October 2025

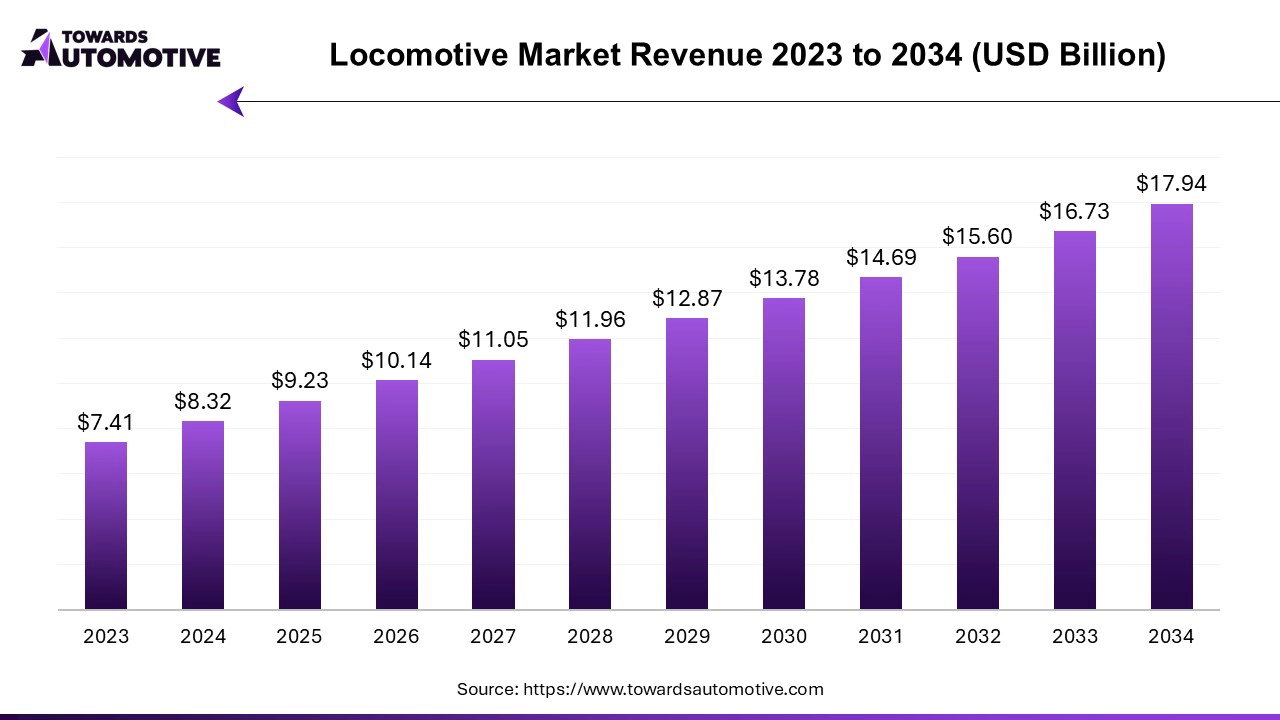

The locomotive market is expected to increase from USD 9.23 billion in 2025 to USD 17.94 billion by 2034, growing at a CAGR of 7.23% throughout the forecast period from 2025 to 2034. The growing adoption of passenger trains in developing nations along with numerous government initiatives aimed at developing the railway sector is playing a vital role in shaping the industrial landscape.

Additionally, technological advancements in the railway industry coupled with rapid expansion of the logistics sector has contributed drastically to the market expansion. The rising emphasis on developing bullet trains and constant research and development activities related to hydrogen-powered trains is expected to create ample growth opportunities for the market players in the upcoming days.

The locomotive market is a crucial sector of the railways industry. This industry deals in development and distribution of locomotives in different parts of the world. There are different types of locomotives developed in this sector comprising of diesel locomotives, electric locomotives and some others. These locomotives consist of several components including rectifier, inverter, traction motors, alternator, auxiliary power unit and some others. The end-user of this sector comprises of freight, passengers, switchers and some others. This market is expected to rise significantly with the rise of the transportation and logistics sector around the globe.

The major trends in this market consists of partnerships, government initiatives and integration of AI in modern trains.

The locomotive companies have started integrating AI in modern trains to detect hazards in real time, monitor worker safety, predicting high-risk situations and some others.

The electric segment dominated the market. The growing demand for electric trains in developed nations such as the U.S., China, Japan and some others with an aim at reducing locomotive emission has boosted the market expansion. Additionally, rapid investment by government of several countries to deploy electric trains in their fleets coupled with rise in number of electric locomotive projects is playing a prominent role in shaping the industrial landscape. Moreover, collaborations among train operators and locomotive companies to develop electric trains is expected to boost the growth of the locomotive market.

