August 2025

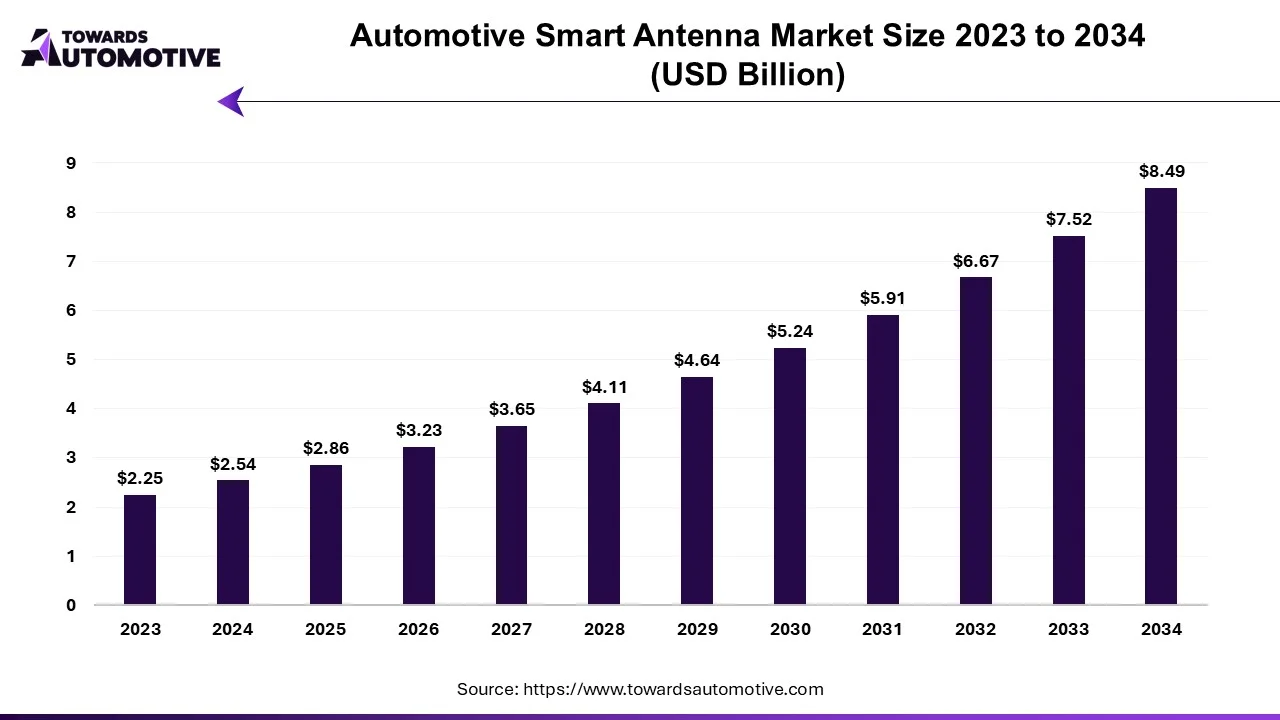

The automotive smart antenna market is forecast to grow from USD 2.86 billion in 2025 to USD 8.49 billion by 2034, driven by a CAGR of 12.83% from 2025 to 2034. The rising adoption of ADAS-enabled vehicles coupled with integration of 5G technology in modern vehicles to enhance V2V connectivity is playing a vital role in shaping the industrial landscape.

Additionally, the growing sales of luxury cars in developed nations as well as increasing popularity of shark fin antennas has contributed to the overall market expansion. The advancements in 6G technology along with surging adoption of driverless taxis by fleet operators is expected to create ample growth opportunities for the market players in the upcoming days.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive smart antenna market is a crucial branch of the automotive industry. This industry deals in manufacturing and distribution of automotive smart antennas in different parts of the world. There are several types of antennas developed in this sector comprising of shark fin antennas, fixed mast antennas and some others. It consists of numerous components including transceiver, ECU and some others. These antennas are designed for various types of vehicles such as SUVs, hatchbacks/sedan, light commercial vehicles, heavy commercial vehicles and some others. The rising use of smart antennas in luxury vehicles has contributed to the market expansion. This market is expected to rise significantly with the growth of the EV sector across the globe.

