August 2025

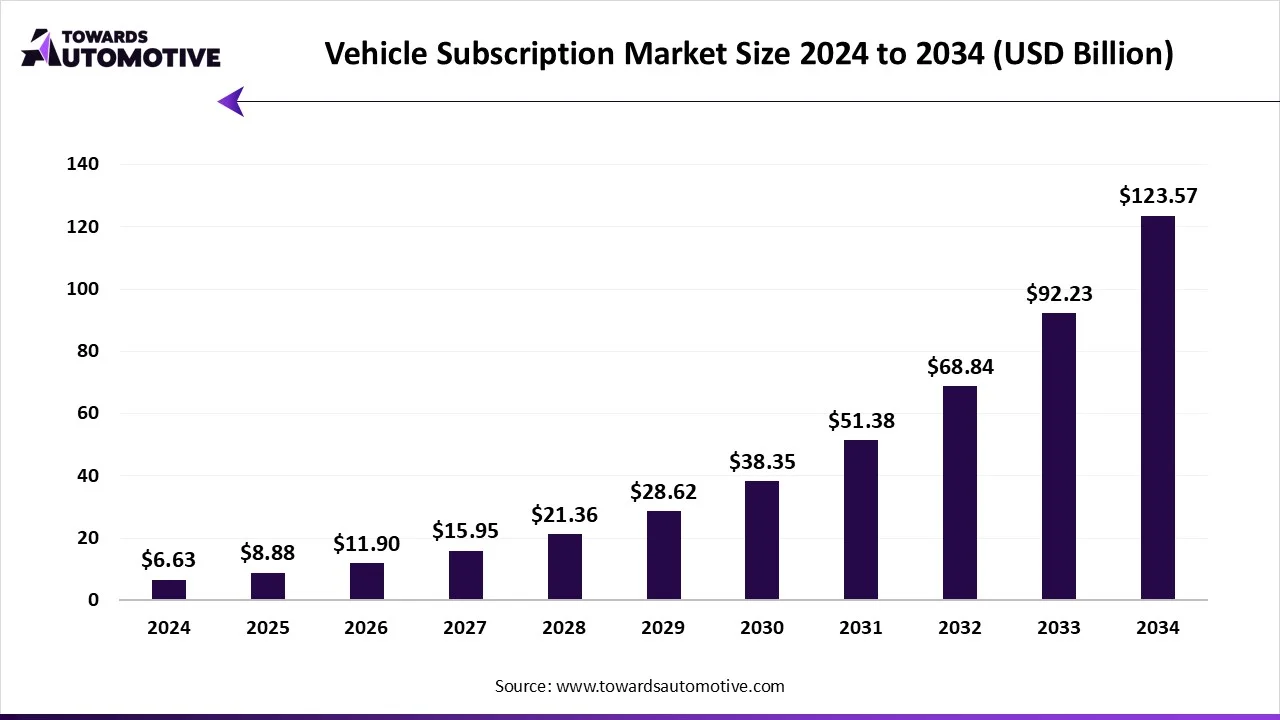

The vehicle subscription market is forecasted to expand from USD 8.88 billion in 2025 to USD 123.57 billion by 2034, growing at a CAGR of 33.98% from 2025 to 2034. The increasing demand for vehicle rental services in developed nations along with rapid investment by automotive companies for providing EV-based subscription services has driven the market expansion.

Additionally, the growing preference of middle-class people to rent car for short-term basis coupled with rising adoption of autonomous vehicles by fleet operators to enhance ride-hailing operations is playing a vital role in shaping the industrial landscape. The integration of advanced telematics solutions in fleet management platforms is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The vehicle subscription market is a crucial sector of the rental services industry. This industry deals in providing car subscription services around the world. There are several types of subscription services provided by this sector consisting of single-brand subscription and multi-brand subscription. These services are operated using different types of vehicles comprising of passenger cars, SUVs, pickup trucks, luxury/premium vehicles, electric vehicles (EVs) and some others. The end-users of these services consist of individuals and fleet consumers. This market is expected to rise significantly with the growth of the automotive sector in different parts of the globe.

The major trends in this market consists of partnerships, launches and popularity of flexible car subscription services.

The single-brand subscription segment led the vehicle subscription market with a share of around 55%. The increasing demand for single-brand car subscription services among middle-class population has driven the market expansion. Also, the cost-effectiveness and easy finance options to adopt single-brand vehicle subscription services is playing a vital role in shaping the industrial landscape. Moreover, the numerous advantages of these services including flexibility, tax rebate, budget-friendly and some others is expected to boost the growth of the vehicle subscription market.

