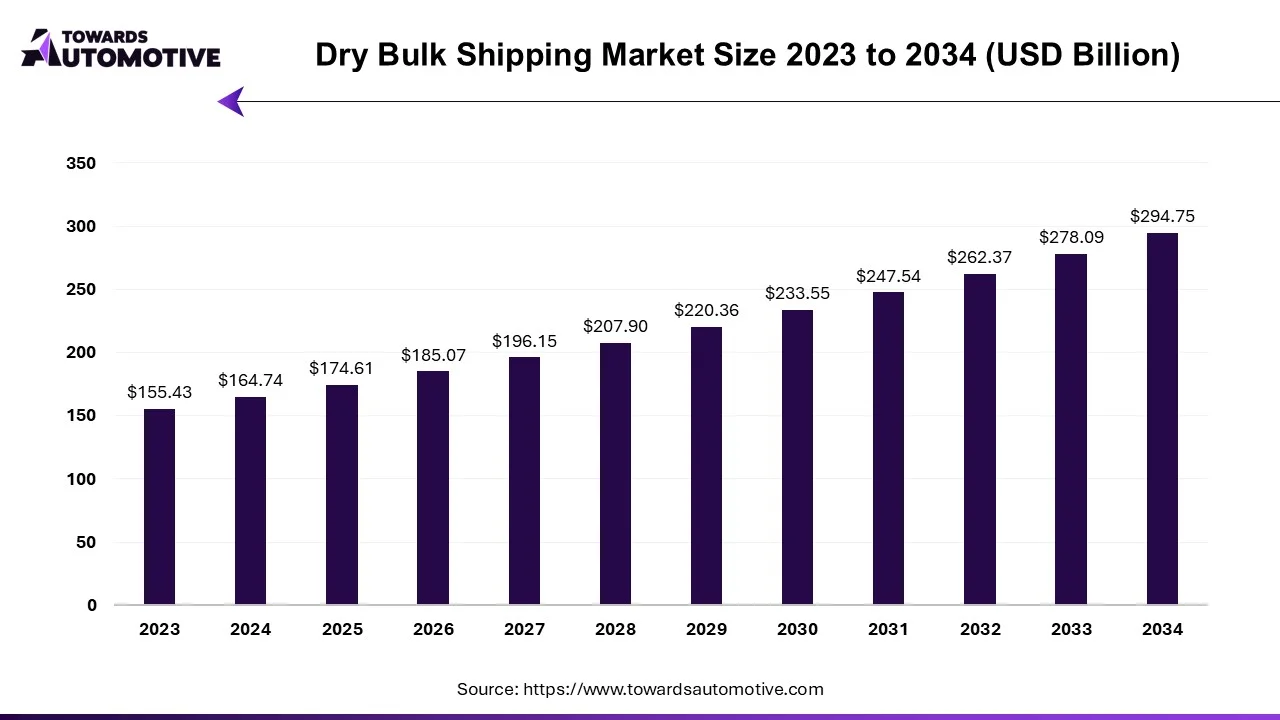

The dry bulk shipping market is set to grow from USD 174.61 billion in 2025 to USD 294.75 billion by 2034, with an expected CAGR of 5.99% over the forecast period from 2025 to 2034. The rise in number of residential constructions in several countries such as the U.S., India, China and some others coupled with rapid investment by public companies in the marine industry has contributed to the industrial expansion.

Additionally, growing adoption of green logistics along with integration of advanced technologies in modern vessels to optimize routes, enhance fuel efficiency, improve overall operations and some others is playing a vital role in shaping the market in a positive direction. The rising awareness of sustainable shipping as well as integration of AI and Cloud in fleet management platforms is expected to create ample growth opportunities for the market players in the upcoming days.

The dry bulk shipping market is a crucial segment of the logistics industry. This industry deals in manufacturing and distribution of vessels used for transporting loose items. There are several types of vessels developed in this sector comprising of Capesize, Handymax, Supramax, Handysize and some others. These vessels are used for transporting numerous commodities including iron ore, coal, steam coal, coking coal, grain, bauxite, nickel, steel and some others. The growing demand for phosphate rock and coal in developed nations has boosted the market expansion. This market is expected to rise significantly with the growth of the marine sector across the globe.

| Metric | Details |

| Market Size in 2025 | USD 174.61 Billion |

| Projected Market Size in 2034 | USD 294.75 Billion |

| CAGR (2025 - 2034) | 5.99% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Vessel Type, By Commodity Type, By Design and By Region |

| Top Key Players | Bahri, Diana Shipping Inc., Eagle Bulk Shipping Inc., Eurodry Ltd., Euronav, Fednav, Genco Shipping & Trading Limited |

The major trends in this market consists of joint ventures, growing emphasis on developing eco-friendly vessels and acquisitions.

Several public companies are announcing joint ventures with private players to launch new services related to dry bulk shipping in developing nations.

The shipbuilding industry is constantly engaged in developing environment-friendly ships with an aim to reduce marine emission.

