October 2025

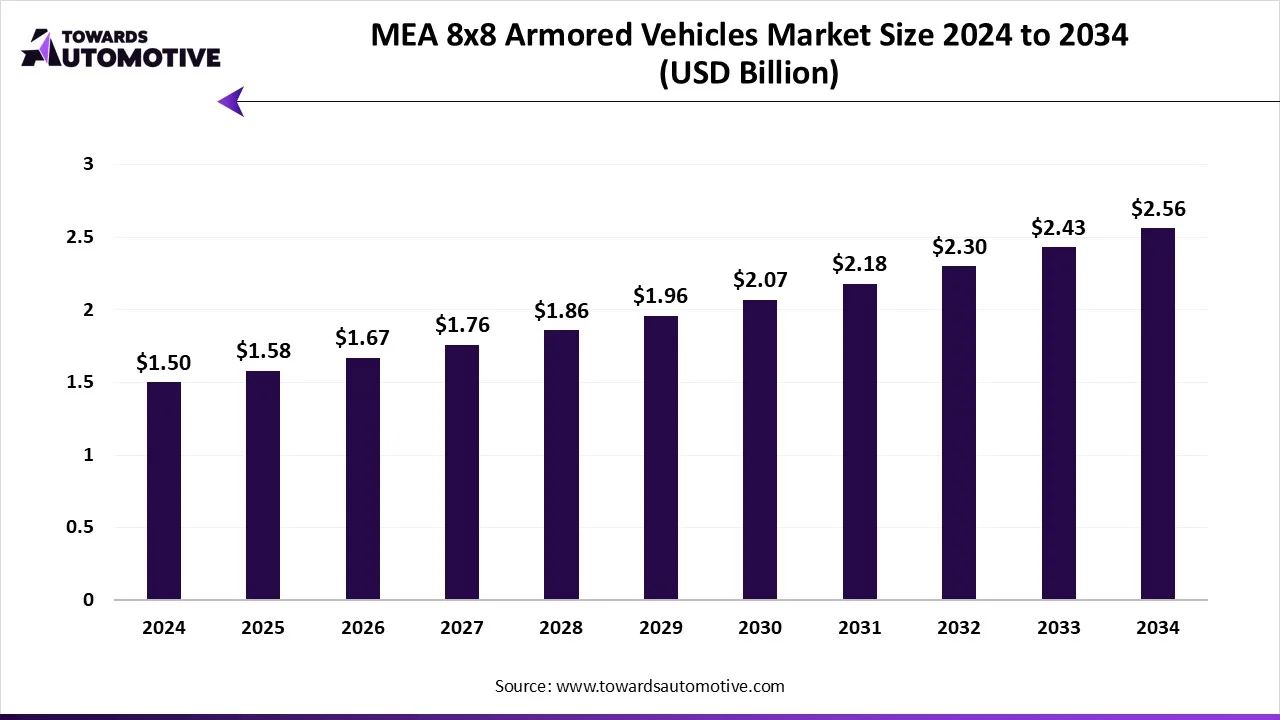

The MEA 8x8 armored vehicles market is projected to reach USD 2.56 billion by 2034, growing from USD 1.58 billion in 2025, at a CAGR of 5.5% during the forecast period from 2025 to 2034. The growing focus of defense companies on developing high-end 8*8 vehicles coupled with integration of advanced technologies in armored vehicles has boosted the market expansion.

Also, rapid investment by government for strengthening the military sector along with rising cases of military tensions in the African region is playing a prominent role in shaping the industrial landscape. The increasing emphasis of automobile companies for developing electric-based 8*8 armored vehicles is expected to create ample growth opportunities for the market players in the upcoming years.

