December 2025

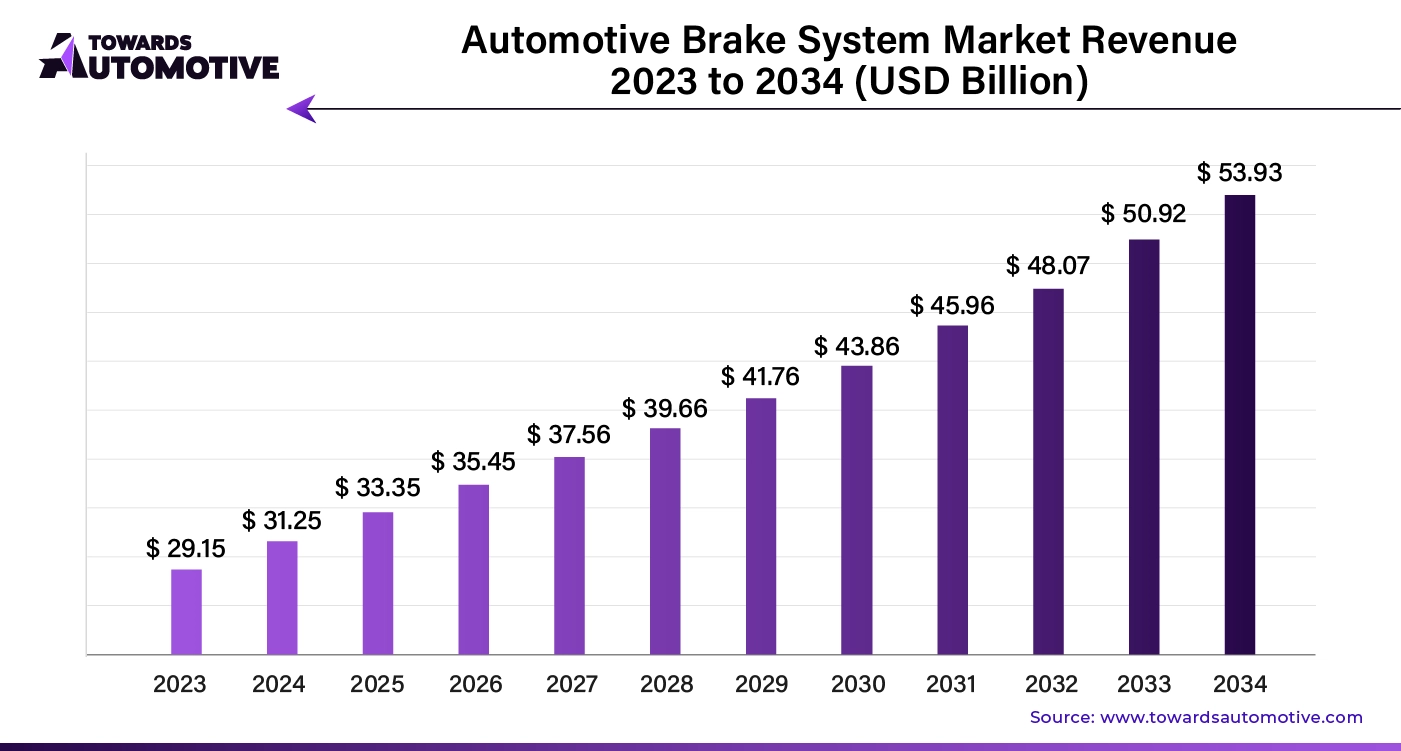

The automotive brake system market is forecast to grow from USD 33.35 billion in 2025 to USD 53.93 billion by 2034, driven by a CAGR of 5.71% from 2025 to 2034.

The automotive brake system market is a prominent segment of the automotive industry. This industry deals in manufacturing and distribution of braking systems for automotives. There are several types of brakes manufactured in this sector consisting of disc brakes and drum brakes. It is designed for different types of vehicles comprising of passenger cars and commercial vehicles. These brakes are integrated with various technologies including anti-lock brake system (ABS), traction control system (TCS), electronic stability control (ESC), electronic brake-force distribution (EBD) and some others. The growing production of passenger vehicles in different parts of the world has boosted the market expansion. This market is projected to grow significantly with the rise of automotive components industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 31.25 Billion |

