Locomotive Maintenance Telematics Market Growth and Trends

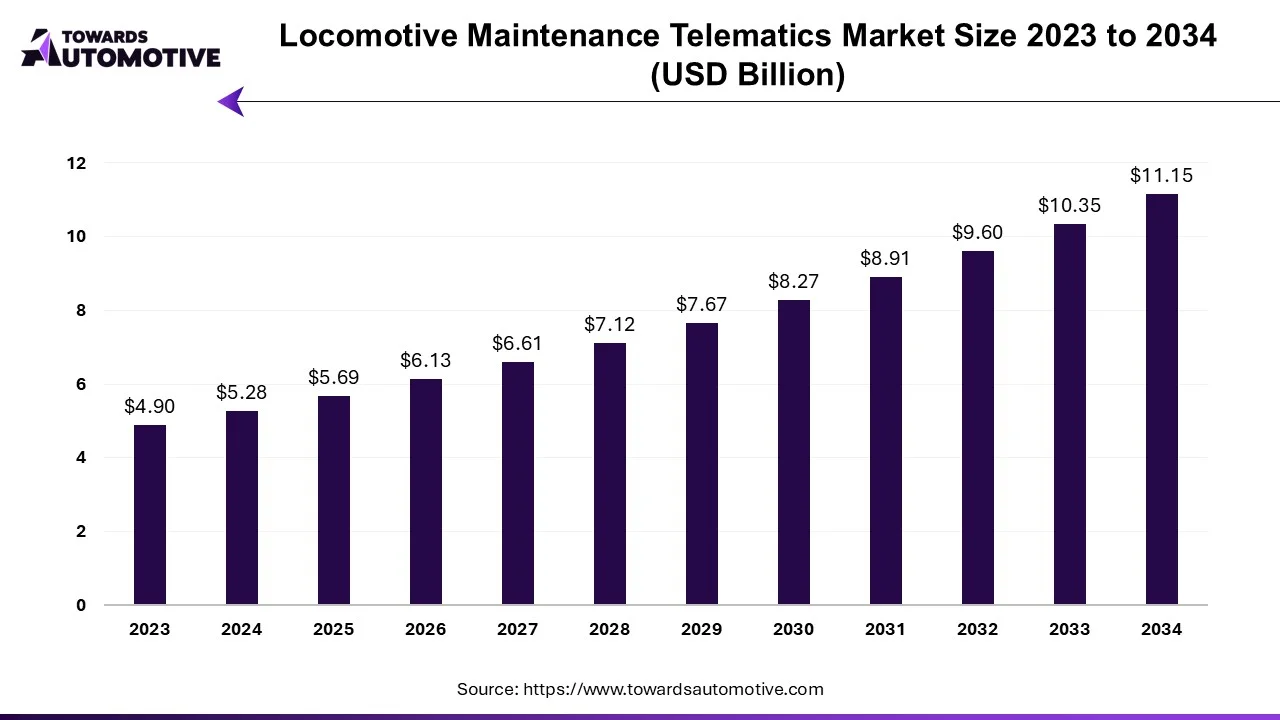

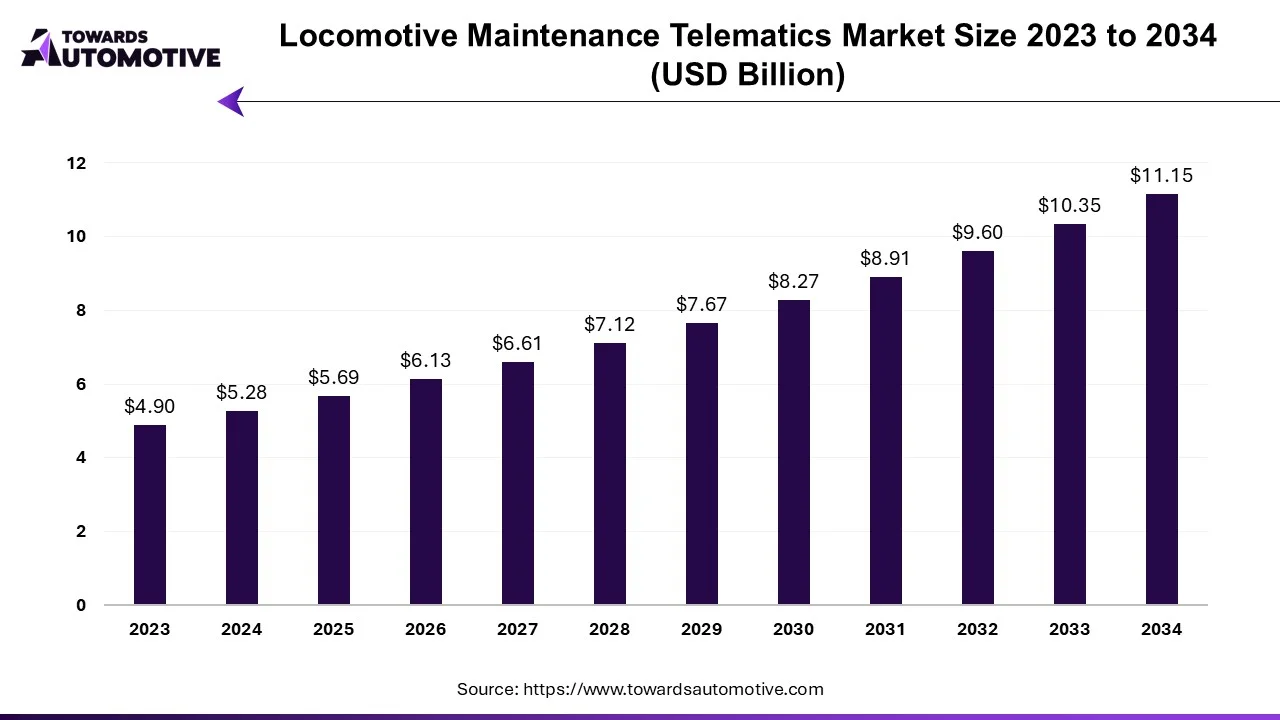

The locomotive maintenance telematics market is forecasted to expand from USD 5.69 billion in 2025 to USD 11.15 billion by 2034, growing at a CAGR of 7.76% from 2025 to 2034.

The locomotive maintenance telematics market is experiencing a surge in growth, propelled by the need for efficient and reliable rail transportation solutions.

The locomotive maintenance telematics market is poised for significant growth, driven by the need for efficient, safe, and reliable rail transportation solutions. With advancements in technology, the adoption of predictive maintenance strategies, and a focus on safety and compliance, telematics systems play a crucial role in modernizing railway operations and ensuring sustainable mobility for the future.

The locomotive maintenance telematics market is poised for robust growth, driven by factors such as the expansion of rail infrastructure, advancements in technology, and the need for predictive maintenance solutions. Telematics systems for locomotives leverage sophisticated sensors, communication networks, and data analytics to monitor the health and performance of trains in real-time, enabling proactive maintenance and minimizing downtime.

Key Components and Functions of Locomotive Maintenance Telematics Systems

- Remote Diagnostics: Telematics systems enable remote monitoring of locomotive components and systems, allowing maintenance teams to identify potential issues before they escalate. Real-time diagnostics help optimize maintenance schedules, reduce repair costs, and enhance fleet reliability.

