October 2025

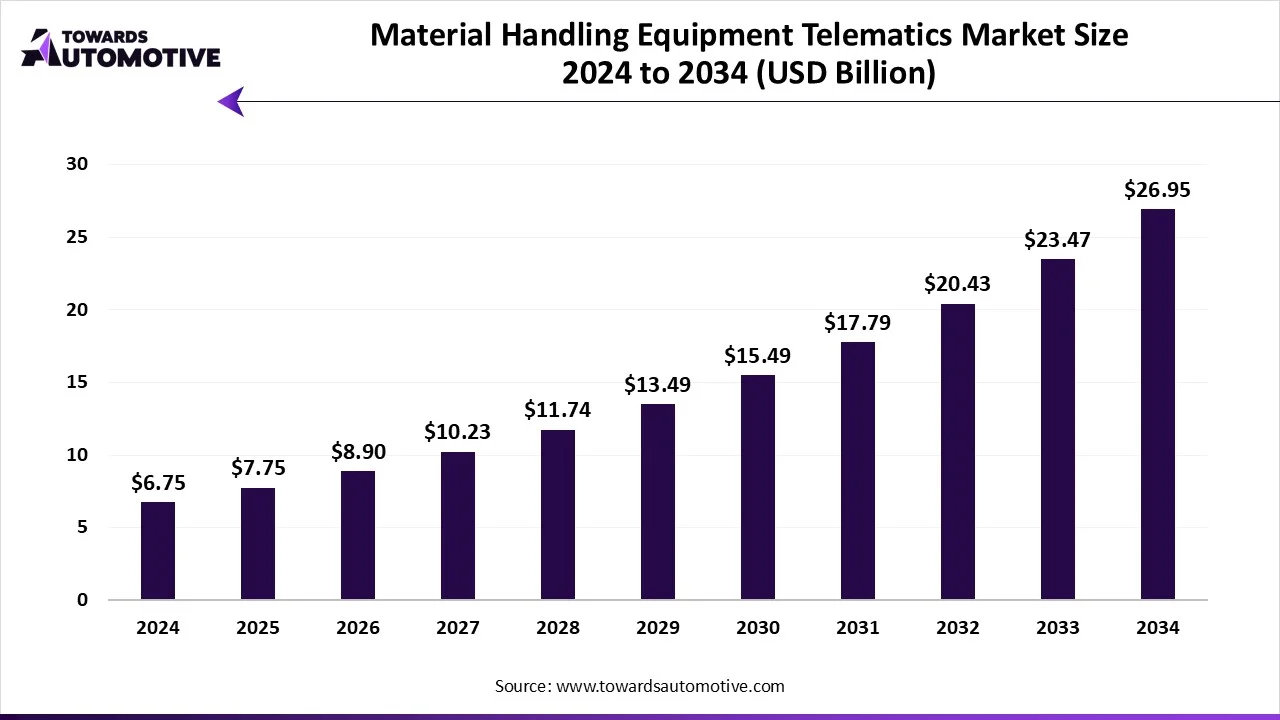

The material handling equipment telematics market is forecast to grow from USD 7.75 billion in 2025 to USD 26.95 billion by 2034, driven by a CAGR of 14.85% from 2025 to 2034. The material handling equipment telematics market continues to grow as industries pursue the benefits of improved efficiency, safety, and cost savings. The growth of e-commerce and logistics has led to increased demand for smarter warehouses, where telematics can help track equipment and manage fleets.

Businesses are increasingly looking at automation and digitalization, which further increases the use of telematics in various industries. Automated guided vehicles also boost the use of telematics. Another key driver that supports telematics growth includes the need for predictive maintenance to reduce downtime. The material handling equipment telematics market is further supported by GPS and IoT technology, along with stricter safety regulations, with financial penalties driving business towards telematics implementation.

The material handling equipment telematics market refers to the integration of telecommunication and informatics technologies into material handling equipment, such as forklifts, cranes, conveyor systems, and automated guided vehicles (AGVs). These solutions enable real-time tracking, monitoring, diagnostics, predictive maintenance, fleet optimization, and safety management. By leveraging technologies like GPS, cellular connectivity, Wi-Fi, and IoT-based analytics, telematics improves operational efficiency, reduces downtime, enhances equipment lifespan, and supports data-driven decision-making in industries such as manufacturing, warehousing, logistics, construction, and automotive. The components in the market comprise hardware, software, and services. Companies provide telematics systems that can help to reduce costs and improve efficiency, reduce damage, or ensure proper use of equipment. Moreover, telematics is increasingly becoming a popular choice as delivery is required faster in e-commerce. There is an increased need for innovation and automation, while telematics will help businesses improve productivity for long-term sustainability.