Numerous market players have started acquiring small companies to enhance the capabilities of dry bulk shipping.

The capesize segment dominated the market. The growing application of capesize bulk carrier to transport bulk materials such as grain, iron ore, coal, and other commodities has boosted the market expansion. Additionally, rapid investment by shipbuilding companies to develop very large ore carriers (VLOC) and very large bulk carriers (VLBC) for enhancing dry bulk shipping is shaping the industry in a positive direction. Moreover, the increasing sales of these vessels in Brazil, Australia and South Africa is expected to drive the growth of the dry bulk shipping market.

The panamax segment is expected to expand with a considerable CAGR during the forecast period. The rising use of panamax vessels for transporting coal, minerals, grain, fertilizers, salt and some others has boosted the market expansion. Also, the growing emphasis on meeting the increasing demands of global trade, the demand for these vessels has increased rapidly as it offers high cargo capacity and operating efficiency. Moreover, partnerships among shipbuilders and dry bulk shipping companies to deploy panamax vessels is expected to propel the growth of the dry bulk shipping market.

The iron ore segment held the largest share of the market. The growing demand for high-quality steels from the construction sector and automotive industry has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the iron ore extraction sector coupled with rapid shift towards hydrogen-based ironmaking is playing a vital role in shaping the industrial landscape. Moreover, the increasing use of panamax vessels and capsize vessels for transporting iron ore in different parts of the world is expected to boost the growth of the growth of the dry bulk shipping market.

The grain segment is expected to rise with a notable CAGR during the forecast period. The growing demand for wood grains from the furniture industry for manufacturing several items such as tables, chairs, desks and some others has driven the market growth. Additionally, the rising demand for different types of metal grains such as ferrite, pearlite, BCC and some others from the steel industry is adding to the industrial expansion. Moreover, partnerships among vessel manufacturers to develop cargo ships for transporting grains from one nation to another is expected to propel the growth of the growth of the dry bulk shipping market.