The 8x8 armored vehicle is as a highly protected military vehicle that is powered by eight wheels. There are several types of 8x8 armored vehicles available in the market consisting of armored personnel carrier (APC), infantry fighting vehicle (IFV), reconnaissance / surveillance vehicle, command & control vehicle, armored ambulance / MEDEVAC, engineering / recovery vehicle, mortar / fire-support carrier, air-defense carrier, anti-tank missile carrier, electronic warfare / CBRN vehicle, logistics / cargo armored truck and some others. These vehicles are powered by different propulsion technologies such as diesel, hybrid-electric, fully-electric and some others. The end-users of these vehicles comprise of army /ground forces, paramilitary / internal security, police / gendarmerie, peacekeeping / multinational forces and some others. The rapid expansion of the aerospace and defense industry is expected to drive the growth of the 8x8 armored vehicle market in MEA region.

The major trends in this market consists of government investment, partnerships, business expansions.

The armored personnel carrier (APC) segment held the largest share of the market with 32%. The increasing sales of armored personnel carrier (APC) in the Middle East region for transporting personnel and equipment in warfare zones has boosted the market expansion. Also, rapid investment by government for deploying armored personnel carrier (APC) in the defense sector is playing a crucial role in shaping the industrial landscape. Moreover, the growing demand for next-gen military vehicles in the African region is expected to proliferate the growth of the MEA 8x8 armored vehicles market

The infantry fighting vehicle (IFV) segment is expected to grow with the highest CAGR during the forecast period. The demand for infantry fighting vehicles (IFVs) has increased from the defense sector due to increasing geopolitical instability in the Middle East region, thereby driving the market expansion. Additionally, rapid adoption of hybrid infantry fighting vehicles (IFV) by the paramilitary forces is playing a vital role in shaping the industry in a positive direction. Moreover, the rising investment by defense companies for developing a wide-range of infantry fighting vehicles (IFV) is expected to drive the growth of the MEA 8x8 armored vehicles market.

The medium (STANAG 3) segment led the market with a share of around 45%. The increasing focus of automotive brands for developing STANAGE 3 compliant vehicles to cater the needs of defense sector has boosted the market growth. Also, the rapid deployment of STANAGE 3 armored vehicles by the paramilitary forces of GCC region is expected to drive the growth of the MEA 8x8 armored vehicles market.

The heavy (STANAG 4–5) segment is expected to rise with the fastest CAGR during the forecast period. The growing use of STANAG 4–5 armored vehicles by military forces due to their ability for providing ballistic protection against artillery and blasts has boosted the market expansion. Additionally, rapid investment by government of Middle East countries for deploying highly protective vehicles in the defense sector is expected to boost the growth of the MEA 8x8 armored vehicles market.

The high-mobility off-road segment led the market with a share of around 40%. The growing use of cargo armored trucks in hilly terrains and remote areas due to their enhanced off-roading capabilities has driven the market expansion. Additionally, the deployment of 8*8 armored vehicles in warfare zones to help armed forces in travelling tough regions is expected to propel the growth of the MEA 8x8 armored vehicles market.

The amphibious segment is expected to grow with the fastest CAGR during the forecast period. The growing use of 8x8 amphibious vehicles for disaster relief operations in the African region has bolstered the market growth. Moreover, the rapid deployment of these vehicles by naval forces to conduct patrols, and enhancing recovery missions us expected to drive the growth of the MEA 8x8 armored vehicles market.

The light RWS (≤12.7 mm MG) segment led the market with a share of around 38%. The growing use of remotely operated light or medium-caliber weapon system by armed forces for fighting potential enemies has boosted the market growth. Additionally, rapid investment by market players for developing light RWS systems is expected to propel the growth of the MEA 8x8 armored vehicles market.

The medium cannon (25–40 mm) segment is expected to rise with the highest CAGR during the forecast period. The rising use of medium caliber ammunition by defense forces in developed nations has boosted the market growth. Also, the integration of medium cannon (25–40 mm) in modern tanks is expected to foster the growth of the MEA 8x8 armored vehicles market.

The medium (12–20 t) segment led the 8*8 armored vehicles market with a share of around 50%. The growing use of medium 12-20 tons armored vehicles in disaster management operations for delivering essential goods to the victims has boosted the market expansion. Also, rapid investment by market players for opening up new production centers in the African region to increase the production of medium-duty armored vehicles is expected to foster the growth of the MEA 8x8 armored vehicles market.