- Condition Monitoring: Locomotive telematics platforms collect data on various parameters such as engine performance, fuel consumption, brake wear, and vibration levels. By analyzing this data, operators can detect anomalies and trends, enabling predictive maintenance and preventing equipment failures.

- Asset Management: Telematics solutions facilitate asset tracking and management, providing insights into locomotive location, utilization, and operational efficiency. This enables operators to optimize fleet deployment, allocate resources effectively, and improve overall fleet performance.

Key Market Dynamics and Trends

- Shift towards Predictive Maintenance: With the adoption of predictive maintenance strategies, rail operators are leveraging telematics data to anticipate maintenance needs, schedule repairs proactively, and minimize unplanned downtime. Predictive analytics algorithms help optimize asset lifecycle management and reduce maintenance costs.

- Integration with IoT and AI: Integration of telematics systems with Internet of Things (IoT) devices and artificial intelligence (AI) technologies enables advanced analytics, predictive modeling, and autonomous maintenance capabilities. AI-powered algorithms analyze vast amounts of data to identify patterns, predict failures, and optimize maintenance processes.

- Emphasis on Safety and Compliance: Locomotive telematics solutions play a crucial role in ensuring safety and regulatory compliance in the rail industry. By monitoring locomotive performance, tracking driver behavior, and recording operational data, telematics systems help operators maintain safety standards, adhere to regulatory requirements, and mitigate risks.

