October 2025

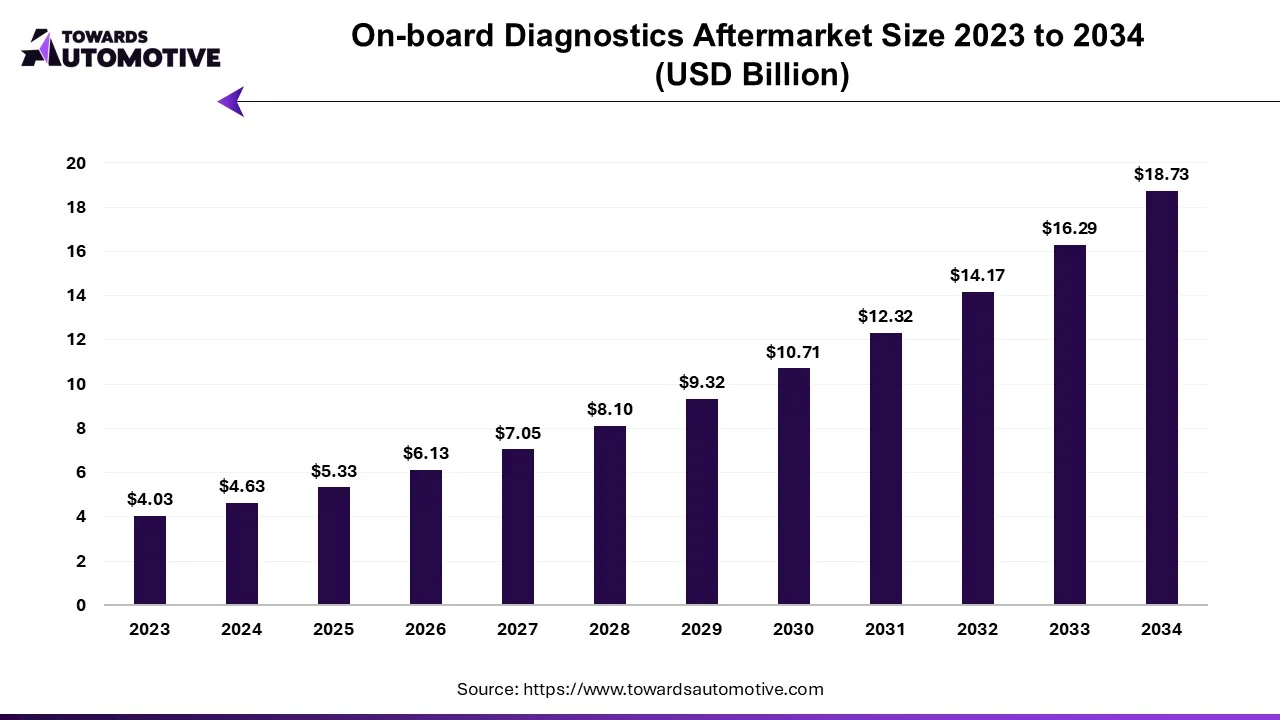

The global on-board diagnostics aftermarket is projected to reach USD 18.73 billion by 2034, growing from USD 5.33 billion in 2025, at a CAGR of 14.99% during the forecast period from 2025 to 2034.

The on-board diagnostics (OBD) aftermarket is experiencing significant growth, driven by the increasing demand for vehicle monitoring systems and advancements in automotive technology. OBD systems are integral to modern vehicles, providing real-time monitoring of vehicle performance, emissions, and mechanical health. By diagnosing issues within a vehicle's engine, exhaust system, and other essential components, OBD systems helps in improving vehicle efficiency, safety, and compliance with environmental standards.

The growth of connected vehicles, along with the rise in the adoption of electric vehicles (EVs), is also contributing to the expansion of the OBD aftermarket. As EVs become more prevalent, the need for sophisticated OBD solutions to monitor battery health, charging cycles, and energy consumption is increasing. Additionally, the integration of OBD systems with telematics and cloud computing allows for remote diagnostics, enabling fleet managers and vehicle owners to track vehicle health and receive alerts about potential issues before they result in breakdowns.

