October 2025

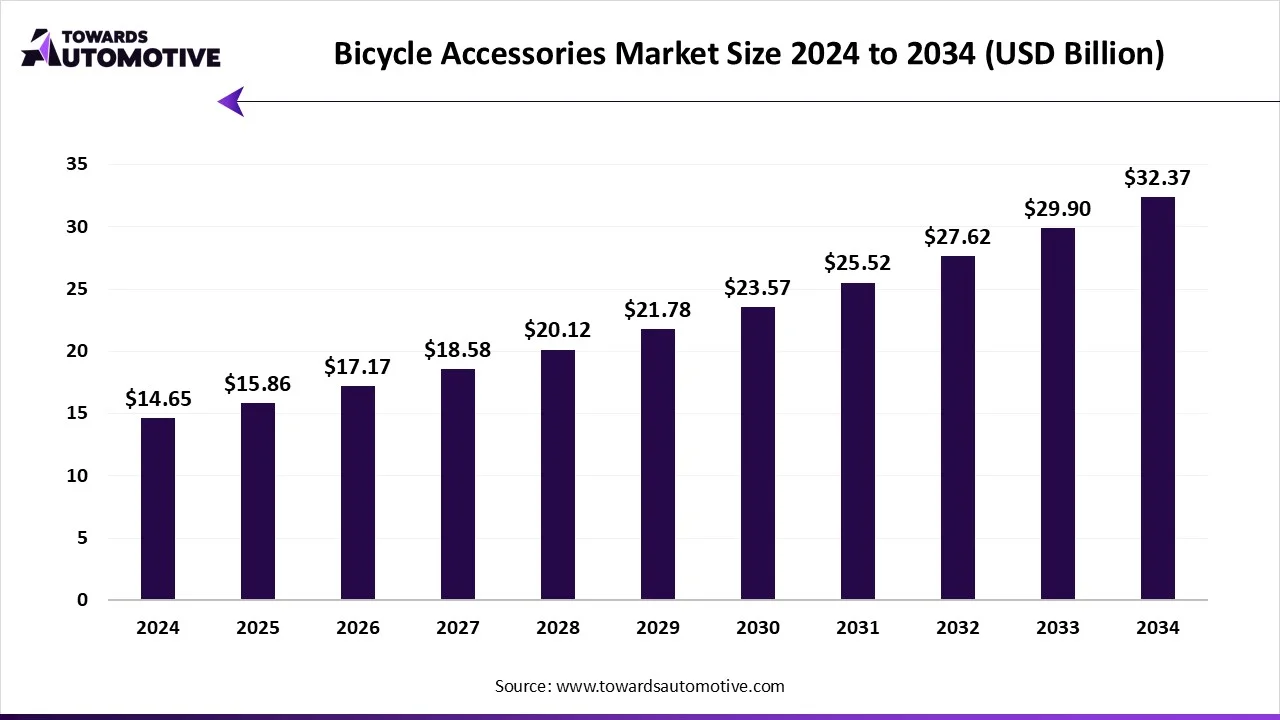

The bicycle accessories market is forecast to grow from USD 15.86 billion in 2025 to USD 32.37 billion by 2034, driven by a CAGR of 8.25% from 2025 to 2034. The increasing demand for designer bicycles in developed nations coupled with numerous government initiatives aimed at developing the cycling infrastructure has driven the market expansion.

Additionally, growing focus of bicycle manufacturers to integrate high-quality accessories in urban bicycles along with availability of accessories in online platforms is playing a vital role in shaping the industrial landscape. The rising use of sustainable materials for manufacturing bicycle accessories is expected to create ample growth opportunities for the market players in the upcoming years.

