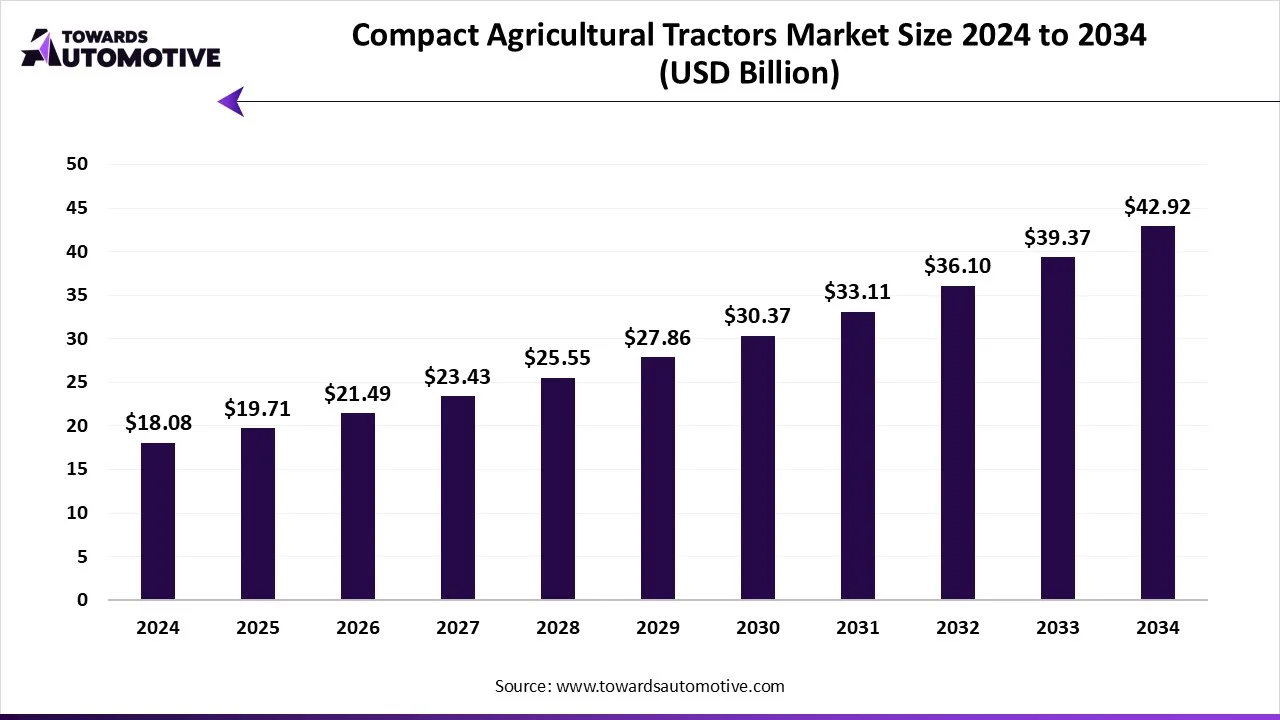

The compact agricultural tractors market is expected to increase from USD 19.71 billion in 2025 to USD 42.92 billion by 2034, growing at a CAGR of 9.03% throughout the forecast period from 2025 to 2034. The growing use of powerful tractors in the agricultural fields to increase crop production coupled with rapid adoption of hybrid tractors in vineyards has boosted the market expansion.

Additionally, numerous government initiatives aimed at strengthening the agricultural sector along with increasing consumer interest towards horticulture is playing a vital role in shaping the industrial landscape. The research and development activities related to solid-state batteries is expected to create ample growth opportunities for the market players in the future.

The compact agricultural tractors market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of agricultural tractors in different parts of the world. There are different types of tractors developed in this sector including diesel tractors, gasoline tractors and electric/hybrid tractors. These tractors comes with numerous engine power options comprising of less than 20 HP, 20-30 HP, 31-40 HP, 41-50 HP, 51-60 HP and some others. It finds application in several sectors consisting of agriculture, landscaping & ground maintenance, horticulture, orchard & vineyard farming, estate & residential, municipal & commercial and some others. This market is expected to rise significantly with the growth of the agricultural equipment industry around the globe.

The major trends in this market consists of partnerships, business expansion and government investment.

The 31–40 HP segment dominated the compact agricultural tractors market with a share of around 35%. The increasing use of low-power tractors in residential sector for gardening purposes has boosted the market expansion. Also, the growing application of 31–40 HP tractors in lawns and golf courses is expected to boost the growth of the compact agricultural tractors market.

The 41–50 HP segment is expected to grow with the fastest CAGR during the forecast period. The increasing application of moderate-power tractors for operating numerous applications in the horticulture sector has driven the market growth. Additionally, the rising use of these tractors in orchard & vineyard farming is expected to propel the growth of the compact agricultural tractors market.