The trends in the market are product innovations, partnerships, and collaborations.

Artificial Intelligence (AI) is transforming the material handling equipment telematics market by making telematics systems intelligent and predictive. Telematics devices collect data on different types of forklifts, AGVs, and some other machines, and the AI, which is integrated with these devices, aggregates data, analyzes, and creates insights. AI-driven predictive maintenance provides companies with the opportunity to identify hidden issues and problems before they become failures, reducing downtime and repair expenses. Fleet optimization is another impact- using AI algorithms to look at usage rates, routes of travel, idle time, and suggest opportunities to shorten those metrics, reducing fuel or energy waste. The AI-driven telematics in warehouses allows AGVs to plan routes, avoid congestion, and complete movements of materials more efficiently. Moreover, AI has led to a more efficient workplace regarding safety by identifying operator unsafe behaviors and reducing accidents. Along with improving waste and reducing expenses, AI-driven analytics are providing real-time analytics to make better and faster decisions about logistics and supply chains, where time is money. The combination of telematics and machine learning is unlocking a competitive edge for companies with higher levels of equipment utilization performance, safety, and productivity. As industries continue to pursue more automated systems and smarter supply chains, AI-driven telematics has moved from a passive state to the core intelligence center for material handling equipment in 2025.

The hardware segment dominated the market as it acts as the physical backbone of every telematics system. The telematics systems that businesses implement rely heavily on hardware components, including tracking sensors, electronic onboard units, and durable telematics control devices to acquire data in real-time. These hardware components are vital for collecting data related to the equipment's location, usage, and health. The hardware segment is an important aspect of the market because if a telematics hardware device were to fail, there would be no data to act upon. Additionally, industries like logistics and manufacturing require durable hardware that will withstand their environments. Therefore, businesses invest in hardware so that their systems can collect data properly, resulting in hardware as the largest segment for material handling equipment telematics.

The software segment is the fastest-growing segment in the material handling equipment telematics market, as software delivers telematics to life by leveraging it into actionable, intelligent aspects. Once the hardware has sensed the information, the software platforms analyze it and showcase it on dashboards, predictive alerts, and/or trend reports. This enables fleet managers to anticipate a breakdown before it ever happens and make educated moves concerning maintenance or operations. Software can connect to an array of other systems, such as warehouse management or enterprise systems. As businesses adopt artificial intelligence (AI) and cloud services, the software segment will become more powerful, flexible, and scalable in the market. Moreover, advancements in software allow businesses to upgrade and add functionality without having to replace physical equipment. In the growing digital world, software offers businesses a way to manage data efficiently, making it the fastest-growing component of the material handling equipment telematics market.

The forklifts segment dominated the material handling equipment telematics market as they are common in warehouses, factories, and distribution centers. This equipment is widely used 24/7 around various industries in the market for moving goods. As the forklifts are operating so frequently and constantly, it is essential that a manager knows exactly where every forklift is operating, how it is operating, and when it requires service. Telematics solutions that are prescribed for use with forklifts monitor their performance and automatically notify the manager if they see fit that a forklift is underutilized, misused, or needs maintenance. Visibility and insight provided in near real-time help companies improve their safety, efficiency, reduce downtime, and allow day-to-day operations to run much more smoothly. Forklifts are clearly the largest segment where telematics solutions are deployed in the material handling industry due to their presence, frequency of operating hours, and the space in coverage.

The automated guided vehicles (AGVs) segment is expected to grow at the fastest rate in the forecasted period due to the transition towards the application of robotics and automation in warehouses and factories. The AGV moves items with no human driver, using sensors and software to guide the machine. With telematics, companies can take AGVs to the next level by allowing managers to monitor performance remotely, prevent collisions, and pre-plan repair and maintenance before a failure takes place. AGVs are inherently more reliable than manual vehicles and also provide a quicker and safer environment. Industries that are labor-intensive and benefit from a greater sense of safety employ AGVs with telematics the quickest. Since e-commerce and fast fulfillment deliveries are increasing, it is noteworthy that the fastest growing segment in the equipment types is AGVs due to their ability to perform continuously and their capability to report performance data in real time.

