Vocational Truck Market Size, Trends and Forecast

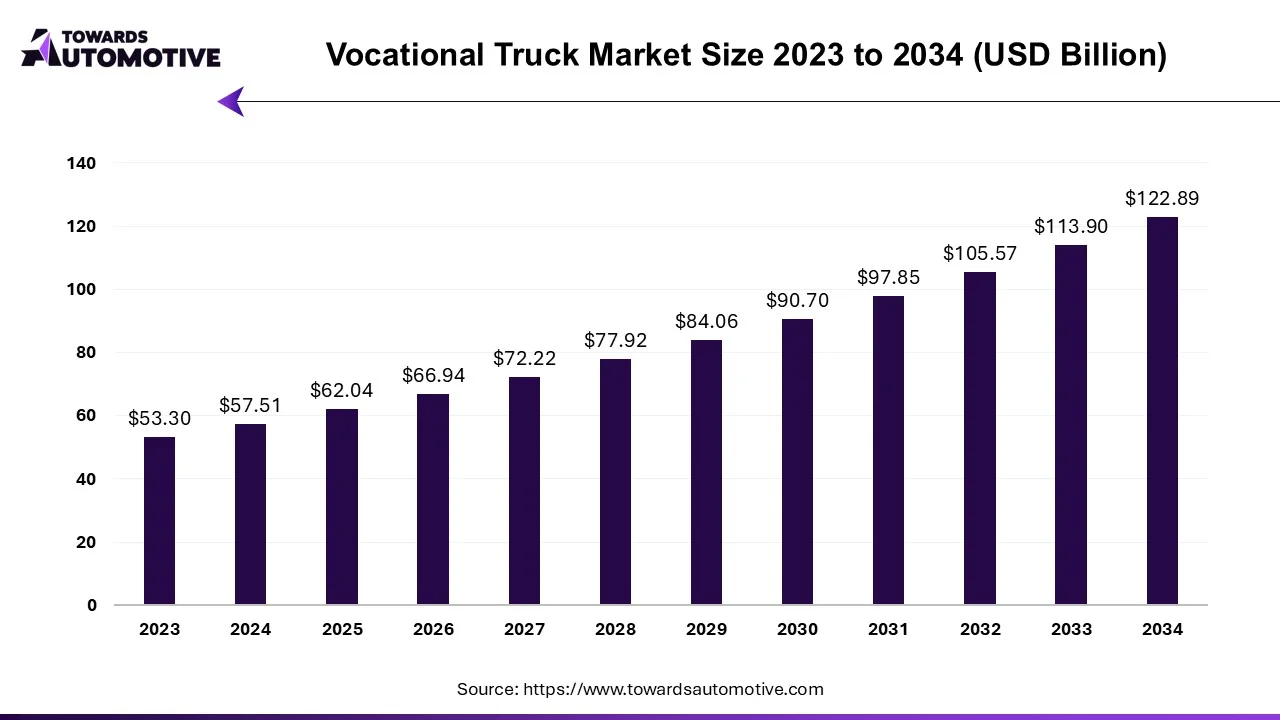

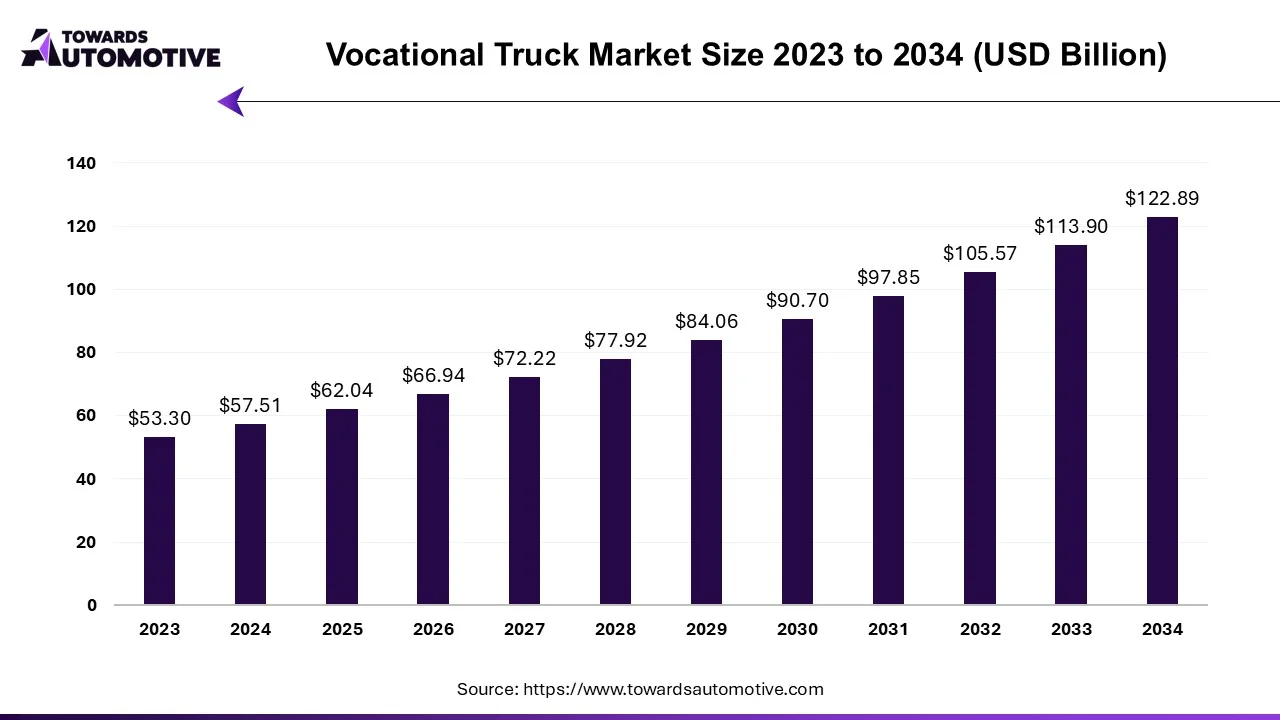

The vocational truck market is projected to reach USD 122.89 billion by 2034, growing from USD 62.04 billion in 2025, at a CAGR of 7.89% during the forecast period from 2025 to 2034.

The vocational truck market is witnessing steady growth, driven by the increasing demand for specialized transportation solutions across various industries. From construction and mining to waste management and forestry, vocational trucks play a crucial role in delivering goods, materials, and equipment to job sites efficiently and safely. With advancements in technology and customization options, vocational trucks are becoming indispensable assets for businesses seeking reliable and versatile transportation solutions.

The vocational truck market is poised for robust growth, propelled by factors such as infrastructure development, urbanization, and industrial expansion. Vocational trucks are purpose-built vehicles designed to perform specific tasks in demanding environments, offering durability, performance, and flexibility for various applications. As industries continue to evolve and diversify, the demand for specialized vocational trucks tailored to specific job requirements is expected to drive market expansion in the coming years.

Key Components and Functions of Vocational Trucks

- Chassis and Cab Design: Vocational trucks feature rugged chassis and cab designs engineered to withstand the rigors of off-road driving and heavy-duty operations. The chassis provides a sturdy foundation for mounting specialized bodies and equipment, while the cab offers comfort, visibility, and safety features for drivers operating in challenging conditions.

- Body and Equipment Options: Vocational trucks are available with a wide range of body and equipment options tailored to specific industry needs. Common configurations include dump bodies for construction and excavation, flatbeds for hauling materials and equipment, and utility bodies for servicing utilities and municipalities. Specialty equipment such as cranes, lifts, and compressors can be integrated into vocational truck bodies to enhance functionality and productivity.

- Powertrain and Performance: Vocational trucks are equipped with powerful engines, robust transmissions, and heavy-duty drivetrain components optimized for performance and reliability. These trucks are capable of hauling heavy loads, navigating rough terrain, and operating in harsh environments, ensuring efficient transportation of goods and materials to job sites with minimal downtime.

