August 2025

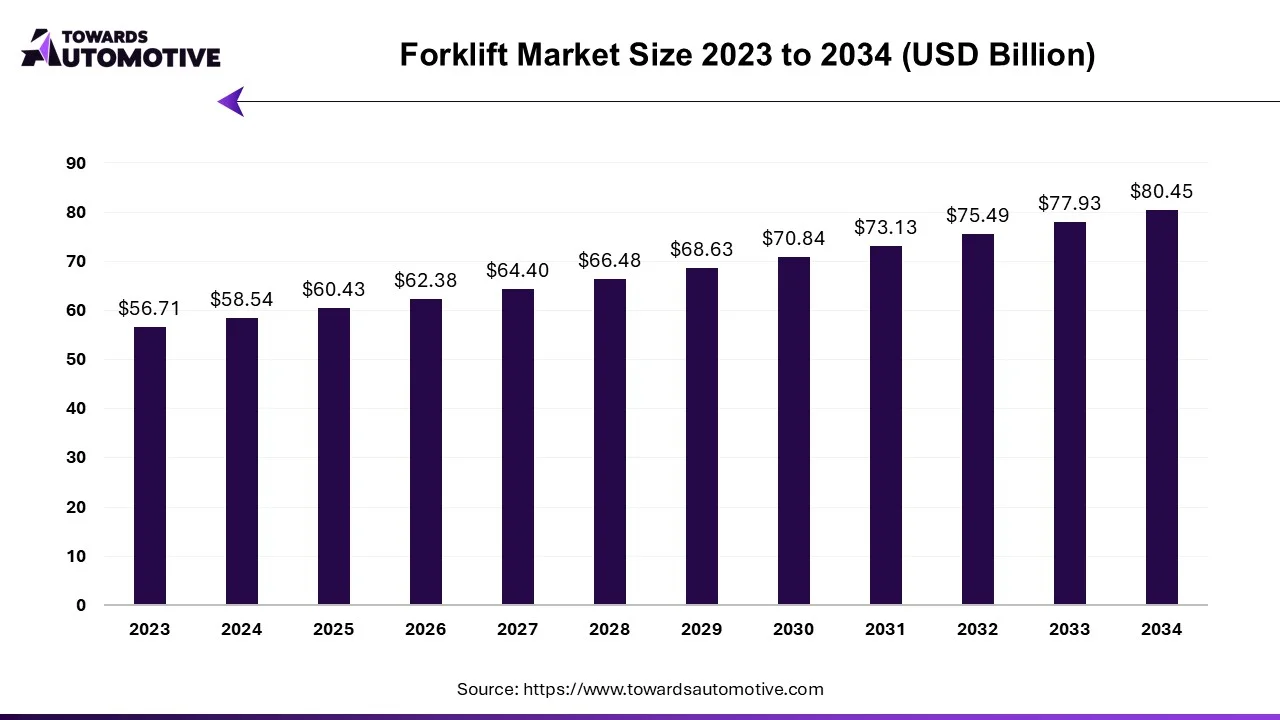

The forklift market is expected to increase from USD 60.43 billion in 2025 to USD 80.45 billion by 2034, growing at a CAGR of 3.23% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

