October 2025

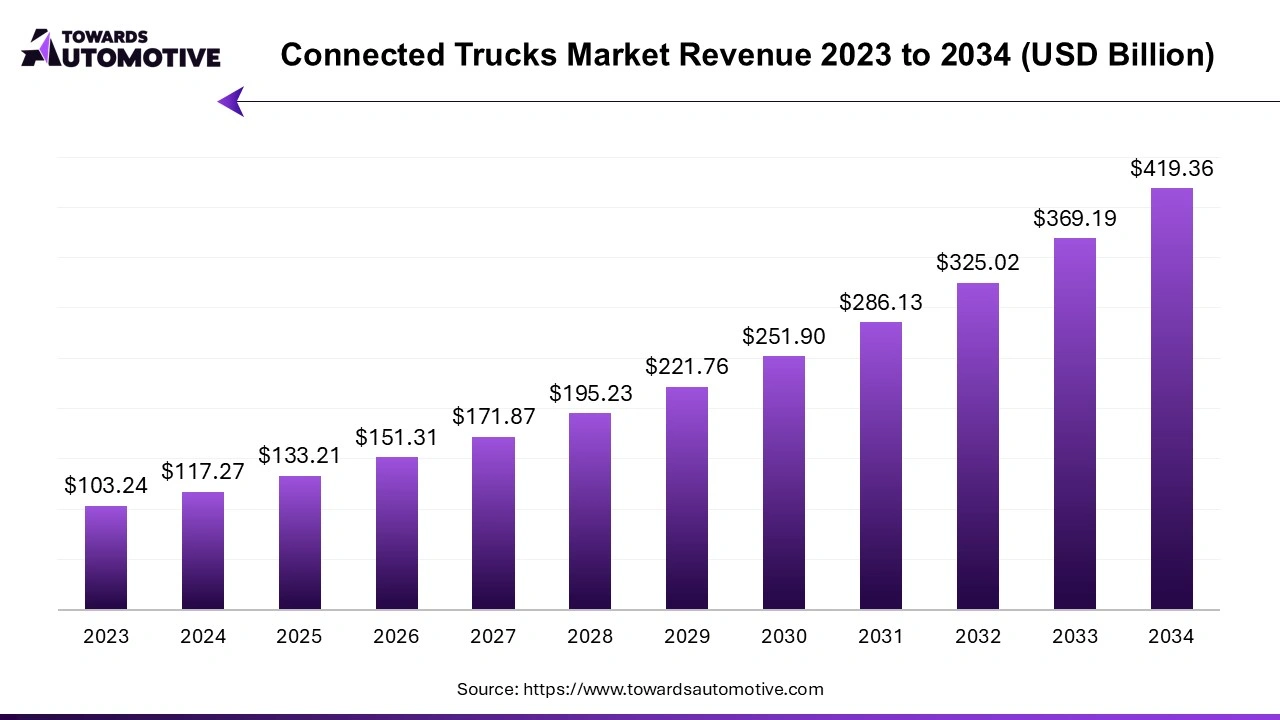

The connected trucks market is forecasted to expand from USD 133.21 billion in 2025 to USD 419.36 billion by 2034, growing at a CAGR of 13.59% from 2025 to 2034. The growing sales of electric trucks in developed nations such as the U.S. and Germany coupled with numerous government initiatives aimed at enhancing connected vehicles technology has boosted the market expansion.

Additionally, the rising demand for advanced fleet management from the logistics sector along with technological advancements in the trucking industry is playing a vital role in shaping the industrial landscape. The increasing adoption of AI-powered diagnostics solutions by fleet operators is expected to create ample growth opportunities for the market players in the upcoming days.

The connected trucks market is a crucial sector of the automotive industry. This industry deals in development and distribution of connected truck platforms in different parts of the world. There are several types of trucks used in this sector including class 3 trucks, class 4 trucks, class 5 trucks, class 6 trucks, class 7 trucks, class 8 trucks and some others. These trucks are operated using numerous types of technologies including vehicle-to-vehicle technology, vehicle-to-infrastructure technology, vehicle-to-cloud technology and some others. It finds application in several end-user industries such as logistics & transportation, construction, utilities and some others. This market is expected to rise significantly with the growth of the telecom sector around the globe.

The major trends in this market consists of partnerships, government initiatives and rapid expansion of the 5G infrastructure.

The diesel segment dominated the market. The growing demand for heavy-duty trucks from several sectors including mining, logistics, construction and some others has driven the market expansion. Additionally, rapid investment by automotive brands for developing high-quality diesel engines for class 7 trucks is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of diesel-powered trucks such as superior fuel efficiency, higher torque and towing capacity, and increased longevity and some others is expected to propel the growth of the connected trucks market.