| Metric | Details |

| Market Size in 2024 | USD 2.54 Billion |

| Projected Market Size in 2034 | USD 8.49 Billion |

| CAGR (2025 - 2034) | 12.83% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Vehicle, By Propulsion, By Sales Channel, By Frequency and By Region |

| Top Key Players | Yokowo Co., Ltd.; Continental AG; DENSO Corporation; HARADA INDUSTRY CO., LTD.; HELLA GmbH & Co. KGaA |

The major trends in this market consists of technological advancements, rising sales of luxury cars and popularity of passive antennas.

The integration of AI and IoT in smart antennas has enhanced navigation experience in modern vehicles.

The sales of luxury cars in several countries such as Germany, UK, the U.S. and others has increased the demand for smart antennas.

The popularity of passive antennas has increased rapidly due to its simple design and cost-effectiveness.

The passenger vehicles segment held the highest share of the market. The rising sales of passenger vehicles in several countries such as India, China, the U.S. and some others has boosted the market expansion. Also, the increasing use of smart antennas in luxury vehicles along with rapid adoption of electric cars is contributing to the overall industrial growth. Moreover, partnerships among automotive brands and market players to integrated advanced antennas in vehicles is expected to drive the growth of the smart antenna market.

The commercial vehicles segment is expected to grow with the fastest CAGR during the forecast period. The growing production of commercial vehicles in numerous countries such as Japan, South Korea, Germany and some others has driven the industrial expansion. Also, rapid deployment of smart antennas in commercial vehicles coupled with integration of advanced telematics solutions in modern trucks is playing a vital role in shaping the industrial landscape. Moreover, collaborations among market players to develop advanced smart antennas for the automotive sector is expected to propel the growth of the smart antenna market.

The OEM segment led the market. The growing demand for genuine antennas from automotive consumers has boosted the market expansion. Additionally, the rising investment by OEMs to develop advanced smart antennas to cater the needs of the automotive sector is playing a vital role in shaping the industrial landscape. Moreover, the integration of smart antennas by automotive OEMs to enhance navigation experience is expected to boost the growth of the smart antenna market.

The aftermarket segment is expected to expand with a significant CAGR during the forecast period. The rising demand for affordable antennas from developing nations such as India, Vietnam, Thailand and some others has boosted the market expansion. Also, the availability of smart antennas in online platforms coupled with offers and incentives provided by e-commerce companies is contributing to the industrial growth. Moreover, collaborations among market players to manufacture low-range automotive antennas is expected to propel the growth of the smart antenna market.

Asia Pacific held the largest share of the automotive smart antenna market. The rising sales of passenger vehicles in several countries such as India, Japan, China, South Korea and some others has driven the market expansion. Additionally, the increasing popularity of ride-sharing companies coupled with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Mitsumi Electric Co., Ltd, Harada Industry Co., Ltd., INFAC Corporation and some others is expected to boost the growth of the smart antenna market in this region.

North America is expected to expand with a significant CAGR during the forecast period. The increasing demand for luxury vehicles in the U.S. and Canada has boosted the market growth. Also, numerous government initiatives aimed at enhancing vehicular safety coupled with rapid adoption of smart antennas by car owners to enhance the navigation experience in vehicles has contributed to the overall industrial expansion. Moreover, the presence of several market players such as TE connectivity, Laird Connectivity, Harman International Inc. and some others is expected to propel the growth of the smart antenna market in this region.

