December 2025

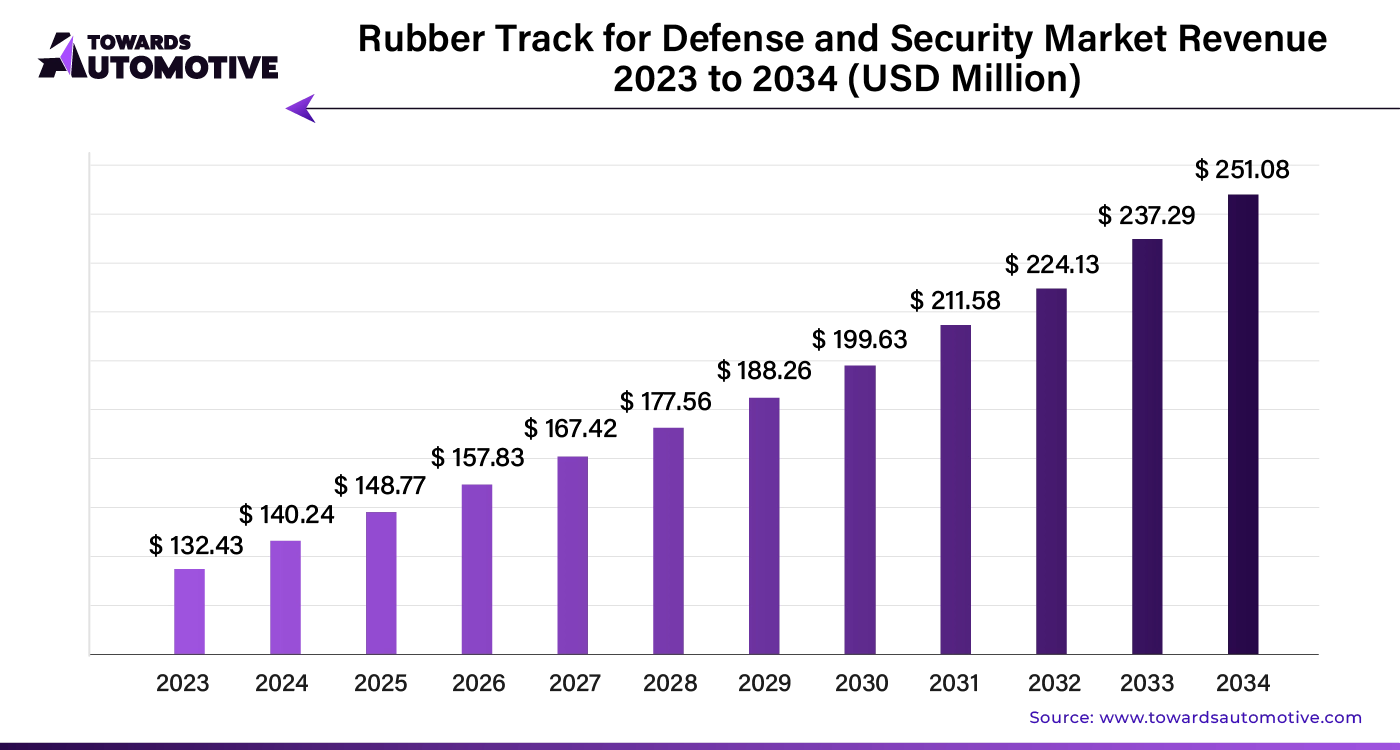

The global rubber track for defense and security market size is calculated at USD 140.24 million in 2024 and is expected to be worth USD 251.08 million by 2034, expanding at a CAGR of 5.90% from 2023 to 2034.

High-performance rubber tracks are increasingly being developed for military tanks and other defense vehicles. Their usage is expanding across various applications, including armored vehicles and unmanned ground vehicles (UGVs). Additionally, the popularity of tracks for robots and drones is on the rise. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

AI integration stands poised to revolutionize the market by significantly enhancing growth opportunities. AI-driven analytics offer businesses deeper insights into market trends and consumer behavior, enabling more precise and strategic decision-making. Machine learning algorithms optimize supply chain management by predicting demand fluctuations, reducing waste, and improving inventory accuracy. This efficiency leads to cost savings and better resource allocation.

Moreover, AI enhances customer engagement through personalized experiences. By analyzing user data, AI systems can tailor marketing efforts and product recommendations, fostering stronger customer relationships and boosting sales. Automation of routine tasks further streamlines operations, allowing human employees to focus on strategic initiatives and creative problem-solving.