The bicycle accessories market is a crucial segment of the two-wheeler industry. This industry deals in the manufacturing and distribution of bicycle accessories in different parts of the world. There are several types of apparels manufactured in this sector comprising of cycling gloves, cycling clothes, cycling shoes, protective gears and some others. Also, numerous components are developed in this industry such as saddles, pedals, lighting system, mirrors, water bottle cages, lock, bar ends/ grips, kickstands, fenders & mud flaps, air pumps & tyre pressure gauge, and some others. These accessories are designed for different types of bicycles including mountain bikes, hybrid bikes, road bikes, cargo bikes and some others. It is available in a distribution channel consisting of specialty bike shops/ local dealers, OEM, e-commerce/ direct-to-consumers, sports & outdoor retail chains / big-box stores, aftermarket distributors / wholesale and some others. This market is expected to rise significantly with the growth of the e-commerce industry across the globe.

The major trends in this market consists of rising demand for compact headlights, business expansion, popularity of cycle racing events.

| Scheme | Initiatives |

| Walking and cycling | In February 2025, the government of England announced to invest around 291 million euros. This investment is done for developing the cycling infrastructure across this nation. |

| Urban Bikeway Design Guide | In January 2025, the National Association of City Transportation Officials (NACTO) launched Urban Bikeway Design Guide. This initiative is aimed at developing the cycle lanes across the U.S. |

| Cycling Cities campaign | In July 2025, the Institute for Transportation and Development Policy launched Cycling Cities campaign. Under this scheme, around 1,200 miles of bicycle lanes have been built in 34 global cities. |

| National Transportation Plan | In February 2025, the Department of Transportation (DOTr) launched the National Transportation Plan. This initiative is launched with an aim at developing the cycling infrastructure in Philippine. |

| Traffic-Calming Initiative | In June 2025, the government of New Jersey launched the Traffic-Calming Initiative. This initiative focuses at adding bicycle lanes with an aim to improve safety and promote sustainable transportation across this city. |

The components & parts segment led the bicycle accessories market with a share of around 65%. The growing use of adaptive pedals in urban bicycles has driven the market expansion. Also, the increasing popularity of saddles and grips among cyclists is playing a crucial role in shaping the industrial landscape. Moreover, rapid investment by market players for opening up new bicycle component production facility in different nations is expected to boost the growth of the bicycle accessories market.

The lighting & electronics segment is expected to grow with the highest CAGR during the forecast period. The growing focus of battery manufacturers to develop high-quality li-ion batteries for e-bikes has boosted the market expansion. Additionally, the rising demand for powerful bicycle lights from professional cyclists is contributing to the industry in a positive manner. Moreover, the popularity of portable GPS systems coupled with increasing use of cycling computers in off-roading vehicles is expected to drive the growth of the bicycle accessories market.

The road bicycles segment led the bicycle accessories market. The growing demand for light-weight road bicycles in developing nations for operating daily tasks has boosted the market expansion. Also, rising use of high-quality electronics systems in road bicycles coupled with rapid investment by cycle manufacturers for developing advanced road bicycles is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among cycles companies and accessories manufacturers for developing a wide range of accessories to cater the needs of road bicycles is expected to propel the growth of the bicycle accessories market.

The urban bicycles segment held a significant share of the bicycle accessories market. The growing demand for versatile bicycle designed to enhance commuting and city riding has driven the market expansion. Additionally, numerous features of these bicycles including upright riding position for comfort, integrated lights for enhance safety, easy handling for handling city conditions and some others is playing a prominent role in shaping the industrial landscape. Moreover, the increasing demand for these bicycles in developed nations as an alternative of passenger cars is expected to drive the growth of the bicycle accessories market.

The e-bikes segment is expected to grow with the fastest CAGR during the forecast period. The rising adoption of eco-friendly transportation solutions in different parts of the world has driven the market expansion. Additionally, rapid investment by battery manufacturers for developing high-quality li-ion batteries for e-bikes is playing a crucial role in shaping the industry in a positive manner. Moreover, the increasing focus of EV startups for developing a wide range of e-bikes is expected to foster the growth of the bicycle accessories market.

The OEM segment dominated the bicycle accessories market with a share of around 56%. The growing demand for high-quality bicycle accessories from professional cyclists has driven the market expansion. Additionally, rapid investment by bicycle OEMs to open new accessories outlets in different regions for gaining maximum consumer attention is playing a prominent role in shaping the industrial landscape. Moreover, the additional trust and guarantee provided by OEMs after purchasing any items is expected to drive the growth of the bicycle accessories market.

