europe despite the pandemic, indicating active market growth during the forecast period.

Over the medium-term forecast period, rapid sales of electric vehicles, stringent emission regulations, advancements in battery technology, and improving charging infrastructure are expected to drive the demand for automotive onboard chargers. The market is already witnessing the adoption of electric passenger vehicles in developed countries, and now new startups and major players in the EV industry are planning to introduce their new electric models in the coming years.

The On-Board Charger plays a crucial role in electric vehicles, allowing the charging of the vehicle's battery by converting AC voltage into DC. Its main components include an input filter, power factor corrector, DC/DC Converter, and a control circuit that facilitates communication with other devices on the vehicle.

The range of EV batteries is increasing rapidly, with models now entering the market with up to 600 miles of range. Trucks and van body sizes are larger compared to passenger cars, enabling them to accommodate more batteries for extended range. Large electric motors can generate significant torque for towing and hauling capacities.

For Instance,

China leads the EV race, with its fleet of electric buses accounting for over 98% of total electric buses worldwide. China boasts a fleet of more than 425,000 electric buses, attributed to the robust municipal framework adopted by many provinces. Over 30 Chinese cities had plans to achieve 100% electrified public transit by 2020, including prominent ones like Guangzhou, Zhuhai, Dongguan, Foshan, and Zhongshan in the Pearl River Delta, as well as Nanjing, Hangzhou, Shaanxi, and Shandong.

Considering these developments, the demand for on-board chargers is expected to remain high during the forecast period.

Electric passenger cars are gradually gaining traction worldwide, with current adoption standing at 9% globally, a figure expected to continue its upward trend in the years to come. Europe witnessed a significant increase in electric passenger car registrations in 2020, jumping from 3.5% to 11% of total new car registrations, signaling a growing preference for electric vehicles.

The shift towards electric mobility is steadily gaining momentum globally, prompting goods transportation companies to transition their fleets to electric propulsion-based vehicles. Original Equipment Manufacturers (OEMs) are also realigning their strategies to embrace electric vehicles.

For example:

Governments of many developed and developing nations have devised green mobility plans, including bans on diesel vehicles and incentives for EV buyers. For instance, the United Kingdom plans to phase out sales of all gasoline and diesel engine cars by 2040, while India aims to ban all diesel-engine cars from its roads by 2030. Norway is leading the way by aiming to make every new car a zero-emission vehicle by 2025. The increasing sales of electric passenger cars and the expansion of charging infrastructure are expected to drive growth in the automotive on-board charger market.

Considering these developments and factors, demand for on-board chargers is anticipated to remain positive in the passenger car segment throughout the forecast period.