The multi-brand subscription segment is expected to rise with the highest CAGR during the forecast period. The increasing adoption of multi-brand car subscription services by fleet operators has driven the market growth. Additionally, the growing demand for these subscription services by individual owners to enhance their driving habits is contributing to the industry in a positive manner. Moreover, numerous benefits of multi-brand car subscription services including affordability, enhanced accessibility, superior flexibility and some others is expected to drive the growth of the vehicle subscription market.

The passenger cars segment dominated the vehicle subscription industry with a share of around 45%. The growing demand for luxury cars from HNIs in developed nations such as Germany, UK, the U.S., Canada and some others has driven the market expansion. Additionally, the increasing emphasis of middle-class consumers to opt for car subscription services is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by automotive brands for launching new vehicle subscription services is expected to drive the growth of the vehicle subscription market.

The electric vehicles (EVs) segment is expected to rise with the fastest CAGR during the forecast period. The growing adoption of electric vehicles in different parts of the world for lowering vehicular emission has driven the market growth. Also, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rise in number of EV startups is contributing to the industry in a positive direction. Moreover, the increasing consumer preference to adopt EV rental services is expected to propel the growth of the vehicle subscription market.

The mid-term (6–12 Months) segment dominated the vehicle subscription market with a share of 40%. The growing adoption of mid-term car rental services by fleet operators due to its cost-effectiveness and flexibility has driven the market expansion. Also, the increasing demand for mid-term vehicle subscription services among middle-class individuals is playing a crucial role in shaping the industrial landscape. Moreover, rapid investment by automotive companies for launching mid-term car subscription services is expected to propel the growth of the vehicle subscription market.

The short-term (≤6 Months) segment is expected to rise with the fastest CAGR during the forecast period. The increasing adoption of short-term vehicle subscription services by foreigners has boosted the market expansion. Additionally, the growing demand for these services among adventure travelers is contributing to the industry in a positive manner. Moreover, increasing emphasis of luxury car brands to launch short-term car rental services is expected to drive the growth of the vehicle subscription market.

The individuals segment led the vehicle subscription market with a share of around 65%. The growing adoption of car rental services by individual consumers has driven the market growth. Additionally, the increasing emphasis of automotive brands to launch monthly car subscription plans for individual consumers is playing a vital role in shaping the industrial landscape. Moreover, the rapid adoption of luxury EVs by elite-class consumers is expected to boost the growth of the vehicle subscription market.

The corporate / fleet customers segment is expected to grow with the highest CAGR during the forecast period. The rising adoption of car subscription services by fleet operators to gain maximum profits has driven the market expansion. Additionally, the growing emphasis of ride-sharing companies for adopting EV car rental services is contributing to the industry in a positive manner. Moreover, partnerships among fleet owners and automotive companies to deploy rental cars is expected to drive the growth of the vehicle subscription market.

The OEMs segment dominated the vehicle subscription market with a share of around 50%. The growing emphasis of automotive brands to provide car subscription services has driven the market expansion. Additionally, rapid investment by car manufacturing companies for opening up car rental outlets in developing nations is contributing to the industry in a positive manner. Moreover, partnerships among automotive OEMs and NBFCs to provide suitable loan options for adoption subscription-based vehicles is expected to drive the growth of the vehicle subscription market.

The third-party aggregators & mobility startups segment is expected to rise with the highest CAGR during the forecast period. The growing focus of mobility startup companies for providing short-term car rental service to individuals has driven the market expansion. Additionally, rise in number of car leasing brands in developing nations coupled with availability of rental cars in online platforms is playing a crucial role in shaping the industrial landscape. Moreover, rapid investment by third-party aggregators for purchasing electric vehicles to cater the needs of eco-friendly consumers is expected to propel the growth of the vehicle subscription market.

North America dominated the vehicle subscription market with a share of around 40%. The growing popularity of luxury cars in the U.S. and Canada has driven the market expansion. Additionally, numerous government initiatives aimed at enhancing EV adoption rates along with rapid adoption of short-term car subscription services by individuals is playing a crucial role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Teslarents, Thrifty, Alamo Group Inc. and some others is expected to drive the growth of the vehicle subscription market in this region.

U.S. led the market in this region. The increasing adoption of hybrid vehicles along with rapid investment by automotive brands for opening up new outlets has played a crucial role in shaping the industrial landscape. Moreover, the growing popularity of short-term car subscription services is contributing to the industry in a positive manner.

