October 2025

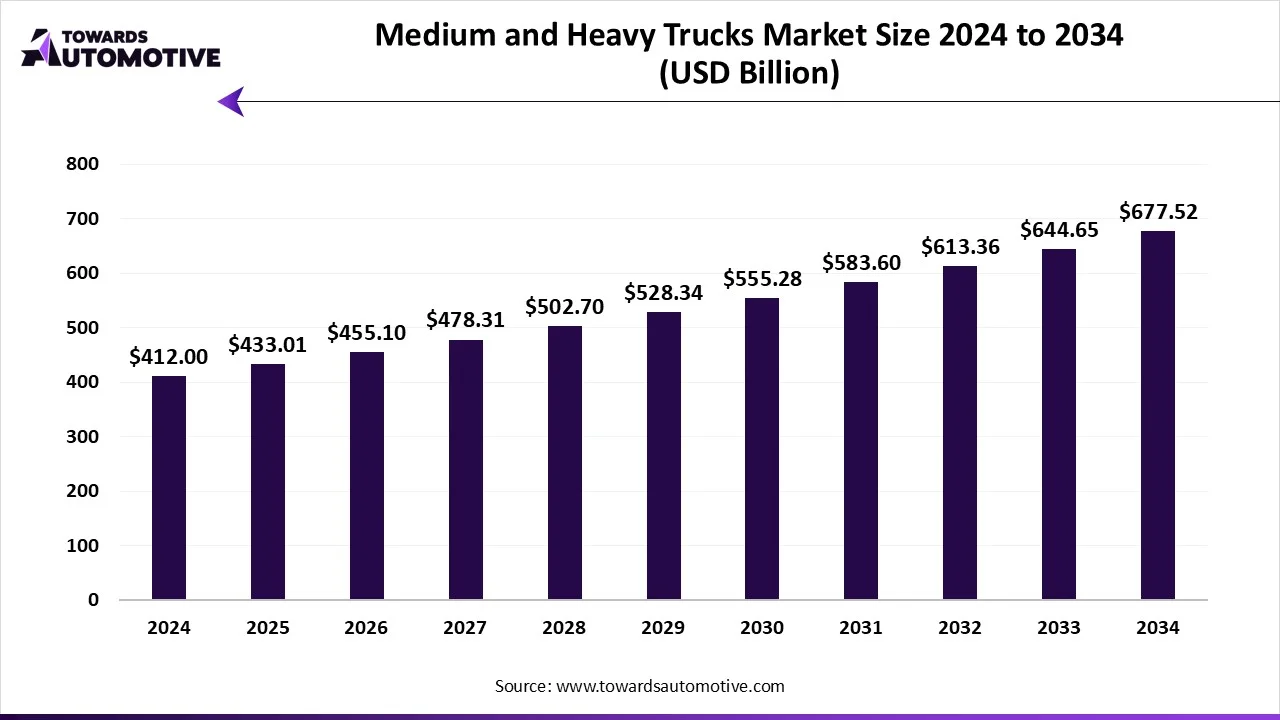

The medium and heavy trucks market is forecasted to expand from USD 433.01 billion in 2025 to USD 677.52 billion by 2034, growing at a CAGR of 5.1% from 2025 to 2034. The rapid expansion of the e-commerce sector along with numerous government initiatives aimed at developing the road infrastructure has boosted the market expansion.

Additionally, the growing investment by automotive brands for developing a wide range of trucks coupled with technological advancements in the EV sector is playing a prominent role in shaping the industrial landscape. The integration of AI and IoT in heavy-duty trucks for improving efficiency through route optimization and predictive maintenance is expected to create ample growth opportunities for the market players in the upcoming days.

The medium and heavy trucks market is a prominent segment of the automotive industry. This industry deals in manufacturing and distribution of medium and heavy trucks in different parts of the world. There are different types of trucks developed in this sector comprising of class 4 trucks, class 5 trucks, class 6 trucks, class 7 trucks, class 8 trucks and some others. These trucks are powered by numerous types of fuel consisting of gasoline, diesel, electric, alternative fuels and some others. It finds application in various industries such as construction, mining, freight, logistics and some others. This market is expected to rise significantly with the growth of the commercial vehicles sector around the globe.

The major trends in this market consists of partnerships, rise in number of residential construction and business expansions.

The 10 to 15 tons segment led the medium and heavy trucks market. The rising use of medium-duty trucks (10-15 tons) in the logistics sector has driven the market expansion. Also, rapid adoption of these trucks in the construction sites for transporting debris is contributing to the industry in a positive manner. Moreover, the increasing deployment of electric trucks in this range in the FMCG and e-commerce sector is expected to boost the growth of the medium and heavy trucks market.