- Safety and Compliance Features: Vocational trucks incorporate safety and compliance features such as advanced braking systems, stability control, and driver assistance technologies to enhance vehicle stability and mitigate accident risks. Compliance with regulatory requirements for emissions, weight limits, and vehicle dimensions is essential for ensuring safe and legal operation of vocational trucks on public roads and job sites.

Key Market Dynamics and Trends

- Customization and Specialization: The trend towards customization and specialization is driving innovation in the vocational truck market, with manufacturers offering a wide range of options and configurations to meet diverse customer needs. Businesses can select from various truck sizes, body styles, equipment packages, and performance enhancements to create tailored solutions for specific applications and industries.

- Sustainability and Efficiency: Increasing emphasis on sustainability and efficiency is shaping the development of vocational trucks, with manufacturers focusing on fuel efficiency, emissions reduction, and alternative powertrain technologies. Electric and hybrid vocational trucks powered by battery-electric or fuel-cell systems are gaining traction as businesses seek to minimize environmental impact and operating costs while complying with regulatory requirements.

- Connectivity and Telematics: The integration of connectivity and telematics solutions into vocational trucks is enabling real-time monitoring, diagnostics, and fleet management capabilities for businesses. Telematics platforms provide insights into vehicle performance, fuel consumption, maintenance needs, and driver behavior, enabling proactive maintenance scheduling, route optimization, and performance tracking for enhanced operational efficiency and cost savings.

- Autonomous and Semi-Autonomous Technologies: The adoption of autonomous and semi-autonomous technologies in vocational trucks is driving efficiency and safety improvements in the industry. Advanced driver assistance systems (ADAS), collision avoidance systems, and autonomous driving features such as platooning and convoying are enhancing vehicle control, situational awareness, and driver productivity, paving the way for future autonomous operations in vocational trucking.

Global Trends and Market Outlook

- Infrastructure Development: The global focus on infrastructure development and construction projects is driving demand for vocational trucks in key markets such as construction, mining, and transportation. Investments in roads, bridges, railways, and utilities require specialized trucks for hauling materials, equipment, and personnel, supporting market growth and expansion opportunities for manufacturers and suppliers.

