July 2025

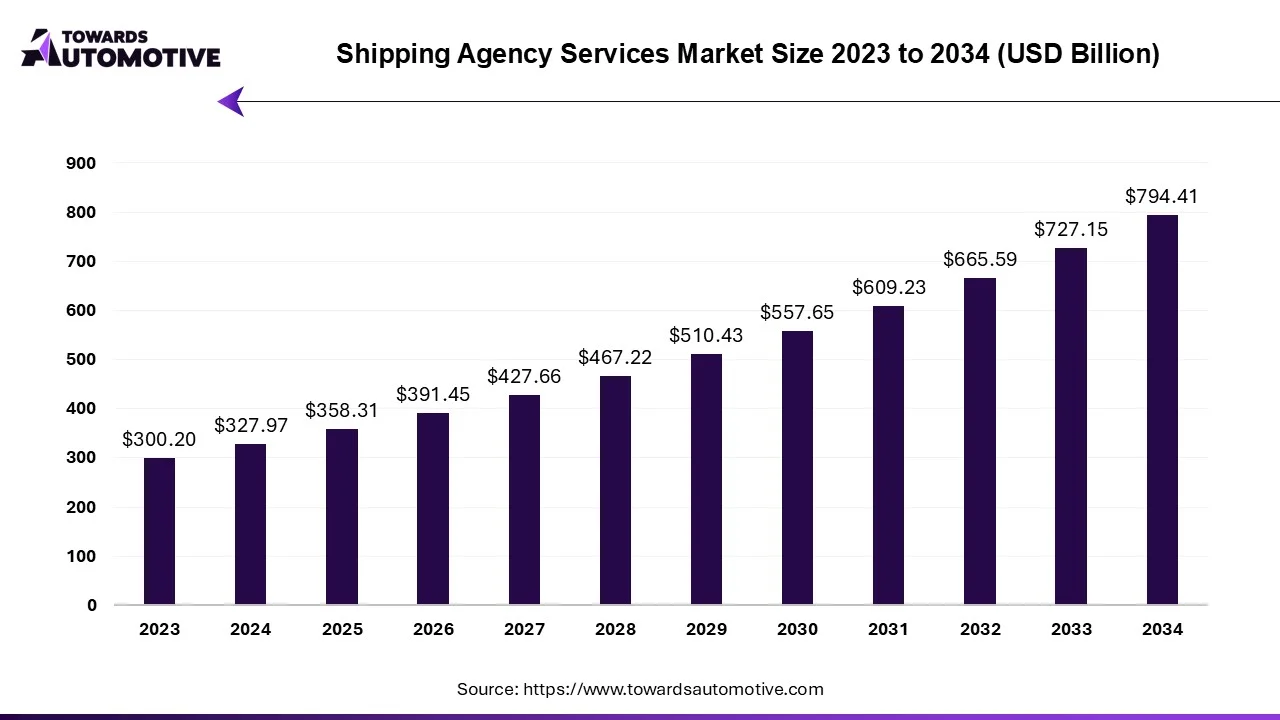

The shipping agency services market is anticipated to grow from USD 358.31 billion in 2025 to USD 794.41 billion by 2034, with a compound annual growth rate (CAGR) of 9.25% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Shipping agency services play a pivotal role in the smooth operation of maritime logistics and trade. Acting as intermediaries between shipowners, charterers, ports, and other stakeholders, shipping agents oversee a range of tasks essential for vessel operations, port calls, and cargo handling. From vessel clearance and documentation to crew services and cargo operations, shipping agency services ensure seamless coordination and compliance with regulatory requirements throughout the shipping process.