Technological advancements such as the development of OBD-II systems, which offer standardized diagnostics across different vehicle makes and models, are further driving market growth. The increasing trend of vehicle automation, alongside the demand for AI-driven diagnostics tools, is creating new opportunities for growth in the market. Moreover, the rising awareness of vehicle maintenance and the need for improved fuel efficiency are also pushing the demand for OBD solutions, making it a critical component in the automotive and transportation sectors. With continuous innovation, the on-board diagnostics market is poised to expand rapidly in the coming years.

Artificial intelligence (AI) is playing an increasingly pivotal role in the on-board diagnostics (OBD) market, enhancing the capabilities of traditional diagnostic systems and driving market growth. AI-powered OBD systems utilize machine learning algorithms to analyze vast amounts of data collected from vehicle sensors, enabling real-time monitoring and more accurate predictions of vehicle health. This integration allows OBD systems to not only detect current issues but also predict potential failures before they occur, significantly reducing the risk of breakdowns and minimizing costly repairs.

AI algorithms can identify patterns in vehicle performance data that may be difficult for human technicians to detect, improving the overall efficiency of diagnostics. For instance, AI systems can detect subtle changes in engine performance, exhaust emissions, or battery health that may indicate an impending issue, allowing for proactive maintenance. This predictive capability is particularly valuable for fleet management, where early detection of vehicle problems can lead to optimized maintenance schedules, reducing downtime and extending the lifespan of vehicles.

With the integration of AI and cloud computing, OBD systems can provide remote diagnostics, allowing vehicle owners and fleet operators to receive instant notifications of any malfunctions or performance degradation. This data can be accessed via mobile apps or dashboards, providing actionable insights and enabling quicker decision-making.

Furthermore, AI enhances the integration of OBD systems with connected vehicle technologies, enabling seamless communication between vehicles, infrastructure, and service providers. This connectivity allows for continuous data exchange, improving not only vehicle diagnostics but also overall traffic management, safety, and user experience. As AI continues to advance, its role in the OBD aftermarket will only expand, driving innovation and increasing the adoption of smart vehicle technologies.

Car-sharing services are playing a significant role in driving the growth of the on-board diagnostics (OBD) aftermarket, as the demand for efficient, real-time vehicle monitoring and management systems continues to rise. In car-sharing models, vehicles are used by multiple users for commuting to different areas. This creates a demand for OBD systems to ensure vehicle health and monitor performance. OBD systems in car-sharing fleets help operators to track the condition of each vehicle, providing critical information on engine performance, fuel efficiency, tire pressure, and other key components in real time.

The implementation of advanced OBD systems enables car-sharing operators to monitor vehicles remotely, receiving alerts about potential issues, such as engine malfunctions or emissions-related problems. This proactive monitoring helps reduce the risk of breakdowns and accidents, ultimately leading to lower maintenance costs and better fleet management. Additionally, by identifying maintenance needs early, OBD systems allow operators to schedule repairs efficiently, minimizing vehicle downtime and ensuring a continuous and reliable service to users.

Furthermore, as car-sharing services expand, especially in urban areas, the need for more connected and sustainable transportation solution is growing rapidly. OBD systems, integrated with AI and telematics, can track vehicle utilization patterns and optimize maintenance schedules, improving overall fleet efficiency and reducing operational costs. In electric vehicle-based car-sharing fleets, OBD systems also play a crucial role in monitoring battery health, charging cycles, and energy consumption. As car-sharing continues to gain popularity, the OBD aftermarket will benefit from increased demand for smart, connected, and efficient vehicle monitoring solutions.