- Urbanization and Municipal Services: Urbanization and population growth are increasing the demand for vocational trucks in municipal services such as waste management, sanitation, and public works. Cities and municipalities rely on vocational trucks for garbage collection, street sweeping, snow removal, and infrastructure maintenance, creating steady demand for specialized vehicles equipped with advanced technologies and environmental controls.

- E-Commerce and Last-Mile Delivery: The rise of e-commerce and online retailing is driving demand for vocational trucks in last-mile delivery and logistics operations. Delivery fleets require efficient and reliable trucks for transporting goods from distribution centers to customer locations, fueling demand for lightweight, maneuverable, and fuel-efficient vocational trucks tailored to urban delivery environments.

Challenges and Opportunities

- Regulatory Compliance and Emissions Standards: Compliance with regulatory requirements for emissions, safety, and vehicle dimensions poses challenges for manufacturers and operators of vocational trucks. Adapting to evolving emissions standards, weight restrictions, and road safety regulations requires investments in technology, engineering, and certification processes to ensure compliance and market competitiveness.

- Technological Integration and Skills Training: The integration of advanced technologies such as connectivity, telematics, and automation into vocational trucks requires specialized skills and training for operators, technicians, and fleet managers. Providing comprehensive training programs and support services for adopting new technologies is essential for maximizing the benefits of innovation and improving operational efficiency and safety in vocational trucking.

- Supply Chain Disruptions and Market Volatility: Supply chain disruptions, market volatility, and geopolitical uncertainties pose risks to the stability and growth of the vocational truck market. Manufacturers and suppliers must manage supply chain risks, diversify sourcing strategies, and adapt to changing market conditions to mitigate disruptions and ensure continuity of operations in a dynamic and competitive environment.