| Projected Market Size in 2034 | USD 53.93 Billion |

| CAGR (2025 - 2034) | 5.71% |

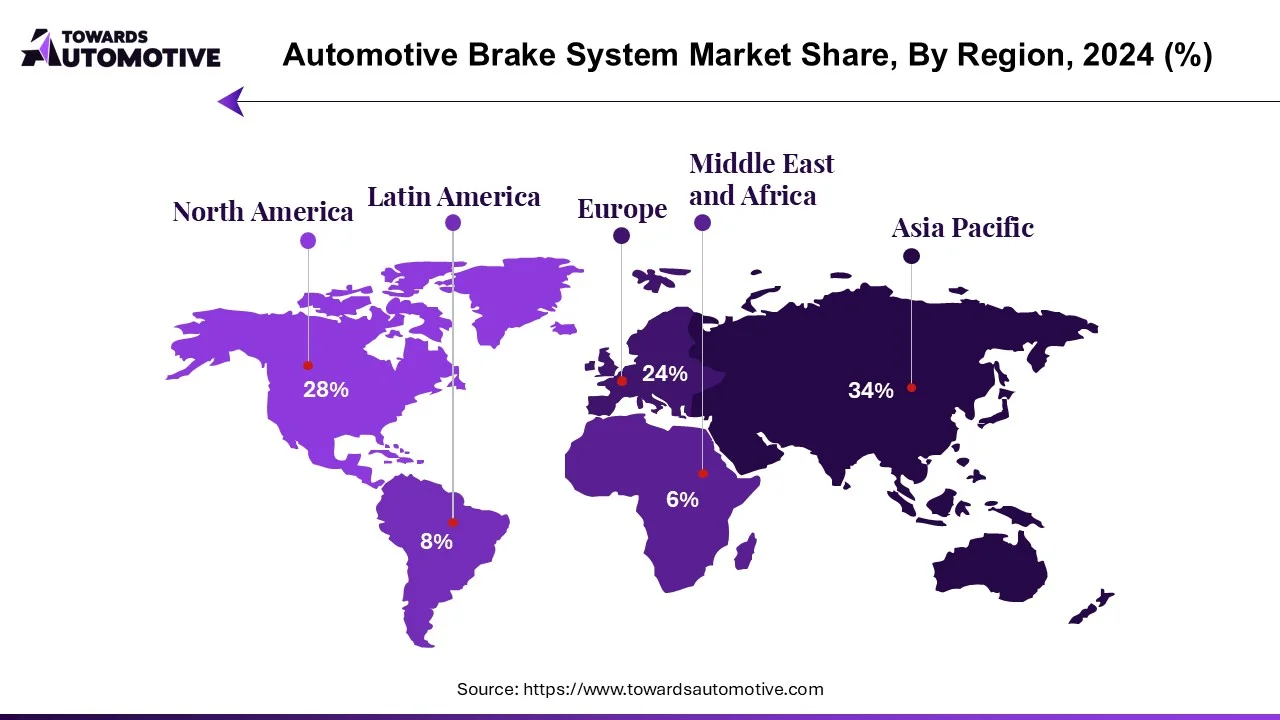

| Leading Region | Asia Pacific |

| Market Segmentation | By Type, By Vehicle Type, By Technology and By Region |

| Top Key Players | AISIN CORPORATION, Haldex, The Web Co, NISSIN KOGYO Co., Ltd |