The GPS segment dominated the material handling equipment telematics market, as it gives location data in real-time that every telematics system depends on to effectively function. When companies use GPS, they know where material handling equipment is located at any time, in the warehouse, manufacturing unit, or factory floor. Telematics data helps companies plan the most efficient routes, assign tasks, and keep equipment from colliding. Moreover, GPS also allows geofencing, where managers are alerted if equipment violates a boundary set by the company. The practical use of GPS to allow accurate tracking is paramount to safety and productivity, so GPS is still a primary technology. Additionally, it is widely adopted as it is field-tested, universal, and works with existing mapping tools. These reasons support GPS to be the central focus of technology in the material handling equipment telematics market.

The cellular segment is expected to be the fastest-growing segment in the market. Cellular technology is growing faster than other forms of telematics as it provides reliable connectivity that allows telematics systems to operate from anywhere, including warehouses or remote worksites. Cellular networks provide the ability to send and receive data in real time, regardless of whether the physical piece of the telematics device is moving across different service areas. The benefit of using cellular technology is that fleet managers have the latest information when it is needed, and therefore, it is efficient and reduces safety risks. Low costs for cellular networks to get data faster, provide real-time alerts, remote software updates, connect to the cloud, and some other features are making connectivity via cellular networks more reliable. The market for material handling equipment telematics may vary from one company to another, depending on whether it is expanding operations or curious about how it manages a mobile fleet; therefore, the wireless reach, flexibility, and agility of cellular technology will position itself as the fastest-growing technology in the telematics software market.

The fleet management segment led the material handling equipment telematics market as it covers an important purpose of telematics, which is to locate and manage multiple pieces of equipment. Every manager in the warehouse, factory, or manufacturing unit needs to know the whereabouts of all the machines, how machines are being used, and when equipment needs maintenance. Fleet management systems collect real-time data on location, usage hours, and health status of equipment to assist businesses in scheduling planned maintenance, allocating tasks, and minimizing the time equipment is idle. The objective is to reduce downtime and increase productivity, while minimizing overall costs. Moreover, as material handling is conducted with multiple vehicles in operation simultaneously, a telematics system to manage the whole fleet is vital to having a telematics strategy.

The predictive maintenance segment is expected to grow at the fastest rate in the forecasted period as it helps companies identify breakdowns before they happen. Inspection systems use telematics systems to classify and track conditions such as temperature, vibration, and usage patterns of machinery. In order to help manufacturers predict when a component might fail, software leverages telematics data and its own baselines to alert the user before a breakdown. Since predictive maintenance can drive maintenance schedules according to predicted failures, this helps save time and money while avoiding unexpected downtime. As the industries and their associated manufacturers modernize, the goal is to have a system that accomplishes both, keeping machinery running longer and reducing expensive repairs. Additionally, predictive maintenance helps provide a more thoughtful approach to companies for maintenance planning while extending the life of their equipment. These forward-looking processes are fast gaining acceptance by equipment users. This rapid acceptance of smarter maintenance methods is driving the growth of this prognostic application in the telematics market.