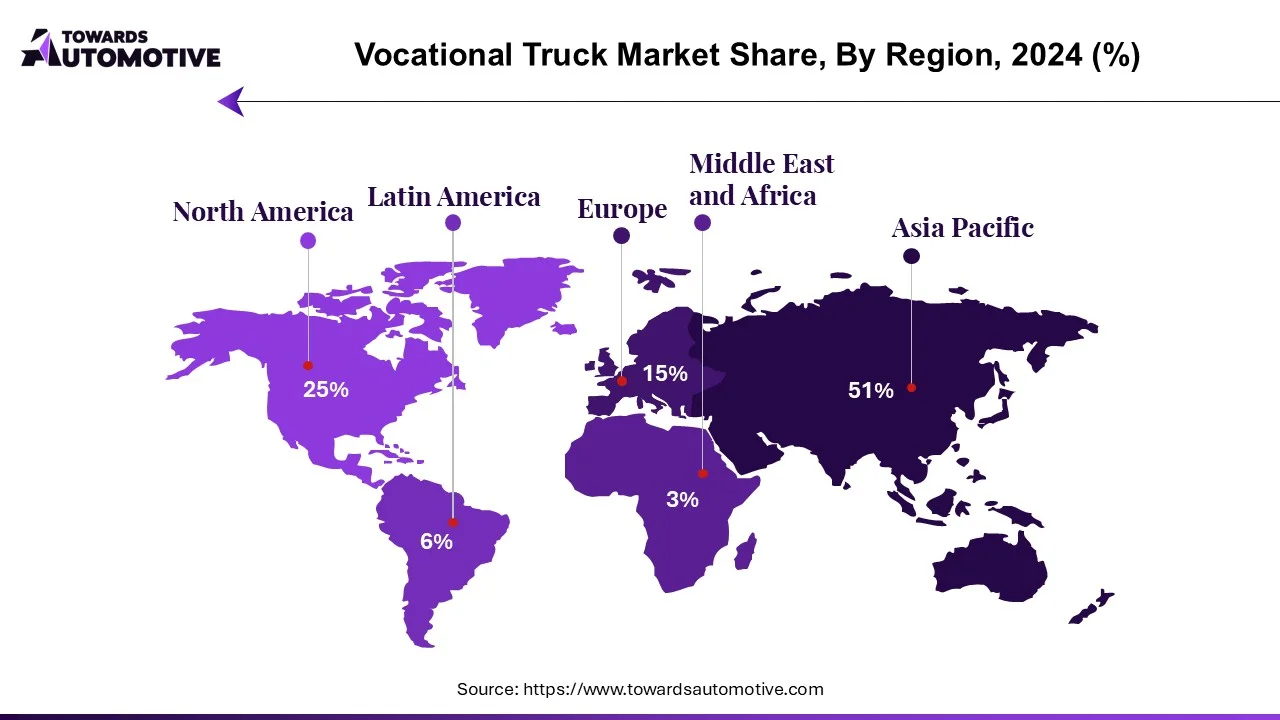

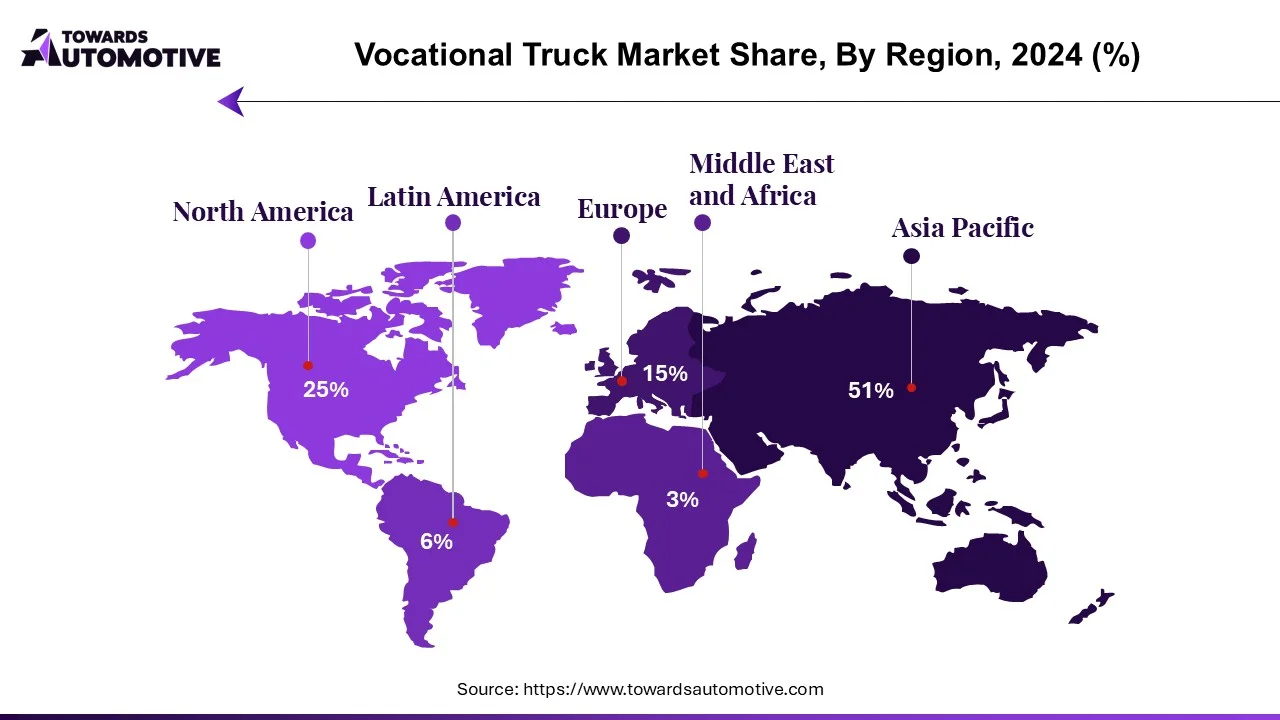

Asia-Pacific Expected to Grow

Fueled by robust infrastructure development and economic prosperity, the Asia Pacific truck market is poised to surpass the 50% mark by 2023. The rapid expansion of roads, bridges, and urban areas has significantly heightened the demand for trucks, particularly in sectors like construction and transportation. Simultaneously, the region's economic upswing has catalyzed an increased need for commercial vehicles, reflecting the intertwined dynamics driving market growth. This underscores the pivotal role of transportation assets in bolstering and sustaining the region's expanding economic landscape.

Leading the charge in this flourishing market are industry stalwarts Volvo and the Mercedes-Benz Group, collectively commanding a market share exceeding 20%. These companies remain at the forefront of innovation, consistently investing in research and development endeavors to introduce cutting-edge features, technologies, and designs tailored to meet the evolving demands of commercial vehicle users. Key focus areas include enhancements in safety, fuel efficiency, and overall performance, reflecting a commitment to driving industry standards forward.

The competitive milieu of the commercial vehicle sector is marked by a multitude of companies offering specialized vehicles catering to diverse industries, fostering an environment conducive to innovation and customization. This emphasis on meeting specific industry needs underscores the adaptability and agility of market players in responding to evolving market demands and technological advancements, ensuring sustained competitiveness and market relevance.