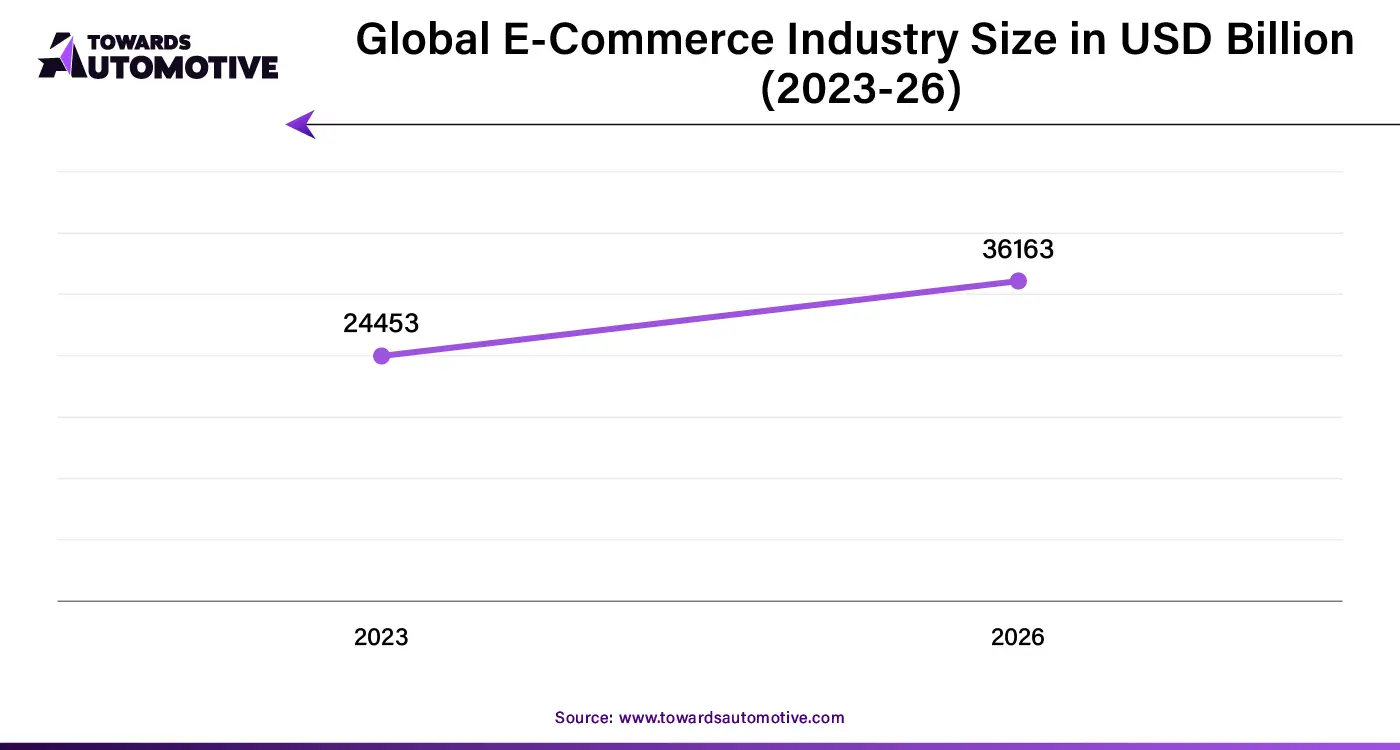

The forklift market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of forklifts across the world. There are several types of forklifts developed in this sector comprising of class 1 forklift, class 2 forklift, class 3 forklift, class 4/5 forklift and some others. These forklifts are powered by ICE engines or electric motors. It finds application in various end-use sectors consisting of industrial, logistics, chemical, food & beverage, and some others. The rising adoption of forklifts in e-commerce sector has driven the market growth. This market is likely to grow significantly with the rise of the battery industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 58.54 Billion |