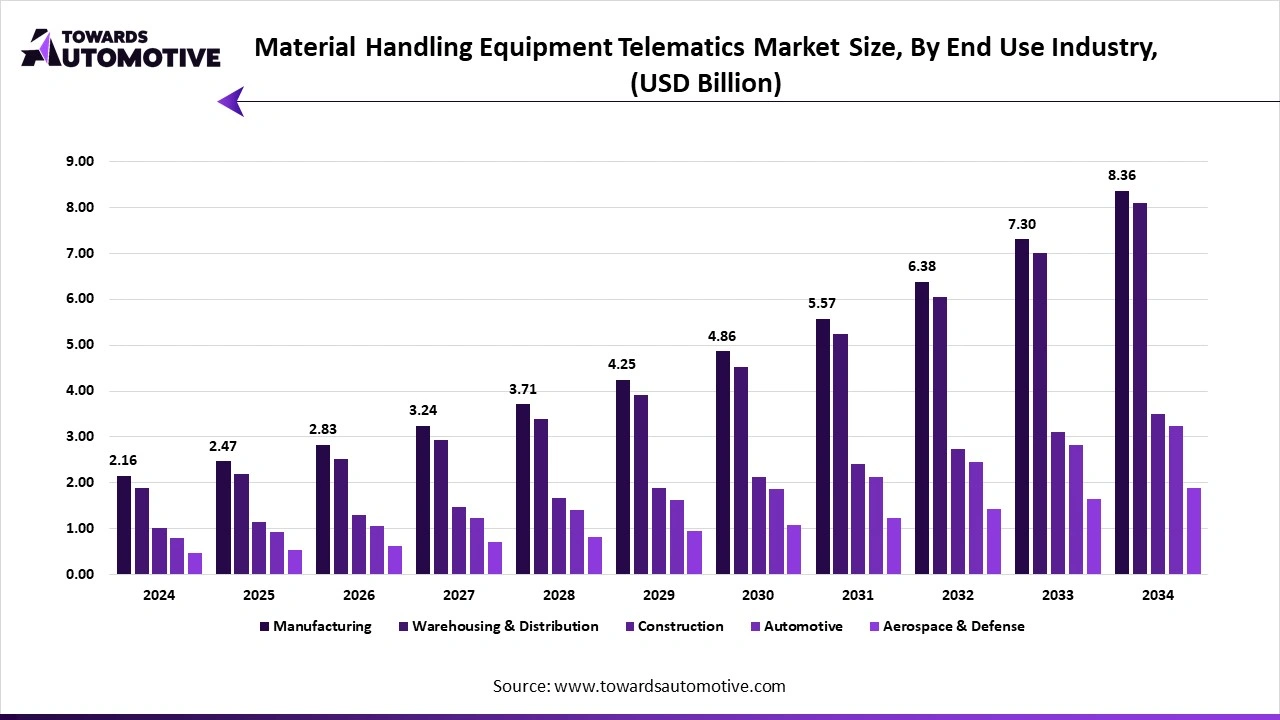

The warehousing & distribution segment dominated the material handling equipment telematics market due to its reliance on material handling equipment to move products quickly and accurately. Given their daily volume and tight delivery schedules, especially in the e-commerce space, they need to understand in real time where their assets are and how they work in the office. Telematics allows them to track the performance of forklifts, AGVs, conveyor systems, and assist in meeting order cut-off times and being able to do this with less confusion. Through telematics, for instance, a manager is able to plan routes in real time, reduce the amount of downtime an asset may incur, and ensure it is operated safely/distinctly in its working life. Due to demand for speed, safety, and efficiency amongst the warehousing and distribution center industry, this segment dominated the material handling equipment telematics market. There is a demand for effective, time-sensitive material handling equipment, which has allowed the warehouse and distribution segment to remain consistently strong in terms of demand.

The automotive segment is expected to grow at the fastest rate in the forecasted period as it is soliciting supporting smart factories, automation, and just-in-time logistics. The latest car and composite manufacturing plants are implementing increasingly complex assembly lines and the highest rates of material flows. This advanced process requires precise timing and minimal delays; thus, telematics systems are beneficial by monitoring assets, forecasting preventative maintenance, and providing insight into maintaining the flow of inputs to assembly. Telematics systems also monitor usage patterns to improve site safety and prevent accidents. In addition, almost every new technology is tested in the automotive industry, including robotics and predictive analytics, and telematics to support these functions. As manufacturers focus on implementing telematics systems to decrease work hours, increase quality, and maximize throughput, the automotive industry will continue to be the fastest-growing segment of the material handling telematics industry.