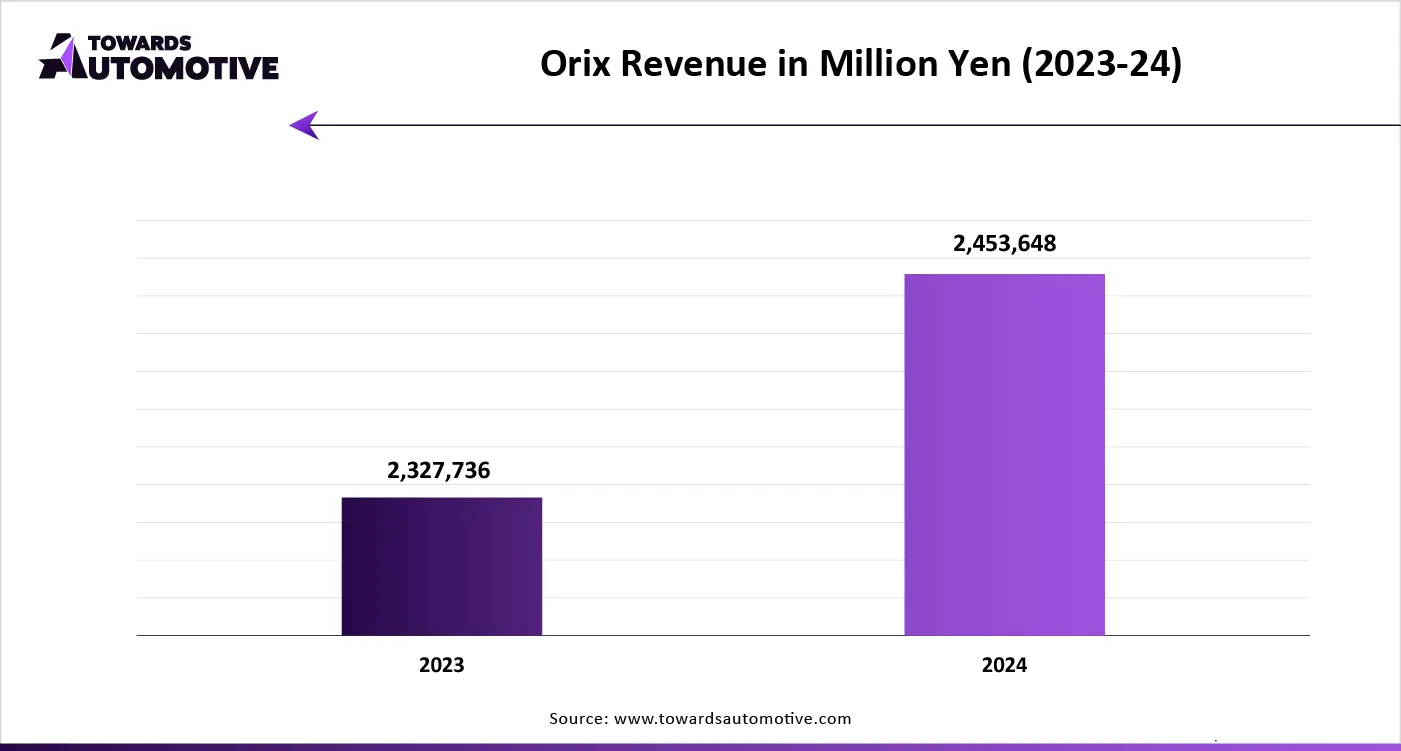

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The rising adoption of mid-term car leasing services in several countries such as India, China, Japan, South Korea and some others has driven the market growth. Also, increasing emphasis of automotive brands to launch long-term car subscription services coupled with availability of car rental platforms in Play Store and Apps Store is contributing to the industry in a positive direction. Moreover, the presence of various market players such as Maruti Suzuki India Limited, Orix, Zoom Car and some others is expected to boost the growth of the vehicle subscription market in this region.

China and India are the major contributors in this region. In China, the market is generally driven by the increasing adoption of car rental services by foreign tourists. In India, the rising consumer interest to adopt multi-brand vehicle subscription services along with presence of numerous third-party rental providers is playing a vital role in shaping the industrial landscape.

The vehicle subscription market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of FINN; ORIX; Volkswagen AG; Roam; Sixt; Carvolution; Mercedes-Benz Mobility; TeslaRents; Maruti Suzuki India Limited; and some others. These companies are constantly engaged in providing vehicle subscription services and adopting numerous strategies such as partnerships, acquisitions, collaborations, joint ventures, launches, business expansions and some others to maintain their dominance in this industry.

By Subscription Type

By Vehicle Type

By Subscription Duration

By End-User

By Distribution Channel

By Region

August 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us