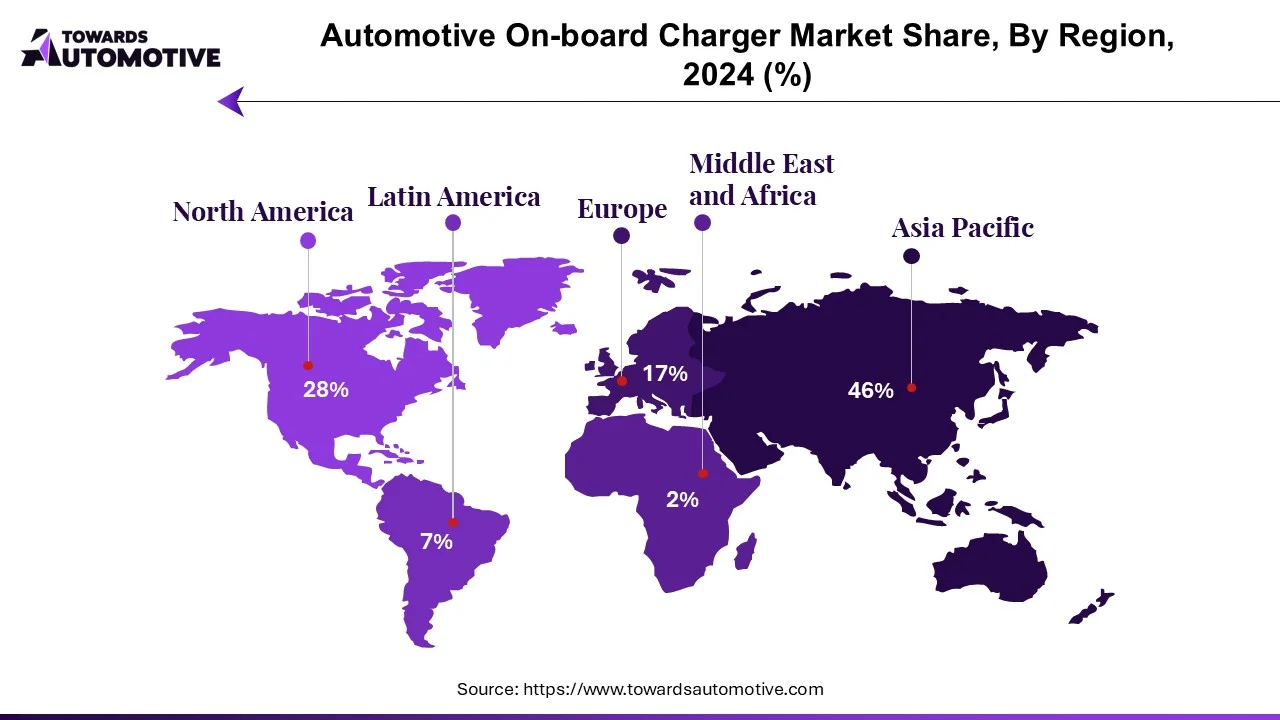

The Asia-Pacific region is poised to take the lead in the automotive on-board charger market, driven by its status as the epicenter of the electric vehicle industry. This is due to several factors including the availability of inexpensive raw materials, low-cost labor, the presence of numerous industry players, a large population base, and active government involvement.

Despite a global downturn in automotive sales caused by the COVID-19 pandemic's semiconductor supply shortage, China saw a remarkable 154 percent increase in electric vehicle sales last year. This surge reflects a growing preference for cleaner transportation options among consumers. In 2021, electric vehicle manufacturers sold a total of 3.3 million units in China, a significant rise from the 1.3 million sold in 2020 and 1.2 million in 2019.

Government policies, including incentives, have played a crucial role in driving the growth of China's electric vehicle sector. However, due to the substantial expansion of the EV market, these incentives have placed a considerable burden on the government. Consequently, in January 2022, China's Ministry of Finance announced a 30% reduction in EV subsidies for the year, with plans to phase out all subsidies by year-end. Such measures could potentially impede market growth.

In India, the government has undertaken various initiatives to promote electric vehicle manufacturing and adoption, aiming to reduce emissions in compliance with international agreements and foster e-mobility amid rapid urbanization. Electric vehicle sales in India surged in 2021, with a 168 percent increase over the previous year, reaching 3,29,190 units sold. Passenger electric vehicle sales tripled in 2021, totaling 14,800 units, indicating ongoing growth momentum.

BYD, a Chinese carmaker, has announced a revised portfolio of three electric cars in Europe, incorporating an innovative 8-in-1 electric engine architecture. This powertrain design, which comprises a vehicle control unit, power distribution unit, battery management system, motor controller, drive motor, gearbox, DC-DC connection, and on-board charger, has an overall efficiency of 90% and aims to dominate the regional market.ransmission, DC-DC connector, and on-board charger, achieving an overall efficiency of 90%.

Considering these developments, the demand for on-board chargers is expected to experience significant growth in the Asia-Pacific region during the forecast period.

The global automotive on-board charger market is characterized by fragmentation and features several active players, attributed to the presence of emerging startups and major automotive electronics manufacturers. Key players in the market include BorgWarner Inc., Ficosa Corporation, and LG Electronics, among others. Some electric vehicle Original Equipment Manufacturers (OEMs), such as BYD and Tesla, produce onboard chargers in-house.

As the market welcomes the introduction of various new electric vehicle models, companies specializing in on-board chargers are expanding their footprint by establishing strategic partnerships with other industry players and introducing new automotive on-board chargers. For example, BorgWarner utilizes silicon carbide technology and offers a range of AC power ratings, including 7.4 kilowatts (kW), 11 kW, and 22 kW. Additionally, BorgWarner provides DC-to-DC converter ratings ranging from 2.3 kW to 3.6 kW as part of its onboard charger offerings.

The onboard charger serves as an integrated car charging system designed to recharge the available high-voltage battery system from the AC grid while the vehicle is parked.

The automotive onboard charger market is segmented based on vehicle type, powertrain type, rated power, and geography. Regarding vehicle type, the market is divided into passenger cars and commercial vehicles. Powertrain types include battery electric vehicles (BEV) and plug-in hybrid vehicles (PHEV). Rated power segments the market into less than 3.3 kW, 3.3-11 kW, and more than 11 kW categories. Geographically, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. Market sizing and forecasting for each segment are based on value (in USD Billion).

By Vehicle Type

By Powertrain Type

By Rated Power Type

By Geography

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us