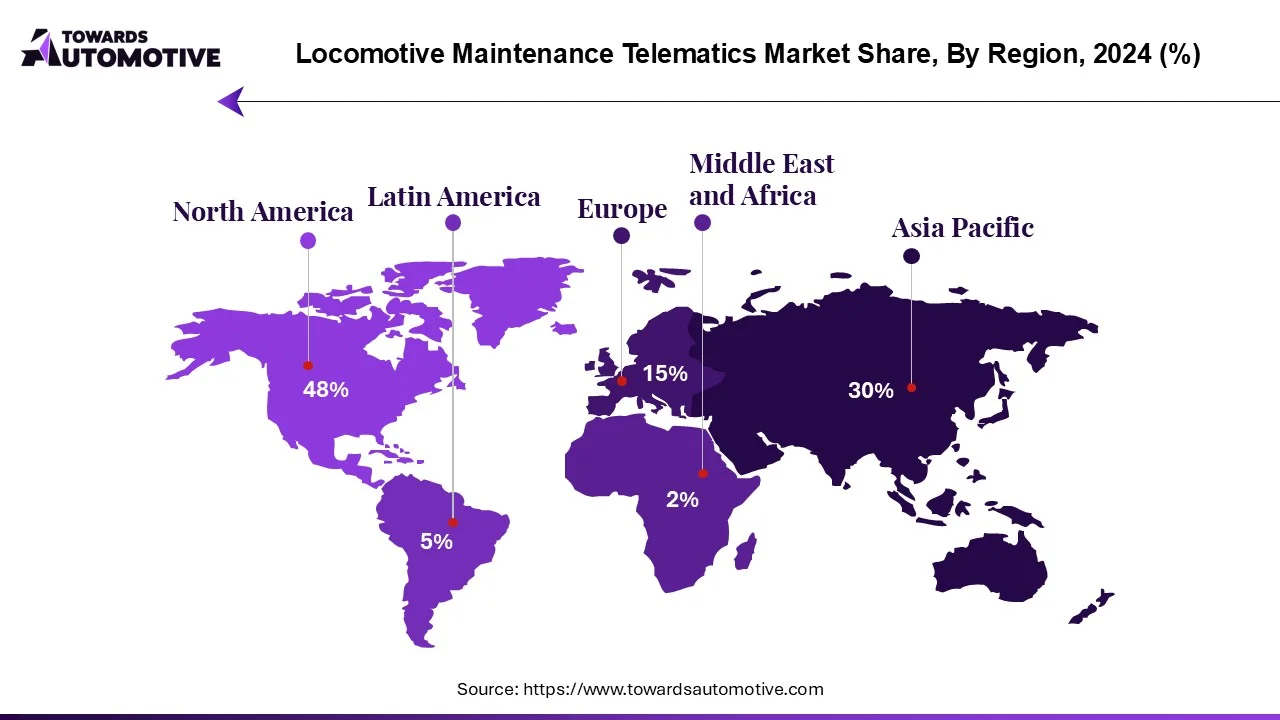

Global Trends and Market Outlook

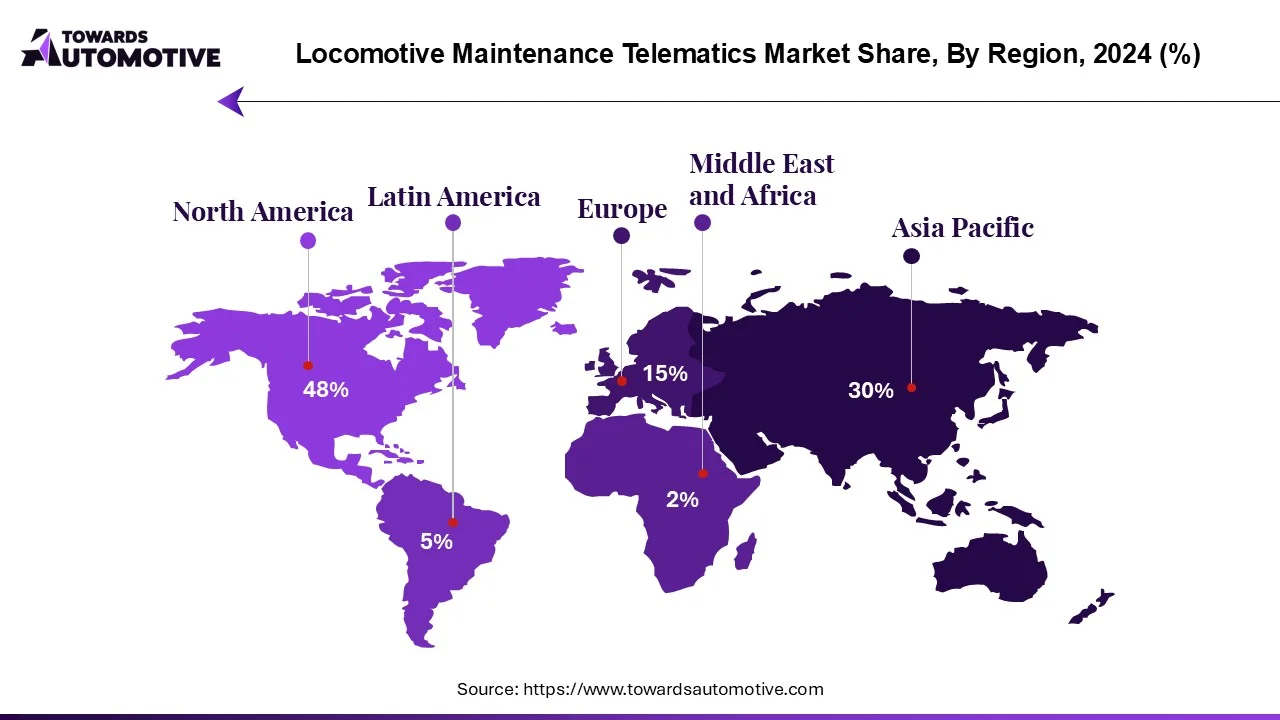

- North America and Europe Driving Innovation: Developed regions such as North America and Europe are leading the adoption of locomotive maintenance telematics solutions, driven by stringent safety regulations, aging infrastructure, and the need for operational efficiency. Rail operators in these regions are investing in advanced telematics technologies to modernize their fleets and improve service reliability.