The 4WD segment led the compact agricultural tractors market with a share of around 60% and is expected to grow with the highest CAGR during the forecast period. The growing application of powerful tractors in the agricultural sector has boosted the market expansion. Also, numerous advantages of 4WD tractor including handling rough and uneven terrains easily., ideal for wet and hilly conditions, better stability and safety, efficiency for heavy-duty tasks and some others is expected to foster the growth of the compact agricultural tractors market.

The diesel segment led the compact agricultural tractors market with a share of around 85%. The increasing demand for diesel-powered tractors from farmers to enhance crop production has boosted the market expansion. Also, numerous advantages of diesel-powered tractors including high torque and power output, superior fuel efficiency, enhanced durability, low RPM operation and some others is expected to drive the growth of the compact agricultural tractors market.

The electric/hybrid segment is expected to grow with the fastest CAGR during the forecast period. The growing adoption of hybrid tractors in several countries such as India, China, Brazil and some others has boosted the market growth. Additionally, rapid investment by battery manufacturing companies for developing high-quality batteries to cater the needs of electric tractors is expected to foster the growth of the compact agricultural tractors market.

The agriculture segment led the compact agricultural tractors market with a share of around 50%. The increasing adoption of diesel tractors by farmers to enhance agricultural output has boosted the market expansion. Also, numerous government initiatives aimed at developing the agricultural sector is expected to propel the growth of the compact agricultural tractors market.

The orchard & vineyard farming segment is expected to rise with the fastest CAGR during the forecast period. The growing use of hybrid tractors to operate orchard & vineyard farming has driven the market growth. Additionally, the increasing demand for grapevines from the winemaking industry is expected to drive the growth of the compact agricultural tractors market.

The manual transmission segment dominated the compact agricultural tractors market with a share of around 40%. The increasing demand for manually transmission tractors from the agricultural sector has boosted the market expansion. Additionally, numerous advantages of these tractors including enhanced control, cost-effectiveness, reliability, fuel efficiency, increased PTO power and some others is expected to propel the growth of the compact agricultural tractors market.

The hydrostatic transmission segment is expected to rise with the highest CAGR during the forecast period. The growing use of hydrostatic transmission tractors in the horticulture sector has driven the market growth. Also, numerous benefits of these tractors such as ease of use, smooth speed control, increased maneuverability and some others is expected to boost the growth of the compact agricultural tractors market.

The loaders segment led the compact agricultural tractors market with a share of around 30%. The growing use of loaders in tractors to lift, move, and load materials such as soil, gravel, and debris has driven the market expansion. Additionally, numerous advantages of loaders including versatility and material handling, increased efficiency, cost-effectiveness, enhanced safety, improved productivity and some others is expected to drive the growth of the compact agricultural tractors market.

The sprayers segment is expected to rise with the highest CAGR during the forecast period. The increasing application of tractor sprayers to apply liquids such as pesticides, herbicides, and fertilizers in crops has boosted the market growth. Also, the growing adoption of mounted sprayers and self-propelled sprayers in agricultural fields is expected to boost the growth of the compact agricultural tractors market.

The OEM segment led the compact agricultural tractors market with a share of around 70%. The growing investment by OEMs to open new tractor outlets has driven the market growth. Additionally, the increasing emphasis of farmers to adopt genuine tractors from OEMs due to enhanced versatility and transparency is expected to boost the growth of the compact agricultural tractors market.

The aftermarket / dealer sales segment is expected to rise with the fastest CAGR during the forecast period. The availability of electric tractors in several online platforms such as Amazon, Alibaba, Walmart and some others has boosted the market expansion. Additionally, numerous benefits of aftermarket sector including cost-effectiveness, wider product choices, opportunities for customization and some others is expected to propel the growth of the compact agricultural tractors market.

Asia Pacific dominated the compact agricultural tractors market. The growing demand for diesel powered tractors in several countries such as India, China, Japan, South Korea, Australia and some others has driven the market expansion. Additionally, numerous government initiatives aimed at developing the agricultural sector coupled with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Mahindra & Mahindra Ltd., Iseki & Co., Ltd., Yanmar Co., Ltd. and some others is expected to boost the growth of the compact agricultural tractors market in this region.