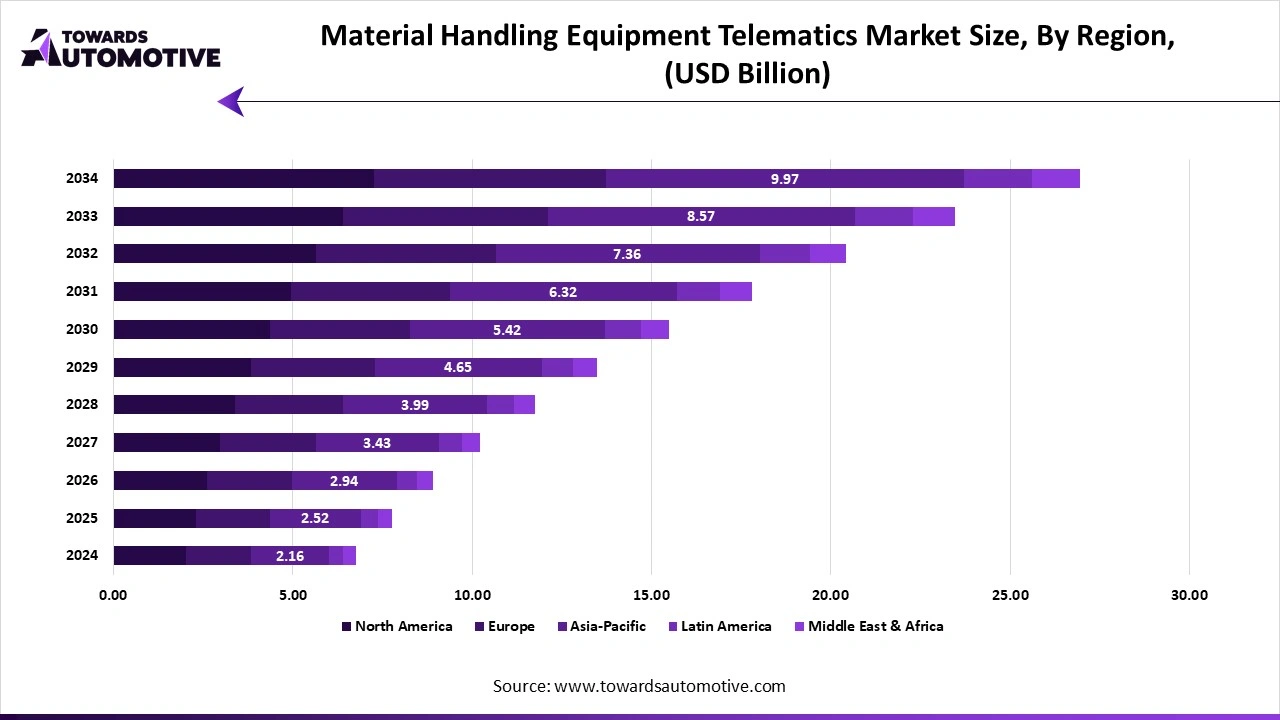

Asia-Pacific dominated the material handling equipment telematics market due to strident industrial developments and strong demand for automation in the warehouse, manufacturing, construction, and automotive industries. Countries such as China, India, South Korea, and Japan are immensely investing in smart warehouses, logistics, and automation. Smart warehouses in the region help implement their automation products to effectively manage the IT infrastructure. Also, with the rapid growth of e-commerce, there is a strong focus on the need for fleet management and predictive maintenance solutions in the growing Asia Pacific telematics market. Moreover, as telematics systems report underutilization of assets, organizations can certainly capitalize and save costs by analyzing them. Basic telematics also help to reduce workplace safety hazards and accidents. Strong areas for opportunities within the Asia Pacific region arise, such as automated guided vehicles and IoT-based systems.

China led the material handling equipment telematics market in the Asia-Pacific region, as it has a large manufacturing and shipping sector. China’s telematics market is underlined by efforts to develop smart factories and warehouses, leading to a significant demand for telematics-enabled equipment, including forklifts and automated vehicles. The Chinese government continues to incentivize industrial digital transformation and industrial automation, helped on through fast-growing investment from businesses to predictable maintenance, monitoring GPS, and improving fleet efficiency. Additionally, with the nation’s deep industrial base and focus on technology, China is a key influence on the growth of the material handling equipment telematics market in the Asia-Pacific region.

North America is the fastest-growing region in the material handling equipment telematics market due to the region’s adoption of advanced technology and automation-centric approach. In North America, logistics, warehousing, and manufacturing companies are leveraging IoT and AI-powered telematics to improve equipment tracking, performance, and availability. Moreover, North America also values the importance of real-time data as applied to predictive maintenance and how it can improve efficiency and cut operational costs. In addition, there is plenty of demand for telematics because of rigorous safety standards and the need for smarter supply chains. Expansion across transportation, automobile, and distribution is also entirely possible because telematics can enhance productivity and dependability in these parts of the economy.