- Emerging Markets in Asia-Pacific: Asia-Pacific is emerging as a key market for locomotive maintenance telematics, fueled by rapid urbanization, industrialization, and infrastructure development. Countries like China and India are investing heavily in rail infrastructure and adopting digitalization initiatives to enhance railway operations and safety.

- Collaboration and Partnerships: Collaboration between technology providers, rail operators, and maintenance service providers is driving innovation and market expansion in the locomotive telematics industry. Strategic partnerships enable the development of integrated solutions, interoperable platforms, and standardized protocols, fostering growth and scalability.

Challenges and Opportunities

- Data Security and Privacy: As locomotive telematics systems generate and transmit sensitive data, ensuring cybersecurity and data privacy is a critical challenge for industry stakeholders. Robust encryption, authentication, and access control measures are essential to protect data integrity and prevent unauthorized access.

- Legacy Infrastructure Integration: Integrating telematics systems with existing locomotive fleets and infrastructure poses challenges due to legacy equipment, compatibility issues, and interoperability concerns. Retrofitting older locomotives with telematics devices and upgrading infrastructure to support digital connectivity require careful planning and investment.

- Regulatory Compliance: Compliance with industry regulations, safety standards, and data protection laws poses challenges for locomotive operators deploying telematics solutions. Addressing regulatory requirements and obtaining certifications for telematics systems are essential to ensure legal compliance and minimize risks.

