September 2025

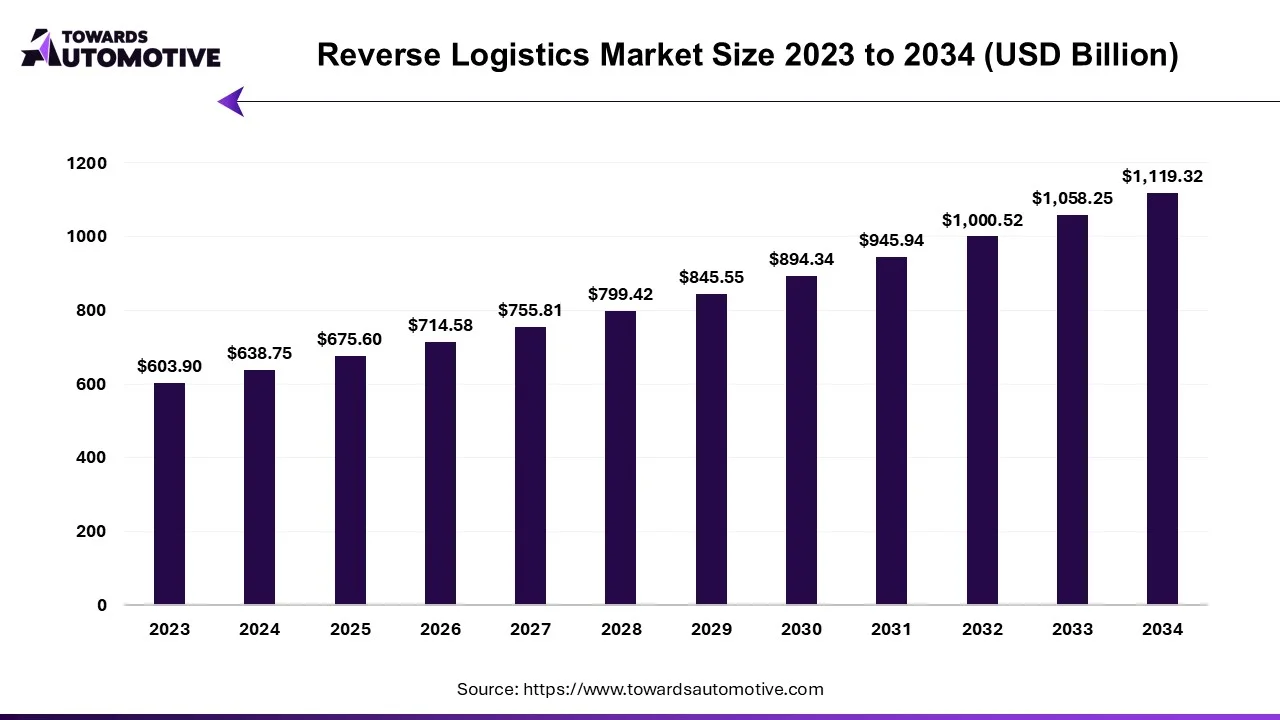

The reverse logistics market is forecast to grow at a CAGR of 5.77%, from USD 675.60 billion in 2025 to USD 1119.32 billion by 2034, over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The reverse logistics market is a prominent branch of the logistics industry. This industry deals in providing reverse logistics services in different parts of the world. There are several types of services provided by this sector including recall returns, B2B returns and commercial returns, repairable returns, end of use returns, end of life returns and some others. The end-users of reverse logistics consist of retail & e-commerce, automotive, consumer electronics, healthcare and some others. The rapid development in the e-commerce sector has contributed to the overall industrial expansion. This market is expected to grow significantly with the rise of the transportation industry in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 1119.32 Billion |

| Projected Market Size in 2034 | USD 638.75 Billion |

| CAGR (2025 - 2034) | 5.77% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Return Type, By Service, By End-User and By Region |

| Top Key Players | Core Logistic Private Limited; Safexpress Pvt. Ltd., DB SCHENKER (Deutsche Bahn AG); Deutsche Post AG |

The major trends in this market consists of partnerships, flexibility by e-commerce brands, increased adoption of refurbished products.

Several logistics brands are partnering with each other to deliver reverse logistics services in different parts of the world.

The e-commerce brands are providing flexible return policies in cases of several issues such as size, quality, timing and some others.

Numerous electronic startup companies have started collecting old gadgets such as mobile phones, laptops, smart watches and some others for refurbishment.

The B2B returns and commercial returns segment led this industry. The rising demand for recyclable goods has enabled companies to collect used products from people, thereby increasing the demand for reverse logistics services. Additionally, the growing adoption of leasing items in MSMEs is further adding to the growth of the reverse logistics market.

