September 2025

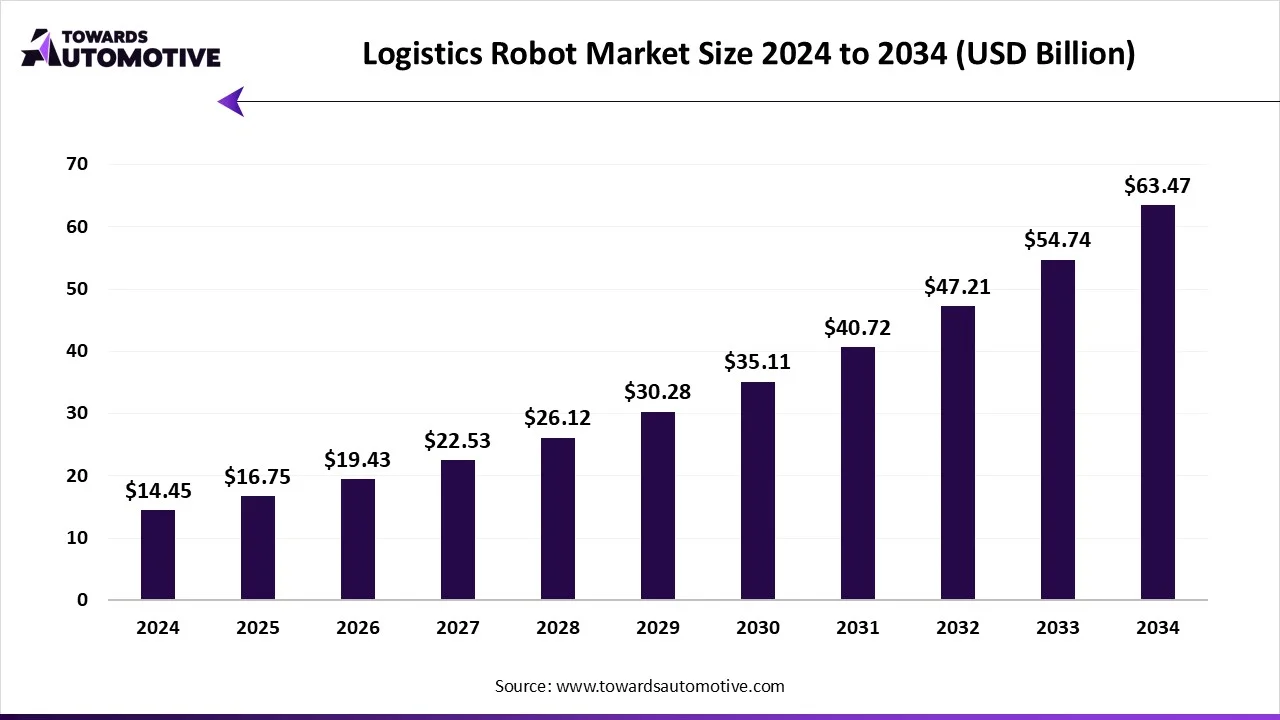

The logistics robot market is forecast to grow at a CAGR of 15.95%, from USD 16.75 billion in 2025 to USD 63.47 billion by 2034, over the forecast period from 2025 to 2034. The growing adoption of automated solutions in the logistics sector coupled with technological advancements in the robotic industry has driven the market expansion.

Additionally, the rising application of automated guided vehicles (AGVs) in the retail industry along with rapid investment by market players for opening up new production facilities is playing a vital role in shaping the industrial landscape. The integration of AI and ML in AMRs is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The logistics robot market is a prominent sector of the robotics & automation industry. This industry deals in manufacturing and distribution of robots designed for the logistics sector. There are several types of robots developed in this sector comprising of automated guided vehicles (AGVs), autonomous mobile robots (AMRs), robotic arms, drones, palletizing & depalletizing robots, hybrid & collaborative robots (cobots) and some others. These robots perform numerous functions consisting of picking & sorting, transportation & material handling, loading & unloading, packaging & palletizing, last-mile delivery, inventory management & cycle counting, and some others. The end-users of these robots consist of e-commerce & retail, manufacturing, food & beverage, healthcare & pharmaceuticals, 3PL & supply chain providers, postal & parcel delivery, aerospace & defense logistics and some others. This market is expected to rise significantly with the growth of the e-commerce sector in different parts of the world.