The e-commerce / direct-to-consumer platforms segment is expected to grow with the fastest CAGR during the forecast period. The growing proliferation of smartphones and rapid expansion of the 5G infrastructure has enabled people to purchase and sell products through online platforms, thereby driving the market expansion. Additionally, the availability of wide range of accessories in e-commerce sites coupled with surging number of e-commerce platforms is contributing to the industry in a positive manner. Moreover, numerous benefits of e-commerce platforms including low-cost, enhanced scalability, improved efficiency, cost savings and some others is expected to foster the growth of the bicycle accessories market.

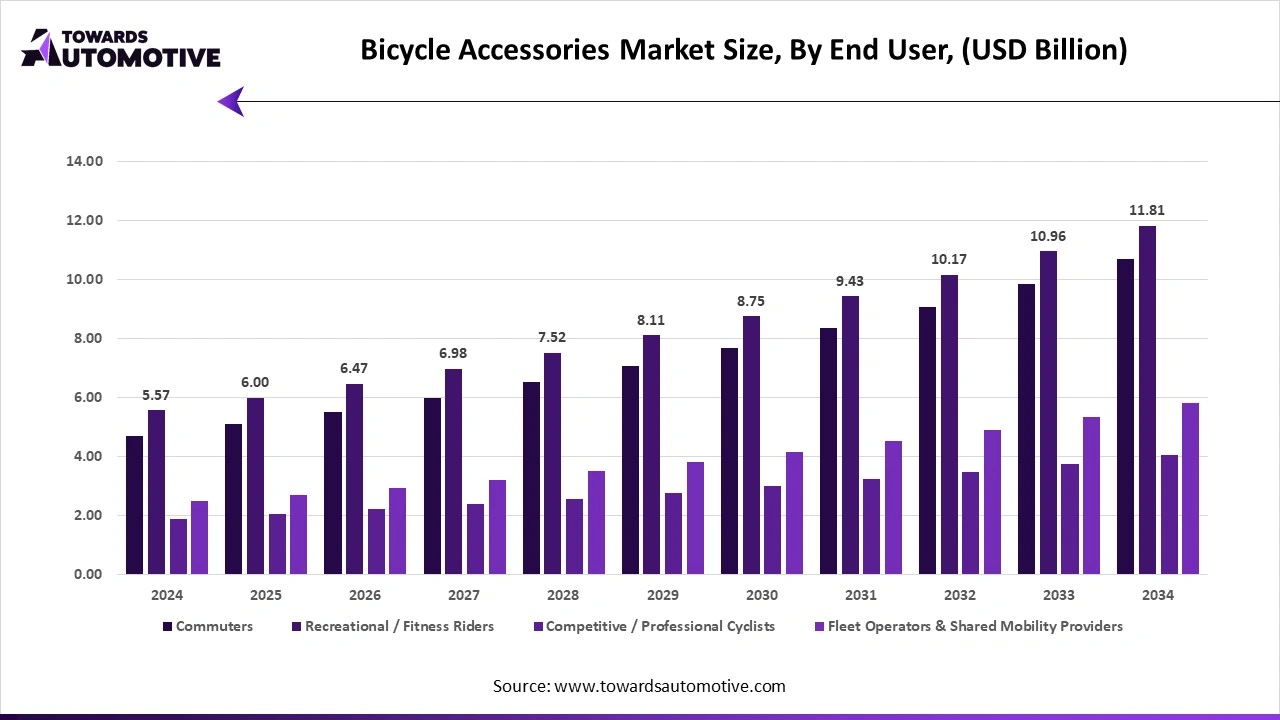

The commuters segment led the bicycle accessories industry with a share of around 61%. The growing demand for road bicycles from urban commuters in several countries such as the U.S., Germany, Canada, Denmark and some others has boosted the market expansion. Additionally, the rising consumer awareness about the health benefits of bicycles is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by cycle manufacturing brands to develop a wide range of bicycles for enhancing daily commutes is expected to foster the growth of the bicycle accessories market.