The U.S. leads the North American telematics market. The U.S. has an advanced logistics infrastructure, the ability to adopt and accelerate technology, and a huge logistics sector. Companies in the U.S. utilize telematics for predictive maintenance, fleet management, and real-time monitoring of equipment, including forklift trucks and automated vehicles. The growth of smart warehouses and trends toward automation in the supply chain have also driven significant telematics solutions through high demand. Additionally, rapid growth in e-commerce and most of the U.S. manufacturing also contributed to demand for telematics, where businesses sought to operate more efficiently and provide a safer work environment. With the current investments and adoption of digital transformation, the U.S. continues to be a key country for influencing telematics growth in North America.

| August 2025 | Announcement |

| Sudipto Moitra, General Manager of ICT Enterprise Business, MTN | This partnership marks a bold step forward in redefining enterprise IoT value creation. By combining MTN's vast network infrastructure and deep connectivity expertise with Powerfleet's Unity AIoT data highway and advanced intelligence stack, we're co-creating a next-generation set of solutions that delivers real-time, AI-led data insights across the entire supply chain. |

| June 2025 | Announcement |

| Robert Stobaugh, Chief Operating Officer, GTM, at Samsara. | Fleet leaders today are facing rising operational costs, evolving regulatory standards, and the need for improved safety and sustainability, With this partnership, enterprise and government fleets can unlock data-driven insights to help them more efficiently, safely and cost effectively manage their fleets. |

| May 2025 | Announcement |

| Steve Cheung, Senior Vice President (SVP) – President Asia, China & MEA, Dematic. | Dematic created Silky in response to the increasingly complex sorting demands of the APAC region, Its design combines advanced technology with a deep understanding of industry-specific applications. Our goal was operational efficiency, simplifying the management of intricate order consolidations, batch picking, and significantly enhancing order fulfilment. |

The material handling equipment telematics market is highly competitive. Some of the prominent players in the market are Trimble Inc., ORBCOMM Inc., Teletrac Navman Group, Wenco International Mining Systems, Topcon Positioning Systems, Actsoft, Inc., Geotab Inc., TomTom Telematics, Zonar Systems, Inc., Sierra Wireless, MiX Telematics, Positioning Universal, KeepTruckin, Inc., Samsara Inc., and Hitachi Construction Machinery. Companies in the material handling equipment telematics market are focusing on advanced technology to gain dominance in the market. These companies are utilizing technology to enhance fleet management, predictive maintenance, and detailed inspection services by integrating artificial intelligence (AI), Internet of Things (IoT), and other cloud-based solutions. Moreover, these companies also offer data-driven insights into operations to enhance operational efficiency and minimize downtime. Strong opportunities in the market arise for companies to partner with Original Equipment Manufacturers (OEMs) and third-party service providers to expand their network and services.

Dark warehouses, which operate without human workers and are completely automated, are unlocking opportunities for telematics systems. In a dark warehouse, forklifts, AGVs, and conveyor units are supposed to be working together, and telematics systems are meant to provide real-time status, route plan, monitor performance, and update any performance or notifications to ensure that any operation is completed without stopping. Furthermore, when paired with AI, telematics can detect predicted failures, schedule maintenance and repairs, all while still being able to operate with little to no interruption. This is essential as business interruption in a dark warehouse operation can be expensive. Additionally, as more companies move toward an entirely automated operation, telematics systems could be considered the backbone of equipment management, efficiency, and safety with the establishment of such next-gen facilities.

With new startups entering the telematics market, there are new specifics and combinations of solutions that will look to address specific problems in a warehouse. Many of these focus on low-cost sensor systems, associated cloud dashboards, and analytics supported through AI. They are likely to try to help small businesses implement telematics as a stopgap without spending too much or losing performance. Startups also start off with modular capabilities and can track or monitor in smaller measures, operator behavior, energy use, etc. With e-commerce accelerating and warehouses getting busier every year, flexibility and affordability continue to be in high demand when looking for telematics. Moreover, this is also going to lead to market opportunities for startup solutions for the innovation of predictive maintenance, route optimization, and other data-driven warehouse automation functions.

By Component

By Equipment Type

By Technology

By Application

By End-Use Industry

By Region

October 2025

October 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us