The on-board diagnostics (OBD) afttermarket faces several restraints, including high implementation costs and the complexity of integrating advanced systems into vehicles. Small-scale manufacturers and fleet operators often find these costs prohibitive. Additionally, privacy concerns regarding data collected by OBD systems pose challenges, as users demand greater data security. The market also grapples with a lack of standardization across regions, creating compatibility issues for manufacturers. Furthermore, reliance on traditional maintenance practices in some markets limits the adoption of modern OBD technologies.

The advancements in cloud-based OBD platforms are revolutionizing the on-board diagnostics (OBD) aftermarket by enabling seamless, real-time access to vehicle data and creating numerous growth opportunities. These platforms allow for the remote monitoring and management of vehicle health, eliminating the need for direct, on-site diagnostics. By leveraging cloud technology, users can access detailed information about engine performance, emissions, fuel efficiency, and other critical parameters through intuitive dashboards or mobile applications. This enhanced accessibility is particularly beneficial for fleet operators, enabling efficient maintenance scheduling and reducing vehicle downtime.

The integration of cloud-based OBD systems with advanced analytics and machine learning further enhances their capabilities, allowing for predictive maintenance. These systems can analyze historical and real-time data to identify potential issues before they escalate, thereby optimizing repair costs and improving vehicle longevity. Additionally, the scalability of cloud-based solutions makes them highly adaptable for various automotive segments, including electric vehicles (EVs), where monitoring battery health and charging cycles is critical.

As automotive connectivity grows, cloud-based OBD platforms facilitate vehicle-to-cloud (V2C) communication, enabling better integration with telematics, smart infrastructure, and third-party services. This connectivity not only enhances user convenience but also drives innovation in personalized vehicle management solutions. For manufacturers and service providers, cloud-based OBD systems open avenues for subscription-based services, recurring revenue models, and data-driven insights, further fueling market expansion in the future.

The passenger vehicle segment held the largest share of the market. Passenger vehicles are a significant driver of growth in the on-board diagnostics (OBD) aftermarket, fueled by increasing vehicle production, stringent emission regulations, and rising consumer demand for advanced automotive technologies. As the global passenger vehicle fleet continues to expand, the adoption of OBD systems becomes essential for ensuring vehicle efficiency, compliance, and safety. Regulatory mandates, such as the implementation of stringent emission standards in regions like Europe, North America, and Asia Pacific, compel automakers to integrate advanced OBD systems to monitor emissions and reduce environmental impact.

Modern passenger vehicles are increasingly equipped with sophisticated electronic systems, including engine control units (ECUs), sensors, and telematics, all of which rely on OBD systems for real-time monitoring and diagnostics. These systems enable drivers to detect potential issues early, reducing the risk of breakdowns and costly repairs. Additionally, the rising demand for electric and hybrid passenger vehicles further accelerates the OBD aftermarket, as these vehicles require advanced diagnostics to monitor battery health, energy consumption, and charging cycles.

The growing awareness among consumers about vehicle maintenance and fuel efficiency also contributes to the rising adoption of OBD systems in passenger vehicles. By offering actionable insights into vehicle performance, OBD systems enhance the driving experience, making them a key factor in the ongoing growth of the OBD aftermarket.

The fleet management segment led the industry. Fleet management is a major driver of growth in the on-board diagnostics (OBD) aftermarket, as businesses increasingly adopt advanced technologies to optimize operations, reduce costs, and enhance vehicle performance. OBD systems provide real-time data on vehicle health, fuel efficiency, emissions, and maintenance needs, enabling fleet managers to monitor and manage their assets more effectively. By integrating OBD with telematics, fleet operators gain actionable insights into engine performance, tire pressure, battery health, and more, allowing them to proactively address potential issues before they escalate into costly breakdowns or downtime.

The growing emphasis on operational efficiency and cost reduction in logistics, transportation, and delivery services has accelerated the adoption of OBD systems. These systems play a crucial role in optimizing fuel consumption, which is particularly important given the rising fuel costs and the environmental concerns associated with emissions. Additionally, OBD-enabled predictive maintenance reduces unexpected repairs and extends vehicle lifespans, contributing to improved fleet reliability and customer satisfaction.