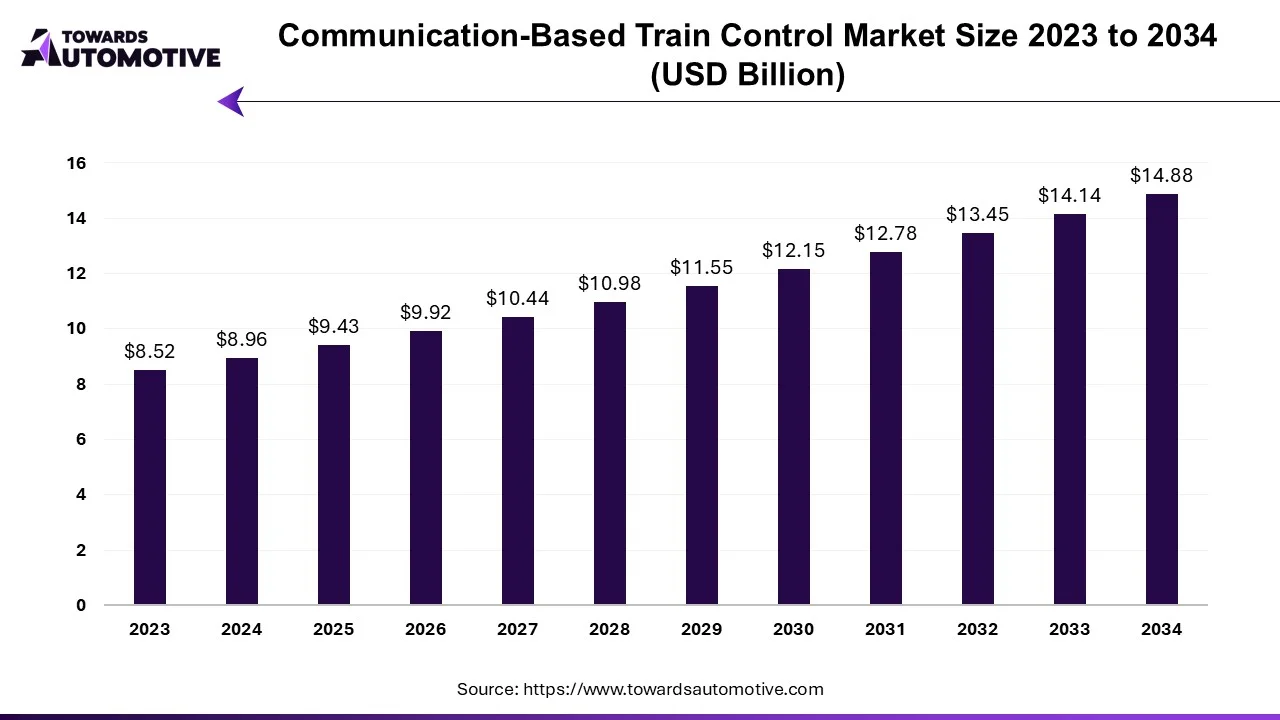

Future of Communication-Based Train Control Market

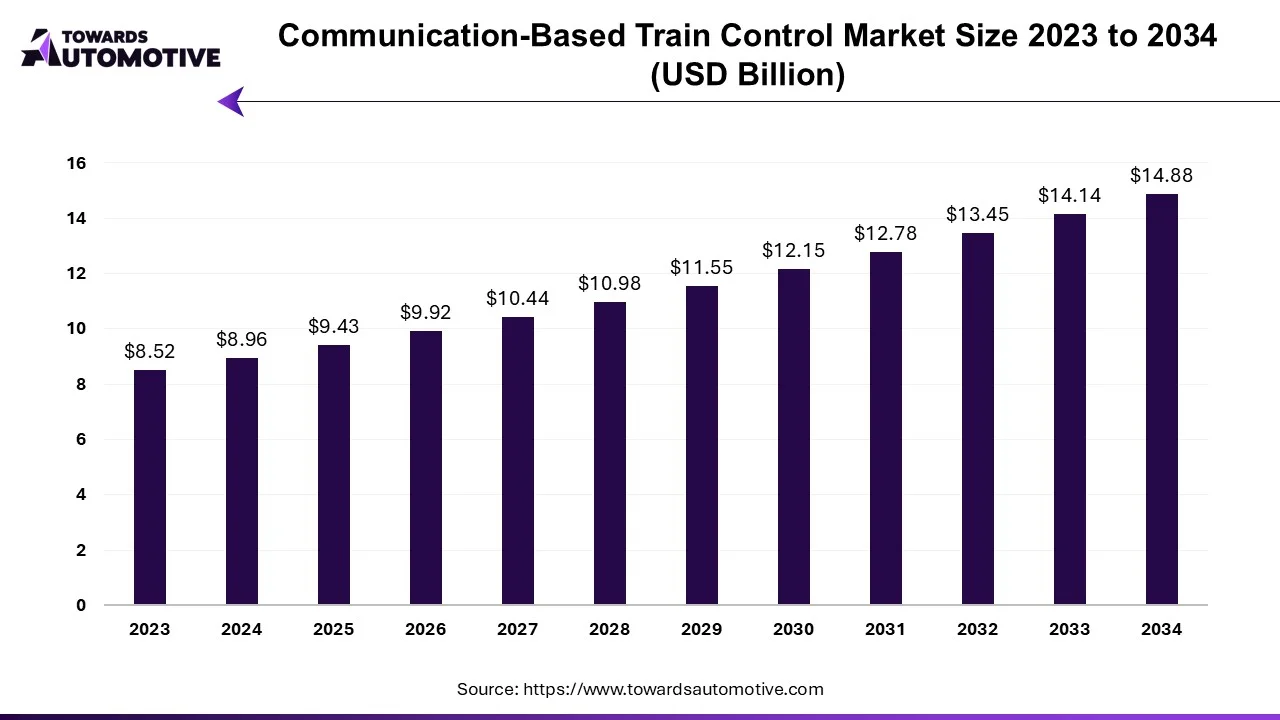

The communication-based train control market is forecast to grow from USD 9.43 billion in 2025 to USD 14.88 billion by 2034, driven by a CAGR of 5.20% from 2025 to 2034. The growing investment by government of several countries for strengthening the railway infrastructure coupled with rapid urbanization in developed nations is playing a vital role in shaping the industrial expansion.

Additionally, rapid investment by market players for developing advanced control systems for the railway sector as well as increasing emphasis on enhancing railway safety has contributed to the market growth. The integration of advanced technologies such as AI and Bigdata Analytics in train control solutions is expected to create ample growth opportunities for the market players in the upcoming days.

The communication-based train control market is a crucial branch of the railway industry. This industry deals in manufacturing and distribution of communication-based train control system in different parts of the world. There are various types of train control systems developed in this sector comprising of basic CBTC and I-CBTC. These systems are designed for operating different types of trains including metro, monorail, commuter rail, and freight rail system. It is available in numerous grades consisting of GoA1, GoA2, GoA3 and GoA4. The growing demand for efficient transportation system has contributed to the overall industrial expansion. This market is expected to rise significantly with the growth of the software industry around the globe.