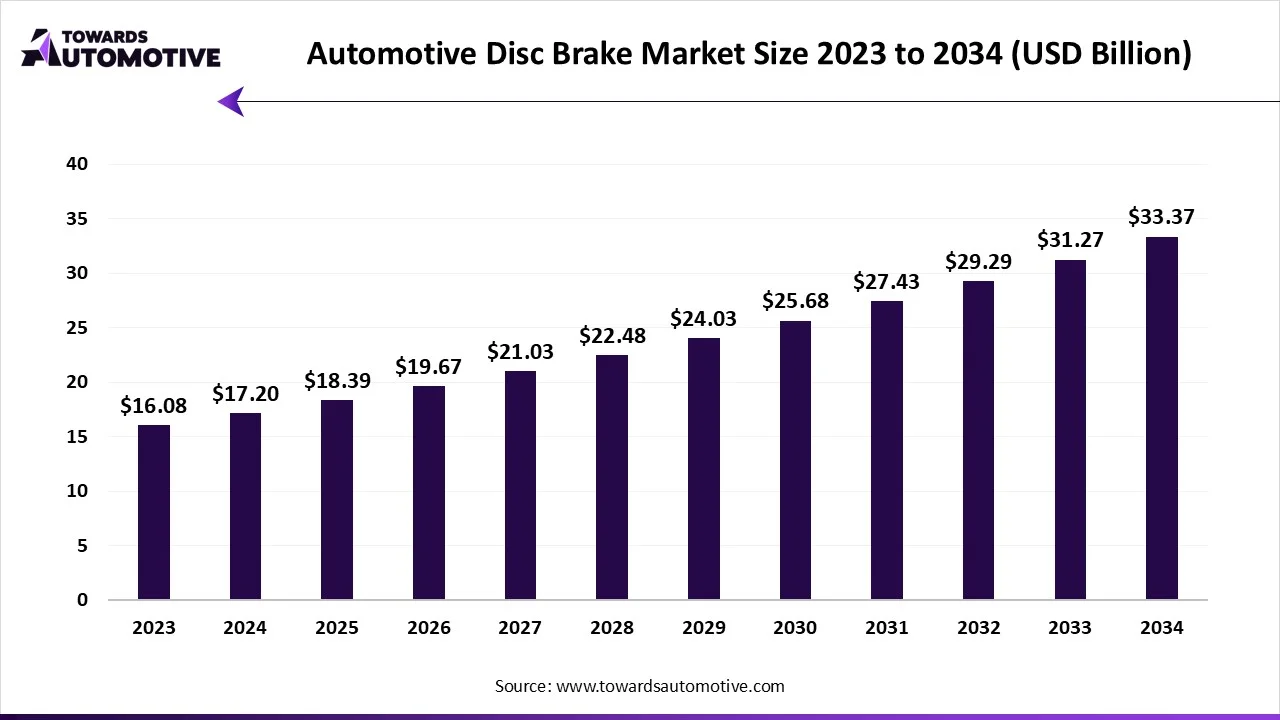

The disc brake segment held a dominant share of the market. The growing demand for advanced braking systems from automotive companies has boosted the market expansion. Additionally, the rapid integration of disc brakes in sports car to deliver superior braking experience is playing a crucial role in shaping the industrial landscape. Moreover, several advantages of disc brakes such as superior heat dissipation, enhanced braking performance, and easier maintenance along with rapid investment by braking brands for developing advanced disc brakes for the automotive sector, thereby driving the growth of the automotive brake system market.

The drum brake segment is likely to rise with a significant growth rate during the forecast period. The growing use of drum brakes in trailers and buses for enhancing their braking efficiency has boosted the industrial expansion. Additionally, the rising application of these brakes in economical vehicles along with continuous research and development activities related to drum brakes is likely to shape the industry in a positive direction. Moreover, numerous advantages of drum brakes consisting of lower manufacturing costs, increased durability, and superior protection is expected to boost the growth of the automotive brake system market.