The major trends in this market consists of partnerships, business expansions and development of the logistics sector.

The automated guided vehicles (AGVs) segment dominated the logistics robot market. The growing use of AGVs for transporting materials automatically in various industries such as manufacturing and warehousing by following predefined paths has boosted the market expansion. Additionally, numerous benefits of AGVs including improved efficiency, enhanced safety, cost reduction, superior flexibility & scalability and some others is expected to propel the growth of the logistics robot market.

The autonomous mobile robots (AMRs) segment is expected to expand with the highest CAGR during the forecast period. Autonomous Mobile Robots (AMRs) are used to perform several tasks including delivery, inspection, material handling, and sanitation in various industries by moving materials autonomously and safely within complex environments, thereby driving the market growth. Moreover, various advantages of AMRs such as superior efficiency & productivity, reduced labor costs, easy integration & flexibility and some others is expected to foster the growth of the logistics robot market.

The picking & sorting segment led the logistics robot market. The growing use of articulated robotic arms in the logistics sector for picking, packing, and palletizing has driven the market expansion. Additionally, rapid investment by robotic companies for developing collaborative robots and collaborative robots to enhance sorting operations is expected to drive the growth of the logistics robot market.

The last-mile delivery segment is expected to rise with the highest CAGR during the forecast period. The increasing use of last-mile delivery robots for navigating various environments such as urban streets, residential areas, university campuses and some others has driven the market expansion. Also, the rising application of robots for transporting goods including packages, food, and groceries autonomously from a distribution hub to consumers is expected to boost the growth of the logistics robot market.

The hardware segment dominated the logistics robot market. The growing use of advanced sensors and high-quality cameras in logistics robots has driven the market expansion. Additionally, rapid investment by robotic companies for developing wide range of hardware components for enhancing the performance of robots is expected to accelerate the growth of the logistics robot market.

The software segment is expected to grow with the fastest CAGR during the forecast period. Robot software provides coded instructions to control a robot's actions, movement, and decision-making by enabling autonomous task performance, thereby driving the market growth. Also, the integration of AI in robotic software for analyzing data, forecast demand, and improve supply chains is expected to boost the growth of the logistics robot market.

The warehouse & fulfillment centers segment held the highest share of the logistics robot market. The growing use of automated guided vehicles in modern warehouses for transporting pallets, cartons, and containers has boosted the market growth. Additionally, rapid investment by e-commerce brands for opening new warehouses to enhance the goods storage capacity is expected to proliferate the growth of the logistics robot market.

The retail stores & backrooms segment is expected to grow with the highest CAGR during the forecast period. The increasing application of palletizing robots and collaborative robots in retail outlets by automating repetitive tasks has driven the market expansion. Also, rapid deployment of AI-integrated robots by retail owners to enhance numerous applications is expected to drive the growth of the logistics robot market.

The up to 100 kg segment led the logistics robot market. The increasing use of medium-capacity robots in retail centers for performing basic tasks has boosted the market growth. Additionally, the growing application of robots with 100 kg payload capacity in several industries such as automotive, aerospace, and machinery is expected to drive the growth of the logistics robot market.

The above 1,000 kg segment is expected to grow with the fastest CAGR during the forecast period. The growing demand for articulated robots with more than 1000 kg payload capacity in the manufacturing sector to enhance lifting operations has driven the market expansion. Also, rapid investment by robotic companies for developing logistics robots with high-payload capacity is expected to propel the growth of the logistics robot market.