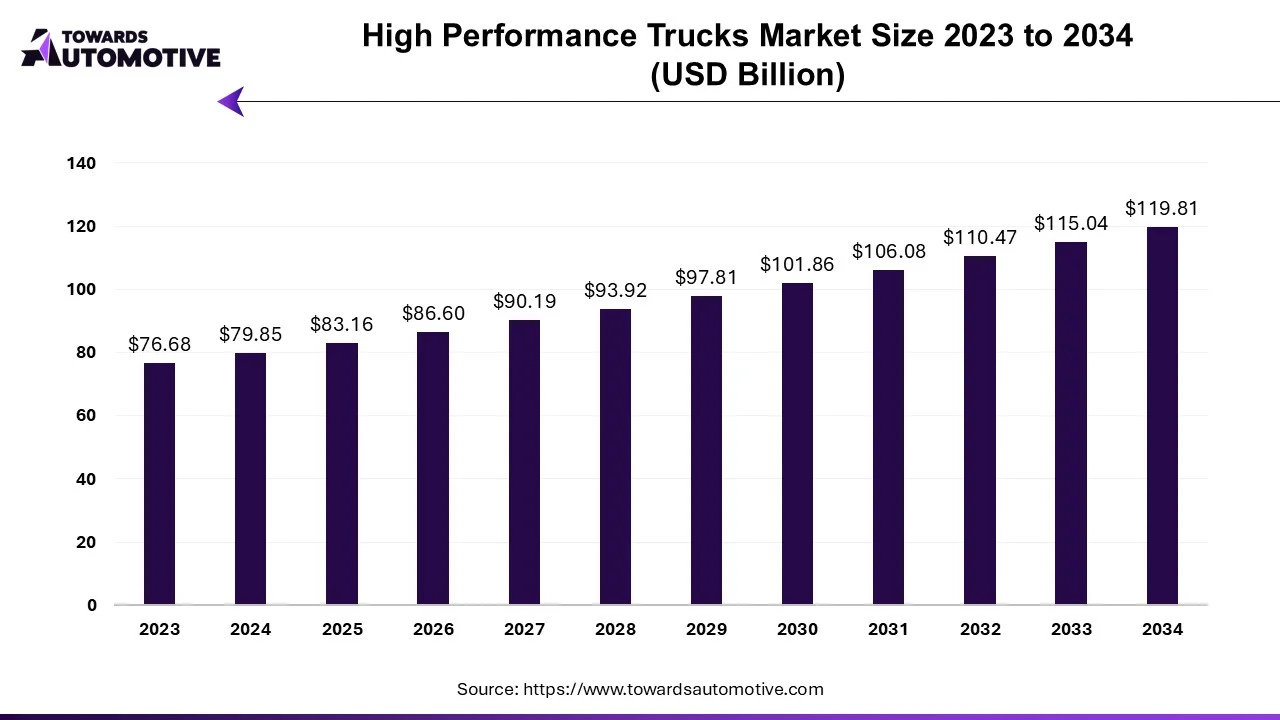

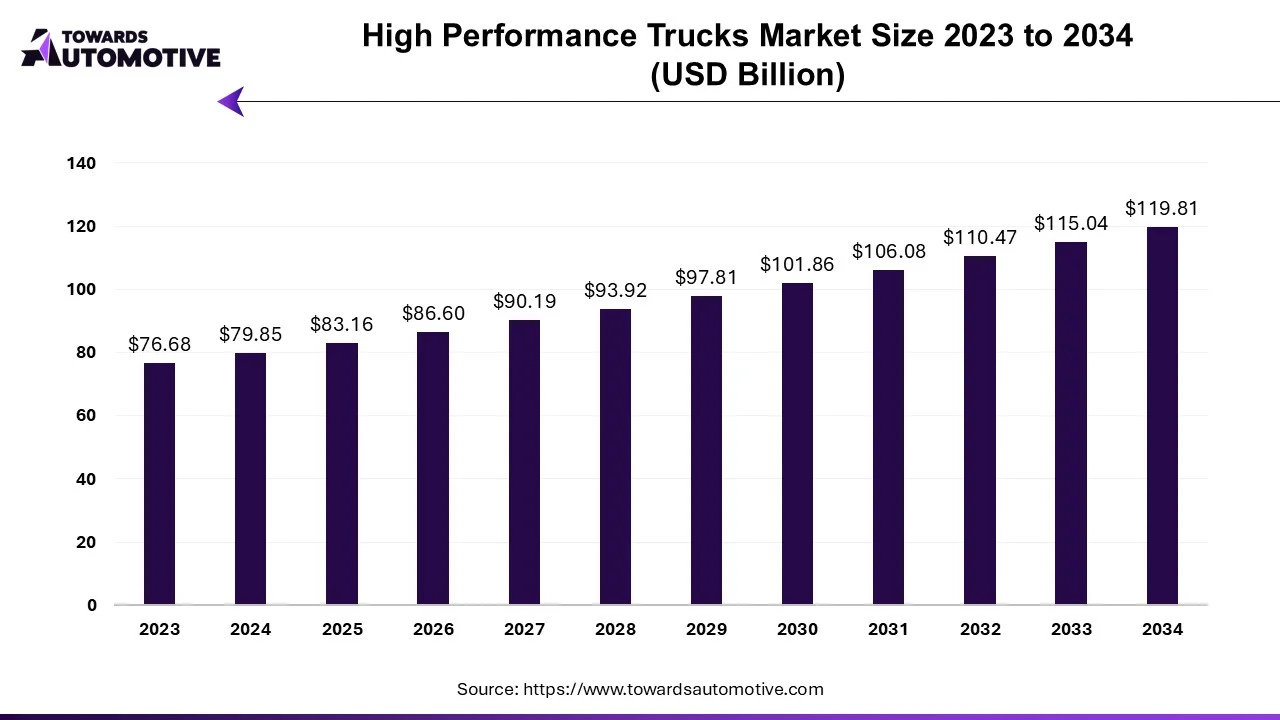

The high performance trucks market is anticipated to grow from USD 83.16 billion in 2025 to USD 119.81 billion by 2034, with a compound annual growth rate (CAGR) of 4.14% during the forecast period from 2025 to 2034.

Initially, trucks were solely utilized for heavy-duty tasks. However, modern automakers have adapted by offering high-performance vehicles that serve as contemporary automobiles, providing enhanced comfort (accommodating up to five occupants), increased interior space, and improved fuel efficiency.