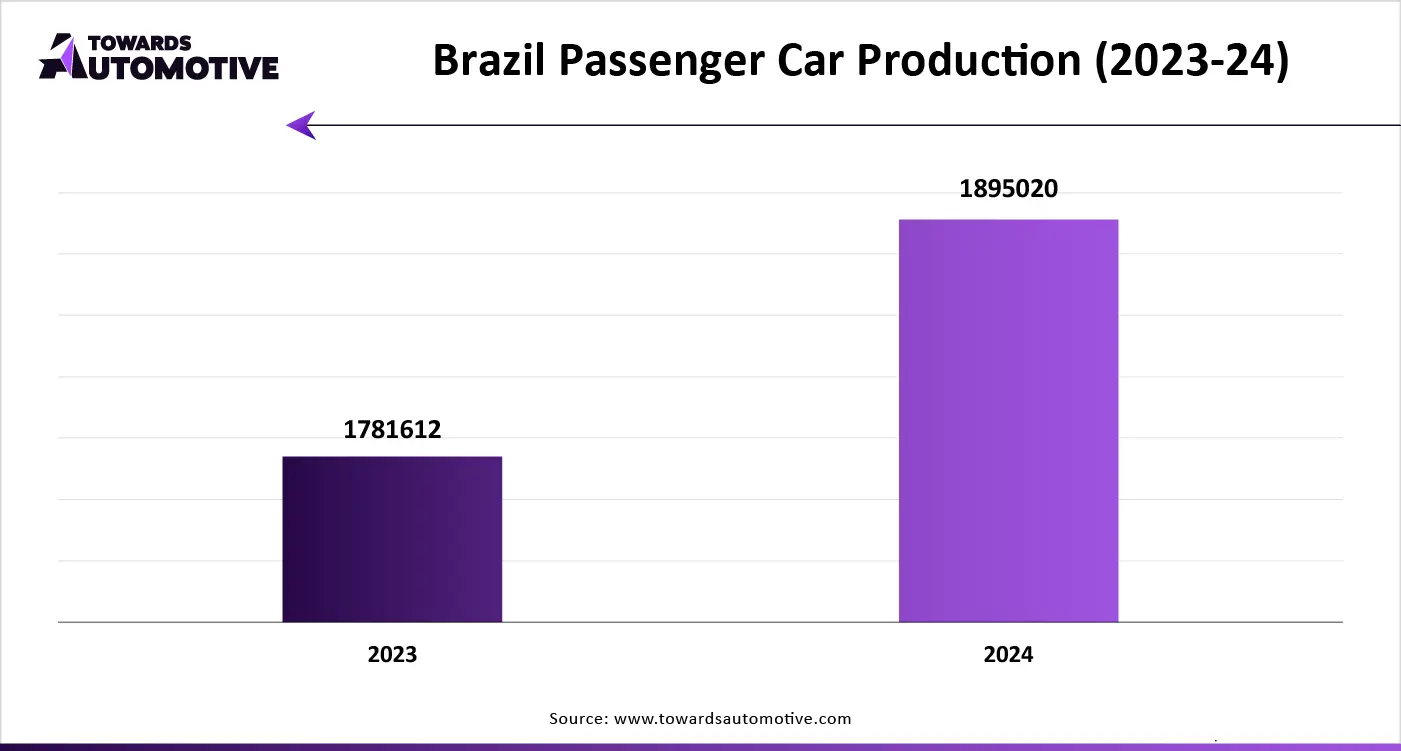

The passenger cars segment held the largest share of the market. The growing demand for economic hatchbacks in developing nations such as India, Vietnam, Indonesia and some others has boosted the market expansion. Additionally, the rising adoption of luxury EVs in developing countries including U.S., UK, Germany, Italy, Japan, China, Australia and some others is shaping the industrial expansion. Moreover, the increasing demand for enhanced safety by passenger car owners coupled with rapid use of disc brakes in high-performance vehicles is anticipated to accelerate the growth of automotive brake system market.

The commercial vehicles segment is anticipated to witness rapid growth during the forecast period. The rising demand for light commercial vehicles from the e-commerce sector has boosted the market expansion. Also, rapid adoption of drum brakes in heavy commercial vehicles such as trucks and buses to maintain braking stability is adding to the industrial growth. Moreover, partnerships and collaborations among commercial vehicle companies and brake manufacturers for developing advanced braking systems has further propelled the growth of the automotive brake system market.

The electronic stability control (ESC) segment dominated this industry. The growing demand for advanced braking systems in luxury vehicles has boosted the market expansion. Also, numerous government initiatives aimed at enhancing automotive safety to reduce road fatalities is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of ESC technology such as prevents skidding and loss of control, improves stability, reducing rollover risk, automatic operation and some others is projected to boost the growth of the automotive brake system market.

The anti-lock brake system (ABS) segment is predicted to rise with a significant CAGR during the forecast period. The rising adoption of anti-lock brake systems in mid-ranged vehicles has boosted the market expansion. Additionally, surge in demand for superior braking among car owners along with rapid advancements in ABS technology is shaping the industry in a positive direction. Moreover, several benefits of ABS technology including prevention of wheel lock-up, improving vehicle stability, reducing stopping distances, enhancing steering control while braking and some others is expected to propel the growth of the automotive brake system market.

