December 2025

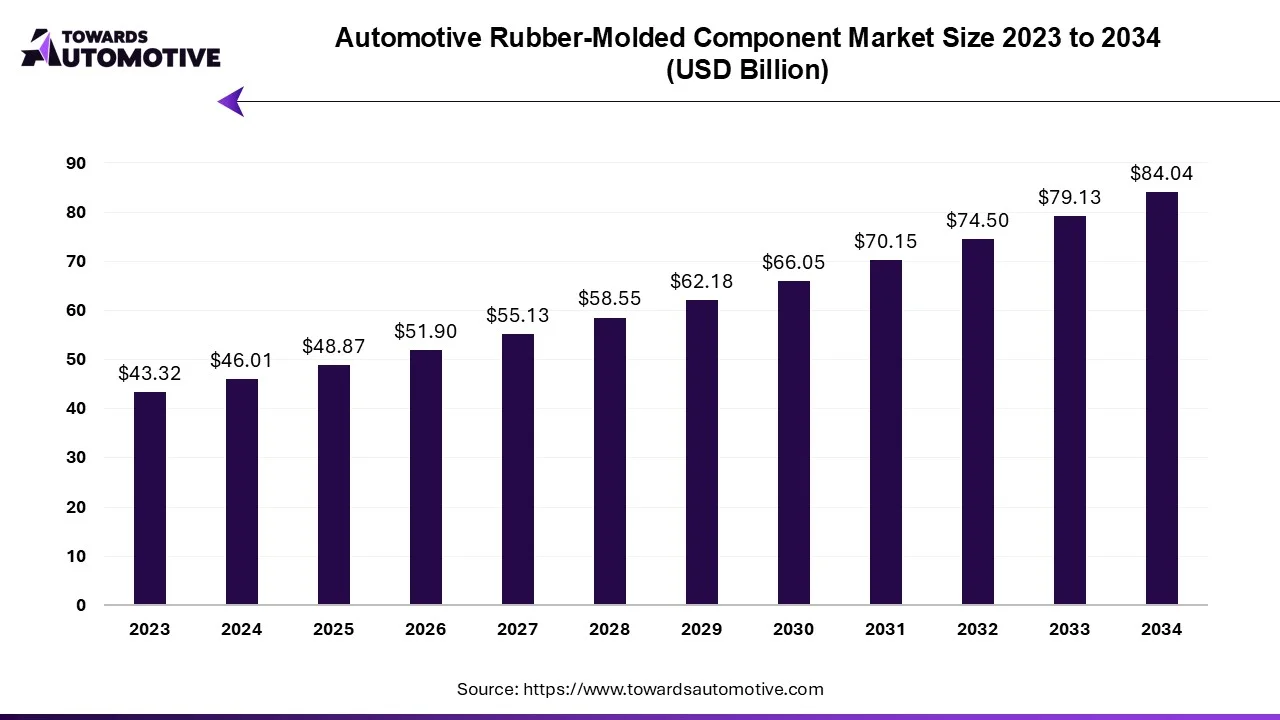

The automotive rubber-molded component market is expected to increase from USD 48.87 billion in 2025 to USD 84.04 billion by 2034, growing at a CAGR of 6.21% throughout the forecast period from 2025 to 2034.