| Metric | Details |

| Market Size in 2024 | USD 327.97 Billion |

| Projected Market Size in 2034 | USD 794.41 Billion |

| CAGR (2025 - 2034) | 9.25% |

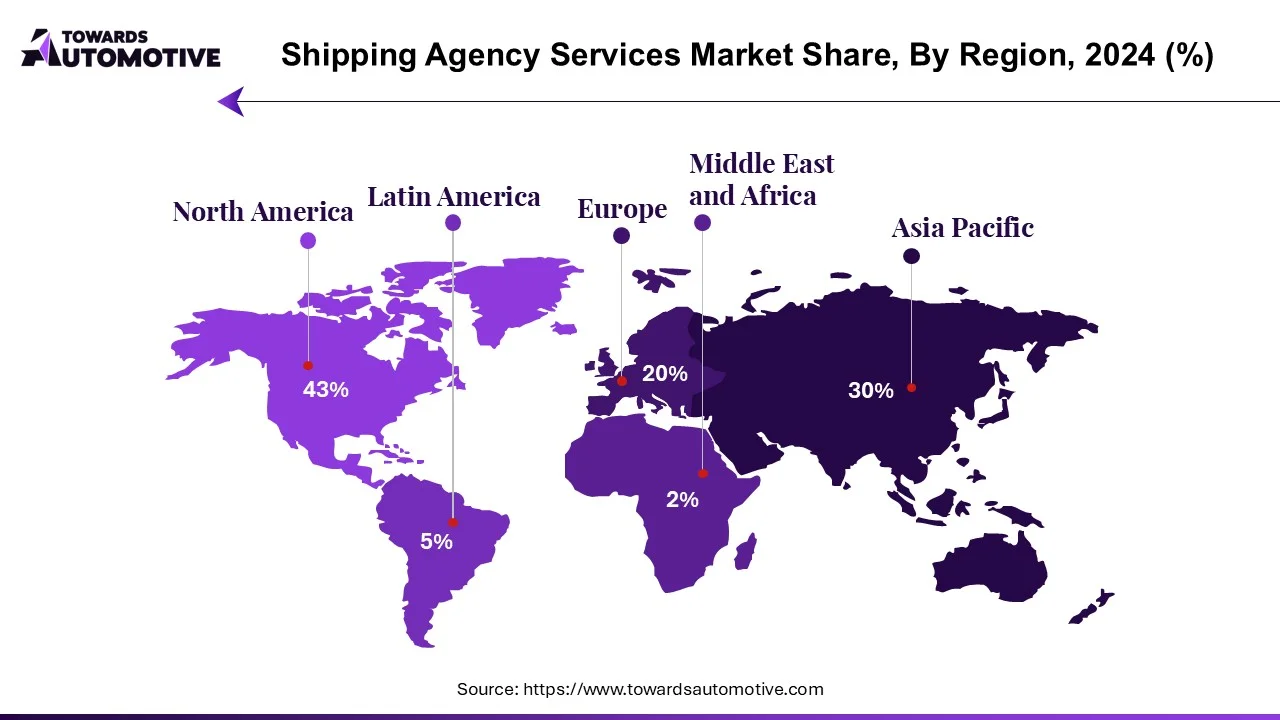

| Leading Region | North America |

| Market Segmentation | By Service Type, By Agency Type and By Region |

| Top Key Players | CEVA Logistics, CMA CGM Group, Hutchison Ports, Kuehne + Nagel |

The major trends in this market consists of trade liberalization and globalization, environmental sustainability along with government investment.

Trade liberalization and globalization are driving demand for shipping agency services, particularly in emerging markets and developing economies. As international trade volumes continue to grow, shipping agents play a crucial role in facilitating trade flows, optimizing logistics chains, and ensuring the efficient movement of goods and commodities across borders.

Increasing awareness of environmental sustainability and climate change is shaping regulatory and industry initiatives in the shipping sector. Shipping agents are adopting green practices, eco-friendly technologies, and sustainable shipping solutions to reduce carbon emissions, minimize environmental impact, and comply with international regulations such as IMO's MARPOL Convention and EEDI requirements.

