December 2025

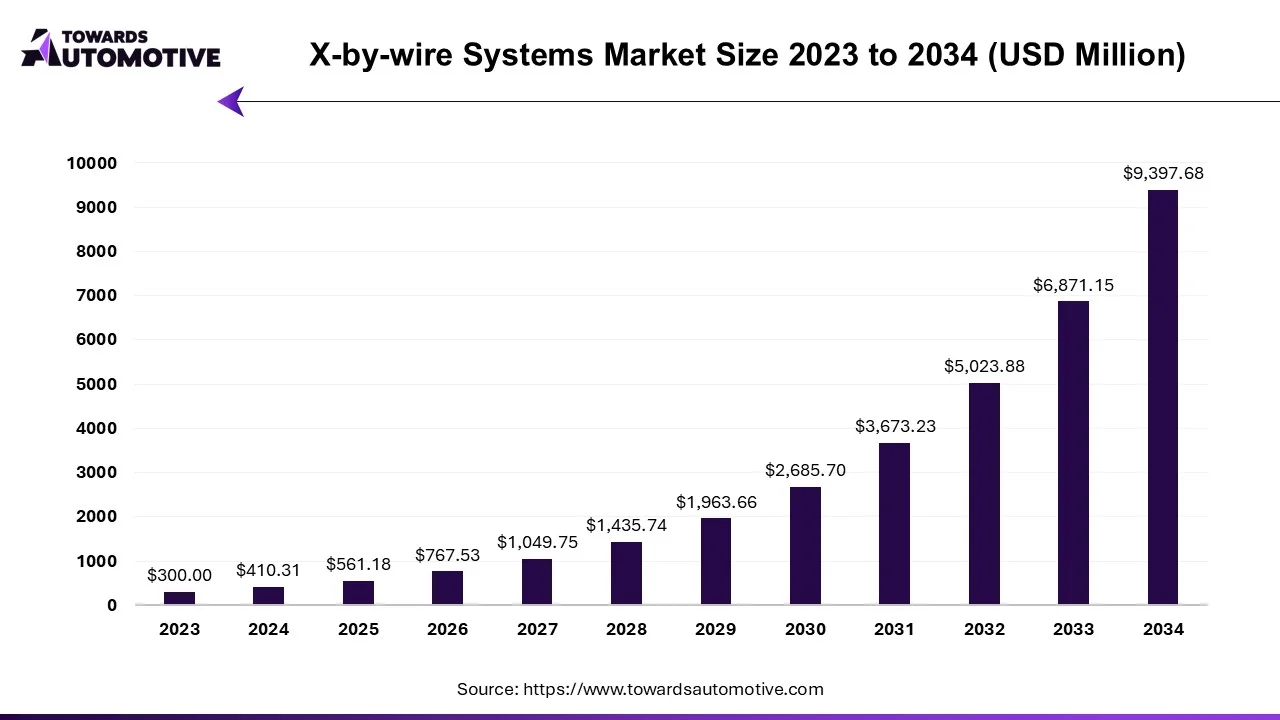

The x-by-wire system market is projected to reach USD 9,397.68 million by 2034, growing from USD 561.18 million in 2025, at a CAGR of 36.77% during the forecast period from 2025 to 2034.

The Covid-19 pandemic led to approximately 95% of relevant auto companies laying off employees during the shutdown, causing a significant impact on global automobile production. However, with the economy's revival and an increase in global automobile production in 2021, the market began to regain strength.

In the long term, the increasing adoption of advanced driver assistance systems and vehicle automation will drive demand for drive-by-wire systems. Although penetration of these systems in the current auto industry is limited, automakers' focus on improving fuel efficiency and reducing vehicle emissions is expected to drive the drive-by-wire system market in the future.

The growth of electric vehicles and their integration into the automotive industry is anticipated to fuel market growth. Advanced features such as autonomous driving, cruise control, automatic transmission, lane departure warning systems, and other monitoring systems are expected to be incorporated into vehicles. There is also increasing demand for fly-by-wire control systems such as throttle and suspension, signaling a shift in gears in the automotive industry.