The diesel-type segment is expected to expand with a considerable CAGR during the forecast period. The rising deployment of high-speed trains in several countries such as Japan, China, Singapore and some others is driving the market growth. Also, the growing demand for diesel-powered locomotives from the logistics sector to enhance transportation of goods is contributing to the industry in a positive direction. Moreover, numerous advantages of these locomotives including versatility, reliability, efficiency and some others is expected to drive the growth of the locomotive market.

The IGBT module segment held the largest share of the market. The increasing demand for efficient and reliable power electronics solutions in modern rail transportation for several functions such as traction, propulsion, control systems and some others has boosted the market growth. Additionally, numerous advantages of IGBT modules including high voltage and current handling, high efficiency, fast switching speed, modular design and some others is expected to boost the growth of the locomotive market.

The SiCpower module segment is expected to grow with the highest CAGR during the forecast period. The increasing demand for lightweight traction converters in locomotives to improve efficiency and deliver high power has driven the market expansion. Also, the rising application of SiCpower module in high-speed trains such as the Shinkansen and freight locomotives such as Dragon 2 is expected to propel the growth of the locomotive market.

The passenger segment dominated the market. The rising consumer interest to adopt local passenger trains due to low ticket costs as compared to other modes of transportation has boosted the market expansion. Additionally, rapid investment by market players for developing high-capacity locomotives to deliver superior power in passenger trains coupled with technological advancements in the locomotive manufacturing sector is contributing to the industry in a positive direction. Moreover, the growing adoption of high-speed passenger trains for travelling long-distances is expected to drive the growth of the locomotive market.

The freight segment is expected to rise with a considerable CAGR during the forecast period. The rising emphasis on deploying electric trains for transporting goods from city to another has driven the market growth. Also, numerous government initiatives aimed at developing new freight corridors to enhance freight railways in developing nations is contributing significantly to the industry. Moreover, collaborations among train companies and freight operators to develop powerful locomotives for freight trains is expected to foster the growth of the locomotive market.