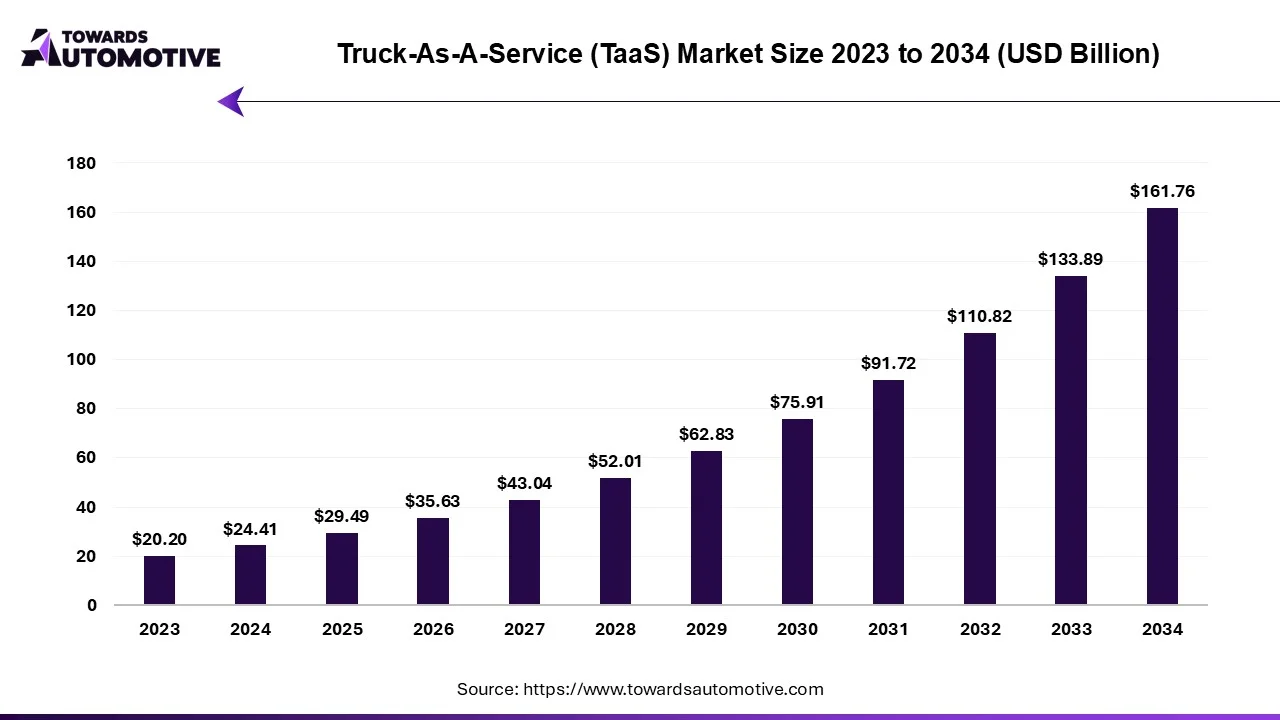

Future of Truck-As-A-Service (TaaS) Market

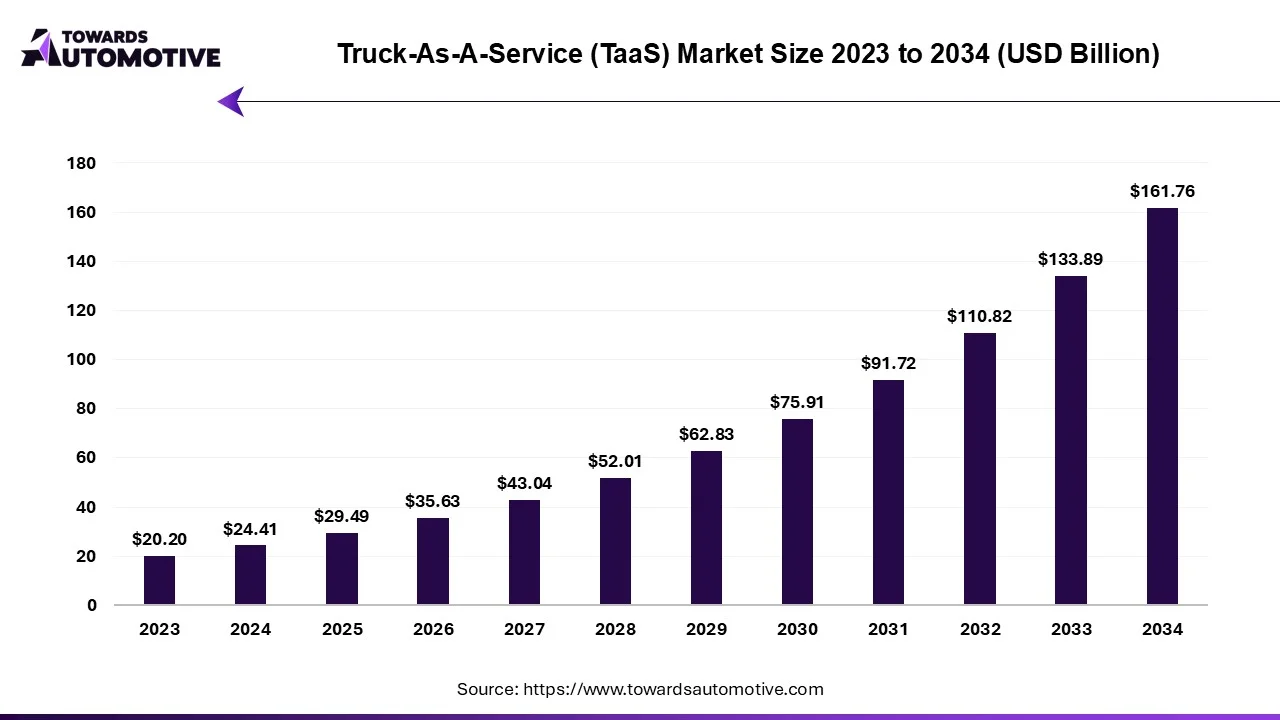

The truck-as-a-service (TaaS) market is forecasted to expand from USD 29.49 billion in 2025 to USD 161.76 billion by 2034, growing at a CAGR of 20.82% from 2025 to 2034.

The truck-as-a-service (TaaS) market is gaining significant traction as a result of the growing demand for cost-efficient and flexible transportation solutions in the logistics and freight industry. TaaS is a business model where trucking companies provide commercial vehicles on a subscription basis, allowing businesses to access vehicles without the need for upfront investments or long-term commitments. This model offers significant advantages, including reduced maintenance costs, fuel management, and fleet optimization, all of which are highly appealing to logistics providers, e-commerce companies, and third-party logistics (3PL) operators.