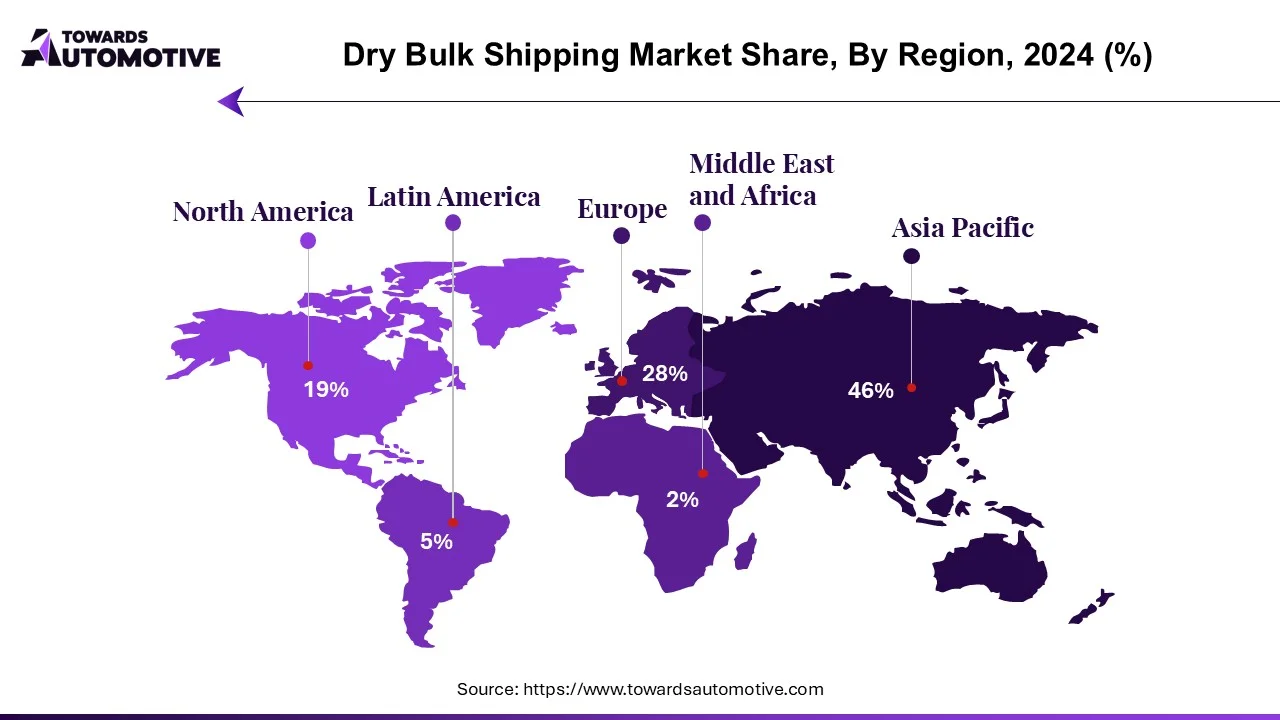

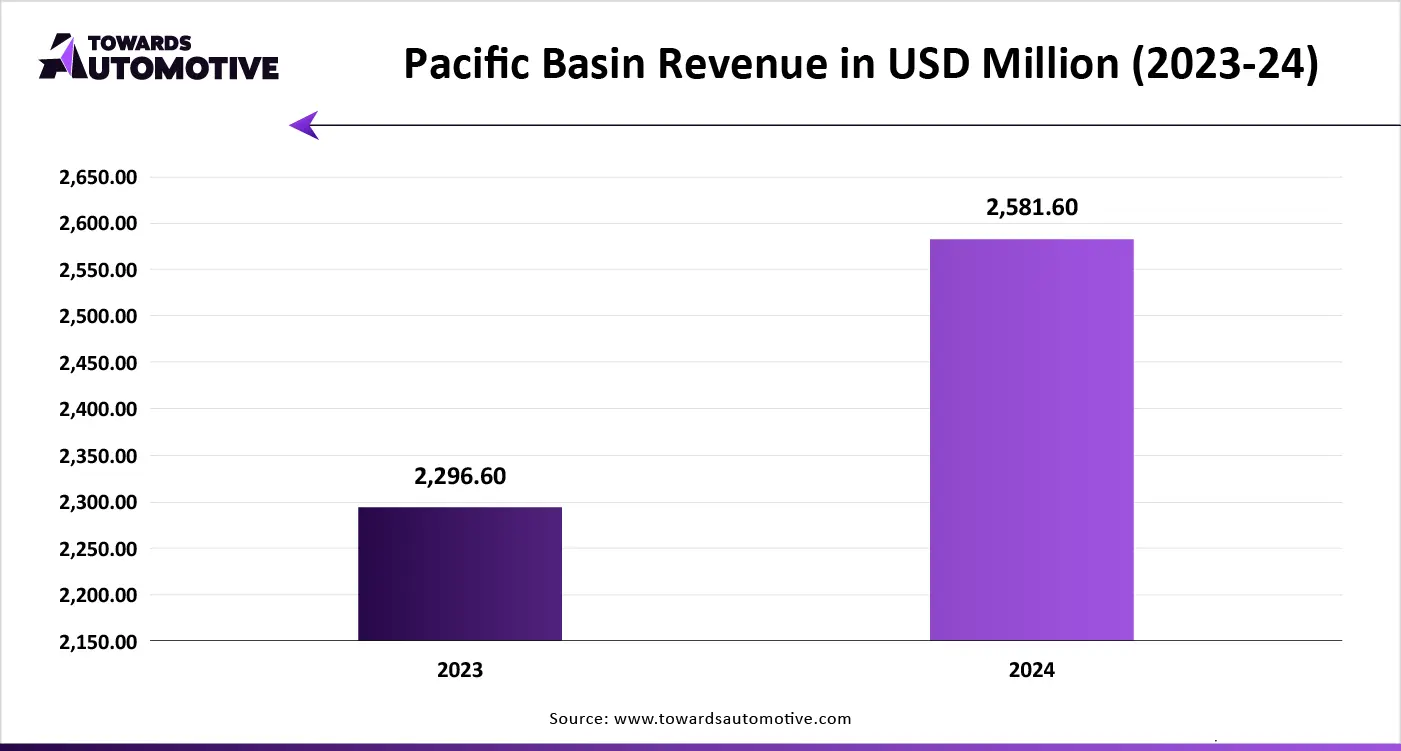

Asia Pacific led the dry bulk shipping market. The growing development in the shipbuilding industry in several countries such as India, China, South Korea, Taiwan and some others has boosted the market expansion. Additionally, rapid investment by government for strengthening the marine logistics sector coupled with abundance of rare earth metals in the APAC region is shaping the industry in a positive direction. Moreover, the presence of numerous market players such as NYK Line, Pacific Basin Shipping, COSCO Shipping Corporation Limited and some others is expected to foster the growth of the dry bulk shipping market in this region.

North America is expected to rise with a significant CAGR during the forecast period. The rising sales of Supramax vessels and Handysize vessels in the U.S. and Canada has boosted the market growth. Additionally, the rising emphasis on adopting green logistics along with technological advancements in the marine transportation sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of several dry bulk shipping companies such as Genco Shipping & Trading Limited, BR LOGISTICS USA INC, Fednav, Intermarine and some others is expected to boost the growth of the dry bulk shipping market in this region.

The dry bulk shipping market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Bahri, Diana Shipping Inc, Eagle Bulk Shipping Inc, Eurodry Ltd, Euronav, Fednav, Genco Shipping & Trading Limited, Golden Ocean Group, Navios Maritime Partners L.P., CMB Tech, Oldendorff, Pacific Basin Shipping Limited, Safe Bulkers, Inc., Star Bulk Carriers, Ultrabulk, Western Bulk and some others. These companies are constantly engaged in providing solutions to transport loose commodities and adopting numerous strategies such as business expansions, acquisitions, launches, collaborations partnerships, joint ventures, and some others to maintain their dominance in this industry.

By Vessel Type

By Commodity Type

By Design

By Region

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us