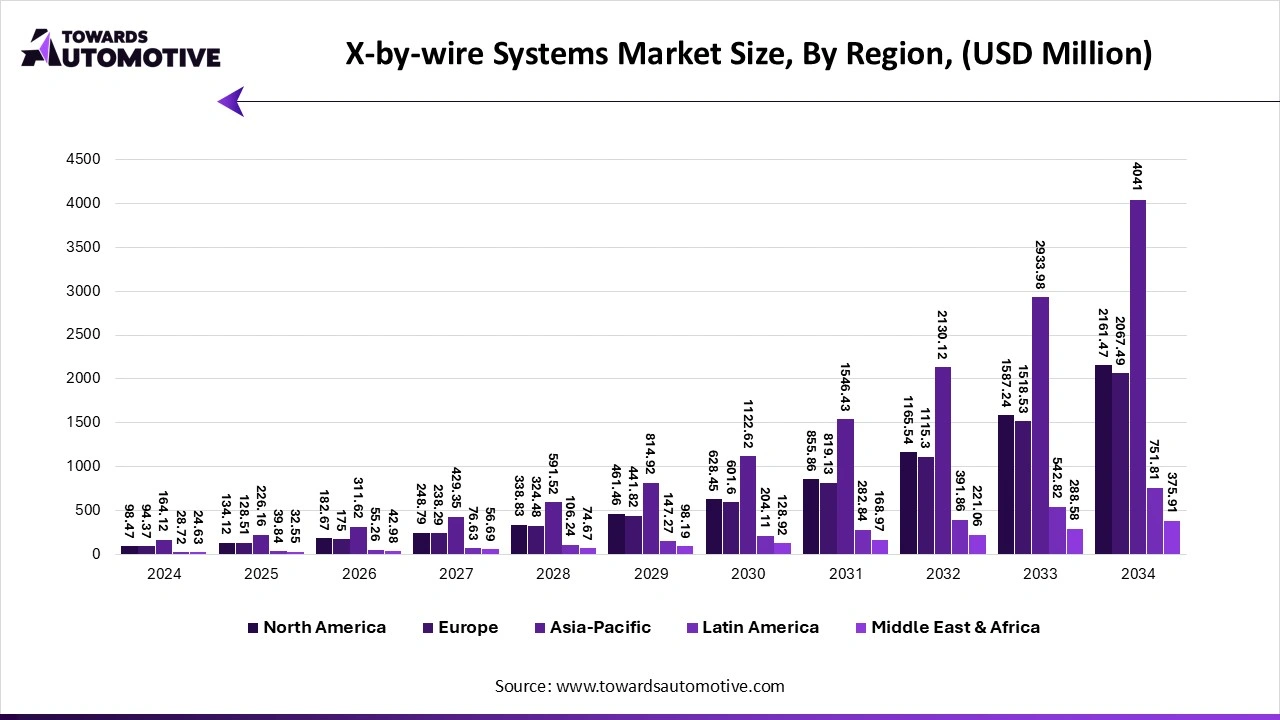

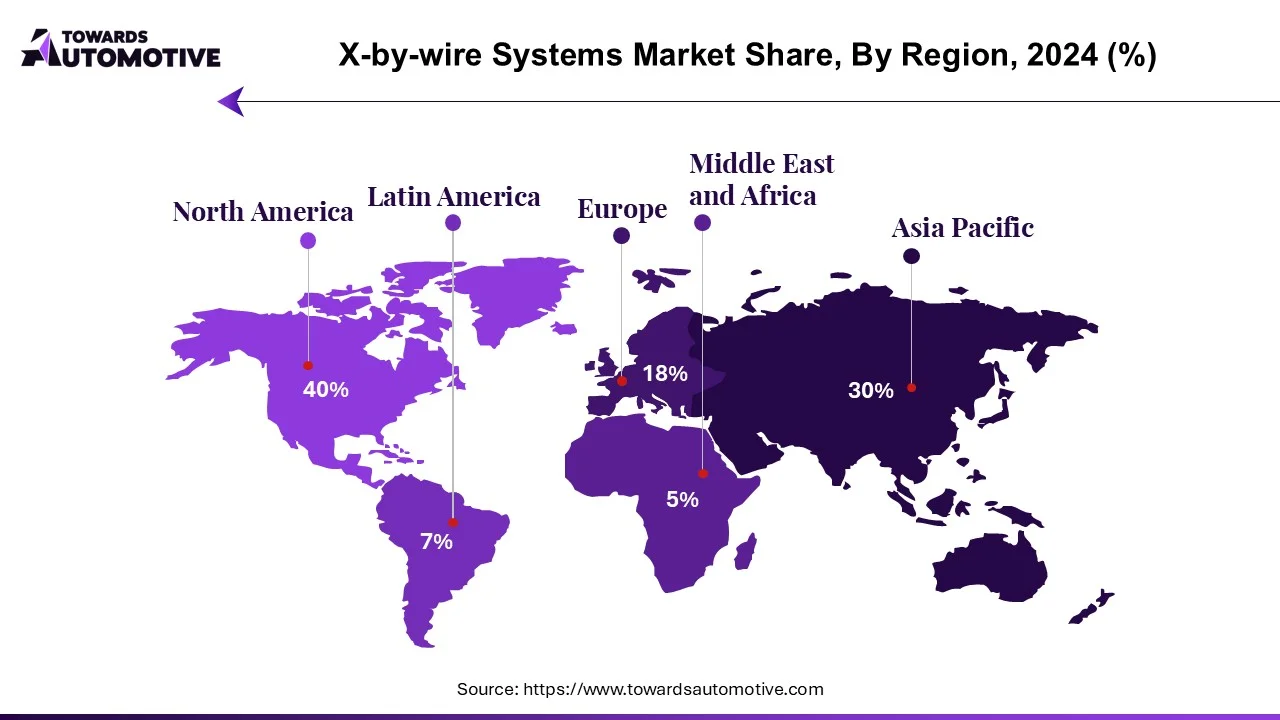

Wired control technology is widely used and successfully developed in Europe and North America. The Asia-Pacific region, driven by increasing consumer spending, demand for enhanced security measures, and automotive industry regulations, is witnessing rapid growth in the use of these systems.

Main markets for this technology include China, Germany, the United States, and Japan. Developing countries like Mexico are expected to quickly adopt this technology, as evidenced by the growing adoption of electrification in various sectors.

The increasing adoption of electric vehicles worldwide is driving demand for drive-by-wire throttle systems in cars. As awareness of Advanced Driver Assistance Systems (ADAS) capabilities grows, large companies previously focused on high-end vehicles are now entering the entry-level consumer market, further boosting demand for these systems.

Throttle by cable has gained popularity due to its numerous advantages over traditional mechanical systems. These include eliminating linkage issues in the transmission system, improving fuel economy, enabling modular systems, and allowing Electronic Control Units (ECUs) to adjust cruise, traction, torque control, and stability control.

Several automakers, such as Audi, Continental, Ford, and Bosch, are actively working on commercializing the concept of driverless cars, where a wired system interprets accelerator pedal input and sends commands to the relevant transducer modules, playing a crucial role in motor control.

In November 2021, China Great Wall Motors introduced a new electrical and electronic equipment based on GEEP 4.0, encompassing five chassis system lines: steering-by-wire, brake-by-wire, switch-by-wire, close-by-wire, and delay-by-wire, integrated to control vehicle movement according to the six degrees of freedom law.

Governments worldwide are also implementing measures to regulate market demand for energy-efficient driving technology.