| Projected Market Size in 2034 | USD 80.45 Billion |

| CAGR (2025 - 2034) | 3.23% |

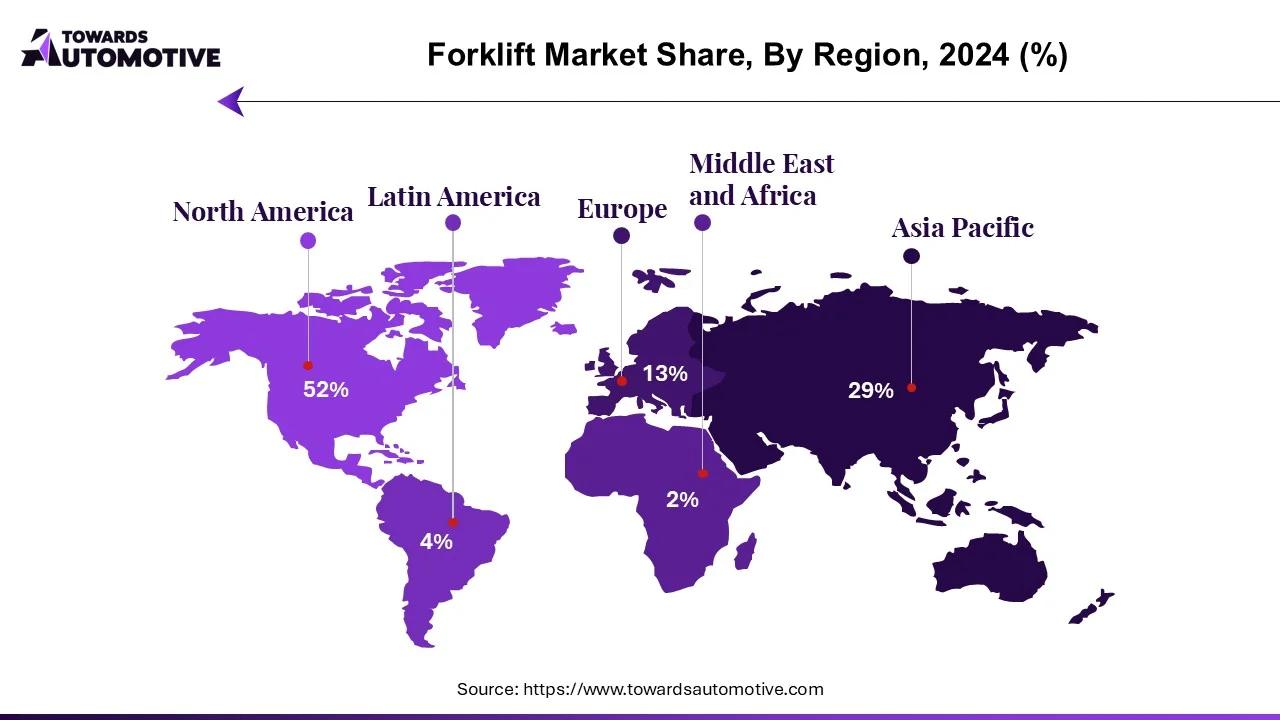

| Leading Region | Asia Pacific |

| Market Segmentation | By Class, By Power Source, By Load Capacity, By Electric Battery Type, By End-Use and By Region |

| Top Key Players | Komatsu Ltd.; Mitsubishi Logisnext Co., Ltd.; Anhui Heli Co., Ltd.; CLARK; Crown Equipment Corporation; Doosan Corporation; Hangcha |

The major trends of forklift market include acquisitions, partnerships, adoption of eco-friendly material handling solutions and technological advancements in forklift tracking.

Numerous market players are partnering with logistics companies to develop advanced forklifts to enhance logistics operations. For instance, in May 2025, EP Equipment partnered with Jungheinrich. This partnership is done for developing an innovate forklift based on lithium-ion battery. (Source: ForkliftAction )

Several forklift manufacturers have started acquiring small companies to enhance the production and development of forklifts. For instance, in September 2024, Wolter Inc acquired Dedicated Material Handling Solutions (DMHS). This acquisition is done with an aim to enhance Wolter’s forklift range across North America. (Source: Wolter)

The manufacturing companies are transitioning rapidly towards eco-friendly material handling solutions due to numerous government regulations related to emission. For instance, in January 2024, Hangcha launched XE Series electric lithium-ion pneumatic forklift. This forklift has a carrying capacity of 4000 lbs. (Source: ForkliftAction)

Various fleet management platforms are developing advanced tracking solutions for managing forklifts. For instance, in April 2025, BlueBotics launched ANT locator. ANT locator is an advanced tracking solution designed for management of manual forklifts. (Source: Robotics and Automation )

The class 3 segment held the largest share of the market. The growing use of class 3 forklifts in warehouses and retail stores has boosted the market expansion. Additionally, the increasing application of these forklifts for transporting palletized loads in short distances is shaping the industry in a positive direction. Moreover, several features of class 3 forklifts such as material handling, loading and unloading, stacking, last-mile inventory management and some others is expected to drive the growth of the forklift market.