The rise of electric vehicles (EVs) in fleet operations further drives the demand for OBD systems, as these vehicles require advanced diagnostics to monitor battery performance and charging cycles. As fleets expand globally and incorporate connected and sustainable technologies, OBD systems will continue to play a vital role in ensuring efficient and reliable fleet management.

North America dominated the on-board diagnostics aftermarket. The on-board diagnostics (OBD) market in North America is experiencing substantial growth, driven by several key factors. One primary driver is the stringent regulatory environment mandating the adoption of advanced OBD systems to monitor vehicle emissions and performance. The U.S. Environmental Protection Agency (EPA) and similar agencies in Canada have established stringent emission standards, compelling automakers to integrate OBD systems to ensure compliance and reduce environmental impact.

The region's high vehicle ownership rates and growing consumer preference for connected and smart vehicles are also significant contributors to market growth. Modern OBD systems equipped with advanced diagnostics and telematics capabilities align with the increasing demand for seamless connectivity, offering features such as real-time vehicle health monitoring, fuel efficiency tracking, and predictive maintenance. This technological innovation enhances the driving experience, encouraging widespread adoption.

Additionally, the rising adoption of electric vehicles (EVs) in North America further boosts the OBD aftermarket. EVs require advanced diagnostic tools to monitor battery performance, energy consumption, and charging efficiency. The U.S. and Canada’s focus on expanding EV infrastructure and incentives for EV adoption support the demand for OBD systems tailored for these vehicles.

The growth of the fleet management industry, including logistics, ride-sharing, and delivery services, also significantly drives the OBD aftermarket in North America. Fleet operators increasingly rely on OBD systems to monitor vehicle performance, optimize fuel usage, and schedule predictive maintenance, ensuring operational efficiency and cost savings. As North America continues to lead in automotive innovation, the OBD aftermarket is expected to witness sustained growth in the region.