Additionally, AI supports innovation by accelerating research and development processes. Predictive models and simulations help companies test new products and strategies more rapidly, staying ahead of competitors. As businesses leverage AI to refine their processes and adapt to changing market conditions, they gain a competitive edge, driving overall market growth and resilience.

In summary, AI integration equips businesses with the tools to optimize operations, engage customers more effectively, and innovate continuously, setting the stage for sustained market expansion and success.

In the rubber track supply chain for defense and security, efficiency and reliability are paramount. The process begins with the procurement of high-quality raw materials, such as synthetic rubber and steel cords, sourced from trusted suppliers. These materials are then transported to specialized manufacturing facilities where they are processed into durable rubber tracks.

Manufacturers play a crucial role in ensuring that each track meets stringent performance and safety standards. Once produced, the tracks are tested rigorously to verify their suitability for defense and security applications. Following quality assurance, the finished products are packaged and shipped to various distribution centers strategically located to serve global defense and security forces.

Logistics providers coordinate the transportation, ensuring timely and secure delivery to military and security installations. Inventory management systems track stock levels and predict future needs, preventing shortages and delays. Throughout the supply chain, continuous monitoring and communication between suppliers, manufacturers, and distributors enhance overall efficiency and responsiveness.

By maintaining a streamlined supply chain, stakeholders can meet the demanding requirements of defense and security sectors, ensuring that rubber tracks are available when and where they are needed.

The rubber track for defense and security market relies on several main components and contributors. At the core of the ecosystem are rubber track manufacturers, who design and produce durable tracks suitable for military and security vehicles. These manufacturers often collaborate with defense contractors to meet specific military requirements. Key companies like Bridgestone and Michelin lead in innovation, offering advanced materials that enhance performance and longevity.

Vehicle manufacturers, such as General Dynamics and BAE Systems, integrate these rubber tracks into their armored and tactical vehicles. They work closely with rubber track suppliers to ensure compatibility and performance standards are met. Additionally, research and development firms play a crucial role by exploring new materials and technologies to improve track resilience and functionality.

Supply chain logistics companies ensure timely distribution of these components, connecting manufacturers with end-users efficiently. Government defense departments and security agencies provide feedback and specifications, guiding the design and manufacturing process. Together, these players create a dynamic market ecosystem focused on enhancing the operational capabilities of defense and security vehicles.

North America is set to maintain its dominance in the global rubber track market for defense and security, with an estimated market share of approximately 30.5% by 2033. Key factors driving this leadership include:

Strong Defense Sector: The U.S. defense budget, which hit $715 billion in 2022, significantly supports demand for rubber tracks. This substantial spending bolsters a thriving market for manufacturers.

Technological Advancements: The region's emphasis on military modernization and innovation creates a high demand for advanced rubber tracks. North American manufacturers benefit from a robust R&D environment, enabling them to produce cutting-edge tracks to meet evolving military needs.

Geopolitical and Security Concerns: Persistent security issues and the need for military readiness in North America drive a steady demand for reliable defense equipment, including rubber tracks. This focus on security reinforces the region's strong position in the market through 2033.

Rubber tracks are becoming increasingly vital for armored personnel carriers (APCs), capturing a 40% share of the market in 2023. This leadership is due to the demand for adaptable and maneuverable military vehicles capable of operating in various terrains and the global push to modernize armed forces.

APCs with rubber tracks are well-suited for tactical operations, adapting to urban, desert, and off-road environments. Compared to traditional steel tracks, rubber tracks lower ground pressure, which reduces environmental impact and enhances mobility. This improvement allows APCs to navigate challenging terrains where wheeled vehicles may struggle, facilitating swift responses in unpredictable combat situations.

Reconnaissance vehicles are also anticipated to drive significant revenue growth for rubber track producers, with an estimated CAGR of 8.5%. Rubber tracks improve the stealth and agility of these vehicles by minimizing noise and vibration, making them ideal for effective reconnaissance across diverse landscapes.

Rubber tracks are rapidly becoming a key component in defense and security vehicles due to their numerous benefits. They offer improved mobility, reduced weight, better fuel efficiency, and increased survivability.

One major advantage is the weight reduction. By replacing traditional steel tracks with advanced composite rubber tracks (CRTs), vehicles like the 39-ton CV90 can save nearly 1.3 tons. This weight reduction leads to enhanced mobility and extended vehicle range.

Rubber tracks also deliver superior performance. They reduce vibration by up to 70%, which enhances crew comfort and minimizes wear on electronic components and ammunition. Additionally, they cut noise levels by up to 13dB, improving vehicle stealth and crew safety. Lower rolling resistance at higher speeds reduces engine and transmission wear.