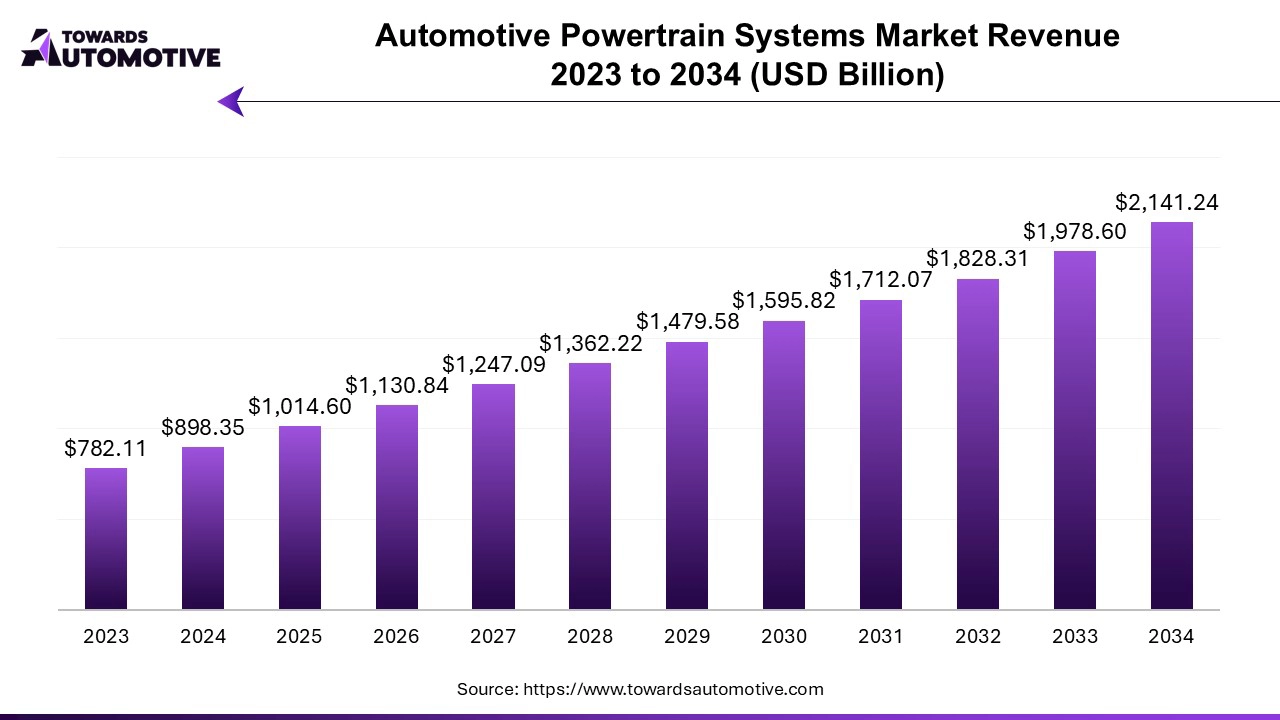

Future of Automotive Powertrain Systems Market

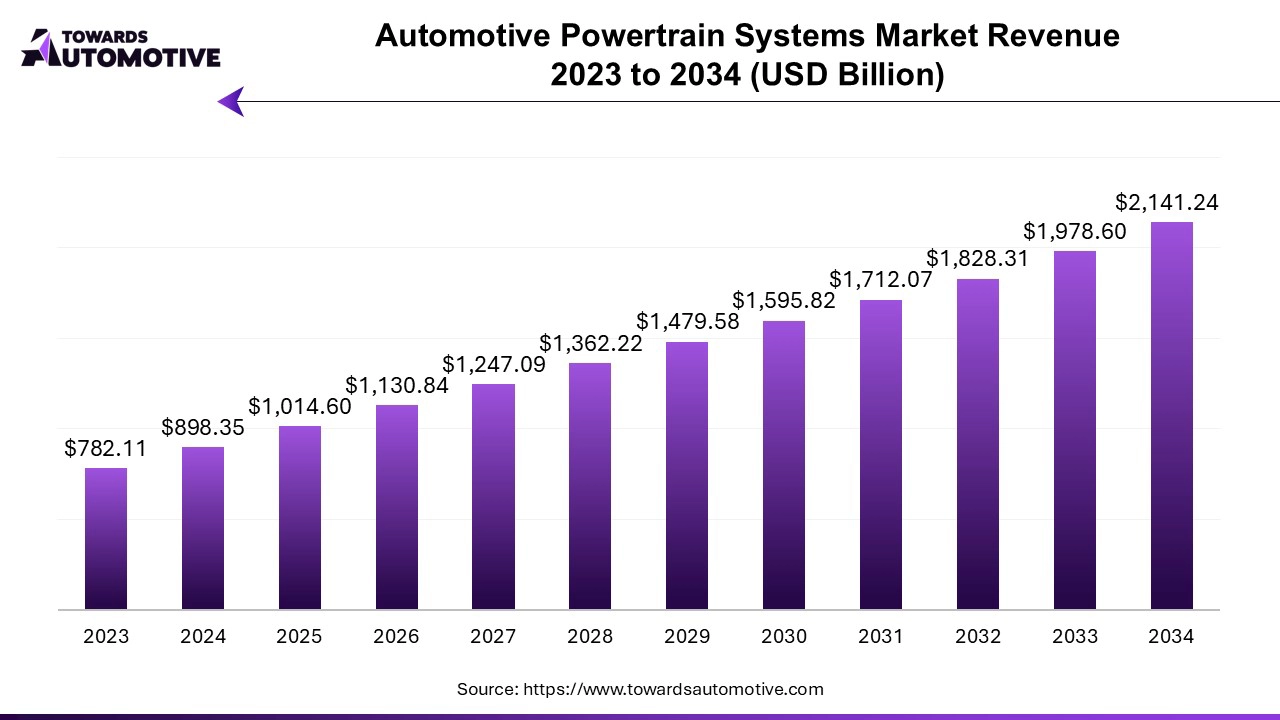

The global automotive powertrain systems market is expected to increase from USD 1,014.60 billion in 2025 to USD 2,141.24 billion by 2034, growing at a CAGR of 8.22% throughout the forecast period from 2025 to 2034.