The more than 15 tons segment is expected to grow with a significant CAGR during the forecast period. The growing application of heavy-duty trucks with a carrying capacity of more than 15 tons in the mining sector has driven the market expansion. Additionally, rapid investment by market players for constructing new production facilities to increase the manufacturing of heavy trucks is playing a vital role in shaping the industrial landscape. Moreover, partnerships among logistics companies and fleet operators to deploy these trucks is expected to propel the growth of the medium and heavy trucks market.

The class 6 segment held the largest share the medium and heavy trucks market. The growing use of class 6 medium-duty trucks in the mining and construction sector has driven the market expansion. Additionally, the rising adoption of these vehicles for operating last-mile delivery services is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by automotive brands for developing class 6 trucks is expected to propel the growth of the medium and heavy trucks market.

The class 4 segment is expected to rise with a considerable CAGR during the forecast period. The rising demand for class 4 trucks in the e-commerce sector for transporting goods from one place to another has driven the market growth. Also, the growing number of small and medium enterprises (SME) has increased the demand for class 4 trucks, thereby boosting the industrial expansion. Moreover, integration of advanced technologies for operating medium-duty operations is expected to drive the growth of the medium and heavy trucks market.

The diesel segment dominated the medium and heavy trucks market. The growing demand for heavy-duty diesel trucks from the mining sector has boosted the market growth. Additionally, lack of well-established charging networks in remote areas coupled with rapid investment by engine manufacturers to develop high-quality diesel engines for trucks is playing a prominent role in shaping the industrial landscape. Moreover, numerous advantages of these trucks including high torque and towing power, exceptional fuel efficiency, low maintenance, high resale value and some others is expected to drive the growth of the medium and heavy trucks market.

The electric segment is expected to grow with the fastest CAGR during the forecast period. The increasing adoption of electric trucks in the logistics sector and construction sites for lowering emission has driven the market expansion. Also, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rise in number of EV startups in economically advanced nations is contributing to the industry in a positive manner. Moreover, rapid investment by automotive brands for developing electric trucks to cater the needs of end-users is expected to propel the growth of the medium and heavy trucks market.

The construction segment led the medium and heavy trucks industry. The rise in number of official buildings in several countries such as Canada, the U.S., Germany, India, Japan and some others has driven the market expansion. Additionally, rapid investment by government for developing the construction sector is playing a prominent role in shaping the industrial landscape. Moreover, the increasing emphasis of automotive brands for developing construction equipment is expected to drive the growth of the medium and heavy trucks market.

The logistics segment is expected to rise with the highest CAGR during the forecast period. The growing development in the logistics sector has boosted the market growth. Also, rapid adoption of electric trucks in the logistics industry for lowering emission is contributing to the industry in a positive direction. Moreover, growing focus of truck manufacturers to develop heavy trucks for the logistics sector is expected to propel the growth of the medium and heavy trucks market.

North America led the medium and heavy trucks market. The increase in number of residential constructions in the U.S. and Canada has increased the demand for heavy-duty trucks, thereby driving the market expansion. Additionally, numerous government initiatives aimed at developing the mining sector coupled with rapid expansion of the EV charging infrastructure is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as Paccar, Inc., Kenworth Truck Company, Peterbilt Motors Company and some others is expected to drive the growth of the medium and heavy trucks market in this region.

Asia-Pacific is expected to expand with the highest CAGR during the forecast period. The growing demand for heavy-duty trucks from the mining sector in several countries including India, China, Japan, South Korea and some others has driven the market growth. Also, rapid investment by government for strengthening the road infrastructure coupled with rapid growth of the logistics sector is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Tata Motors Limited, Mitsubishi Fuso, Ashok Leyland and some others is expected to boost the growth of the medium and heavy trucks market in this region.

| June 2025 | Announcement |

| Martin Lundstedt, the President and CEO of the Volvo Group | Coretura represents a bold step forward in the evolution of commercial vehicles. By leveraging cutting-edge technology and collaborative innovation, we're setting the stage for a new era of connectivity and efficiency in the industry. This venture underscores our commitment to not only advancing our products but also paving the way for sustainable and intelligent transportation solutions. |

The medium and heavy trucks market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Tata Motors Limited, Mitsubishi Fuso, DAF Trucks, Renault Trucks, Paccar, Inc., Daimler, Volvo Group, MAN SE, Ashok Leyland and some others. These companies are constantly engaged in developing medium & heavy trucks and adopting numerous strategies such as launches, partnerships, collaborations, business expansions, acquisitions, joint ventures and some others to maintain their dominance in this industry.

By Tonnage Type

By Class

By Fuel Type

By Application

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us