The durability of rubber tracks improves vehicle survivability. They can withstand mine blasts and come with a repair kit for field repairs. Maintenance requirements are significantly lower, cutting costs by 25% compared to steel tracks and reducing maintenance time by 53 hours per 1,000 miles.

Top military forces, including those from the U.S., Russia, and China, have adopted rubber tracks for their armored vehicles. As global demand for advanced military and defense vehicles grows, rubber tracks are expected to see increased use. Continued advancements in design and materials ensure these tracks provide optimal traction and maneuverability across various terrains.

Rubber tracks are crucial for enhancing mobility, reducing ground pressure, and ensuring optimal performance on diverse terrains. The push for modernization in defense forces is driving the demand for advanced track technologies. As military strategists emphasize maneuverability and agility, rubber tracks are becoming essential for optimal performance in defense and security applications worldwide.

A notable trend is the increasing use of advanced composite materials in manufacturing vehicle tracks. These composites offer a combination of strength, lightness, and environmental resistance, which are ideal for military use. As a result, the popularity of these materials is expected to drive market growth.

Key Market Dynamics

High Initial and Maintenance Costs Drive Demand for Alternatives The substantial initial and maintenance costs of rubber tracks lead end-users to explore alternative solutions. While rubber track pads are designed to last up to 2,500 miles, they usually require replacement after 600 to 800 miles. Maintenance expenses and mandatory periodic servicing, as required by regulatory authorities, can constrain market growth. With a limited number of market players, consumer bargaining power is diminished, resulting in higher prices and discouraging potential buyers.

Shortage of Skilled Operators Impedes Market Growth A lack of qualified operators for rubber track systems can cause safety issues and reduce productivity. Approximately 10% of the vehicle fleet’s rubber pads need annual replacement, demanding skilled workers for proper installation and upkeep. The emphasis from authorities on adhering to safety standards highlights the need for well-trained operators, further impacting market expansion.

The rubber track market for defense and security is showing significant regional differences in growth and leadership. The United States is set to lead the market, with projected revenues of approximately US$ 60 million by 2033. Russia and Germany are also key players, with expected revenues of around US$ 20 million and US$ 10 million, respectively.

Among the fastest-growing regions, the Balkan & Baltics, the Kingdom of Saudi Arabia, and Japan are leading with impressive compound annual growth rates (CAGRs). The Balkan & Baltics are anticipated to grow at a strong CAGR of 12%, followed closely by the Kingdom of Saudi Arabia at 11%, and Japan at 10%. This growth is driven by increased defense investments and modernization efforts.

China, with its extensive tank fleet and varied topography, is also a significant market player. The Chinese rubber track market is expected to reach about US$ 9.5 million by 2033, with a steady CAGR of 5%. This growth is supported by China’s focus on operational efficiency and the need for versatile track systems to navigate its diverse terrains.