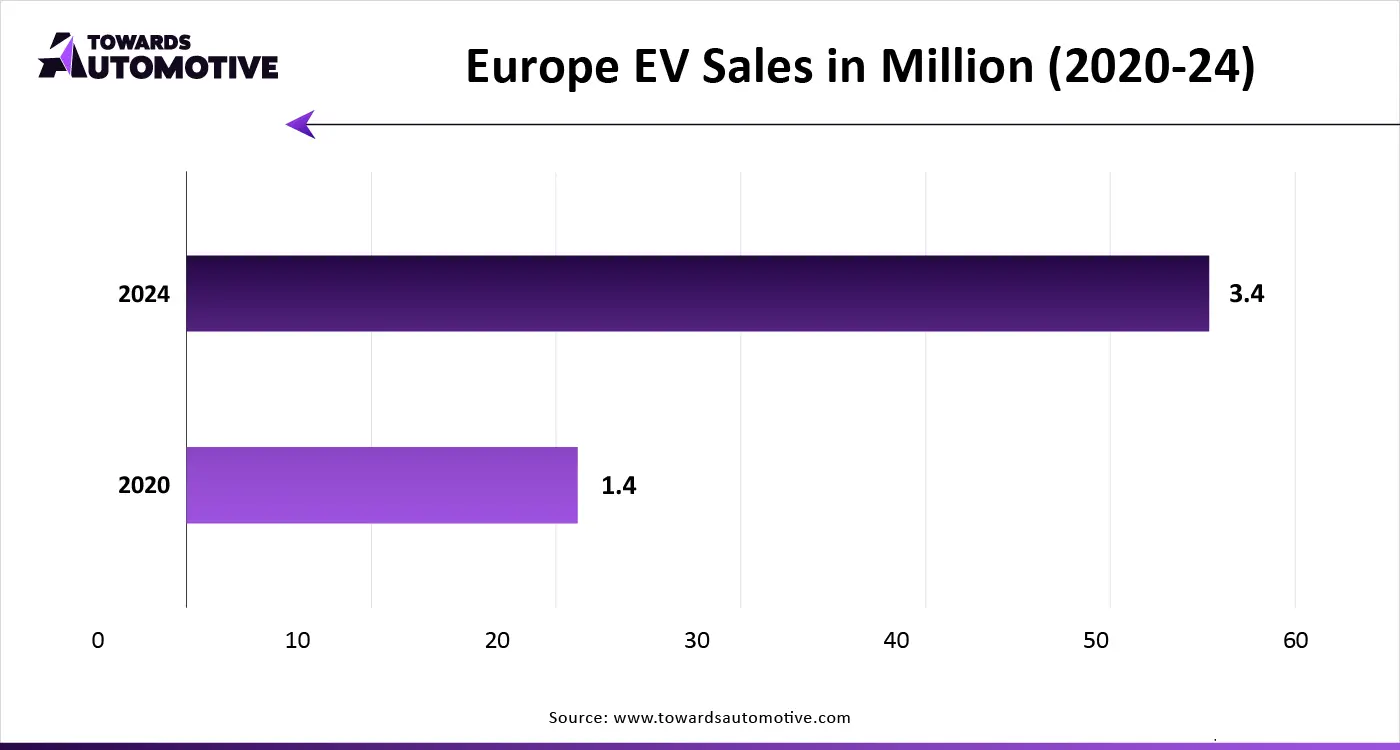

The automotive rubber-molded component market is a prominent segment of the automotive industry. This industry deals in manufacturing and distribution of rubber-molded components for the automotive sector. There are various types of components developed in this sector consisting of seals, gaskets, hoses, weather-strips and some others. These components are manufactured using several types of materials comprising of ethylene propylene diene monomer (EPDM), natural rubber (NR), styrene-butadiene rubber (SBR) and some others. It is designed for numerous types of vehicles including passenger cars and commercial vehicles. The growing sales of electric vehicles has increased the demand for rubber products, thereby boosting the market expansion. This market is expected to grow significantly with the rise of the automotive materials industry in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 46.01 Billion |

| Projected Market Size in 2034 | USD 84.04 Billion |

| CAGR (2025 - 2034) | 6.21% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material Type, By Component Type, By Vehicle Type and By Region |