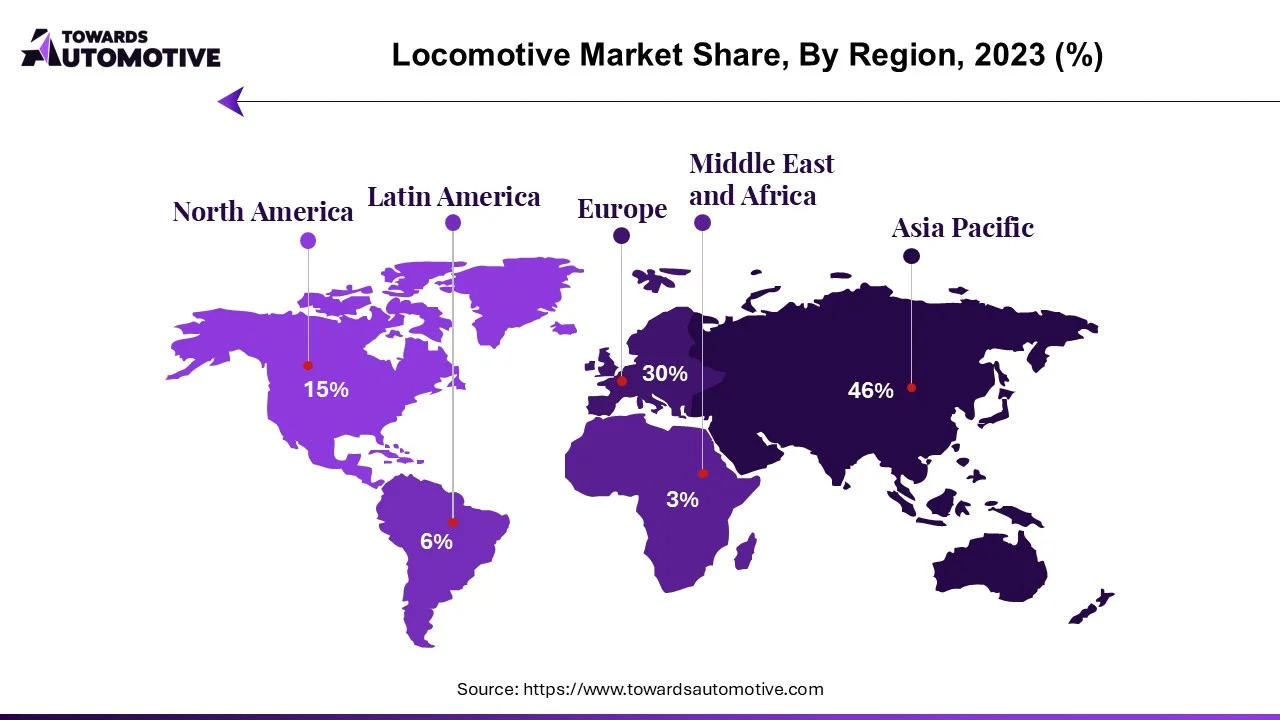

North America led the locomotive market. The growing demand for sustainable transportation solutions in the U.S. and Canada to reduce emission has boosted the market growth. Additionally, numerous government initiatives aimed at strengthening the railway infrastructure coupled with rapid adoption of railways by logistics sector to transport goods from one region to another is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Wabtec Corporation, Bombardier Inc, General Electric Company, Republic Locomotive and some others is expected to drive the growth of the locomotive market in this region.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The growing adoption of electric locomotives in several countries such as India, Singapore, Australia and some others has boosted the market expansion. Additionally, rapid investment by government of several countries such as China and Japan for strengthening the bullet train infrastructure is crucial for the industrial growth. Moreover, the presence of various market players such as Toshiba Corporation, Hyundai Rotem Company, Kawasaki Heavy Industries, Ltd. and some others is expected to foster the growth of the locomotive market in this region.

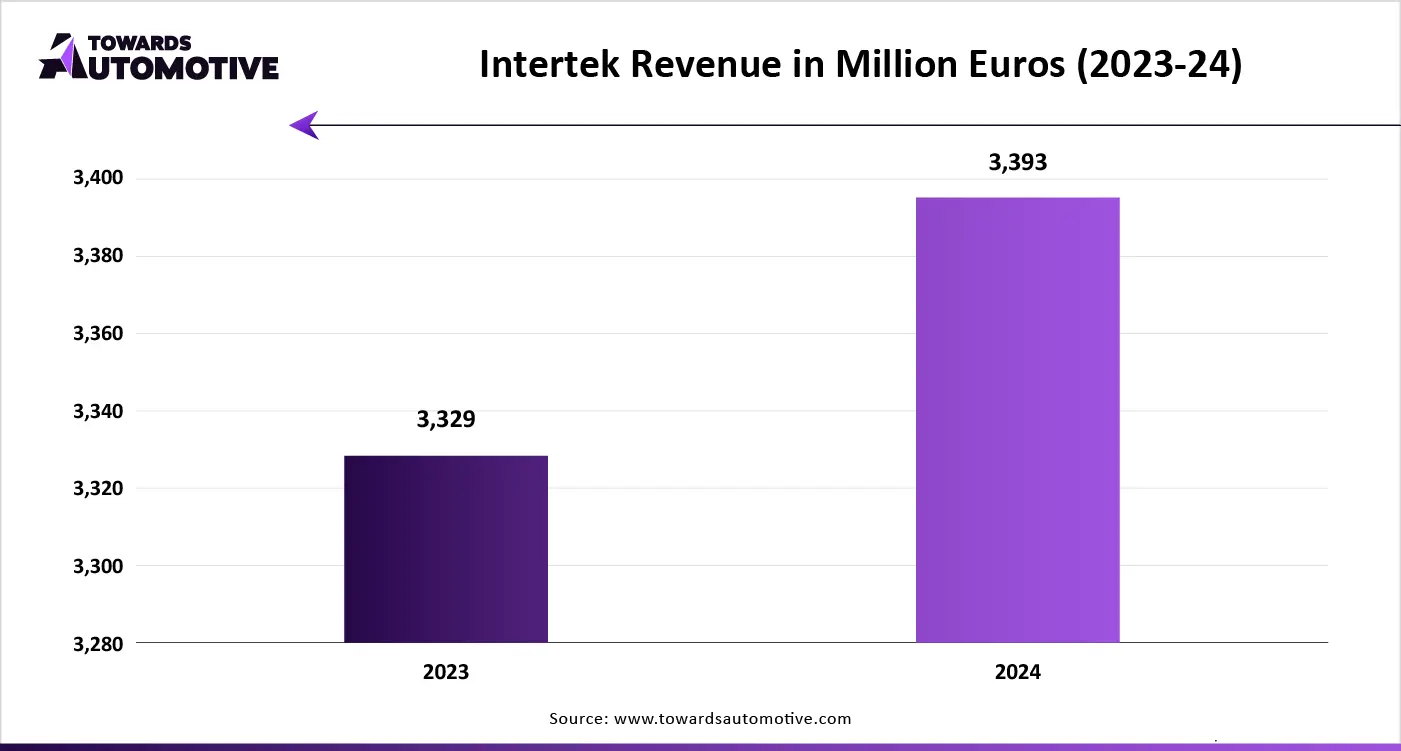

The locomotive market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Siemens AG; Strukton; Toshiba Corporation; AEG Power Solutions B.V.; Alstom; Bharat Heavy Electricals Limited; CRRC Corporation Limited; Hitachi, Ltd.; Mitsubishi Heavy Industries, Ltd.; Wabtec Corporation and some others. These companies are constantly engaged in developing locomotives and adopting numerous strategies such as launches, partnerships, joint ventures, collaborations, business expansions, acquisitions, and some others to maintain their dominance in this industry.

By Type

By Technology

By Component

By End-Use

By Region

October 2025

September 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us