The electric segment is expected to expand with a considerable CAGR during the forecast period. The rising adoption of electric trucks from several sectors including e-commerce, utilities and some others has boosted the market growth. Additionally, numerous government initiatives aimed at enhancing the EV charging infrastructure coupled with technological advancements in the EV sector is contributing to the industry in a positive direction. Moreover, rapid investment by automotive brands for developing powerful electric trucks is expected to boost the growth of the connected trucks market.

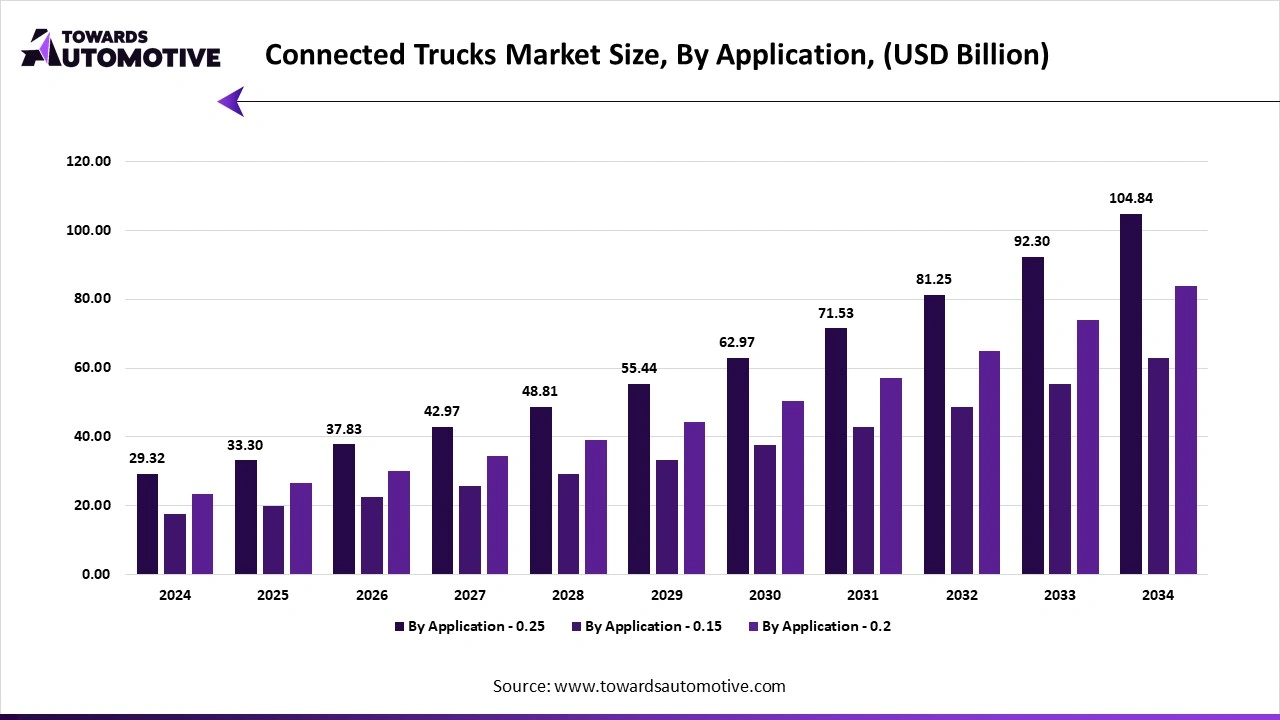

The long-haul trucking segment held the largest share of the market. The growing demand for heavy-duty trucks for operating long-haul applications has boosted the market expansion. Additionally, the deployment of electric tricks by fleet operators with an aim to reduce vehicular emission for transporting goods over long distances is contributing to the industry positively. Moreover, partnerships among automotive brands and technology providers to deploy advanced connectivity in modern trucks is expected to boost the growth of the connected trucks market.

The regional trucking segment is expected to rise with a notable CAGR during the forecast period. The growing use of class 7 and class 8 trucks for enhancing regional trucking has boosted the market growth. Additionally, collaborations among fleet operators and truck manufacturers to develop advanced fleet management platforms is expected to foster the growth of the connected trucks market.