| Top Key Players | Sumitomo Riko Co. Ltd, Jayem Auto Industries Pvt Ltd |

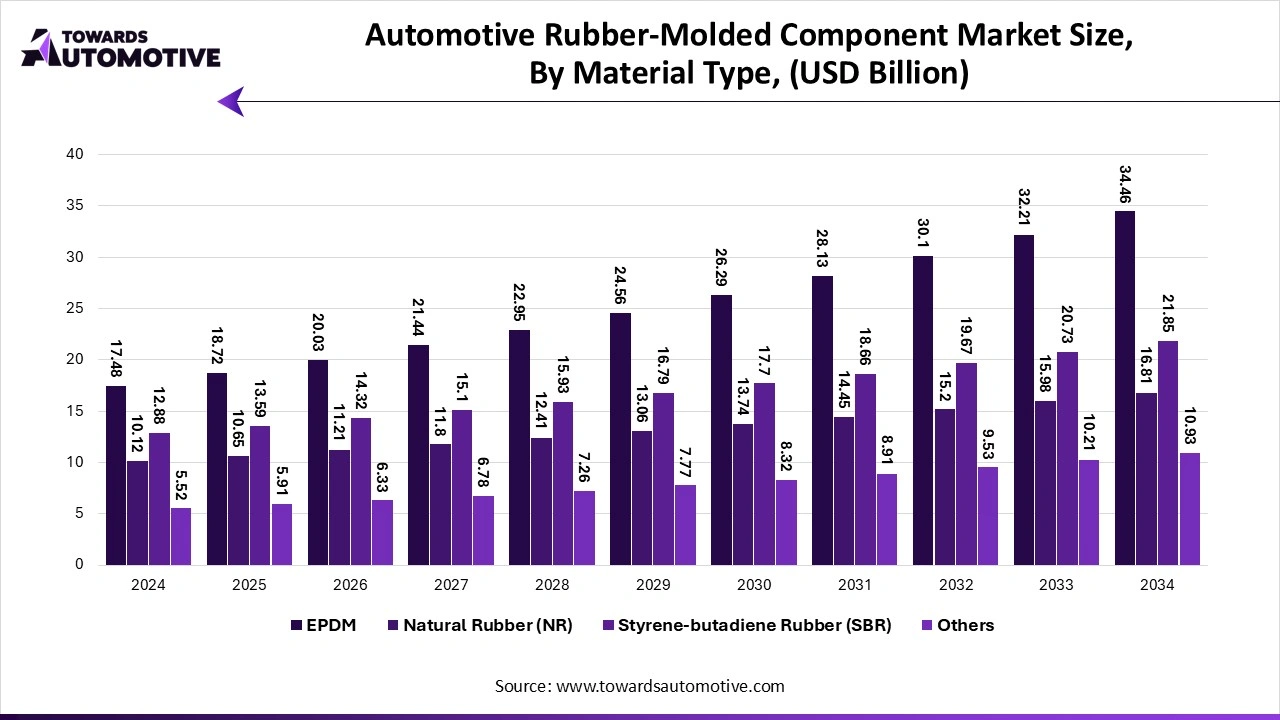

The ethylene propylene diene monomer (EPDM) segment accounted for the highest market share. The growing adoption of EPDM rubber for several automotive applications such as sealing, braking, electrical systems and some others has boosted the market growth. Additionally, technological advancements in molding processes along with rapid investment by market players for developing high-quality EPDM is further adding to the overall industrial expansion. Moreover, numerous advantages of EPDM including weather resistance, chemical resistance, water resistance, cost-effectiveness, versatility and some others is expected to drive the growth of the automotive rubber-molded component market.

The styrene-butadiene rubber (SBR) segment is likely to witness significant growth during the forecast period. The rising use of styrene-butadiene rubber for manufacturing different automotive components including tires, drive couplings, belts, gaskets and some others has driven the market expansion. Additionally, the technological advancements in emulsion polymerization and solution polymerization is playing a crucial role in shaping the industrial landscape. Moreover, several advantages of SBR including high tensile strength, superior abrasion resistance, cost-effectiveness and some others is likely to boost the growth of the automotive rubber-molded component market.

The seals segment held the highest share of the market. The growing sales of engine seals for preventing leaks in engine components has boosted the market expansion. Also, the rising use of EPDM and SBR for manufacturing various types of automotive seals is further playing a positive role in shaping the industrial landscape. Moreover, the increasing demand for different types of seals including oil seals, O-rings, fluid seals, transmission seals and some others is driving the growth of the automotive rubber-molded component market.

The gaskets segment is expected to grow with a significant CAGR during the projection period. The rising demand for different types of automotive gaskets such as valve cover gaskets, intake manifold gaskets, exhaust manifold gaskets and some others has boosted the market expansion. Also, the increasing use of EPDM and silicone rubber for manufacturing automotive gaskets is further adding to the industrial growth. Moreover, the growing sales of automotive in different parts of the globe has increased the demand for gaskets, thereby fostering the growth of the automotive rubber-molded component market.

The passenger cars segment accounted for the largest market share in 2024. The growing demand for luxury cars in several countries such as UK, France, Germany, U.S., Italy, Singapore and some others has boosted the market expansion. Additionally, the rising adoption of electric SUVs in developed nations coupled with numerous government initiatives aimed at developing the automotive sector is further contributing to the industrial growth. Moreover, rapid investment by automotive brands such as BYD, Tesla, Ford, Chevrolet, Tata Motors, Toyota and some others for developing passenger cars is expected to drive the growth of the automotive rubber-molded component market.