The automotive powertrain systems market is experiencing significant growth due to the increasing demand for fuel-efficient and high-performance vehicles. The powertrain, which comprises the engine, transmission, driveshafts, and differential, plays a crucial role in delivering power to the vehicle’s wheels. With the global shift towards reducing emissions and improving energy efficiency, automakers are focusing on developing advanced powertrain technologies, including hybrid and electric powertrains. The rise in electric vehicle (EV) adoption is particularly driving innovation, as electric powertrains offer a cleaner alternative to traditional internal combustion engines (ICE), supporting sustainability goals.

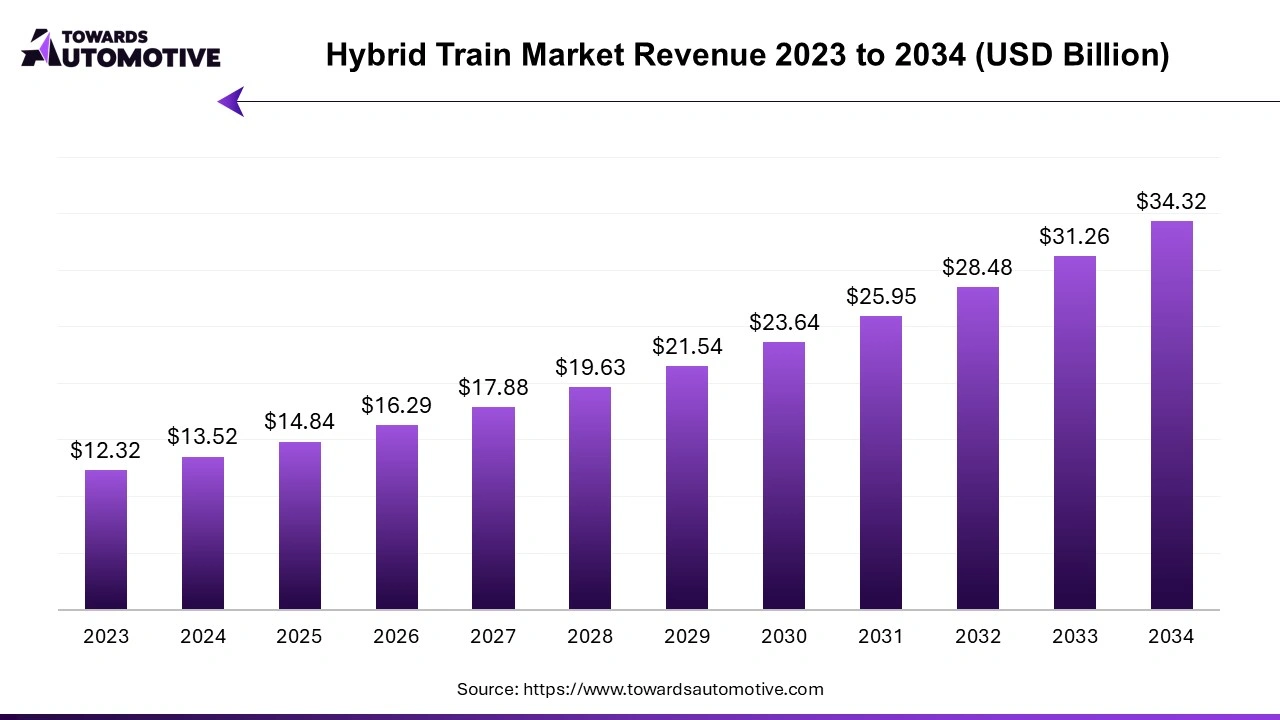

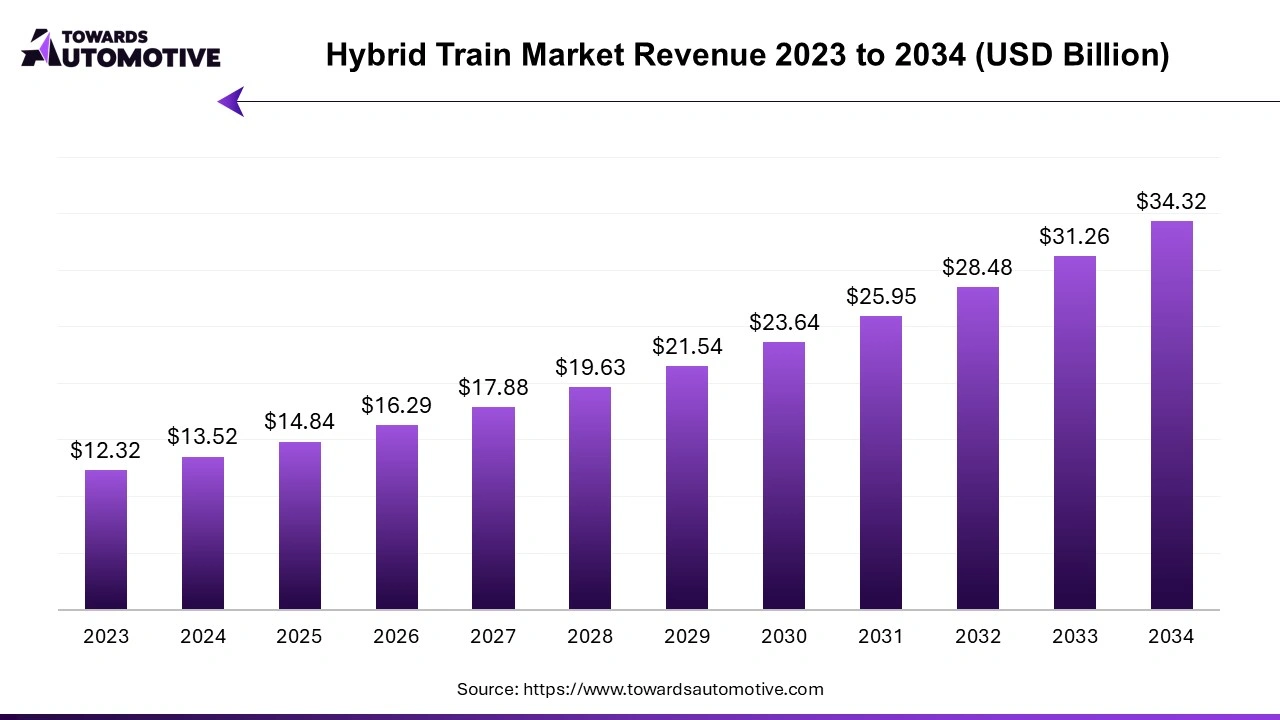

Hybrid Train Market

The hybrid train market is expected to increase from USD 14.84 billion in 2025 to USD 34.32 billion by 2034, growing at a CAGR of 9.76% throughout the forecast period from 2025 to 2034. The growing investment by government of several countries for strengthening the railway infrastructure along with technological advancements in the locomotive manufacturing sector is playing a vital role in shaping the industry in a positive direction.

Moreover, rising awareness of consumers towards adopting eco-friendly transportation solutions coupled with rapid investment by market players for developing hybrid trains has boosted the market growth. The research and developments related to heavy-duty train batteries is expected to create ample growth opportunities for the market players in the future.

The hybrid train market is a crucial segment of the railway industry. This industry deals in manufacturing and distribution of hybrid trains across the world. There are several types of trains developed in this sector comprising of electro-diesel trains, battery electric trains, hydrogen powered trains and some others. These trains are capable of attaining different speeds including below 100 km/h, 100-200 km/h, above 200 km/h and some others. It finds application in passenger transportation and goods delivery.

Key Players in the Locomotive Maintenance Telematics Market

The locomotive maintenance telematics market comprises a diverse ecosystem of technology providers, railway operators, maintenance service providers, and solution integrators.

Some of the prominent players in the market include

- Siemens Mobility

- GE Transportation

- Bombardier Transportation

- Wabtec Corporation