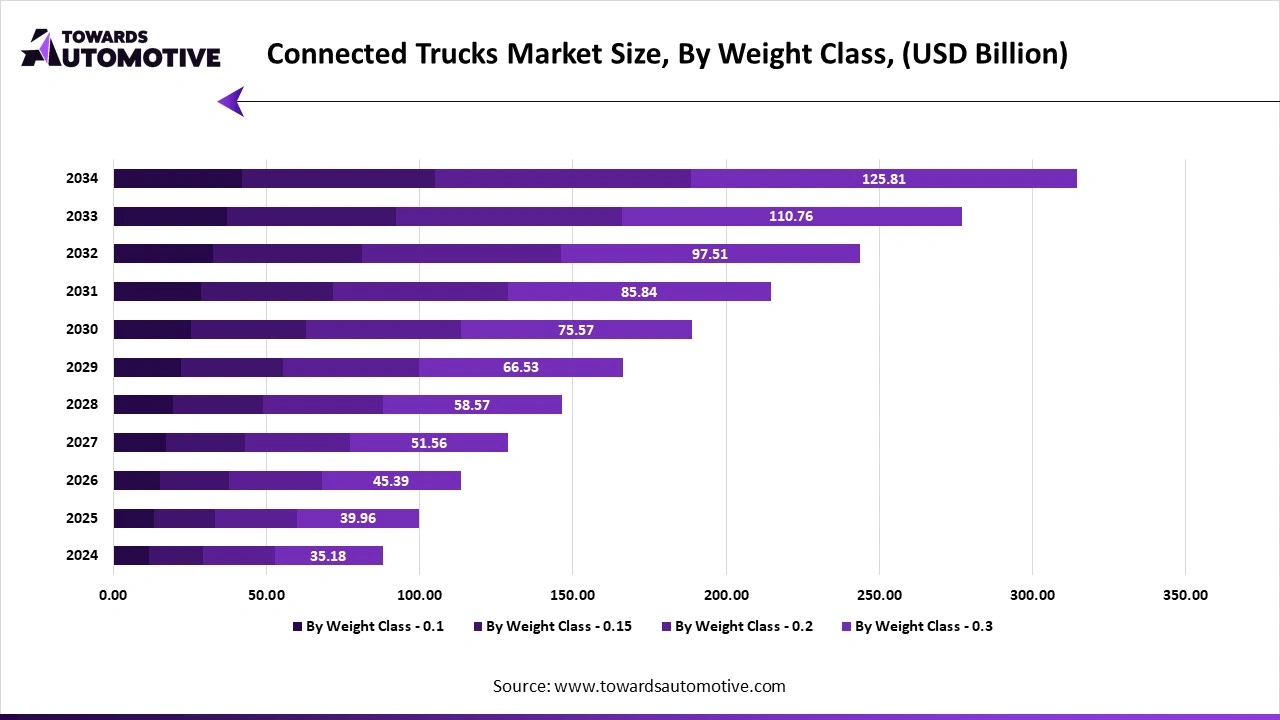

The class 8 segment led the market. The growing demand for class 8 trucks from several sectors including long haul freight, construction, heavy equipment movement and some others has driven the market expansion. Additionally, increasing emphasis of automotive brands to develop a wide range of class 8 trucks is expected to propel the growth of the connected trucks market.

The class 6 segment is expected to grow with a significant CAGR during the forecast period. The rising application of class 6 trucks from numerous sectors such as delivery services, construction, emergency response and some others has boosted the market expansion. Moreover, rapid investment by truck manufacturers for developing technologically advanced class 6 trucks for operating long-haul applications is expected to boost the growth of connected trucks market.

