August 2025

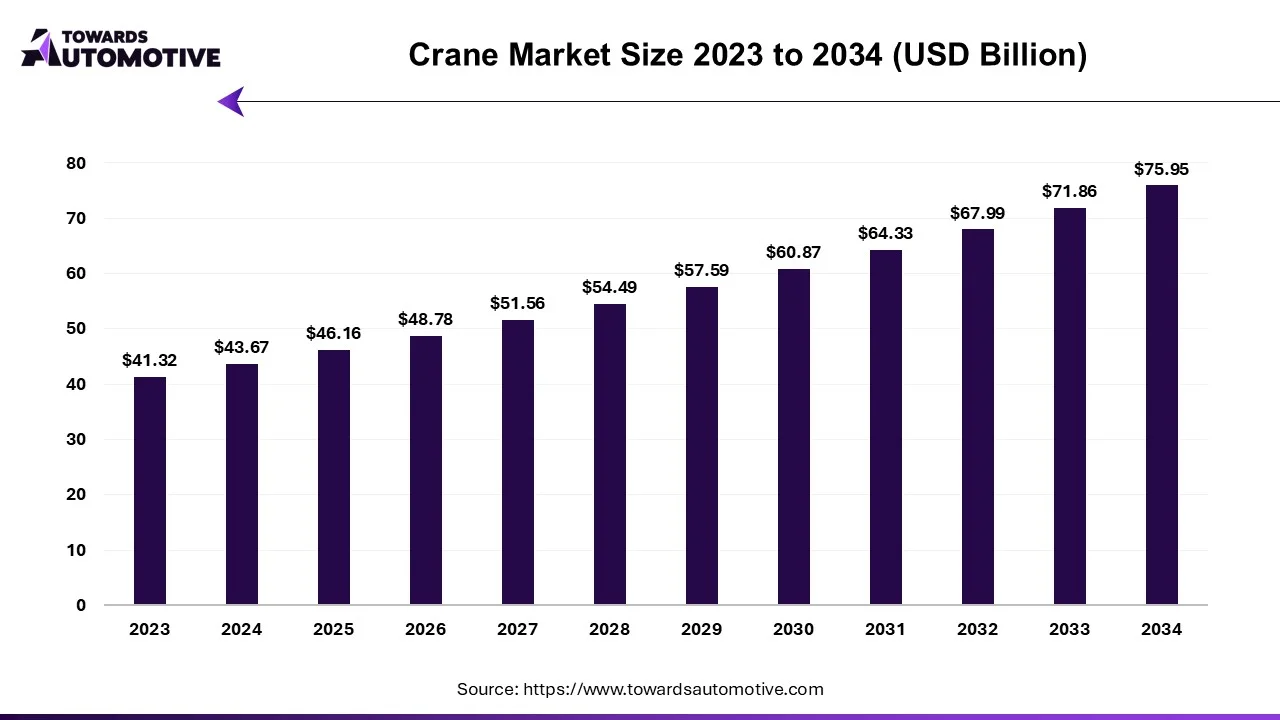

The crane market is expected to increase from USD 46.16 billion in 2025 to USD 75.95 billion by 2034, growing at a CAGR of 5.69% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The crane market is a crucial branch of the heavy equipment industry. This industry deals in manufacturing and distribution of cranes in different parts of the world. There are various types of cranes developed in this industry consisting of crawler crane, rough terrain crane, monorail crane, stiff leg crane, tower crane and some others. These cranes are capable of carrying loads ranging between 20 tons and 200 tons. Most of the cranes are powered by traditional diesel engines while some cranes are equipped with electric motors. It finds application in numerous end-use sectors including construction, mining, industrial, oil & gas and some others. The growing adoption of cranes in mining sector has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the automotive industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 43.67 Billion |

| Projected Market Size in 2034 | USD 75.95 Billion |

| CAGR (2025 - 2034) | 5.69% |

| Leading Region | North America |

| Market Segmentation | By Product, By Application and By Region |

| Top Key Players | Demag Cranes & Components GmbH; GORBEL INC.; Hitachi Construction Machinery Europe NV; BUCKNER HEAVYLIFT CRANES, LLC; |

The major trends in this industry consists of collaborations, rapid adoption of hydrogen-powered cranes, ongoing demand for electric cranes and increased use of cranes for undersea operations.