The laser/LiDAR-based navigation segment held the largest share the logistics robot market. The increasing focus of robotic companies to use laser/LiDAR-based navigation technology in modern robots has boosted the market expansion. Additionally, the integration of LiDAR technology in mobile robots for material handling and delivery is expected to boost the growth of the logistics robot market.

The GPS & sensor fusion-based navigation segment is expected to expand with the highest CAGR during the forecast period. The growing adoption of GPS & sensor fusion-based navigation in logistics robots for operating different tasks in warehouses has driven the market expansion. Also, the advancements in GPS & sensor fusion technology is expected to drive the growth of the logistics robot market.

The in-house / owned systems segment led the logistics robot industry. The rapid deployment of robots in the retail sector for enhancing numerous tasks and easing operations of manual staffs has boosted the market expansion. Additionally, the rising investment by large business organizations for deploying advanced robotic systems in their production units is expected to drive the growth of the logistics robot market.

The robotics-as-a-service (RaaS) segment is expected to rise with the fastest CAGR during the forecast period. The growing adoption of subscription-based robots in small organizations to automate several tasks has driven the market growth. Also, constant emphasis of robot manufacturers to launch robotics-as-a-service plans is expected to foster the growth of the logistics robot market.

The e-commerce & retail segment led the logistics robot industry. The growing development in the e-commerce sector has boosted the market expansion. Additionally, the rapid deployment of AGVs in the retail industry for enhancing real-time operations is expected to drive the growth of the logistics robot market.

The healthcare & pharmaceuticals segment is expected to expand with the fastest CAGR during the forecast period. The rapid growth in the pharmaceutical sector has increased the demand for AMRs to enhance to automate processes, improving accuracy, speed, and safety in drug discovery has driven the market expansion. Also, the increasing use of logistics robots in the healthcare sector for automating the movement of supplies, medications, food, and samples is expected to boost the growth of the logistics robot market.