The heavy (20–30 t) segment is expected to grow with the fastest CAGR during the forecast period. The increasing demand for heavy-duty armored vehicles from the defense forces to carry large amount ammunitions and personnel in warfare zones has driven the market growth. Additionally, rapid deployment of armored tankers by government organizations for protecting the border areas is expected to propel the growth of the MEA 8x8 armored vehicles market.

The diesel internal combustion engine (ICE) segment dominated the market with a share of around 72%. The increasing demand for diesel-powered armored vehicles in several countries including UAE, Saudi Arabia, Morocco, Qatar and some others has boosted the market growth. Also, rapid investment by automotive companies for developing high-quality diesel engines to cater the needs of armored vehicles is playing a crucial role in shaping the industrial landscape. Moreover, numerous advantages of diesel internal combustion engine (ICE) such as high efficiency and torque, compact design and high power-to-weight ratio, enhanced reliability and durability, and some others is expected to drive the growth of the MEA 8x8 armored vehicles market.

The hybrid-electric segment is expected to rise with the fastest CAGR during the forecast period. The growing emphasis of automotive companies for developing hybrid armored vehicles to cater the needs of the military sector has boosted the market expansion. Additionally, the rising emphasis of powertrain manufacturers to develop advanced hybrid-powertrains for armored vehicles is contributing to the industry in a positive manner. Moreover, numerous benefits of hybrid-electric technology such as reduced carbon emissions, improved fuel efficiency, lower maintenance costs and some others is expected to propel the growth of the MEA 8x8 armored vehicles market.

The independent suspension segment led the market with a share of around 55%. The rising use of independent suspension systems in armored personnel carrier (APC) and infantry fighting vehicle (IFV) for enhancing off-roading capabilities has boosted the market growth. Additionally, numerous benefits of these suspension systems including improved stability & control, better safety & braking, superior maneuverability and some others is expected to propel the growth of the MEA 8x8 armored vehicles market.

The hydropneumatics suspension segment is expected to grow with the fastest CAGR during the forecast period. The increasing use of hydropneumatic suspension in modern tanks and other large armored vehicles due to their enhanced impact absorption capability has boosted the market growth. Also, partnerships among suspension manufacturers and defense companies to develop high-quality hydropneumatics suspension systems for 8*8 vehicles is expected to accelerate the growth of the MEA 8x8 armored vehicles market.

The direct import (foreign OEM supply) segment led the market with a share of around 48%. The growing focus of government in several countries such as Morocco, Qatar, Kuwait and some others for importing high-quality 8*8 armored vehicles to enhance their defense capabilities has bolstered the market growth. Additionally, partnerships among international automotive companies and defense organizations to supply armored vehicles in different countries is expected to drive the growth of the MEA 8x8 armored vehicles market.

The licensed production / JV (local assembly) segment is expected to rise with the highest CAGR during the forecast period. The rising investment by automotive in numerous countries such as UAE, Saudi Arabia, South Africa and some others for opening up new production facilities to increase the production of armored vehicles is expected to propel the growth of the MEA 8x8 armored vehicles market. Additionally, collaborations among government organizations and defense companies for manufacturing wide range of armored vehicles is expected to propel the growth of the MEA 8x8 armored vehicles market.

The new build (OEM) segment dominated the industry with a share of around 63%. The rising investment by military organizations of developed nations such as UAE, Saudi Arabia, South Africa and some others for deploying newly developed armored vehicles to provide enhanced protection against potential threats has driven the market expansion. Additionally, collaborations among automotive brands and defense organizations for developing high-end 8*8 armored vehicles is expected to proliferate the growth of the MEA 8x8 armored vehicles market.

The upgrade / modernization segment is expected to rise with the fastest CAGR during the forecast period. The growing focus of mid-income countries of MEA region to upgrade their armored vehicles with modern hardware and software to enhance defense capabilities has boosted the market growth. Moreover, rapid investment by defense companies for opening up armored vehicles refurbishment centers in the African region is expected to drive the growth of the MEA 8x8 armored vehicles market.