The commercial vehicles segment is anticipated to rise with a notable growth over the studied period. The growing adoption of heavy-duty trucks in several industries such as oil & gas, mining, construction and some others has driven the market growth. Additionally, surge in demand for LCEVs for operating e-commerce and logistics applications is playing a vital role in shaping the industry in a positive direction. Moreover, growing sales of commercial vehicles in economically advanced nations such as UK, Germany, U.S. and some others is predicted to foster the growth of the automotive rubber-molded component market.

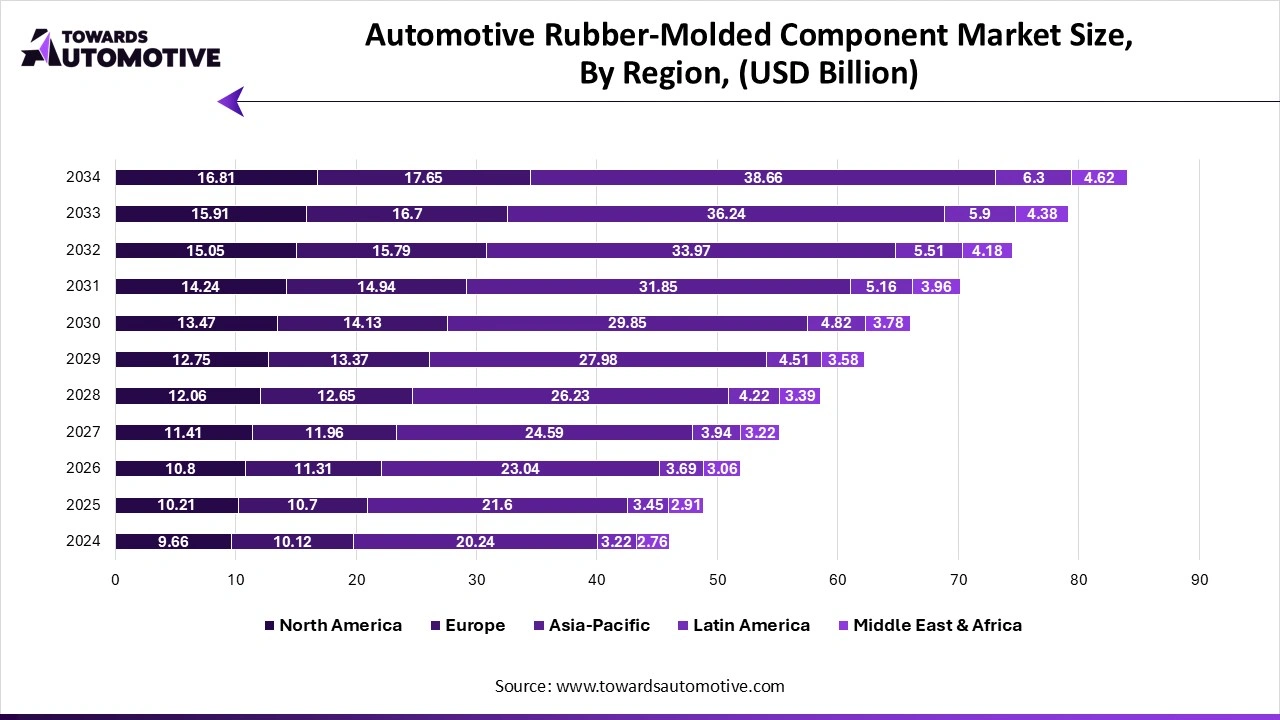

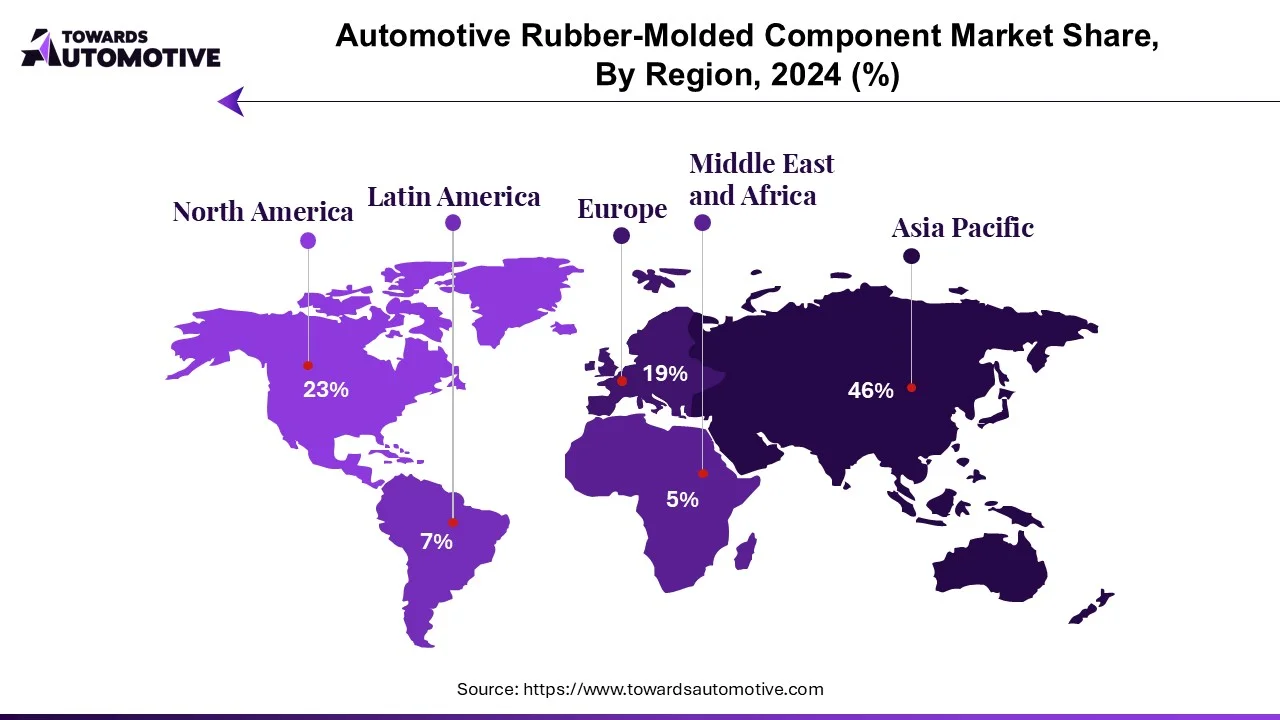

Asia Pacific dominated the automotive rubber-molded component market. The rising sales and production of passenger vehicles in countries such as China, India, Japan, South Korea and some others has boosted the market growth. Additionally, surge in demand for electric buses to lower emission along with rise in number of rubber molding startups is further adding to the industrial expansion. Moreover, the presence of several market players such as Sumitomo Riko, Bony Polymers Pvt Ltd, Hebei Shinda Seal Group and some others is further driving the growth of the automotive rubber-molded component market in this region.

China dominated the market in this region. In China, the market is generally driven by the growing demand for electric trucks along with technological advancements in automotive sector. Additionally, the availability of skilled labor force along with abundance of raw materials at low prices is further accelerating the market expansion.

North America is anticipated to grow with a notable CAGR during the forecast period. The growing demand for high-performance cars in countries such as Canada and the U.S. has boosted the market growth. Also, the increasing sales of hybrid cars and autonomous vehicles along with rapid investment by private entities and public companies for developing the rubber industries is playing a significant role in shaping the industrial landscape. Moreover, the presence of several automotive brands such as Tesla, Ford, Chevrolet, General Motors and some others is projected to foster the growth of the automotive rubber-molded component market in this region.

U.S. and Canada are the significant contributors in this region. In U.S., the market is generally driven by the presence of several EV manufacturers such as Rivian and Tesla. In Canada, the growing sales of commercial vehicles along with availability of rubber for commercial purposes is driving the market growth.