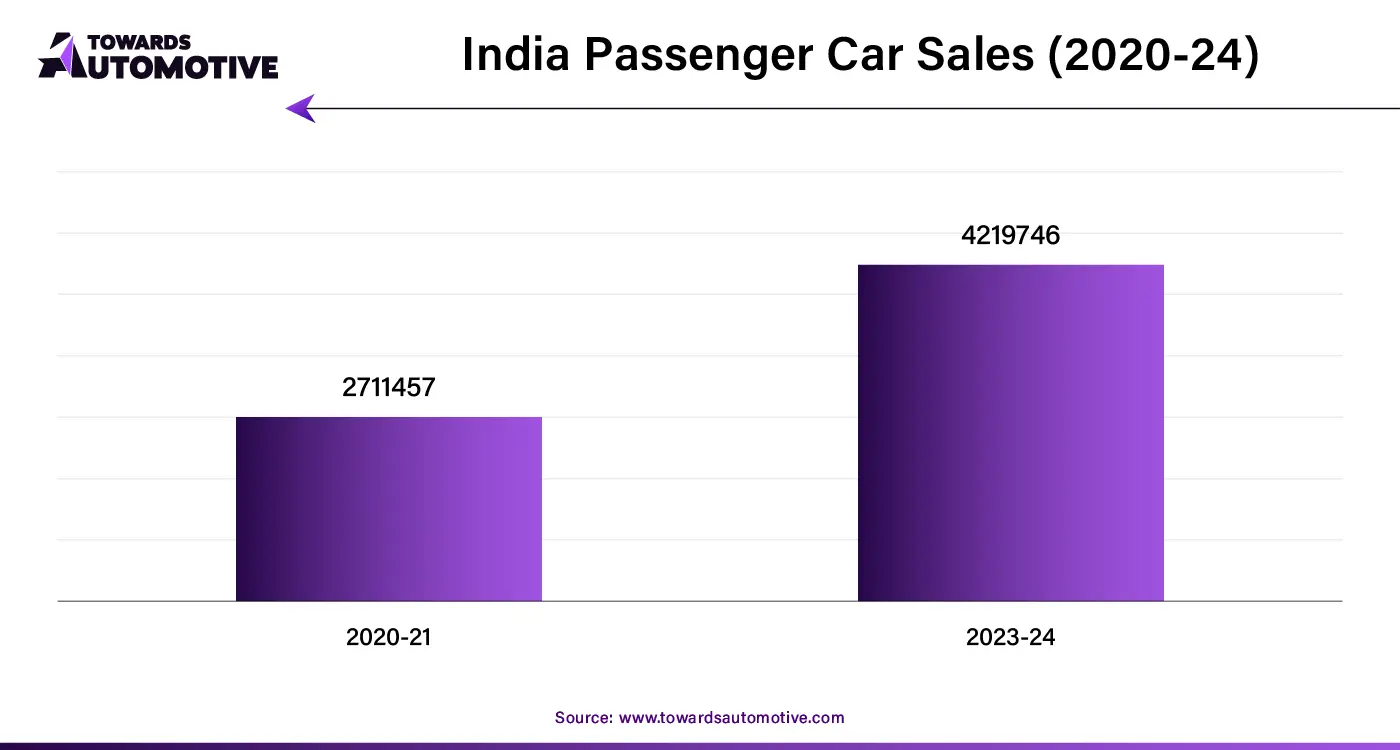

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The on-board diagnostics (OBD) aftermarket in Asia Pacific is witnessing robust growth, driven by the region's expanding automotive industry, stringent emission regulations, and increasing adoption of advanced vehicle technologies. Rapid urbanization and rising disposable incomes in countries like China, India, and Southeast Asian nations have spurred a significant rise in passenger and commercial vehicle sales. This growing vehicle fleet has, in turn, increased the demand for OBD systems to monitor and maintain vehicle performance effectively.

Regulatory mandates by government of several countries to combat air pollution is also a crucial factor for the industrial expansion. For instance, China's implementation of the China 6 emission standard and India's Bharat Stage VI (BS-VI) regulations have pushed automakers to integrate advanced OBD systems in vehicles to comply with these stringent standards. These systems play a crucial role in ensuring vehicles meet emission limits while maintaining optimal performance.

The growing adoption of electric vehicles (EVs) in the region also contributes to the OBD market’s expansion. Asia Pacific, led by China, is a global leader in EV adoption. Advanced OBD systems are essential for EVs to monitor battery health, energy consumption, and charging cycles, ensuring vehicle efficiency and reliability.

Furthermore, the rapid development of connected vehicle technologies is driving demand for OBD systems that enable real-time monitoring, predictive maintenance, and telematics integration. Fleet management solutions in logistics, e-commerce, and ride-hailing services are also propelling the adoption of OBD systems to optimize operations and reduce costs. With strong government support, technological advancements, and an expanding automotive market, Asia Pacific is emerging as a key growth region for the OBD aftermarket.