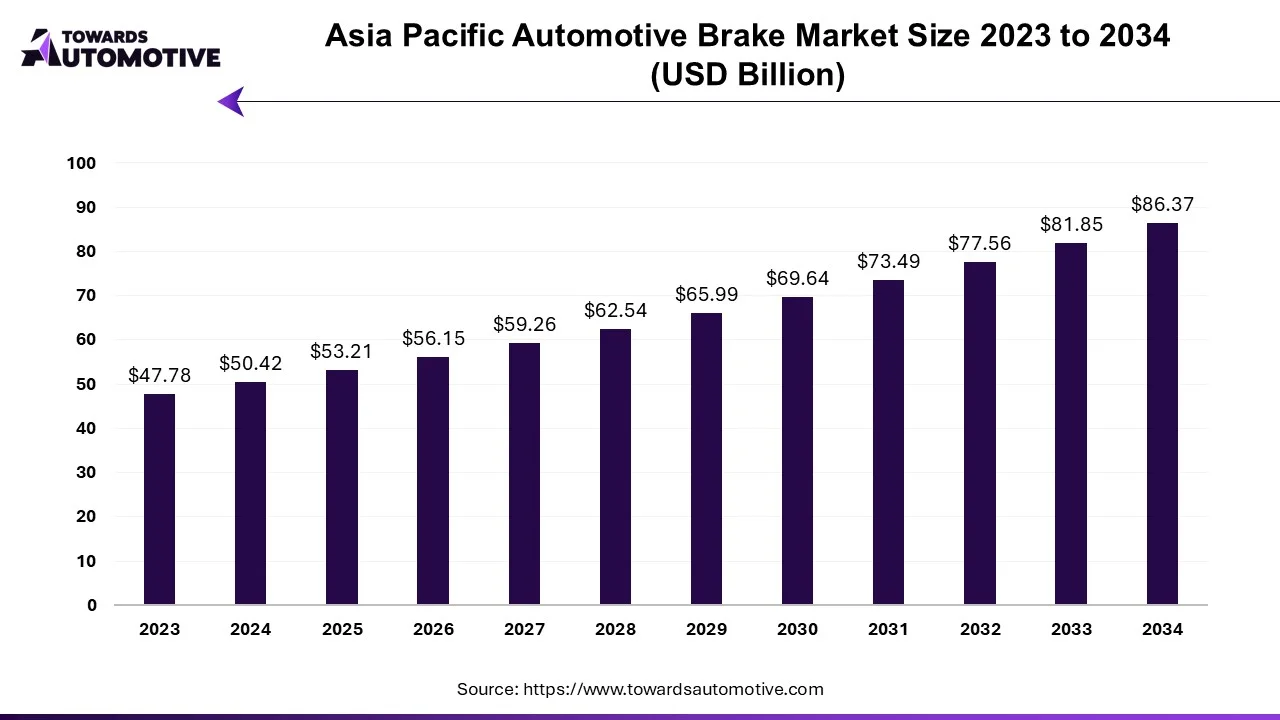

Asia Pacific held the highest share of the automotive brake system market. The growing demand for commercial vehicles in countries such as Japan, India, China, South Korea and some others has boosted the market expansion. Also, rise in number of startups brands dealing in automotive components coupled with rapid adoption electric vehicles is contributing to the overall industrial growth. Additionally, the presence of several automotive brands such as Tata, Mahindra, BYD, XPENG, Toyota, Mitsubishi, Nissan, Mazda, Suzuki and some others is further accelerating the growth of the automotive brake system market in this region.

China dominated the market in this region. The growing sales and production of passenger vehicles has boosted the market growth. Additionally, the availability of raw materials at lower prices along with accessibility of skilled labor force is further contributing to the industrial growth. Moreover, the presence of several braking companies such as Dongying Xinyi Automobile Parts, Zibo Yihaojia Auto Parts, Shandong Huahua Braking and some others is predicted to propel the market growth.

North America is expected to grow with the fastest growth rate during the forecast period. The growing demand for hyper cars among racing enthusiasts along with numerous government mandates to integrate advanced braking systems in vehicles has boosted the market growth. Additionally, the rapid adoption of electric vehicles coupled with increasing demand for autonomous vehicles is further adding to the industrial expansion. Moreover, the presence of several automotive companies such as Tesla, General Motors, Ford, Rivian and some others is driving the growth of the automotive brake system market in this region.

The U.S. and Canada are the major contributors of the market in this region. In the U.S., the market is generally driven by the presence of various market players such as TRW, Wilwood, Raybestos and some others. In Canada, the growing adoption of LCEVs along with increasing sales of commercial vehicles has boosted the market growth.

The global automotive carbon ceramic market size is calculated at USD 618.13 million in 2024 and is expected to be worth USD 1638.25 million by 2034, expanding at a CAGR of 10.46% from 2023 to 2034.

As automakers strive to meet stringent safety and emissions regulations, they are increasingly turning to advanced braking technologies, such as carbon ceramic brakes. This shift is largely driven by the need to comply with government standards and enhance vehicle performance.

Carbon ceramic brakes are rapidly gaining popularity, especially in high-end and luxury vehicles. These brakes are known for their exceptional performance, including superior heat resistance, reduced weight, and enhanced durability. They offer a significant upgrade over traditional braking systems, making them a desirable feature for discerning buyers who seek the latest in automotive technology and premium components.