The basic (standard comms) segment led the market with a share of around 52%. The rising emphasis of automotive brands for integrating basic features in armored vehicles to operate in tough conditions has boosted the market growth. Also, the growing use of night vision & cameras in infantry fighting vehicle (IFV) and reconnaissance / surveillance vehicle for identifying threats is expected to drive the growth of the MEA 8x8 armored vehicles market.

The network-enabled (BMS + optronics) segment is expected to grow with the highest CAGR during the forecast period. The growing integration of BMS + optronics systems in armored vehicles for enhancing surveillance operations has boosted the market growth. Additionally, technological advancements in optronics systems is expected to propel the growth of the MEA 8x8 armored vehicles market.

The mid-tier balanced segment led the market with a share of around 50%. The growing use of mid-tier balanced armored vehicles in the desert areas for patrolling purposes has boosted the market growth. Additionally, the cost-effectiveness and less maintenance of mid-segment armored vehicles makes it suitable for underdeveloped countries, thereby driving the growth of the MEA 8x8 armored vehicles market.

The high-end advanced segment is expected to rise with the highest CAGR during the forecast period. The growing adoption of high-end armored vehicles by armed forces of several developed nations such as UAE, Qatar, South Africa and some others has driven the market expansion. Also, rapid investment by automotive brands for developing high-end 8*8 vehicles is expected to boost the growth of the MEA 8x8 armored vehicles market.

The desert-optimized segment led the industry with a share of around 37%. The growing emphasis of automotive companies for developing high-end armored vehicles by operating in desert areas has driven the market expansion. Additionally, rapid investment by government organizations for deploying advanced 8*8 vehicles for enhancing desert patrolling is expected to foster the growth of the MEA 8x8 armored vehicles market.

The urban-optimized segment is expected to grow with the highest CAGR during the forecast period. The increasing adoption of high-end armored vehicles by police forces to enhance patrolling activities in urban areas has boosted the market growth. Also, the growing focus of automotive companies to develop high-end armored vehicles for enhancing disaster management capabilities is expected to boost the growth of the MEA 8x8 armored vehicles market.