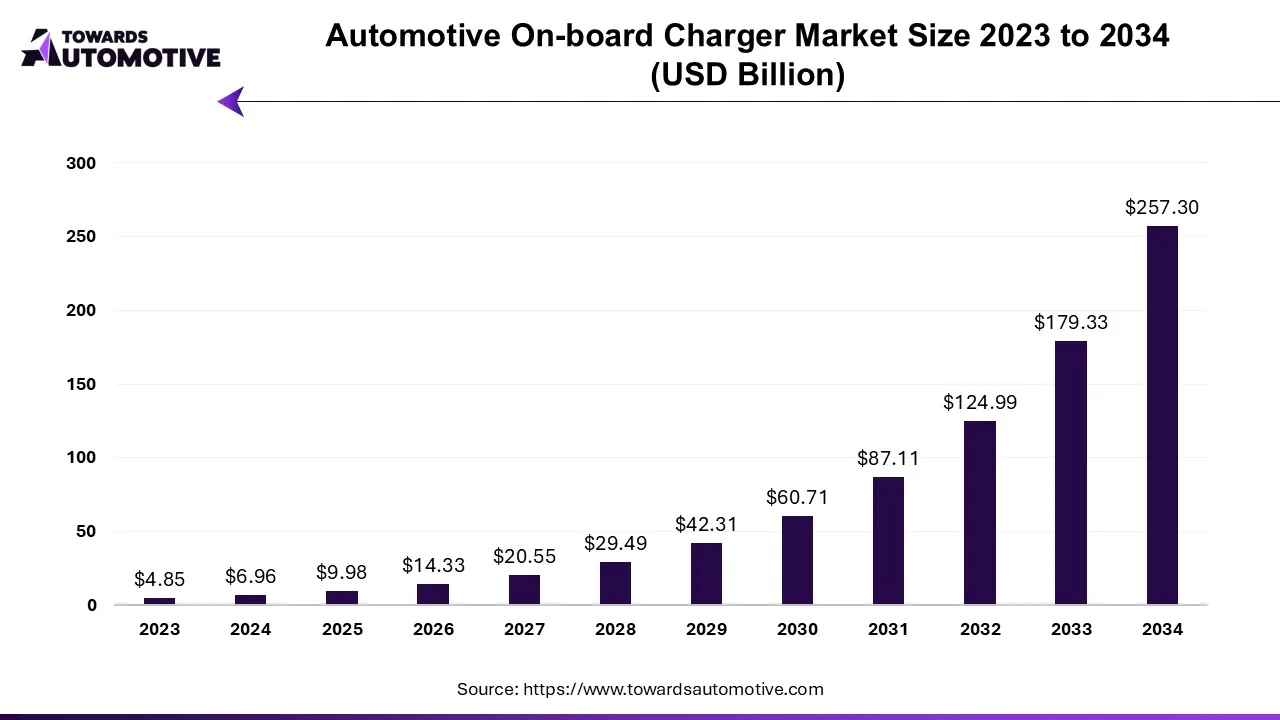

The automotive on-board charger market is forecast to grow from USD 9.98 billion in 2025 to USD 257.30 billion by 2034, driven by a CAGR of 43.48% from 2025 to 2034.

The impact of COVID-19 on the onboard charger market was inevitable as it affected nearly every other industry worldwide. However, the electric vehicle (EVs) market is experiencing significant growth due to the rapidly increasing adoption rate of battery electric vehicles year-on-year. For example, there was a dramatic rise in electric vehicle sales in China and Europe despite the pandemic, indicating active market growth during the forecast period.

Over the medium-term forecast period, rapid sales of electric vehicles, stringent emission regulations, advancements in battery technology, and improving charging infrastructure are expected to drive the demand for automotive onboard chargers. The market is already witnessing the adoption of electric passenger vehicles in developed countries, and now new startups and major players in the EV industry are planning to introduce their new electric models in the coming years.

