September 2025

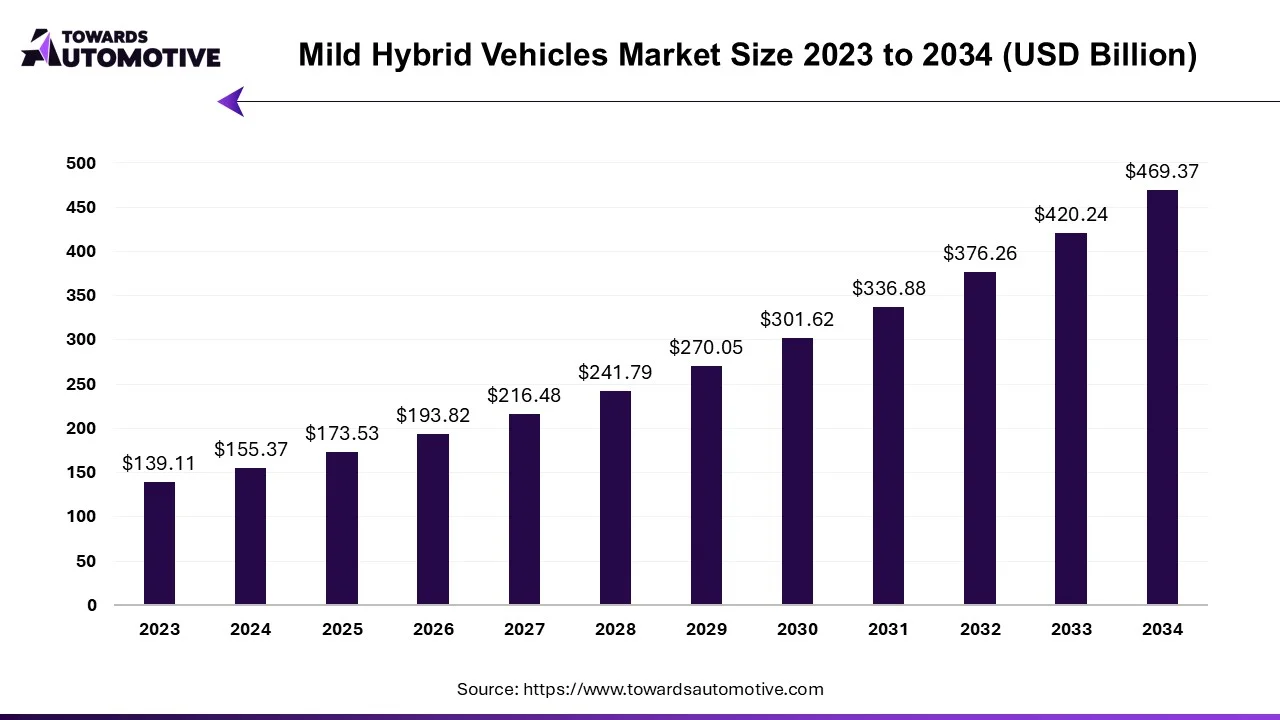

The global mild hybrid vehicles market is projected to reach USD 469.37 billion by 2034, expanding from USD 173.53 billion in 2025, at an annual growth rate of 11.69% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Strong emission standards, fuel efficiency, and government incentives are driving both car manufacturers and buyers toward hybrid vehicles as alternatives to conventional vehicles. However, the increasing demand for battery electric vehicles may pose a challenge to the growth of the mild hybrid vehicle market.

Hybrid vehicles represent a middle ground between internal combustion engine (ICE) vehicles and battery electric vehicles, contributing to the vision of achieving net-zero carbon emissions within a specified timeframe. Governments worldwide have implemented various policies and incentives to promote hybrid vehicle adoption and facilitate the transition to electric vehicles. The automotive market is expected to be a key driver of hybrid vehicle development, further boosting the global mild hybrid car market's growth.