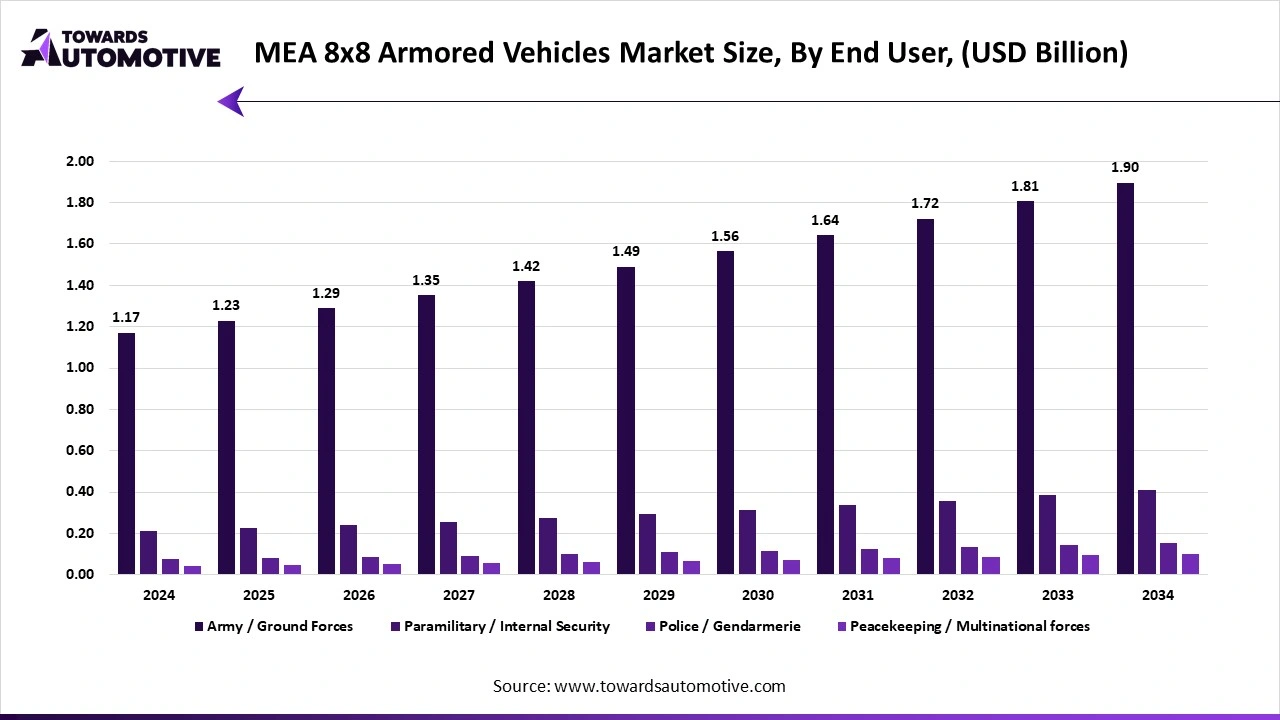

The army / ground forces segment led the market with a share of around 58%. The growing investment by government for deploying advanced armed forces in border areas of MEA region has boosted the market expansion. Additionally, the rapid adoption of electric 8*8 vehicles by ground forces to reduce vehicular emission is playing a prominent role in shaping the industrial landscape. Moreover, the rising investment by market players for developing high-quality armored vehicles for the army is expected to boost the growth of the MEA 8x8 armored vehicles market.

The paramilitary / internal security segment is expected to grow with the highest CAGR during the forecast period.

The rising defense expenditure by government of several countries such as South Africa, UAE, Saudi Arabia, Qatar and some others for strengthening the internal security has driven the market growth. Additionally, the deployment of hybrid armored vehicles by paramilitary forces for invading warfare areas is contributing to the industry in a positive manner. Moreover, rapid investment by defense organizations for opening up new training centers for paramilitary forces is expected to propel the growth of the MEA 8x8 armored vehicles market.