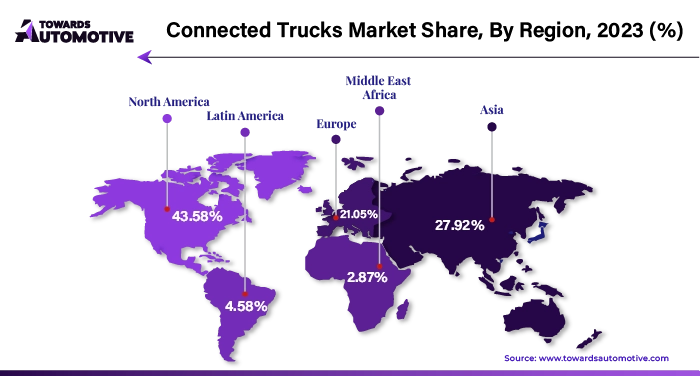

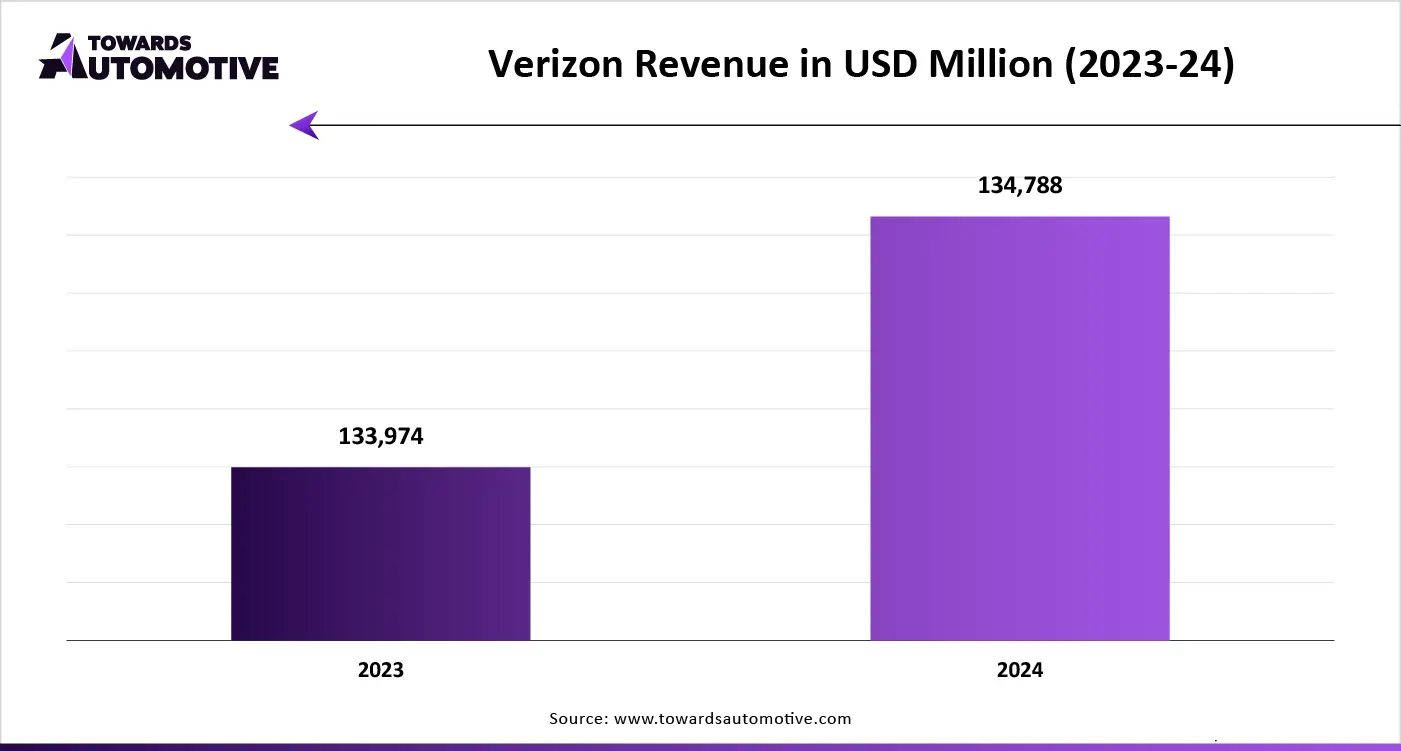

North America dominated the connected trucks market. The growing demand for heavy-duty trucks from several sectors including e-commerce, logistics, mining and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at strengthening the connected vehicles infrastructure coupled with technological advancements in the automotive sector is playing a prominent role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Harman International, Verizon Communications, Mack Trucks, Geotab and some others is expected to propel the growth of the connected trucks market in this region.

Asia Pacific is expected to expand with a significant CAGR during the forecast period. The rising adoption of autonomous trucks in numerous countries such as India, China, Japan, South Korea and some others has driven the market expansion. Also, rapid urbanization in developed nations coupled with launch of various government initiatives for strengthening the logistics sector is playing a crucial role in shaping the industry in a positive direction. Moreover, the presence of various market players such as Denso Corporation, BYD, Huawei Technologies and some others is expected to drive the growth of the connected trucks market in this region.

The connected trucks market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Vodafone, CATL, Deutsche Telekom, Samsara, Geotab, TMobile, Teletrac Navman, Omnitracs, Telefonica, Huawei, Verizon Connect, Trimble, Orange, Qualcomm, AT&T and some others. These companies are constantly engaged in developing connected truck technology and adopting numerous strategies such as acquisitions, joint ventures, business expansions, launches, collaborations, partnerships, and some others to maintain their dominance in this industry.

By Propulsion Type

By Application

By Connectivity Level

By Weight Class

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us