For Instance,

Given these developments, the cable gas market segment is expected to witness significant growth during the forecast period.

North America is projected to dominate the market during the forecast period, driven by the increasing demand for electric vehicles, particularly EVs. The metalworking industry in North America is mature and well-established.

Many companies have begun to collaborate through partnerships, alliances, and other initiatives to develop their businesses:

These initiatives are anticipated to boost the demand for drive-by-wire systems in North America. Additionally, the Asia-Pacific region is experiencing increasing adoption of drive-by-wire systems due to rising energy consumption, growing preference for enhanced safety measures, and stricter fuel efficiency regulations in the automotive sector.

The global vehicle tracking systems market size is calculated at USD 28.13 billion in 2024 and is expected to be worth USD 93.39 billion by 2034, expanding at a CAGR of 14.15% from 2024 to 2034.

![]()

The vehicle tracking systems market is experiencing rapid growth, driven by advancements in technology, increasing demand for fleet management solutions, and a heightened focus on safety and security. Vehicle tracking systems utilize GPS, RFID, and other technologies to monitor the real-time location and movement of vehicles, providing valuable insights for businesses and individuals alike. As companies seek to optimize their operations and improve efficiency, the demand for tracking solutions has surged, particularly in industries such as logistics, transportation, and delivery services.

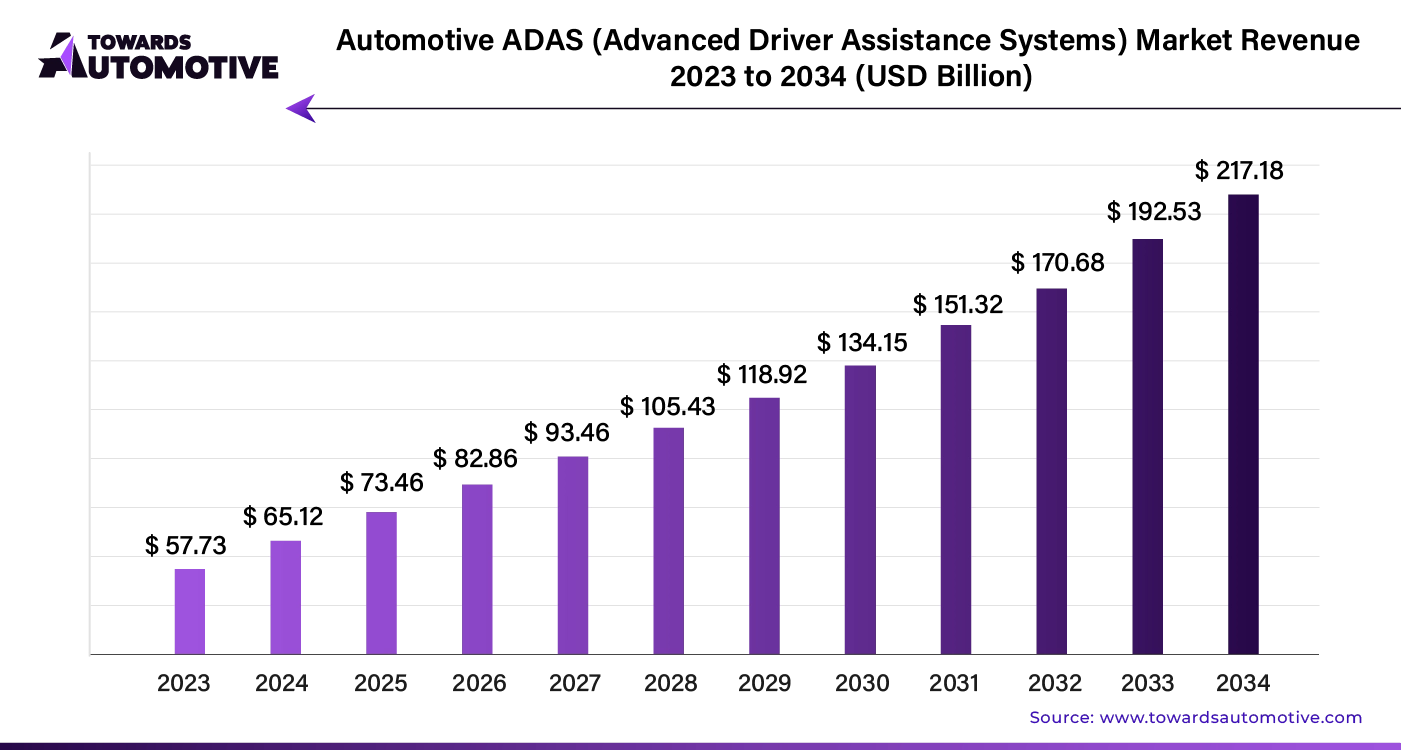

The automotive ADAS (Advanced Driver Assistance Systems) market is forecast to grow from USD 73.46 billion in 2025 to USD 217.18 billion by 2034, driven by a CAGR of 12.8% from 2025 to 2034. The growing emphasis of government on enhancing road safety coupled with technological advancements in the ADAS sector has driven the market expansion.

Additionally, rising investment by automotive companies for integrating advanced sensors in modern cars along with rising deployment of robotaxis by fleet operators is playing a crucial role in shaping the industrial landscape. The integration of AI and machine learning in ADAS system is expected to create ample growth opportunities for the market players in the upcoming years.

The automotive ADAS (Advanced Driver Assistance Systems) market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of ADAS solutions in different parts of the world. There are several solutions developed in this sector comprising of adaptive cruise control (ACC), blind spot detection system (BSD), park assistance, lane departure warning system (LDWS), tire pressure monitoring system (TPMS), autonomous emergency braking (AEB), adaptive front lights (AFL) and some others. These solutions are operated using numerous components including processors, sensors, software and some others. It is designed for various types of vehicles consisting of passenger cars and commercial vehicles. This market is expected to rise significantly with the growth of the EV sector around the globe.