The class 1 segment is anticipated to rise with a notable CAGR during the forecast period. The increasing adoption of electric forklifts in several industries such as retail, food and beverage, manufacturing and some others has driven the market growth. Also, numerous partnerships and collaborations among market players for developing class 1 forklifts is likely to shape the industrial landscape. Moreover, numerous advantages of these forklifts including quiet and emission-free operation, indoor versatility, reduced maintenance costs, versatile tire options, ergonomic design and some others is anticipated to foster the growth of the forklift market.

The electric segment dominated this industry. The growing demand for electric forklift from end-users has boosted the market expansion. Additionally, numerous government initiatives aimed at lowering emission along with advancements in battery technology is playing a vital role in shaping the industrial landscape. Moreover, numerous partnerships and collaborations among market players for developing advanced electric forklifts is likely to drive the growth of the forklift market.

The ICE segment is predicted to rise with a considerable CAGR during the forecast period. The increasing adoption of traditional forklifts for operating heavy-duty applications has boosted the market expansion. Also, the advancements in ICE technology along with several problems associated with battery systems is contributing to the overall industrial growth. Additionally, rapid investment by market players for developing ICE-based forklifts is anticipated to boost the growth of the forklift market.

The industrial segment led the industry. The growing adoption of electric forklifts in heavy-duty industries has boosted the market growth. Additionally, the rising use of forklifts for operating several applications such as moving raw materials, transporting intermediate products, conveying finished goods and some others is playing a vital role in shaping the industrial landscape. Moreover, technological advancements in forklift industry coupled with launches of several forklifts designed for industrial operations is likely to boost the growth of the forklift market.

The retail & e-commerce segment is projected to grow with a significant growth rate during the forecast period. The growing adoption of advanced forklifts in retail industry for numerous applications has boosted the market growth. Also, the rapid development in the e-commerce sector has increased the demand for forklifts, thereby driving the industrial expansion. Moreover, numerous partnerships among e-commerce companies and forklift manufacturers is likely to drive the growth of the forklift market.

Asia Pacific held the largest share of the forklift market. The rising development in the e-commerce sector in several countries such as India, China, Japan and some others has increased the demand for forklifts, thereby driving the market expansion. Also, technological advancements in battery manufacturing sector coupled with rapid adoption of warehouse automation is further adding to the industrial growth. Moreover, the presence of several forklift companies such as Mitsubishi Logisnext Co., Ltd., Toyota Material Handling, Komatsu Limited and some others is expected to boost the growth of the forklift market in this region.

North America is expected to grow with a significant CAGR during the forecast period. The rising adoption of electric forklift in numerous industries such as e-commerce, retail, food and beverage, chemicals and some others has boosted the market growth. Also, the growing demand for sustainable material handling solutions along with rise in number of warehouses in the U.S. and Canada has further added to the industrial expansion. Moreover, the presence of various market players such as Raymond Corporation, Caterpillar Inc., Crown Equipment Corporation and some others is anticipated to drive the growth of the forklift market in this region.

U.S. is the major contributor in this region. The growing demand for advanced material handling equipment in the e-commerce sector along with rapid adoption of autonomous forklifts in industrial sector has boosted the market growth.

The forklift market is a highly competitive industry with the presence of a several dominating players. Some of the prominent companies in this industry consists of Komatsu Ltd.; Mitsubishi Logisnext Co., Ltd.; Anhui Heli Co., Ltd.; CLARK; Crown Equipment Corporation; Doosan Corporation; Hangcha; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; KION Group AG; Toyota Material Handling and some others. These companies are constantly engaged in developing forklifts and adopting numerous strategies such as launches, partnerships, joint ventures, business expansions, collaborations, acquisitions and some others to maintain their dominance in this market.

By Class

By Power Source

By Load Capacity

By Electric Battery Type

By End-Use

By Region

August 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us