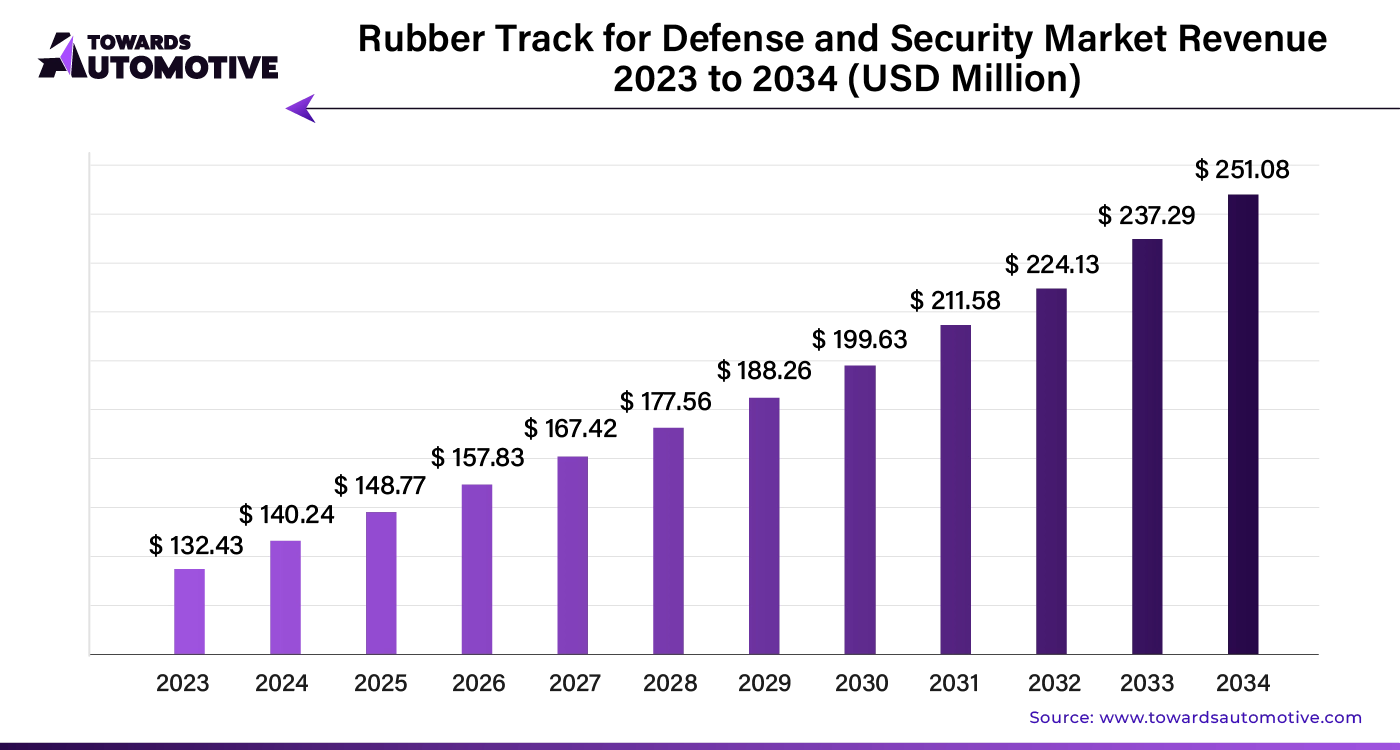

The global rubber track for defense and security market size is calculated at USD 140.24 million in 2024 and is expected to be worth USD 251.08 million by 2034, expanding at a CAGR of 5.90% from 2023 to 2034.

High-performance rubber tracks are increasingly being developed for military tanks and other defense vehicles. Their usage is expanding across various applications, including armored vehicles and unmanned ground vehicles (UGVs). Additionally, the popularity of tracks for robots and drones is on the rise. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The automotive rubber-molded component market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Sumitomo Riko Co. Ltd, Jayem Auto Industries Pvt Ltd, DANA Holding Corporation, Freudenberg and Co. Kg, Bohra Rubber Pvt. Ltd, Cooper-Standard Automotive, Hebei Shinda Seal Group, Hutchinson SA, Steele Rubber Products, and some others. These companies are constantly engaged in manufacturing rubber-molded products for the automotive sector and adopting numerous strategies such as business expansions, collaborations, launches, partnerships, acquisitions, joint ventures and some others to maintain their dominant position in this industry. For instance, in April 2025, Freudenberg Sealing Technologies launched a high-performance sealing material. This material is developed for sealing battery cells in automotive. Also, in December 2024, Sumimoto Riko inaugurated a rubber bearing plant in Japan. This manufacturing facility is opened with an aim to enhance the production of rubber bearings in Japan.

By Material Type

By Component Type

By Vehicle Type

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us