The fleet operators segment is expected to rise with the highest CAGR during the forecast period. The growing adoption of e-bikes by fleet operators to provide eco-friendly transportation in developed nations has boosted the market expansion. Additionally, the increasing preference of fleet operators to integrate high-quality GPS system in bicycles to track real-time location is contributing to the industry in a positive manner. Moreover, partnerships among fleet owners and market players for developing advanced electronics components for modern bicycles is expected to propel the growth of the bicycle accessories market.

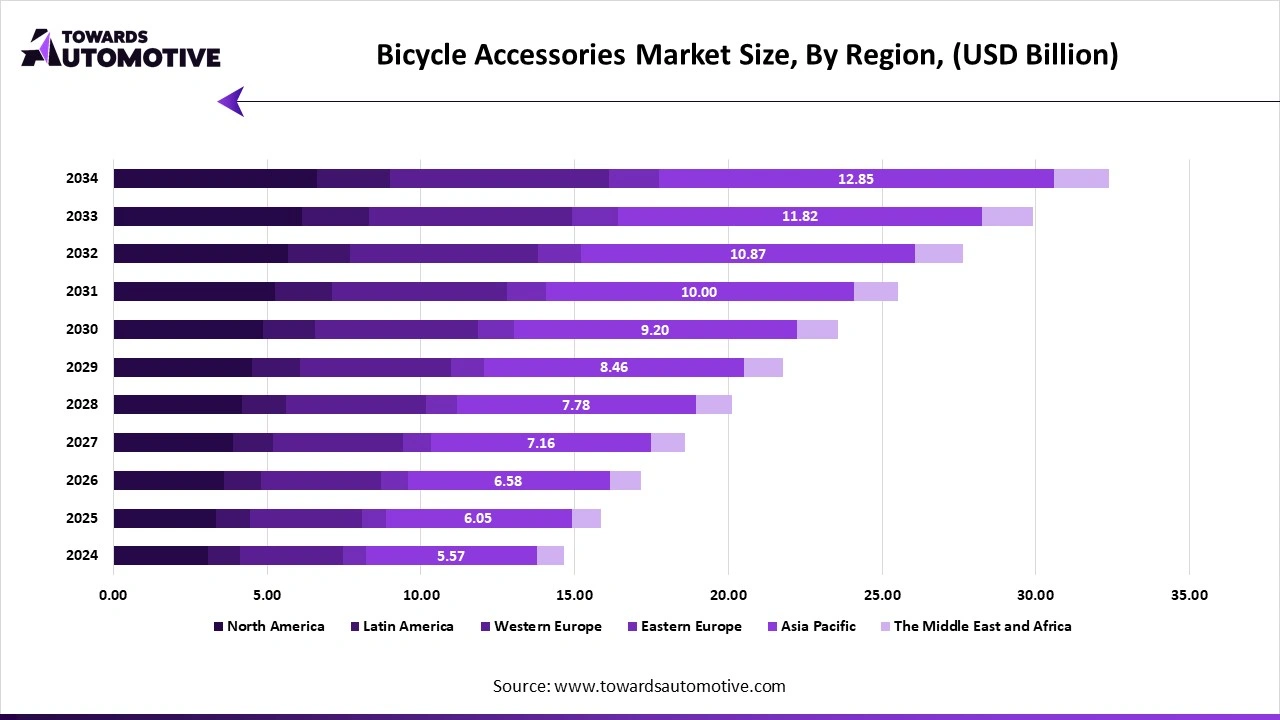

Asia Pacific dominated the bicycle accessories market with a share of around 38%. The growing demand for commuter bicycles in several countries such as China, India, Japan, South Korea, Singapore, Australia and some others has driven the market expansion. Additionally, the increasing consumer awareness regarding the health benefits of bicycles along with technological developments in advanced materials industry is playing a prominent role in shaping the industrial landscape. Moreover, the presence of various market players such as Avon Cycles Ltd., Merida Industry Co. Ltd., Giant Manufacturing Co. Ltd. and some others is expected to propel the growth of the bicycle accessories market in this nation.