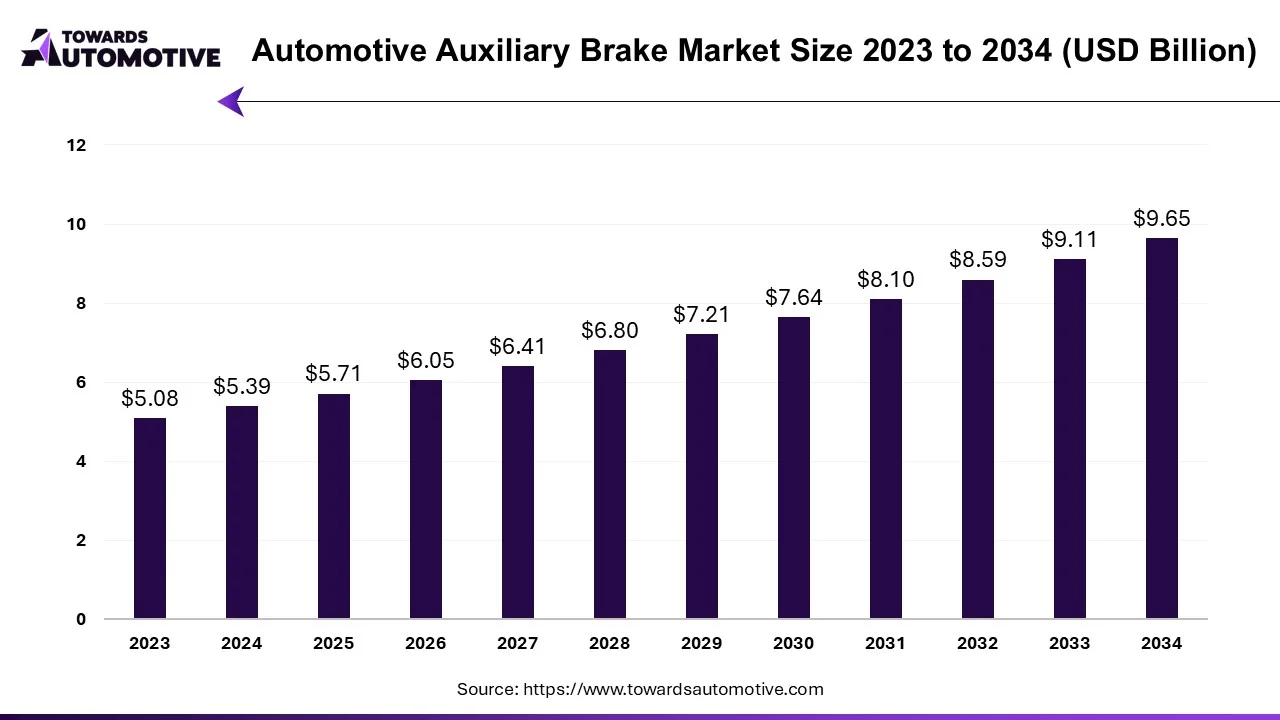

The automotive auxiliary brake market is forecast to grow from USD 5.71 billion in 2025 to USD 9.65 billion by 2034, driven by a CAGR of 6% from 2025 to 2034.

The automotive auxiliary brake market is a crucial sector of the automotive components industry. This industry deals in manufacturing and distribution of auxiliary brakes for automotives. There are several types of brakes developed in this sector consisting of hydraulic auxiliary brake, electronic auxiliary brake, pneumatic auxiliary brake, mechanical auxiliary brake and some others. These brakes consist of various components such as brake pads, brake discs, brake calipers, brake valves and some others. It finds several applications in different vehicles including passenger vehicles, commercial vehicles, heavy-duty trucks and recreational vehicles. The growing sales of passenger vehicles around the world has contributed to the industrial expansion. This market is predicted to rise significantly with the growth of the automotive sector in different parts of the world.