Collaborations

Several crane manufacturers have started collaborating with each other for developing mobile crane simulators. For instance, in May 2025, Liebherr collaborated with Tenstar Simulation. This collaboration is done for developing an advanced mobile crane simulator.(Source: Liebherr)

Rapid Adoption of Hydrogen-Powered Cranes

Numerous ports are adopting hydrogen cranes to enhance their material handling capabilities. For instance, in May 2024, Yusen Terminals announced to deploy hydrogen-powered rubber-tired gantry (RTG) crane in the Port of Los Angeles. (Source: Yusen Terminals)

Ongoing Demand for Electric Cranes

The demand for electric cranes is increasing rapidly due to numerous strict regulations put forwarded by government in several countries such as China, U.S., Germany and some others. For instance, in February 2025, Marchetti launched Trio 0e. Trio 0e is an electric crane powered by Lithium battery to deliver superior performance. (Source: Cranes Today)

Increased Use of Cranes for Undersea Operations

The application of cranes for undersea operations has gained traction due to their mobility and flexibility. For instance, in October 2023, Huisman launched a new range of knuckle boom cranes. These cranes are designed for enhancing various subsea operations. (Source: Offshore Energy.biz)

The mobile cranes segment held the largest share of the market. The growing demand for rough terrain cranes in mining sector has boosted the market expansion. Additionally, the increasing application of crawler cranes in construction sites for several activities such as heavy lifting and erection is playing a vital role in shaping the industrial landscape. Moreover, the rising sales of loader cranes for weighing loads of above 200 tons is expected to propel the growth of the crane market.

The fixed cranes segment is anticipated to rise with a notable CAGR during the forecast period. The growing adoption of monorail cranes in manufacturing industries has boosted the market growth. Additionally, the rising application of gantry cranes in shipbuilding sector along with increased use of stiffleg cranes in construction sector is contributing to the overall industrial expansion. Moreover, surge in demand for tower cranes due to their adaptability and versatility is anticipated to foster the growth of the crane market.

The construction segment dominated this industry. The rise in number of residential constructions in developing nations such as India, Hong Kong, Thailand and some others has driven the market growth. Additionally, the growing use of aerial cranes and overhead cranes in construction sites for enhancing the lifting capabilities is playing a crucial role in shaping the industry in a positive direction. Moreover, numerous partnerships among local players and industry giants for developing advanced cranes for the construction sector is likely to propel the growth of the crane market.

The industrial segment is predicted to rise with a significant CAGR during the forecast period. The growing adoption of electric cranes in heavy industries to lower emission has boosted the market expansion. Also, the rising use of jib cranes in warehouses and assembly centers along with numerous applications of overhead cranes in oil and gas industry is contributing to the overall industrial growth. Moreover, the increasing demand for bridge cranes and workstation cranes to operate critical applications is anticipated to foster the growth of the crane market.

North America held the highest share of the crane market. The rising adoption of advanced equipment in manufacturing sector for enhancing the operational capabilities has boosted the market growth. Additionally, numerous government initiatives aimed at lowering industrial emission coupled with rapid investment in oil and gas industry by public companies for deploying advanced equipment is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of several market players such as CERTEX USA, Caterpillar Inc., Manitowoc, Terex Corporation and some others is expected to boost the growth of the crane market in this region.

U.S. dominated the market in this region. The rising adoption of electric cranes in heavy industries along with rise in number of office construction has driven the market growth. Additionally, the rapid adoption of overhead cranes and gantry cranes in the automotive sector coupled with presence of several coal mines is contributing to the overall industrial growth.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The growing investment in the mining sector by public companies has driven the market expansion. Additionally, the rise in number of infrastructural projects in several countries such as India, China, Japan and some others has increased the demand for hammerhead cranes, thereby contributing to the overall industrial growth. Moreover, the presence of various crane manufacturers such as SANY Group, XCMG, Komatsu Limited and some others is projected to drive the growth of the crane market in this region.