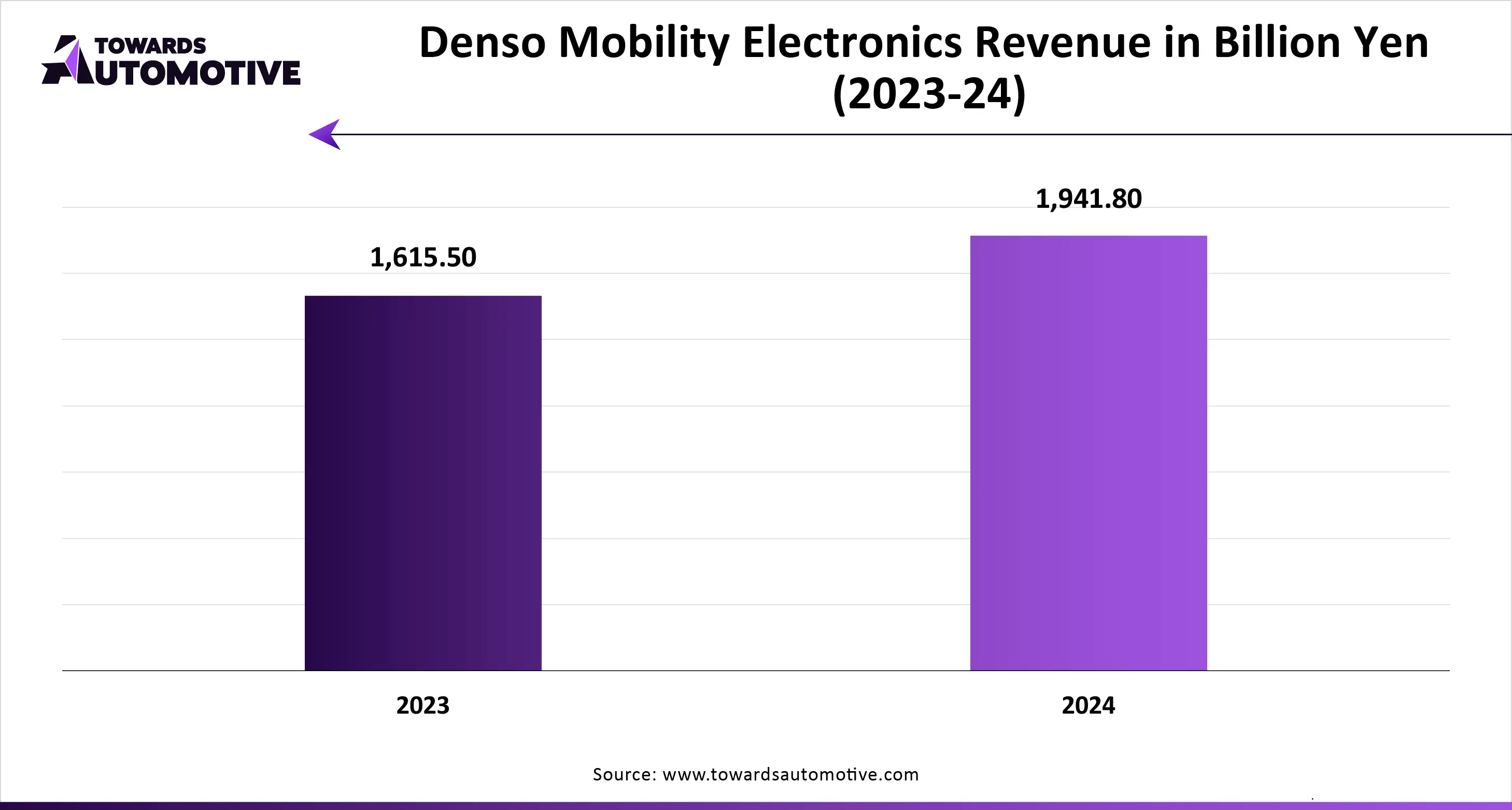

The automotive smart antenna market is a rapid developing industry with the presence of various dominating players. Some of the prominent companies in this industry consists of TE Connectivity Corporation; Yokowo Co., Ltd.; Continental AG; DENSO Corporation; HARADA INDUSTRY CO., LTD.; HELLA GmbH & Co. KGaA; Laird Technologies, Inc.; Schaffner Holding AG; NXP Semiconductors N.V.; FICOSA Group; Robert Bosch GmbH; Kathrein SE. and some others. These companies are constantly engaged in manufacturing automotive smart antennas and adopting numerous strategies such as joint ventures, acquisitions, partnerships, launches, business expansions, collaborations and some others to maintain their dominance in this industry.

By Vehicle

By Propulsion

By Sales Channel

By Frequency

By Region

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us