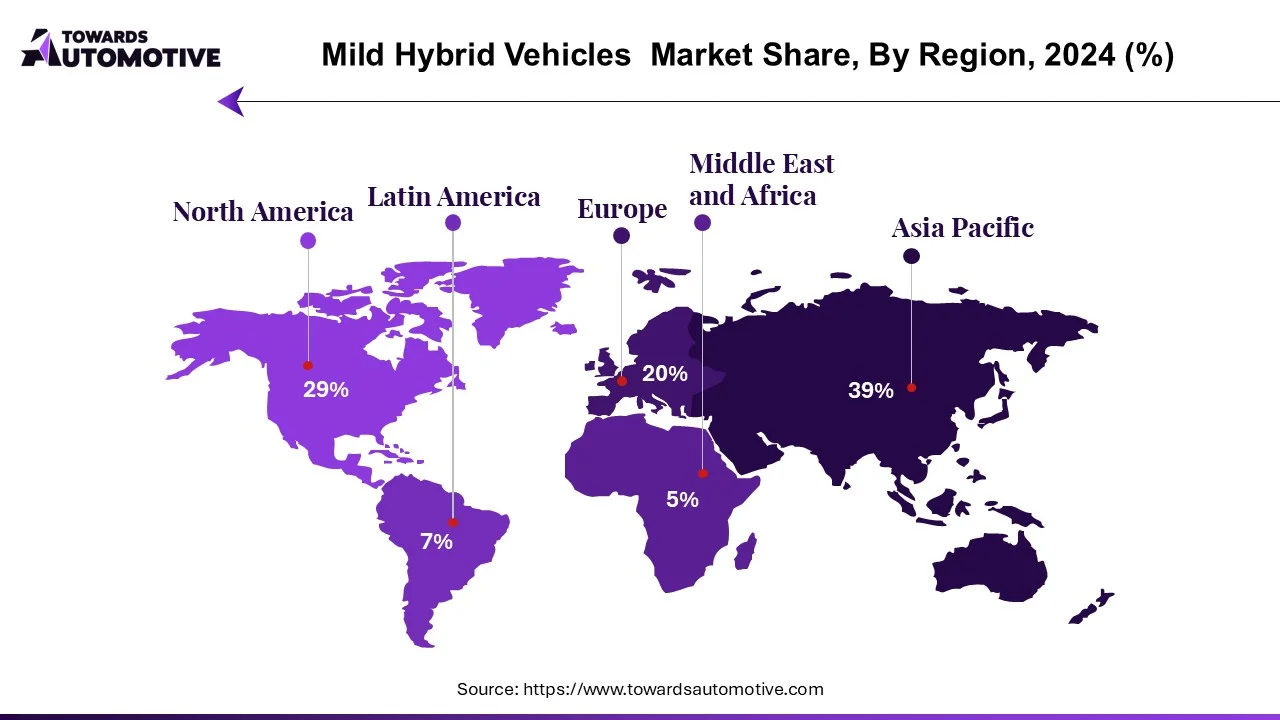

The Asia Pacific region is anticipated to experience rapid growth during the forecast period. However, changes in emerging markets like India, which recently provided subsidies for mild vehicles under the FAME program, may impact hybrid car sales. North America and Europe are expected to witness significant growth in mild hybrid vehicles, with a focus on expanding the adoption of pure electric or full hybrid vehicles.

Over the past three years, many automakers have begun to integrate 48V mild hybrid systems into their new vehicles. There is a growing demand for mild vehicles equipped with systems below 48V across various countries worldwide. Despite government incentives for electric vehicles, they may still require substantial investment. However, vehicle owners can opt for fuel-efficient mild hybrid engines as an alternative. The exceptional fuel efficiency offered by vehicles with mild hybrid powertrains presents a significant opportunity for fleet owners and is expected to drive the growth of the global mild hybrid vehicle market.

Mild hybrids present valuable opportunities for companies to offer products in a mobility-as-a-service (MaaS) environment. With fuel consumption approximately 5% higher than vehicles with the same engine, they reduce total costs, providing numerous opportunities for service providers and users. This is anticipated to stimulate the growth of mild vehicles globally.

Mild hybrids, particularly those with capacities below 48V, offer advantages such as regenerative braking and engine start-stop functionality at a lower cost. This makes them beneficial for enhancing fuel efficiency and reducing emissions, particularly in larger vehicles like SUVs and trucks.

Major companies like Mercedes-Benz, Audi, and BMW have heavily invested in 48V mild hybrid technology, with many of their new models featuring this technology. For instance, the 2022 Mercedes-Benz S-Class is equipped with a 48V mild-hybrid system, providing an additional 22 horsepower and up to 184 pound-feet of torque while improving fuel efficiency by up to 10 percent.

The demand for sub-48V capacity segment vehicles has surged, prompting automakers like Suzuki, Mahindra, and Hyundai to focus on developing 48V mild hybrid system vehicles. This trend is expected to drive market growth in the forecast period as manufacturers strive to meet stricter emissions standards and carbon emission targets.

Additional components such as a 48V battery, motor, power control, and other technologies are also equipping vehicles with significant operational advantages. The substantial demand for new models and the growth prospects for suppliers to meet this demand are anticipated to propel growth in the global light automobile market.

Asia Pacific, particularly China, holds the largest market share in the mild hybrid vehicle market due to the region's high automobile sales volume. Many automobile companies are planning to invest in the Asia-Pacific market to meet the strong demand for hybrid vehicles. Chinese automakers are focusing on developing technologies like hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and high-performance engines, while also introducing 48V mild hybrid technology.

For Instance,

These initiatives include incentives for consumers and companies, such as subsidies and funding for electric vehicle infrastructure. The plans by both automakers and governments are expected to continue driving sales of mild hybrid vehicles in the Asia-Pacific market.

In the mild hybrid vehicle market, major players include Nissan Motor Co., Ltd., Volkswagen Group, Suzuki Motor Corporation, Hyundai Motor Company, Ford Motor Company, and Toyota Motor Corporation, among others. New product launches from various automobile manufacturers are increasing the demand for mild hybrid vehicles.

The market is divided into two segments based on capacity type: below 48V and 48V and above. The sub-48V segment is expected to lead the market as power producers in many countries introduce sub-48V vehicles. Additionally, the 48V and above segment will witness strong growth due to increasing demand for electrical devices in vehicles.

The market is also segmented based on vehicle type into commercial vehicles and passenger vehicles. The passenger car segment is expected to dominate the market as demand for mild hybrid passenger vehicles increases. Mild hybrid technology is gaining momentum in this segment due to the introduction of new products by automakers.

Overall, the automotive segment, especially light commercial vehicles, is expected to see significant growth due to the widespread adoption of mild hybrid technology. Major OEMs like RAM and Daimler are involved in the production and certification of new technologies and products to meet global demand.

Mild hybrids combine an internal combustion engine (ICE) with an electric motor, allowing the engine to shut down during coasting, stopping, or when the vehicle comes to a stop, and quickly restart. These vehicles do not feature proprietary electric propulsion but utilize regenerative braking and some power assistance from the internal combustion engine. These features are currently available in the market.

The mild hybrid vehicle market is segmented based on capacity, vehicle type, and geography. Capacity segmentation includes below 48V and above 48V categories. Vehicle type segmentation comprises passenger vehicles and commercial vehicles. Geographically, the market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. The market size and estimated prices (in USD) of mild hybrid vehicles will be provided.

By Capacity Type

By Vehicle Type

By Geography

September 2025

September 2025

August 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us