The repairable returns segment is expected to rise with a significant CAGR during the forecast period. The growing interest of consumers to return defective goods to the shipping party has increased the demand for reverse logistics services, thereby driving the market expansion. Moreover, partnerships and collaboration among market players and e-commerce brands to launch new reverse logistics services to cater the needs of the B2C sector is expected to foster the growth of the reverse logistics market.

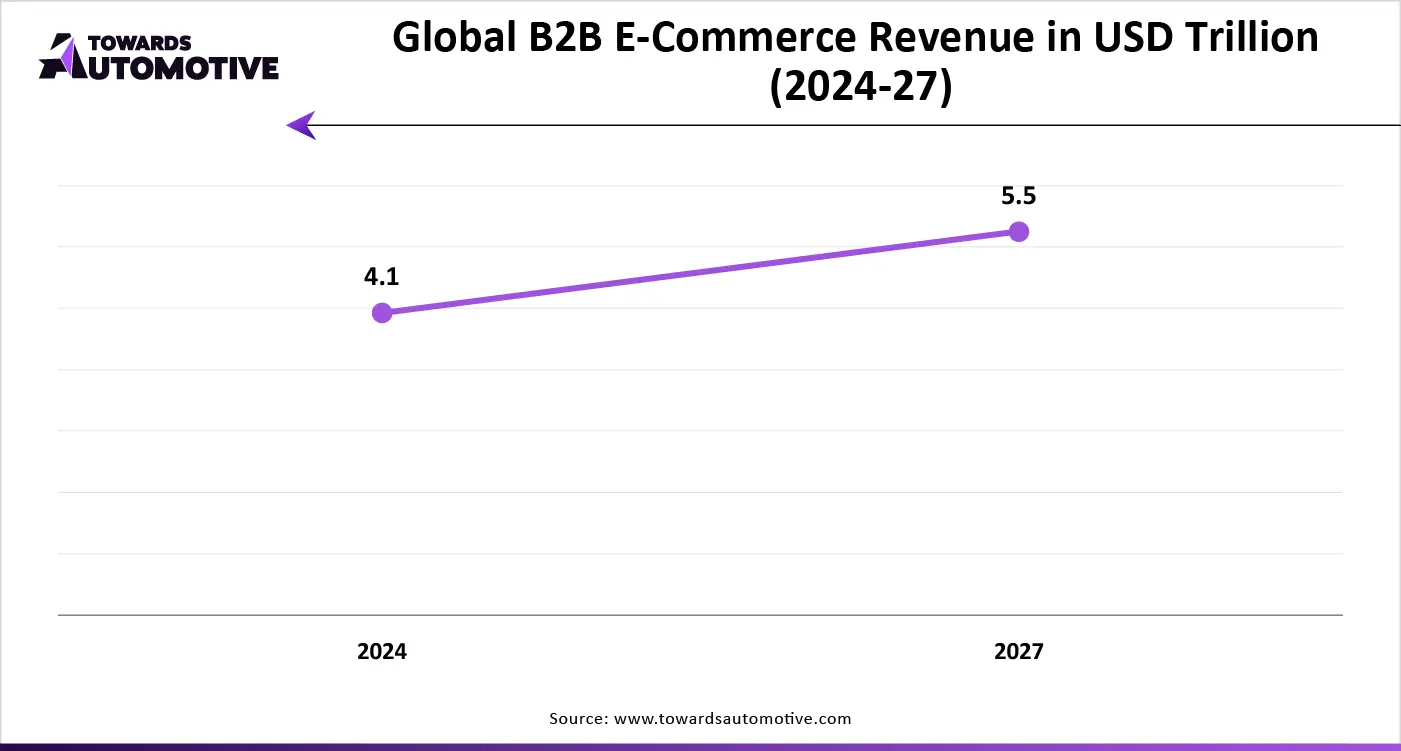

The retail and e-commerce segment dominated the market. The rising proliferation of smartphones in different parts of the world has enabled people to sell and purchase goods in online platforms, thereby driving the market expansion. Also, numerous government initiatives aimed at developing the e-commerce sector coupled with flexible return policies provided by e-commerce brands is further contributing to the overall industrial growth. Moreover, rapid growth in the retail industry along with availability of EMI payment method in e-commerce platforms is expected to propel the growth of the reverse logistics market.

The automotive segment is expected to rise with a significant CAGR during the forecast period. The rising popularity of automotive e-commerce brands such as O'Reilly Auto Parts, AutoZone, Autotrader and some others has driven the market growth. Additionally, several problems of purchasing automotive parts from online platforms including compatibility issues, counterfeit items, fraudulent source and some others has increased the demand for reverse logistics services, thereby contributing to the industrial expansion. Moreover, the increasing emphasis on vehicle modification coupled with availability of old vehicle parts in e-commerce platforms is expected to drive the growth of the reverse logistics market.