China led the market in this region. The growing demand for commuter bicycles coupled with availability of essential raw materials is playing a vital role in shaping the industrial landscape. Additionally, rise in number of cycle startups along with technological advancements in the two-wheeler industry has boosted the market growth.

North America is expected to grow with the highest CAGR during the forecast period. The increasing adoption of urban bicycles in the U.S. and Canada has driven the market growth. Also, numerous government initiatives aimed at developing the cycle infrastructure along with rising sales of racing bicycles in several cities including California, Texas, Florida, Virginia and some others is contributing to the industry in a positive manner. Moreover, the presence of numerous market players including Garmin Ltd., Specialized Bicycle Components, Inc., Trek Bicycle Corporation and some others is expected to foster the growth of the bicycle accessories market in this nation.

U.S. dominated the market in this region. The growing popularity of mountain bikes among the youths along with increasing sales of bicycle jackets has boosted the market expansion. Also, rapid adoption of hybrid bicycles as well as technological developments in the cycle manufacturing sector is playing a vital role in shaping the industrial landscape.

Europe is expected to rise with a considerable CAGR during the forecast period. The rising sales of electric bicycles in several nations such as UK, Germany, France, Italy, Denmark, Spain and some others has boosted the industrial expansion. Also, rapid investment by government for developing the cycling mobility sector along with availability of various types of cycle accessories in e-commerce platforms is playing a prominent role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Endura Ltd, Accell Group N.V., DT Swiss and some others is expected to drive the growth of the bicycle accessories market in this nation.

Germany and Italy are the significant contributors in this region. In Germany, the market is generally driven by the increasing sales of bicycles lighting systems and cycling shoes. In Italy, the growing demand for cycling gloves and protective gears from cyclists is playing a crucial role in shaping the industry in a positive manner.

The foundation of bicycle accessories production lies in the extraction and supply of essential minerals such as metals, polymers and composites and natural materials.

Component fabrication in bicycle accessories involves developing individual parts for a bicycle including pedals, gears, brake levers, and handlebars. The fabrication method is operated using various technologies such as injection molding, metalworking, 3D printing, and CNC machining.

The battery cell manufacturing involves developing lithium-ion cells that are sorted and tested for quality assembling into larger modules and a complete battery pack.

Designing bicycle accessories is the process of developing and engineering a wide range of products for bicycles, focusing on aspects such as user-centered design, materials, aesthetics, functionality, safety, and superior performance to meet specific user needs and enhance the cycling experience in different parts of the world.

Completed accessories are delivered to bicycle manufacturing companies for integrating into their products.

| August 2025 | Announcement |

| Daniel Conka, the Division Manager Product Development at Sigma | With our new lights, we are not only focusing on technical innovation, but also on emotionally accessible communication, our superheroes are designed to motivate children to engage with the topic of safety – and at the same time show parents how important good bicycle lighting is. |

| June 2025 | Announcement |

| Mandy Davis, the CEO of Dharco | We didn’t want to make just another knee pad. It had to solve real problems and bring something new to the table. Riders skip protection because it’s uncomfortable. That was our starting point - make protection you actually want to wear. |

| April 2025 | Announcement |

| Jeff Schneider, the Global Head of Product for CADEX | The Amp 3D represents the next evolution in saddle technology, By integrating a high-resilience, 3D-printed gyroid structure with a precision-engineered carbon shell, we’ve created a saddle that dynamically adapts to the rider, minimizes weight, and maximizes power transfer without compromising comfort. |

| June 2024 | Announcement |

| Giovanni Fogal, Brand Manager at Fizik | We know that a good, accurate fit depends on many factors: bike geometry, intended use, saddle shape, and position. But most importantly every cyclist is unique: experience, sensitivity, history of injuries, body shape, riding goals. All of this can affect the way we sit on the saddle. It’s clear that a traditional one-to-many saddle design can only provide an approximate solution to very specific problems. With One-to-One today we achieve what every saddle manufacturer has always dreamed of: bringing to life customized support available to every cyclist. |