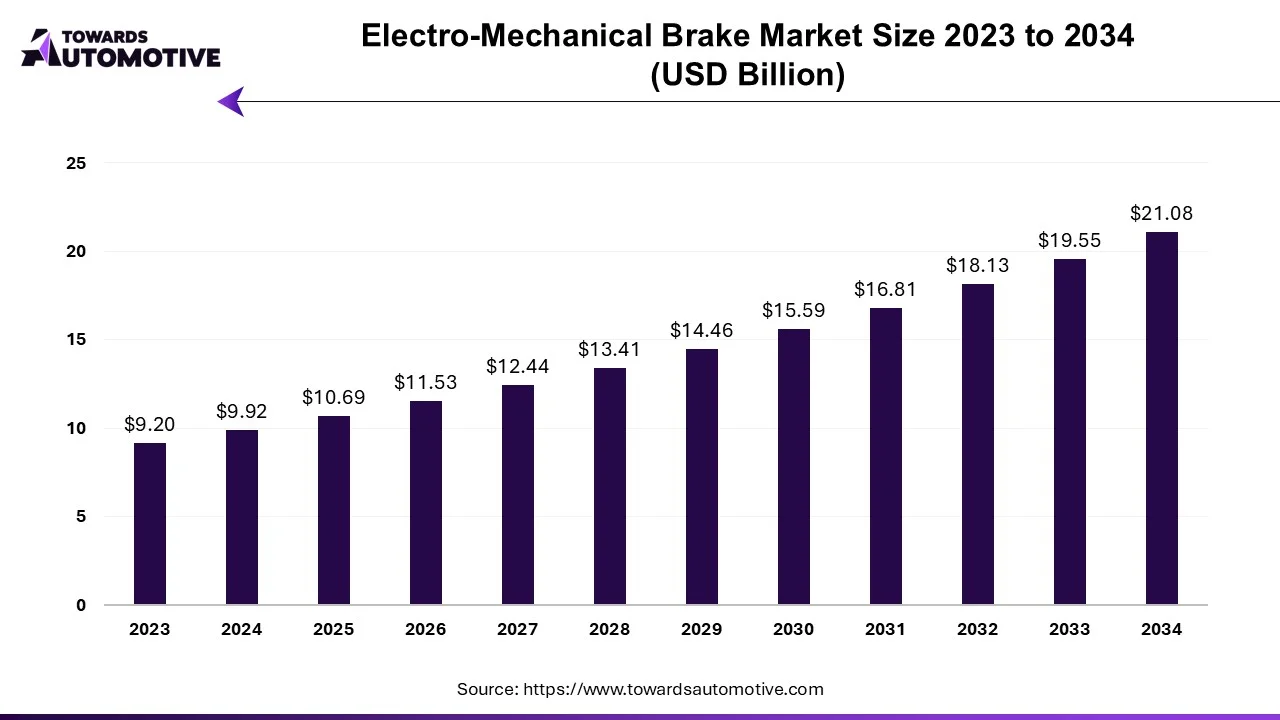

The electro-mechanical brake market is projected to reach USD 21.08 billion by 2034, growing from USD 10.69 billion in 2025, at a CAGR of 7.83% during the forecast period from 2025 to 2034.

The electro-mechanical brake market is a prominent segment of the automotive component industry. This industry deals in production and distribution of electro-mechanical braking systems for automotives. There are different types of brakes manufactured in this sector comprising of single face break, power off brake, particle brake, hysteresis power brake, multiple disk brake and some others. These brakes finds applications in locomotives, trams, trains, automotive, industrial, marine and some others. It is available in an organized distribution channel including OEM and aftermarket. The growing sales of passenger cars in different parts of the world has played a crucial role in shaping the industrial landscape. This market is expected to grow significantly with the rise of the automotive industry across the globe.