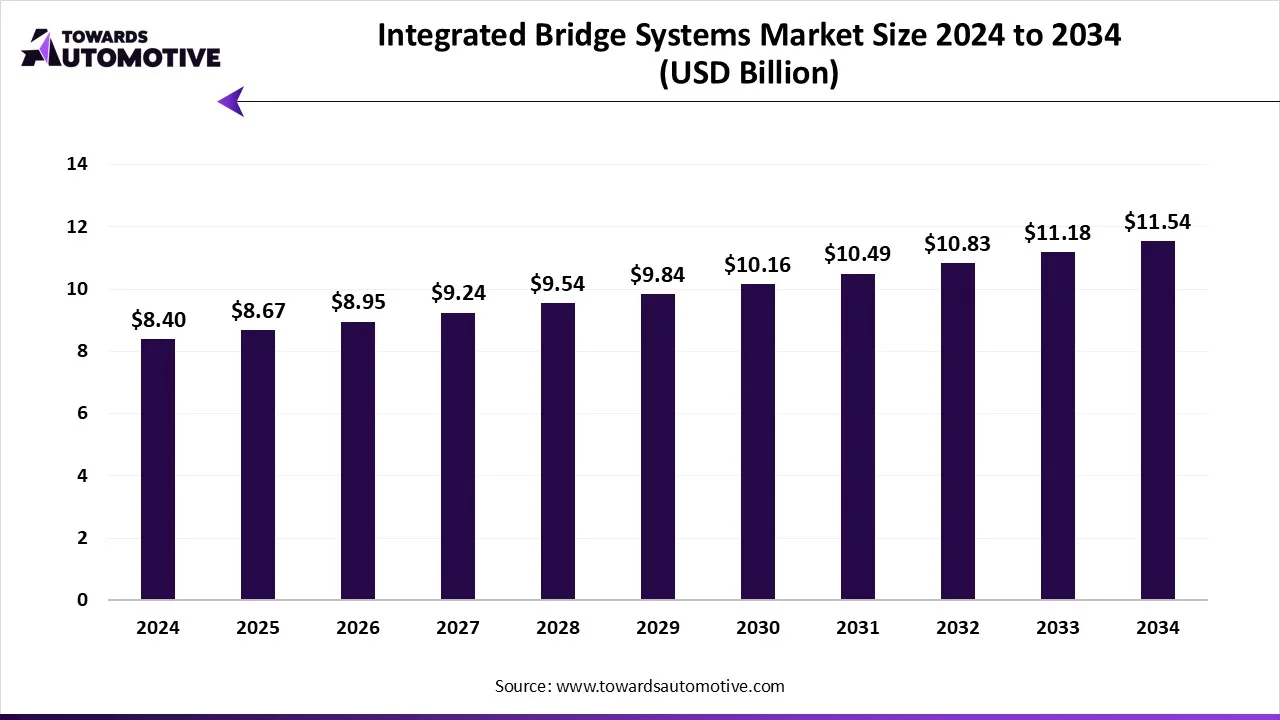

The integrated bridge systems market is projected to reach USD 11.54 billion by 2034, growing from USD 8.67 billion in 2025, at a CAGR of 3.23% during the forecast period from 2025 to 2034.

The integrated bridge systems market is a crucial branch of the maritime industry. This industry deals in the development of integrated bridge systems for enhancing the marine sector. These systems are designed for operating different types of ships including commercial vehicles and defense ships. It comprises of various components such as hardware and software. The hardware components include displays, control unit, data storage devices, sensors, alarms and some others. The growing defense expenditure in different regions of the world has boosted the market growth. This market is expected to rise significantly with the growth of the logistics sector around the globe.

The AI-based driving systems (L2 to L5) market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The growing adoption of autonomous vehicles by fleet operators to reduce their dependency on manual drivers coupled with rapid development in the ADAS industry has played a vital role in shaping the industrial landscape.

Moreover, the integration of AI in driving systems for enhancing safety as well as numerous government initiatives aimed at mandating ADAS in commercial vehicles is contributing to the industry in a positive way. The technological advancements in autonomous driving coupled with the increasing use of embedded sensors in modern vehicles is expected to create ample growth opportunities for the market players in the upcoming days.

The AI-based driving systems (L2 to L5) market is a crucial sector of the automotive industry. This industry deals in the development and distribution of AI-enabled driving solutions across the world. There are several levels of autonomous driving developed in this sector comprising of level 2, level 3, level 4, and level 5. The main components of this sector include AI hardware (Chips, GPUs, ASICs, FPGAs), software (perception, planning, control algorithms), sensors (LiDAR, radar, cameras, ultrasonic sensors), connectivity modules (V2X, 5G, Edge Devices), HD mapping & localization tools and some others. These components are designed for different types of vehicles including passenger cars, commercial vehicles, robotaxis and some others. The end-users of this sector comprise of OEMs, tech providers / ai startups, fleet operators, mobility-as-a-service (MaaS) companies, logistics & delivery companies and some others. This market is expected to grow significantly with the rise of the electric vehicle industry in different parts of the globe.

The market is dominated by key players such as Robert Bosch GmbH and Continental AG, which hold a significant share. While some major players are focusing on expanding their business through acquisitions, partnerships, and the introduction of new technologies, others have implemented various strategies to gain a competitive edge.

Key players in the market include Robert Bosch GmbH, ZF, JTEKT AG, Infineon Technologies AG, and Continental AG.

The X-by-wire system is a vital safety feature in vehicles. It involves replacing mechanical or hydraulic systems, such as braking or steering, with electronic counterparts. The goal is to eliminate the physical linkage between the steering wheel and the car's wheels. Instead, electrically controlled motors are used to alter the wheel's direction and provide feedback to the driver.

By Type

By Vehicle Type

By Geography

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us