- Alstom SA

- Hitachi Rail

- SKF Group

- Progress Rail (Caterpillar Inc.)

- Trimble Inc.

- LILEE Systems

Market Segmentation and Regional Outlook

By Component

- Hardware

- Software

- Services (Maintenance, Support, Consulting)

By Deployment

- On-board Telematics

- Wayside Telematics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Recent Developments in the Locomotive Maintenance Telematics Market

- Integration of Predictive Maintenance Solutions: In December 2023, leading locomotive manufacturers such as General Electric (GE) and Siemens announced the integration of advanced predictive maintenance solutions into their locomotive fleets. These solutions leverage telematics technology to monitor the health of critical components in real-time, enabling proactive maintenance scheduling and reducing unplanned downtime.

- Expansion of Remote Diagnostics Capabilities: In November 2023, Caterpillar Inc., a major player in the locomotive maintenance telematics market, expanded its remote diagnostics capabilities for locomotive engines. The enhanced system enables remote monitoring of engine performance, fuel efficiency, and emissions, allowing operators to optimize maintenance schedules and improve overall fleet reliability.

- Introduction of Cloud-Based Fleet Management Platforms: In October 2023, a prominent telematics service provider launched a cloud-based fleet management platform tailored specifically for the locomotive industry. The platform offers features such as asset tracking, performance monitoring, and predictive analytics, empowering operators to streamline maintenance operations and maximize asset utilization.

- Collaboration Between OEMs and Telematics Providers: In September 2023, a strategic collaboration was announced between a leading locomotive OEM and a specialized telematics provider to develop integrated maintenance solutions for locomotive fleets. By combining OEM expertise with telematics insights, the collaboration aims to deliver comprehensive maintenance solutions that optimize fleet performance and reduce total cost of ownership.

- Adoption of Artificial Intelligence for Fault Detection: Tesla Rail, a pioneering company in the locomotive maintenance telematics market, unveiled an AI-powered fault detection system in August 2023. The system utilizes machine learning algorithms to analyze sensor data from locomotives in real-time, accurately identifying potential faults or performance issues before they escalate, thereby minimizing operational disruptions