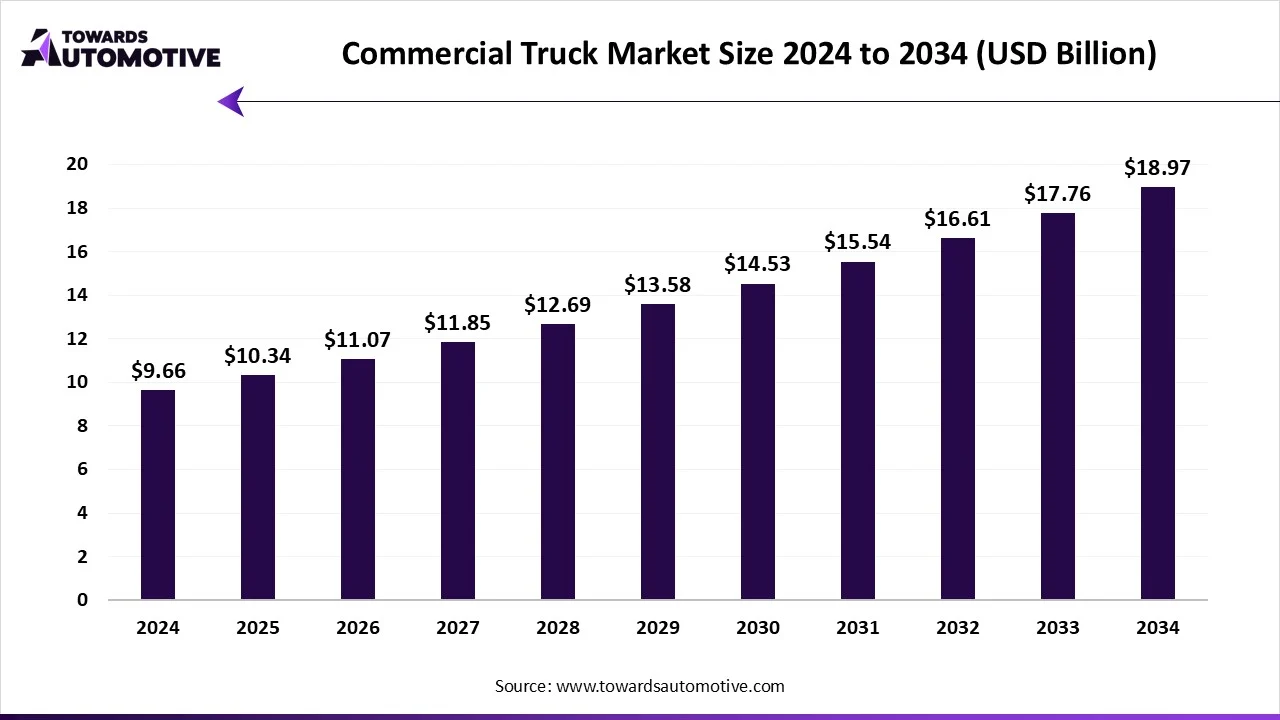

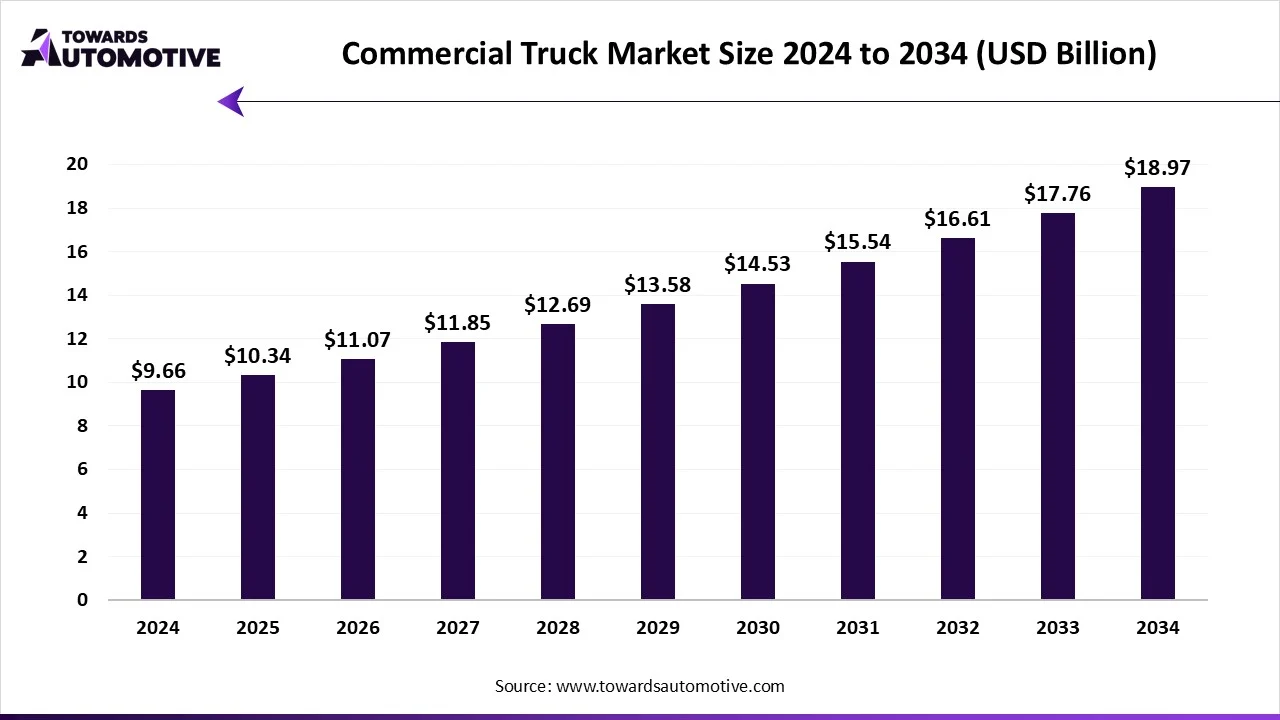

Future of Commercial Truck Market

The commercial truck market is expected to increase from USD 10.34 billion in 2025 to USD 18.97 billion by 2034, growing at a CAGR of 7.03% throughout the forecast period from 2025 to 2034.

The commercial truck market is a prominent branch of the commercial vehicle industry. This industry deals in manufacturing and distribution of commercial trucks around the world. There are several types of trucks developed in this sector comprising of class 1 trucks, class 2 trucks, class 3 trucks, class 4 trucks, class 5 trucks, class 6 trucks, class 7 trucks, class 8 trucks and some others. These trucks are powered by different types of fuel consisting of diesel, natural gas, hydrogen, electric and some others. It is owned by numerous entities including fleet operator and owner operator. The commercial trucks find applications in various sectors such as freight delivery, utility services, construction & mining and some others. This market is expected to rise significantly with the growth of the automotive sector across the globe.

Key Players in the Vocational Truck Market

The vocational truck market comprises a diverse ecosystem of manufacturers, dealers, and suppliers specializing in the design, production, and distribution of vocational trucks and related equipment.

Some of the prominent players in the market include

- Caterpillar Inc.

- Daimler Trucks North America LLC

- PACCAR Inc.

- Volvo Group

- Hino Motors, Ltd.

- Isuzu Motors Limited

- Ford Motor Company

- Kenworth Truck Company

- Mack Trucks, Inc.

- International Truck