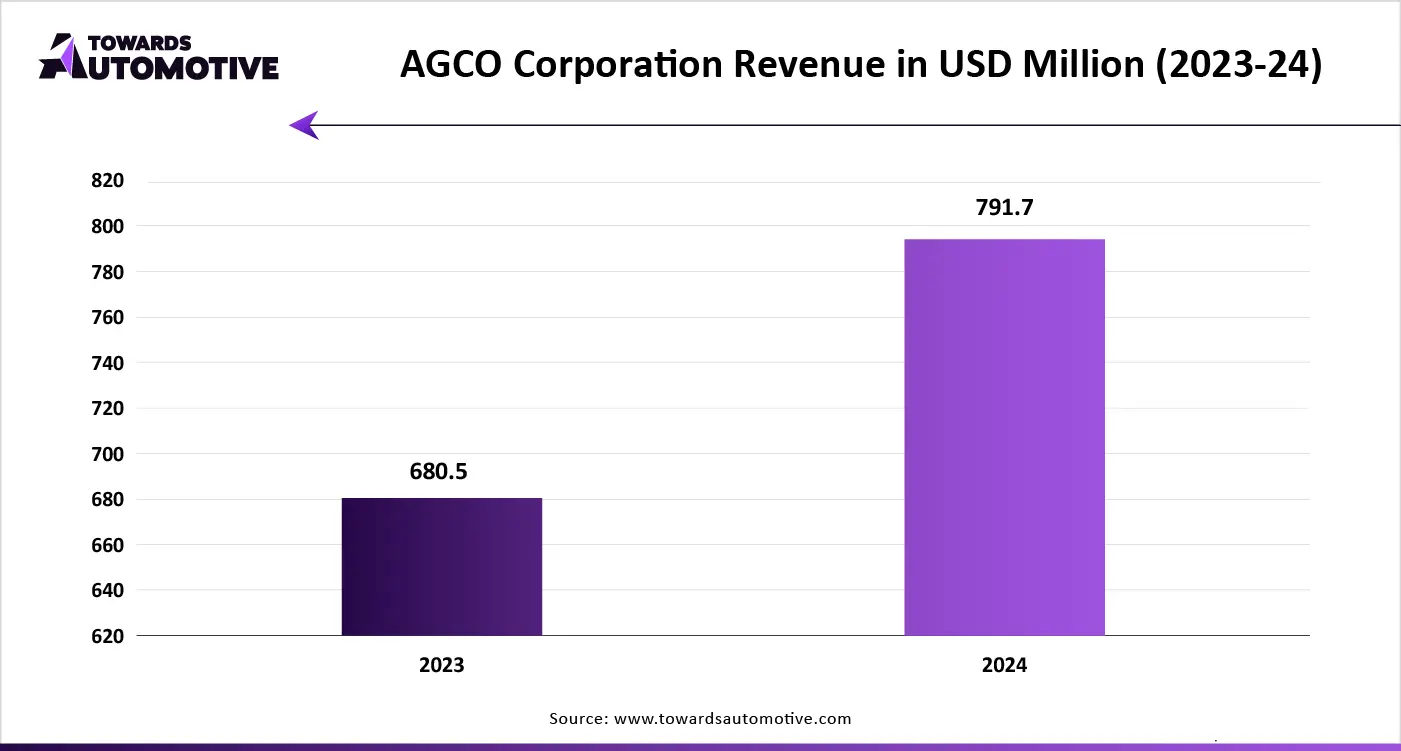

North America is expected to grow with the highest CAGR during the forecast period. The growing adoption of hybrid and electric tractors in the U.S. and Canada has driven the market growth. Also, rapid investment by government for deploying advanced equipment in the agricultural sector coupled with increasing demand for numerous cash crops such as coffee, tea, sugarcane, cotton and some others is contributing to the industry in a positive manner. Moreover, the presence of various market players such as John Deere, Branson Tractors, AGCO Corporation and some others is expected to drive the growth of the compact agricultural tractors market in this region.

The production of tractors mainly depends on several raw materials including steel, cast iron, rubber, aluminum and plastics.

Component fabrication in agricultural tractors refers to the process of manufacturing individual parts, or components, that make up the overall tractor.

Agricultural tractor testing and certification ensures that tractors meet specific safety, performance, and environmental standards.

Agricultural tractors are primarily distributed through authorized dealerships.

The compact agricultural tractors market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Mahindra & Mahindra Ltd., AGCO Corporation (Massey Ferguson, Fendt), Yanmar Co., Ltd., TAFE – Tractors and Farm Equipment Ltd., Iseki & Co., Ltd., Claas KGaA mbH, LS Mtron Ltd., John Deere, Kubota Corporation, CNH Industrial (New Holland, Case IH), Kioti Tractor (Daedong Industrial Co., Ltd.), Argo Tractors S.p.A. (Landini, McCormick), Escorts Kubota Limited, SDF Group (Same Deutz-Fahr), Branson Tractors (Kukje Machinery), Zetor Tractors a.s., Solis (International Tractors Limited), Lovol Heavy Industry Co., Ltd., VST Tillers Tractors Ltd., Farmtrac Tractors (Escorts Group) and some others. These companies are constantly engaged in developing agricultural tractors and adopting numerous strategies such as acquisitions, collaborations, launches, joint ventures, partnerships, business expansions and some others to maintain their dominance in this industry.

By Engine Power

By Drive Type

By Fuel Type

By Application

By Transmission Type

By Implement/Attachment Type

By Sales Channel

By Region

According to market projections, the micro automotive relays sector is expected to grow from USD 2.93 billion in 2024 to USD 5.67 billion by 2034, ref...

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us