The government of several countries are investing heavily for developing the port infrastructure. For instance, in November 2024, the government of India announced to invest around US$ 82 billion. This investment is done for developing the port infrastructure in India. (Source: Press Information Bureau)

The drivers of this industry consist of digitalization and automation, data analytics and predictive insights as well as e-commerce and supply chain integration.

The digitalization of shipping agency services is driving efficiency and transparency in maritime operations. Digital platforms and automation tools streamline workflows, enhance communication, and enable real-time tracking and monitoring of vessel movements, cargo operations, and documentation processes.

Advanced analytics and predictive modeling provide shipping agents with valuable insights into market trends, vessel performance, and operational efficiencies. By analyzing historical data and market trends, shipping agents can optimize route planning, vessel scheduling, and resource allocation to maximize profitability and minimize risks.

The integration of e-commerce platforms and supply chain management systems is transforming shipping agency services by enabling seamless collaboration and data exchange among stakeholders. E-commerce platforms facilitate online booking, documentation, and payment processing, streamlining the shipping process and enhancing customer experience.

The main challenges include port congestion and infrastructure constraints along with regulatory compliance and documentation.

Port congestion and infrastructure limitations pose challenges for shipping agency services, particularly in major trade hubs and congested waterways. Shipping agents must navigate port restrictions, berth availability, and operational constraints to minimize delays and optimize vessel turnaround times.

Regulatory compliance and documentation requirements are complex and vary across jurisdictions, posing challenges for shipping agents. Compliance with customs regulations, port protocols, and international conventions requires meticulous planning, coordination, and documentation to ensure smooth port calls and cargo operations.

The container services segment dominated this industry. The ongoing trend of containers as a service (CaaS) for enhancing scalability and managing containerized workloads has boosted the growth of the shipping agency services market. Some major container services provider includes Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure.

The cargo handling segment is expected to grow with the fastest CAGR during the forecast period. The growing emphasis on transporting goods from one nation to another has increased the demand for cargo handling services, thereby driving the growth of the shipping agency services market. Some prominent cargo handling companies include APT Logistics, Seal Freight and Ocean Sky Logistics.

The cargo agency segment dominated the market. The deployment of advanced shipping solution by cargo agencies to enhance the movement of goods has boosted the market growth. Additionally, rapid adoption of cargo insurance services by these agencies to enhance security is expected to drive the growth of the shipping agency services market.

The port agency segment is expected to rise with a considerable CAGR during the forecast period. The growing demand for efficient logistics operations in modern ports has driven the market expansion. Also, rapid investment by port agencies for deploying cloud-based cargo handling solutions to enhance supply chain management is expected to drive the growth of the shipping agency services market.

North America dominated the shipping agency services market. This growth is driven by several factors, including the region's robust economy, rising consumer demand for imported goods, and the increasing prevalence of e-commerce. As a result, there is a rising demand for professional services that streamline the transportation of goods between ports and across borders.

Moreover, North America's strategic positioning of border crossing points and modern ports contributes to its economic prosperity, making it a crucial hub in the global supply chain. This advantageous location facilitates efficient trade routes and fosters economic growth by facilitating the movement of goods and services. Furthermore, the presence of various market players such as Flexport, ILG Logistics, Beacon52 and some others is expected to drive the growth of the shipping agency services market in this region.

Asia Pacific is expected to grow with a considerable CAGR during the forecast period. The rapid development in the maritime transportation sector coupled with rising export activities from several countries such as China, India, Japan, South Korea and some others has driven the market expansion. Additionally, numerous government initiatives aimed at developing the port infrastructure along with rise in number of container leasing companies is crucial for the industrial expansion. Moreover, the presence of several market players such as Sinotrans, NYK (Nippon Yusen Kaisha) Line, Asian Global Shipping Agencies Pvt Ltd and some others is expected to propel the growth of the shipping agency services market.