Market Segmentation and Regional Outlook

By Truck

- Dump Trucks

- Concrete Mixers

- Utility Trucks

- Tow Trucks

- Fire Trucks

- Refuse Trucks

- Forestry Trucks

- Mining Trucks

- Snowplows

By Application

- Construction

- Mining and Quarrying

- Forestry and Logging

- Waste Management

- Utilities and Municipal Services

- Agriculture

- Oil and Gas

- Emergency Services

By Region

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

Recent Developments in the Vocational Truck Market

- In December 2023, Daimler Trucks North America introduced the Freightliner eCascadia electric vocational truck for commercial applications, offering zero-emission transportation solutions for urban delivery and distribution fleets.

- In November 2023, Volvo Group announced the launch of its Volvo VHD vocational truck equipped with advanced safety features and connectivity solutions, enhancing productivity and performance for customers in construction and municipal services.

- In October 2023, PACCAR Inc. unveiled its Kenworth T880S vocational truck with enhanced aerodynamics and fuel efficiency, providing customers with cost-effective and environmentally friendly transportation solutions for heavy-duty applications.

- In September 2023, Caterpillar Inc. introduced its Cat CT681 vocational truck with improved payload capacity and performance, catering to the needs of customers in construction, mining, and waste management industries.

- In August 2023, Hino Motors, Ltd. launched its Hino XL vocational truck series featuring advanced safety systems and driver assistance technologies, enhancing vehicle control and safety for operators in demanding environments.