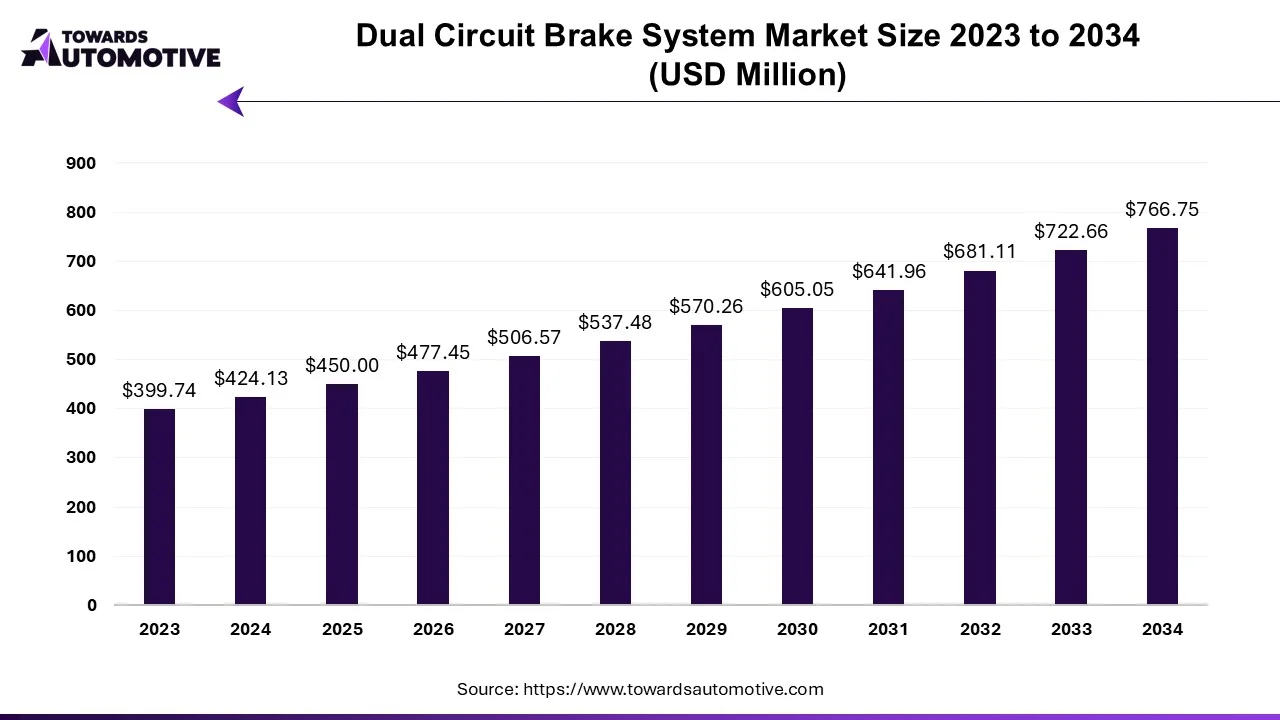

The dual circuit brake system market is expected to increase from USD 450 million in 2025 to USD 766.75 million by 2034, growing at a CAGR of 6.1% throughout the forecast period from 2025 to 2034.

The dual circuit brake system market is a crucial branch of the automotive industry. This market deals in manufacturing and distribution of dual circuit brake system for the automotive sector. There are several types of brakes developed in this sector comprising of disc brakes, drum brakes and some others. It is designed for various types of vehicles consisting of passenger cars, commercial vehicles and some others. The growing sales of passenger cars in different parts of the world has contributed to the industrial expansion. This market is projected to rise significantly with the growth of the automotive components sector around the globe.

The Asia Pacific automotive brake market is expected to increase from USD 53.21 billion in 2025 to USD 86.37 billion by 2034, growing at a CAGR of 5.53% throughout the forecast period from 2025 to 2034.

The Asia Pacific automotive brake market is a crucial branch of the automotive component industry. This industry deals in manufacturing and distribution of automotive brakes across the APAC region. There are different types of brakes developed in this sector comprising of disc brakes and drum brakes. These brakes are integrated with various technologies consisting of anti-lock brake system (ABS), traction control system (TCS), electronic stability control (ESC), electronic brake-force distribution (EBD) and some others. It is designed for numerous types of vehicles including passenger cars and commercial vehicles. The growing sales of electric vehicles in China has driven the market expansion. This market is predicted to grow significantly with the rise of the automotive sector in this region.

The automotive disc brake market is forecast to grow from USD 18.39 billion in 2025 to USD 33.37 billion by 2034, driven by a CAGR of 6.93% from 2025 to 2034.

The automotive disc brake market is a prominent segment of the automotive components industry. This industry deals in manufacturing and distribution of disc brakes for the automotive sector. There are different types of brakes manufactured in this sector consisting of fixed brakes, floating brakes, sliding caliper brakes and some others. These brakes are developed using numerous types of materials comprising of cast iron, aluminum, stainless steel and some others. It is designed for various types of vehicles including two-wheelers, passenger cars, HCV and some others. The growing application of disc brakes in electric buses has contributed positively to the market expansion. This market is predicted to rise significantly with the growth of the automotive industry in different regions of the world.

The automotive brake system market is a highly fragmented industry with the presence of a numerous dominating players. Some of the prominent companies in this industry consists of AISIN CORPORATION, Haldex, The Web Co, NISSIN KOGYO Co., Ltd. AKEBONO BRAKE INDUSTRY CO., LTD.; ZF Friedrichshafen AG, ADVICS CO.,LTD., Hitachi Astemo Ltd., Brembo S.p.A, Robert Bosch GmbH, and some others. These companies are constantly engaged in developing high-quality braking systems for automotives and adopting numerous strategies such as partnerships, collaborations, business expansions, launches, acquisitions, joint ventures and some others to maintain their dominant position in this industry. For instance, in February 2025, Robert Bosch launched a drive-by-wire braking system. This braking system is equipped with several components including cables, control units and actuators. Also, in November 2024, Akebono Brake Corporation launched a series of ultra-premium brake pads. These brake pads are designed for providing reliable braking in vehicles.

By Type

By Vehicle Type

By Technology

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us