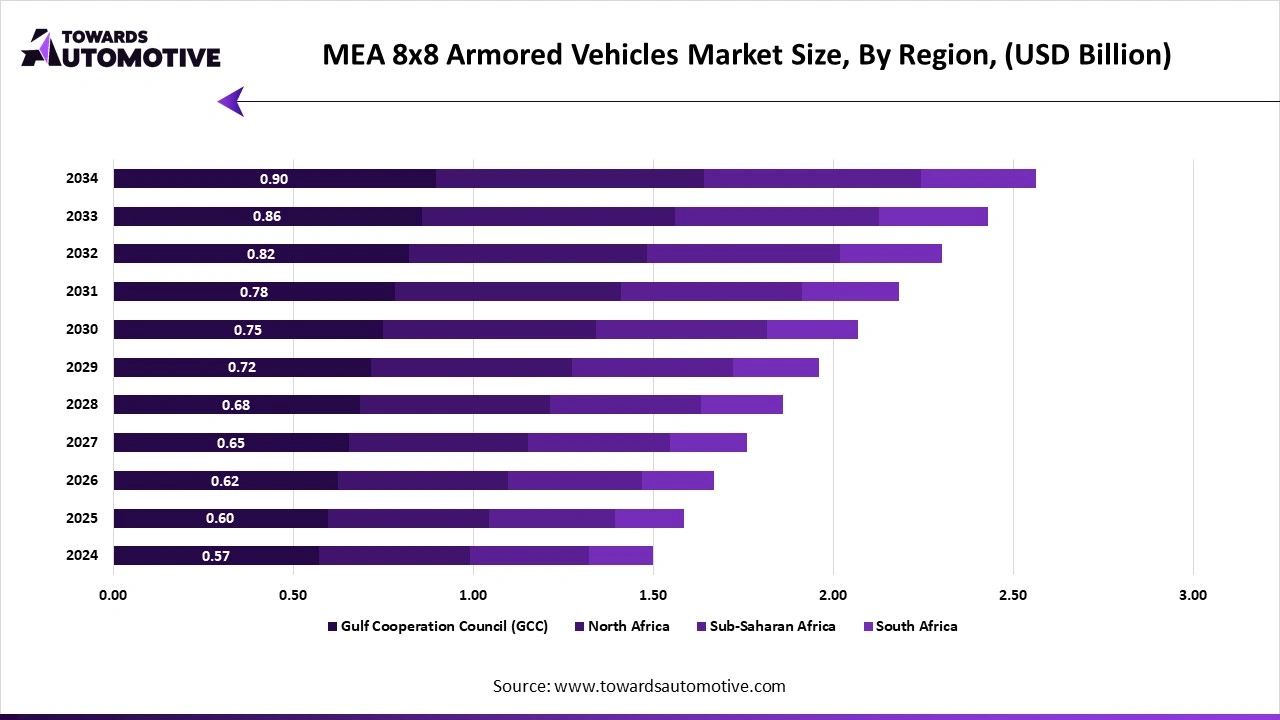

Gulf Cooperation Council (GCC) led the 8x8 armored vehicles market with a share of around 40%. The rapid investment by government of several countries such as Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, Oman and some others for strengthening the defense sector has driven the market expansion. Also, rising emphasis of market players for opening up new production facilities to increase the manufacturing of armored vehicles is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as SAMI, BMC, FNSS Savunma Sistemleri and some others is expected to boost the growth of the MEA 8*8 armored vehicles market.

Sub-Saharan Africa is expected to expand with the highest CAGR during the forecast period. The increasing emphasis of government organizations in various nations such as South Africa, Eritrea, Niger, Guinea and some others for deploying advanced armored vehicles in the military sector has driven the market growth. Additionally, rising cases of geopolitical tensions coupled with rapid investment by market players for opening up new production facilities is playing a positive role in shaping the industry. Moreover, the presence of numerous market players such as Denel SOC Ltd, Paramount Group, Milkor, Truvelo, Reutech and some others is expected to propel the growth of the MEA 8*8 armored vehicles market.

The foundation of armoured vehicle production lies in the extraction and supply of essential materials such as cobalt, lithium, nickel, and graphite.

Raw materials are processed into hardware components for integrating into armoured vehicles.

Completed armoured vehicles are delivered to defence organizations for enhancing military capabilities.

| February 2025 | Announcement |

| Khaled Al Zaabi, President – Platforms & Systems at EDGE | As we continue to expand our land systems portfolio, EDGE is delivering advanced, globally competitive solutions that address the full spectrum of operational requirements – manned and unmanned. Through NIMR, MILREM ROBOTICS, and AL JASOOR, we are strengthening our capabilities with cutting-edge platforms that enhance mobility, survivability, and mission effectiveness. By investing in innovation and scalable technologies, we are positioning EDGE as a leader in next-generation land systems, ensuring our solutions remain at the forefront of modern warfare and meet the evolving demands of global defence forces. |

| February 2025 | Announcement |

| Rebecca McGrane, vice president of Amphibious Programs at BAE Systems |

The ACV is a trailblazer for amphibious warfare, designed to have significant growth potential and the flexibility to meet mission roles of military forces across the globe. The 8×8 platform is a unique mix of true open-ocean amphibious capability and land mobility in the most challenging terrain, and we are confident we can enhance operational effectiveness for our allies |