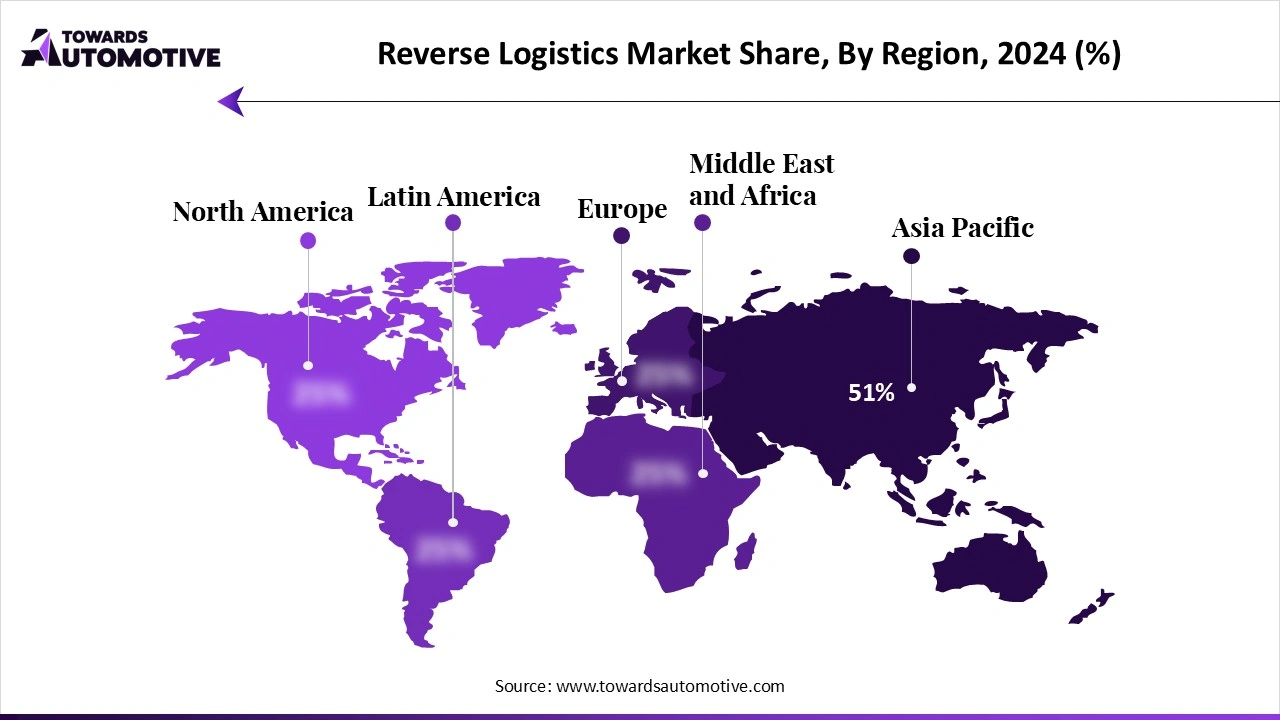

Asia Pacific held the dominant share of the reverse logistics market. The growing adoption of several e-commerce platforms such as Alibaba, Flipkart, Chroma and some others has driven the market growth. Additionally, the rapid adoption of green logistics in several countries such as India, China, Japan, Singapore and some others coupled with availability of high-quality road infrastructure is contributing to the industrial expansion. Moreover, the presence of several market players such as Kintetsu World Express, Inc., Yusen Logistics, Safexpress Pvt. Ltd. and some others is driving the growth of the reverse logistics market in this region.

The Middle East and Africa is expected to rise with the highest CAGR during the forecast period. The ongoing trend of gadget leasing services in several countries such as UAE, Saudi Arabia, Kenya, Morocco and some others has increased the demand for reverse logistics services, thereby driving the market expansion. Additionally, the rapid growth of the e-commerce industry coupled with technological advancements in the transportation sector has contributed to the overall industrial expansion. Moreover, the presence of various reverse logistics companies such as Naqel Express, BAFCO, DP World, BSL Logistics and some others is expected to boost the growth of the reverse logistics market in this region.

The reverse logistics market is a rapidly developing industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of FedEx Corporation; Kintetsu World Express, Inc.; United Parcel Service, Inc.; RLG Systems AG; Core Logistic Private Limited; Safexpress Pvt. Ltd., DB SCHENKER (Deutsche Bahn AG); Deutsche Post AG; Yusen Logistics Co., Ltd and some others. These companies are constantly engaged in providing reverse logistics services and adopting numerous strategies such as collaborations, acquisitions, partnerships, joint ventures, launches, business expansions and some others to maintain their dominance in this industry.

By Return Type

By Service

By End-User

By Region

September 2025

June 2025

June 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us