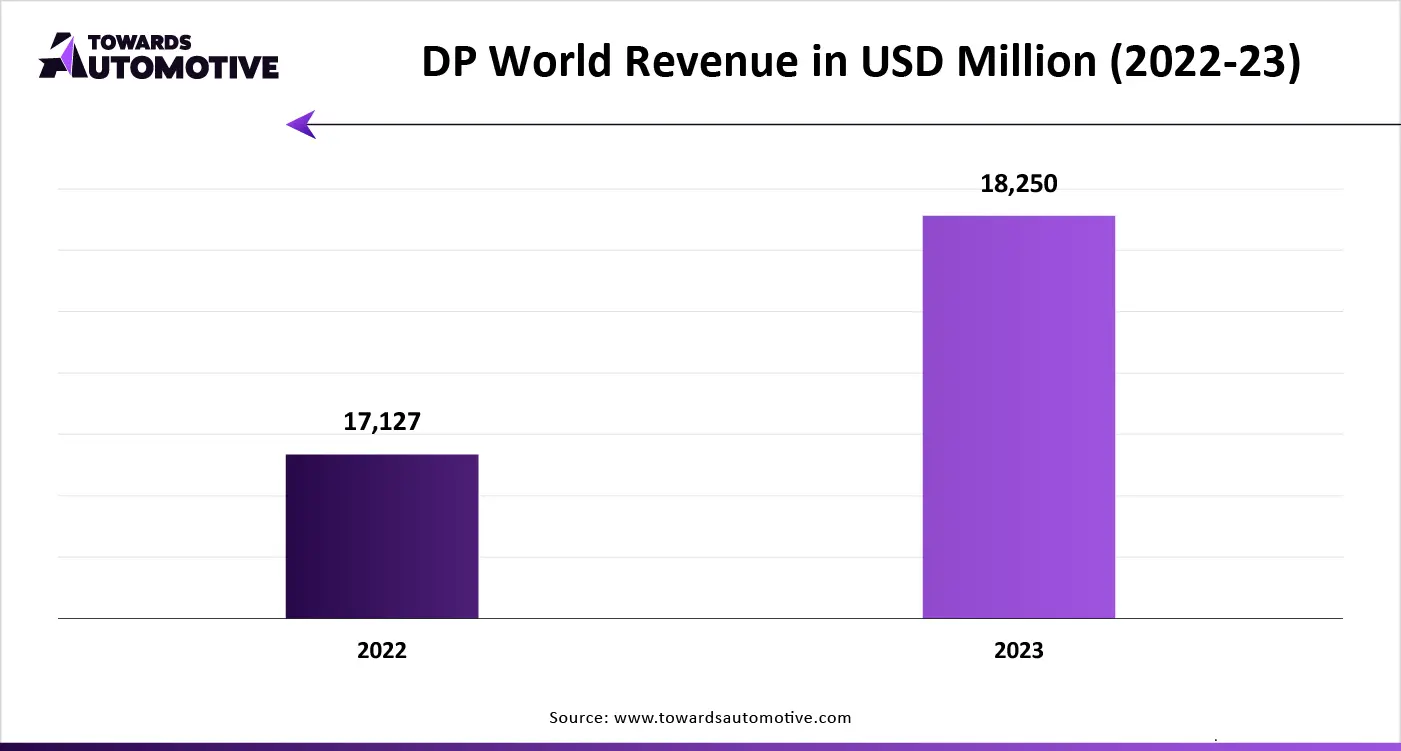

The shipping agency services market is a highly fragmented industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of Cargotec, CEVA Logistics, CMA CGM Group, Hutchison Ports, Kuehne + Nagel, PSA International, DHL Global Forwarding, DP World, and some others. These companies are constantly engaged in developing solutions for enhancing cargo operations and adopting numerous strategies such as joint ventures, acquisitions, partnerships, launches, collaborations, business expansions and some others to maintain their dominance in this industry.

By Service Type

By Agency Type

By Region

July 2025

April 2025

April 2025

March 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us