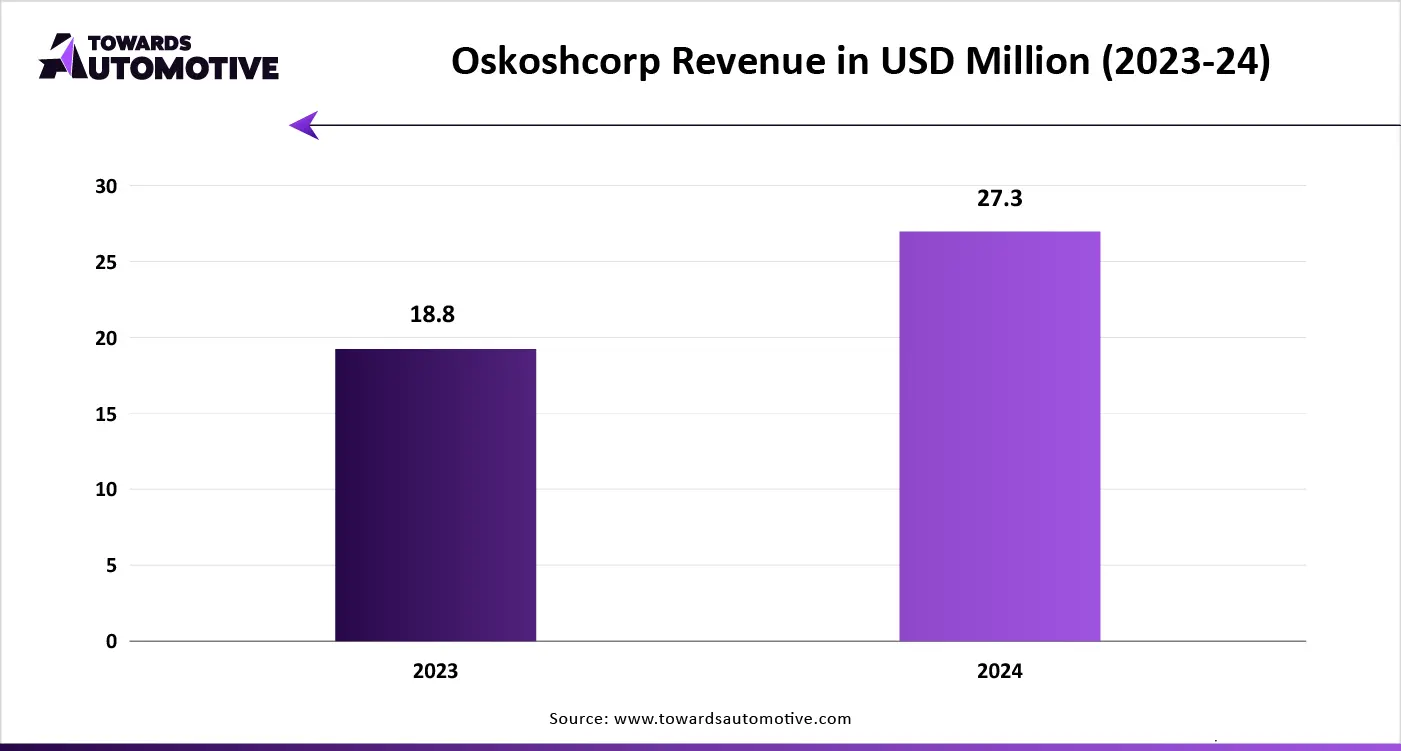

The MEA 8x8 armored vehicles market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Paramount Group, Denel Land Systems, BAE Systems, General Dynamics Land Systems (GDLS), General Dynamics European Land Systems (GDELS), Rheinmetall Landsysteme, KNDS (Krauss-Maffei Wegmann + Nexter), Oshkosh Defense, Tatra Defence Vehicles, Patria Oyj, Arquus, FNSS Savunma Sistemleri, Otokar, BMC, Military Industrial Company (VPK), Norinco (China North Industries Corporation), UralVagonZavod, Iveco Defence Vehicles, ST Engineering Land Systems, AM General and some others. These companies are constantly engaged in developing 8*8 armored vehicles and adopting numerous strategies such as collaborations, launches, acquisitions, partnerships, business expansions, joint ventures and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Vehicle Role/ Mission

By Protection Level

By Firepower / Armament

By Weight Class

By Power Source

By Suspension / Drivetrain

By Manufacturing / Procurement Type

By Lifecycle Stage

By Onboard Systems

By End-User

By Cost Tier

By Operational Environment

By Region

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us