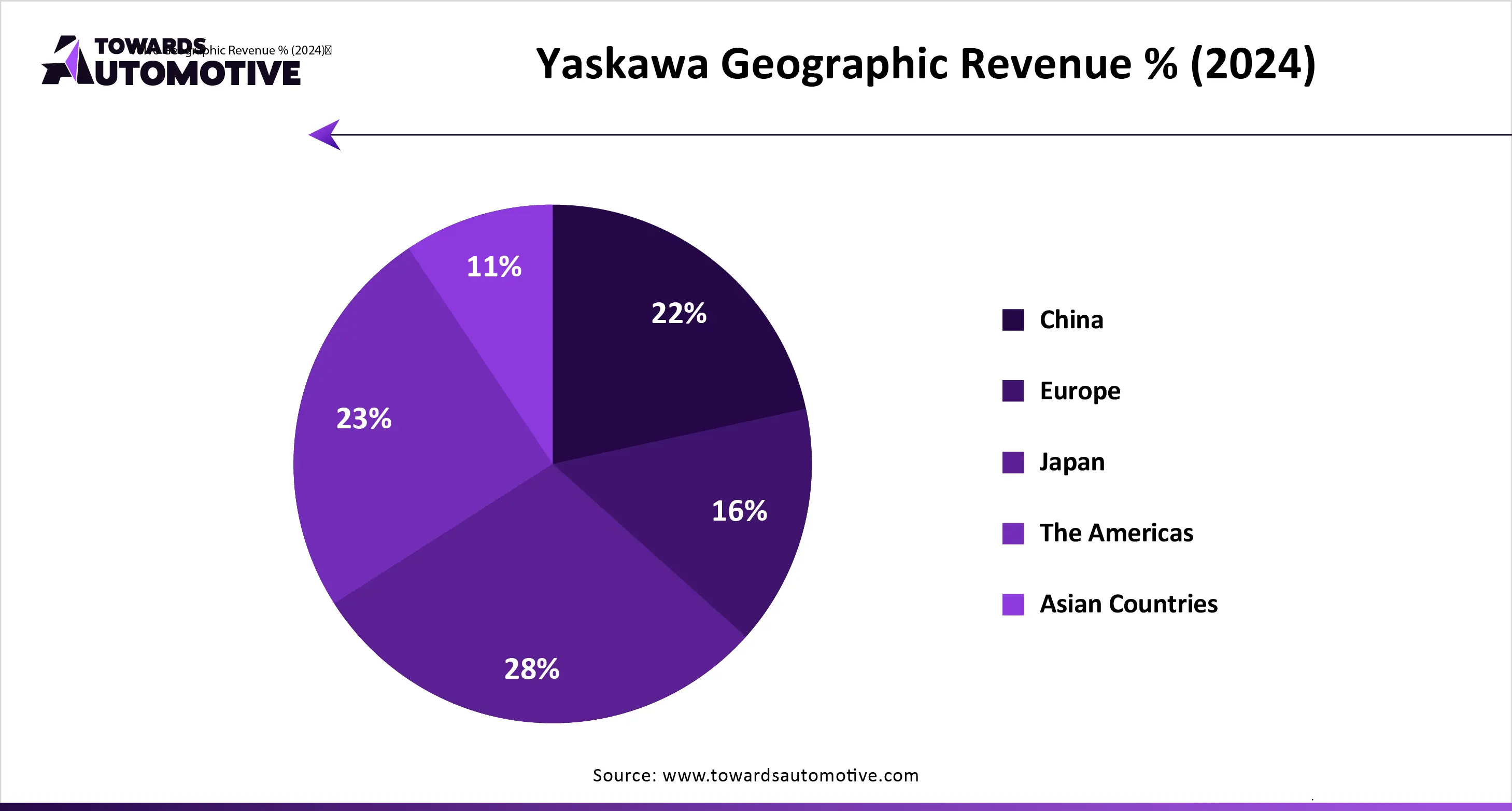

Asia Pacific held the highest share of the logistics robot market. The increasing sales of robots in various countries such as Japan, China, India, South Korea and some others has boosted the market growth. Additionally, the deployment of collaborative robots in the manufacturing sector coupled with rapid investment by robot companies for opening up new robot manufacturing facilities is playing a crucial role in shaping the industrial landscape. Moreover, the presence of several market players such as Yaskawa Electric Corporation, Omron Corporation, Fanuc Corporation and some others is expected to boost the growth of the logistics robot market in this region.

Middle East & Africa is expected to grow with the fastest CAGR during the forecast period. The growing adoption of SCARA robots in the logistics sector across Middle-East region has driven the market expansion. Also, numerous government initiatives aimed at deploying AI-based robots in the e-commerce sector along with technological advancements in the robotics industry is contributing to the industry in a positive direction. Moreover, the various market players such as Unique World Robotics, Dexter Robotics, Harbot, Tahaluf and some others is expected to drive the growth of the logistics robot market in this region.

There are several types of raw materials used in the production of logistics robots such as metals, carbon fiber and composite materials.

Component fabrication for logistics robots involves creating parts for sensors, actuators, structural elements, and control systems using materials such as metals, plastics, and composites.

Testing and quality control (QC) of logistics robots involve hardware inspection, software validation using methods such as the V-model for requirements verification, functional testing of navigation, manipulation, and sensor performance, and integrated system testing in realistic environments.

The logistics robot market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Boston Dynamics, Clearpath Robotics, KUKA AG, ABB Ltd., FANUC Corporation, Yaskawa Electric Corporation, Omron Corporation, Daifuku Co., Ltd., Geek+ Robotics, GreyOrange, Locus Robotics, Fetch Robotics, Vecna Robotics, Amazon Robotics, Toyota Industries Corporation and some others. These companies are constantly engaged in manufacturing logistics robots and adopting numerous strategies such as partnerships, joint ventures, business expansions, collaborations, launches, expansions, acquisitions, and some others to maintain their dominance in this industry.

By Robot Type

By Function

By Component

By Operation Environment

By End-Use Industry

By Payload Capacity

By Navigation Technology

By Deployment Model

By Region

September 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us