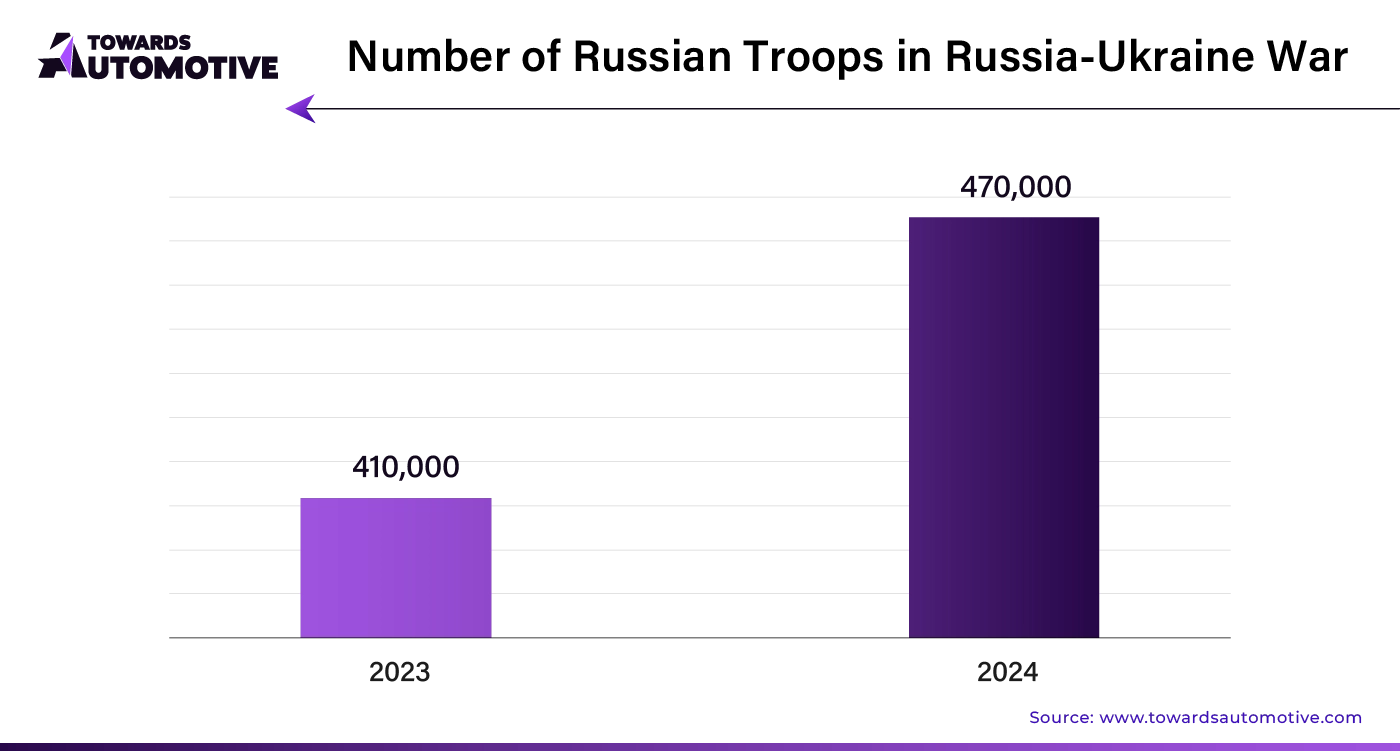

Russia is making a notable impact on the market with a projected valuation of around US$ 20 million by 2033 and a CAGR of 5%. The country’s large tank fleet and commitment to military modernization are driving the increased demand for rubber tracks, especially in challenging environments like the Arctic.

Rubber Band Tracks Lead Growth with Strong CAGR

Among the various product types in the global rubber track market for defense and security, rubber band tracks are emerging as the fastest-growing segment. Forecasted to expand at a 6.5% compound annual growth rate (CAGR) from 2023 to 2033, rubber band tracks are expected to reach a market value of approximately US$ 120 million by the end of the forecast period.

The surge in demand for rubber band tracks is driven by their impressive durability, convenience, and cost-effectiveness. These tracks leverage advanced composite rubber technology, ensuring longevity and resilience in harsh operational environments. Their superior traction on diverse terrains—such as mud, snow, and rocky surfaces—enhances vehicle stability and agility during military operations. Additionally, the reduced rolling resistance and lighter weight of rubber band tracks contribute to better fuel efficiency and extended operational range for military vehicles. The tracks' resilience to mine blasts further distinguishes them from traditional steel tracks, providing enhanced protection.

15 to 45 Tons Payload Segment Dominates the Market

In terms of vehicle payload, the 15 to 45 tons segment stands out as the dominant category. This segment is projected to grow at a 5.0% CAGR between 2023 and 2033, reaching a market value of around US$ 105 million by the end of the forecast period.

Vehicles within the 15 to 45 tons payload range are highly versatile, making them suitable for a wide range of defense applications, from tactical operations to logistical support. Their substantial payload capacity and balanced weight distribution allow them to traverse rough terrains effectively, without sacrificing mobility. This combination of capacity and maneuverability makes the 15 to 45 tons segment a crucial player in military logistics and operations.

The rubber track for defense and security market is highly consolidated, with 12 to 15 major global manufacturers. Leading players include Soucy Holding Inc., GMT Rubber Metal Technic Ltd., LS Mtron Ltd., TGL SP Industries Ltd., Cauchos Puntes S.L., William Cook Holding Limited, Northern Plains Track (Camso Group), Martin’s Rubber Company Ltd., Mackay Consolidated Rubber Technology, COECA Sa, and Ocean Rubber Factory LLC.

As the market grows, key players are heavily investing in research and development to create more efficient tracks and enhance their performance. They also promote their products by offering free rubber band tracks to OEMs for demonstration and reducing wear and tear.

Soucy Holding Inc.; GMT Rubber Metal Technic Ltd.; LS Mtron Ltd.; TGL SP Industries Ltd.; Cauchos Puntes S.L; William Cook Holding Limited; Northern Plains Track (Camso Group); Martin’s Rubber Company Ltd.; Mackay Consolidated Rubber Technology; COECA SA; Ocean Rubber Factory LLC

By Product Type

By Vehicle Type

By Vehicle Payload

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us