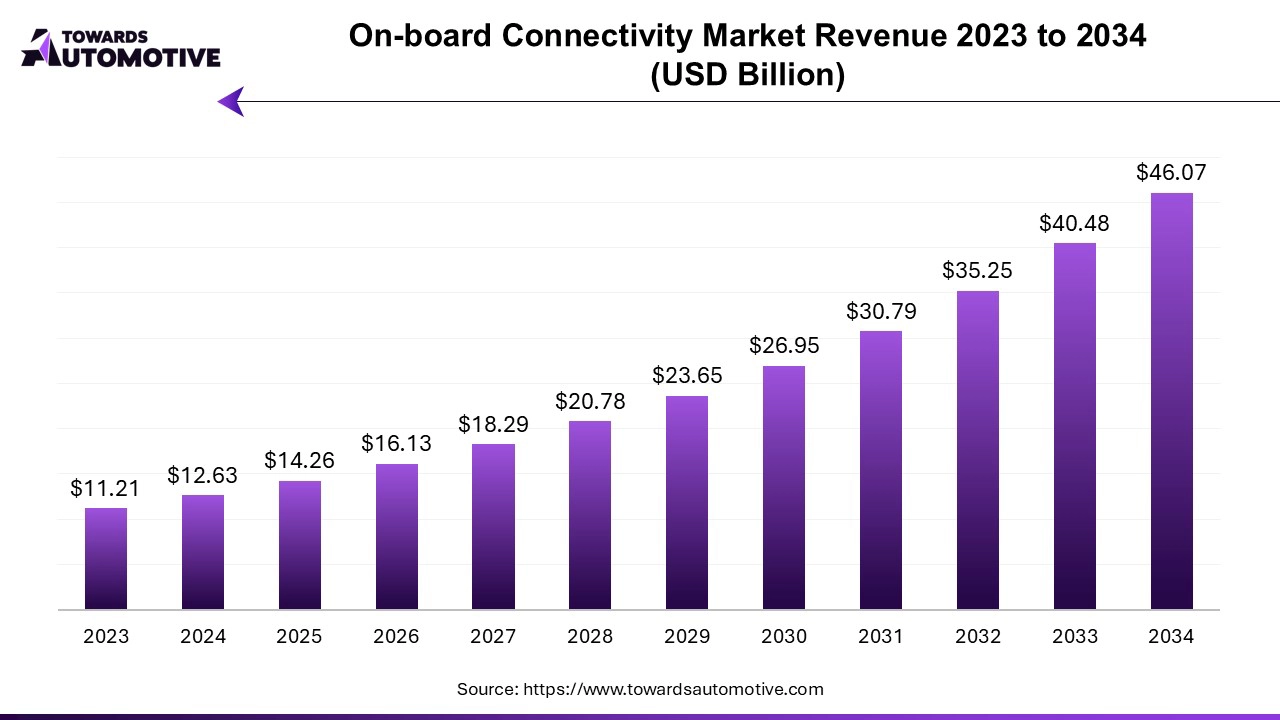

The on-board connectivity market is expected to increase from USD 14.26 billion in 2025 to USD 46.07 billion by 2034, growing at a CAGR of 13.81% throughout the forecast period from 2025 to 2034.

The on-board connectivity market is rapidly expanding as demand for seamless internet access, communication services, and entertainment systems grows across multiple transportation sectors, including aviation, maritime, and railways. With passengers increasingly expecting uninterrupted connectivity during their journeys, airlines, shipping companies, and rail operators are investing in advanced solutions to enhance customer experience and operational efficiency. On-board connectivity systems enable travelers to browse the internet, stream content, use social media, and stay connected with their personal and professional networks, which has become a critical service differentiator, especially in the highly competitive aviation and maritime industries.

The on board chargers and stationary chargers market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2023 and 2034, powering sustainable infrastructure globally.

The on-board chargers and stationary chargers market is rapidly evolving as electric vehicle (EV) adoption accelerates globally. On-board chargers (OBCs) are integral to EVs, converting alternating current (AC) from external sources into the direct current (DC) needed to charge the vehicle’s battery. These systems allow EVs to plug into conventional outlets, making them crucial for home and public charging. Stationary chargers, on the other hand, are fixed units designed to deliver higher charging power, available in both AC and DC variants. While on-board chargers cater to the convenience of slow, overnight charging, stationary chargers especially those offering DC fast charging provide quicker, more powerful options at public or dedicated charging stations.

By Components

By Components

By Region

The Railcar Unloader Market is expected to expand from USD 180.2 billion in 2025 to USD 224.5 billion in 2030. In North America, the U.S. is projected...

According to market projections, the trailer and cargo container tracking sector is expected to grow from USD 2.98 billion in 2024 to USD 7.99 billion...

According to forecasts, the global all-terrain crane market will grow from USD 9.07 billion in 2024 to USD 16.84 billion by 2034, with an expected CAG...

The global riding gear market, valued at USD 7.88 billion in 2024, is anticipated to reach USD 11.25 billion by 2034, growing at a CAGR of 3.65% over ...

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us