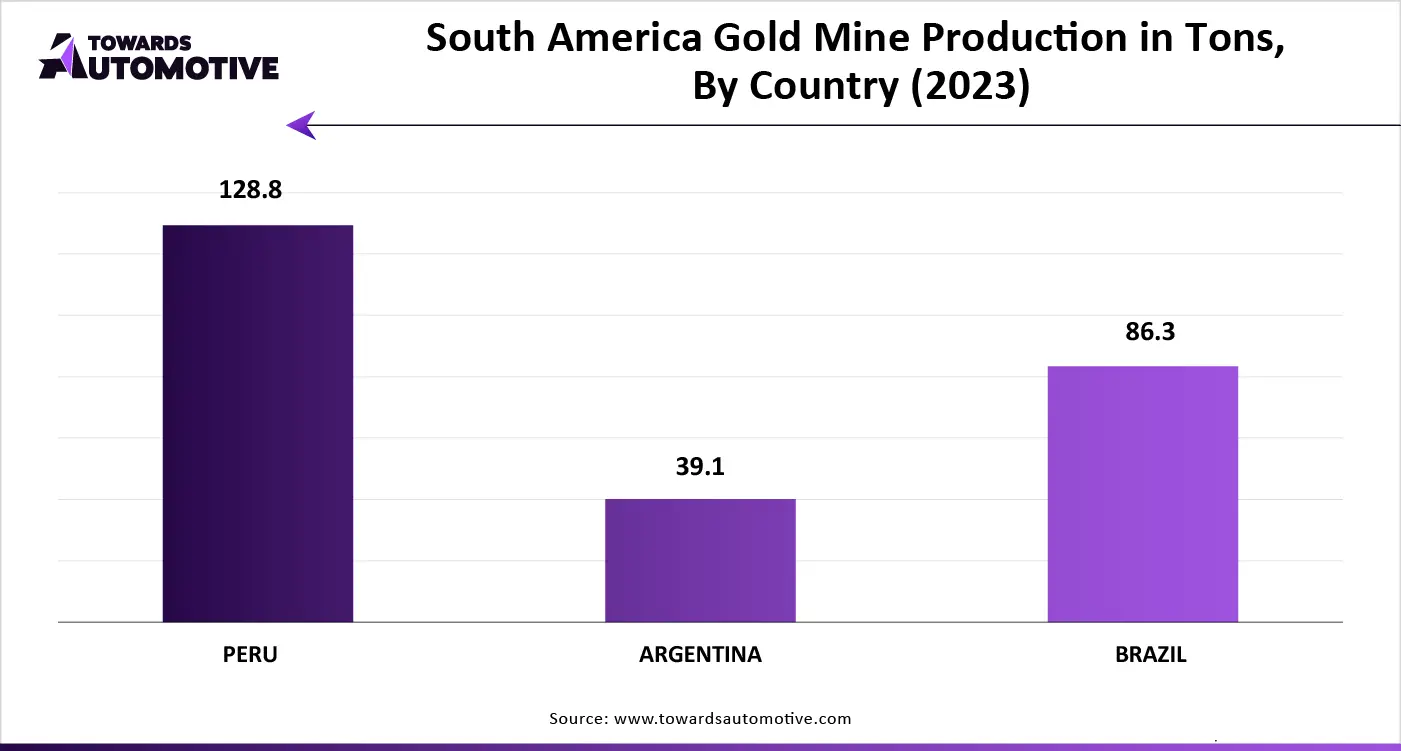

China is the major contributor in this region. In China, the market is generally driven by the rising emphasis on gold mining along with increase in number of residential constructions. Moreover, rapid development in the oil and gas industry coupled with presence of local crane manufacturers is driving the market growth.

The crane market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Demag Cranes & Components GmbH; GORBEL INC.; Hitachi Construction Machinery Europe NV; BUCKNER HEAVYLIFT CRANES, LLC; CARGOTEC CORPORATION; Caterpillar; CERTEX USA; KITO CORPORATION; Komatsu Ltd; Konecranes; LIEBHERR; PALFINGER AG; Pelloby Premier Cranes; SANY Group; Street Crane Company Limited; Tadano Ltd; Terex Corporation; The Manitowoc Company, Inc.; XCMG; and some others. These companies are constantly engaged in developing advanced cranes and adopting numerous strategies such as business expansions, acquisitions, joint ventures, collaborations, launches, partnerships, and some others to maintain their dominance in this industry.

By Product

By Application

By Region

August 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us