| March 2024 | Announcement |

| Jeffrey Tomasi, the senior product manager at CamelBak | We’ve all been there before, enjoying one of our favorite outdoor activities in the heat of the day, when nothing sounds better than a cold, refreshing sip of water, For cyclists, specifically, there was an opportunity to provide a better solution in the form of a bottle cage-specific design, so we took the silhouette of our time-tested Podium bottles and blended it with our best-in-class vacuum-insulation technology, to deliver a bottle that will retain icy cold water well beyond the duration of a long bike ride. In cycling, ‘forever bikes’ made of steel or titanium are commonplace, now, the same exists in the form of forever bottles. |

The bicycle accessories market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Specialized, Maxxis, Schwalbe, Continental, Cateye, Topeak, Lezyne, Wahoo Fitness (incl. Speedplay), Garmin, Kenda, Selle Italia, Selle Royal, Abus, Thule, Fox Racing, Sidi, Shimano and some others. These companies are constantly engaged in manufacturing bicycle accessories and adopting numerous strategies such as collaborations, business expansions, joint ventures, launches, acquisitions, partnerships, and some others to maintain their dominance in this industry.

| Companies | Model |

| 1. Maxxis | Maxxis is a subsidiary of Cheng Shin Rubber, founded in Taiwan in 1967. They manufacture and distribute high-quality tires for a wide range of vehicles including bicycles. This company is constantly developing high-quality tubes & valves, gloves and some others for the cyclist across the world. |

| 2. Schwalbe | Schwalbe is a private German company founded in 1973, with manufacturing facilities in Indonesia and Vietnam. This company focuses on manufacturing high-quality bicycle tires, tubes, and accessories for numerous types of bicycles including city, touring, road, gravel, and mountain bikes. |

| 3. Topeak | Topeak is a leading designer and manufacturer of high-quality cycling accessories, tools, and equipment. This company is engaged in manufacturing high-quality cycling accessories such as pumps, storage solutions, safety gears and some others for the cyclists of Taiwan. |

| 4. Lezyne | Lezyne is a private company founded in 2007 that is engaged in designing and manufacturing of high-performance, stylish bicycle accessories, including GPS units, lights, pumps, and multi-tools, focusing on innovative functionality and modern aesthetics |

| 5. Kenda | Kenda is a Taiwanese manufacturer of pneumatic tires for various types of bicycles. This company is involved in manufacturing high-quality tires for road bike, mountain bike, cyclocross bike, trekking bike and some others to deliver superior experience to cyclists. |

| 6. Shimano | Shimano is a Japanese multinational company, founded in 1921, that produces and distributes high-quality bicycle components. This company is offering a wide range of products including brakes, reels, gears, and rods under various brands such as DURA-ACE, XTR, and DEORE. |

| 7. Thule | Thule Group is a Swedish company specializing in sports and outdoor products, offering a wide range of carriers for bicycles. This company is engaged in developing several products including roof boxes, bike racks, child seats and some others for bicycle users. |

| 8. Polar Leasing, Inc. | Giant Manufacturing is a Taiwanese company founded in 1972. It is the world's largest bicycle designer and manufacturer, known for high-quality bicycles and components such as electric bikes and performance road and mountain bikes. |

| 9. Fox Racing | Fox Racing is a global brand founded in 1974 by Geoff Fox specializing in motocross and mountain biking gear and apparels. It is involved in manufacturing high-quality jackets and gloves to cater the needs of professional cyclists across the world. |

| 10. Trek | Trek Bicycle is a renowned company, headquartered in Waterloo, Wisconsin. This company is engaged in designing, manufacturing, and distributing bicycles and cycling products, including apparel and accessories in different parts of the globe. |

By Product Type

By Bicycle Type

By End User

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us